Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump: Framework for Greenland Agreement is reached; Strong employment data boosts the Australian dollar......

Australia’s job market delivered a stunning surprise in December, with unemployment falling to a seven-month low and job creation far exceeding all forecasts. The robust data has sent shockwaves through financial markets, with traders now pricing in a greater than 50% chance of an interest rate hike from the Reserve Bank of Australia (RBA) next month.

The market reaction was swift. The Australian dollar surged 0.4% to a 15-month high of $0.6791, while yields on three-year government bonds climbed to a 14-month peak of 4.227%.

Before the data release, investors saw only a 29% probability of a rate hike on February 3. That figure has now jumped to 53%, signaling a dramatic shift in expectations for the RBA's next move.

"We're now closer to an RBA rate rise," noted Russel Chesler, head of investments and capital markets at VanEck. "While it's good news that Australians are fully employed, this is another indicator of a robust economy and inflation levels that are still too high for the RBA."

Data from the Australian Bureau of Statistics (ABS) painted a picture of a resilient labor market, defying predictions of a slowdown.

• Unemployment Rate: Dropped to 4.1% from 4.3% in November, well below the 4.4% rate analysts and the RBA itself had forecast for the December quarter.

• Job Growth: The economy added a massive 65,200 net new jobs, smashing market expectations for a 30,000 gain and reversing a revised 28,700 drop from the previous month.

• Full-Time Employment: Rebounded strongly with an increase of 54,800 positions.

• Participation: The participation rate edged up to 66.7%, and total hours worked grew by 0.4% to a record high of over 2 billion hours.

The ABS suggested the strength was partly driven by a festive season surge, with more young people between the ages of 15 and 24 entering the workforce. However, the data also showed that annual job growth has moderated, slowing to 1.1% in December from 3.5% at the start of the year.

This unexpectedly strong employment report, combined with record-high house prices and healthy consumer spending, raises questions about whether current monetary policy is tight enough. Despite three rate cuts last year that brought the cash rate to 3.6%, the economy continues to show signs of significant momentum.

The focus now shifts entirely to the fourth-quarter inflation figures, due next Wednesday. This data release is widely seen as the final piece of the puzzle that will determine whether the RBA hikes rates in February.

"The magic number for trimmed mean inflation is 3.2%," said Harry Murphy Cruise, head of economic research for Oxford Economics Australia. He explained that a reading above this level would likely warrant a rate hike, while a figure at or below it should give the RBA board reason to hold steady.

This sentiment is echoed by some of the country's largest financial institutions. Both the Commonwealth Bank of Australia and the National Australia Bank have been calling for a February rate hike since late last year, arguing that the economy is running up against its limits.

Several people were missing following a landslide near a campsite in New Zealand's North Island on Thursday, as heavy rains caused widespread damage, with homes being evacuated, thousands without power and roads closed.

Emergency services were responding to a landslide near a campsite in Mount Maunganui, a popular tourist spot in the Bay of Plenty region along the northern coast of New Zealand.

The campsite has been evacuated and emergency services are working to locate anybody who remains in the area, police said in a statement.

Local media reports said helicopters have also been deployed to support ongoing search and rescue efforts.

Prime Minister Christopher Luxon said on X that he was "actively monitoring situations across the country – including the major incident in Mt Maunganui", adding extreme weather continues to cause dangerous conditions across the North Island.

Emergency Management and Recovery Minister Mark Mitchell said on Radio NZ that the heavy rains hit almost the entire eastern seaboard of the North Island.

"The good news is everyone responded very quickly. There was time to get prepared, and that helps to mitigate and create a strong response," he said.

New Zealand Transport Authority reported a number of main road closures in Northland, Bay of Plenty and Waikato. Local authorities said some small communities remain cut off due to damage to the roads.

New Zealand forecaster MetService has lifted all weather warnings in the North Island as the tropical low moves east. Some warnings remain in place for the South Island, but they are expected to ease on Thursday, it added.

