Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

Kang Zen

ID: 2668949

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japanese PM Takaichi reportedly weighs a snap February election, aiming to leverage high approval and a firm China stance, even as she prioritizes the economy.

Speculation is mounting that Japanese Prime Minister Sanae Takaichi may call an early general election, with reports suggesting a vote could happen as soon as February. The move would allow Japan's first female prime minister to capitalize on high approval ratings she has maintained since taking office in October.

Takaichi's popularity has been bolstered by her firm stance on China, a position that appeals to right-wing voters but has also triggered a significant diplomatic dispute with the neighboring economic power.

The possibility of a snap election gained traction after Hirofumi Yoshimura, leader of Takaichi's coalition partner, the Japan Innovation Party (Ishin), commented on the matter. In an appearance on public broadcaster NHK on Sunday, Yoshimura said he met with the prime minister on Friday and sensed her thinking on an election's timing had entered a new "stage."

"I won't be surprised if she made the decision as reported by media," Yoshimura stated, though he confirmed they did not discuss specific dates during their meeting.

Yoshimura's comments follow a report from the Yomiuri newspaper on Friday, which cited government sources. According to the newspaper, Prime Minister Takaichi is actively considering holding a snap election on either February 8 or February 15.

An early election would be a strategic maneuver to secure a stronger mandate while her public support remains strong.

Despite the growing rumors, Takaichi herself has remained non-committal. In an interview with NHK recorded on Thursday and broadcast on Sunday, the prime minister deflected questions about a potential election.

Instead, she emphasized her immediate priorities, stating she had instructed her cabinet to focus on two key areas:

• Ensuring the timely execution of the current fiscal year's supplementary budget.

• Securing parliamentary approval for the budget for the fiscal year starting in April.

"At present, I am focusing on the immediate challenge of ensuring that the public feels the benefits of our stimulus policies aimed at cushioning the blow of inflation," Takaichi said.

China, long a critical driver of global demand for liquefied natural gas (LNG), is rapidly boosting its domestic production. This strategic shift means that forecasts banking on China's massive appetite for LNG imports will need a major revision.

Less than a decade ago, China struggled to unlock its vast shale gas reserves, facing geological challenges different from those in U.S. basins. Today, the country's state-owned energy giants are not only pumping more natural gas than ever but also announcing significant new discoveries, particularly in its shale regions.

The production numbers speak for themselves. Citing official data, energy analytics firm Kpler reported that China's natural gas output reached 22.1 billion cubic meters in November of last year, a 7.1% increase year-over-year. This growth was largely driven by a faster-than-expected ramp-up of shale gas projects in the Sichuan Basin.

Based on this momentum, Kpler projects China's total domestic gas production will hit 263 billion cubic meters in 2025 and climb to 278.5 billion cubic meters this year. The continued expansion of shale gas operations in the Sichuan and Shanxi basins is expected to fuel this growth.

As with oil, a surge in domestic production inevitably curtails the need for imports, even as China increases its reliance on natural gas to meet emissions targets. Last year provided a clear example: as domestic output rose, China’s LNG imports fell to their lowest level in six years after 12 consecutive months of declines.

Looking ahead, Kpler anticipates that Chinese demand for LNG will continue to fall this year. The increase in shale gas production alone is expected to displace roughly 600,000 tons of LNG demand, bringing the country's total imports down to 73.9 million tons.

While 600,000 tons is a relatively small volume in a market where the United States alone exported over 100 million tons last year, it highlights a powerful trend. Beijing is determined to reduce its dependence on energy imports, a policy with far-reaching implications for global commodity markets that have long counted on China as the ultimate source of demand growth.

The projected decline in China's LNG demand could disrupt ambitious plans for new LNG capacity worldwide. Major exporters like the United States and Qatar are planning a wave of new supply set to come online by the end of the decade. Softening Chinese demand could shrink producer profits and complicate these projects.

Many analysts already expect an oversupplied LNG market by 2030, which would put sustained pressure on prices. China's growing self-sufficiency only adds weight to this forecast.

Competition within the LNG market is also intensifying. Amid ongoing trade disputes, China is no longer importing U.S. LNG. Instead, Russia is exporting record volumes to its neighbor. While these volumes are not yet massive, they demonstrate that gas, much like oil, will find a market if the price is right, even from sanctioned facilities.

These dynamics could be further amplified by the European Union's plan to ban Russian energy imports, including gas, next year. As the current largest buyer of Russian LNG, the EU's ban will force Moscow to redirect these flows, with China and India as the most likely destinations.

