Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

Iran's Supreme Leader Khamenei: If Americans Start A War This Time, It Will Be A Regional Conflict

Ukraine President Zelenskiy: Ukraine Is Recording Russian Attempts To Disrupt Logistics And Connectivity Between Cities And Communities

[Bitcoin Briefly Drops Below $78,000] February 1st, According To Htx Market Data, Bitcoin Briefly Dropped Below $78,000, And Is Now Trading At $78,184, With A 24-Hour Decrease Of 6.52%

India Budget: Targets 3.16 Trillion Rupees Dividend From Reserve Bank Of India, Financial Institutions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The UK economy flirts with recession, signaling aggressive rate cuts, yet analysts surprisingly champion UK equities.

The UK economy is showing clear signs of strain, raising the risk of a significant recession and setting the stage for aggressive interest rate cuts by the Bank of England, according to a recent analysis by BCA Research.

Key economic growth indicators in the United Kingdom are flashing warning signs. Analysts, including Robert Timper at BCA Research, point to weakening business confidence and deteriorating job data as evidence that the economy is on shaky ground.

The labor market, in particular, is a major source of concern. While widespread layoffs have been limited so far, falling corporate profit growth suggests that job cuts could increase. Analysts warn that the UK labor market is weakening at a worrying pace and is already exhibiting recessionary characteristics. Without a significant improvement in the data, mounting job market weakness could be enough to tip the entire economy into a recession.

As the economy slows, inflationary pressures are also receding. Wage growth has moderated, and price distribution in the services sector has returned to normal levels. These trends support projections that underlying inflation will fall back to the Bank of England's 2% target within the year.

This cooling inflation gives the central bank the justification it needs to shift its policy stance. The market is currently pricing in 41 basis points of interest rate cuts in 2024, followed by a more substantial 100 basis points of cuts in 2025.

Despite the bleak domestic outlook, analysts at BCA Research see a compelling investment case for UK stocks. They argue that several factors could drive market performance, making UK equities a better bet than their Eurozone counterparts over the next three to six months.

Key drivers for UK stocks include:

• Monetary Easing: Potential borrowing cost reductions from the Bank of England would support equity valuations.

• Currency Weakness: A weaker British pound would boost the value of overseas earnings for UK-listed multinational corporations.

• Global Exposure: Many companies in the UK market derive a large portion of their revenue from international sales, insulating them from domestic weakness.

Furthermore, UK stocks are currently trading at a discount and are not considered overbought, offering an attractive entry point for investors.

The energy sector could provide another catalyst for UK equities. Analysts highlight the possibility of a historic oil supply shock, potentially triggered by a collapse of the ruling regime in Iran.

Given the significant presence of major oil and gas companies on the London Stock Exchange, the UK's broad market has historically outperformed Eurozone equities during periods of rising oil prices. Such a scenario could provide an unexpected but powerful boost to UK stock performance.

India has unveiled an annual budget that doubles down on manufacturing, signaling a strategic push to boost factory output and accelerate growth in Asia's third-largest economy. Finance Minister Nirmala Sitharaman outlined a plan focused on structural reforms designed to navigate a volatile global environment.

The budget prioritizes strengthening the manufacturing sector, building a more robust financial system, and increasing investment in advanced technologies like artificial intelligence. This comes as the Modi government aims to lift manufacturing's contribution to GDP from its current level of under 20% to a more ambitious 25%, a move critical for creating jobs for millions of new workforce entrants.

The Indian economy is projected to grow by 7.4% in the current financial year, with inflation expected to be near 2%. The government forecasts a fiscal deficit of 4.4% of GDP for the same period.

To drive private investment and demand, the government's budget builds on recent reforms, including tax cuts and an overhaul of labor laws. Sitharaman identified seven key sectors for a manufacturing scale-up:

• Pharmaceuticals

• Semiconductors

• Rare earth magnets

• Chemicals

• Capital goods

• Textiles

• Sports goods

In addition to focusing on these priority areas, the government also plans to revive 200 legacy industrial clusters to further bolster its manufacturing base.