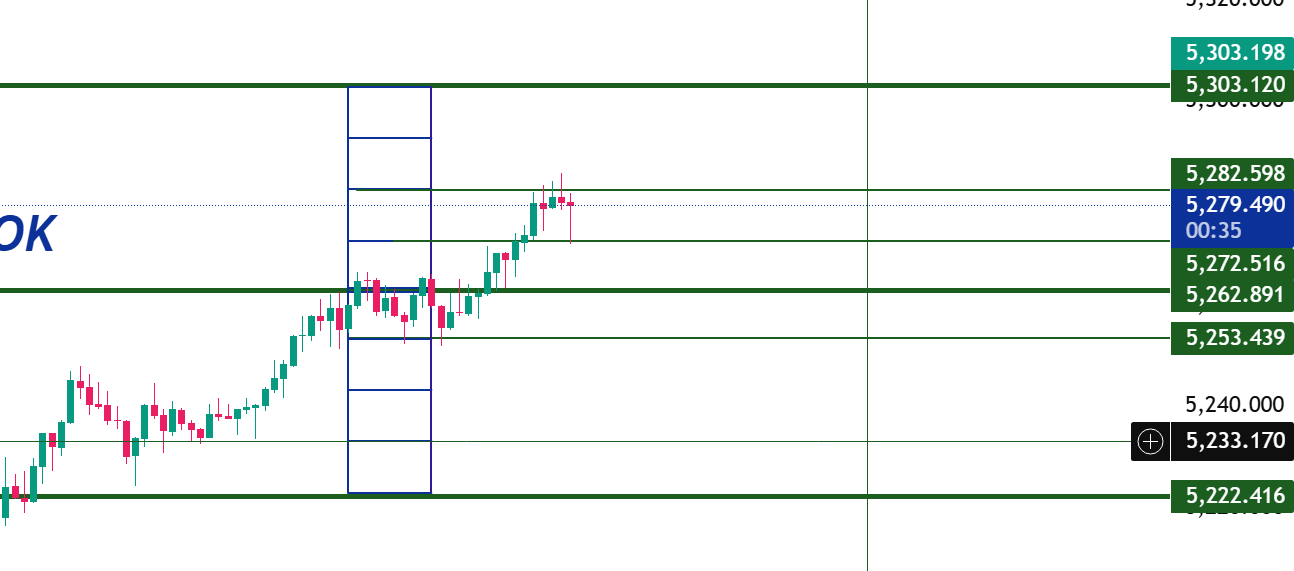

Gold prices retreated during Asian trading on Thursday, pulling back from a record high set in the previous session. The decline in safe-haven demand followed comments from U.S. President Donald Trump, who stepped back from tariff threats linked to a dispute over Greenland.

The precious metal saw a significant reversal after a strong performance.

• Spot gold dropped 0.7% to $4,799.55 per ounce. This came after it reached a record high of $4,888.1 per ounce in the prior session.

• U.S. gold futures for the March contract fell 0.8%, settling at $4,801.75 per ounce.

The rally earlier in the week was driven by investors seeking shelter from global uncertainty, pushing bullion close to the key psychological level of $5,000 per ounce. The initial surge was fueled by heightened geopolitical risk stemming from a transatlantic dispute over Greenland and threatened tariffs on European imports.

The catalyst for the pullback came from President Trump’s remarks at the World Economic Forum in Davos. He announced that he would not impose the threatened tariffs and ruled out using force in the dispute over the Danish territory.

Trump signaled that a "framework" deal to resolve tensions with NATO allies was on the horizon. "It's a long-term deal. It's the ultimate long-term deal," he told reporters. "It puts everybody in a really good position, especially as it pertains to security and to minerals."

These comments swiftly reduced the market’s appetite for safe-haven assets like gold, causing prices to correct.

A minor rebound in the U.S. dollar also contributed to gold's weakness. The US Dollar Index, which measures the greenback against a basket of other currencies, traded marginally higher after posting a 0.1% gain in the previous session. A stronger dollar typically puts pressure on gold prices, as it makes the dollar-denominated commodity more expensive for buyers using other currencies.

Valero (VLO.N) bought a cargo of Venezuelan crude oil, two sources said on Wednesday, the first deal by a U.S. Gulf Coast refiner struck as part of Washington's deal with Caracas to buy up to 50 million barrels of the South American country's crude.

