Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Colombia Central Bank Technical Team Revises 2026 Economic Growth Projection To 2.6% From Previous 2.9%

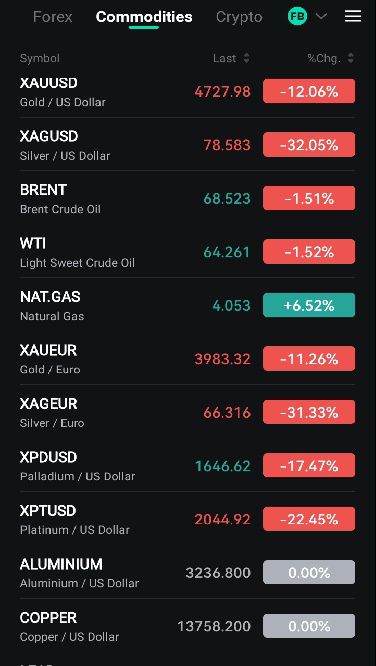

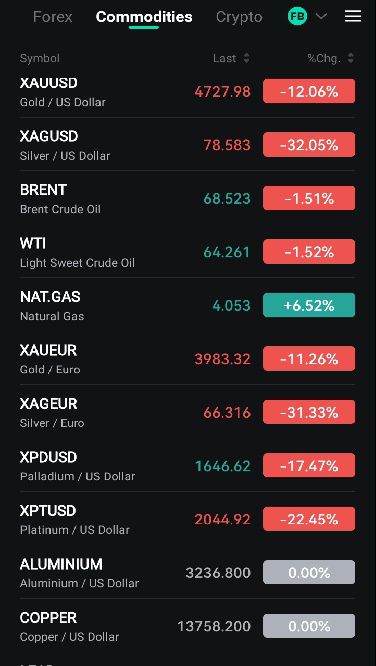

Spot Gold Fell 12.0% On The Day, To $4,725.64 Per Ounce. Spot Silver Fell 34.5% On The Day, To $75.25 Per Ounce

Spot Silver Fell 30.0% On The Day, Closing At $80.64 Per Ounce. New York Silver Fell 29.5% On The Day, Closing At $80.65 Per Ounce

Equipo Técnico Del Banco Central De Colombia Revisa Pronóstico De Crecimiento Económico Para 2025 A 2,9% Desde Previo De 2,6%

Colombia's Central Bank Hikes Interest Rate By 100 Basis Points To 10.25%, Surprising The Market

Baker Hughes - US Oil Drilling Rig Count Unchanged At 411 (Down 68 Versus Year Ago) In Week To Jan 30

Spot Gold Fell 10.5% On The Day, Its Biggest Drop In Decades, To $4,807.99 Per Ounce. New York Gold Fell 9.5% To $4,838.1 Per Ounce. Spot Silver Fell 26.0% To $85.06 Per Ounce. New York Silver Fell 25.5% To $85.17 Per Ounce

LME Copper Futures Closed Down $460 At $13,158 Per Tonne. LME Aluminum Futures Closed Down $74 At $3,144 Per Tonne. LME Zinc Futures Closed Down $10 At $3,402 Per Tonne. LME Lead Futures Closed Down $5 At $2,009 Per Tonne. LME Nickel Futures Closed Down $415 At $17,954 Per Tonne. LME Tin Futures Closed Down $3,129 At $51,955 Per Tonne. LME Cobalt Futures Closed Unchanged At $56,290 Per Tonne

Ukrainian Prime Minister Svyrydenko Says Russia Is Attacking Logistics, Launched Seven Attacks On Rail Facilities In Past 24 Hours

Ukraine President Zelenskiy: Ukraine Conducted No Strikes On Russian Energy Infrastructure On Friday