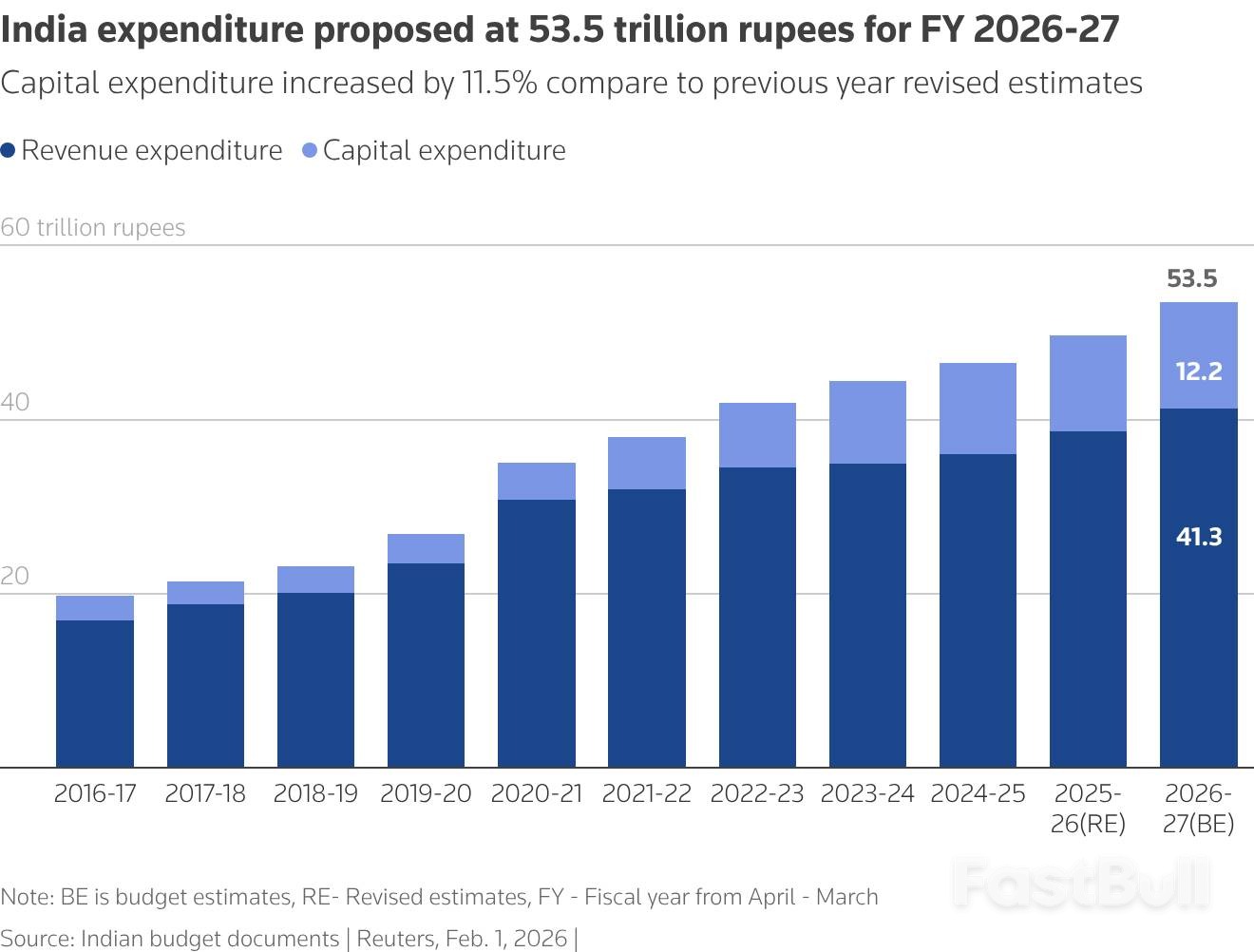

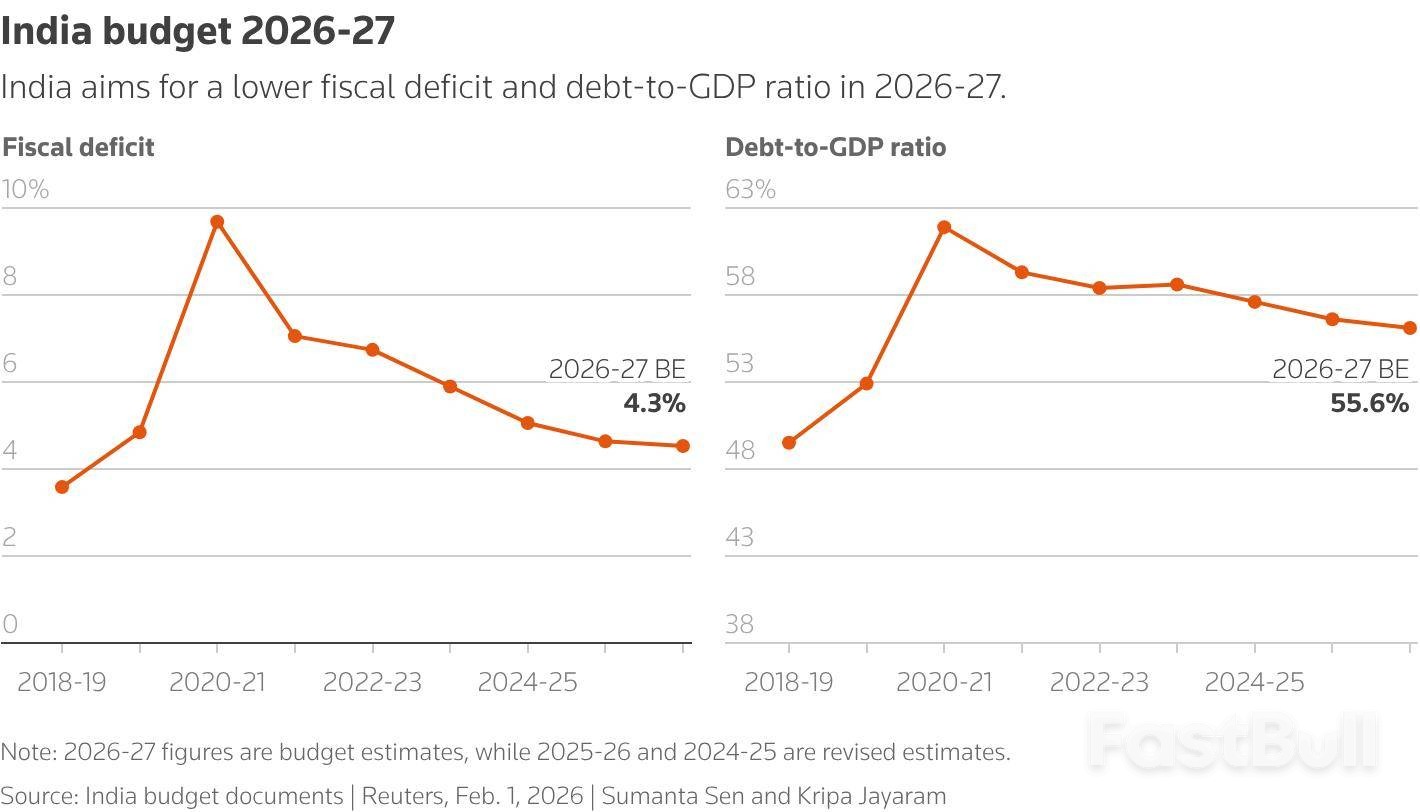

A key shift in fiscal policy is the adoption of the debt-to-GDP ratio as the primary target. The government aims to reduce this ratio from 56.1% in the current year to 55.6%.

