Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)A:--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)A:--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. PCE Price Index MoM (Nov)

U.S. PCE Price Index MoM (Nov)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Nov)

U.S. PCE Price Index YoY (SA) (Nov)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Nov)

U.S. Real Personal Consumption Expenditures MoM (Nov)--

F: --

P: --

U.S. Personal Income MoM (Nov)

U.S. Personal Income MoM (Nov)--

F: --

P: --

U.S. Core PCE Price Index MoM (Nov)

U.S. Core PCE Price Index MoM (Nov)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Jan)

U.S. Kansas Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Jan)

U.S. Kansas Fed Manufacturing Production Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Iran's oil supply faces an overlooked, potent threat: labor unrest fueled by its severe economic crisis.

For decades, traders have viewed Iran through the lens of geopolitical conflict. The mere mention of the country conjures images of chokepoints in the Strait of Hormuz, a vital channel for global oil flow. But while markets fixate on the possibility of military action, the most significant danger to Iran's oil supply is far less dramatic: a labor strike by its own oil industry workers.

This distinction is critical. The risk of a US attack has cooled, yet the potential for labor unrest has quietly grown. A military strike scares the market but rarely disrupts supply for long. Widespread strikes, however, are often overlooked but have historically triggered massive production outages.

Recent protests in Iran were met with brutal state repression, and for now, the government has regained control of its major cities. The violence was severe, with a death toll potentially reaching several thousand, possibly making it the worst in the regime's 47-year history and surpassing the crackdowns of 1988, 1999, 2011, and 2022.

This suppression gave President Donald Trump an off-ramp. After initially encouraging protestors, Trump noted on January 14 that "the killing in Iran is stopping." When asked about military options, he adopted a wait-and-see approach.

But this sense of closure is misleading. The government can suppress dissent, but it cannot solve the severe economic crisis fueling public anger. The core grievances remain:

• Inflation is running near 50%.

• The national currency, the rial, is in free fall.

• Unemployment continues to rise.

Unless the authorities address this cost-of-living crisis, instability will persist, and with it, the risk of turmoil spreading to the country's vital oilfields.

While international sanctions and low oil prices have damaged Iran's economy, the root problem is internal. The economy is increasingly defined by corruption and military control, with Supreme Leader Ali Khamenei's inner circle and the powerful Islamic Revolutionary Guards Corps (IRGC) dominating a vast network of local companies.

Without genuine economic and political reform, Iran appears headed for more turmoil. Raz Zimmt, an analyst at the Institute for National Security Studies in Tel Aviv, suggests the country could be entering a period of civil disobedience marked by sporadic eruptions of protest.

The 2018-2019 protests, which included nationwide strikes in sectors like transportation, offer a potential blueprint. On January 10, Reza Pahlavi, the exiled son of the Shah deposed in the 1979 revolution, called on protestors to cut the regime's "financial lifelines" by launching nationwide strikes in the oil, gas, and energy sectors.

History proves that labor action can have a catastrophic impact on Iran's oil output. In mid-1978, a strike by oil workers caused production to collapse by roughly 80% in a matter of weeks. That event, which remains the largest oil outage in history, helped pave the way for the revolution that brought Ayatollah Khomeini to power the following year.

However, the industry has changed significantly since then. Several factors now make a repeat more difficult:

1. IRGC Control: The IRGC now tightly controls the oil industry, owning major infrastructure and employing loyal workers.

2. Heavy Security: The security apparatus maintains a firm grip on Khuzestan and Kohgiluyeh and Boyer-Ahmad, the two provinces where the largest oilfields are located.

3. Precarious Labor: Many oil employees are contract workers with little job security, making them less likely to risk their livelihoods by striking.

Today, Iran produces nearly 5 million barrels a day of crude and other petroleum liquids, a level comparable to 1978. The potential for internal disruption remains a low-probability but high-impact scenario.