[German 10-year Bond Yields Fell More Than 6 Basis Points This Week And More Than 1 Basis Point In January] On Friday (January 30), In Late European Trading, The Yield On 10-year German Government Bonds Rose 0.3 Basis Points To 2.843%, A Cumulative Drop Of 6.3 Basis Points This Week, Continuing Its Overall Downward Trend. In January, It Fell 1.2 Basis Points, With An Overall Trading Range Of 2.910%-2.792%. The Yield On 2-year German Bonds Rose 0.5 Basis Points To 2.089%, A Cumulative Drop Of 4.1 Basis Points This Week And 3.2 Basis Points In January, Trading Within A Range Of 2.156%-2.048%. The Yield On 30-year German Bonds Rose 0.5 Basis Points To 3.494%, A Cumulative Increase Of 1.9 Basis Points In January. The Spread Between The 2-year And 10-year German Bond Yields Fell 0.163 Basis Points To +75.288 Basis Points, Down 2.147 Basis Points This Week And Up 2.142 Basis Points In January

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Venezuela's interim leader privatizes the oil sector under intense US pressure, reversing decades of state control with US overseeing sales.

Venezuela's interim President Delcy Rodriguez has signed a landmark reform bill designed to open the nation's state-run oil sector to private investment. The move fulfills a major demand from the United States and marks a significant shift in the country's economic policy.

The bill was signed into law on Thursday, just hours after being passed by the National Assembly, which is dominated by Rodriguez's United Socialist Party. During a signing ceremony with state oil workers, Rodriguez framed the reform as a crucial step toward a better economic future.

"We're talking about the future," she said. "We are talking about the country that we are going to give to our children."

This legislative action follows intense pressure from the Trump administration, which began after the US military's abduction of former leader Nicolas Maduro and his wife on January 3. President Trump had explicitly warned Rodriguez that she could "pay a very big price, probably bigger than Maduro" for failing to comply with his demands to open the oil sector.

The new legislation introduces several fundamental changes aimed at attracting foreign companies, many of which have been wary of investing in Venezuela. The core components of the bill include:

• Private Sector Control: The law gives private firms control over the sale and production of Venezuelan oil.

• External Dispute Resolution: It mandates that legal disputes be resolved in courts outside of Venezuela, addressing a long-standing concern from foreign companies about the domestic judicial system.

• Royalty Cap: Government-collected royalties on oil activities will be capped at 30 percent.

These reforms are designed to create a more appealing environment for outside petroleum firms, who have been hesitant to invest due to the country's history of political instability and economic turmoil under Maduro.

Coinciding with Rodriguez signing the bill, the Trump administration announced it would ease some of the sweeping sanctions imposed on Venezuela's oil industry in 2019.

The U.S. Department of the Treasury stated it would now permit limited transactions involving the Venezuelan government and its state oil company, PDVSA. These transactions are specified as those "necessary to the lifting, exportation, reexportation, sale, resale, supply, storage, marketing, purchase, delivery, or transportation of Venezuelan-origin oil" by established U.S. entities.

The policy shift comes after a period of intense U.S. intervention. The abduction of former president Nicolas Maduro, who is now awaiting trial in a New York prison, resulted in dozens of deaths and drew accusations that the U.S. had violated Venezuelan sovereignty.

Trump administration officials have asserted that the U.S. will now determine who can purchase Venezuelan oil and under what terms. The proceeds from these sales are slated to be deposited into a bank account controlled by the United States. This approach has been criticized, though President Trump and his allies have previously claimed that Venezuelan oil should "belong" to the U.S.

This new era of privatization reverses decades of state control. Venezuela first nationalized its oil sector in the 1970s. In 2007, Maduro's predecessor, Hugo Chavez, further tightened government control by expropriating foreign-held assets, setting the stage for years of confrontation with international oil companies.

Canadian Prime Minister Mark Carney is championing a series of new trade agreements, signaling a strategic push to diversify Ottawa's global partnerships while asserting his country's sovereignty in the face of pressure from the United States.

During a meeting with provincial and territorial leaders on Thursday, Carney celebrated the successful negotiation of 12 new economic and security accords over the past six months. "Our country is more united, ambitious and determined than it has been in decades, and it's incumbent on all of us to seize this moment, build big things together," he stated.

This drive for diversification comes amid persistent friction with the administration of US President Donald Trump, who has previously antagonized Ottawa with rhetoric suggesting Canada could become a "51st state."

A central element of Canada's new strategy is a recent agreement with China aimed at lowering trade levies. The deal immediately drew a sharp rebuke from President Trump, who threatened to impose a 100 percent tariff on Canada, accusing the country of acting as a "drop-off port" for Chinese goods.

