Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Venezuela Top Economic Advisor Ortega: Want Venezuela To Be Known As A Country With One Of The Highest Oil Production Levels

Swedish Central Bank Governor Thedeen:-, My Assessment Is That The Likelihoodof Very Restrictive Trade Barriers Is Nevertheless Limited

Swedish Central Bank Governor Thedeen:-The Greenland Crisis Hascreated Renewed Uncertainty Regarding The Rules That Will Apply To Our Economicexchanges With The United States

Swedish Central Bank's Seim: I Assess That The Increased Uncertainty Reduces The Risk Of Demand Driven Inflation In Sweden Somewhat

Swedish Central Bank's Deputy Governor Bunge: Will Probably Have To Monitor Both Whether The Strengthening Of The Krona Continues And Its Impact On Prices

Iceland's Central Bank: Further Decisions To Lower Interest Rates Will Depend On Clear Evidence That Inflation Is Falling Back To Bank's 2½% Inflation Target

Swedish Central Bank Governor Thedeen:-At Present I Assess That Monetarypolicy Is Following A Stable And Reasonable Course

Regional Official: Regional Invitees To Istanbul Talks Were Discussed With Iran During Planning Process

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)A:--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)A:--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)A:--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)A:--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

No matching data

View All

No data

Germany's Merz seeks Middle East energy deals, wary of US dependency and geopolitical leverage.

German Chancellor Friedrich Merz is leading a delegation to the Middle East this week in a strategic push to diversify energy supplies and lessen Germany's dependence on liquefied natural gas (LNG) from the United States.

The three-day trip begins Wednesday in Riyadh with a scheduled meeting with Crown Prince Mohammed bin Salman. The chancellor and accompanying corporate leaders will then travel to Qatar and the United Arab Emirates before returning to Berlin.

According to government officials, the visit is a core part of Germany's broader strategy to secure new global energy sources and find new markets for its industrial exports.

Germany's move is driven by growing concerns over its reliance on American energy. Following Russia's invasion of Ukraine, Germany banned Russian pipeline gas, which had previously accounted for over half of its natural gas imports. This forced a rapid pivot to other suppliers.

Today, LNG makes up about 13% of Germany's total gas imports, with a staggering 94% of that LNG coming from the U.S.

This heavy concentration is now viewed as a potential security risk, particularly after the Trump administration used energy as a bargaining chip in tariff negotiations. Last year, Europe pledged to purchase $750 billion in US energy through 2028. However, recent rhetoric from Trump has renewed fears in Berlin that this economic leverage could be used strategically.

"High dependency is a problem in view of the authoritarian development of the US government and the risk of geopolitical blackmail," explained Susanne Nies, an energy expert at the Helmholtz-Zentrum Berlin think tank. Nies suggested Germany should also explore alternatives like increased pipeline gas from Norway and LNG from Canada or Australia.

This effort follows a similar trip made by Merz's predecessor, Olaf Scholz, who visited the Gulf states in September 2022 to secure LNG deals immediately after the break with Russia. Merz's current visit aims to build on that foundation and further reduce exposure to any single supplier.

Beyond energy, the chancellor's agenda includes discussions on closer defense cooperation and the tense security situation in the region. The visit, however, is shadowed by concerns over potential renewed US attacks on Iran following a harsh crackdown on protestors in Tehran.

A significant challenge in pivoting to Gulf suppliers is a mismatch in timelines. Gulf LNG producers typically require buyers to sign long-term contracts of at least 20 years.

This conflicts with Germany's climate policy, which mandates a complete ban on all LNG imports from the end of 2043. This deadline gives German companies a strong incentive to continue using US export terminals, which offer greater contractual flexibility.

Claudia Kemfert, head of the energy department at the German Institute for Economic Research, highlighted the underlying issue. "The very high dependence on the US is problematic because it creates new geopolitical and price risks," she said. "The lesson to be learned from this is that Germany should reduce its overall dependence on fossil fuels and not just switch supplier countries."

South Korean officials are engaged in a high-stakes effort to prevent the United States from imposing a threatened 25% tariff hike, a move that could disrupt a trade agreement reached last year. The diplomatic scramble comes as lawmakers in Seoul work to pass a special bill needed to authorize investment funds pledged to the U.S.

To de-escalate the situation, South Korea's top diplomat, Cho Hyun, met with Secretary of State Marco Rubio in Washington on Tuesday. According to South Korea's Foreign Ministry, Minister Cho used the meeting to detail the country's domestic efforts to implement the tariff agreement and reaffirmed its investment commitments.

This visit follows a similar trip last week by Industry Minister Kim Jung-kwan, who held talks with Secretary of Commerce Howard Lutnick. During that meeting, Kim clarified that Seoul has no intention of delaying or failing to implement the trade deal. Cho stated before his departure that he would seek American understanding of South Korea's legislative process.

The diplomatic push was triggered after President Donald Trump announced last week that he would raise the levy on South Korean goods from 15% to 25%. Trump cited the failure of the country's legislature to formally codify the trade deal the two nations agreed upon last year.

That agreement, which took months to negotiate, was designed to lower threatened U.S. tariff rates in exchange for significant investment promises from South Korea. However, the latest threat highlights the persistent risks facing U.S. trading partners. While it remains unclear if or when Washington will formalize the tariff hike, officials in Seoul have indicated that the U.S. is holding internal discussions on the matter.

Back in South Korea, Finance Minister Koo Yun-cheol has been lobbying parliament for the swift passage of the "Special Law on Strategic Investment with the US." This legislation is crucial as it underpins South Korea's pledge to invest $350 billion in the United States.

