Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US controls Venezuela's oil: China pays market rates, boosting revenue, but imports may still decline.

The Trump administration has given China the green light to purchase Venezuelan oil, but under a strict new pricing policy, a U.S. official confirmed on Thursday. This development follows the removal of President Nicolas Maduro on January 3, after which the U.S. assumed control over the country's oil sales.

According to an administration official who spoke on the condition of anonymity, China is now permitted to buy Venezuelan crude at "fair market prices." This directive explicitly ends the practice of selling oil at "unfair, undercut prices," which Caracas previously used to service its massive debts to Beijing.

For years, China has been Venezuela's primary oil buyer, with sales structured as debt-for-oil deals. The official stated that the U.S. will maintain control over Venezuela's oil sales indefinitely. While the crude will enter the global marketplace, a key stipulation is that the majority of it must be sold to the United States.

The official credited President Donald Trump's "decisive and successful law enforcement operation" for the policy shift, arguing it ensures "the people of Venezuela will collect a fair price for their oil from China and other nations rather than a corrupt, cheap price."

The financial impact of the new arrangement is already clear. U.S. Energy Secretary Chris Wright said last week that the U.S. is receiving approximately $45 per barrel for Venezuelan oil.

This price point is a significant increase from the roughly $31 per barrel Venezuela received before Maduro’s capture, underscoring the end of the previous discount-based sales model.

Leading trading houses have stepped in to manage the first wave of transactions under the new U.S.-led framework. Trafigura and Vitol have successfully sold around 11 million barrels of stranded crude in an initial supply deal. This volume accounts for roughly a quarter of a $2 billion agreement between Venezuela and the United States.

Trafigura has already completed its first sale to a customer, Spanish energy company Repsol. At the same time, Vitol has negotiated cargo shipments to U.S. refiners, including Valero and Phillips 66, as well as to its own refinery in Italy, according to sources.

Despite these initial deals, traders and analysts project that China's oil imports from Venezuela will likely decline starting in February. The expected slump is attributed to the logistical constraints imposed by U.S. control over the OPEC nation's oil sales, which has limited the number of tankers able to leave port.

The U.S. economy is showing robust growth, fueled by strong consumer spending in October and November that points to another powerful quarter. However, this economic boom is unfolding alongside a surprisingly sluggish labor market, creating a complex picture for policymakers and investors.

While top-line numbers suggest a thriving economy, economists point to President Donald Trump's trade and immigration policies as factors that have dampened both the demand for and supply of workers. At the same time, businesses are investing heavily in artificial intelligence, which curbs hiring and creates uncertainty about future staffing needs.

This has resulted in a "low-hiring, low-firing" state for the labor market. The current economic expansion is largely powered by high-income households spending on travel and experiences, alongside significant business investment in AI, rather than broad-based job growth.

Given the resilient consumer spending and stable, if uninspired, labor market, economists believe the Federal Reserve has little reason to cut interest rates next week. Although inflation was moderate in October and November, these figures were likely distorted by the 43-day government shutdown, and newer data suggests price pressures are building again.

"Consumer spending remained remarkably resilient... yet this impressive strength masks a more troubling reality," said Lydia Boussour, senior economist at EY-Parthenon. "Beneath the surface, many families are grappling with depleted savings and the challenges of fewer job opportunities and slower income growth, which is eroding their purchasing power."

According to the Commerce Department's Bureau of Economic Analysis (BEA), consumer spending—which accounts for over two-thirds of U.S. economic activity—rose by 0.5% in both October and November. The combined data, delayed by the shutdown, met economists' expectations.

Key drivers for spending in November included:

• Services: Healthcare, financial services, insurance, housing, and utilities saw strong growth. Consumers also spent more on hotels, restaurants, and bars, with services spending rising 0.4%.

• Goods: Spending on goods jumped 0.7%, led by purchases of motor vehicles, clothing, furniture, and recreational goods. Higher energy prices also contributed to a surge in spending on gasoline.

After adjusting for inflation, real consumer spending increased by 0.3% in both months, reinforcing the economy's high-growth trajectory for the fourth quarter.

This spending spree supports other strong economic indicators. The BEA also reported that GDP grew at an upwardly revised 4.4% annualized rate in the third quarter, its fastest pace in two years. This followed a 3.8% expansion in the second quarter. Looking ahead, the Atlanta Fed is forecasting an even stronger 5.4% GDP growth rate for the fourth quarter, supported by a smaller trade deficit and increased business investment.