Meanwhile, pipeline gas is also set to play a larger role. Kpler estimates that imports through Russia's Power of Siberia pipeline could increase by 8 billion cubic meters compared to 2025, contributing to an overall 8% rise in pipeline imports to 80.7 billion cubic meters. In contrast, pipeline gas imports from Central Asian nations are projected to fall by 4 billion cubic meters in 2026 as those countries prioritize their own domestic demand.

Beijing's priority is clear: reduce reliance on energy imports by ramping up domestic production. However, this transition will be gradual and will eventually face natural limits. Until then, price will remain a key factor driving import decisions.

While China's pivot will undoubtedly influence the global LNG market, its impact may be less dramatic than trends in its oil demand. The reason is simple: plenty of other nations have a strong appetite for liquefied gas, especially if lower Chinese demand and new supply capacity cause prices to fall and stay there.

Recent tensions between the United States and China are showing signs of easing. Following a pivotal October 2025 meeting between President Donald Trump and President Xi Jinping, officials from both nations have launched dialogues on a range of critical issues, from fentanyl and soybeans to Ukraine and Taiwan. President Trump, in a notable shift, has moved from threatening China to courting it. The key question is whether this strategic pivot is enough to win over American public support.

Evidence suggests it might be. Before the Trump-Xi negotiations, U.S. public opinion was decidedly against Trump's aggressive stance, with a clear preference for more engagement with China. While Americans view China as a threat, they seem to consider the risks of direct competition too high. Polling indicates that if the Trump administration continues to seek a more stable equilibrium with Beijing, the American public will back the policy.

Prior to the recent diplomatic thaw, President Trump's approach to China was deeply unpopular, particularly amid escalating trade disputes. A public opinion poll from the Institute for Global Affairs at Eurasia Group, conducted from October 6–14, 2025, revealed that most U.S. voters felt Trump's policies were actively worsening tensions. Of 13 foreign policy issues surveyed, Trump's net approval was negative on 11, with his China policy ranked as the absolute worst.

This sentiment was echoed in other surveys. An October 2025 poll by the Chicago Council on Global Affairs found that 54% of the American public opposed higher tariffs on Chinese goods—the kind Trump had threatened earlier that month. For the first time since 2019, a majority of respondents believed the U.S. should pursue friendly cooperation with China. Less than four in ten Americans supported further reductions in trade or increased tariffs.

One reason for this shift may be that competition with China doesn't rank as a top daily concern for most Americans, even though they acknowledge the threat. The Institute for Global Affairs report noted that while a majority of the public views China as a moderate threat, almost none consider it a primary day-to-day worry.

Still, the perception of China as a national security risk remains strong.

• The Chicago Council found that 50% of the U.S. public sees China as a critical threat.

• The Institute for Global Affairs reported that 62% view China as at least a moderate threat.

When asked what shaped their view, respondents most often cited China's powerful technology (31%). Many also believe China has hostile intentions, with 22% saying it aims to replace the international order and 15% believing it wants to destroy the United States—a view most common among Republicans.

Despite these concerns, Trump's confrontational approach lost its appeal. For years, a tough stance on China was a rare point of bipartisan consensus, but that agreement has collapsed. By 2025, nearly a quarter of Trump's own Republican base disapproved of his China policy.

On the campaign trail, Trump promised sweeping changes to the U.S.–China relationship, including a 60% tariff on all Chinese goods, crackdowns on espionage, and a push to reshore industry. The administration appeared ready to deliver in early 2025, threatening tariffs over 100%, imposing new restrictions on Chinese student visas, and creating licensing requirements for semiconductor sales to China.

However, as public opinion turned, the administration adjusted its course. New tariffs on Chinese goods were lowered to around 20%, all restrictions on Chinese student visas were lifted, and the White House signaled an openness to the sale of advanced U.S. semiconductors to China. This suggests that despite its rhetoric, the administration has proven remarkably responsive to public sentiment.

If President Trump can steer his foreign policy toward a more stable and predictable relationship with China, he may finally gain the voter approval that previously eluded him. The challenge will be restraining his administration's inclination toward policy chaos, which appears unpopular regardless of the issue.

Economic

Cryptocurrency

Traders' Opinions

Remarks of Officials

Data Interpretation

Central Bank

Political

Stocks

The future of the U.S. economy has split investors and analysts into two distinct camps. One side anticipates a massive liquidity injection that could fuel a prolonged expansion. The other sees structural weaknesses that even aggressive stimulus can't fix, echoing the 2008 crisis when bank bailouts failed to revive the broader economy. A third group remains on the sidelines, waiting for a clearer signal.

