Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)A:--

F: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)A:--

F: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)A:--

F: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)A:--

F: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)A:--

F: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)A:--

F: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)A:--

F: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)A:--

F: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)A:--

F: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)A:--

F: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)A:--

F: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

Japan PPI MoM (Dec)

Japan PPI MoM (Dec)--

F: --

P: --

Australia Consumer Inflation Expectations (Jan)

Australia Consumer Inflation Expectations (Jan)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Dec)

U.K. 3-Month RICS House Price Balance (Dec)--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest Rate--

F: --

P: --

Saudi Arabia CPI YoY (Dec)

Saudi Arabia CPI YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Nov)

U.K. Services Index MoM (SA) (Nov)--

F: --

P: --

U.K. Services Index YoY (Nov)

U.K. Services Index YoY (Nov)--

F: --

P: --

U.K. Manufacturing Output MoM (Nov)

U.K. Manufacturing Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance (Nov)

U.K. Trade Balance (Nov)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Nov)

U.K. Monthly GDP 3M/3M Change (Nov)--

F: --

P: --

U.K. GDP MoM (Nov)

U.K. GDP MoM (Nov)--

F: --

P: --

U.K. Industrial Output MoM (Nov)

U.K. Industrial Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Nov)

U.K. Trade Balance Non-EU (SA) (Nov)--

F: --

P: --

U.K. Trade Balance (SA) (Nov)

U.K. Trade Balance (SA) (Nov)--

F: --

P: --

U.K. Manufacturing Output YoY (Nov)

U.K. Manufacturing Output YoY (Nov)--

F: --

P: --

U.K. Construction Output MoM (SA) (Nov)

U.K. Construction Output MoM (SA) (Nov)--

F: --

P: --

U.K. Industrial Output YoY (Nov)

U.K. Industrial Output YoY (Nov)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output YoY (Nov)

U.K. Construction Output YoY (Nov)--

F: --

P: --

U.K. GDP YoY (SA) (Nov)

U.K. GDP YoY (SA) (Nov)--

F: --

P: --

U.K. Trade Balance EU (SA) (Nov)

U.K. Trade Balance EU (SA) (Nov)--

F: --

P: --

France HICP Final MoM (Dec)

France HICP Final MoM (Dec)--

F: --

P: --

Germany Annual GDP Growth

Germany Annual GDP Growth--

F: --

Italy Industrial Output YoY (SA) (Nov)

Italy Industrial Output YoY (SA) (Nov)--

F: --

P: --

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. existing home sales accelerated in December, boosted by lower mortgage rates and slow growth in house prices.

WASHINGTON, Jan 14 (Reuters) - U.S. existing home sales accelerated in December, boosted by lower mortgage rates and slow growth in house prices.

Home sales jumped 5.1% last month to a seasonally-adjusted annual rate of 4.35 million units, the National Association of Realtors said on Wednesday. Economists polled by Reuters had forecast home resales would rise to a rate of 4.21 million units. Home sales increased 1.4% on a year-over-year basis.

"In the fourth quarter, conditions began improving, with lower mortgage rates and slower home price growth," Lawrence Yun, the NAR's chief economist, said in a statement. "Inventory levels remain tight, with fewer sellers feeling eager to move, homeowners are taking their time deciding when to list or delist their homes."

Mortgage rates dropped in 2025 though they remain considerably higher than they were three years ago. President Donald Trump last week ordered the Federal Housing Finance Agency, which oversees mortgage finance giants Fannie Mae and Freddie Mac, to purchase $200 billion of bonds issued by the two companies in a bid to bring down mortgage rates.

Analysts expect the mortgage purchases to have a modest impact. Mortgage rates, which track the benchmark 10-year Treasury yield, remain elevated.

The inventory of existing homes rose 3.5% from a year ago to 1.18 million units in December. At December's sales pace, it would take 3.3 months to exhaust the current inventory of existing homes, up from 3.2 months a year ago.

The median existing home price last month increased 0.4% from a year ago to $405,400. Trump also has proposed banning institutional investors from buying single-family homes to improve affordability.

China's crude oil imports from Venezuela are set to plummet in February, crippled by a month-long U.S. blockade that has effectively trapped tankers in Venezuelan waters. The disruption marks a dramatic halt to a major global energy trade route.