In response to the data, stocks on Wall Street traded higher, the dollar fell against a basket of currencies, and U.S. Treasury yields were mixed.

This surge in spending is coming at a cost to household savings. The personal saving rate fell to 3.5% in November, a three-year low, down from 3.7% in October.

Meanwhile, income growth has been modest. Personal income increased by 0.3% in November following a 0.1% rise in October. Government wages and salaries fell by $13.0 billion, partly due to public employees accepting a deferred resignation offer in September. Private-sector wages rose 0.4% in November.

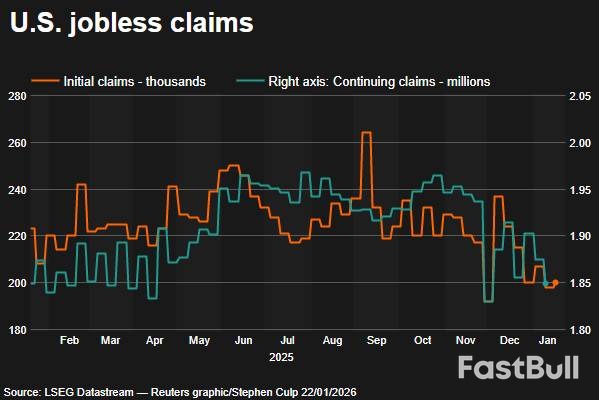

The labor market remains stuck in a holding pattern. A separate report from the Labor Department showed initial claims for state unemployment benefits rose by just 1,000 to a seasonally adjusted 200,000 for the week ended January 17. However, recent claims data has been difficult to interpret due to challenges in seasonal adjustments around the holidays.

The four-week moving average of claims, a more stable measure, increased slightly between December and January. Nonfarm payrolls increased by only 50,000 jobs in December, consistent with the monthly average for 2025.

The number of people receiving benefits after an initial week of aid, known as continuing claims, fell by 26,000 to 1.849 million for the week ended January 10. This decline may also be influenced by seasonal adjustment issues and some individuals exhausting their 26 weeks of eligibility. Consumer surveys indicate that those who are laid off are finding it increasingly difficult to secure new employment.

