Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Venezuela Top Economic Advisor Ortega: Want Venezuela To Be Known As A Country With One Of The Highest Oil Production Levels

Swedish Central Bank Governor Thedeen:-, My Assessment Is That The Likelihoodof Very Restrictive Trade Barriers Is Nevertheless Limited

Swedish Central Bank Governor Thedeen:-The Greenland Crisis Hascreated Renewed Uncertainty Regarding The Rules That Will Apply To Our Economicexchanges With The United States

Swedish Central Bank's Seim: I Assess That The Increased Uncertainty Reduces The Risk Of Demand Driven Inflation In Sweden Somewhat

Swedish Central Bank's Deputy Governor Bunge: Will Probably Have To Monitor Both Whether The Strengthening Of The Krona Continues And Its Impact On Prices

Iceland's Central Bank: Further Decisions To Lower Interest Rates Will Depend On Clear Evidence That Inflation Is Falling Back To Bank's 2½% Inflation Target

Swedish Central Bank Governor Thedeen:-At Present I Assess That Monetarypolicy Is Following A Stable And Reasonable Course

Regional Official: Regional Invitees To Istanbul Talks Were Discussed With Iran During Planning Process

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)A:--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)A:--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)A:--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)A:--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

No matching data

View All

No data

Trump announced a landmark US-India trade deal, potentially reshaping India's economy and global geopolitical alignments.

Donald Trump announced a landmark trade deal between the United States and India on Monday, outlining terms that could significantly reshape economic and geopolitical alignments. While Indian Prime Minister Narendra Modi confirmed an agreement had been reached, he stopped short of validating the specific details Trump shared.

According to Trump’s statement, the deal involves the U.S. lowering tariffs on Indian imports to 18%, while India would eliminate its tariffs on U.S. imports entirely. He also claimed Modi agreed to cease purchasing Russian oil, replacing it with supplies from the U.S. and potentially Venezuela. Furthermore, Trump said India committed to buying $500 billion in American energy, technology, agricultural goods, and other products.

However, this announcement warrants caution, as Trump incorrectly claimed late last year that India had already halted Russian oil purchases. If his account of the new deal is accurate this time, the agreement would be truly historic.

The potential domestic impact on India could be profound. With 42% of the Indian population employed in agriculture, the arrival of tariff-free U.S. agricultural products could threaten the livelihoods of millions. Such a disruption could trigger a mass migration from rural areas to cities, potentially leading to significant socio-economic turbulence and political unrest if not managed carefully.

Prime Minister Modi may be calculating that this risk is worth taking. Increased investment from the U.S. and the EU—which secured its own trade deal with India last month—could create new employment opportunities to offset the agricultural displacement. This high-stakes gamble appears to be driven by a combination of macroeconomic ambitions and pressing security concerns.

The motivations behind India's potential concessions seem to be threefold: accelerating economic growth, reasserting regional dominance, and responding to geo-economic pressures.

From a macroeconomic perspective, the deal aims to supercharge India's GDP, which was already projected to grow by 7.4% this year despite existing 50% U.S. tariffs. This could help India achieve its goal of becoming the world's third-largest economy by 2030 or even sooner.

On the regional security front, the agreement would restore India's status as the primary U.S. partner in South Asia, a position recently challenged by rival Pakistan. This move could preempt a scenario where the U.S. might use Pakistan and its partner Bangladesh to undermine India's rise.

Geo-economically, India has been navigating a complex landscape. The punitive 25% U.S. tariffs for importing discounted Russian oil are becoming increasingly costly. With the U.S. now offering similarly priced Venezuelan oil as an alternative, the calculus may have shifted. Simultaneously, threatened U.S. sanctions related to business with Iran, coupled with concerns over that country's stability, have made the North-South Transport Corridor through Iran to Russia an unviable option for now. This economic pressure likely pushed India toward prioritizing a deal with the U.S.