Optimists point to the momentum from ongoing fiscal and monetary stimulus, which they expect to accelerate under a potential "Trump 2.0" administration. The Federal Reserve has already cut interest rates multiple times, and Trump has suggested he could replace Fed Chair Jerome Powell with a more dovish successor. Such a move could open the door for "ultra-dovish" rate cuts and a significant infusion of liquidity.

Some analysts believe this stimulus could be timed to secure political victories for Republicans in the midterm elections and bolster approval ratings.

This strategy draws comparisons to the deregulation policies of the 1980s under Ronald Reagan, with proponents arguing that similar policies could extend economic growth if liquidity is deployed effectively. This was a key topic in a recent episode of Token Narratives, where Bitcoin.com’s Graham Stone and David Sencil discussed the potential impact of direct liquidity measures.

One key example is Trump's directive for Fannie Mae and Freddie Mac to purchase up to $200 billion in mortgage-backed securities (MBS) to lower mortgage rates.

"Trump just went out and posted something like, 'I'm telling Freddie Mac to buy MBS.' That's like straight-up 2020, 2008-style QE," Sencil noted. "That's QE infinity. So if that kind of thing does happen... what happens when he gets control of the Fed when Powell steps down?"

Sencil concluded that such a massive liquidity injection would likely benefit risk assets, including crypto.

Conversely, the bearish camp argues that while liquidity injections may seem inevitable, they can only delay—not prevent—an economic downturn. Marc Faber, editor of the Gloom Boom & Doom Report, has warned of "doom" in 2026. He advises investors to exit U.S. equities, citing persistent asset price inflation and the Federal Reserve’s weakening control over bond markets. In his view, the era of exceptional market gains is over, with inflation and economic strain set to rise.

Other bearish arguments focus on several key risks:

• Consumer Strain: Rising debt levels and financial pressure on households could overwhelm the positive effects of stimulus.

• Asset Bubbles: Valuations in the tech and AI sectors appear increasingly frothy and vulnerable to a correction.

• Political Risk: Sliding approval ratings for Trump and the upcoming 2026 midterms could trigger a premature "Trump put"—an attempt to boost the market for political gain that may not be sustainable.

These analysts believe the era of effective quantitative easing has passed, and any new interventions may come too late to alter the fundamental trajectory.

Forecasts for a 2026 recession vary. JPMorgan Global Research estimates the probability of a U.S. and global downturn at 35%, driven by persistent inflation and slowing growth.

