Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Nationwide protests are challenging Iran's theocracy amid a failing economy, internet blackouts, and weakening regional influence.

Nationwide protests sparked by a failing economy are placing renewed pressure on Iran's theocracy, which has responded by shutting down internet and telephone access across the country.

The unrest comes as Tehran reels from multiple crises. A 12-day war with Israel in June saw the United States bomb nuclear sites within Iran. Meanwhile, economic pressure has intensified since the United Nations reimposed sanctions in September over the country's atomic program. This has sent the Iranian rial into a free fall, with the currency now trading at over 1.4 million to the U.S. dollar.

At the same time, Iran's "Axis of Resistance"—its network of allied countries and militant groups—has been severely weakened since the start of the 2023 Israel-Hamas war.

Understanding the full scope of the protests has been challenging. Iranian state media has offered minimal information, while online videos provide only brief glimpses of demonstrations amid the sound of gunfire. An internet shutdown has further complicated reporting, and journalists in Iran already face significant restrictions.

Despite this, reports indicate the movement is widespread and persistent.

• Geographic Reach: The U.S.-based Human Rights Activists News Agency (HRANA) reported on Sunday that more than 570 protests have occurred across all 31 of Iran's provinces.

• Casualties and Arrests: The group, which relies on a network of activists inside Iran, stated the death toll had reached at least 116, with over 2,600 arrests.

The demonstrations appear to be continuing, even after Supreme Leader Ayatollah Ali Khamenei declared that "rioters must be put in their place." U.S. President Donald Trump has warned Tehran that if it "violently kills peaceful protesters," the U.S. "will come to their rescue," a threat that carries new weight after American troops captured Venezuela's Nicolás Maduro, a longtime Iranian ally.

The collapse of the rial is at the heart of Iran's widening economic crisis. The nation is grappling with an annual inflation rate of approximately 40%, driving up the prices of staples like meat and rice.

Recent government policies have added to the population's financial strain:

• Fuel Prices: In December, Iran introduced a new pricing tier for its subsidized gasoline, increasing the cost of some of the world's cheapest fuel. The government plans to review these prices every three months, signaling potential future hikes.

• Subsidized Exchange Rate: Iran's Central Bank recently ended a preferential, subsidized dollar-rial exchange rate for all products except medicine and wheat, a move expected to cause a spike in food prices.

The protests began in late December among merchants in Tehran before spreading nationwide. While initially focused on the economy, the demonstrations quickly evolved, with protesters chanting anti-government slogans. Public anger has been building for years, notably after the 2022 death of 22-year-old Mahsa Amini in police custody, which triggered its own wave of massive demonstrations. Some protesters have chanted in support of Iran's exiled Crown Prince Reza Pahlavi, who has encouraged the demonstrations.

Iran's "Axis of Resistance," a network that grew in prominence after the 2003 U.S.-led invasion of Iraq, is now reeling from a series of major defeats.

• Hamas: The group has been crushed by Israel in a devastating war in the Gaza Strip.

• Hezbollah: The Lebanese militant group has lost its top leadership to Israeli strikes and has been struggling since.

• Syria: A lightning offensive in December 2024 overthrew President Bashar Assad, a key Iranian ally and client.

• Houthis: The Iranian-backed rebels in Yemen have been pounded by Israeli and U.S. airstrikes.

Meanwhile, Iran's larger partners have not offered overt military support. China remains a major buyer of Iranian crude oil but has not provided military aid. Russia, which has used Iranian drones in its war on Ukraine, has also refrained from direct military involvement.

For decades, Iran has insisted its nuclear program is peaceful. However, its officials have increasingly threatened to pursue a nuclear weapon. Before the U.S. attack in June, Iran was enriching uranium to near weapons-grade levels—the only non-nuclear-weapon state to do so.