If the details announced by Trump hold true, it signals that India is recalibrating its grand strategy toward the West, largely as a result of economic coercion. This pivot could have several major international implications:

• A reduced strategic focus on the BRICS alliance.

• A slowdown in efforts to diversify away from the U.S. dollar.

• An increase in defense deals with the United States.

• New challenges in maintaining its recent rapprochement with China.

The most immediate strategic dilemma would fall on Russia. If India, a major customer, stops importing its discounted oil, Moscow would face a critical choice. To stabilize its budget and the ruble, Russia could either become more dependent on China to absorb its oil exports or agree to difficult compromises with the U.S. over Ukraine in exchange for phased sanctions relief.

This decision would have the power to dramatically shift the global balance, tilting it further in favor of either China or the United States. Should this Indo-U.S. trade deal force Russia's hand, it will indeed be remembered as a historic turning point.

Bank of America has upgraded its forecast for the Chinese yuan, joining a growing consensus among Wall Street firms that Beijing will allow its currency to strengthen further. The move signals rising confidence in the yuan's rally, which has been gaining momentum in recent weeks.

Other major institutions, including Goldman Sachs, Morgan Stanley, and Australia & New Zealand Banking Group, have also recently revised their yuan estimates upward as the currency's advance accelerates.

Bank of America now projects the onshore yuan will reach 6.7 per U.S. dollar by the end of the third quarter, a notable revision from its previous forecast of 6.8.

Claudio Piron, head of Asia rates and currency strategy at BofA Global Research, cited "robust exports and firmer policy signals" as key factors behind the new forecast. "The yuan's strength is spilling into broader emerging-market FX gains," he noted.

Goldman Sachs also sees continued strength, forecasting the yuan will hit 6.80 in six months and 6.70 in twelve months. The bank credits this outlook to greater tolerance from Chinese policymakers and record capital inflows.

The yuan's appreciation isn't happening in a vacuum. Several powerful forces are fueling its recent performance:

• Sustained Capital Inflows: A significant surge in capital flowing into China since last year has provided a strong foundation for the currency.

• A Weaker U.S. Dollar: Expectations that the United States may favor a weaker dollar have created a favorable environment for the yuan's rise.

• Support from Beijing: Recent comments from President Xi Jinping, detailed in state media, expressing an ambition for a "powerful currency" have bolstered investor confidence.

Actions from the People's Bank of China (PBOC) have reinforced the bullish sentiment. On Wednesday, the central bank set its daily reference rate for the yuan at its strongest level since May 2023. This followed a move last month where the PBOC raised the "fixing" by the largest margin in over a year.

The policy signals have translated directly into market performance. This week, the yuan touched its strongest point in nearly three years in both onshore and overseas trading.

Despite the widespread bullishness, analysts believe the PBOC will aim for a managed and orderly pace of appreciation. A currency that strengthens too quickly could pose risks to China's formidable export engine and attract speculative "hot-money" inflows.

According to strategists at TD Securities, the central bank could adjust "structural FX parameters" if the yuan's appreciation becomes too sudden. Potential policy tools include:

• Removing risk reserves on foreign exchange forward sales.

• Increasing the reserve requirements on foreign exchange.

These measures would allow the PBOC to moderate the currency's ascent without derailing its overall trajectory.

