Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

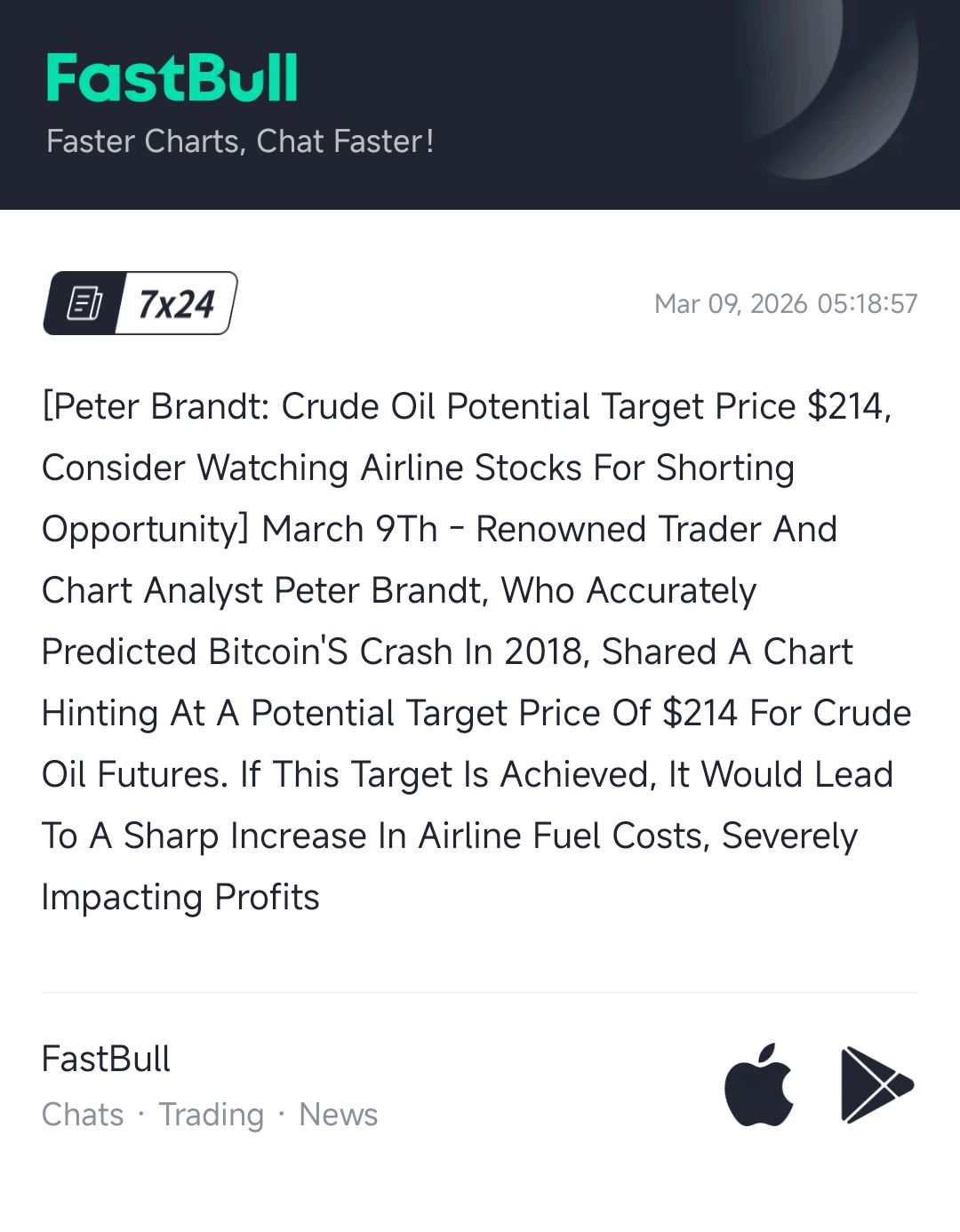

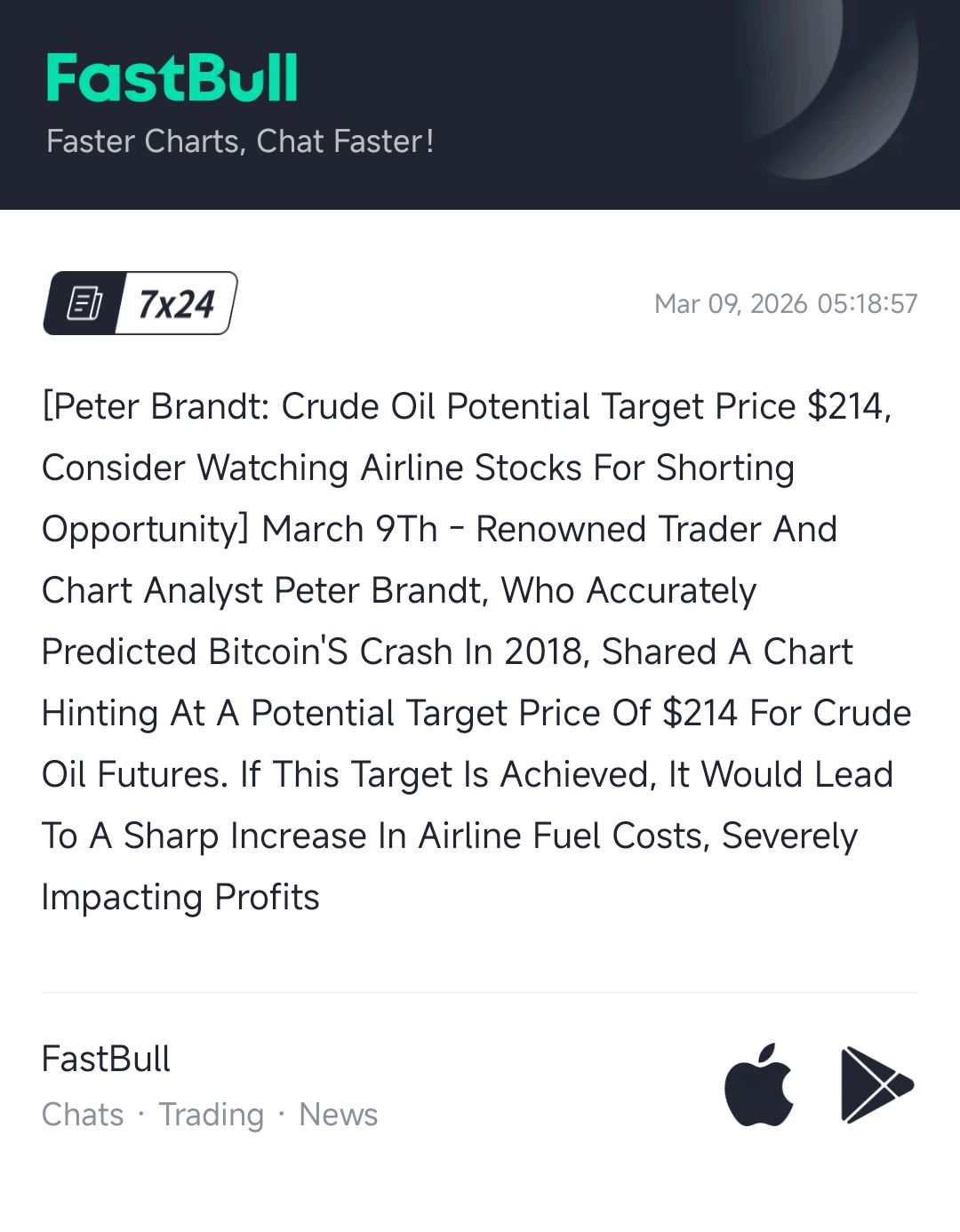

[Peter Brandt: Crude Oil Potential Target Price $214, Consider Watching Airline Stocks For Shorting Opportunity] March 9Th - Renowned Trader And Chart Analyst Peter Brandt, Who Accurately Predicted Bitcoin'S Crash In 2018, Shared A Chart Hinting At A Potential Target Price Of $214 For Crude Oil Futures. If This Target Is Achieved, It Would Lead To A Sharp Increase In Airline Fuel Costs, Severely Impacting Profits