Crucially, this is a threat beyond Washington's control. The White House can calibrate military action to avoid hitting the energy sector, as it did in June when it discouraged attacks on oil facilities. But it cannot control the actions of protestors on the streets or in the oilfields. For those watching the energy markets, the real story isn't about bombs—it's about the workers.

HSBC is taking a contrarian stance on U.S. monetary policy, predicting the Federal Reserve will maintain current interest rates throughout 2026. The bank argues there is simply no macroeconomic justification for a rate reduction.

This forecast puts HSBC directly at odds with the prevailing market consensus, which anticipates one or two rate cuts in 2026.

According to Frederic Neumann, HSBC's chief Asia economist, several factors will sustain U.S. economic growth and eliminate the need for rate cuts. These include the impact of tax cuts, a booming artificial intelligence (AI) hardware sector, and robust equity prices.

"HSBC is actually not expecting the Fed to cut interest rates," Neumann stated during a recent outlook webinar. He projects that U.S. growth will accelerate to 2.3% in 2026, an increase from 2.2% last year.

"It's not clear [if] the Fed necessarily has major macroeconomic justifications for cutting rates aggressively this year," Neumann added.

For context, the U.S. Fed delivered a 25 basis point cut in its December meeting last year, which brought the federal funds rate to a range of 3.5%-3.75%.

The Fed's policy decisions have unfolded amid heightened tensions between the Trump administration and Fed Chair Jerome Powell.

The central bank was served grand jury subpoenas concerning renovations at its headquarters. Powell alleged this action was a direct result of the Fed's refusal to align its interest rate policy with President Donald Trump's preferences.

While Powell's term as Fed Chair is set to end in May, he will remain a governor at the central bank until January 2028. The Federal Open Market Committee (FOMC) has scheduled its next policy meeting for January 27 and 28.

Romania’s central bank is set to maintain one of the highest interest rates in the European Union as it struggles to control inflation that is running close to 10%. The inflation rate is expected to cool only gradually over the coming months.

According to a Bloomberg survey, economists unanimously predict the National Bank of Romania will hold its benchmark interest rate at 6.5% for the eleventh consecutive meeting.

This rate, matched within the EU only by neighboring Hungary, has been in place for a year and a half. During this period, the Black Sea nation has navigated significant political turmoil and a market selloff.

The central bank faces persistent price pressures driven by the government's fiscal policies. In an effort to reduce the EU's widest budget deficit, the ruling coalition has implemented several key measures:

• Increases in value-added tax (VAT)

• Higher excise duties

• Removal of a price cap on energy

These actions contributed to an inflation rate of 9.7% in December.

Despite the high inflation, a rate hike is considered improbable. Kevin Daly, an economist at Goldman Sachs Group Inc. in London, noted that the primary drivers of inflation are beyond the central bank's direct control.

"The elevated inflation has primarily been due to two factors that are beyond the control of monetary policy — the removal of the energy price cap and a VAT rate hike," Daly stated in a report. He predicts that interest rates will likely remain on hold until at least the third quarter of this year.

Governor Mugur Isarescu also signaled in November that any discussions about potential rate cuts would likely not begin before the summer. The central bank, which targets an inflation range of 1.5% to 3.5%, forecasts that price growth will slow to 3.7% by the end of this year.