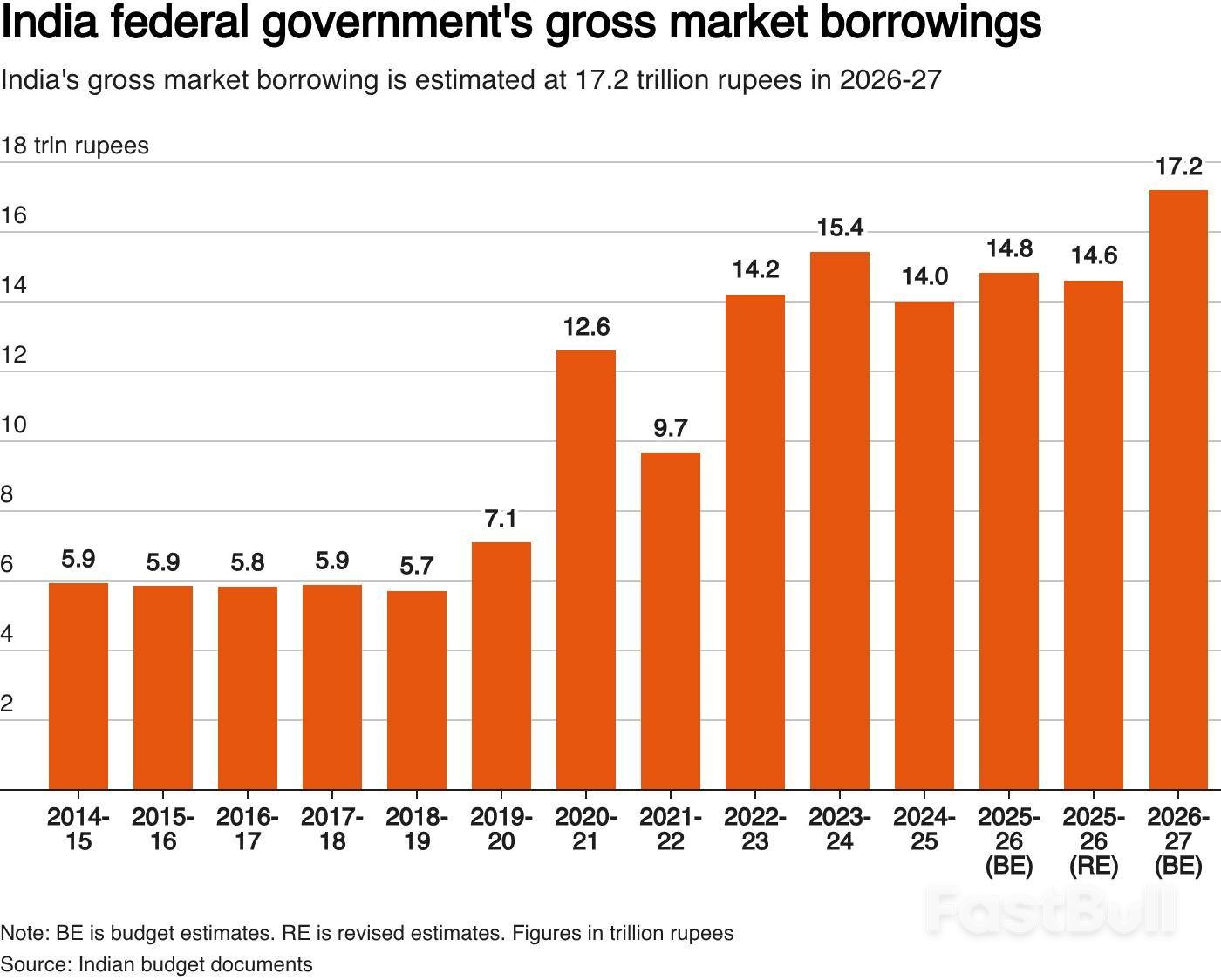

To achieve this, the fiscal deficit is targeted to remain at 4.4% in the new financial year. To finance its spending, the government will undertake gross borrowing of 17.2 trillion rupees from the bond markets.

A significant portion of this spending is earmarked for infrastructure. The budget allocates 12.2 trillion Indian rupees ($133.08 billion) for infrastructure projects in the upcoming year, an increase from 11.2 trillion rupees last year.

The government will establish a high-level committee to review the country's financial sector regulations. The goal is to ensure the financial system can effectively support a growing economy. This review will cover rules for non-banking financial companies (NBFCs) and streamline foreign investment management rules to improve market access for international investors.