Tehran has also scaled back its cooperation with the International Atomic Energy Agency (IAEA), the U.N.'s nuclear watchdog. The IAEA's director-general has warned that Iran could build as many as 10 nuclear bombs if it chose to weaponize its program. U.S. intelligence agencies assess that Iran has not yet started a weapons program but has taken steps to "better position it to produce a nuclear device."

In a potential signal to the West, Iran recently claimed it was no longer enriching uranium anywhere in the country. However, no significant negotiations to ease sanctions have occurred in the months since the June war.

The current standoff is rooted in a long and complex history. Before 1979, Iran was a top U.S. ally under Shah Mohammad Reza Pahlavi. The 1953 CIA-backed coup that cemented the shah's rule laid the groundwork for future animosity.

The 1979 Islamic Revolution led by Ayatollah Ruhollah Khomeini created Iran's theocratic government and shattered the alliance. The subsequent U.S. Embassy hostage crisis severed diplomatic relations entirely. During the 1980s Iran-Iraq war, the U.S. backed Saddam Hussein, attacked Iran's navy, and shot down an Iranian commercial airliner.

Relations saw a brief high with the 2015 nuclear deal, which lifted sanctions in exchange for limits on Iran's nuclear program. But in 2018, President Trump unilaterally withdrew the U.S. from the accord, reigniting tensions that have continued to escalate.

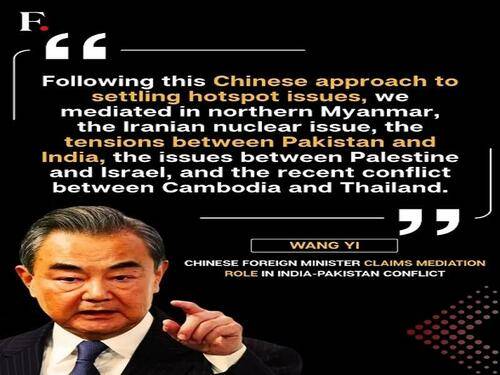

Chinese Foreign Minister Wang Yi recently stated that his country played a mediating role between India and Pakistan during their military clashes last spring. However, an analysis of the region's long-standing diplomatic protocols and geopolitical realities suggests this claim is difficult to substantiate.

The statement echoes similar claims made by U.S. President Trump, which were consistently denied by India and contributed to a deterioration in U.S.-India relations. India's position on this matter has been firm for nearly half a century, making Beijing's assertion particularly noteworthy.

Since the 1972 Simla Agreement, India has maintained a strict policy that all disputes with Pakistan are bilateral issues, explicitly rejecting third-party mediation. This long-standing principle shapes how New Delhi engages with other nations during regional crises.

While India cannot stop foreign diplomats from communicating with Pakistan, it treats each interaction as a distinct bilateral engagement. Indian officials will always take calls from international counterparts to present their country's perspective and prevent Pakistan from controlling the narrative. However, these separate conversations do not constitute a trilateral mediation process.

This context is crucial for understanding what likely transpired last spring. Records show Wang Yi spoke with his Pakistani counterpart, Ishaq Dar, and Indian National Security Advisor Ajit Doval on the same day. From India's perspective, these would have been viewed as two separate bilateral calls, not a coordinated mediation effort led by China.

China's capacity to act as a neutral arbiter between India and Pakistan is fundamentally compromised by its own strategic interests.

• Territorial Disputes: Beijing has its own unresolved border disputes with New Delhi.

• Military Support for Pakistan: China is a key military supplier to Pakistan, providing advanced weaponry, including the JF-17 fighter jets that were used against India in last spring's conflict.

These factors position China as a party with vested interests in the region rather than an impartial mediator.

The timing and context of Wang Yi's statement offer clues to its underlying purpose. The claim was made over six months after the events, during a symposium on "International Situation and China's Foreign Relations."

At the event, Wang listed the India-Pakistan de-escalation as one of several examples of the "Chinese approach to settling hotspots."