Carney has clarified that Ottawa is not pursuing a full free-trade agreement with Beijing. Instead, he highlighted the targeted benefits for Canada's agricultural sector. "Part of that agreement unlocks more than $7bn in export markets for Canadian farmers, ranchers, fish harvesters and workers across our country," Carney explained.

Looking ahead, the Prime Minister announced that his government would pursue deeper trading relationships with other major economic players, including:

• India

• The Association of Southeast Asian Nations (ASEAN)

• The South American trade bloc Mercosur

At the same time, Carney affirmed Ottawa's commitment to its primary economic partner, noting plans to "renew our most important economic and security relationship with the United States through the joint review of the Canada-United States-Mexico agreement later this year." The regional trade pact is set to expire in July.

Carney's push for new trade partners follows an attention-grabbing speech he delivered at the World Economic Forum in Davos, Switzerland, just eight days earlier. In his address, he argued that the "rules-based" international order was a fading fiction, giving way to an "era of great power rivalry" where might makes right.

"We knew the story of the international rules-based order was partially false, that the strongest would exempt themselves when convenient, that trade rules were enforced asymmetrically," Carney told the Davos audience. "We knew that international law applied with varying rigour depending on the identity of the accused or the victim."

His speech, widely interpreted as a rebuke of the Trump administration's aggressive tariff campaigns, concluded with a call for the world's "middle powers" to band together in these uncertain times.

The geopolitical backdrop includes a series of aggressive moves by President Trump. His administration abducted Venezuelan leader Nicolas Maduro in what critics called a violation of international law and has made threatening statements toward Greenland, a self-governing Danish territory. These actions have caused unease within the NATO alliance.

Trump has also repeatedly targeted Canada, referring to the country as a "state" and its prime minister as a "governor." Following Carney's Davos speech, Trump withdrew an invitation for the Canadian leader to join his "Board of Peace."

Carney has stood by his remarks, publicly refuting claims by US Treasury Secretary Scott Bessent that he had "aggressively" walked back his position in a private call with Trump.

The tensions came to a head on Thursday when Carney was asked about reports that US officials had met with separatists from Alberta. The Financial Times reported that State Department officials held three meetings with the Alberta Prosperity Project, a group advocating for a referendum on the oil-rich province's independence from Canada.

Carney's response was direct and unambiguous.

"We expect the US administration to respect Canadian sovereignty," he said. "I'm always clear in my conversations with President Trump to that effect."

Prime Minister Sanae Takaichi's new fiscal agenda, featuring increased spending and tax cuts, has sent a jolt through Japan's bond market. Investors are growing concerned that the nation's already massive government debt is set to expand, pushing the 10-year Japanese Government Bond (JGB) yield up 26 basis points to 2.33% this year as of January 20.

For years, the Japanese government enjoyed the benefits of extremely low interest rates, which averaged around 0.33% between 2016 and 2025. With the 10-year JGB yield now trading above 2.2%, the cost of servicing Japan’s JPY 1,287 trillion in outstanding debt is poised to climb sharply as it gets refinanced over the next decade.

A sensitivity analysis reveals just how severe the budget pressure could become:

• Surging Interest Payments: If JGBs are refinanced at an average rate of 2.0% to 2.5%, Japan's interest servicing costs could balloon from the current 9% of total government expenditure to between 20% and 25%.

• Total Debt Service: This would push the total debt service expense to an estimated 35% to 40% of all government spending.

This forecast assumes revenue grows at 3% (factoring in 1% GDP growth and 2% inflation) and non-debt spending also increases by 3%. For perspective, an interest burden of 20%-25% is exceptionally high for an investment-grade OECD member. The last peak for OECD nations was 11.3% in 1988, a period of high inflation that preceded a global recession.

To keep debt service at its current 25% level, the government would need to find significant new revenue streams to limit new bond issuance. Prime Minister Takaichi has indicated a desire to keep the debt-to-expenditure ratio stable, which implies a focus on raising revenue.

The pressure in the JGB market is already spilling over into Japanese equities. The Morningstar Japan TME Index, which gained 7.9% through January 14, has since pulled back by 3.6%. These bond market jitters, combined with recent discussions about potential intervention to support the yen, have weighed on stocks.