The budget also introduces measures to deepen the corporate bond market. This includes the introduction of total return swaps (TRS), a type of derivative contract that allows parties to transfer the economic exposure of a bond without an outright sale. Incentives will also be provided to encourage fundraising through municipal bonds.

Prime Minister Narendra Modi framed the budget as part of a long-term strategy, stating, "The nation is moving away from long-term problems to tread the path of long-term solutions."

Before the budget announcement, the government's economic survey projected growth between 6.8% and 7.2% for the fiscal year starting in April. Modi affirmed that India will press ahead with "next-generation reforms," calling the next 25 years crucial for transforming the nation into a developed economy.

These domestic reforms are complemented by international trade efforts, such as a landmark agreement with the European Union, intended to counter the impact of U.S. tariffs on certain Indian goods.

The stock market registered a muted initial response to the budget announcement. India's benchmark Nifty 50 index was nearly flat on the day.

However, specific sectors targeted by the budget saw positive movement. Stocks in electronics manufacturing, infrastructure, textiles, and pharmaceuticals edged higher, with the Nifty pharmaceutical index rising 0.1% and an infrastructure company gauge advancing by about 0.2%.

($1 = 91.6710 Indian rupees)

India's federal government is set to spend a record 12.2 trillion rupees ($133.08 billion) on infrastructure in the 2027 fiscal year, an 11.4% annual increase designed to accelerate growth in Asia's third-largest economy amid global uncertainty.

The plan, unveiled in the federal budget presented by Finance Minister Nirmala Sitharaman, continues a strategy of significantly raising infrastructure investment that began after the COVID-19 pandemic. This approach aims to stimulate economic activity and create jobs in the world's most populous nation, with a renewed focus on the manufacturing sector.

For the current fiscal year ending in March 2026, the government's capital expenditure (capex) was revised down to 10.95 trillion rupees from the initially allocated 11.21 trillion rupees.

The upcoming fiscal year's proposed spending marks a clear commitment to continued public investment.

"The capex outlay for fiscal year 2027 looks a bit modest and misses market expectations slightly, but overall, a positive for the manufacturing sector," said Amit Anwani, an analyst at Prabhudas Lilladher. "It will also be good for private sector capex."

Following the budget announcement, capital goods companies saw their shares rise on the news of higher infrastructure development spending.

Key movers included:

• Larsen & Toubro

• IRB Infra

• NBCC

• Action Construction

These stocks jumped between 1.3% and 4% in response to the government's plans.

The consistent government spending on infrastructure, along with cuts to income and consumption taxes, has helped India's economy remain resilient. The country has so far weathered punitive U.S. tariffs imposed by President Donald Trump.

Economic growth for the current fiscal year is forecast at 7.4%, underscoring the effectiveness of the government's fiscal strategy.

($1 = 91.6710 Indian rupees)

South Korea's economy is on track to be dominated by its semiconductor sector in 2026, with chips projected to account for 30% of the nation's total exports. According to analysis from BofA Securities, a price-driven "super-cycle" in the semiconductor market is extending into its third year, reshaping the country's economic landscape.

The trend has already delivered a significant impact. In 2025, semiconductor exports surged by 22%, contributing 4.6 percentage points to South Korea's overall headline export growth of 3.8%.

The momentum has accelerated dramatically. In early January, daily chip export growth hit 70.2% year-over-year, marking the fastest pace recorded since 2017. This surge is largely fueled by DRAM prices, which have already climbed between 20% and 30% year-to-date.

BofA analysts forecast this trend will continue, with projections showing:

• Global DRAM sales will grow by 60% in 2026, following 50% growth in 2025.

• Average selling prices are expected to rise by 40% this year, on top of gains of 62% in 2024 and 26% in 2025.

This current upcycle, which began in the second half of 2023, is now the longest in decades. It has already outlasted the typical two-year cycles seen in 2019-2021, 2016-2018, and 2012-2014.

The semiconductor boom is strengthening South Korea's national finances and supporting the won. In the January-October 2025 period, government tax revenue jumped 12.6% to 331 trillion won ($246 billion). Improved profitability for exporters drove a 22% surge in corporate and income tax receipts, which rose from 152 trillion won to 185 trillion won over the same period a year earlier.