Following a meeting with Minister Koo, the chair of the National Assembly's finance committee confirmed that they will push to hold a hearing on the law before this month's Lunar New Year holiday, signaling a potential path forward to resolving the impasse.

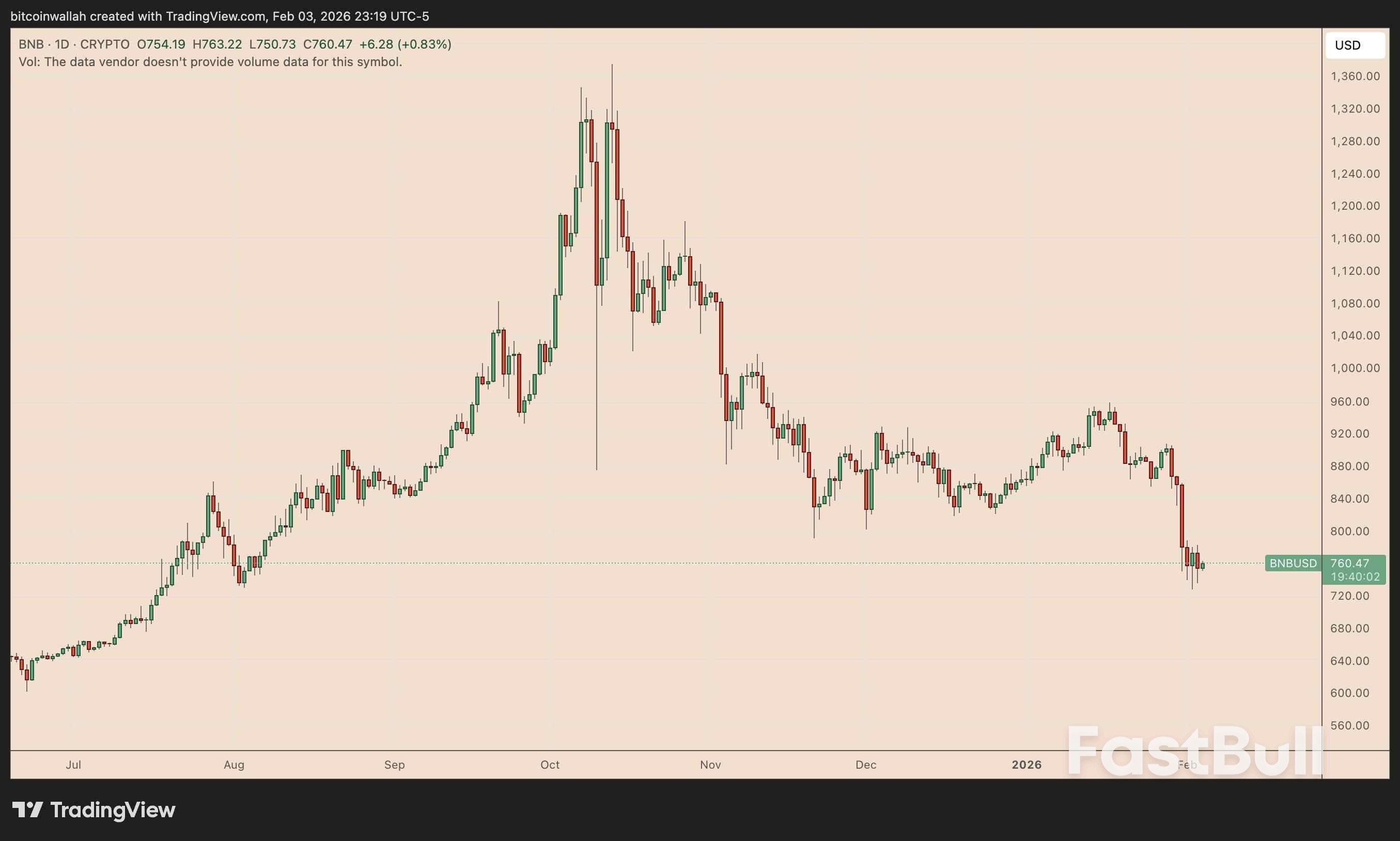

BNB (BNB), a Binance-tied cryptocurrency, may plunge by another 15% in February, continuing its slide from the October top above $1,300 and now struggling to hold above the $750 support level.

BNB/USD daily price chart. Source: TradingView

BNB/USD daily price chart. Source: TradingViewLet's examine the reasons behind my bearish outlook.