IMF Managing Director Georgieva: We Are Seeing Resilience Tested Again By New Conflict In Middle East

[Bahrain Sounds Air Raid Siren Again] This Morning (March 9th) Local Time, Bahrain Sounded Air Raid Sirens Again. The Bahraini Ministry Of The Interior Issued A Notice Urging All Residents To Take Shelter In Their Nearest Shelter. Iran Subsequently Announced An Attack On A US Military Base In Bahrain

Hsi Down 656 Pts, Hsti Down 115 Pts, Ping An Down Over 5%, Baba Down Over 3%, Cnooc, China Shenhua, Petrochina, Yancoal Aus, Yankuang Energy Hit New Highs

Malaysia Finance Minister:Government Will Try To Hold Subsidised Price Of Ron95 Transport Fuel At 1.99 Rgt Per Litre For Two Months

Malaysia Finance Minister:Malaysia In Good Economic Position, Has Capacity To Absorb Some Changes Stemming From Middle East Crisis

[Slowmist Ciso: Security Risk Found In Usb Version Of Openclaw] March 9Th, Slowmist Ciso 23Pds Posted On X Platform, Stating That Taobao And Xianyu Have Seen A Usb Version Of Openclaw, Claiming That Users Can Buy And Plug In The Model For Immediate Use. However, Openclaw Has Excessive Permissions, And Malicious Skills Are Difficult For Ordinary Users To Identify, Which Can Easily Lead To Asset Loss

