Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

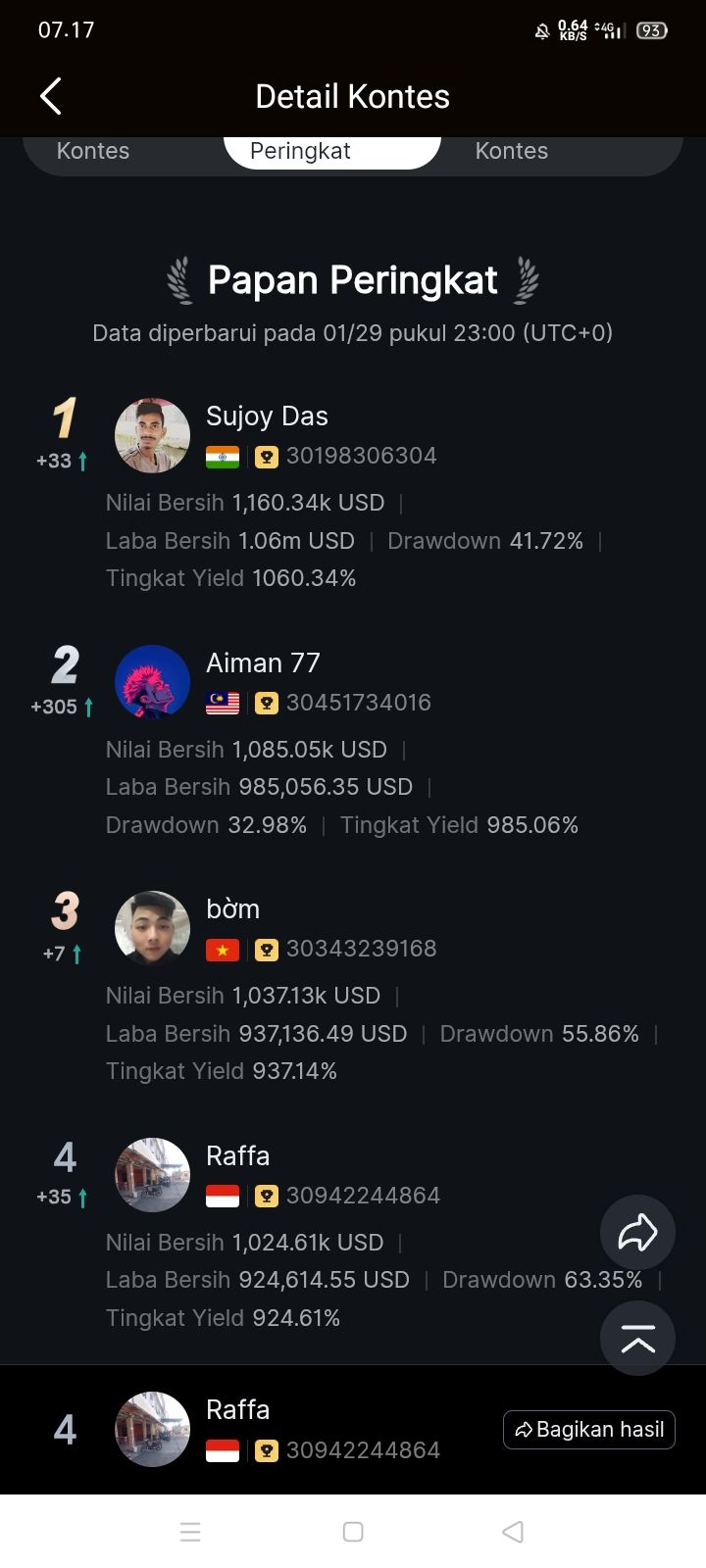

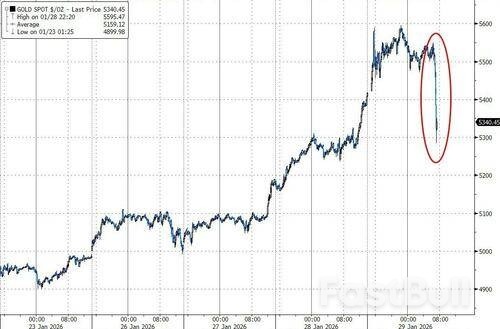

Signal Accounts for Members

All Signal Accounts

All Contests

China Central Bank Injects 477.5 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

