Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Washington eyes lifting Venezuela oil sanctions next week, facilitating sales and financial system re-entry.

The United States could begin lifting sanctions on Venezuela as soon as next week to facilitate oil sales, according to Treasury Secretary Scott Bessent. The move is part of a broader strategy to re-engage with the country following the capture of Venezuelan leader Nicolas Maduro.

In an interview on Friday, Bessent stated the Treasury is examining changes that would allow the proceeds from oil sales—much of it currently stored on ships—to be repatriated to Venezuela.

"We're de-sanctioning the oil that's going to be sold," he said. The administration's focus, he explained, is on how these funds "can help... run the government, run the security services and get it to the Venezuelan people."

When asked about the timeline, Bessent confirmed that sanctions could be removed "as soon as next week," though he did not specify which measures would be lifted. This policy shift is central to the Trump administration's efforts to stabilize Venezuela and encourage the return of U.S. oil producers.

Alongside sanctions relief, the U.S. is pushing for Venezuela's reintegration into the global financial system. Bessent, who represents the U.S. at the International Monetary Fund and the World Bank, confirmed he will meet with the heads of both institutions next week to discuss their re-engagement with Venezuela.

A key part of this plan involves unlocking nearly $5 billion of Venezuela's assets held at the IMF in the form of Special Drawing Rights (SDRs). Bessent said the Treasury would be willing to convert the country's 3.59 billion SDRs, valued at approximately $4.9 billion, into dollars to help rebuild the economy. These assets are currently inaccessible to Venezuela.

This approach mirrors a previous U.S. action, when the Treasury backed a $20 billion swap line for Argentina using its SDRs to stabilize the peso. An IMF spokesperson confirmed the fund is monitoring developments in Venezuela but declined to comment on the upcoming meeting.

Venezuela has been largely cut off from international financial institutions for years. The IMF has not completed a formal economic assessment of the country since 2004, and Venezuela paid off its last World Bank loan in 2007 under the late Hugo Chavez.

Current U.S. sanctions have been a major impediment to restructuring the country's complex $150 billion debt, as they prohibit international banks from dealing with the Venezuelan government without a license.

In a related move, President Donald Trump signed an executive order on Friday to safeguard Venezuelan oil revenues held in U.S. Treasury accounts. The order blocks courts or creditors from seizing these funds, stating they should be used to help create "peace, prosperity and stability" in Venezuela.

A source familiar with internal discussions at the World Bank said the lender is in the early stages of exploring how it can assist, noting its rapid support for countries like Afghanistan and Syria after regime changes.

Bessent expressed confidence that smaller, privately held companies would be the first to re-enter Venezuela's oil sector. "I think it's going to be the typical progression where the private companies can move quickly and will come in very quickly," he said, noting they have not raised financing concerns.

While some major oil companies like Exxon Mobil remain hesitant due to past nationalizations of their assets, Bessent believes others will expand their presence. "Chevron has been there a long time and will continue to be there, so I believe that their commitment will greatly increase," he stated.

He also echoed comments from U.S. Energy Secretary Chris Wright, suggesting a role for the U.S. Export-Import Bank in guaranteeing financing for the recovering oil sector.

Former President Donald Trump declared that the United States "stands ready to help" Iranians pursuing freedom, a statement that surfaced just as reports revealed senior U.S. officials have been holding preliminary discussions about potential military action against Iran.

In a post on Truth Social, Trump described Iran as "looking at FREEDOM, perhaps like never before." This public show of support coincided with a Wall Street Journal report detailing private conversations among administration officials about potential attack scenarios, including possible targets for an aerial strike on Iranian military facilities.

However, U.S. officials familiar with the discussions emphasized that these talks are in their early stages and do not signal an impending decision to attack. No military forces have been repositioned, and the planning remains conceptual rather than operational.

Trump's comments come amid some of the most widespread protests Iran has seen in years. Demonstrations have erupted across major cities, fueled by discontent over economic conditions and political repression. The government has responded with force, leading to hundreds of arrests and a rising death toll. Internet blackouts have also complicated independent reporting from within the country.

The former president's message echoes similar sentiments from other U.S. lawmakers. Republican Senator Ted Cruz noted that American public opinion is broadly behind the Iranian demonstrators and credited Trump with reinforcing this supportive stance.