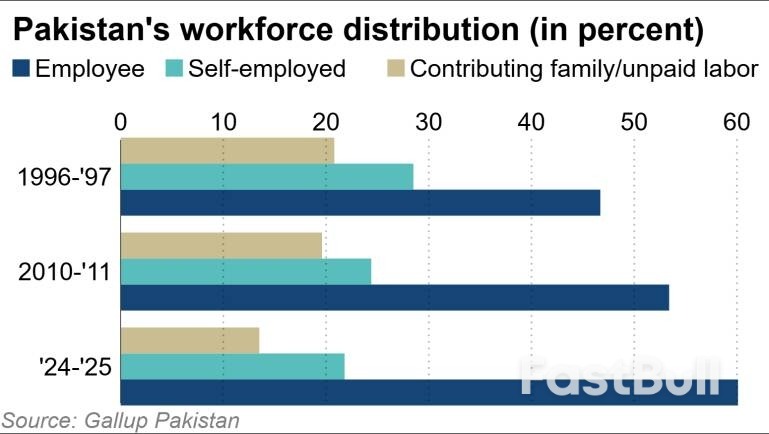

The cost of doing business in Pakistan is about one-third higher than in regional peers and the gap appears to be discouraging entrepreneurship and quietly pushing more people toward salaried employment instead of pursuing their own startups, recent private research shows.

Last month, Pakistan Business Forum (PBF), a national organization representing trade and industry, found that operating a business in the country is 34% costlier than in neighboring South Asian countries. Ahmed Jawad, the PBF's chief organizer, shared the findings with Nikkei Asia in an interview on Friday.

Jawad said the analysis was based on industrial data available as of December 2025 and that a mix of structural factors is driving the costs. "Fuel taxes remain high, with an additional petroleum development levy of about 80 rupees ($0.28) per liter, while interest rates are around 12.5%, nearly double the 6 to 7% seen in the region," he said.

He added that electricity expenses average about 34 rupees per unit, compared with a regional average of 17 rupees. The sharp depreciation of Pakistan's currency -- which tumbled from 110.7 rupees per dollar in January 2018 to 280 rupees per dollar in December 2025 -- has made imports far more expensive. "In addition, the overall tax burden can reach up to 55%, significantly higher than in regional economies," he told Nikkei Asia, referring to the effective tax rate for companies.

Bilal Ghani, executive director of research and consultancy firm Gallup Pakistan, said hat input costs have risen largely because of policy choices that restrict competition. "Trade and industrial policies have often protected domestic producers by restricting imports of cheaper foreign inputs," he told Nikkei. "Instead of allowing firms to access globally competitive inputs, businesses are forced to rely on more expensive local alternatives."

He further added that Pakistan is perceived as a high-risk jurisdiction due to terrorism, money-laundering concerns, and geopolitical tensions. Therefore, its firms face far more licensing, certification and due diligence requirements than companies in most other developing countries. "[Those] requirements raise the fixed cost of doing business, particularly for exporters and technology firms," he said.

The costly environment appears to be hurting Pakistan's economy, particularly exports, which have struggled to achieve sustained growth since 2021, as Jawad offering as examples the "hundreds of medium-sized businesses in the textile sector" that have shut down in recent years. "The trade agreement between the European Union and India, which is favorable to India, could further disadvantage Pakistan's textile sector," he added.

That is Pakistan's largest exporting industry, accounting for around 60% of total overseas shipments in fiscal year 2024. In December last year, the PBF wrote a letter to Prime Minister Shehbaz Sharif, asking the government to address the cost of doing business with concrete measures, including regionally competitive electricity tariffs and more competitive corporate tax rates.

In addition to the PBF's analysis, Gallup Pakistan released one covering household income and expenditure last month. It shows that salaried employees now account for 60.1% of the workforce, up from 53.4% in fiscal 2010-2011, while self-employment has remained low at 21.8%, down from 24.4% in 2010-2011.

Ali, a business graduate based in Islamabad who asked that his full name not be used, said he tried to start a restaurant after completing his studies but later abandoned the plan in frustration. "I was hounded by so many government departments that I ultimately decided to give up the idea and started looking for a job," he told Nikkei.

"The cost of doing business is high, which is pushing more people toward salaried jobs, while bureaucratic hurdles, limited access to finance and ongoing political and economic uncertainty continue to constrain small businesses," Niaz Murtaza, an independent economist based in Islamabad, told Nikkei.