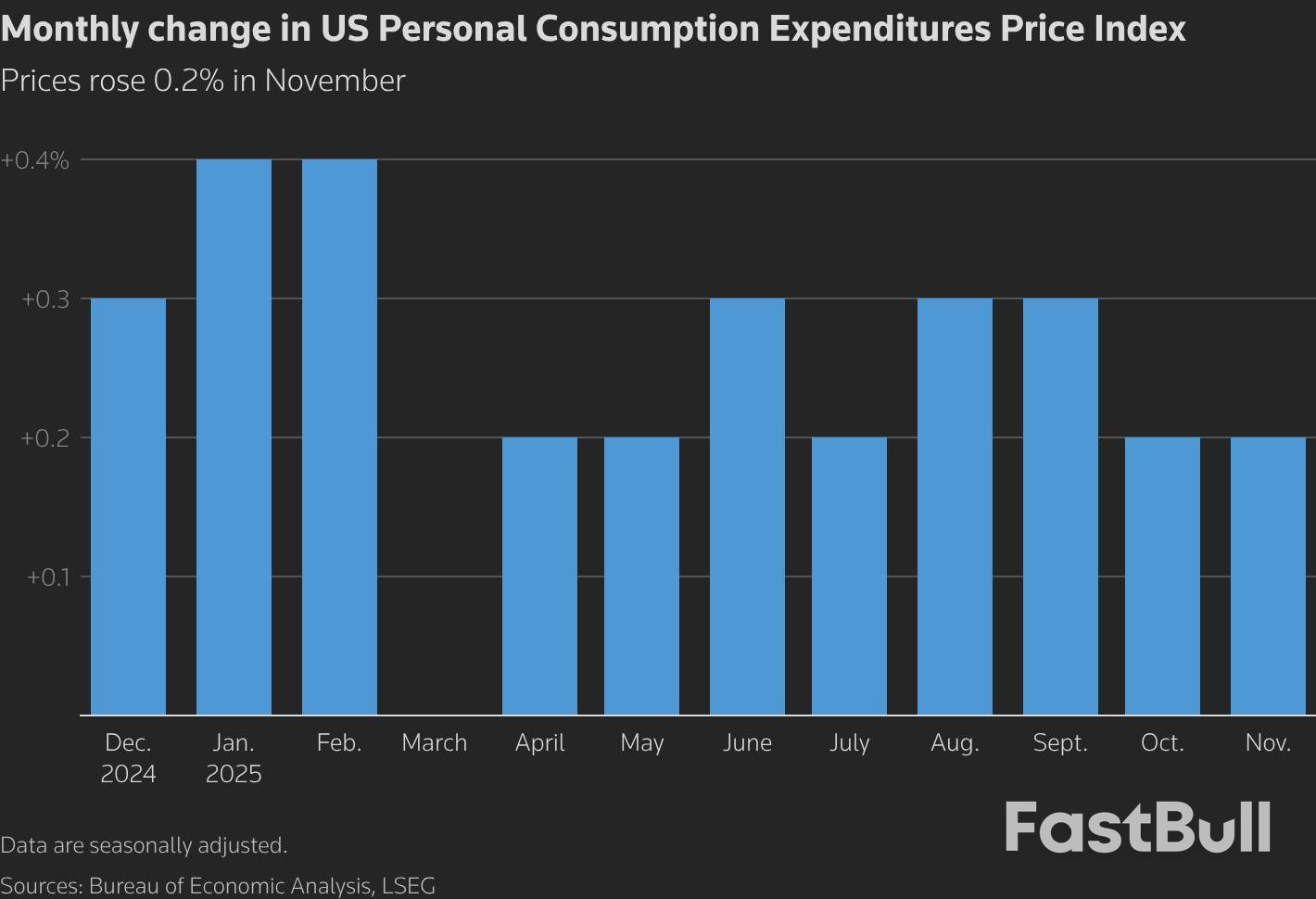

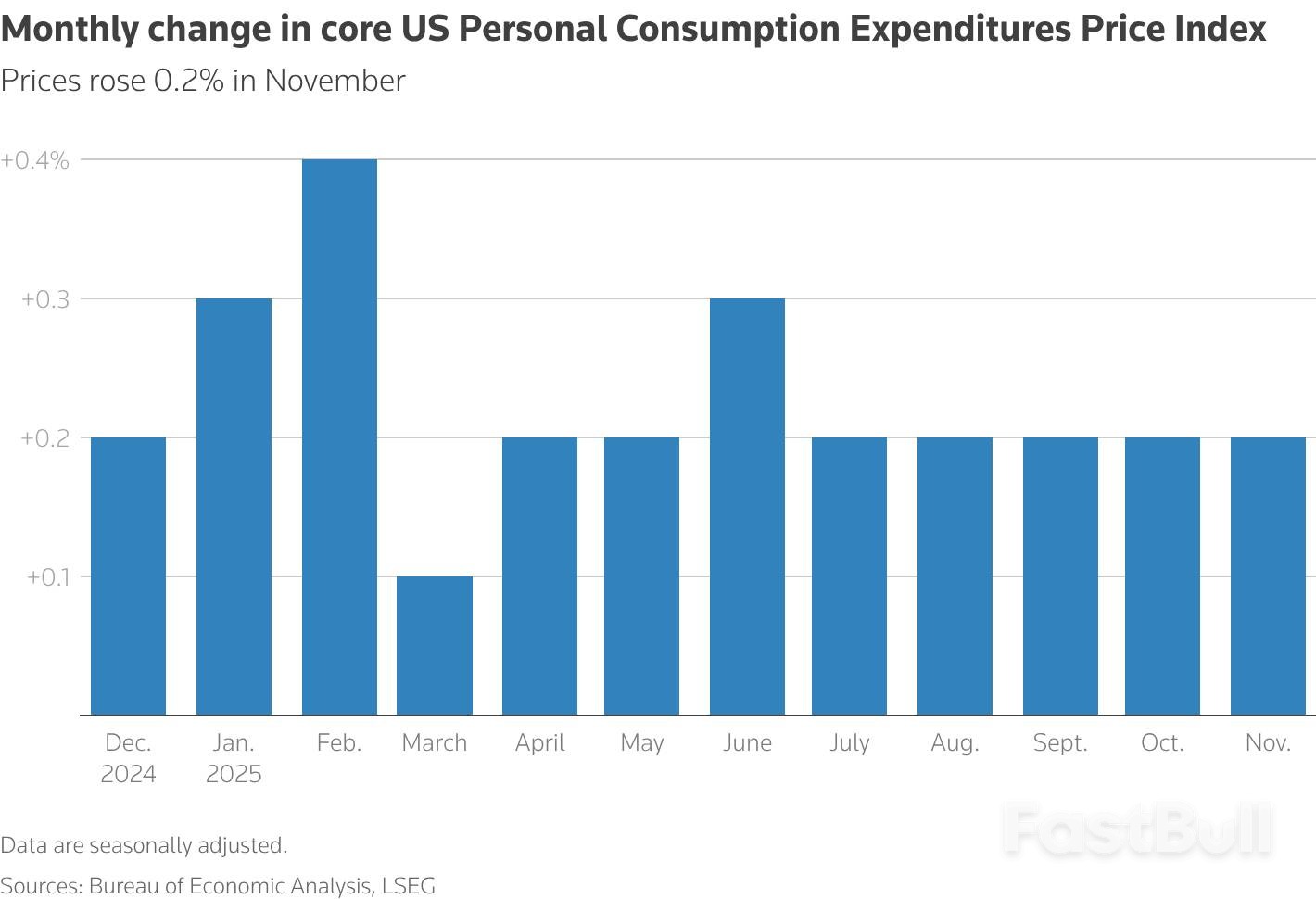

Inflation appeared to subside in October and November, but this was largely an illusion caused by the government shutdown. The government was unable to collect complete data for the Consumer Price Index (CPI) and import prices reports for those months, which in turn affected the Personal Consumption Expenditures (PCE) price indexes—the Federal Reserve's preferred inflation gauge.

To compensate, the BEA used an average of September and November data for its calculations.

The PCE price index increased by 0.2% in November, matching October's gain. On a year-over-year basis, it rose 2.8%.

Core PCE inflation, which excludes volatile food and energy prices, also rose 0.2% for the month and 2.8% from a year earlier. More recent CPI data from December suggests that core PCE inflation may have accelerated, with some economists forecasting a monthly increase as high as 0.4%. This would push the annual rate to 3.1%.

This potential for rising inflation makes the Federal Reserve's next move critical. "The Fed will postpone cuts until it sees evidence of easing inflationary pressures," said Michael Gapen, chief economist at Morgan Stanley. The official PCE inflation data for December is scheduled for release on February 20.

A new government report shows that American households faced increasing financial pressure in October and November as rising prices outpaced income growth, pushing the personal savings rate to its lowest level since 2022.

The data, released Thursday by the Bureau of Economic Analysis, highlights the ongoing challenge of inflation, which continues to run well above the Federal Reserve's target.

Consumer prices, measured by the Personal Consumption Expenditures (PCE) price index, climbed 2.8% in the year through November. This marks an acceleration from the 2.7% annual rate recorded in October.

The "core" PCE index, which excludes volatile food and energy prices, also registered a 2.8% annual increase in both October and November, holding steady from September's levels. The Federal Reserve closely monitors core PCE as its primary benchmark for inflation.

While prices rose, household finances struggled to keep pace. After adjusting for inflation, disposable income fell by 0.1% in October before recovering with a slight 0.1% gain in November.