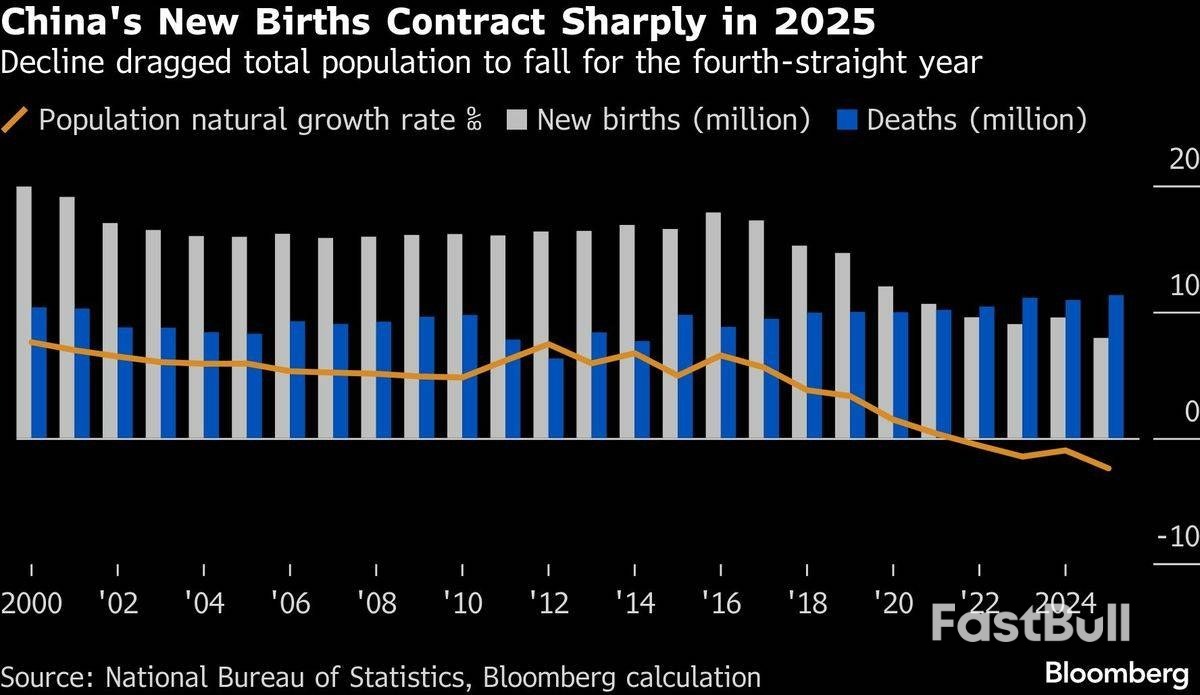

China's birthrate fell last year to its lowest level since 1949, highlighting a deepening demographic struggle for Beijing even as officials roll out new subsidies to encourage couples to have more children.

The number of births per 1,000 people dropped to 5.6, the lowest since at least the founding of the People's Republic, according to data released by the National Statistics Bureau on Monday. The number of newborns decreased 1.6 million, the most since 2020, to 7.9 million.

The figure is a setback for President Xi Jinping's campaign to promote a fertility-friendly society including by offering cash rewards for parents. The total population fell by 3.4 million, the sharpest drop since the 1960 Great Famine under former leader Mao Zedong, to 1.405 billion.

A shrinking workforce and ageing population are major threats to the world's second-largest economy. As the elderly cohort grows, the worker-to-retiree ratio shrinks, piling more pressure on the underfunded pension system.

To counter these structural headwinds, the Chinese government has implemented a series of pro-natalist policies in recent years, from extending paternity and maternity leave to making it easier to register a marriage.

Among the incentives, couples are offered about US$500 (RM2,028.50) a year for each child born on or after Jan 1, 2025, until they reach the age of three. Starting this year, the government also imposed a 13% value-added tax on contraceptive drugs and devices, including morning-after pills and condoms.

He Yafu, an independent demographer, said the amount of government subsidies is "too small" to meaningfully lift birth rates.

He attributed the drop to young people's unwillingness to get married and a decline in the number of women of childbearing age, which fell by 16 million from 2020 to 2025.

This shrinking pool of potential mothers is partly the result of the one-child policy, which hollowed out the demographic base for future growth before being scrapped in 2015.

A basket of exchange-traded funds owned by China's so-called national team saw another day of record outflows on Friday, adding to signs that authorities are stepping in to curb the risk of a bubble.