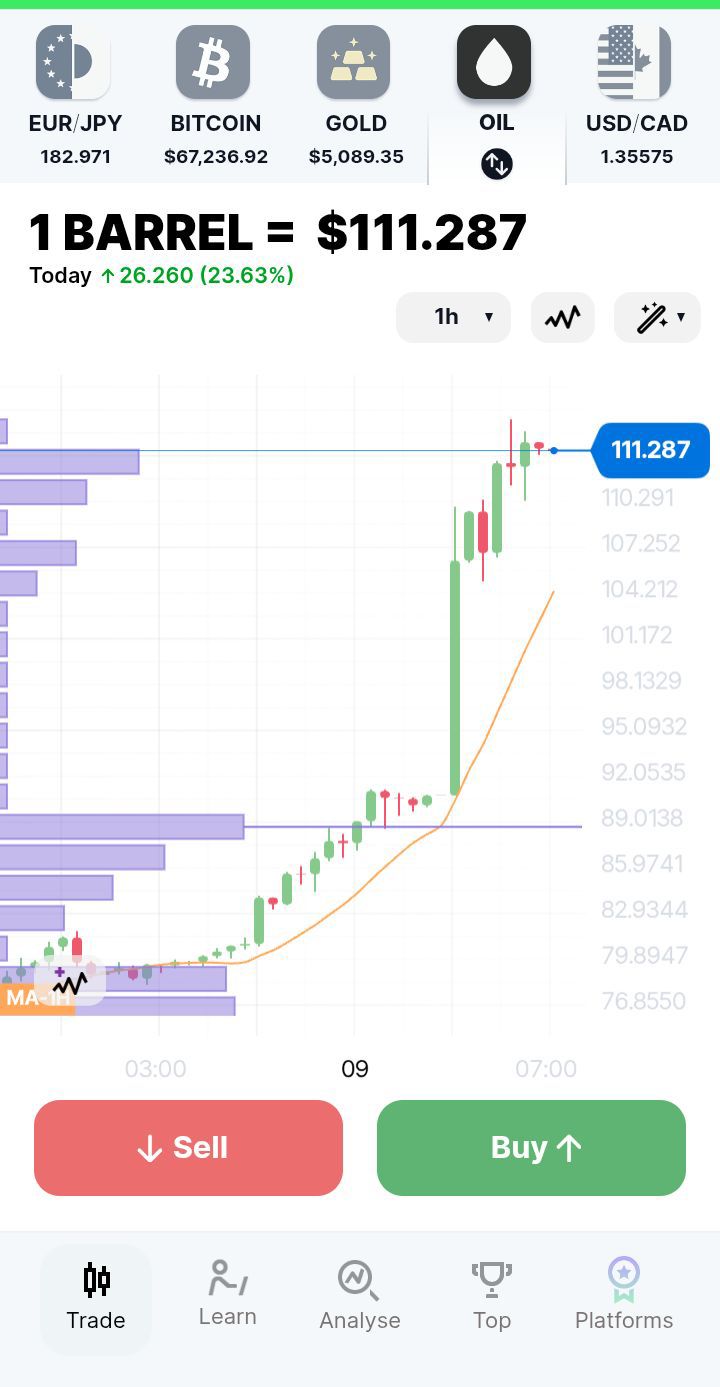

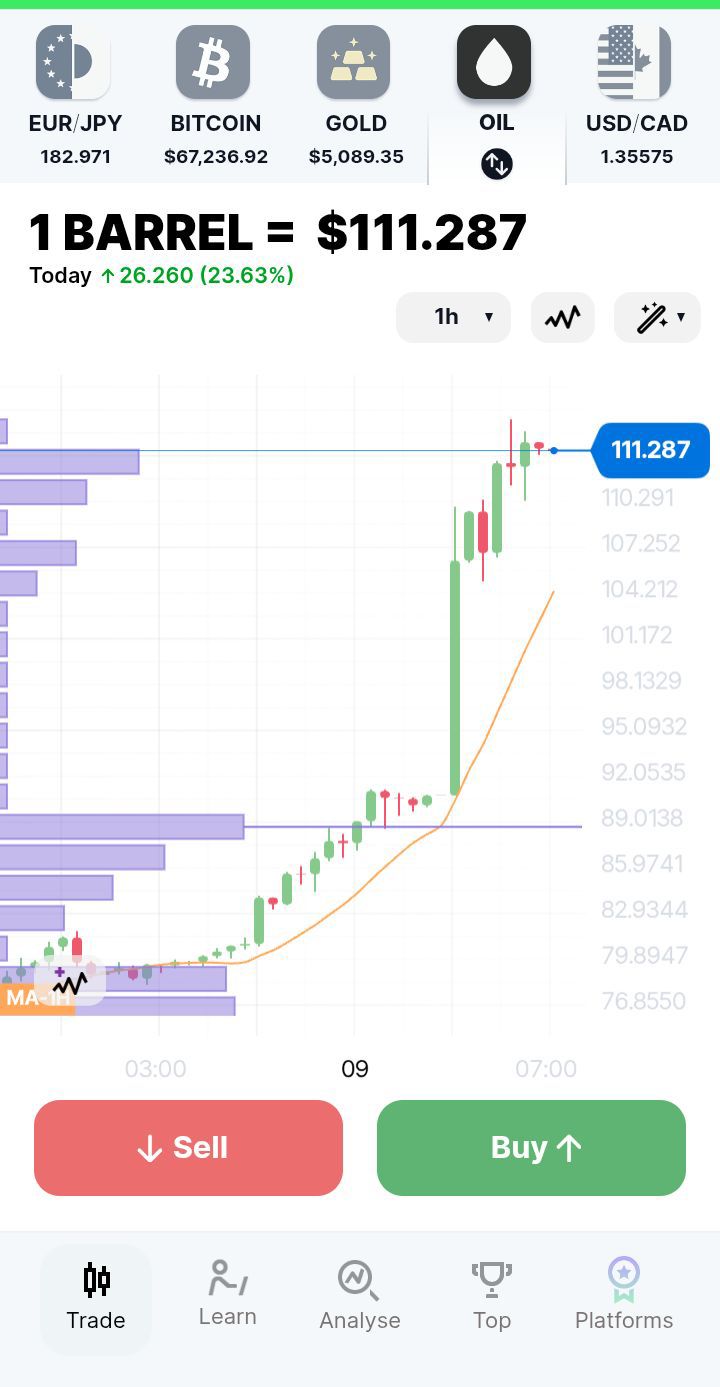

[A Whale Went 5X Short On 90,000 Barrels Of Crude Oil, Worth $10.2 Million] March 9, According To Lookintochain Monitoring, In The Past 2 Hours, The Newly Created Wallet 0Xab96 Opened A 5X Short Position For 90,000 Xyz:Cl Tokens ($10.2 Million), With A Liquidation Price Of $130.45

[Switzerland: US And Israeli Attacks On Iran Violate International Law] On March 8, Switzerland Announced That Federal Councillor And Minister Of Defense, Civil Protection And Sports Martin Pfister Stated That The US And Israeli Attacks On Iran Violated International Law. Pfister Expressed Concern About The Escalating Situation In The Middle East. He Said The Swiss Federal Council Believes The US And Israeli Attacks On Iran Violate International Law And The Principle Of Prohibiting Violence. Pfister Called On All Parties To The Conflict To Cease Violence And Protect Civilians

[The Ethena Team Has Deposited 6500 Eth To Binance In The Last 10 Hours] March 9Th, According To The Data Nerd Monitoring, In The Past 10 Hours, The Ethena Team Deposited 6500 Eth (Approximately $12.58 Million) Into Binance.In Addition, The Cryptocurrency Market Maker B2C2 Deposited 3050 Eth (Approximately $5.89 Million) Into Coinbase

[Military Projectile Lands In Saudi Residential Area, Killing 2 And Injuring 12] Saudi Arabia's Civil Defense Issued A Statement On The Evening Of The 8th, Saying That A "military Projectile" Landed In A Residential Area In Khairji, Saudi Arabia, Killing Two People And Injuring 12. The Statement Said The Deceased Were From India And Bangladesh, While All The Injured Were From Bangladesh