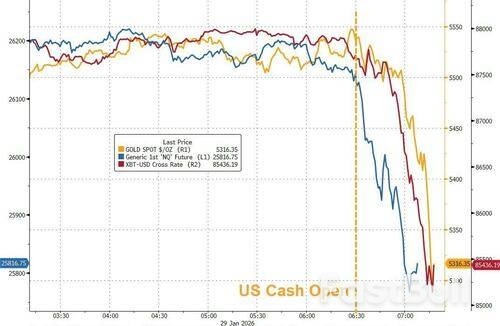

Spot Gold Fell Sharply, Dropping Nearly $50 In The Short Term To A Low Of $5,325.33 Per Ounce, Down 0.80% On The Day

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Trump: 'Very Dangerous' For UK To Get Into Business With China, More Dangerous For Canada To Get Into Business With China

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump considers Iran strikes, engaging Israeli and Saudi officials in high-level defense talks.

The Trump administration is holding separate, high-level talks with senior defense and intelligence officials from Israel and Saudi Arabia in Washington this week, as President Donald Trump considers military strikes against Iran.

Tensions in the region have been escalating amid a U.S. military buildup. On Wednesday, Trump publicly urged Iran to negotiate a nuclear weapons deal or face a potential U.S. attack, prompting Tehran to threaten a harsh response.

Two distinct sets of meetings are underway, focusing on the strategic challenge posed by Iran.

Israel Details Potential Iranian Targets

Israel's military intelligence chief, General Shlomi Binder, met with senior officials at the Pentagon, the CIA, and the White House on Tuesday and Wednesday. According to one source, Binder shared intelligence on possible Iranian targets during these discussions.

Saudi Arabia Navigates De-escalation

Separately, Saudi Defense Minister Prince Khalid bin Salman was also in Washington for meetings with U.S. officials centered on Iran. While participating in these talks, Saudi Arabia and other Gulf states have officially sought to de-escalate the situation and prevent a wider conflict.

In a recent communication, Saudi Crown Prince Mohammed bin Salman assured Iranian President Masoud Pezeshkian that Riyadh would not permit its territory or airspace to be used for military actions against Tehran, as reported by the state news agency SPA.

Sources familiar with the matter say President Trump is weighing several options against Iran. These include targeted strikes on security forces and key leaders in an effort to inspire internal protests.

However, some Israeli and Arab officials have expressed doubt that air power alone would be sufficient to topple Iran's clerical leadership.

One source, along with a U.S. official, confirmed that Trump has not yet made a final decision on a course of action, including whether to pursue a military path. The White House did not provide an immediate response to a request for comment.

Eurozone bond yields ticked lower on Thursday, driven by growing speculation that the European Central Bank may be forced to cut interest rates sooner than expected. The main catalyst is the euro's recent strength, which is raising questions about its potential impact on inflation.

Germany’s benchmark 10-year bond yield fell 2.5 basis points to 2.824%. Shorter-term debt also saw downward pressure, with the German two-year yield dropping 2 basis points to 2.06%, its lowest level in a week.

The euro recently broke above the $1.20 mark against the U.S. dollar for the first time since mid-2021 before settling back to $1.1932. This appreciation has caught the attention of policymakers and traders alike.

Because the Eurozone is a net importer of energy, a stronger currency directly reduces the cost of imports, which can have a disinflationary effect. This dynamic has fueled market bets on an earlier ECB rate cut.

The speculation gained credibility after ECB policymaker Martin Kocher told the Financial Times that further appreciation of the euro could compel the central bank to lower rates.

Despite the growing chatter, some analysts believe the market is getting ahead of itself. Andrzej Szczepaniak, senior European economist at Nomura, argued that traders would need to see a decisive and sustained break above the $1.20 level before fully pricing in another rate cut.

He pointed out that rising oil prices are creating an opposing, inflationary force that counteracts the euro's strength.

"The stronger euro-dollar and also the rise in oil prices actually offset each other," Szczepaniak explained. "Obviously, stronger euro-dollar having a disinflationary impact, whereas higher oil prices having an inflationary impact."