Other examples mentioned included:

• Northern Myanmar

• The Iranian nuclear issue

• Disputes between Palestine and Israel

• Conflict between Cambodia and Thailand

Among these, only the ceasefire in northern Myanmar is an indisputable diplomatic achievement for China. The others are either unproven or primarily credited to other actors. The repeated and questionable claims of mediation appear designed to build a specific narrative.

This effort is likely intended to promote President Xi Jinping's flagship Global Security Initiative, a core pillar of China's foreign policy alongside initiatives on development, civilization, and governance. By framing itself as a global peacemaker, Beijing aims to bolster its international standing.

It appears Chinese officials made a strategic calculation that the benefits of promoting the Global Security Initiative outweighed the risk of offending India. Wang Yi would have been aware of India's strong negative reaction to Trump's similar claims and the damage it caused to U.S.-India ties.

Despite this, the decision was made to publicly frame the diplomatic calls as mediation. While intended for a global audience, this boast could needlessly complicate the recent, fragile rapprochement between China and India.

A potential second Trump administration's strategy for Venezuela's oil sector appears to fundamentally misread the complex realities on the ground. The ambitious plan to overhaul the nation's energy industry and control its output faces significant obstacles, from geopolitical ties with China to deep-seated technical challenges that simple subsidies cannot solve.

The core of the proposed U.S. strategy involves a series of non-negotiable demands directed at Venezuela's interim President, Delcy Rodriguez. These ultimatums include:

• Cracking down on drug trafficking.

• Expelling Iranian and Cuban operatives deemed hostile to Washington.

• Halting all oil sales to U.S. adversaries.

These conditions are unlikely to be met, setting the stage for continued confrontation. The administration's vision for overhauling Venezuela’s oil business seems equally detached from reality. Initial suggestions of a subsidy-funded revival, projected to take less than 18 months, quickly evolved into an admission that "a tremendous amount of money will have to be spent," with the expectation that "the oil companies will spend it."

However, major U.S. energy firms are hesitant to invest billions in a nation facing potential chaos, especially if Washington attempts to install a new government over its 28 million citizens.

The ultimate objective behind this high-stakes plan is to drive global oil prices down to a maximum of $50 per barrel. To achieve this, a Trump administration would theoretically seize total control of Venezuela's state-owned oil company, PDVSA, managing the acquisition and sale of nearly all its production.

U.S. Energy Secretary Chris Wright confirmed this strategy at a Goldman Sachs conference, stating, "We are going to market the crude coming out of Venezuela... we will sell the production that comes out of Venezuela into the marketplace."

This plan effectively involves capturing the revenue from PDVSA's crude sales, with the proceeds theoretically deposited into U.S.-controlled offshore accounts for the "benefit of the Venezuelan people." Unsurprisingly, the government in Caracas is expected to reject what it views as outright theft. This strategy is backed by what Homeland Security Advisor Stephen Miller has described as a "military threat" to maintain control over Venezuela.

While the U.S. focuses on control, it overlooks China's deeply entrenched role in Venezuela's energy sector. Although China's daily imports of roughly 746,000 barrels from Venezuela are not irreplaceable—Beijing can easily source oil from Iran, Russia, and Saudi Arabia—its relationship goes far beyond simple trade.

For the past two decades, China has become the operational backbone of Venezuela's oil industry. Its contributions include:

• Refinery technology and heavy crude upgrading systems

• Infrastructure design and control software

• Spare parts logistics and software support

Removing Chinese engineers, technicians, and supply chains would not "liberate" a functioning oil industry. It would leave behind an inert shell. Industry experts estimate that converting Venezuela's Chinese-built oil infrastructure into an American-operated system would take a minimum of three to five years.

Furthermore, Beijing sees the U.S. push in the region as an attempt to force it to purchase energy using petrodollars. This is unlikely to succeed, as China increasingly settles energy transactions with Russia and Gulf nations in petroyuan.