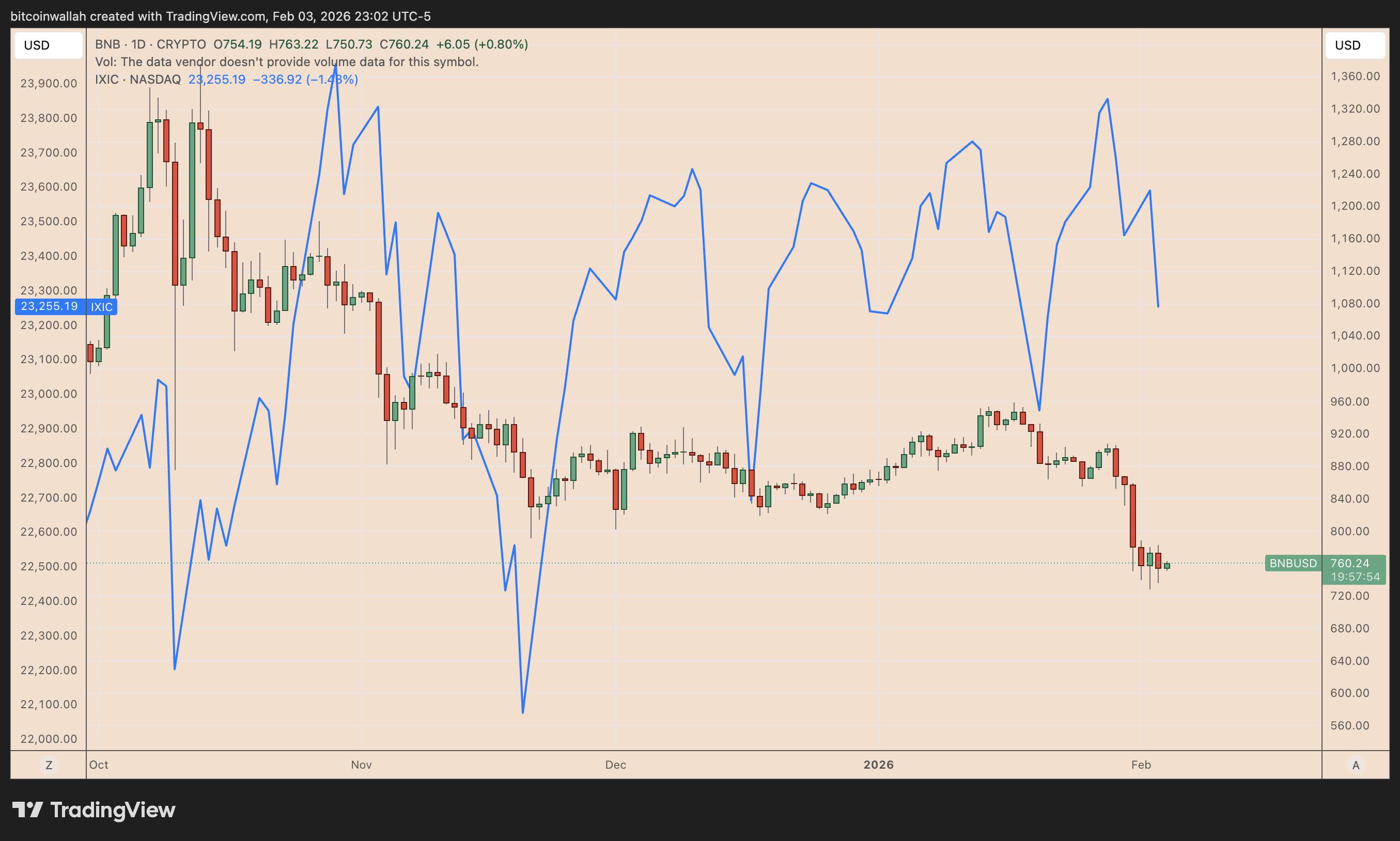

Markets have started pricing a sharper pullback in AI-linked equities after a crowded rally, and crypto has tracked that risk-off move.

A Goldman Sachs basket of US software stocks fell 6% on Tuesday, marking its biggest one-day drop since April's tariff-driven selloff. The tech-heavy Nasdaq-100 slipped 1.6%.

BNB/USD vs. Nasdaq Composite daily performance chart. Source: TradingView

BNB/USD vs. Nasdaq Composite daily performance chart. Source: TradingViewBNB fell alongside, showing how closely cryptocurrencies have been tracking the tech sector's gains and losses.

AI trades have dominated US equities for the past three years. Still, more investors now see that rally, driven by the "Magnificent Seven" megacaps, starting to fade as leadership broadens across the market.

In 2026, that shift has become clearer, with value stocks sharply outperforming growth. I therefore expect further downside in these riskier assets, as gold (XAU) and silver (XAG) show signs of recovery.

XAU/USD vs. XAG/USD daily price chart. Source: TradingView

XAU/USD vs. XAG/USD daily price chart. Source: TradingViewThat's a bid for protection from equities' overvaluations, which will likely hurt BNB.

At the same time, the nomination of Kevin Warsh as the next Fed chairman has pushed traders to reassess the "higher-for-longer" path for rates. Higher expected rates usually pressure liquidity-sensitive assets like BNB first.

BNB has also faced coin-specific pressure from negative coverage tied to Binance and co-founder Changpeng Zhao.

The latest wave centers on allegations of market manipulation linked to '10/10,' with claims circulating that Binance-linked activity amplified a price crash on Oct. 10 that triggered roughly $19 billion in liquidations across the crypto market.

Binance and CZ have pushed back on manipulation claims previously, and no new confirmed legal determination has emerged yet. Still, the headlines have weighed on sentiment during an already fragile BNB market.

On the 4-hour chart, BNB is carving a bear pennant: a sharp drop followed by tight, contracting consolidation. That structure often resolves in the direction of the prior downside move.

BNB/USD four-hour price chart. Source: TradingView

BNB/USD four-hour price chart. Source: TradingViewA breakdown from the pennant's lower trendline would keep the downtrend intact and open the door to a move toward the mid-$650s, roughly another 15% lower from current levels.

The nearby moving averages sit above the BNB price, which adds overhead resistance if bulls try to reclaim momentum.

