Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Former President Trump announced plans for direct U.S. land strikes against Mexican drug cartels, a move swiftly rejected by Mexico's government amidst sovereignty concerns.

Former President Donald Trump has announced that the United States plans to launch direct strikes against drug cartels inside Mexico, signaling a significant shift in counternarcotics strategy from sea to land operations.

In an interview aired on January 8, Trump told Sean Hannity of Fox News that after successfully interdicting most maritime drug routes, the focus must now turn to land. "We knocked out 97 percent of the drugs coming in by water, and we are going to start now hitting land with regard with the cartels," he said.

Trump asserted that cartels now control Mexico and are responsible for hundreds of thousands of deaths in the United States annually. "They're killing 250,000, 300,000 in our country every single year," he stated.

The announcement came just five days after Trump ordered an operation to capture Venezuelan leader Nicolás Maduro and bring him to the U.S. on narco-terrorism charges. Following that action, Trump issued warnings to several Latin American countries, including Mexico.

He urged Mexico to "get its act together," telling reporters that while he would prefer Mexico to handle the problem, the U.S. may be forced to intervene. "We're going to have to do something. We'd love Mexico to do it; they're capable of doing it, but unfortunately, the cartels are very strong in Mexico," Trump said.

He also noted that he has spoken with Mexican President Claudia Sheinbaum multiple times and offered to send in U.S. troops, an offer she has declined. Trump described her as "afraid" and claimed "the cartels are running Mexico," not her administration.

Mexico has consistently opposed proposals for U.S. military action on its soil. Responding to the pressure, President Sheinbaum firmly rejected the idea of foreign interference.

"We categorically reject intervention in the internal affairs of other countries," Sheinbaum stated during a press conference. "The history of Latin America is clear and compelling: Intervention has never brought democracy, never generated well-being, nor lasting stability."

This potential escalation is part of a broader intensification of anti-cartel policy under Trump's administration, which includes designating Mexican syndicates as terrorist organizations. Officials maintain that with sea-based trafficking nearly halted, land operations are the logical next step.

Trump has previously indicated that a formal declaration of war is not a prerequisite for taking military action. "I think we're just going to kill people that are bringing drugs into our country," he said on October 23, 2025.

While U.S. officials link the cartels to tens of thousands of American overdose deaths each year, Trump did not provide a specific timeline for when the announced land strikes might begin.

American workers are taking home the smallest portion of the country’s economic output since federal records began in 1947, according to new data that highlights a growing disconnect between economic growth and employee compensation.

Figures from the Bureau of Labor Statistics (BLS) reveal that the share of GDP paid to workers through wages and salaries fell to 53.8% in the third quarter of last year. This marks the lowest level ever recorded in the modern data series.

The figure represents a sharp decline from 54.6% in the previous quarter and sits well below the 55.6% average recorded so far in the 2020s. This trend has emerged even as the overall economy expands and many companies report some of their strongest profit margins in decades, raising fresh questions about income distribution.

The labor share metric, tracked since 1947, briefly spiked in 2020 during the pandemic but has been on a steady downward trajectory since. Over the same period, corporate profits have climbed, suggesting that the benefits of GDP expansion are not being shared proportionally with the workforce.

The BLS defines labor share as "the percentage of economic output that accrues to workers in the form of compensation." This includes not only wages and salaries but also bonuses and pension contributions. Despite solid GDP growth, this percentage has continued to fall.

The same BLS report that detailed the shrinking labor share also showed a significant jump in U.S. labor productivity, which rose at its fastest pace in two years during the third quarter. Economists suggest this gain may be partly linked to the increasing adoption of artificial intelligence.

This creates a complex economic picture:

• On one hand, higher productivity allows for faster GDP growth without triggering higher inflation.

• On the other, it enables companies to increase their output while hiring fewer workers, putting downward pressure on overall wage growth relative to GDP.

More data is needed to fully understand AI's long-term impact on jobs and pay, but the current trend points toward a scenario where efficiency gains are not translating into a larger slice of the economic pie for employees.

Federal Reserve officials are closely monitoring these dynamics. Tom Barkin, President of the Federal Reserve Bank of Richmond, characterized the current situation as a "low-hiring environment" with modest job growth.