Ghani, from Gallup, points toward an educational dimension in which the number of salaried workers in Pakistan is increasing. "Entrepreneurship, risk-taking and opportunity recognition were never meaningfully integrated into higher education curricula in Pakistan. Instead, students were socialized to become efficient workers for large firms and multinationals," he added.

Traders' Opinions

Remarks of Officials

Data Interpretation

Economic

Central Bank

Forex

Commodity

Daily News

Gold prices surged over 2% on February 4, extending a powerful rally that began the previous day with the metal's best performance since 2008. The move was driven by a combination of bargain hunting and a softer U.S. dollar, which made bullion more attractive to international buyers.

As of 9:12 a.m. Singapore time, spot gold was trading 2.2% higher at US$5,044.74 per ounce. This followed a massive 5.9% gain on February 3, its largest single-day jump since November 2008. The precious metal had previously hit a record high of US$5,594.82 on February 29.

A key factor fueling gold's recovery was the U.S. dollar, which fell against most major currencies on February 3. Traders appeared to be consolidating recent gains in the greenback, which had been powered by strong U.S. economic data and expectations of a less dovish Federal Reserve after President Donald Trump nominated Kevin Warsh as its next chair. A weaker dollar makes gold, which is priced in dollars, more affordable for investors holding other currencies.

According to Daniel Ghali, a senior commodity strategist at TD Securities, the recent wave of forced selling in precious metals has likely concluded. However, he cautioned that the market's recent turbulence could deter retail investors.

"The intense volatility over the last week could certainly keep retail participants on the sidelines, removing an increasingly important cohort of buyers," Ghali noted.

The latest price action comes after a period of extreme volatility. In January, precious metals soared on speculative momentum, geopolitical tensions, and concerns over the independence of the Federal Reserve.

However, many market watchers warned that the rally was too large and too fast. This sentiment proved correct when the surge abruptly ended late last week. Gold experienced its most significant plunge since 2013, while silver suffered its biggest daily drop on record.

Analysts at Bank of America expect this elevated volatility in precious metals to continue. Niklas Westermark, the bank's head of EMEA commodities trading, stated that gold possesses a stronger long-term investment case than silver. He added that while market turmoil might influence position sizing, it is unlikely to diminish overall investor appetite for gold.

Despite the recent turbulence, many major financial institutions remain confident in gold's long-term prospects. On February 2, Deutsche Bank reiterated its forecast that bullion will eventually rally to US$6,000 an ounce, signaling that the fundamental drivers for the precious metal remain intact.

