Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

In The Past 24 Hours, The Marketvector™ Digital Asset 100 Small Cap Index Fell 2.57% To 2912.23 Points. The Marketvector™ Digital Asset 100 Mid Cap Index Fell 2.11% To 2961.65 Points. The Marketvector™ Digital Asset 100 Index Fell 3.70% To 14801.19 Points

The U.S. Bureau Of Labor Statistics Announced That It Will Postpone The Release Of The January Employment Report To February 11 And The January CPI Report To February 13

Spot Silver Fell Nearly $2 In The Short Term, Last Trading At $84.96 Per Ounce, After Previously Reaching A High Of $92 Per Ounce

Market News: A Survey Shows That OPEC's Output Declined Last Month Due To The Unrest In Venezuela

The Main Shanghai Gold Futures Contract Fell By 2.00% During The Day, Currently Trading At 1098.00 Yuan/gram

Bessent: Cap On Credit Card Interest At 10% For One Year Would Help Allow Americans To Recover From Past Inflation

The Survey Results Show That OPEC Oil Production Declined In January, With Venezuela Experiencing Significant Fluctuations

U.S. Treasury Secretary Bessant Stated That The U.S. Will Not "go To Any Lengths" To Loosen Financial Regulations

A Senior Iranian Source Said The Outcome Of The Negotiations Depends On Whether The United States Changes Its Current Approach. Consultations Are Currently Underway Regarding The Final Arrangements For Friday's Talks And Whether Direct Negotiations Can Take Place

U.S. Treasury Secretary Bessenter: The Federal Reserve’s Involvement In Other Areas Would Damage Its Independence

[Italian Banking Sector Continues To Hit Record Closing Highs] Germany's DAX 30 Index Preliminarily Closed Down 0.54% At 24,647.18 Points. France's Stock Index Preliminarily Closed Up 1.22%, Italy's Stock Index Preliminarily Closed Up 0.69% With Its Banking Index Up 0.36%, And The UK Stock Index Preliminarily Closed Up 1.22%

The STOXX Europe 600 Index Closed Up 0.27% At 619.57 Points, A Record Closing High. The Eurozone STOXX 50 Index Closed Down 0.17% At 5984.95 Points. The FTSE Eurotop 300 Index Closed Up 0.21% At 2468.84 Points

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

cos i saw you typed it - Anyways i am glad it worked out, i will be adding below 4870 though, if that happens to set up nicely!

cos i saw you typed it - Anyways i am glad it worked out, i will be adding below 4870 though, if that happens to set up nicely!

No matching data

View All

No data

Xi and Trump's call signals a fragile calm in US-China relations, despite persistent geopolitical friction.

Chinese President Xi Jinping and U.S. President Donald Trump held a phone conversation on Wednesday, as reported by China's state-run Xinhua News Agency.

The official report confirmed the discussion took place but did not provide any specific details about its content. The call occurred just hours after President Xi had also spoken with his Russian counterpart, Vladimir Putin.

The high-level communication comes during a period of relative calm between the world's two largest economies. Relations have largely stabilized since Xi and Trump agreed to a one-year trade truce in South Korea last year.

Looking ahead, the two leaders are slated to meet four times this year. A potential summit could be scheduled as soon as April, continuing the dialogue established by the temporary trade agreement.

Despite the recent calm, ongoing geopolitical tensions threaten this fragile peace. President Trump's actions related to countries allied with China, including Venezuela and Iran, are testing the limits of the current understanding.

Further complicating the relationship, the U.S. president has criticized Canada for its trade agreements with Beijing. In a move aimed at reducing economic dependency on China, the Trump administration has also begun efforts to secure alternative supplies of rare earths, seeking to loosen China's control over the critical mineral market.

Indian refiners are facing a critical decision as sellers offer Russia's flagship Urals crude at an increasingly steep discount to Brent, a move that directly challenges a new trade agreement with the United States designed to limit Russian oil purchases.

Sellers are now marketing Urals crude at an $11 per barrel discount, a significant increase from the $9 discount seen just ten days ago, according to traders familiar with the matter.

Under normal circumstances, such a favorable price difference would trigger a wave of buying from Indian refineries eager to lock in cheaper supply. However, the current market dynamics are far from typical.

The primary complication is a new trade deal announced by U.S. President Donald Trump. This agreement ties lower U.S. tariffs on Indian products to a commitment from New Delhi to significantly reduce its imports of Russian crude oil.

