News

Analysis

7x24

Quotes

Economic Calendar

Video

Data

- Names

- Latest

- Prev

Latest Views

Latest Views

Trending Topics

To quickly learn market dynamics and follow market focuses in 15 min.

In the world of mankind, there will not be a statement without any position, nor a remark without any purpose.

Inflation, exchange rates, and the economy shape the policy decisions of central banks; the attitudes and words of central bank officials also influence the actions of market traders.

Money makes the world go round and currency is a permanent commodity. The forex market is full of surprises and expectations.

Top Columnists

Hi there! Are you ready to get involved into the financial world?

The latest breaking news and the global financial events.

I have 5 years of experience in financial analysis, especially in aspects of macro developments and medium and long-term trend judgment. My focus is maily on the developments of the Middle East, emerging markets, coal, wheat and other agricultural products.

BeingTrader chief Trading Coach & Speaker, 8+ years of experience in the forex market trading mainly XAUUSD, EUR/USD, GBP/USD, USD/JPY, and Crude Oil. A confident trader and analyst who aims to explore various opportunities and guide investors in the market. As an analyst I am looking to enhance the trader’s experience by supporting them with sufficient data and signals.

Market Trend

Popular Indicators

Latest Update

How to Make Forecasts with Pre-trained Machine Learning Models?

Curious about my trading success with a self-trained Decision Tree model on US stocks? Stay tuned for valuable insights and a test script of the strategy for your reference!

Full Course: Optimize Parameters for Machine Learning Model that Gives a Sharpe Ratio 5% +

Today, we delve into how to optimize machine learning model parameters to triple your invested capital and achieve an impressive Sharpe ratio of 5%+ in just 350 trades.

Full Course: Begin Mining in 10 Minutes

Think you need a super-powered computer to mine crypto? Not at all! Your trusty home computer can do the job just fine. I'll show you how to start mining from the comfort of your own home.

Full Course: How to Auto-Generate Triangle Patterns

Triangle patterns serve as crucial reference signals within the realm of trading, and today I am thrilled to unveil a remarkably efficient tool that expedites the detection of trading signals.

Business

White Label

Data API

Web Plug-ins

Tools

Awards

View All

No data

Market Trend

Popular Indicators

Latest Update

How to Make Forecasts with Pre-trained Machine Learning Models?

Curious about my trading success with a self-trained Decision Tree model on US stocks? Stay tuned for valuable insights and a test script of the strategy for your reference!

Full Course: Optimize Parameters for Machine Learning Model that Gives a Sharpe Ratio 5% +

Today, we delve into how to optimize machine learning model parameters to triple your invested capital and achieve an impressive Sharpe ratio of 5%+ in just 350 trades.

Full Course: Begin Mining in 10 Minutes

Think you need a super-powered computer to mine crypto? Not at all! Your trusty home computer can do the job just fine. I'll show you how to start mining from the comfort of your own home.

Full Course: How to Auto-Generate Triangle Patterns

Triangle patterns serve as crucial reference signals within the realm of trading, and today I am thrilled to unveil a remarkably efficient tool that expedites the detection of trading signals.

Business

White Label

Data API

Web Plug-ins

Tools

Awards

Reminders Temporarily Unavailable

Rules for using redeem codes:

1. The activated redeem code cannot be used again

2. Your redeem code becomes invalid if it has expired

FastBull Membership Privileges

Quick access to 7x24

Quick access to more editor-selected real-time news

Follow more assets

You can add more assets to your watchlist to follow more real-time quotes.

More comprehensive macro data and economic indicators

More comprehensive historical data on indicators to help analyze macro markets

U.S. oil and gas production continued to rise strongly in March - the delayed impact of very high prices that prevailed until the third quarter of 2022.