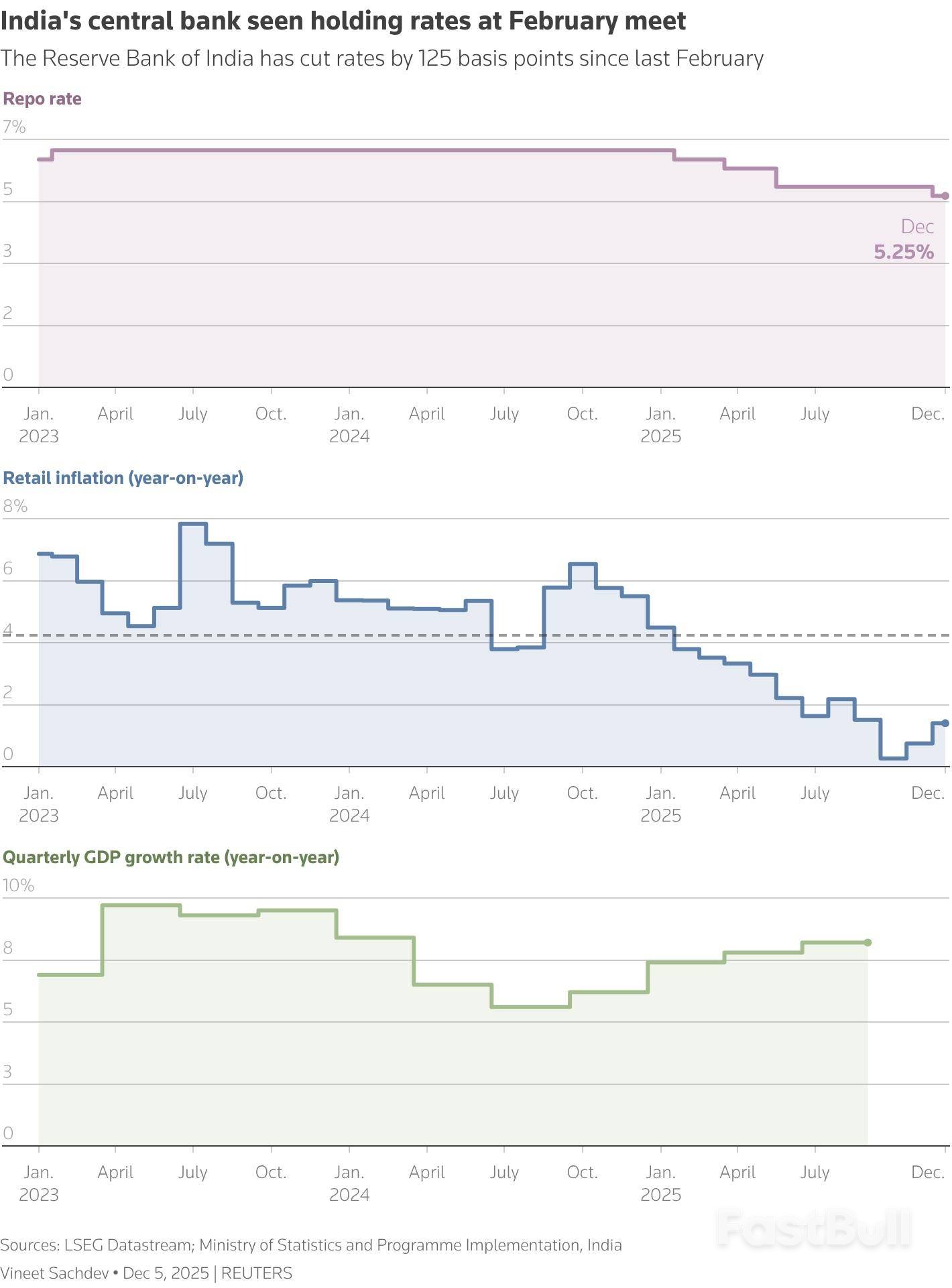

The Reserve Bank of India (RBI) is widely expected to hold its key interest rate steady on Friday, shifting its focus from further cuts to ensuring its previous monetary easing effectively filters through the economy. A new U.S.–India trade deal has eased immediate pressure on the central bank to provide more stimulus.

A Reuters poll conducted before the trade deal was announced showed a strong consensus, with 59 of 70 economists anticipating no change in rates. While a minority had called for another cut due to low inflation and U.S. tariff risks, the trade agreement has reinforced the case for a policy pause.

Dhiraj Nim, an economist at ANZ Bank, noted, "The U.S.-India trade deal further bolsters the case for the RBI keeping rates unchanged this week."