The deal explicitly pushes India to increase its purchases of American oil and other commodities. In exchange for cutting ties with Russian supply, the U.S. has also suggested that Indian buyers could gain access to crude from Venezuela and potentially even Iran, offering alternative sources.

Refiners Pause and Await Government Clarity

In response to the deal, Indian refiners are reportedly halting new purchases of Russian oil as they seek official guidance from their government. Sources indicate that companies are preemptively pausing transactions until they receive clarification on how to navigate the new trade relationship with the U.S.

The situation marks a potential turning point for India, the world's third-largest oil importer. Following Russia's invasion of Ukraine in early 2022, India dramatically ramped up its intake of discounted Russian crude.

For nearly four years, this strategy made Russia its single largest oil supplier, accounting for approximately one-third of the nation's total crude imports. Now, refiners must weigh the immediate benefit of cheap Russian oil against the broader economic implications of the U.S. trade agreement.

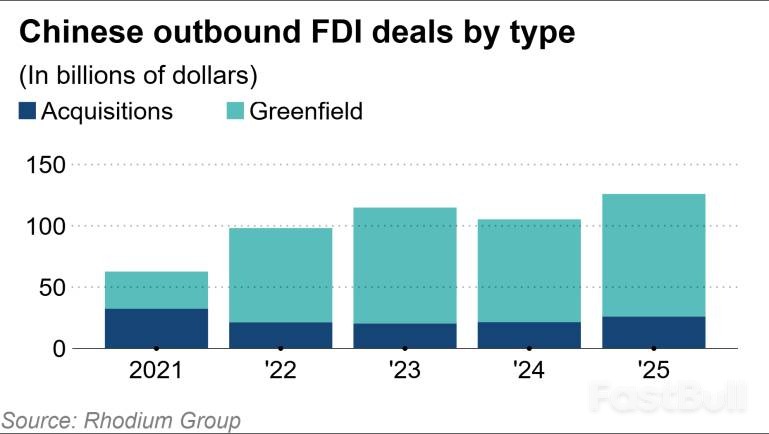

Chinese foreign direct investment (FDI) abroad surged by 18% in 2025, reaching $124 billion in a clear strategic shift away from Western nations and toward emerging markets in Africa, the Middle East, and Asia. This marks the highest level of outbound investment since 2018, though it remains below the peak seen in 2016.

According to a report released Wednesday by the Rhodium Group, a New York-based research firm, this new wave of capital is overwhelmingly focused on energy and basic materials. The trend highlights how the world's second-largest economy is adapting to global trade tensions and rising resource demand.

Nearly half of all announced Chinese outbound investments last year targeted the energy sector—spanning both fossil fuels and renewables—and essential commodities. This surge is propelled by escalating trade and technology disputes between Washington and Beijing that have disrupted supply chains, as well as the growing energy needs of data centers worldwide.

"Energy and basic materials investment will continue [this year], partly because these sectors are naturally high-value and long-term in nature," noted Danielle Goh, a senior research analyst at Rhodium. "Commodities like these tend to attract follow-on investment over time."

In contrast, the automotive sector's share of Chinese FDI fell to its lowest point since 2020. The slowdown reflects a deceleration in new electric vehicle manufacturing and upstream supply chain projects abroad, even as Chinese firms continue to localize some production in regions like Eastern and Central Europe. However, the report notes that overseas markets are still primarily served by exports from China's domestic manufacturing base.

The flow of Chinese capital has decisively turned toward Asia and sub-Saharan Africa. Asia received approximately $40 billion in new transactions, while Africa saw several landmark deals.

Key projects in 2025 that underscore this trend include:

• Guinea: Major investment in the Simandou iron ore mine.

• Nigeria: Two significant lithium processing plants.

• Indonesia: A $5.9 billion joint venture for a refining and chemical complex by Tongkun Group, Xinfengming Group, and Tingshan Group, one of the year's largest transactions.

Separate research from Griffith Institute Asia and Shanghai's Green Finance & Development Center confirms that China's Belt and Road Initiative (BRI) also remains highly active, with most funds directed toward mineral processing in metals and mining. In 2025, Kazakhstan emerged as the top recipient, securing about $25.8 billion for projects related to aluminum and copper.

While Chinese FDI remains dominated by greenfield investments focused on new manufacturing facilities, mergers and acquisitions (M&A) are making a strong comeback. After a steady decline from 2016, the value of M&A transactions has nearly doubled since 2022, partly driven by Chinese consumer goods companies expanding abroad.