This squeeze on income forced many to dip into their savings. The personal savings rate fell to just 3.5% in November, a significant drop from 4% in September and its lowest point in three years. The savings rate has been on a downward trend every month since April, when President Donald Trump announced broad tariffs that created economic uncertainty and contributed to higher prices for households.

The release of this report was delayed by about a month due to the federal government shutdown in October and November. Economists caution that this disruption could have distorted the data, as it placed additional financial strain on government workers and may have affected survey collection.

"Consumers are still spending, but they dipped heavily into savings during the shutdown," noted Heather Long, an economist at Navy Federal Credit Union. "Incomes need to continue to grow in 2026 to fuel a healthy economy. It's likely the data was skewed by the shutdown, but this is worth watching closely."

The report adds to growing evidence that household budgets, particularly for middle and lower-income families, are under significant stress. If consumers are forced to cut back, it could weaken consumer spending, which serves as the main engine of the U.S. economy.

Because of the potential data distortions from the shutdown, the elevated core inflation figures may carry less weight in the Federal Reserve's upcoming interest rate decisions. Central bank officials are currently debating whether to maintain higher interest rates to combat persistent inflation or to lower them to support a slowing job market.

The fed funds rate dictates borrowing costs across the economy, and keeping it elevated is a key tool for discouraging spending and taming price increases. Despite the inflation data, the Federal Reserve is widely expected to hold interest rates steady at its policy meeting next week.

Bank of America and Citigroup are reportedly exploring options to launch new credit cards with a 10% interest rate. According to a Bloomberg News report citing sources familiar with the discussions, the move is a potential response to President Donald Trump's call for a broad cap on credit card rates.