Driven by a weaker dollar and geopolitical tensions, the price of oil has climbed 16% this month to its highest point since July. Szczepaniak suggested that as long as these two forces remain in balance, the ECB has room to keep its policy on hold.

Meanwhile, the U.S. Federal Reserve concluded its recent meeting by leaving interest rates unchanged, as was widely anticipated. The central bank noted that inflation remains elevated while the labor market continues to stabilize.

In his press conference, Fed Chair Jerome Powell adopted a slightly hawkish tone but clarified that a rate hike was not part of the baseline outlook for policymakers.

The International Monetary Fund (IMF) has issued a stark warning to emerging market economies: while they have weathered recent trade shocks and geopolitical turmoil, their current stability rests on a narrow base that may not last.

According to IMF chief economist Pierre-Olivier Gourinchas, the global economy has absorbed the initial impact of tariff shocks. This resilience has been fueled by companies reconfiguring their supply chains, supportive financial conditions, and a major investment boom in technology and artificial intelligence that has boosted exports, especially in Asia.

These same forces have propped up emerging markets, sustaining economic activity and capital flows despite high levels of uncertainty.

While the global economy appears stable, the IMF cautions that this growth is becoming increasingly concentrated. Activity is clustered in a handful of sectors, with technology and AI leading the charge. This creates significant risks.

"While the current investment boom offers the promise of a long-lasting productivity boost, the question remains whether returns will continue to meet or exceed expectations," Gourinchas stated at a roundtable ahead of the AlUla Conference on Emerging Market Economies.

IMF officials warned that if the tech investment cycle turns, emerging markets could be hit hard by a sudden tightening of financial conditions and a rush of capital outflows.

The Fund also flagged emerging concerns in the labor market, noting early signs of softening in several countries. Over the longer term, the widespread adoption of AI could displace workers, creating new and complex challenges for policymakers.

Further complicating the picture is the US dollar. Gourinchas noted that its depreciation over the past year has eased financial pressure in many emerging markets. However, he cautioned that this relief has been unevenly distributed, particularly for commodity-exporting nations.

On the policy front, many countries have successfully used countercyclical fiscal measures to soften economic downturns. Yet, for economies already burdened with high debt levels, borrowing costs remain elevated.

The IMF has previously credited emerging market resilience to stronger monetary credibility, flexible exchange rates, and improved fiscal frameworks. While these factors are still crucial, officials now say that easier external financial conditions and the tech-led investment boom have played a more significant role in supporting recent growth.

The Fund's latest global economic update reinforces its warning: the current stability is narrow. Governments are urged to use this period to prepare for potentially less favorable conditions ahead.

Gourinchas outlined a clear strategy for policymakers:

• Strengthen fiscal buffers: Use the current window to shore up national finances.

• Improve debt management: Get a handle on sovereign borrowing before conditions worsen.

• Safeguard price stability: Maintain control over inflation.

• Enact structural reforms: Implement policies to lift productivity and diversify the sources of economic growth beyond just a few hot sectors.

Oil prices surged to their highest levels in four months as markets grappled with a combination of escalating geopolitical risk and severe weather-related supply disruptions in the United States.

On Thursday, Brent crude futures for March delivery rose 2.2% to trade at $68.85 per barrel, after briefly touching $70.35, a peak not seen since late September. Meanwhile, West Texas Intermediate (WTI) crude futures gained 2.4%, reaching $64.72 a barrel and earlier clearing the $65 mark. Both oil benchmarks have climbed approximately 9% over the past week.

The primary driver behind the rally is mounting tension between the U.S. and Iran, which has injected a significant risk premium into the market. Traders are concerned that a potential conflict could disrupt crude output from a key Middle Eastern producer.

Recent reports indicated that U.S. President Donald Trump was considering new military actions against Iran, potentially targeting its leadership and nuclear facilities. This follows earlier calls for Tehran to renegotiate its nuclear program, which were rejected. The situation has been intensified by the arrival of U.S. warships in the Middle East, with Trump suggesting more naval assets are en route.