U.S. Retail Sales (Jan)

U.S. Retail Sales (Jan)A:--

F: --

P: --

U.S. Core Retail Sales (Jan)

U.S. Core Retail Sales (Jan)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Jan)

U.S. Core Retail Sales MoM (Jan)A:--

F: --

P: --

U.S. Government Employment (Feb)

U.S. Government Employment (Feb)A:--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Feb)

U.S. U6 Unemployment Rate (SA) (Feb)A:--

F: --

U.S. Manufacturing Employment (SA) (Feb)

U.S. Manufacturing Employment (SA) (Feb)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Feb)

U.S. Labor Force Participation Rate (SA) (Feb)A:--

F: --

U.S. Unemployment Rate (SA) (Feb)

U.S. Unemployment Rate (SA) (Feb)A:--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Feb)

U.S. Nonfarm Payrolls (SA) (Feb)A:--

F: --

U.S. Average Hourly Wage YoY (Feb)

U.S. Average Hourly Wage YoY (Feb)A:--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Feb)

U.S. Average Hourly Wage MoM (SA) (Feb)A:--

F: --

P: --

U.S. Retail Sales MoM (Jan)

U.S. Retail Sales MoM (Jan)A:--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Feb)

U.S. Average Weekly Working Hours (SA) (Feb)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Feb)

U.S. Private Nonfarm Payrolls (SA) (Feb)A:--

F: --

Canada Ivey PMI (Not SA) (Feb)

Canada Ivey PMI (Not SA) (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Feb)