Eight ETFs tracked by Bloomberg, which include the Huatai Pinebridge CSI 300 Index ETF and E Fund ChiNext ETF, saw a record 101 billion yuan ($14.5 billion) in outflows on Friday. Though state funds' involvement will be evident only through filings, analysts and traders have attributed those flows as proof that the national team is acting to cool markets.

The back-to-back record outflow is the first clear sign that the national team isn't simply taking a buy-and-hold strategy, but appears to be actively in the market working to smooth out moves both to the upside and downside. It's occurring as concern rises about crowding and speculation in sectors such as commercial rockets.

The securities watchdog on Friday pledged to step up oversight of market manipulation and to prevent wild swings, another move seen as trying to rein in major fluctuations. Earlier last week, regulators also tightened rules on margin financing.

Bloomberg Intelligence estimates that the selling by Central Huijin Investment on Thursday alone may have reached around $10 billion, marking its first move to offload holdings in three years, after amassing around $180 billion in such assets as of the end of August.

"Eight of 23 ETFs held by Central Huijin recorded abnormally large trade sizes, a typical indicator of national team activity, analysts including Rebecca Sin wrote in a note. "Additional selling can be expected if the intervention fails to cool markets, so far taking a targeted approach focusing on the tech-heavy Star 50 and ChiNext indexes."

Traders have pointed to clear signs of intervention throughout Friday in the expanded turnover in some of the ETFs that came in conjunction with market downdrafts in the session on Friday. However some analysts say that the moves may only be meant to slow, rather than end, the rally.

"Record outflows in stabilization fund ETFs and other market cooling factors should be read as a preemptive move to cool sentiment in the middle of a rally, not the end of an uptrend," Founder Securities analysts including Yuan Daoyu wrote in a note. Investors should watch whether the outflows subside and whether margin trades start to decelerate as signals of when the cooling measures may taper off, they added.

XRP fell for a fifth consecutive day on Sunday, January 18, and extended its losses in early trading on Monday, January 19.

Delays to the US Senate Banking Committee's Market Structure Bill markup vote triggered a sharp pullback from a January 6 high of $2.4151. However, increased geopolitical tensions added to the negative sentiment.

US President Trump announced fresh tariffs over the weekend, reviving the risk of a US-EU trade war. XRP and the broader crypto market previously came under selling pressure as President Trump rolled out tariffs in 2024.

Crucially, XRP dropped below the $2.0 psychological level, despite strong demand for XRP-spot ETFs through January. Nevertheless, the medium-term outlook remains bullish.

Below, I will explore the key drivers behind recent price trends, the medium-term (4-8 weeks) outlook, and the key technical levels traders should watch.

US President Trump announced a 10% tariff on eight European countries on Saturday, January 17, including Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. The tariffs will take effect on February 1. Tariffs will then increase to 25% on June 1 as Trump pressures the EU to allow the US to acquire Greenland. Trump stated:

"This Tariff will be due and payable until such time as a Deal is reached for the Complete and Total purchase of Greenland."

The EU is reportedly preparing to retaliate, fueling fears of a full-blown trade war. The Kobeissi Letter reported:

"The EU is preparing up to €93 billion in tariffs and other restrictions on US companies in response to President Trump's 10% tariff and demands for Greenland. Expect a busy night ahead for tariff headlines. US stock market futures open in 4 hours."

Notably, the Dow Jones E-mini fell 0.66% in early trading on Monday, January 19. The Nasdaq 100 E-mini and the S&P 500 E-mini slid 1.08% and 0.80%, respectively.

XRP and the broader market remain exposed to tariff risks. XRP plunged from $2.8406 to $0.7773 (Binance) on October 10 before closing down 15.29% at $2.3756 in response to Trump threatening a 100% tariff on China.

XRPUSD – Daily Chart – 190126 – Tariffs

XRPUSD – Daily Chart – 190126 – TariffsWhile markets reacted to the escalation in the US-EU trade war, analysts continued to criticize the efforts of US banks to block stablecoin rewards.