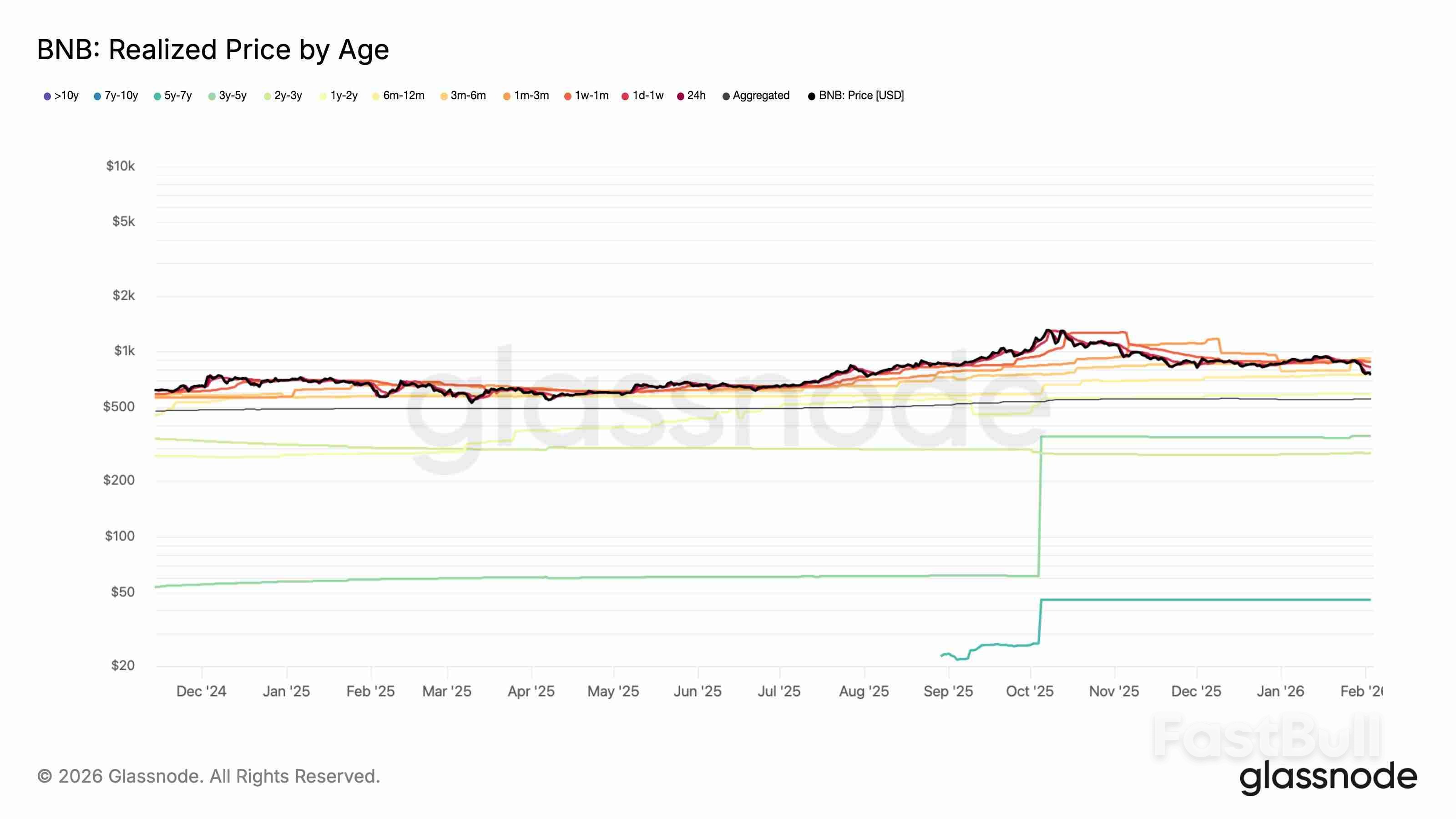

Moreover, BNB cost-basis bands keep the downside pressure intact.

Most buyers from the last 12 months are sitting on losses, according to Glassnode data. That makes quick selloffs more likely if BNB tries to bounce, because many holders will use rallies to reduce damage.

BNB realized price by age vs. price. Source: Glassnode

BNB realized price by age vs. price. Source: GlassnodeBuyers from around 12 months ago sit close to break-even. That creates another layer of selling if the price climbs back toward their average entry level.

Overall, my bias is strongly bearish toward BNB.

The British Pound rallied above 1.3650 and 1.3750 against the US Dollar. GBP/USD even climbed above 1.3850 before the bears appeared.

Looking at the 4-hour chart, the pair traded as high as 1.3869 and recently saw a downside correction. There was a drop below the 1.3800 and 1.3750 levels. The pair declined below the 38.2% Fib retracement level of the upward move from the 1.3342 swing low to the 1.3869 high.

It found bids near the 1.3640 zone. Immediate support could be 1.3645. The first major area for the bulls might be near 1.3600 or the 50% Fib retracement level of the upward move from the 1.3342 swing low to the 1.3869 high.

There is also a declining channel or a possible bullish flag forming with support at 1.3600. The main support sits at 1.3550 and the 100 simple moving average (red, 4-hour), below which the pair might test the 200 simple moving average (green, 4-hour).

If there is a fresh increase, the pair could face resistance near 1.3750. The first key hurdle could be 1.3800. The next stop for the bulls might be 1.3860, where they could face hurdles. A close above 1.3860 could open the doors for more gains. In the stated case, the bulls could aim for a move toward 1.4000.

Looking at EUR/USD, the pair corrected some gains and tested the 1.1780 support. It is now stuck in a range and facing hurdles near 1.1850.

Yen selloff returned to focus in Asian trading today as investors positioned ahead of Japan's snap election this weekend. continues to enjoy solid public support. Although recent polls show a modest dip in approval, her standing remains strong enough to anchor expectations of electoral success.

More importantly for markets, her ruling Liberal Democratic Party appears on track to comfortably exceed the 233-seat threshold needed for a single-party majority in the House of Representatives. A new survey by Asahi Shimbun, conducted between January 31 and February 1, suggests that with coalition partner Nippon Ishin, the ruling bloc could secure more than 300 of the 465 seats at stake in a landslide outcome.