The physical nature of Venezuelan oil presents another major challenge. The country produces superheavy crude, which is as thick as tar and requires specialized processes for extraction. It must be melted to reach the surface and then mixed with a diluent to prevent it from hardening again. For every barrel of oil exported, approximately 0.3 barrels of diluent must be imported.

This technical complexity is compounded by an energy infrastructure that, while shaped by Chinese technology, has been degraded by years of American sanctions. The damage is considered even more severe than that inflicted on Iraq's oil sector in the early 2000s, making any quick revival of production highly improbable.

While the strategic goals of the U.S. plan face serious questions, the turmoil has created opportunities for financial players. Hedge fund vultures are circling, anticipating massive returns. Paul Singer, whose firm Elliott Management acquired the Houston-based subsidiary of CITGO in November for $5.9 billion—less than a third of its $18 billion market value—is a prominent example. Singer has also been a major donor to MAGA-aligned super PACs, contributing $42 million in 2024.

The broader speculative market is eyeing potential profits of up to $170 billion in Venezuela's debt market, with defaulted PDVSA bonds alone valued at over $60 billion. This financial maneuvering underscores how instability, regardless of policy outcomes, generates immense wealth for a select few. Ultimately, the intricate web of technical, geopolitical, and financial factors makes the situation in Venezuela far more complex than a simple strategy of control can address.

Speculation is mounting that Japanese Prime Minister Sanae Takaichi may call an early general election, with reports suggesting a vote could happen as soon as February. The move would allow Japan's first female prime minister to capitalize on high approval ratings she has maintained since taking office in October.

Takaichi's popularity has been bolstered by her firm stance on China, a position that appeals to right-wing voters but has also triggered a significant diplomatic dispute with the neighboring economic power.

The possibility of a snap election gained traction after Hirofumi Yoshimura, leader of Takaichi's coalition partner, the Japan Innovation Party (Ishin), commented on the matter. In an appearance on public broadcaster NHK on Sunday, Yoshimura said he met with the prime minister on Friday and sensed her thinking on an election's timing had entered a new "stage."

"I won't be surprised if she made the decision as reported by media," Yoshimura stated, though he confirmed they did not discuss specific dates during their meeting.

Yoshimura's comments follow a report from the Yomiuri newspaper on Friday, which cited government sources. According to the newspaper, Prime Minister Takaichi is actively considering holding a snap election on either February 8 or February 15.

An early election would be a strategic maneuver to secure a stronger mandate while her public support remains strong.

Despite the growing rumors, Takaichi herself has remained non-committal. In an interview with NHK recorded on Thursday and broadcast on Sunday, the prime minister deflected questions about a potential election.

Instead, she emphasized her immediate priorities, stating she had instructed her cabinet to focus on two key areas:

• Ensuring the timely execution of the current fiscal year's supplementary budget.

• Securing parliamentary approval for the budget for the fiscal year starting in April.

"At present, I am focusing on the immediate challenge of ensuring that the public feels the benefits of our stimulus policies aimed at cushioning the blow of inflation," Takaichi said.

China, long a critical driver of global demand for liquefied natural gas (LNG), is rapidly boosting its domestic production. This strategic shift means that forecasts banking on China's massive appetite for LNG imports will need a major revision.

Less than a decade ago, China struggled to unlock its vast shale gas reserves, facing geological challenges different from those in U.S. basins. Today, the country's state-owned energy giants are not only pumping more natural gas than ever but also announcing significant new discoveries, particularly in its shale regions.

The production numbers speak for themselves. Citing official data, energy analytics firm Kpler reported that China's natural gas output reached 22.1 billion cubic meters in November of last year, a 7.1% increase year-over-year. This growth was largely driven by a faster-than-expected ramp-up of shale gas projects in the Sichuan Basin.

Based on this momentum, Kpler projects China's total domestic gas production will hit 263 billion cubic meters in 2025 and climb to 278.5 billion cubic meters this year. The continued expansion of shale gas operations in the Sichuan and Shanxi basins is expected to fuel this growth.