According to the reports, one military option being considered involves large-scale aerial strikes against Iranian military installations. Officials stressed that there is no consensus on this approach and that such preliminary discussions are a standard part of contingency planning for global hotspots, not a sign of imminent conflict.

Strategic planners regularly develop options for potential conflicts. However, moving from a conceptual plan to an approved military operation involves multiple layers of review, including detailed assessments of the potential repercussions for regional stability, diplomatic fallout, and legal justification.

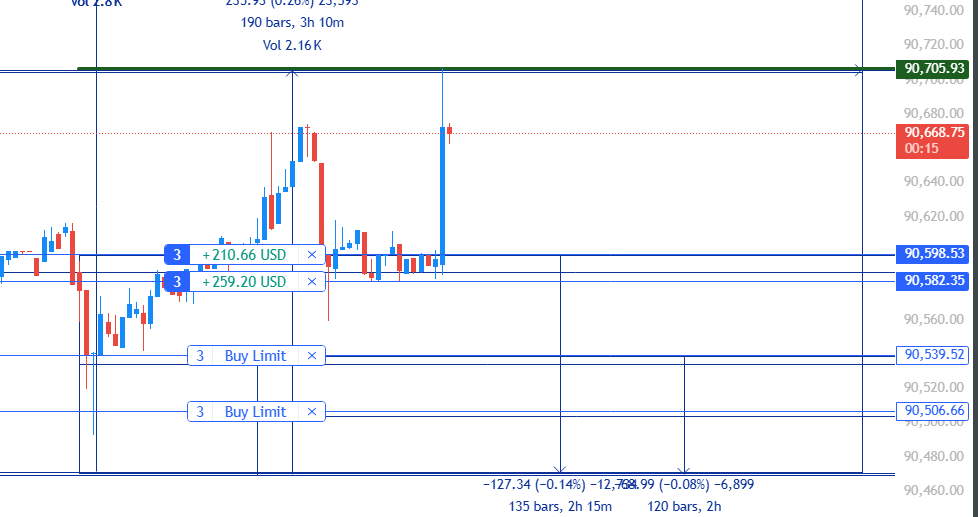

Heightened geopolitical risk has historically been a major driver of volatility in financial markets, affecting everything from commodities and equities to digital assets.

During past periods of tension in the Middle East, risk-sensitive assets like Bitcoin have often moved in correlation with traditional markets as investors adopt a "risk-off" posture. However, analysts note that cryptocurrency markets can behave differently from traditional assets during such events. Some episodes have shown initial sell-offs followed by a recovery as the broader macroeconomic picture evolves. This reflects the dual identity of assets like Bitcoin, which can function as both a risk asset and a potential hedge depending on wider financial dynamics.

The current tensions are rooted in a long history of conflict between the U.S. and Iran over issues like nuclear proliferation, regional influence, and proxy wars. Previous military actions, including strikes on Iranian nuclear and military sites, have led to retaliation and prolonged regional instability.

Iran's leadership has consistently stated that it does not seek war with the United States or its allies, while also asserting its readiness to defend itself. Diplomatic channels have also been explored, including negotiations in 2025 that focused on limiting Iran's nuclear program in exchange for sanctions relief, though these talks did not result in a lasting agreement.

For now, discussions about a potential military strike remain in their early stages, and Trump's public statements fall short of any operational commitment. The administration continues to position itself as a supporter of the Iranian protest movement while navigating the complex realities of regional security and global diplomacy.

As the situation evolves, financial markets, including the cryptocurrency sector, will likely continue to price in the possibility of either military escalation or a diplomatic resolution, highlighting how distant political developments can shape financial conditions worldwide.

President Donald Trump has signed an executive order declaring a national emergency to control the proceeds from future sales of Venezuelan oil. The directive is designed to block creditors and other claimants from seizing the revenue.

According to a White House fact sheet, the order safeguards Venezuelan oil revenue held in U.S. Treasury accounts. It prevents the money from being used to satisfy debts or other legal claims lodged against the Latin American country.

The executive order affirms that the funds are the "sovereign property of Venezuela," even when held in U.S. custody for diplomatic and governmental purposes. This designation, the White House stated, makes the revenue not subject to private claims.