Voting on February 8 will determine the next lower house, but markets are already pricing in the implications of a decisive LDP victory rather than waiting for confirmation. A commanding victory would strengthen Takaichi's hand in pursuing fiscal stimulus. Investors fear that expanded spending plans would worsen Japan's already heavy debt load, pressuring government bonds and undermining Yen.

In the US, attention briefly shifted away from shutdown risk after President Donald Trump signed a spending deal into law on Tuesday, ending a partial government shutdown. The legislation ensures full-year federal funding through September, with the exception of the Department of Homeland Security, which receives only a two-week extension as lawmakers debate immigration enforcement measures. The deal passed the Senate with broad bipartisan backing and scraped through the House by a narrow margin, removing a near-term tail risk for markets.

Elsewhere, oil prices rebounded as geopolitical risks intensified. Markets reacted after the US military said it had shot down an Iranian drone that approached the Abraham Lincoln in the Arabian Sea. The incident has raised concerns that efforts to de-escalate US–Iran tensions could falter. Oil markets are rapidly repricing geopolitical risk as the perceived probability of direct US action increases.

For the week so far, Yen sits firmly at the bottom of the FX performance table, followed by Swiss Franc and Euro. Aussie remains the strongest performer, trailed by Kiwi and Sterling. Dollar and Loonie trade in the middle of the pack.

In Asia, at the time of writing, Nikkei is down -0.92%. Hong Kong HSI is down -0.21%. China Shanghai SSE is up 0.12%. Singapore Strait Times is up 0.10%. Japan 10-year JGB yield is down -0.009 at 2.251. Overnight, DOW fell -0.34%. S&P 500 fell -0.84%. NASDAQ fell -1.43%. 10-year yield fell -0.001 to 4.274.

New Zealand's labor market delivered mixed signals in Q4. Employment rose 0.5% qoq, beating expectations for a 0.3% gain, pointing to continued job creation. Employment rate edged up to 66.7% from 66.6%, reinforcing the view that labor demand remains resilient.

At the same time, unemployment rate climbed to 5.4% from 5.3%, above expectations and the highest since the September 2015 quarter. The rise was accompanied by an increase in the labor force participation rate to 70.5% from 70.3%, suggesting that more people are entering or re-entering the job market, which is adding to slack even as hiring continues.

Wage pressures remained contained. The labor cost index rose 2.0% yoy, with private sector wages up 2.0% and public sector wages up 2.2%. The combination of steady employment growth, rising participation, and moderate wage inflation points to a labor market that is still cooling gradually.

NZD/USD is trading steadily in range after New Zealand's Q4 employment data delivered few surprises for policy expectations. The mixed report offered early hints of stabilization but stopped well short of forcing a rethink at the RBNZ. Interest rate is expected to remain on hold at 2.25% for most of the year.

The next policy move is still expected to be a hike rather than another cut, but timing remains highly uncertain. Whether that comes late in 2026 or slips into early 2027 will depend on how growth, inflation, and labor market slack evolve. For now, it is too early to draw firm conclusions.

Technically, NZD/USD continues to consolidate below the 0.6092 short-term top. While a deeper pullback cannot be ruled out, downside should be contained well above 0.5852 resistance turned support. Current rise from 0.5580 is seen as the third leg of the pattern from 0.5484 (2025 low). Above 0.6092 should send NZD/USD through 0.6119 (2025 high) to 100% projection of 0.5484 to 0.6119 from 0.5580 at 0.6215.

Longer term, the 0.62 resistance area is decisive. Sitting near 38.2% retracement of 0.7463 (2021) to 0.5484 at 0.6240, it will define whether the recovery from 0.5484 evolves into a broader bullish trend reversal or stalls as a corrective rally within a dominant downtrend.

Japan's PMI Services was finalized at 53.7 in January, up from December's 51.6. PMI Composite rose to 53.1 from 51.1. The data point to a clear acceleration in private-sector activity at the start of 2026, with growth firmly back above expansionary levels.

According to Annabel Fiddes of S&P Global Market Intelligence, business activity rebounded at the fastest pace since May 2023. Services remained the primary growth engine, posting the strongest rise in activity in nearly a year, while manufacturing output also returned to growth for the first time since last June.

The surveys suggest the recovery is becoming more broad-based. Demand improved across both manufacturing and services simultaneously for the first time in more than two-and-a-half years, a notable shift after a prolonged period of uneven momentum. Employment was another bright spot, with firms adding staff across both sectors to expand capacity in response to stronger demand.

Cost pressures eased at the start of the year, with input prices rising at their slowest pace in almost two years. However, companies raised selling prices more aggressively, indicating efforts to rebuild margins.

Daily Pivots: (S1) 211.69; (P) 212.29; (R1) 213.28;

Immediate focus is back on 214.83 as GBP/JPY's rebound accelerates higher. Firm break there will resume larger up trend to 220.90 projection level next. Rejection by 214.83 will bring more consolidations first. But in case of another dip, downside should be contained by 55 D EMA (now at 209.70) to bring rally resumption.

In the bigger picture, up trend from 123.94 (2020 low) is in progress. Next target is 61.8% projection of 148.93 (2022 low) to 208.09 (2024 high) from 184.35 at 220.90. On the downside, break of 205.30 resistance turned support is needed to indicate medium term topping. Otherwise, outlook will stay bullish even in case of deep pullback.