As with oil, a surge in domestic production inevitably curtails the need for imports, even as China increases its reliance on natural gas to meet emissions targets. Last year provided a clear example: as domestic output rose, China’s LNG imports fell to their lowest level in six years after 12 consecutive months of declines.

Looking ahead, Kpler anticipates that Chinese demand for LNG will continue to fall this year. The increase in shale gas production alone is expected to displace roughly 600,000 tons of LNG demand, bringing the country's total imports down to 73.9 million tons.

While 600,000 tons is a relatively small volume in a market where the United States alone exported over 100 million tons last year, it highlights a powerful trend. Beijing is determined to reduce its dependence on energy imports, a policy with far-reaching implications for global commodity markets that have long counted on China as the ultimate source of demand growth.

The projected decline in China's LNG demand could disrupt ambitious plans for new LNG capacity worldwide. Major exporters like the United States and Qatar are planning a wave of new supply set to come online by the end of the decade. Softening Chinese demand could shrink producer profits and complicate these projects.

Many analysts already expect an oversupplied LNG market by 2030, which would put sustained pressure on prices. China's growing self-sufficiency only adds weight to this forecast.

Competition within the LNG market is also intensifying. Amid ongoing trade disputes, China is no longer importing U.S. LNG. Instead, Russia is exporting record volumes to its neighbor. While these volumes are not yet massive, they demonstrate that gas, much like oil, will find a market if the price is right, even from sanctioned facilities.

These dynamics could be further amplified by the European Union's plan to ban Russian energy imports, including gas, next year. As the current largest buyer of Russian LNG, the EU's ban will force Moscow to redirect these flows, with China and India as the most likely destinations.

Meanwhile, pipeline gas is also set to play a larger role. Kpler estimates that imports through Russia's Power of Siberia pipeline could increase by 8 billion cubic meters compared to 2025, contributing to an overall 8% rise in pipeline imports to 80.7 billion cubic meters. In contrast, pipeline gas imports from Central Asian nations are projected to fall by 4 billion cubic meters in 2026 as those countries prioritize their own domestic demand.

Beijing's priority is clear: reduce reliance on energy imports by ramping up domestic production. However, this transition will be gradual and will eventually face natural limits. Until then, price will remain a key factor driving import decisions.

While China's pivot will undoubtedly influence the global LNG market, its impact may be less dramatic than trends in its oil demand. The reason is simple: plenty of other nations have a strong appetite for liquefied gas, especially if lower Chinese demand and new supply capacity cause prices to fall and stay there.

Recent tensions between the United States and China are showing signs of easing. Following a pivotal October 2025 meeting between President Donald Trump and President Xi Jinping, officials from both nations have launched dialogues on a range of critical issues, from fentanyl and soybeans to Ukraine and Taiwan. President Trump, in a notable shift, has moved from threatening China to courting it. The key question is whether this strategic pivot is enough to win over American public support.

Evidence suggests it might be. Before the Trump-Xi negotiations, U.S. public opinion was decidedly against Trump's aggressive stance, with a clear preference for more engagement with China. While Americans view China as a threat, they seem to consider the risks of direct competition too high. Polling indicates that if the Trump administration continues to seek a more stable equilibrium with Beijing, the American public will back the policy.

Prior to the recent diplomatic thaw, President Trump's approach to China was deeply unpopular, particularly amid escalating trade disputes. A public opinion poll from the Institute for Global Affairs at Eurasia Group, conducted from October 6–14, 2025, revealed that most U.S. voters felt Trump's policies were actively worsening tensions. Of 13 foreign policy issues surveyed, Trump's net approval was negative on 11, with his China policy ranked as the absolute worst.