The Rhodium report also highlighted that Chinese firms have leveraged capital made available from the deleveraging of the domestic property sector to expand manufacturing capacity at home, which continues to outpace overseas investment.

The pivot toward emerging economies coincides with a sharp decline in investment in developed nations. According to Rhodium, North America, Europe, and Oceania now account for less than 20% of total announced Chinese FDI, a drop of roughly 70% from 2016 levels.

This retreat is a direct response to increasing scrutiny and protectionist policies from Western governments. Germany has blocked several Chinese acquisition attempts, and Switzerland recently passed legislation to screen Chinese investments in strategic industries.

US Market Sees Heightened Caution

Chinese companies have become particularly guarded about investing in the United States amid rising geopolitical tensions. Last year, the White House instructed the Committee on Foreign Investment in the U.S. (CFIUS) to intensify its reviews of Chinese investments in advanced technology, infrastructure, and farmland.

This cautious environment has led to a reluctance to commit significant capital. "There's growing risk that projects may not ultimately move forward, so Chinese companies have been reluctant to invest heavily," said Goh.

President Trump began the week with a stark warning for Iran, stating that "bad things" would likely happen if a new deal isn't reached. Speaking to reporters from the Oval Office, Trump confirmed that significant U.S. naval assets were en route to the region.

"We have ships heading to Iran right now, big ones - the biggest and the best - and we have talks going on with Iran and we'll see how it all works out," he said. "If we can work something out, that would be great and if we can't, probably bad things would happen."

While expressing a desire for a negotiated settlement, Trump remained uncertain about the outcome, adding, "I'd like to see a deal negotiated. I don't know that that's going to happen." For its part, Iran appears willing to engage, having little to lose from direct talks at this stage.

A key logistical hurdle has emerged over the location of the potential negotiations. Initial reports suggested the talks would take place in Istanbul, Turkey. However, the venue now appears to have shifted to Oman, a change that threatens to complicate the process before it even starts.

According to a report from Axios, the request to move the talks came directly from Tehran. The Trump administration has reportedly agreed to this change.

Iran Pushes for Bilateral-Only Format

The venue change is not Iran's only condition. Tehran is also pushing to alter the format of the discussions. According to Axios, Iran wants the negotiations to be strictly bilateral, involving only the U.S. This would exclude the several Arab and Muslim countries that were expected to attend as observers.

A source familiar with the matter told Axios that this demand is linked to Iran's desire to keep the focus narrow.

The most significant challenge will be the scope of the negotiations. Iran is prepared to discuss its nuclear program but has refused to include its ballistic missile arsenal on the agenda, which it considers vital for national security, particularly in a potential conflict with Israel.

The Axios source noted that Iran wants "to limit the talks to nuclear issues and not discuss things like missiles and proxy groups that are priorities for other countries in the region."

Adding to the tense atmosphere, Trump made another pointed comment on Tuesday, referencing a past operation. "They had a chance to do something a while ago, and it didn't work out. And we did 'Midnight Hammer', I don't think they want that happening again," he said.

In response, Tehran has warned it is prepared to retaliate forcefully against any attack, even if it leads to a wider war. Iranian officials stated that their military and missile forces are on high alert and that Tel Aviv would be targeted in the event of U.S. aggression.

Meanwhile, Israel is reportedly lobbying the White House to pursue regime change in Tehran. However, the Trump administration does not appear ready to take such a drastic step, with some reports suggesting the Pentagon would need more time to position its assets for such a scenario.

The US Treasury will maintain its current debt-issuance strategy, confirming it will not make significant changes to its bond auction schedule in a move that met dealer expectations. This decision comes despite market speculation that officials might intervene to bring down longer-term borrowing costs.

In its quarterly refunding statement on Wednesday, the Treasury Department said it expects to keep auction sizes for nominal notes, bonds, and floating-rate notes (FRNs) unchanged "for at least the next several quarters." This forward guidance continues a policy that has been in place for the last two years.

John Canavan, lead analyst at Oxford Economics, described the announcement as "very much steady-as-she-goes," reaffirming the department's commitment to its current path.

Looking ahead, the Treasury said it "continues to evaluate potential future increases to nominal coupon and FRN auction sizes," focusing on structural demand trends and the potential costs and risks of different issuance profiles.