The stated goal is to ensure the funds are preserved to advance U.S. foreign policy objectives.

The Trump administration has announced its intention to use the proceeds from Venezuelan oil sales to benefit both the Venezuelan and American people. The initial sales are expected to involve what the president has claimed to be 30 million to 50 million barrels of crude.

These sales are also meant to help clear a growing accumulation of oil in storage and maintain a flow of revenue following the capture of Nicolás Maduro.

The White House warned that allowing other countries or creditors to access the funds would jeopardize American objectives. It specified that such claims could "empower malign actors like Iran and Hezbollah."

By blocking these claims, the administration aims to maintain control over the funds and direct them toward its stated policy goals.

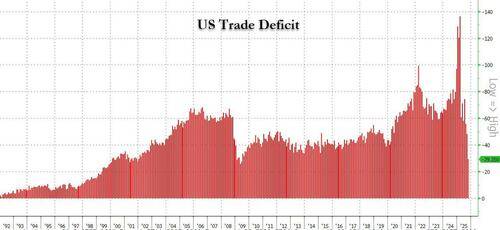

The U.S. trade deficit saw a stunning collapse in October, a development revealed in data delayed by last year's government shutdown. This sharp correction highlights structural shifts in the global economy driven by new trade policies and energy market dynamics.

For years, the deficit has reflected America's industrial base and the unique status of the U.S. dollar as the world's reserve currency, which fueled cheap imports and the outsourcing of manufacturing. In the year before the 2024 inauguration, this gap reached $918 billion, a figure comparable to China’s entire trade surplus.

However, recently released survey data from the U.S. Chamber of Commerce shows a dramatic change for October. The monthly trade deficit fell from $48.1 billion to just $29.4 billion, defying market expectations of a nearly $60 billion deficit.

A core objective of the Trump administration has been to tackle the trade deficit through a combination of restrictive policies and a push for reindustrialization.

This strategy involves two main fronts. First, tariffs have made imports more expensive, significantly reducing trade volumes with China. President Trump's diplomatic trip to the Arab Gulf states, which resulted in investment pledges worth hundreds of billions for American industrial production, complements this effort.

Second, there is a systematic push to rebuild U.S. industry, which recently constituted only about 10 percent of GDP. This is most visible through massive investments in key sectors like artificial intelligence and energy. As a result, China and its subsidized export economy are being forced to find other markets, increasing competitive pressure on the European Union.

The delayed data brings several critical factors into focus that explain the sharp drop in the U.S. deficit.

• The Inventory Cycle: In anticipation of U.S. tariffs, companies stockpiled imports to avoid price hikes and supply risks. That trend is now reversing, leading to a drop in import demand that is reflected in the new trade figures.

• Surging LNG Exports: U.S. exports of liquefied natural gas (LNG) are being used as a strategic geopolitical tool. Last year, LNG exports climbed 25 percent to 116 million tons. With market prices estimated between $8.50 and $9.50 per MMBtu, the total value of these exports likely exceeds $50 billion. Germany, in particular, has become a major buyer after halting cheap Russian gas imports, though at a significantly higher price.

• Domestic Household Spending: A less visible factor may be a pullback in demand from middle- and lower-income U.S. households dealing with high prices. However, this effect is likely tempered by the strong momentum of the U.S. economy, which grew at an annualized rate of roughly 4.5 percent in the last two quarters of the previous year.

Furthermore, falling domestic energy prices and easing housing costs in some regions may be providing relief to households. The government recently reported the repatriation of approximately 2.6 million illegally residing immigrants, a move that could dampen rent and housing prices.

While the International Monetary Fund (IMF) projects global economic growth of around 3 percent this year—below the historical trend of 3.5–4 percent—other indicators signal a potential rebound.

Dynamic measures like shipping indices suggest a tentative recovery in global trade. The Drewry World Container Index (WCI), a key benchmark, has shown early signs of improvement on major routes connecting China with the U.S. and European ports. This indicates that companies across global supply chains have adapted to U.S. tariffs and are gradually normalizing operations.

In contrast to the U.S., Germany's export sector had a modest performance last year. While nominal exports grew by 0.6 percent to approximately €1.6 trillion, volume-adjusted exports fell by about 2 percent.