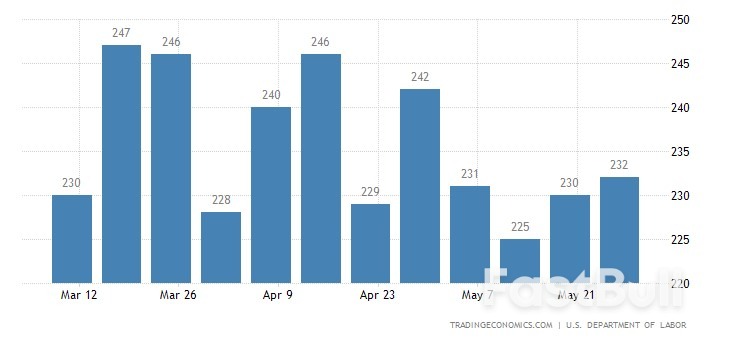

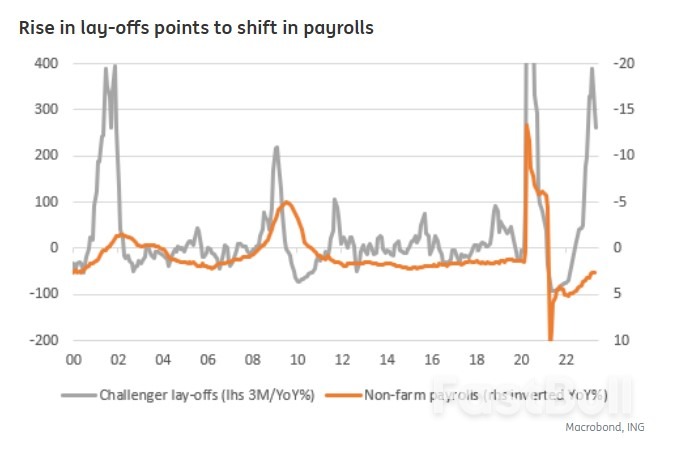

Stable Labor Market Signals Persist

Stable Labor Market Signals Persist Watch for slowing wage growth despite record low unemployment

Watch for slowing wage growth despite record low unemployment

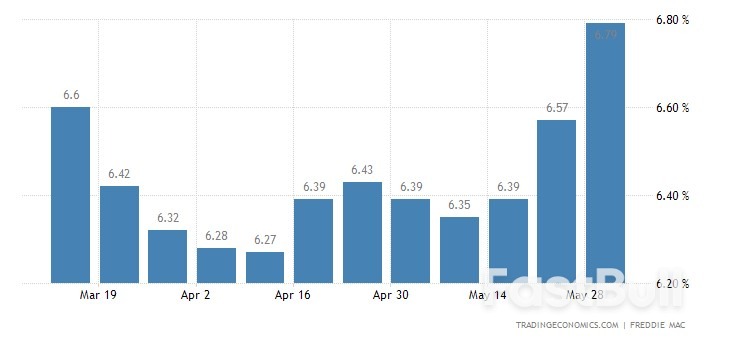

A batch of indicators suggested U.S. inflationary pressures are cooling, which could allow the Fed to pause its rate-hiking cycle later this month, while other data showed the labor market remains strong.

A batch of indicators suggested U.S. inflationary pressures are cooling, which could allow the Fed to pause its rate-hiking cycle later this month, while other data showed the labor market remains strong. The Australian dollar had its best day in six weeks, and the Japanese yen rose for a fourth consecutive session - its longest winning streak since November.

The Australian dollar had its best day in six weeks, and the Japanese yen rose for a fourth consecutive session - its longest winning streak since November.

The risk of loss in trading financial assets such as stocks, FX, commodities, futures, bonds, ETFs or crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No consideration to invest should be made without thoroughly conduct your own due diligence, or consult with your financial advisors. Our web content might not suit you, since we have not known your financial condition and investment needs. It is possible that our financial information might have latency or contains inaccuracy, so you should be fully responsible for any of your transactions and investment decisions. The company will not be responsible for your capital lost.

Without getting the permission from the website, you are not allow to copy the website graphics, texts, or trade marks. Intellectual property rights in the content or data incorporated into this website belongs to its providers and exchange merchants.