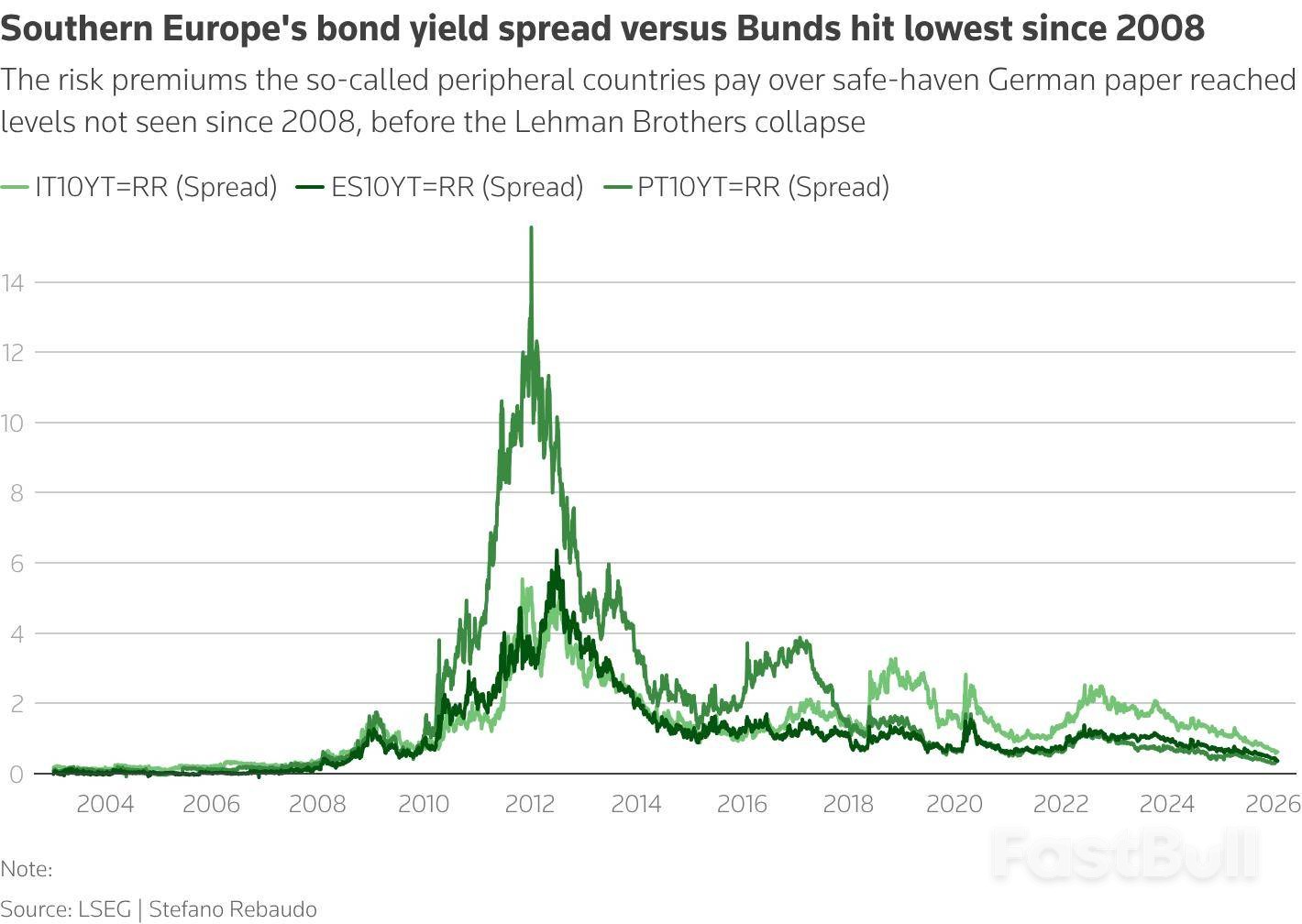

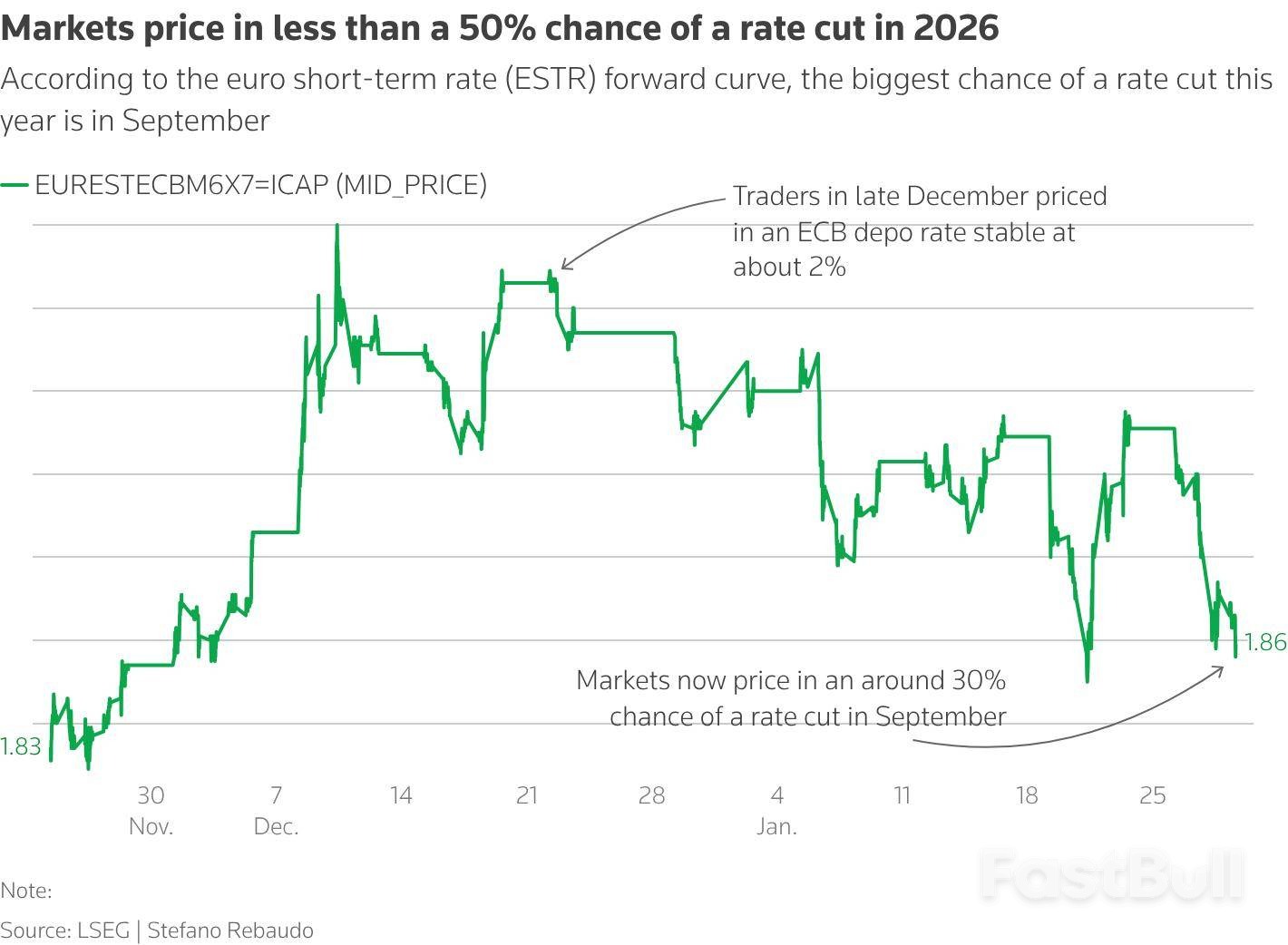

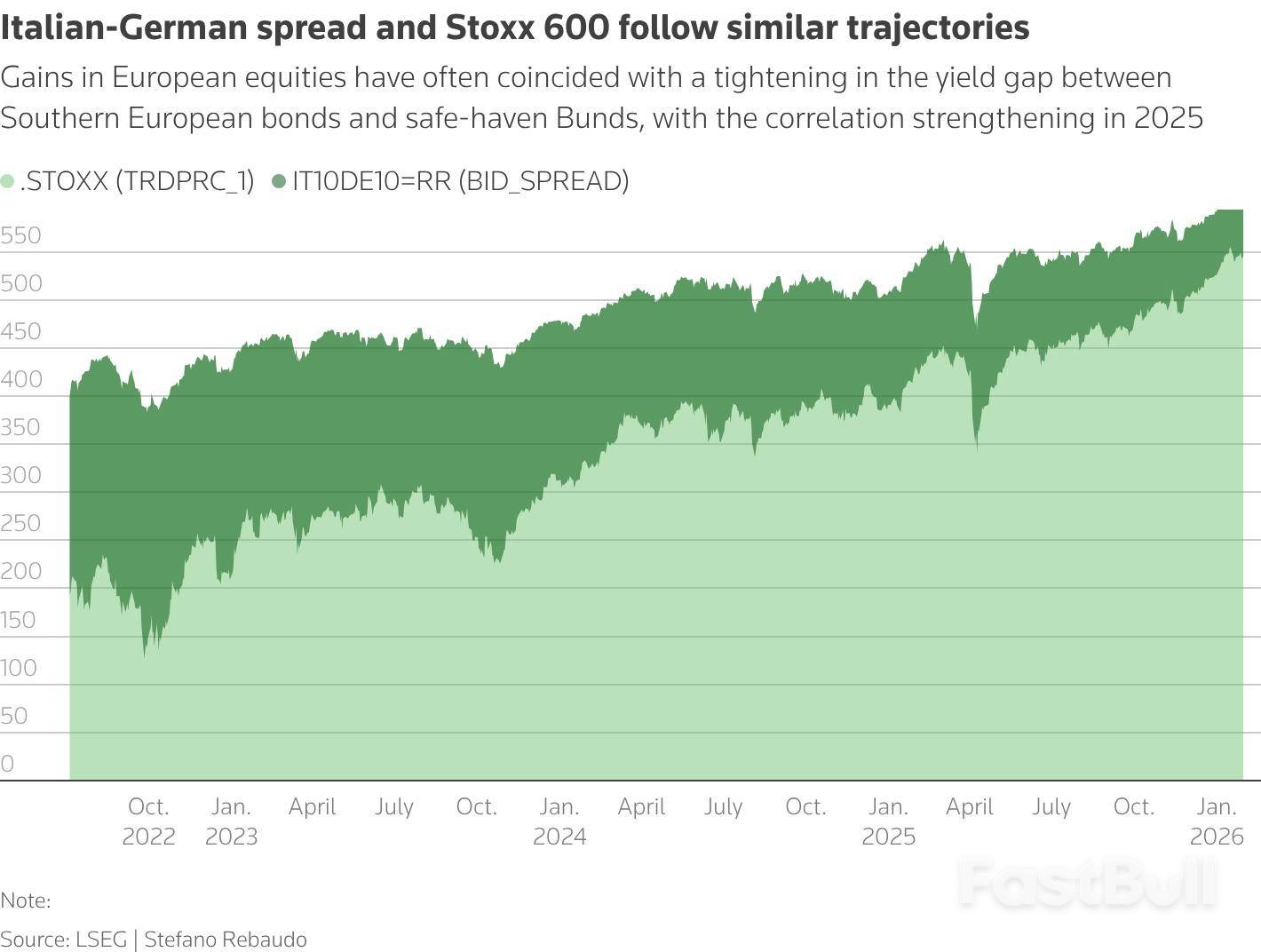

The gap in borrowing costs between Southern European governments and Germany has shrunk to its narrowest point since the 2008 Lehman Brothers collapse. This rally, driven by expectations of European Central Bank interest rate cuts, has compressed yield spreads to levels not seen in over a decade.