Historically, Japanese equities have had an inverse relationship with the yen, primarily due to the impact of currency conversion on earnings from exports and overseas operations. However, this is seen as a neutral factor for shareholders.

The yen is expected to hover around the JPY 150 level. Over the long term, the narrowing gap between U.S. Treasury and JGB yields should offer the currency some support. U.S. 10-year Treasuries are forecast to yield around 3.3% by 2028 as American monetary policy normalizes. Despite this, the yen could still face near-term pressure from risk aversion tied to Japan's debt concerns.

The primary risk remains the high cost of debt, along with the possibility that financial institutions could be asked to help stabilize the market by purchasing government bonds. While this may not directly impact the earnings of banks and insurers, it could be viewed as an unpopular short-term use of their capital.

After the initial spike, the JGB market has stabilized slightly following government assurances and hints of support from the Bank of Japan (BoJ). While direct intervention from the BoJ to calm the bond market would not be surprising, such a move would also fuel inflation risks. The central bank is already expected to raise its policy rates from the current 0.75% to a range of 1.25%-1.50% by 2028.

Politics adds another layer of complexity. With a snap election scheduled for February 8, Prime Minister Takaichi is unlikely to reverse course on her plan to remove the 8% sales tax on food, as deteriorating affordability is a key concern for voters.

The Bull Case

Optimists point to several factors that could help shore up government finances. Japan's low unemployment and expected wage growth could boost tax revenues. Other potential sources of income include new stamp duties on real estate purchases by non-Japanese citizens and the targeted removal of certain tax breaks. Proponents believe that once yields adjust to reflect normalizing policy, demand for JGBs from domestic institutions and the public will stabilize over the medium-to-long term.

The Bear Case

Pessimists argue that even if tax increases or spending cuts are implemented, rising social security costs will continue to strain the budget. This persistent spending pressure will make it difficult to significantly reduce the issuance of new government bonds, keeping the debt pile growing.

President Donald Trump is pursuing a dual strategy with Iran, pairing the threat of military strikes with repeated calls for Tehran to negotiate a new agreement. The administration's message is clear: accept Washington's terms or face severe consequences.

At the heart of Trump's demands is a complete overhaul of Iran's strategic posture. In exchange for the removal of crippling sanctions and a promise of no military action, Tehran would be required to:

• End its nuclear program entirely.

• Accept limits on its ballistic missile capabilities.

• Cut all ties with its armed proxy groups across the Middle East.

Should Iran refuse, Trump has warned of consequences "far worse" than those of the previous year, when the United States and Israel reportedly bombed Iranian nuclear sites. However, experts believe Tehran is unlikely to accept what it considers maximalist demands, viewing them as a call for total capitulation that would reverse decades of established policy.

The White House has reinforced its hardline stance, urging Tehran to negotiate "before it is too late." In a written statement to RFE/RL, an official noted that Trump "hopes that no action will be necessary" but pointed to past military operations as proof of his resolve. The official cited "Operation Midnight Hammer" and "Operation Absolute Resolve"—the June 2025 strikes on Iran's nuclear facilities and the January 3 ousting of Venezuelan leader Nicolas Maduro, respectively—as evidence that the president "means what he says."

The rhetoric is backed by significant military and economic pressure. The U.S. has recently deployed an aircraft carrier and additional bombers to the region. Economically, Trump has announced a new 25 percent tariff on any country conducting business with Iran, alongside fresh sanctions. This escalation follows nationwide protests in Iran in late December 2025, which were met with a violent government crackdown that resulted in thousands of deaths.

Experts are split on whether Trump's strategy will lead to a deal or a conflict. The key variables are Iran's internal instability and Washington's appetite for risk.

The Case for Imminent Military Action

Jason Brodsky, policy director at United Against Nuclear Iran, argues that military action is "very likely." He points to the administration's pattern of alternating between confrontational and conciliatory statements—a tactic he says is designed to keep the Iranian regime off-balance and was previously seen before the military actions in June and in Venezuela.

According to Brodsky, the objectives of a strike would be to hold Iran accountable for its crackdown on protesters, deter its regional activities, and degrade its military capabilities. He suggests that President Trump might see "further military action as the prelude to an eventual deal down the line."