This sentiment was echoed in other surveys. An October 2025 poll by the Chicago Council on Global Affairs found that 54% of the American public opposed higher tariffs on Chinese goods—the kind Trump had threatened earlier that month. For the first time since 2019, a majority of respondents believed the U.S. should pursue friendly cooperation with China. Less than four in ten Americans supported further reductions in trade or increased tariffs.

One reason for this shift may be that competition with China doesn't rank as a top daily concern for most Americans, even though they acknowledge the threat. The Institute for Global Affairs report noted that while a majority of the public views China as a moderate threat, almost none consider it a primary day-to-day worry.

Still, the perception of China as a national security risk remains strong.

• The Chicago Council found that 50% of the U.S. public sees China as a critical threat.

• The Institute for Global Affairs reported that 62% view China as at least a moderate threat.

When asked what shaped their view, respondents most often cited China's powerful technology (31%). Many also believe China has hostile intentions, with 22% saying it aims to replace the international order and 15% believing it wants to destroy the United States—a view most common among Republicans.

Despite these concerns, Trump's confrontational approach lost its appeal. For years, a tough stance on China was a rare point of bipartisan consensus, but that agreement has collapsed. By 2025, nearly a quarter of Trump's own Republican base disapproved of his China policy.

On the campaign trail, Trump promised sweeping changes to the U.S.–China relationship, including a 60% tariff on all Chinese goods, crackdowns on espionage, and a push to reshore industry. The administration appeared ready to deliver in early 2025, threatening tariffs over 100%, imposing new restrictions on Chinese student visas, and creating licensing requirements for semiconductor sales to China.

However, as public opinion turned, the administration adjusted its course. New tariffs on Chinese goods were lowered to around 20%, all restrictions on Chinese student visas were lifted, and the White House signaled an openness to the sale of advanced U.S. semiconductors to China. This suggests that despite its rhetoric, the administration has proven remarkably responsive to public sentiment.

If President Trump can steer his foreign policy toward a more stable and predictable relationship with China, he may finally gain the voter approval that previously eluded him. The challenge will be restraining his administration's inclination toward policy chaos, which appears unpopular regardless of the issue.

Economic

Cryptocurrency

Traders' Opinions

Remarks of Officials

Data Interpretation

Central Bank

Political

Stocks

The future of the U.S. economy has split investors and analysts into two distinct camps. One side anticipates a massive liquidity injection that could fuel a prolonged expansion. The other sees structural weaknesses that even aggressive stimulus can't fix, echoing the 2008 crisis when bank bailouts failed to revive the broader economy. A third group remains on the sidelines, waiting for a clearer signal.

Optimists point to the momentum from ongoing fiscal and monetary stimulus, which they expect to accelerate under a potential "Trump 2.0" administration. The Federal Reserve has already cut interest rates multiple times, and Trump has suggested he could replace Fed Chair Jerome Powell with a more dovish successor. Such a move could open the door for "ultra-dovish" rate cuts and a significant infusion of liquidity.

Some analysts believe this stimulus could be timed to secure political victories for Republicans in the midterm elections and bolster approval ratings.

This strategy draws comparisons to the deregulation policies of the 1980s under Ronald Reagan, with proponents arguing that similar policies could extend economic growth if liquidity is deployed effectively. This was a key topic in a recent episode of Token Narratives, where Bitcoin.com’s Graham Stone and David Sencil discussed the potential impact of direct liquidity measures.

One key example is Trump's directive for Fannie Mae and Freddie Mac to purchase up to $200 billion in mortgage-backed securities (MBS) to lower mortgage rates.

"Trump just went out and posted something like, 'I'm telling Freddie Mac to buy MBS.' That's like straight-up 2020, 2008-style QE," Sencil noted. "That's QE infinity. So if that kind of thing does happen... what happens when he gets control of the Fed when Powell steps down?"

Sencil concluded that such a massive liquidity injection would likely benefit risk assets, including crypto.