Last week, Coinbase (COIN) withdrew its support for the US Senate Banking Committee's draft text of the Market Structure Bill. The Banking Committee responded by postponing its markup vote on the draft text, kick-starting XRP's retreat. Coinbase CEO Brian Armstrong referenced text relating to stablecoin rewards, stating:

"Draft amendments that would kill rewards on stablecoins, allowing banks to ban their competition."

US banks have warned that crypto legislation permitting stablecoin rewards could trigger more than $6 trillion in deposit outflows from the US banking system. The debate continued over whether US banks' push to block stablecoin rewards is competition-related or protection-related.

Bloomberg Intelligence ETF Analyst James Seyffart commented on US banks' concerns over stablecoin rewards, stating:

"I don't fully understand the Banks' argument here. There are so many high yield savings accounts out there that offer 3% or more. Betterment, Marcus/Goldman, CIT, SoFi, Amex, Wealthfront, etc. How are these not the same pressure on<0.1% yield deposits as stablecoin yields?"

Recent price action has highlighted XRP's sensitivity to developments in crypto-related legislation.

XRP rallied from $1.8103 on December 31 to a January 6 high of $2.4151 in response to the Banking Committee announcing a January 15 markup vote on the draft text. However, XRP has fallen to a January 19 low of $1.8502 following the Banking Committee's postponement of the markup vote.

Despite the delays to the markup vote, optimism over US lawmakers delivering much-needed crypto legislation supports a bullish medium-term price outlook for XRP.

Coinbase CEO Brian Armstrong fueled the optimism after withdrawing support for the draft text, stating:

"I'm actually quite optimistic that we will get to the right outcome with continued effort. We will keep showing up and working with everyone to get there."

XRPUSD – Daily Chart – 190126 – Market Structure Bill Price Action 2026

XRPUSD – Daily Chart – 190126 – Market Structure Bill Price Action 2026Strong demand for XRP-spot ETFs, the progress of the Market Structure Bill, and increased XRP utility reaffirm a cautiously positive short-term outlook (1-4 weeks), with a $2.5 price target.

Furthermore, hopes that US lawmakers will pass crypto-friendly legislation reinforced the bullish longer-term price targets:

Several events could change the positive outlook. These include:

These events would likely weigh on sentiment, sending XRP below $1.85, which would signal a bearish trend reversal.

XRP slid 3.4% on Sunday, January 18, following the previous day's 0.27% loss, closing at $1.9915. The token faced heavier selling pressure than the broader crypto market cap, which declined 1.60%.

A five-day losing streak left XRP below its 50-day and 200-day EMAs, signaling a bearish bias. However, the bullish fundamentals continue to offset technicals, limiting the downside.

Key technical levels to watch include:

Viewing the daily chart, a break above $2.0 would bring the 50-day EMA into play. A sustained move through the 50-day EMA would indicate a near-term bullish trend reversal. A bullish trend reversal would open the door to testing $2.2. A breakout above $2.2 would enable the bulls to target the 200-day EMA.

Significantly, a breakout above the EMAs would reaffirm the bullish medium- and longer-term price targets.

XRPUSD – Daily Chart – 190126 – EMAs

XRPUSD – Daily Chart – 190126 – EMAsNear-term price drivers include:

Holding above $1.85 will be crucial for the short- to medium-term outlook. Positive fundamentals, including spot ETF demand and increased XRP utility, continue to counter bearish technicals, indicating a near-term recovery. The token's recovery from a December low of $1.7712 and January gains of 6.25% reaffirmed the bullish structure and short- to medium-term price projections.

A breakout above $2.0 would pave the way toward the upper trendline. A sustained move through the upper trendline would affirm the bullish trend reversal and validate the bullish structure, supporting the price targets:

However, a sustained fall below the lower trendline would invalidate the bullish structure, signaling a bearish trend reversal.

XRPUSD – Daily Chart – 190126 – Bullish Structure

XRPUSD – Daily Chart – 190126 – Bullish StructureLooking ahead, trade developments and crypto-related regulatory headlines are likely to influence XRP's price outlook.