The causes are familiar: the energy crisis and declining competitiveness are weighing on Germany's industrial core, particularly the automotive and machinery sectors. As a result, Germany's trade surplus with the U.S. shrank by 7.3 percent.

The decline in trade with China was even steeper, with German exporters losing around 10 percent of their business volume. At the same time, Germany's imports from China rose 4.4 percent, driven by capital goods. This signals a reversal in knowledge transfer, with China increasingly exporting technology rather than just serving as the world's low-cost factory.

For the full year 2025, Germany's trade surplus is projected to be around €195 billion, its lowest level since 2012, excluding the outlier year of the Corona lockdown.

Israeli Prime Minister Benjamin Netanyahu has outlined a plan to end Israel's long-standing dependence on American military aid, setting a goal to achieve complete self-reliance within the next decade.

While Netanyahu has previously advocated for reducing reliance on foreign military support, he has now attached a firm timeline to this strategic shift.

In an interview with The Economist, Netanyahu stated his ambition to "taper off the military [aid] within the next 10 years." When asked if this meant reducing the aid "down to zero," he confirmed, "Yes."

The Prime Minister also noted that he had communicated this perspective to U.S. President Donald Trump during a recent visit. Netanyahu said he expressed Israel's deep appreciation for America's historical military support but emphasized that the nation has "come of age and we've developed incredible capacities."

This push for self-sufficiency is backed by significant financial commitment. In December, Netanyahu announced that Israel would invest 350 billion shekels ($110 billion) to develop its independent arms industry, directly aiming to reduce dependency on other countries.

This new direction comes even as a major aid package remains in effect. In 2016, the U.S. and Israeli governments signed a memorandum of understanding that provides $38 billion in military assistance over ten years, running through September 2028. The package includes $33 billion in grants for military equipment and $5 billion for missile defense systems.

Underscoring the growing strength of its domestic sector, Israel's defense exports saw a 13 percent increase last year. This growth was driven by major contracts for advanced Israeli defense technology, including its multi-layered aerial defense systems.

Fears of a market shock rippled through financial circles this week, centered on a potential U.S. Supreme Court ruling that could strike down tariffs from the Trump administration. For traders, the logic was simple: a massive, court-ordered tariff refund could force the U.S. Treasury to flood the system with liquidity, potentially destabilizing bond markets and sending risk assets like crypto into a tailspin.

However, U.S. Treasury officials have moved quickly to address these concerns, signaling that the risk of a financial cataclysm is minimal.

U.S. Treasury Secretary Scott Bessent has reassured markets that the government is fully equipped to handle any potential tariff refunds. He clarified that even a worst-case scenario would not involve a single, massive payout.

Instead, any refunds would be distributed gradually over weeks, months, or longer. This staggered approach is designed to prevent the kind of sudden liquidity event that could rattle markets.

Bessent stated that the Treasury is well-prepared for this contingency and does not foresee the process disrupting government funding or overall financial stability. While expressing doubt that the Supreme Court would overturn the tariffs, he emphasized that robust contingency plans are in place regardless.

Beyond the Treasury's capacity to pay, the refund process itself is expected to be highly complex. According to Bessent, any court ruling would likely come with conditions that complicate how the money flows back into the economy.

There is also significant uncertainty about whether corporations that paid the tariffs, such as large retailers, would pass the refunds on to consumers. These logistical challenges make a rapid, market-disrupting payout even less probable.

Earlier in the week, analysts had warned that a ruling against the tariffs could trigger a broad market correction. The primary concern was that a large refund obligation might compel the Treasury to issue more bonds, which would push yields higher and drain liquidity from speculative assets, including the crypto market.

These fears began to subside after the Supreme Court adjusted its timeline in a separate case, effectively delaying the tariff decision. This postponement reduced immediate market pressure and helped stabilize investor sentiment.

A key factor calming the market is the Treasury's exceptionally strong cash position. Government cash balances currently stand near $774 billion and are projected to grow to approximately $850 billion by the end of March 2026.

This substantial buffer means there is no need for emergency borrowing or an aggressive bond issuance to fund potential refunds. For crypto markets, this suggests that the threat of a liquidity-driven crash tied to the Trump-era tariffs is largely overblown.

For now, the systemic risk from this issue appears to be contained. Here are the key takeaways:

• Gradual Payouts: Any tariff refunds would be spread out over time, preventing a sudden shock to the financial system.