Valero bought the crude from trading house Vitol, one of the two sources said. The crude was traded for delivery to the U.S. Gulf Coast at a discount of about $8.50 to $9.50 to Brent crude , two sources said.

While Valero has been a buyer of Venezuelan crude through Venezuelan state oil company's partner, Chevron (CVX.N), the deal would mark the first purchase from trading houses that were only authorized this month to market crude from Venezuela.

Offers of Venezuelan flagship Merey heavy crude to U.S. refiners began last week at a discount of between $6 and $7.50 per barrel to Brent.

Before sanctions were imposed in 2019, several large U.S. Gulf Coast refineries bought and processed about 800,000 barrels per day of Venezuela's heavy oil, according to U.S. government data.

NATO Secretary-General Mark Rutte confirmed that the status of Greenland as part of Denmark was not discussed in his recent talks with U.S. President Donald Trump. The statement, made during an interview on Fox News, follows a significant shift in Trump's approach to the strategic Arctic territory.

President Trump has backed away from earlier threats to use tariffs or military force to gain control of Greenland. Instead, he is now signaling that a new agreement among Western Arctic allies is achievable.

After his meeting with Rutte, Trump suggested a deal could be forged over the island of 57,000 people. Such an agreement would aim to satisfy U.S. strategic interests, including the development of a "Golden Dome" missile-defense system and securing access to the island's critical minerals.

Previously, Trump had repeatedly stated that Washington needed to own Greenland to block potential Russian or Chinese military expansion into the resource-rich and strategically vital Arctic.

According to Rutte, the conversation with Trump centered on a shared goal: protecting the Arctic from growing external influence.

When asked if a new framework deal would keep Greenland under Danish sovereignty, Rutte replied, "That issue did not come up anymore in my conversations tonight with the president."

He explained that Trump is "very much focused on what do we need to do to make sure that that huge Arctic region—where change is taking place at the moment, where the Chinese and the Russians are more and more active—how we can protect it."

This indicates a new emphasis on cooperative security in the region, driven by concerns over the ambitions of Russia and China.

Context: Greenland's Stance is Unchanged

Despite the shifting U.S. tone, both Greenlandic and Danish officials have maintained that Greenland is not for sale. The United States and Denmark are both founding members of the NATO alliance. Trump's foreign policy has been characterized by many experts as imperialist.

Speaking at the Davos forum on January 13, 2026, President Donald Trump declared victory over inflation, framing it as a core achievement of his administration's economic strategy. The announcement pointed to a combination of effective tariffs and deregulation as the primary drivers behind the improved economic climate.

According to a White House release, the claim is supported by declining inflation rates, which have fallen to 2.7%, alongside notable wage growth for American workers.

The Trump administration attributes its success to a specific set of policy outcomes and fiscal management. The core evidence cited includes:

• Reduced Federal Spending: A cut of $100 billion from the federal budget.

• Real Wage Growth: A 4% increase in real wages.

• Lower Trade Deficits: A significant reduction in trade imbalances since the start of the term.

In his address, President Trump highlighted these metrics as proof of a thriving economy. "Growth is exploding, productivity is surging, investment is soaring, incomes are rising, inflation has been defeated," he stated.

Despite the confident declaration, the immediate impact on global markets has been limited. The cryptocurrency sector, in particular, showed little to no reaction, with major stakeholders remaining silent on the news.

Traditional financial markets responded with slight optimism, reflecting a broader trend of macroeconomic improvement during the post-pandemic recovery. However, the announcement itself did not trigger any major shifts in trading activity.

While the administration celebrates these figures, analysts suggest that long-term monitoring is necessary to confirm a sustained victory over inflation. Historical trends show that macroeconomic claims often require more time to be fully validated.

The announcement also exists within a contested political landscape. While the White House promotes the benefits of its policies for workers, groups like the Senate Democrats have previously criticized the administration's economic approach, particularly concerning its impact on areas like healthcare. The long-term effects on regulation and investment landscapes remain a key point of uncertainty.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up