Deliveries of crude and fuel oil from Venezuela to China this month are estimated to fall to just 166,000 barrels per day (bpd). This sharp decline is based on the mere 5 million barrels of Venezuelan oil that have successfully departed the country in recent weeks.

To put this into perspective, internal documents from Venezuela's state-owned oil company, PDVSA, show that combined exports to China averaged approximately 642,000 bpd throughout 2025.

The drastic reduction in oil flow is a direct result of U.S. naval operations. Since mid-December, U.S. forces have seized at least five tankers originating from Venezuela. In response, many other vessels have been forced to turn back to Venezuelan ports to avoid a similar fate.

This "oil quarantine" intensified around the January 3 capture of Nicolas Maduro by U.S. forces, leaving PDVSA unable to execute oil shipments to its customers in Asia.

Currently, Chevron is the only Western oil major with authorization from the U.S. Treasury to operate in Venezuela, but its activities are limited to shipping crude to the U.S. Gulf Coast. As a result, Venezuelan shipments to Asia, and particularly to its top customer China, have ground to a halt.

Beyond the blockade, economic factors are also dampening China's appetite for Venezuelan crude. Chinese buyers have scaled back purchases as the price advantage has narrowed. The discount for Venezuela's flagship Merey crude against the Brent benchmark has shrunk from $15 per barrel last month to $13 per barrel.

In a significant market shift, trading giants Trafigura and Vitol are now stepping in to manage the sale of Venezuelan oil at the request of the U.S. government. Following a meeting between oil executives and U.S. President Donald Trump, Trafigura confirmed it would provide logistical and marketing services.

Trade sources report that both Vitol and Trafigura are already offering Venezuelan crude to refiners in China and India for delivery in March, signaling a new, highly managed phase for the country's oil exports.

Twelve Democratic state attorneys general sued on Tuesday seeking to block the Trump administration from withholding hundreds of billions of dollars in funding from them, hospitals and universities unless they comply with new conditions they say would force them to discriminate against transgender Americans.

The state attorneys general, including from New York and California, in the lawsuit challenged conditions U.S. health agencies imposed on grants after Republican President Donald Trump signed an executive order last year instructing them to end the funding of "gender ideology." The suit was filed in federal court in Providence, Rhode Island.

That order directed the government to recognize only two sexes - male and female - and sought to undo what it described as the "misapplication" of laws prohibiting sex discrimination to protect transgender people by the administration of Democratic President Joe Biden.

The states say the U.S. Department of Health and Human Services' policy applies retroactively rather than only to new grants, exposing funding recipients to potential grant terminations, repayment demands, and civil and criminal penalties.

"This policy threatens healthcare for families, life-saving research, and education programs that help young people thrive in favor of denying the dignity and existence of transgender people," New York Attorney General Letitia James, a Democrat who is leading the lawsuit, said in a statement.

HHS, which has also sought to restrict gender-affirming care for transgender youth, referred a request for comment to the White House.

"The administration is committed to using every lever of executive power to prevent federal funds from being dispensed towards child mutilation," White House spokesperson Kush Desai said in a statement.

The lawsuit alleges that HHS under the leadership of Health Secretary Robert F. Kennedy Jr. has sought to shoehorn Trump's executive order into Title IX -- the landmark civil rights law barring sex discrimination in federally funded education programs -- by imposing retroactive conditions on grants.

Agencies within HHS did so by imposing conditions on grants that would require recipients to certify compliance with Title IX protections, which were characterized as "including the requirements" of Trump's executive order.

The agencies that have adopted the funding condition in recent months include the Centers for Medicare & Medicaid Services and the National Institutes of Health.

The lawsuit argues HHS lacks the authority to impose those conditions, has infringed on Congress' power over spending under the U.S. Constitution, and has not provided a reasoned explanation for the change in how it interprets Title IX.

Other states included in the case were Colorado, Delaware, Illinois, Michigan, Minnesota, Nevada, Oregon, Rhode Island, Vermont and Washington.

UK government bond yields have dropped to their lowest point since December 2024, driven by a combination of strong investor demand for new debt and mounting evidence of a slowing economy.

The yield on the 10-year UK government bond, or gilt, fell by four basis points to 4.36% on Wednesday, a more significant move than seen in its European counterparts. The rally gained momentum after a successful auction of £4.5 billion in 10-year notes, which was oversubscribed by more than 3.2 times, signaling robust appetite from investors.