This rally could also reduce the country's projected fiscal deficit for 2026, which currently stands at 4.0%. According to BofA, this may create more room for government spending on research and development and social welfare programs.

While the benefits are clear, the economy's growing dependence on semiconductors creates significant vulnerabilities. Market concentration has reached new heights, with Samsung Electronics and SK Hynix now accounting for nearly 40% of the KOSPI index, a substantial increase from 25.4% in 2020. This makes the market highly sensitive to any reversal in the chip cycle.

Furthermore, with semiconductors representing 24% of total exports—the highest level in recent decades—the nation's economic cyclicality is amplified. The report warns that this risk is compounded by persistent weakness in other key sectors like consumer electronics, autos, and traditional intermediate goods.

The primary driver of the current cycle is the soaring demand for advanced chips used in artificial intelligence. BofA notes that capacity for high-bandwidth memory remains extremely tight, which helps sustain elevated prices. Analysts expect the upcycle to continue through the second half of 2026.

This optimistic outlook has prompted the central bank to signal a likely upgrade to its 1.8% growth forecast for 2026 at its February meeting. BofA anticipates the Bank of Korea will hold interest rates steady throughout the year.

Despite the positive momentum, significant risks remain. On January 26, President Donald Trump announced on social media that he would raise tariffs on Korean goods to 25% from 10%, targeting autos, lumber, pharmaceuticals, and other products.

The cycle could also be derailed by a sharp reversal in DRAM prices, particularly if major technology companies alter their capital spending plans.

A key feature of this cycle is that it is driven more by price than by volume. Despite the strong export growth, facility investment by chipmakers has only grown moderately, lagging historical patterns. This suggests manufacturers are maintaining tight supply to support higher prices.

In 2025, semiconductor production rose by 15%. This figure is well below the 29% increase seen in 2021 and the 39% surge recorded in 2010, underscoring the price-centric nature of the current boom.

The euro's recent surge has turned heads toward the European Central Bank, but economists argue that the currency's rapid appreciation is unlikely to force policymakers into immediate action.

Last week, the euro climbed to $1.20 against the U.S. dollar, a level not seen since mid-2021. According to analysis from Capital Economics, the speed of this move is historically unusual. The currency has only strengthened by a similar magnitude over a 10-day period a few times in the last decade, and its trade-weighted exchange rate has now hit an all-time high.

Despite the sharp rise, the immediate effect on the eurozone's inflation is expected to be minimal.

Capital Economics cites the ECB's own sensitivity analysis, which suggests that if the euro stays at its current level against the dollar, headline inflation would only be about 0.1 percentage points lower next year than the central bank projected in December.

While this tilts inflation risks slightly to the downside, analysts say it falls far short of the threshold needed to justify intervening in the foreign exchange market on grounds of price stability.

The ECB is expected to discuss the euro's strength at its upcoming meeting, but direct intervention appears highly improbable.

The central bank has the power to intervene in currency markets to counter disorderly conditions that could threaten price stability. However, Capital Economics notes the euro would have to rise much further before such a move would be considered. Even then, an intervention involving the purchase of U.S. dollars is seen as very unlikely.

Historically, the ECB has intervened in currency markets on only two occasions: in late 2000 and March 2011. Both times, the goal was to support a stronger euro, and the actions were coordinated with other major central banks. Today, Capital Economics finds that a coordinated effort to push the euro lower is extremely unlikely, particularly given the U.S. administration's stated preference for a weaker dollar.

So far, ECB officials have downplayed the currency's climb. Vice President Luis de Guindos previously described levels above $1.20 as "complicated" but also called the $1.20 mark "perfectly acceptable." Similarly, Austria's central bank governor reportedly referred to the recent rise as "modest."

Capital Economics expects ECB President Christine Lagarde may reiterate that policymakers are closely monitoring the euro but is unlikely to take active steps to talk it down.

While immediate action is not on the horizon, sustained gains in the euro could influence monetary policy over time.

