Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)A:--

F: --

P: --

Japan PPI MoM (Nov)

Japan PPI MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)A:--

F: --

P: --

China, Mainland CPI YoY (Nov)

China, Mainland CPI YoY (Nov)A:--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)A:--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)A:--

F: --

P: --

Indonesia Retail Sales YoY (Oct)

Indonesia Retail Sales YoY (Oct)A:--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)A:--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks South Africa Retail Sales YoY (Oct)

South Africa Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)A:--

F: --

P: --

Brazil CPI YoY (Nov)

Brazil CPI YoY (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)A:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Dec)

Turkey Overnight Lending Rate (O/N) (Dec)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Dec)

Turkey Late Liquidity Window Rate (LON) (Dec)--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Brazil Retail Sales MoM (Oct)

Brazil Retail Sales MoM (Oct)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Imports (SA) (Sept)

Canada Imports (SA) (Sept)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

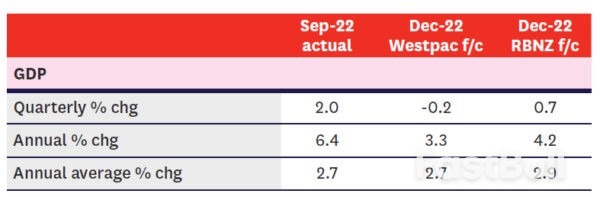

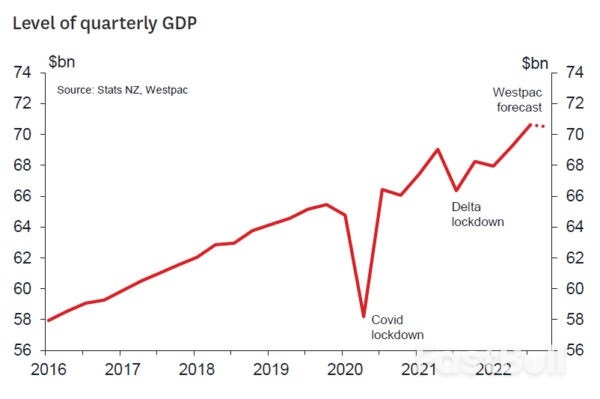

The New Zealand economy went on a tear through the middle part of last year, as the return of overseas tourists lifted GDP by almost 4% over the June and September quarters.

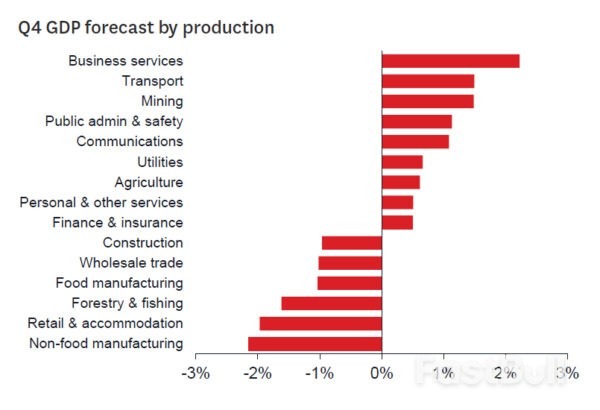

Weak Q4 not a sign of recession – yet

Weak Q4 not a sign of recession – yet Whether this is a sign that recession has come upon us earlier than expected is unclear. The GDP figures have been choppy since the Covid pandemic, with Stats NZ often having to use alternative data sources, and with the border closure in particular throwing out the normal seasonal patterns in activity. If our forecast is right, this will be the third time in two years that we see a drop in quarterly GDP that wasn't the result of a lockdown.

Whether this is a sign that recession has come upon us earlier than expected is unclear. The GDP figures have been choppy since the Covid pandemic, with Stats NZ often having to use alternative data sources, and with the border closure in particular throwing out the normal seasonal patterns in activity. If our forecast is right, this will be the third time in two years that we see a drop in quarterly GDP that wasn't the result of a lockdown. We now expect a 25bp OCR hike in April

We now expect a 25bp OCR hike in April One such shock was Friday's collapse of SVB Financial group, a startup-focused lender, which has raised concerns about its impact on the broader financial sector.

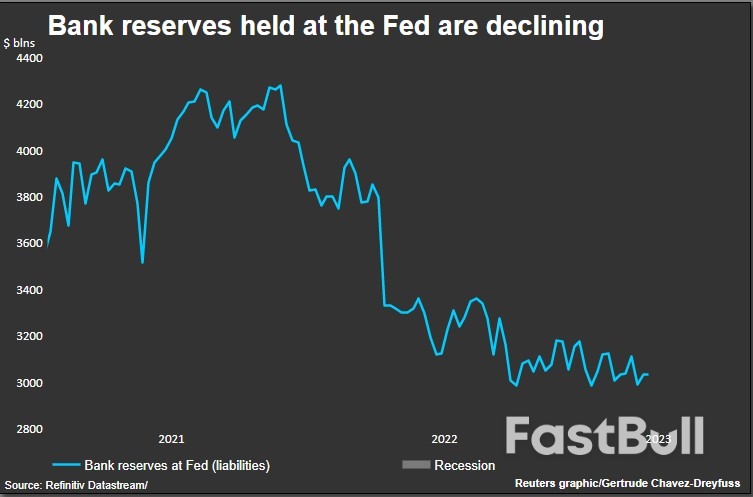

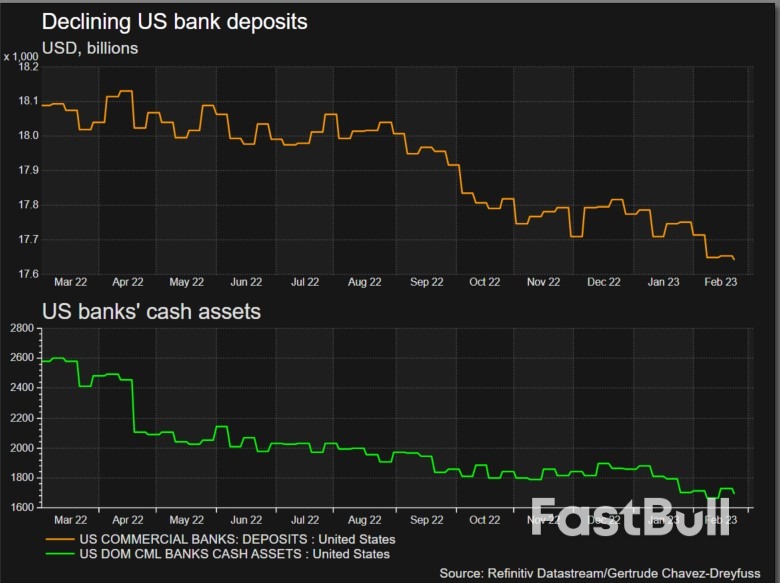

One such shock was Friday's collapse of SVB Financial group, a startup-focused lender, which has raised concerns about its impact on the broader financial sector. Deposit outflows, reverse repos, and bank reserves are all inter-related. Deposits are finding their way into money market funds which invest in reverse repos. Higher reverse repo usage, in turn, effectively cuts reserves.

Deposit outflows, reverse repos, and bank reserves are all inter-related. Deposits are finding their way into money market funds which invest in reverse repos. Higher reverse repo usage, in turn, effectively cuts reserves.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up