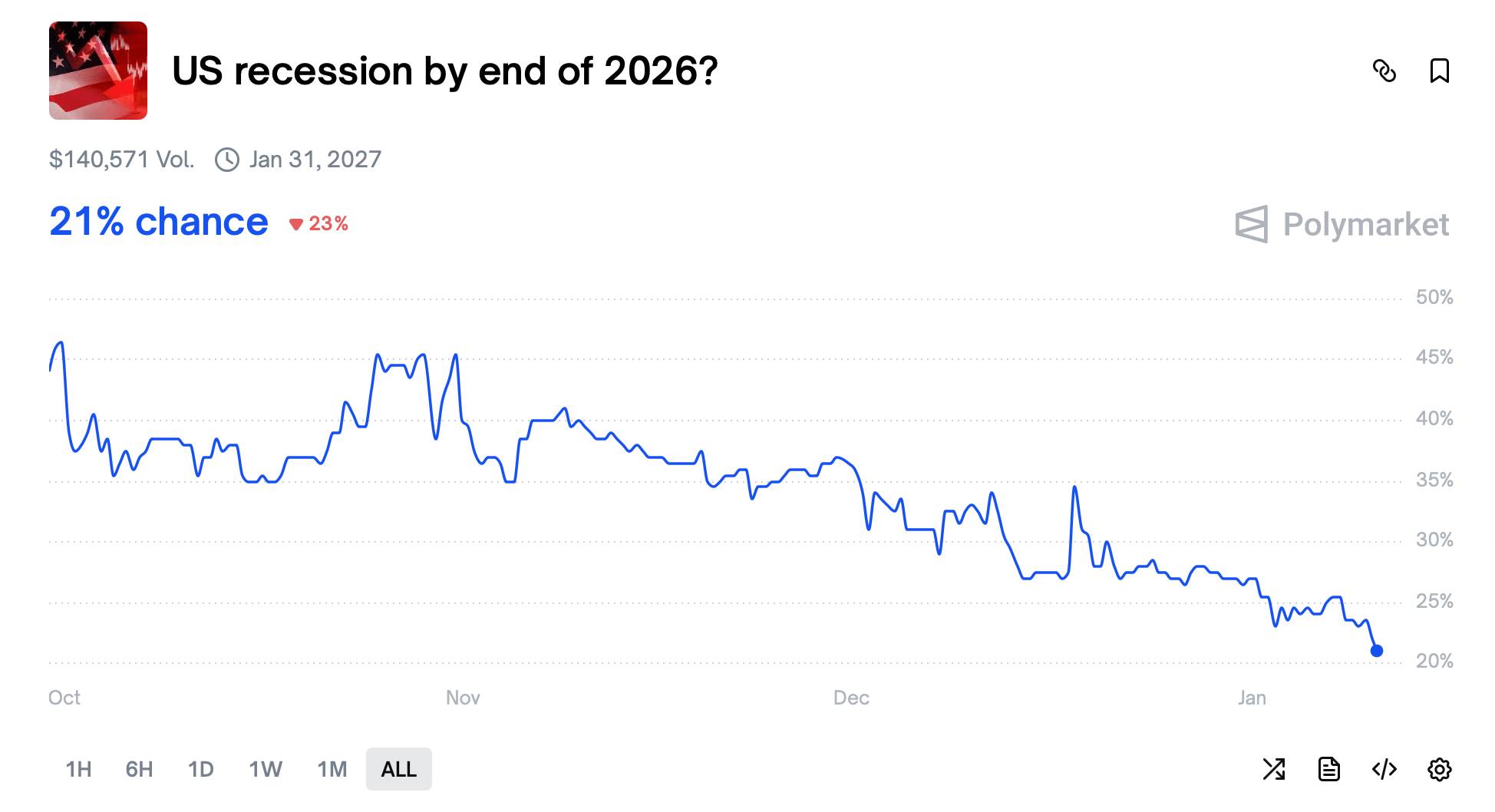

Prediction markets, however, are pricing in lower odds. As of January 10, 2026, bettors on Polymarket gave a 21% chance of a U.S. recession by the end of the year, in a market that has seen over $140,571 in volume.

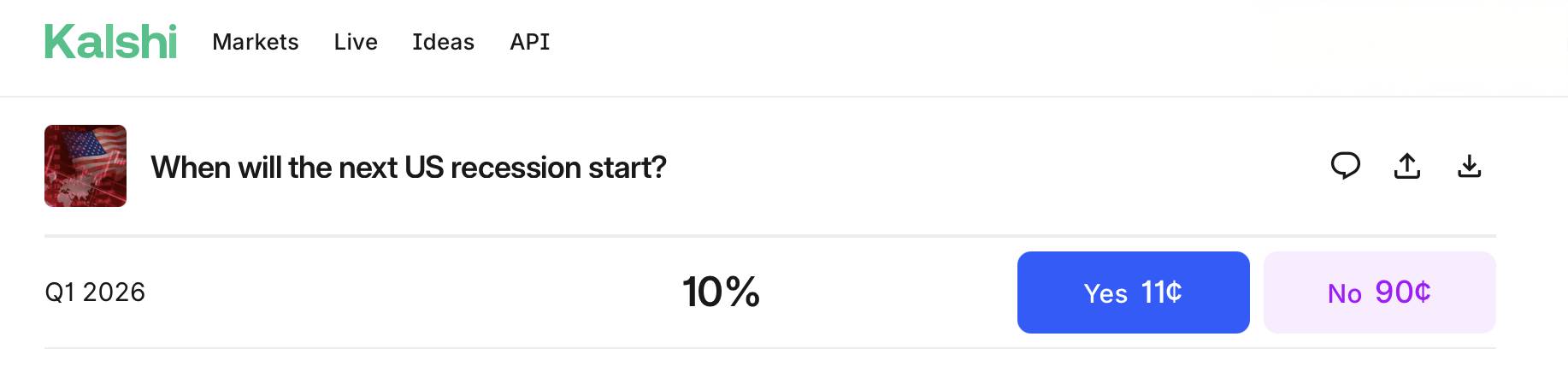

A separate contract on Kalshi places the odds of a recession beginning in the first quarter of 2026 at just 10%. The divergence in these forecasts highlights the deep uncertainty facing investors.

For now, the market remains guardedly optimistic, pricing in potential risks without fully committing to either a growth or recession scenario. This tension between stimulus hopes and underlying economic fears is likely to define the year ahead.