• Ample Liquidity: The U.S. Treasury confirms it has more than enough cash on hand to manage refunds without disrupting bond markets.

• Delayed Timeline: The Supreme Court has pushed its decision further out, removing any immediate threat to market stability.

• No Forced Selling: With a strong cash position, the Treasury will not need to issue a wave of new bonds that could pull capital away from risk assets like crypto.

Prominent German economist Moritz Schularick, president of the Kiel Institute for the World Economy, has suggested that Germany’s path out of its economic slump lies in a pivot toward a war economy, signaling a striking embrace of central planning over market principles.

In an interview with the Neue Osnabrücker Zeitung, Schularick identified a leadership vacuum in German arms policy. He framed a state-directed industrial policy focused on weapons manufacturing as the solution to Germany's economic challenges, even calling increased arms production a potential "job booster."

His argument is rooted in geopolitical strategy. "If we want Europe to truly stand on its own in defense soon and not remain dependent on the MAGA-USA," Schularick stated, "then Defense Minister Boris Pistorius must be given the order to work with European partners to eventually replace the USA and its capabilities."

This rhetoric of "orders to march" and military self-sufficiency reveals a dangerous convergence between politics and state-aligned economic research. Instead of advocating for deregulation and lower taxes to cure economic ills, the focus has shifted to centrally managed industrial policy.

Schularick proposes a top-level arms coordinator to manage investment funds, citing the Russian threat as justification. With over €500 billion in defense investments planned by the end of the decade, the goal is to reduce Germany's security dependence on the United States.

A key frustration for Schularick is the slow pace of ramping up arms production. He notes that four years into the war, little has been done to significantly boost manufacturing capacity.

"How many Taurus missiles are finished per month? Not even a handful," he lamented, diagnosing this as a clear deficit in industrial policy.

This perspective highlights a new trend in German economic thinking, where state-aligned research champions an active industrial policy directed by Berlin and Brussels. Central planners like Schularick appear to believe that idle German industrial capacity can simply be repurposed for the defense sector. The assumption is that civilian car production can be easily converted into tank production.

However, this approach creates a new subsidy-dependent industry that pulls resources from civilian manufacturing, produces goods not demanded by private households, and artificially inflates costs for consumers.

Schularick seems to find a "rediscovered" work ethic in the prospect of a war economy, noting that arms production still operates on a single-shift, five-day work week. The implication is that these state-directed jobs represent Germany's economic future.

Yet, this vision overlooks critical questions. Little thought is given to what civilian goods should be produced to prevent empty shelves during a potential conflict. Schularick acknowledges that Germany has fallen behind not just in producing armored vehicles but also in future technologies like autonomous systems, satellites, AI, and robotics.

The interview fails to address the source of this competitive disadvantage. The possibility that burdensome German policy and Brussels bureaucracy are the primary antagonists is seemingly ignored. This reveals a growing gap between economic reality and the insulated world of politics and state-backed research, which promotes massive economic mismanagement while failing to critically assess Russia's actual military capabilities.

The practical challenges of converting civilian production lines to military manufacturing are immense. Beyond financing, the knowledge transfer required to build a centrally planned war economy is a massive and time-consuming undertaking. Germany's political learning curve appears flat, even after decades of a green transformation that primarily succeeded in driving capital out of the country.

This raises a cynical question: Was the goal of restrictive climate policies to corner industry until it faltered, only to fill the resulting capacity with arms production?

As the climate subsidy model fails, a new one appears to be emerging: the European defense sector. Whether this experiment can survive real-world economic pressures like falling productivity and rising debt is highly doubtful.

No deep economic expertise is needed to see that such a militarization strategy is likely to fail. A brief look at 20th-century history reveals the pitfalls of massive resource mismanagement under central planning. Furthermore, modern obstacles include issues of national sovereignty, divergent geopolitical interests within the EU, and a divided union in which Eastern European nations are wary of conflict with Russia.

When economists like Schularick champion the logic of powerful central planning, it suggests a departure from sound economic principles. The allure of high-level positions, such as a ministerial-level arms coordinator, may be a powerful incentive, but it risks leading the economy down a path of short-term ambition and long-term failure.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up