Both banks are independently evaluating the new card offerings as a possible solution to avoid a government-mandated rate ceiling. When asked for a statement, neither Citigroup nor Bank of America provided an immediate comment.

Following the news, Bank of America's shares saw a nearly 2% increase in afternoon trading, while Citigroup's stock climbed 2.4%.

The consideration by the two major banks follows President Trump's announcement that he would ask Congress to approve a 10% interest rate cap on all credit cards for a one-year period.

U.S. banks had previously faced a Tuesday deadline to implement this cap, which Trump first proposed in a Truth Social post. However, the White House had not released any details on how such a limit would be enforced.

Financial industry executives have voiced concerns that a wide-ranging cap on all credit card interest rates would force a pullback in lending and negatively impact economic growth.

Bank of America CEO Brian Moynihan has stated that the proposal would ultimately restrict consumer access to credit. Similarly, Citigroup CEO Jane Fraser warned that a rate cap would have a direct impact on consumer spending and the broader economy.

While executives warn of negative consequences, some experts argue that the credit card industry is highly profitable and has enough margin to accommodate lower interest rates.

Market analysts believe that implementing such a rate cap would require new legislation, which is considered unlikely to pass in Congress.

Some observers have suggested that the industry might seek a compromise. Under this scenario, lenders could voluntarily launch no-frills credit cards at the proposed 10% rate. These cards would likely come with fewer benefits and rewards compared to standard offerings.

Canada is fundamentally reshaping its trade strategy, forging a major energy and economic partnership with China in a clear move to reduce its long-standing reliance on the United States. This pivot signals a significant adjustment in global trade flows, driven by new infrastructure and shifting political alliances.

The new alliance was solidified during Prime Minister Mark Carney’s visit to China, the first by a Canadian leader in nearly a decade. Following meetings with President Xi Jinping, the two nations outlined a strategic partnership focused on collaboration in energy, clean technology, and climate change.

A key objective of this agreement is for Canada to increase its exports to China by 50% by the year 2030, marking an ambitious new chapter in the country's foreign trade policy.

This strategic shift is widely seen as a direct response to a strained trade relationship with the United States. In 2025, the Trump administration imposed steep tariffs on Canadian goods, including:

• A 50% tariff on copper imports

• A 25% tariff on steel and aluminum imports

• A 10% tariff on energy imports like oil

These measures highlighted Canada's economic vulnerability. In 2024, a staggering 95% of the nation's energy exports were sent to the United States, underscoring the high stakes of its dependence on a single trading partner. While Canada has traditionally been one of America's top two trading partners, this dynamic is now rapidly changing.

The groundwork for this pivot was laid long before the recent tensions. The crucial piece of infrastructure enabling this diversification is the Trans Mountain Expansion (TMX) project, which was completed in the summer of 2024.

Announced in 2013 with construction starting in 2019, the TMX pipeline provides a vital corridor for Canada's landlocked oil reserves. It allows crude oil from Alberta to be transported directly to the Pacific coast in British Columbia, opening up direct access to Asian and Pacific markets for the first time.

The impact has been immediate and dramatic. In 2025, as Chinese imports of U.S. crude oil fell by over 60%, its imports of Canadian oil skyrocketed by more than 300%, demonstrating the pipeline's game-changing role.

The new agreement extends far beyond energy, creating a broader economic alliance between Canada and China. Other key components of the deal include:

• Electric Vehicles: China will export 49,000 EVs to Canada in 2026, with plans for further expansion.

• Agriculture: China will slash tariffs on Canadian canola seeds from 84% to just 15% and is expected to lower duties on Canadian lobsters, peas, and crabs.

• Metals: Canada will open its markets to Chinese steel and aluminum products, further reducing its reliance on U.S. supply chains.

This comprehensive trade pact represents an evolution in Canadian foreign policy, prioritizing economic strength and diversification. It signals that Canada is serious about creating a new economic future for itself, independent of the political and trade pressures from its southern neighbor.