Canada Ivey PMI (SA) (Feb)A:--

F: --

P: --

U.S. Commercial Inventory MoM (Dec)

U.S. Commercial Inventory MoM (Dec)A:--

F: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Jan)

U.S. Consumer Credit (SA) (Jan)A:--

F: --

China, Mainland Foreign Exchange Reserves (Feb)

China, Mainland Foreign Exchange Reserves (Feb)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Feb)

China, Mainland M0 Money Supply YoY (Feb)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Feb)

China, Mainland M2 Money Supply YoY (Feb)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Feb)

China, Mainland M1 Money Supply YoY (Feb)--

F: --

P: --

Japan Wages MoM (Jan)

Japan Wages MoM (Jan)A:--

F: --

P: --

Japan Trade Balance (Jan)

Japan Trade Balance (Jan)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Jan)

Japan Trade Balance (Customs Data) (SA) (Jan)A:--

F: --

P: --

China, Mainland CPI MoM (Feb)

China, Mainland CPI MoM (Feb)A:--

F: --

P: --

China, Mainland PPI YoY (Feb)

China, Mainland PPI YoY (Feb)A:--

F: --

P: --

China, Mainland CPI YoY (Feb)

China, Mainland CPI YoY (Feb)A:--

F: --

P: --

Japan Leading Indicators Prelim (Jan)

Japan Leading Indicators Prelim (Jan)--

F: --

P: --

Germany Industrial Output MoM (SA) (Jan)

Germany Industrial Output MoM (SA) (Jan)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Mar)

Euro Zone Sentix Investor Confidence Index (Mar)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Mexico Core CPI YoY (Feb)

Mexico Core CPI YoY (Feb)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Feb)

Mexico 12-Month Inflation (CPI) (Feb)--

F: --

P: --

Mexico PPI YoY (Feb)

Mexico PPI YoY (Feb)--

F: --

P: --

Mexico CPI YoY (Feb)

Mexico CPI YoY (Feb)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Feb)

U.S. Conference Board Employment Trends Index (SA) (Feb)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q4)

Japan Nominal GDP Revised QoQ (Q4)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q4)

Japan GDP Annualized QoQ Revised (Q4)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Feb)

U.K. BRC Overall Retail Sales YoY (Feb)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Feb)

U.K. BRC Like-For-Like Retail Sales YoY (Feb)--

F: --

P: --

China, Mainland Exports YoY (CNH) (Feb)

China, Mainland Exports YoY (CNH) (Feb)--

F: --

P: --

Indonesia Retail Sales YoY (Jan)

Indonesia Retail Sales YoY (Jan)--

F: --

P: --

Germany Exports MoM (SA) (Jan)

Germany Exports MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Jan)

France Trade Balance (SA) (Jan)--

F: --

P: --

France Current Account (Not SA) (Jan)

France Current Account (Not SA) (Jan)--

F: --

P: --

Italy PPI YoY (Jan)

Italy PPI YoY (Jan)--

F: --

P: --

South Africa GDP YoY (Q4)

South Africa GDP YoY (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Feb)

U.S. NFIB Small Business Optimism Index (SA) (Feb)--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. Yield--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Feb)

U.S. Existing Home Sales Annualized Total (Feb)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Feb)

U.S. Existing Home Sales Annualized MoM (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Mar)

U.S. EIA Natural Gas Production Forecast For The Next Year (Mar)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Mar)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Mar)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Mar)

U.S. EIA Short-Term Crude Production Forecast For The Year (Mar)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

China, Mainland Trade Balance (USD) (Feb)

China, Mainland Trade Balance (USD) (Feb)--

F: --

P: --

No matching data

Views from Analysts

Tank

Manuel

Manuel

Manuel

Eva Chen

Eva Chen

Gerik

Gerik

Eva Chen

Warren Takunda

Warren Takunda

Warren Takunda

Gerik

Tank

Tank

Tank

Eva Chen

Eva Chen

Warren Takunda

Warren Takunda

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up