However, investors and analysts are questioning how much further this trend can run. Without deeper institutional reforms and with new geopolitical pressures forcing a rethink on spending, the era of easy gains may be coming to an end.

Since late 2023, the yield premium that countries like Italy, Spain, and Portugal pay over ultra-safe German Bunds has steadily declined. The catalyst was the growing certainty that the ECB was preparing to lower interest rates.

This has brought spreads to historically tight levels:

• Italy: around 53 basis points (bps)

• Spain: around 37 bps

• Portugal: around 24 bps

• Greece: around 43 bps

While impressive, these levels are still wider than in 2007, before the global financial crisis when debt loads were much smaller. Back then, Italy's spread was about 22 bps, while Spain and Portugal were near 5 bps.

Market participants believe there's limited room for spreads to fall further toward a unified point. Such a convergence would be a critical step in creating a deeper, more liquid European bond market and strengthening the euro's global role.

Konstantin Veit, a portfolio manager at PIMCO, notes that the pre-crisis optimism was fueled by a different dynamic. "It wasn't always about fundamentals," he said, explaining that spreads were near zero "because there was a hope that over time, the monetary union would evolve into a fully-fledged fiscal and political union."

That hope remains unfulfilled. "We remain constructive on peripheral spreads, but compression potential might be limited without improvements on the institutional side," Veit added. Key reforms include completing the banking and capital markets unions, establishing a shared fiscal capacity, and enabling common debt issuance—steps ECB President Christine Lagarde has identified as essential for the euro.

The strategic landscape is also shifting. The United States, under President Donald Trump, has become a less predictable partner on trade and security, insisting that Europe must shoulder more of its own defense costs.

In response, Eurozone governments, led by Germany, are planning significant increases in borrowing to fund military spending. This new fiscal pressure adds another layer of complexity to the bond market outlook. Even short-lived political tremors, like Trump's brief threat in January to take over Greenland, caused spreads to temporarily widen before tightening again.

ECB Easing and Joint Debt Hopes

Analysts widely expect the ECB to deliver another rate cut this year, a move that should help keep yield spreads stable.

Furthermore, the EU’s pandemic-era Next Generation fund, combined with the push for higher military spending, has fueled expectations for more joint debt issuance. This prospect has supported the bonds of Southern European nations, an effect analysts believe could last through 2027.

The Hurdle to Deeper Integration

Despite these tailwinds, many economists are skeptical about greater joint issuance, primarily due to Germany's opposition.

"I think more integration will only come in a stress scenario, and we're not yet in a stress scenario," said Carsten Brzeski, global head of macro research at ING. He warned that debt-to-GDP ratios in Southern Europe could rise if the economy slows. "We can enjoy the good place, but we should be cautious in deriving any longer-term conclusions from the current state."

Italy's Shifting Role and Future Risks

The political calculus has also changed. Italy, long considered a source of instability, has become one of Europe's more politically stable countries. Meanwhile, German politics has grown more volatile, partly due to the rise of far-right, eurosceptic parties like Alternative für Deutschland.

"Politics in Italy or other Southern European countries is the part I'm least concerned about," said Rohan Khanna, head of euro rates strategy at Barclays. "What I'm more concerned about is how the market thinks about Italy in a post-NGEU world."

Barclays anticipates that spreads will trade in a tight range, concluding that there is less room for Italian spreads to fall compared to those of other Southern European countries.

Poland's central bank faces a difficult interest rate decision this week, as stronger-than-expected economic growth has left economists sharply divided on the next policy move.

A Bloomberg survey reveals the split: while a majority of 19 out of 32 economists expect the Monetary Policy Council (MPC) to hold its key rate at 4% for a second consecutive month, 13 are betting on a quarter-point cut. This represents the largest minority calling for a rate reduction since the current easing cycle began last May.

The primary factor fueling the uncertainty is recent economic data. A report last week showed that Poland's gross domestic product expanded by 3.6% in 2025, surpassing forecasts. This robust performance could give policymakers a reason to delay further rate cuts.

Compounding the difficulty, the central bank will make its decision without the latest consumer price figures. Publication of the data has been postponed due to annual updates to the inflation basket.

"The MPC may prefer to wait for the March macroeconomic projection, particularly given that recently published GDP data confirmed a strong finish last year," noted Cezary Chrapek, an economist at Bank Millennium SA.

Roman Ziruk, an analyst at Ebury Technology Ltd., described the upcoming decision as "one of the hardest to call in recent months," citing the short three-week interval since the January meeting and the absence of fresh inflation numbers.

The division isn't limited to external analysts; members of the rate-setting committee have also sent conflicting signals.

After cutting rates by a total of 175 basis points in 2025, the path forward is unclear.

• MPC member Ludwik Kotecki suggested that the bank could resume rate cuts this month.

• In contrast, newly appointed policymaker Marcin Zarzecki indicated that further easing is not guaranteed and might only happen later.

Central bank Governor Adam Glapinski, who leads the 10-member panel, did not rule out a rate cut in February. However, he also stated there was little room left for more monetary easing throughout 2026.

The central bank is expected to announce its decision on Wednesday afternoon, with Governor Glapinski scheduled to hold a press conference at 3 p.m. in Warsaw on Thursday.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up