Recent BLS figures support this view, showing employers added 50,000 jobs last month. The unemployment rate edged down to 4.4%, but the pace of hiring has slowed considerably.

"This fine balance between a modest job growth environment with a modest labor-supply growth environment seems to be continuing, and that was encouraging," Barkin told reporters.

Businesses Prioritize Efficiency

According to Barkin, businesses are remaining cautious, choosing to rely on productivity gains to operate with fewer workers rather than expanding their payrolls. This strategic choice is a key factor shaping hiring decisions and contributing to the suppressed labor share, even as GDP continues to grow.

He stressed that Federal Reserve officials must remain vigilant about the dual risks of rising unemployment and persistent inflation.

Uncertainty Clouds Future Rate Cuts

While policymakers cut the benchmark interest rate for a third consecutive meeting last month, they are divided on the path forward. Uncertainty surrounding inflation and the labor market has tempered expectations for further cuts.

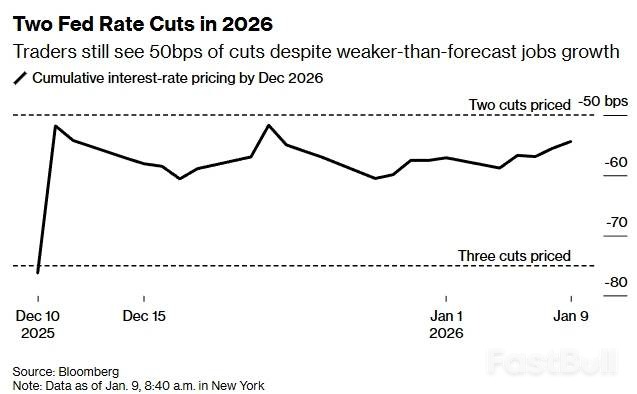

Investors are currently pricing in two quarter-point rate cuts this year, with the first move not anticipated until April or June.

Barkin noted that while inflation has improved, the fight is not over. "Inflation has been above our target now for almost five years," he said. "It's in a lot better shape than it was two or three years ago, but it's certainly not all the way there."

He concluded that policymakers must keep a close eye on both sides of their mandate. "The unemployment rate has ticked up in the last year, and job growth is modest," Barkin said. "So I think you've got to watch both of them."

President Donald Trump has escalated his campaign to acquire Greenland, stating he is prepared to secure the Danish territory "the hard way" if a deal cannot be reached.

“I would like to make a deal, you know, the easy way. But if we don't do it the easy way, we're going to do it the hard way,” Trump told reporters at the White House on Friday.

The president's focus on Greenland, which he frames as a national security imperative, has sharpened following a recent U.S. raid targeting Venezuelan leader Nicolas Maduro. The move has heightened concerns among allies about the potential use of U.S. military force to achieve foreign policy objectives.

When asked about a potential financial offer for the island, Trump dismissed the idea for now.

"I'm not talking about money for Greenland yet," he said. "I might talk about that, but right now, we are going to do something on Greenland, whether they like it or not."

The president justified his stance by pointing to geopolitical competition with Russia and China, arguing that U.S. action is necessary to prevent them from establishing a presence in the region. “We’re not going to have Russia or China as a neighbor,” Trump stated.

The comments have strained relations with Denmark, a key NATO member. Danish Prime Minister Mette Frederiksen issued a stark warning, stating that a U.S. attack on Greenland would signify the end of the NATO alliance.

Other European leaders echoed this sentiment, calling on Trump to respect the island’s territorial integrity and affirming that it is protected under the bloc's collective security framework.

While the president has not ruled out using military force, the official U.S. position appears to be focused on a transaction.

On Tuesday, U.S. Secretary of State Marco Rubio told lawmakers that the administration’s goal is to buy the island. Rubio is scheduled to meet with Danish officials next week to discuss the matter.

The massive spending on artificial intelligence that drove stocks to record highs last year may not need an encore to keep the rally going. According to a report from BCA Research, potential interest rate cuts from the Federal Reserve could be enough to support tech stocks, even if AI infrastructure investment slows down.