The Risks of Regional Escalation

Other analysts see the situation as a high-stakes diplomatic maneuver. Alex Vatanka, director of the Iran program at the Middle East Institute, notes that U.S. officials view Iran's current weakness as a strategic opportunity. The clerical establishment is grappling with a severe economic crisis and the aftermath of major protests, while its regional allies—including Hezbollah, the Houthi rebels, and Hamas—have seen their military capabilities weakened by Israel.

Despite this, Vatanka offers a more cautious assessment, arguing there are "still reasons for the United States to think twice." He emphasizes that "the Pentagon knows any strike could trigger a regional chain reaction" involving Iran's network of allied militias. From this perspective, the U.S. military buildup could be a defensive measure or a tool to force diplomatic concessions rather than a prelude to regime change.

Iranian officials, including Foreign Minister Abbas Araqchi and parliament speaker Mohammad Baqer Qalibaf, have publicly stated that Tehran is open to talks. However, they have also accused Washington of not being interested in a fair agreement.

The core challenge remains the nature of the U.S. demands. According to Brodsky, Iran's Supreme Leader Ayatollah Ali Khamenei would be "very skeptical and resistant to accept" Trump's terms. He would likely perceive any concession on core national security issues as a move that could "pave the way for the collapse of the Islamic republic." This fundamental disagreement leaves both sides locked in a standoff, with the potential for either diplomacy or conflict remaining on the table.

India's economy is on track to expand by over 7% this fiscal year, but its future outlook is clouded by global headwinds. In a key report released just days before the annual federal budget, officials outlined a path to sustained growth while warning that international market turmoil and geopolitical tensions pose significant risks.

The Finance Ministry's economic survey, presented to parliament on Thursday, forecasts growth between 6.8% and 7.2% for the next fiscal year. The report also upgraded India's medium-term potential growth rate from 6.5% to approximately 7%, attributing the stronger outlook to reforms and public investment.

Finance Minister Nirmala Sitharaman is set to present the 2026-27 budget on Sunday. The announcement is widely expected to include policy measures designed to maintain India's rapid economic expansion and insulate it from external shocks.

According to Chief Economic Adviser V. Anantha Nageswaran, achieving the upper end of the growth projection is possible, but it depends heavily on external factors.

"If global financial markets and the political situation do not deteriorate to the extent that sentiment gets affected... then I think the upper end is well within reach," Nageswaran stated in a Friday interview with Reuters.

However, he cautioned that several factors could push growth toward the lower end of the 6.8% forecast:

• Financial Market Volatility: A significant or prolonged correction in global financial markets could dampen sentiment.

• Geopolitical Conflicts: Events that disrupt commodity movements and global supply chains remain a major concern.

• Rising Oil Prices: Recent tensions in the Middle East have driven up crude oil prices, creating another external risk for India's economy.

These warnings come as Indian equity markets posted their sharpest monthly decline in nearly a year this January, driven by sustained selling from foreign investors amid trade uncertainty. The Indian rupee also fell to a record low, marking its worst month in over three years.

To counter these external pressures, India is banking on new trade agreements and a resolution to existing tariff disputes. Nageswaran noted that easing trade tensions, particularly with the United States, would provide a significant boost to investor confidence.

Resolving tariff issues would "add to a sense of relief, and therefore willingness to commit more investments on the ground by Indian and foreign businesses," he explained. This follows President Donald Trump's move in late August to impose a 50% tariff on certain Indian goods.

Furthermore, new free trade agreements are expected to open up crucial market access and cushion the economy. India recently concluded trade negotiations with the European Union and has signed pacts with the UK and Oman. These agreements are particularly beneficial for labor-intensive sectors, which stand to gain from lower or zero duties.

"As and when they become operational, Indian businesses have a good shot at supplying these markets," Nageswaran added.

While global factors remain a primary focus, the government also recognizes the importance of domestic economic drivers. Nageswaran emphasized that private investment is ultimately more responsive to underlying demand in the economy than to policy incentives like tax cuts.

He pointed to early indicators suggesting that a pickup in private investment is already underway. When asked about specific priorities for the upcoming budget, Nageswaran declined to comment publicly.

Daily March E-mini Nasdaq 100 Index Futures

Daily March E-mini Nasdaq 100 Index FuturesWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up