As the fourth-largest producer within OPEC, Iran's output of 3.2 million barrels per day is critical to global supply. Analysts at ING noted that while an immediate disruption to Iranian oil is a key concern, a wider escalation could endanger the nearly 20 million barrels of oil that pass through the Strait of Hormuz daily.

However, not all analysts see a conflict as inevitable. Kepler Cheuvreux argued in a note that the probability of a major supply disruption is low. They believe President Trump's main objective is a nuclear deal, not regime change, making a large-scale bombing campaign unlikely. While Kepler acknowledged that oil prices could continue to rise in the short term, they expect the gains to be temporary, lasting perhaps a couple of weeks.

Adding to supply-side pressures, a severe winter storm has swept across the United States, bringing heavy snow and freezing temperatures that have disrupted domestic crude production.

An estimated 2 million barrels per day of oil production were taken offline over the past week, and exports from the Gulf Coast were also hampered. The impact of these disruptions is already visible in official data, with U.S. oil inventories showing an unexpectedly sharp decline.

According to government figures released Wednesday, U.S. oil stockpiles for the week ending January 23 fell by 2.295 million barrels. This drawdown significantly outpaced market expectations of a 0.2 million barrel drop.

A closer look at the data reveals the sources of this tightening supply:

• Imports: Dropped by 805,000 barrels per day.

• Exports: Increased by 901,000 barrels per day week-over-week.

• Production: Crude output in the Lower 48 states fell by an estimated 42,000 barrels per day.

• Refinery Activity: Operating rates at U.S. refineries declined by 2.4 percentage points to 90.9% of capacity.