If a wave of liquidity arrives early and decisively, risk assets could rally, validating the expansionist view. However, if stimulus measures are delayed or prove insufficient, the bear case could quickly gain ground, sending recession probabilities higher. Until a clear direction emerges, the most crowded trade may be watching from the sidelines.

A week after US forces captured President Nicolás Maduro, Venezuela has continued to release political prisoners, including a key member of opposition leader María Corina Machado's party. The move signals a potential shift in the nation's political crisis amid intense American pressure.

Venezuelan authorities freed at least five individuals on Saturday, a development confirmed by the human rights group Foro Penal. Among those released was Virgilio Laverde, the youth coordinator for Machado's Vente Venezuela party in the state of Bolívar.

The release of political prisoners has been a central demand of the opposition. So far, approximately two dozen people have been freed, though Foro Penal estimates that more than 800 remain in detention. National Assembly head Jorge Rodríguez stated on Thursday that a significant number of prisoners would be released as a gesture of peace.

Other notable figures released include:

• Biagio Pilieri: A former lawmaker and an ally of Machado.

• Enrique Márquez: Former vice president of the opposition-led National Assembly.

• Five Spanish citizens.

The political dynamic extends beyond Venezuela, as neighboring Nicaragua also freed 20 political prisoners on Saturday following increased pressure from the United States.

Despite the releases, Venezuela's acting President, Delcy Rodriguez, maintained a defiant stance. Speaking at a food market, she vowed to secure Maduro's return. "We will not rest until we have President Maduro back; we are going to rescue him," she said, making no mention of the prisoner releases.

The United States has responded to the developments with a mix of incentives and warnings. President Donald Trump confirmed he had canceled a second wave of attacks on Venezuela, citing cooperation from the South American nation. American diplomats have reportedly visited the capital, Caracas.

Simultaneously, the US issued a security advisory on Saturday, cautioning Americans in Venezuela about reports of armed militias establishing roadblocks and searching vehicles for US citizens or signs of support for the United States.

On the economic front, President Trump signed an executive order to protect Venezuelan oil revenue held in US Treasury accounts. The order shields these funds from creditors, preventing their seizure to settle debts or other legal claims. Furthermore, Treasury Secretary Scott Bessent told Reuters that the US might lift some sanctions as early as next week to help facilitate oil sales.

Despite the political maneuvering and potential sanctions relief, major US oil companies remain wary of reinvesting in Venezuela.

On Friday, top oil executives expressed caution regarding a push from President Trump for them to commit at least $100 billion to rebuild the nation's energy sector. The head of Exxon Mobil Corp. provided a blunt assessment, calling Venezuela "uninvestable" in its current state.

Political leaders in Greenland have issued a firm rejection of American control after U.S. President Donald Trump renewed his interest in the mineral-rich territory, suggesting Washington might use force to acquire it. The unified stance comes as European allies express alarm over the White House's refusal to rule out military action.

In a joint statement, leaders of five parties in Greenland's parliament declared their national identity and right to self-determination. "We don't want to be Americans, we don't want to be Danish, we want to be Greenlanders," the statement read. "The future of Greenland must be decided by Greenlanders... without interference from other countries."

The declaration followed Trump's comment that Washington was "going to do something on Greenland, whether they like it or not."

The remarks have sent shockwaves through European capitals. French Foreign Minister Jean-Noel Barrot labeled the U.S. posture "blackmail" but expressed doubt that a military intervention would actually occur. "Greenland is a European territory, placed under the protection of NATO," he stated. "The Europeans have very powerful means to defend their interests."

In Denmark, public anxiety is palpable. A poll by the Ritzau agency found that over 38 percent of Danes believe the United States will launch an invasion of Greenland during the Trump administration.

This sentiment is echoed on the streets of Nuuk, Greenland's capital. "American? No! We were a colony for so many years. We're not ready to be a colony again," said Julius Nielsen, a 48-year-old fisherman.

Inaluk Pedersen, a 21-year-old shop assistant, noted the strain on regional ties, saying, "I feel like the United States' interference disrupts all relationships and trust" between Denmark and Greenland.

A former Danish colony until 1953, Greenland gained home rule 26 years later and has been debating full independence. While many, like telecoms worker Pitsi Mari, support the idea in principle, they urge caution. "I really like the idea of us being independent, but I think we should wait," she said.

The current ruling coalition favors a measured approach to sovereignty. However, the opposition party Naleraq, which secured 24.5 percent of the vote in the 2025 legislative elections, advocates for a faster timeline. Despite its stance on independence, Naleraq was also a signatory to the joint declaration rejecting U.S. influence.