The rally in UK bonds is underpinned by growing expectations that the Bank of England will pursue monetary easing as the nation's inflation and labor markets show signs of cooling.

A recent survey indicated that UK employers scaled back hiring again in December, adding to policymakers' concerns about a weakening jobs market. This follows slower-than-expected inflation data in November, together prompting money markets to increase wagers on future interest-rate cuts.

The financial markets are now actively anticipating policy changes from the Bank of England. Swap markets are currently implying nearly two quarter-point interest rate reductions by the end of the year. The consensus suggests the first of these cuts will be delivered within the first half of this year.

This outlook is further supported by a more cautious fiscal stance from the UK government and a strategic shift by the nation's Debt Management Office to focus debt sales on shorter-maturity bonds.

According to Jamie Searle, a strategist at Citigroup Inc., gilts are "a preferred long for 2026." He points to two primary factors supporting this view:

• Greater scope for rate cuts: The weakening economic data gives the Bank of England more room to lower interest rates.

• A more supportive issuance backdrop: The government's debt management strategy is seen as favorable for the bond market.

A top Federal Reserve official argued Wednesday that the Trump administration's push for deregulation will cool inflation, providing a fresh reason for the central bank to cut interest rates.

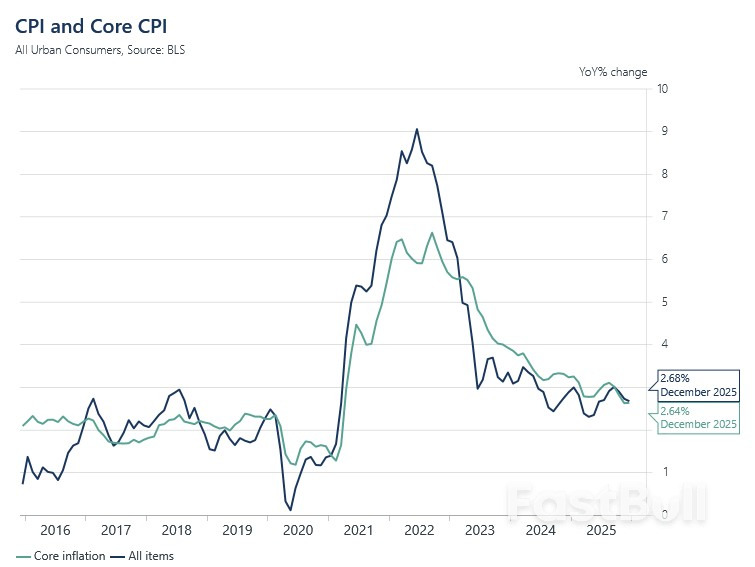

Speaking at an economic forum in Greece, Fed Governor Stephen Miran explained that these regulatory changes could have a significant macroeconomic impact. He projected that initiatives started in 2025, combined with future plans, could eliminate as much as 30% of business regulations by 2030. This, he estimated, could lower annual inflation by half a percentage point.

Miran framed the policy as a major boost to the economy's supply side. "The substantial deregulation that has occurred in 2025 will continue over at least the next three years and be a large positive shock to productivity that will put downward pressure on prices," he said.

He concluded that this dynamic ultimately justifies a shift in central bank policy. "On net, this supports a more accommodative stance of monetary policy," Miran stated.

Miran warned that if the Fed fails to account for these productivity gains, financial conditions could become unnecessarily tight. He argued that when supply and productivity improve, the central bank must respond accordingly to avoid negative outcomes.

"If the Federal Reserve fails to reduce policy rates in response to deregulation, there will be adverse consequences," he cautioned, adding that inaction could needlessly result in "deflation and economic contraction." In his view, policy has already been "tighter than it should have been."

Miran has consistently advocated for more aggressive rate cuts than many of his colleagues at the Federal Reserve, including other appointees from the Trump administration.

While some other Fed policymakers have recently acknowledged potential improvements in productivity, they remain cautious. They suggest it is too early to adjust monetary policy based on supply-side shifts whose durability and impact on inflation are still uncertain.

The Federal Reserve last lowered its policy rate by 0.25 percentage points, bringing it to the current range of 3.50%-3.75%. However, the central bank is widely expected to hold rates steady at its upcoming meeting on January 27-28.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up