This combination of lower rates and persistent inflation could delay or prevent a market crash reminiscent of the Dotcom Bubble.

America's largest tech companies—Microsoft, Alphabet, Amazon, Meta, and Oracle—are on track to spend over $500 billion on infrastructure this year, with a significant portion dedicated to AI.

According to Dhaval Joshi, chief strategist at BCA Research, this level of capital expenditure as a percentage of GDP is approaching a threshold that historically marked the peak of major tech investment cycles. Previous cycles include the personal computing boom of the 1980s, the dot-com boom of the 1990s, and the post-pandemic "Zoom boom."

In past cycles, tech stocks typically started to underperform the broader market about a year before capital spending peaked. If history repeats itself, Joshi noted, "AI-plays in the stock market are in imminent danger."

Despite historical parallels, the current environment may have more in common with the recent "Zoom boom" than the dot-com crash, primarily due to the Federal Reserve's monetary policy stance.

"Even if the AI capex boom ends, an ultra-accommodative Fed can prolong the stock market rally," Joshi wrote.

This matters because fears of slowing AI spending already caused tech stocks to hesitate in late 2025. The key difference lies in the behavior of real interest rates.

The Critical Role of Real Bond Yields

For stock valuations, what truly matters is not the nominal interest rate but the real bond yield—a bond's return after adjusting for inflation.

Joshi points out that the tech sector held its ground in 2021 because while inflation was rising, real bond yields continued to fall. Tech stocks only began to falter in 2022 when the Federal Reserve’s aggressive rate hikes sent real rates soaring.

Today, the situation is reversed. "Fast forward to today, and rate hikes are not on the Fed's agenda. Quite the contrary, the Fed is signalling more rate cuts," Joshi explained. If inflation remains around 3% while the central bank cuts rates, real yields would decline, providing crucial support for stock valuations.

Of course, an "ultra-accommodative" Fed is not guaranteed. Several factors could force policymakers to delay or limit rate cuts, including:

• Persistently sticky or resurgent inflation

• A surprisingly stable job market

• Robust overall economic growth

Following a mixed jobs report on Friday, the probability of the Fed holding rates steady through the first half of the year rose to a one-month high.

While most Wall Street analysts remain optimistic about the stock market's prospects for 2026, the sustainability of the AI rally is a primary concern. Mega-cap tech stocks now represent an unusually large portion of the S&P 500, making the entire index vulnerable to a downturn in the tech sector.

However, lower interest rates could also boost market liquidity, while tax cuts from last year's One Bi Beautiful Bill could stimulate economic growth, potentially offsetting any drag from a slowdown in tech investment.

Wall Street is bracing for the Federal Reserve to continue cutting interest rates in 2026, with analysts now forecasting at least a 50 basis point reduction. The expectation comes as President Donald Trump prepares to name a successor to Fed Chair Jerome Powell, signaling a potential policy shift.

Leading financial institutions have revised their outlooks, anticipating a more aggressive easing cycle. According to recent client notes:

• Morgan Stanley now projects two 25-bps rate cuts in 2026, shifting its timeline from January and April to June and September.

• Citigroup has also adjusted its forecast, now expecting rate cuts in March, July, and September. This outlook implies a total reduction of up to 75 bps in 2026, which would push the federal funds rate range below 3%.

The market's dovish sentiment is building on the three rate cuts already anticipated for 2025. The primary driver is the expected appointment of a new Fed Chair by President Trump, which investors believe will lead to a more accommodative monetary policy.

This view is supported by officials like Treasury Secretary Scott Bessent, who has advocated for lower interest rates to stimulate economic growth, despite weaker-than-expected jobs data.

This macroeconomic environment is seen as highly favorable for digital assets. The expected rate cuts align with other expansionary policies, including the Federal Reserve's Quantitative Easing (QE) program that began in early December 2025 and a planned $200 billion injection into the housing industry by President Trump.

These dovish signals are prompting Wall Street investors to adopt a "risk-on" appetite. As the stock market continues its bull rally, a capital rotation away from precious metals and into riskier assets is expected. Consequently, Bitcoin and the wider altcoin industry appear poised to benefit, potentially triggering a strong bull run in 2026.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up