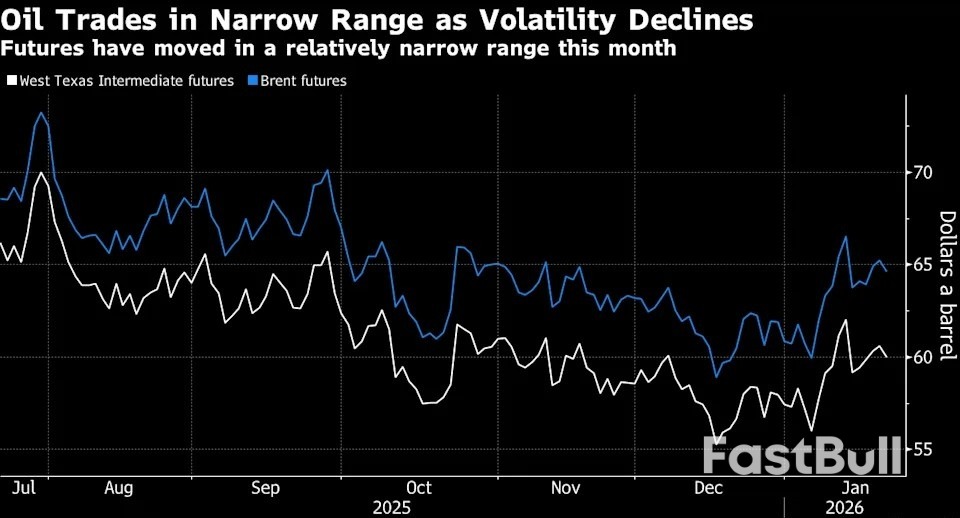

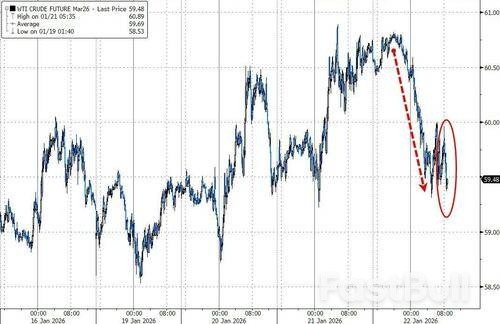

Oil prices are lower this morning after Ukrainian President Zelenskiy said that the US, Russia and Ukraine will meet in coming days for trilateral team meetings.

WTI dropped below $60 as Zelenskiy urged Russia to be "ready for compromises."

Any breakthrough to end Moscow's war in Ukraine could iron out supply disruptions and end sanctions on Russian crude in an already oversupplied global market, sapping a longstanding geopolitical risk premium.

Adding to pressure on prices, Kazakhstan is getting closer to ending a weeks-long export constraint as repairs at a key Black Sea oil-loading facility near completion. A backlog of cargoes at the Caspian Pipeline Consortium terminal is easing.

And supplies are also returning to the global market from Venezuela.

Easing tensions returned the focus to market fundamentals, as traders look to rising global inventories as supply runs well ahead of demand (seemingly confirmed by a large build in crude and product stocks reported overnight by API).

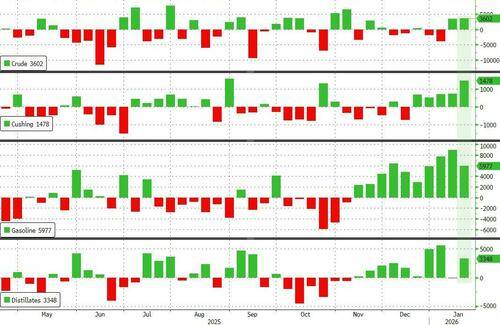

Crude +3.04mm

Cushing +1.2mm

Gasoline +6.2mm

Distillates -33k

Crude +3.6mm

Cushing +1.478mm - biggest build since Aug 2025

Gasoline +5.977mm

Distillates +3.348mm

The official data showed inventory builds across the board with Cushing stocks jumping by the most since August and gasoline inventories up for the 10th week in a row

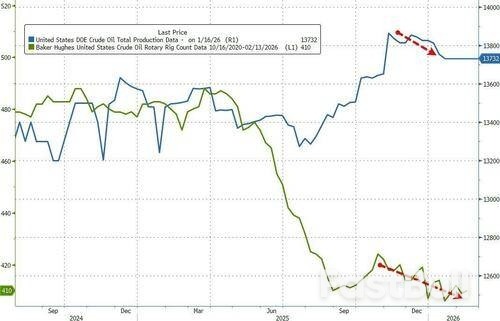

US Crude production dipped a little from record highs as rig counts continue to trend lower...

WTI extended losses after the across the board builds...

"The geopolitical temperature has eased a few degrees," said Ole Sloth Hansen, a strategist at Saxo Bank A/S in Copenhagen.

But with a range of supply threats unresolved, and colder weather set to bolster US demand, prices will likely "hold firm."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up