[Peter Brandt: Crude Oil Potential Target Price $214, Consider Watching Airline Stocks For Shorting Opportunity] March 9Th - Renowned Trader And Chart Analyst Peter Brandt, Who Accurately Predicted Bitcoin'S Crash In 2018, Shared A Chart Hinting At A Potential Target Price Of $214 For Crude Oil Futures. If This Target Is Achieved, It Would Lead To A Sharp Increase In Airline Fuel Costs, Severely Impacting Profits

IMF Managing Director Georgieva: We Are Seeing Resilience Tested Again By New Conflict In Middle East

[Bahrain Sounds Air Raid Siren Again] This Morning (March 9th) Local Time, Bahrain Sounded Air Raid Sirens Again. The Bahraini Ministry Of The Interior Issued A Notice Urging All Residents To Take Shelter In Their Nearest Shelter. Iran Subsequently Announced An Attack On A US Military Base In Bahrain

Hsi Down 656 Pts, Hsti Down 115 Pts, Ping An Down Over 5%, Baba Down Over 3%, Cnooc, China Shenhua, Petrochina, Yancoal Aus, Yankuang Energy Hit New Highs

Malaysia Finance Minister:Government Will Try To Hold Subsidised Price Of Ron95 Transport Fuel At 1.99 Rgt Per Litre For Two Months

Malaysia Finance Minister:Malaysia In Good Economic Position, Has Capacity To Absorb Some Changes Stemming From Middle East Crisis

[Slowmist Ciso: Security Risk Found In Usb Version Of Openclaw] March 9Th, Slowmist Ciso 23Pds Posted On X Platform, Stating That Taobao And Xianyu Have Seen A Usb Version Of Openclaw, Claiming That Users Can Buy And Plug In The Model For Immediate Use. However, Openclaw Has Excessive Permissions, And Malicious Skills Are Difficult For Ordinary Users To Identify, Which Can Easily Lead To Asset Loss

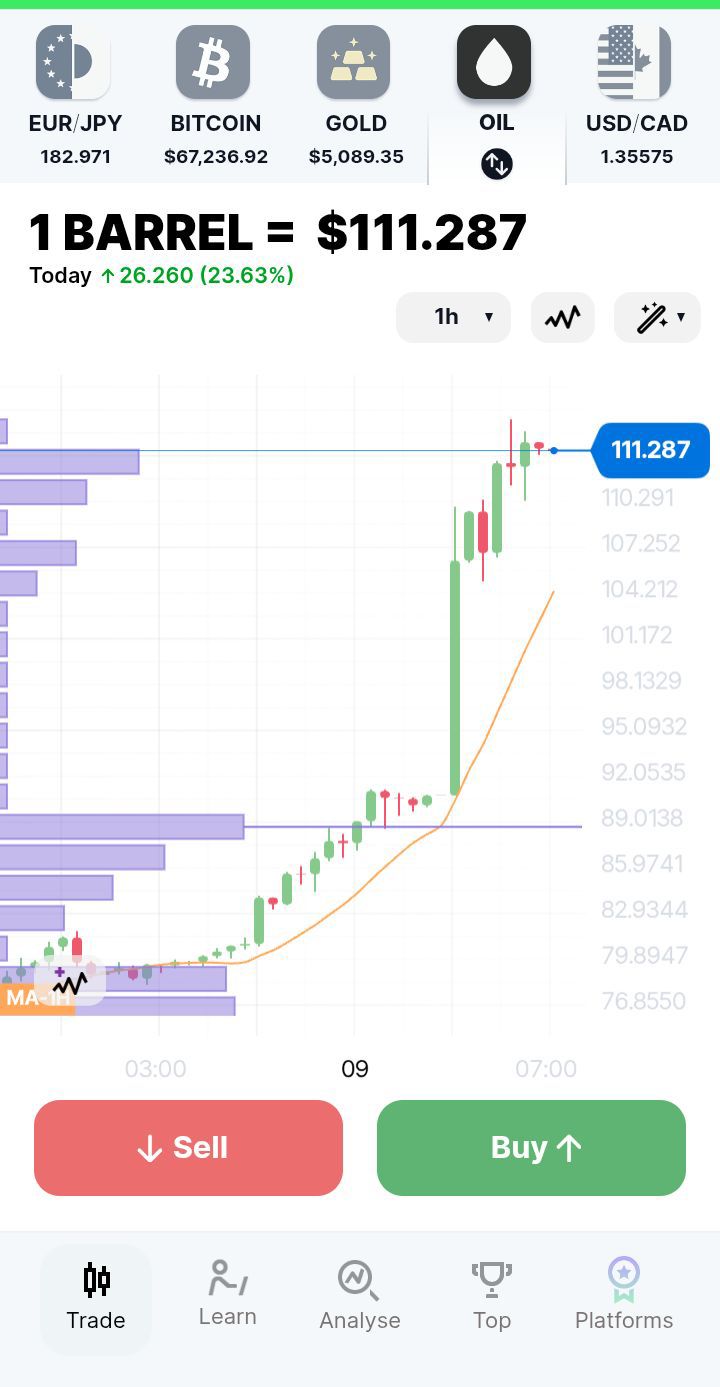

[A Whale Went 5X Short On 90,000 Barrels Of Crude Oil, Worth $10.2 Million] March 9, According To Lookintochain Monitoring, In The Past 2 Hours, The Newly Created Wallet 0Xab96 Opened A 5X Short Position For 90,000 Xyz:Cl Tokens ($10.2 Million), With A Liquidation Price Of $130.45