"It's time for us to start preparing for the independence we have fought for over so many years," Naleraq MP Juno Berthelsen posted on Facebook.

President Trump has framed his interest in Greenland as a matter of national security, citing growing Russian and Chinese military activity in the Arctic. The U.S. has maintained a military base on the strategic island since World War II.

"We're not going to have Russia or China occupy Greenland. That's what they're going to do if we don't," Trump said, adding, "So we're going to be doing something with Greenland, either the nice way or the more difficult way."

While Russia and China have increased their regional military presence, neither has made a territorial claim on the island. Greenland has also drawn global attention for its vast natural resources, which include rare earth minerals and potentially large oil and gas reserves.

The crisis has triggered a flurry of diplomatic activity. U.S. Secretary of State Marco Rubio is scheduled to meet with Denmark's foreign minister and representatives from Greenland. European leaders are attempting to de-escalate the situation while managing a volatile relationship with Trump, who is nearing the end of his first year back in office.

Danish Prime Minister Mette Frederiksen issued a stark warning, stating that an invasion of Greenland would destroy "everything," including the NATO defense pact and the entire post-World War II security structure.

Trump, who first offered to buy Greenland during his previous presidential term in 2019, remained dismissive of Denmark's historical claim. "The fact that they had a boat land there 500 years ago doesn't mean that they own the land," he commented.

The United States could begin lifting sanctions on Venezuela as soon as next week to facilitate oil sales, according to Treasury Secretary Scott Bessent. The move is part of a broader strategy to re-engage with the country following the capture of Venezuelan leader Nicolas Maduro.

In an interview on Friday, Bessent stated the Treasury is examining changes that would allow the proceeds from oil sales—much of it currently stored on ships—to be repatriated to Venezuela.

"We're de-sanctioning the oil that's going to be sold," he said. The administration's focus, he explained, is on how these funds "can help... run the government, run the security services and get it to the Venezuelan people."

When asked about the timeline, Bessent confirmed that sanctions could be removed "as soon as next week," though he did not specify which measures would be lifted. This policy shift is central to the Trump administration's efforts to stabilize Venezuela and encourage the return of U.S. oil producers.

Alongside sanctions relief, the U.S. is pushing for Venezuela's reintegration into the global financial system. Bessent, who represents the U.S. at the International Monetary Fund and the World Bank, confirmed he will meet with the heads of both institutions next week to discuss their re-engagement with Venezuela.

A key part of this plan involves unlocking nearly $5 billion of Venezuela's assets held at the IMF in the form of Special Drawing Rights (SDRs). Bessent said the Treasury would be willing to convert the country's 3.59 billion SDRs, valued at approximately $4.9 billion, into dollars to help rebuild the economy. These assets are currently inaccessible to Venezuela.

This approach mirrors a previous U.S. action, when the Treasury backed a $20 billion swap line for Argentina using its SDRs to stabilize the peso. An IMF spokesperson confirmed the fund is monitoring developments in Venezuela but declined to comment on the upcoming meeting.

Venezuela has been largely cut off from international financial institutions for years. The IMF has not completed a formal economic assessment of the country since 2004, and Venezuela paid off its last World Bank loan in 2007 under the late Hugo Chavez.

Current U.S. sanctions have been a major impediment to restructuring the country's complex $150 billion debt, as they prohibit international banks from dealing with the Venezuelan government without a license.

In a related move, President Donald Trump signed an executive order on Friday to safeguard Venezuelan oil revenues held in U.S. Treasury accounts. The order blocks courts or creditors from seizing these funds, stating they should be used to help create "peace, prosperity and stability" in Venezuela.

A source familiar with internal discussions at the World Bank said the lender is in the early stages of exploring how it can assist, noting its rapid support for countries like Afghanistan and Syria after regime changes.

Bessent expressed confidence that smaller, privately held companies would be the first to re-enter Venezuela's oil sector. "I think it's going to be the typical progression where the private companies can move quickly and will come in very quickly," he said, noting they have not raised financing concerns.

While some major oil companies like Exxon Mobil remain hesitant due to past nationalizations of their assets, Bessent believes others will expand their presence. "Chevron has been there a long time and will continue to be there, so I believe that their commitment will greatly increase," he stated.

He also echoed comments from U.S. Energy Secretary Chris Wright, suggesting a role for the U.S. Export-Import Bank in guaranteeing financing for the recovering oil sector.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up