While its strategy for longer-term debt is stable, the Treasury is closely watching developments in the market for bills, which mature in a year or less. The department noted it is "monitoring" two key factors:

1. The Federal Reserve's Bill Purchases: The central bank is buying $40 billion in Treasury bills per month until April to ensure the banking system has ample reserves.

2. Private Sector Demand: The Treasury is also keeping an eye on "growing demand for Treasury bills from the private sector."

The department has increasingly relied on bills to fund rising federal spending.

Before the announcement, some market participants speculated that the Treasury might take aggressive steps, such as reducing bond issuance, to help lower yields. These long-term yields serve as crucial benchmarks for mortgages and other loans.

However, this speculation ran counter to the views of most dealers. "While the administration's focus on affordability measures has brought back questions about potential efforts to lower borrowing costs via more active adjustments to the issuance mix, we do not expect Treasury to do so at this point," wrote Goldman Sachs Group Inc. strategists William Marshall and Bill Zu.

Any move to cut sales of bonds or 10-year notes would have contradicted the Treasury's long-standing pledge to be "regular and predictable" in its debt management—a principle Treasury Secretary Scott Bessent reaffirmed in a November speech.

The Federal Reserve's ongoing bill purchases reduce "the risk of Treasury oversupplying" the market, according to a preview from Morgan Stanley strategists led by Martin Tobias.

However, the Fed's plans beyond April are unclear. This uncertainty is heightened by the nomination of Kevin Warsh to become the next Fed chair in May. Warsh has previously advocated for shrinking the central bank's securities portfolio, a policy shift that could impact the market.

The Treasury announced that its refunding auctions next week will total $125 billion. This refunding is expected to raise approximately $34.8 billion in new cash.

Gold prices surged on Wednesday, reclaiming the key $5,000 level as escalating tensions between the United States and Iran triggered a flight to safety among investors. The precious metal is bouncing back after its worst two-day sell-off since 1983.

As of 08:45 ET, spot gold was trading 1.9% higher at $5,041.45 an ounce. April gold futures saw a more significant jump, climbing 2.6% to $5,064.19 an ounce. This recovery follows a single-day rally that was the best in over 17 years.

The primary driver behind Wednesday's rally is renewed geopolitical risk in the Middle East. Safe-haven demand intensified following overnight reports that the U.S. had shot down an Iranian drone in the Arabian Sea. In a separate incident, Iranian gunboats were reportedly seen approaching a U.S.-linked tanker in the strategic Strait of Hormuz.

These events have largely negated the optimism surrounding planned talks between Tehran and Washington scheduled for Friday. News of the diplomatic discussions had initially eased market concerns and dampened the appeal of gold.

The recent sharp decline in gold was largely fueled by speculation about U.S. monetary policy. The market reacted to President Donald Trump's nomination of Kevin Warsh as the next head of the Federal Reserve, with many investors betting he would pursue a less dovish stance than previously anticipated.

This outlook triggered a strong rally in the U.S. dollar, which exerted downward pressure on metals markets. The yellow metal was also vulnerable to profit-taking after climbing to a record high of nearly $5,600 an ounce last week. Despite the recent volatility, gold remains up over 15% for the year in 2026.

Market analysts believe the fundamental case for gold remains strong. According to a note from ING, the medium-term outlook is supported by three key factors:

• Persistent safe-haven demand

• Ongoing purchases by central banks

• The outlook for real interest rates

"The foundation of gold's multiyear uptrend continues to rest on steady official‑sector accumulation," ING analysts stated, noting that this trend began after Russia's invasion of Ukraine in 2022.

Analysts at OCBC share a similar view, describing the recent price drop as a "price normalization" rather than a "trend reversal." They believe the rebound suggests that forced selling and margin-related liquidations have subsided for now. However, they caution that the recovery remains sensitive to the U.S. dollar, yield repricing, and uncertainty around the Fed's new leadership.

OCBC expects gold to continue drawing support from central bank buying, while ongoing geopolitical and fiscal risks will underpin its role as a safe-haven asset.

Other precious metals also rallied on Wednesday, extending their recovery. Spot silver posted a significant gain of 8.5%, reaching $90.405 an ounce, while spot platinum rose 3% to $2,274.75 an ounce.

OCBC anticipates that silver will also benefit from its dual identity as both a precious and an industrial metal. The brokerage reiterated its end-of-2026 price targets, forecasting gold at $5,600 an ounce and silver at $133 an ounce.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up