According to ECB analysis cited by Capital Economics, a gradual rise to between $1.25 and $1.30 over the next three years would lower headline inflation by approximately 0.3 percentage points in 2028. In such a scenario, policymakers would more likely turn to stronger verbal warnings and interest rate cuts rather than direct currency market operations.

For now, economists believe the euro's strength is more a reflection of dollar weakness than fundamental momentum in the eurozone, which lessens the need for an ECB response. As a result, the central bank is expected to remain on the sidelines unless the currency's appreciation becomes significantly larger and more persistent.

India's federal government plans to borrow a record 17.2 trillion rupees ($187.63 billion) in the 2026–27 fiscal year, a figure that surpasses most market expectations. The proposal was announced by Finance Minister Nirmala Sitharaman during her budget speech on Sunday.

For the upcoming fiscal year, the country's net market borrowing is projected to be 11.70 trillion rupees, which is slightly lower than the borrowing for the 2025-26 fiscal year.

The announcement comes as India's bond yields have already been climbing for months. The heavy borrowing by both federal and state governments has been overwhelming demand for government debt securities.

Even after the Reserve Bank of India cut its policy rate by 125 basis points, the benchmark 10-year bond yield has edged slightly higher since February of last year. Market analysts had anticipated gross borrowings to be in the range of 16 trillion to 17.50 trillion rupees, with a Reuters poll of 35 economists showing a median expectation of 16.3 trillion rupees.

Traders fear the substantial supply of new debt could continue to suppress demand and keep yields elevated. This concern persists despite significant support from the Reserve Bank of India, which has included record bond purchases and foreign-exchange swaps designed to inject more liquidity into the banking system.

With government bond markets closed on Sunday, the benchmark 10-year bond yield (IN10YT=RR) is expected to see a further increase when trading resumes on Monday. A trader at a private bank noted that any negative reaction might be partially offset by the central bank's choice of paper for its open market purchase scheduled for Thursday.

The government is shifting its fiscal policy to focus on a debt-to-GDP ratio target. The goal is to lower this ratio to 55.6% in the next fiscal year.

This strategy corresponds to a fiscal deficit target of 4.3% of the gross domestic product (GDP). The fiscal deficit, which measures the gap between government spending and revenue, is a critical metric for markets as it directly influences borrowing requirements, overall debt levels, and investor confidence.

($1 = 91.6710 Indian rupees)

India is set to unveil an annual budget designed to accelerate and sustain strong economic growth while enhancing business competitiveness in a volatile global climate. Finance Minister Nirmala Sitharaman announced that the government's priorities are geared towards long-term stability and expansion.

The upcoming fiscal year's budget will center on critical areas, including structural reforms, strengthening the financial sector, and increasing investment in advanced technologies like artificial intelligence.

The Indian economy is projected to grow at a rate of 7.4% in the current financial year, with inflation expected to remain near 2%. Meanwhile, the government's fiscal deficit for the year is anticipated to be 4.4% of GDP.

Looking ahead, the government's economic survey has forecast growth between 6.8% and 7.2% for the fiscal year beginning in April.

To stimulate private investment and demand, New Delhi has recently implemented a series of significant policy changes. More adjustments are expected in the forthcoming budget. Key reforms already rolled out include:

• Cuts to consumption and income taxes.

• A comprehensive overhaul of labor laws.

• Measures to open up the tightly controlled nuclear power sector.

Prime Minister Modi emphasized a shift in focus, stating, "The nation is moving away from long-term problems to tread the path of long-term solutions." He noted that such solutions create the predictability needed to foster global trust.

Modi added that India will push forward with "next-generation reforms," highlighting the next 25 years as crucial for achieving the goal of transforming the South Asian nation into a developed economy.

Revitalizing Domestic Manufacturing

A core component of this long-term strategy is a third major initiative to boost manufacturing's share of the economy, following two previous attempts. The government is also expected to ease regulations for investment in defense manufacturing to support this objective.

On the international front, India is actively pursuing new trade agreements to mitigate external economic pressures. A landmark trade deal with the European Union is a key example of this strategy.

This move is intended to offset the impact of the 50% tariffs that President Donald Trump's administration imposed on certain Indian goods exported to the United States.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up