[Switzerland: US And Israeli Attacks On Iran Violate International Law] On March 8, Switzerland Announced That Federal Councillor And Minister Of Defense, Civil Protection And Sports Martin Pfister Stated That The US And Israeli Attacks On Iran Violated International Law. Pfister Expressed Concern About The Escalating Situation In The Middle East. He Said The Swiss Federal Council Believes The US And Israeli Attacks On Iran Violate International Law And The Principle Of Prohibiting Violence. Pfister Called On All Parties To The Conflict To Cease Violence And Protect Civilians

[The Ethena Team Has Deposited 6500 Eth To Binance In The Last 10 Hours] March 9Th, According To The Data Nerd Monitoring, In The Past 10 Hours, The Ethena Team Deposited 6500 Eth (Approximately $12.58 Million) Into Binance.In Addition, The Cryptocurrency Market Maker B2C2 Deposited 3050 Eth (Approximately $5.89 Million) Into Coinbase

[Military Projectile Lands In Saudi Residential Area, Killing 2 And Injuring 12] Saudi Arabia's Civil Defense Issued A Statement On The Evening Of The 8th, Saying That A "military Projectile" Landed In A Residential Area In Khairji, Saudi Arabia, Killing Two People And Injuring 12. The Statement Said The Deceased Were From India And Bangladesh, While All The Injured Were From Bangladesh

[Analysis: If Oil Prices Remain At Their Current Level For 3 Months, The U.S. Inflation Rate Will Reach Its Highest Level Since September 2023] March 9Th, According To The Kobeissi Letter Analysis, With The Current U.S. Oil Price Nearing $120 Per Barrel, Its Model Shows That If This Level Continues For 3 Months, The U.S. CPI Inflation Rate Will Rise To Around 3.7%.This Would Bring The U.S. Inflation Rate To Its Highest Level Since September 2023

Taiwan Economy Ministry: Any Local Oil Price Hikes Would Be Subject To Inflation Stability

Cctv - China's Long March 8A Yao-8 Rocket Transferred To Launch Area, Will Be Launched At A Later Date

South Korea President Lee Says To Prepare Preemptive Measures With Worst Case Scenario In Mind Concerning Middle East Crisis -News1

[WTI Crude Oil Surges 30% Intraday] March 9Th, According To Bitget Market Data, International Oil Prices Continued To Rise, With WTI Crude Oil Surging 30.00% Intraday To $118.86 Per Barrel

[China’s Special Envoy For Middle East Issues Zhai Jun Meets With Gulf Cooperation Council Secretary-General Boudawi] On March 8, 2026, China’s Special Envoy For Middle East Issues Zhai Jun Met With Gulf Cooperation Council Secretary-General Boudawi In Riyadh

Japan Chief Cabinet Secretary Kihara Says Japan Has Not Made Any Decision To Release Oil Reserves, When Asked About Report That Japan Is Preparing To Do So

Brent Rises Nearly 24%, Putting It On Track For Record Single Day Gain, WTI Futures Up Over 26%

Canadian Prime Minister Carney Discussed The Situation In The Middle East And Trade Relations With Trump

The Death Toll In The U.S. Military Operation Against Iran Has Risen To Eight. The U.S. Central Command Issued A Statement On Social Media On The Evening Of The 8th, Saying That The Death Toll In The U.S. Military Operation Against Iran Has Risen To Eight

United Arab Emirates, Kuwait Announce Oil Output Cuts, Iran's Southern Oil Region Reportedly Cuts Output By 3M Barrels/Day

[Coinbase CEO: Platform Currently Custodies Over 12% Of Global Cryptocurrency Assets] March 9Th, Coinbase CEO Brian Armstrong Posted On Social Media, Saying, "Coinbase Serves Thousands Of Financial Institutions. We Have Been Serving Institutional Clients For Over A Decade, Which Is Also Why We Can Custody Over 12% Of The World'S Crypto Assets And Most Of The US Spot Crypto ETFs."

Foreign Ministry - Saudi Arabia Says Continued Iranian Attacks Will Lead To Further Escalation And Have Serious Impact On Relations 'Now And In The Future'

[Israeli Military Says State Of Emergency "will Continue For A Long Time"] According To Israeli Media Reports On The 8th, Israeli Defense Forces Chief Of Staff Zamir Said That The Israeli People Have Been In A "long-term State Of Emergency" Since The Outbreak Of A New Round Of Israeli-Palestinian Conflict In October 2023, And This State "will Continue For A Long Time" As The Conflict Between Israel And Iran Continues

No data