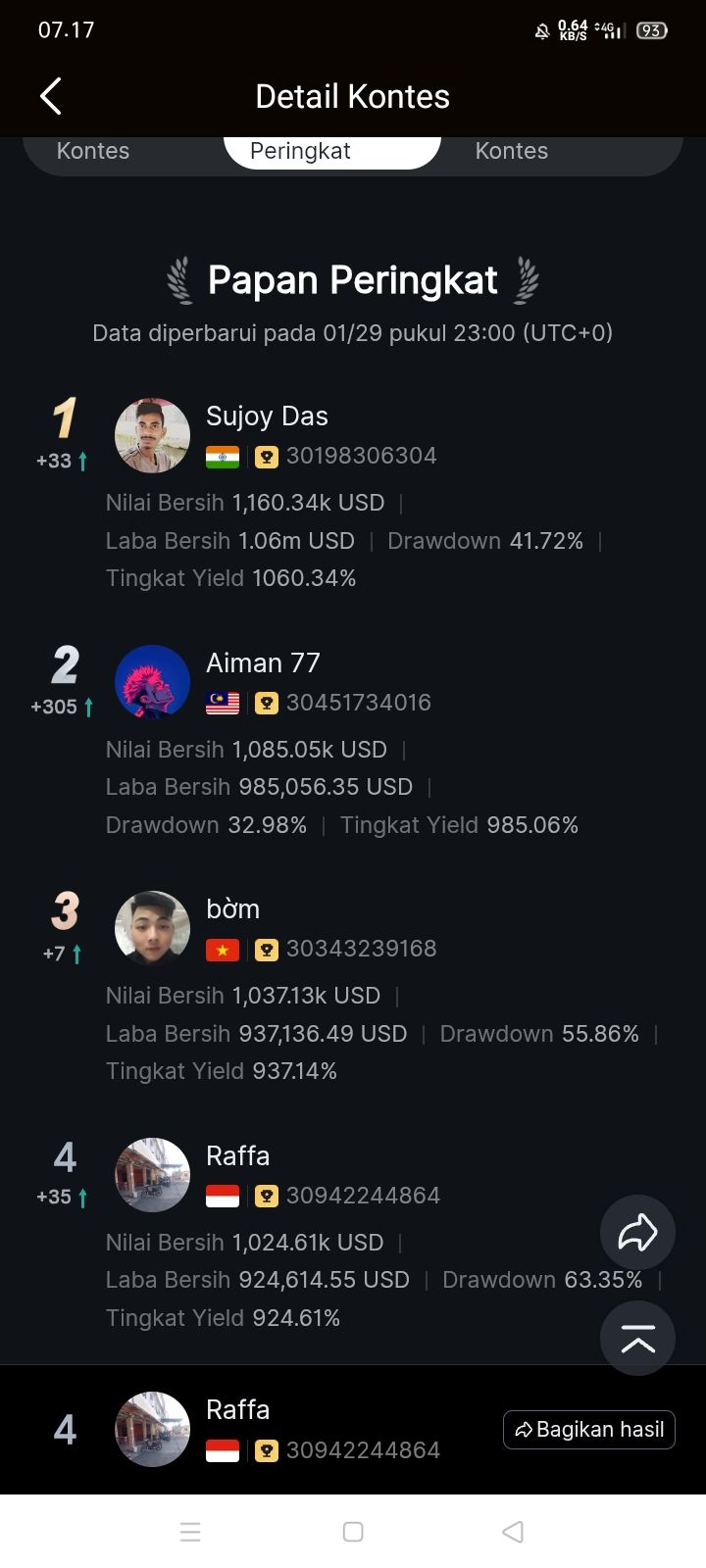

...aaaand it's gone!

Tech's wreck at the open started it... following Goldman's Privorotsky's warning earlier to 'keep an eye on the megacap tech names today'...

US equities puked as the cash market opened, with Nasdaq erasing overnight gains rapidly...

...as losses in MSFT accelerated...

...crypto followed with Bitcoin crashing to its lowest since Dec 18th...

...and then gold plunged back below $5300...

And for now we see no catalyst for this break.

India's economy is on track to grow between 6.8% and 7.2% in the fiscal year beginning in April, propelled by strong domestic demand even as global volatility presents significant headwinds.

The projection, detailed in the government's annual economic survey, marks a slight moderation from the current fiscal year's estimated 7.4% growth. Presented to parliament by Finance Minister Nirmala Sitharaman, the report strikes a tone of cautious optimism, forecasting "steady growth amid global uncertainty."

The government's assessment for the current year at 7.4% notably surpasses the 6.3%-6.8% range predicted in last year’s survey.

While the domestic outlook is robust, the report acknowledges that global conditions introduce considerable uncertainty. Key external risks threatening India's economy include:

• Slower growth among major trading partners.

• Trade disruptions stemming from international tariff policies.

• Volatility in capital flows that could affect exports and investor sentiment.

The report, authored by Chief Economic Adviser V. Anantha Nageswaran and his team, positions these challenges as sources of uncertainty rather than immediate macroeconomic distress.

The survey directly addresses the impact of global trade tensions, particularly with the United States. In August, President Donald Trump imposed a 50% tariff on certain Indian goods, prompting New Delhi to accelerate efforts to diversify its export markets through new trade deals with the European Union, New Zealand, and Oman.

Since the tariffs were introduced, the Indian rupee has fallen 5%, hitting a record low of 91.9850 per dollar on Thursday.

The economic survey argues that the currency is now "punching below its weight." The report states that the rupee's valuation does not align with India's strong economic fundamentals. However, this "undervalued" status provides a partial buffer against the impact of higher U.S. tariffs on Indian exports.

This currency weakness comes with a trade-off. While beneficial for exporters and manageable during a period of low inflation, it has made foreign investors hesitant. This reluctance led to a record withdrawal of $19 billion from Indian equities in 2025, with foreign investors continuing to be net sellers in January.

To counter external pressures, the government is relying on a series of domestic reforms to stimulate investment and consumption. The survey highlights recent policy changes expected to strengthen the economy, including consumption-tax cuts, a comprehensive overhaul of labor laws, and measures to open up the nuclear power sector.

Furthermore, the report expresses optimism that "ongoing trade negotiations with the United States are expected to conclude during the year," which could help reduce uncertainty on the external front.

The Indian government's growth forecast is broadly in line with projections from major international institutions.

The International Monetary Fund (IMF) recently raised its growth forecast for India for the upcoming fiscal year to 7.3%. Similarly, the World Bank upgraded its projection to 7.2%.

Domestically, the Reserve Bank of India (RBI) has noted that high-frequency indicators point to sustained demand. The central bank has actively supported growth by cutting interest rates by 125 basis points since February 2025, its most aggressive easing cycle since 2019.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up