Traders should closely monitor trade developments. Additionally, updates from the Banking Committee and Agriculture Committee will be key. This week, the Agriculture Committee will release its draft text on the Market Structure Bill. The Agriculture Committee has scheduled a markup vote on January 27.

Meanwhile, central bank chatter and XRP-spot ETF flow trends will also influence the near-term price outlook.

Increased bets on a March Fed rate cut, and a dovish BoJ neutral rate (potentially 1%-1.25%) would lift sentiment. Strong demand for XRP-spot ETFs and positive crypto-related news from Capitol Hill would reinforce the constructive bias.

In summary, these scenarios support a medium-term (4–8 weeks) move to $3.0. Meanwhile, a March Fed rate cut and the Senate passing the Market Structure Bill would reaffirm the longer-term (8–12 weeks) price target of $3.66.

Looking beyond the 12-week time horizon, these events are likely to drive XRP to its all-time high of $3.66 (Binance). A break above $3.66 would support a 6- to 12-month price target of $5.

American battery companies are shifting supply chains away from China to South Korea to comply with U.S. restrictions aimed at strengthening domestic development of drones and advanced electric aircraft.

SES AI and Amprius Technologies have both announced they will expand battery cell manufacturing capacity in South Korea, as the U.S. National Defense Authorization Act (NDAA) will bar the Department of Defense from buying made-in-China batteries beginning in October 2027.

Boston-headquartered SES AI has converted electric vehicle battery production lines in its Chungju factory to make battery cells for drones and electric vertical takeoff and landing (eVTOL) aircraft. Built in 2021 for EV batteries, the South Korean facility will now produce mostly drone products -- to the tune of 1 million battery cells annually -- and production could eventually be ramped up to 1 gigawatt hour (GWh), matching the company's capacity in China. One-tenth of Chungju's production will be dedicated to SES AI's evTOL vehicle customers, which include Hyundai.

SES AI founder Qichao Hu said that the pivot to South Korea is in response to a series of U.S. policies and investments aimed at developing a domestic drone industry.

"[Defense Secretary] Pete Hegseth unleashed this really fast growth in the industry," Hu said. "So I think it's an opportunity."

U.S. President Donald Trump signed an executive order last July ordering federal agencies to fast track approvals for American drone manufactures and protect the U.S. drone supply chain from "foreign influence."

Producing a battery pouch cell in South Korea is two times more expensive than making it in its factory in China, Hu said. But, as demand grows for NDAA-compliant batteries, products from the South Korean factory will make up nearly half of its sales this year, he added. SES AI's Chinese factory and its contract manufacturers will continue to serve customers that are not U.S. defense contractors.

American drone executives have raised concerns over the industry's supply chain after Beijing barred Skydio and BRINC Drones from procuring from Chinese companies last April. After being added to the Chinese Commerce Ministry's "unreliable entity" list, Skydio began to ration batteries as it sought alternative suppliers.

America's drone industry is still in its early days and it will take time and capital for it to be able to meet the needs of the U.S. military.

In comparison, China's DJI is the world's largest drone manufacturer and accounts for about 70% of all commercial drones sold globally for hobby and industrial use.

Amprius Technologies, meanwhile, announced in December that it will also increase production in South Korea as its sales in the U.S. grew in the third quarter last year.

The addition of three South Korean companies to its list of contract manufacturers means it now works with as many such producers in that country as it does in China.

Tom Stepien, CEO of Amprius Technologies, said that while its South Korea factory serves only customers working with the U.S. government, there is growing interest from other clients in considering non-Chinese made batteries.

"I expect that drum beat for NDAA compliance will increase for sure," he said.

While the company has a pilot production line located at its headquarters in Fremont, California, producing batteries and NDAA-compliant components, it has no plans to revive construction of a Colorado factory that ceased last year as the market outlook for electric vehicles deteriorated.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up