Conversely, the bearish camp argues that while liquidity injections may seem inevitable, they can only delay—not prevent—an economic downturn. Marc Faber, editor of the Gloom Boom & Doom Report, has warned of "doom" in 2026. He advises investors to exit U.S. equities, citing persistent asset price inflation and the Federal Reserve’s weakening control over bond markets. In his view, the era of exceptional market gains is over, with inflation and economic strain set to rise.

Other bearish arguments focus on several key risks:

• Consumer Strain: Rising debt levels and financial pressure on households could overwhelm the positive effects of stimulus.

• Asset Bubbles: Valuations in the tech and AI sectors appear increasingly frothy and vulnerable to a correction.

• Political Risk: Sliding approval ratings for Trump and the upcoming 2026 midterms could trigger a premature "Trump put"—an attempt to boost the market for political gain that may not be sustainable.

These analysts believe the era of effective quantitative easing has passed, and any new interventions may come too late to alter the fundamental trajectory.

Forecasts for a 2026 recession vary. JPMorgan Global Research estimates the probability of a U.S. and global downturn at 35%, driven by persistent inflation and slowing growth.

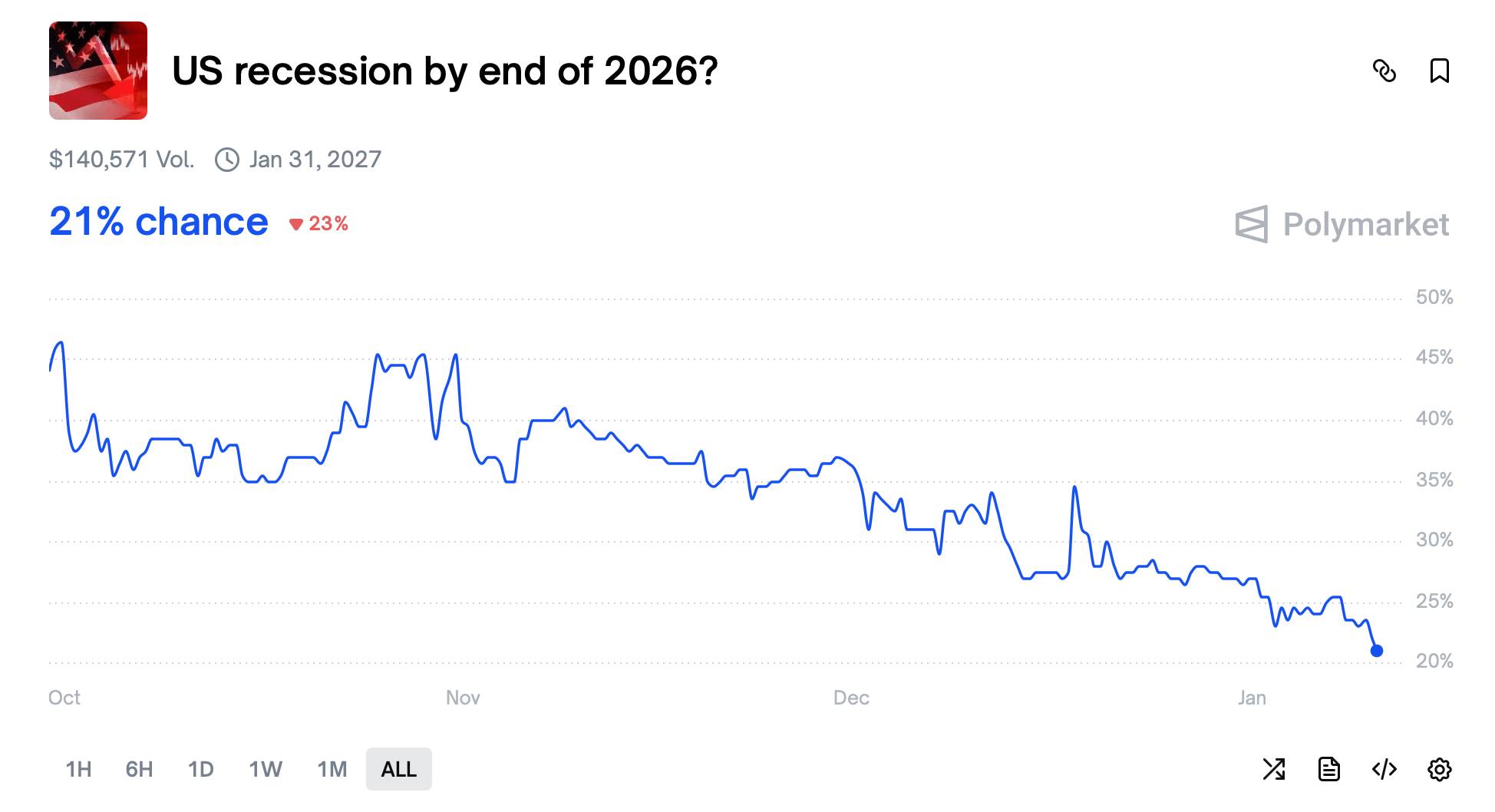

Prediction markets, however, are pricing in lower odds. As of January 10, 2026, bettors on Polymarket gave a 21% chance of a U.S. recession by the end of the year, in a market that has seen over $140,571 in volume.

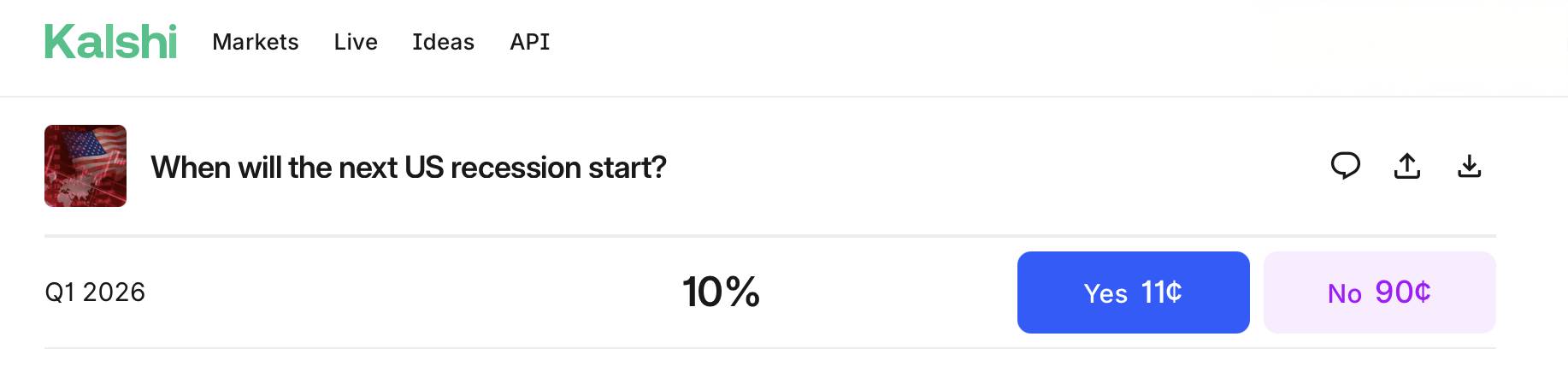

A separate contract on Kalshi places the odds of a recession beginning in the first quarter of 2026 at just 10%. The divergence in these forecasts highlights the deep uncertainty facing investors.

For now, the market remains guardedly optimistic, pricing in potential risks without fully committing to either a growth or recession scenario. This tension between stimulus hopes and underlying economic fears is likely to define the year ahead.

If a wave of liquidity arrives early and decisively, risk assets could rally, validating the expansionist view. However, if stimulus measures are delayed or prove insufficient, the bear case could quickly gain ground, sending recession probabilities higher. Until a clear direction emerges, the most crowded trade may be watching from the sidelines.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up