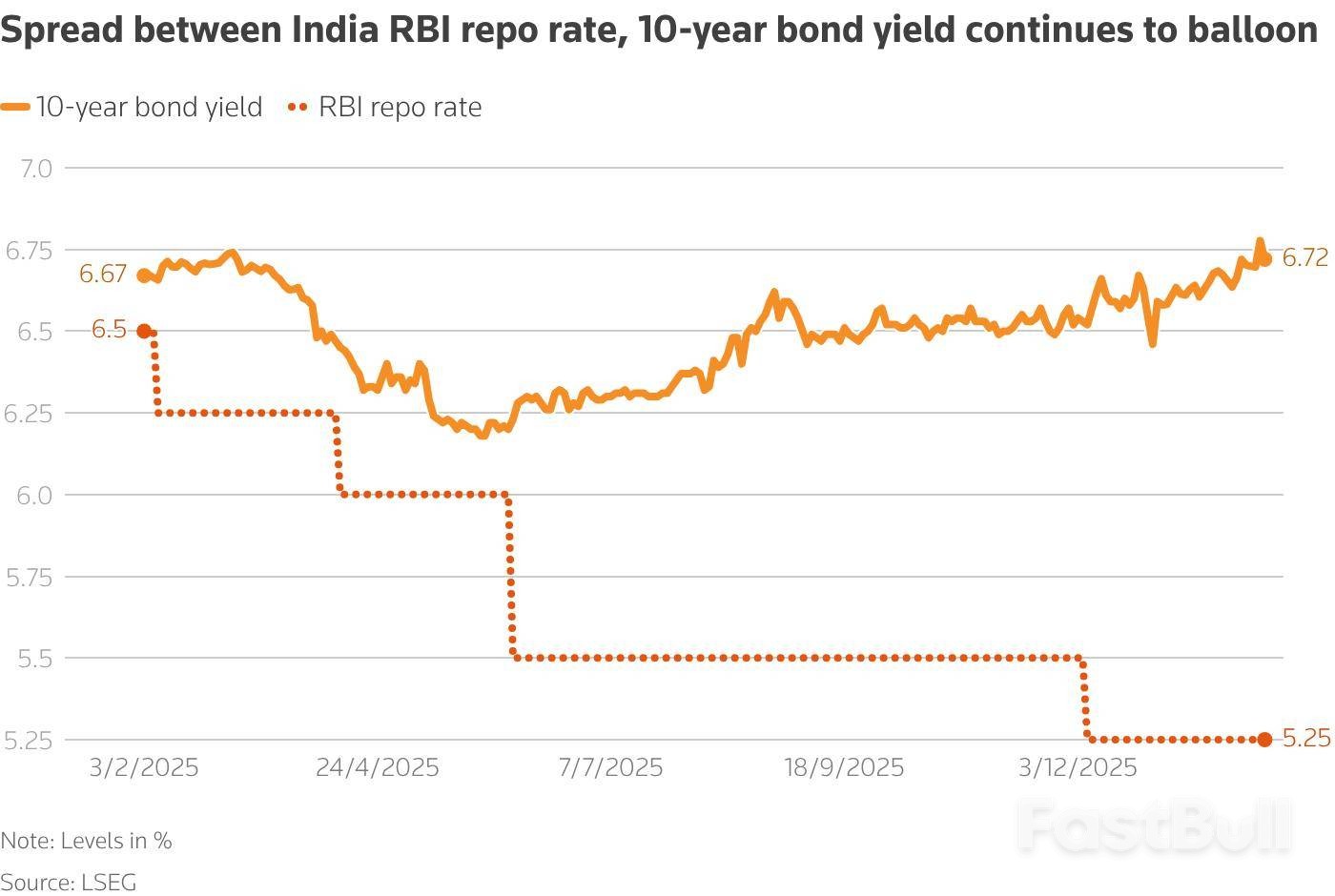

Since last February, the RBI has already cut its policy repo rate by a total of 125 basis points, bringing it down to 5.25%.

The decision to hold rates is supported by India's strong economic performance. RBI Governor Sanjay Malhotra described the economy as being in a "Goldilocks phase" at the last policy meeting in December.

Official forecasts reflect this optimism:

• GDP growth is projected to hit 7.4% in the current financial year.

• The government's economic adviser anticipates growth between 6.8% and 7.2% for the next fiscal year.

• The RBI’s own forecast for the fiscal year ending March 31 was 7.3% growth with CPI inflation at 2%.

This backdrop of steady growth and controlled inflation gives the central bank room to observe the impact of its past actions.

Despite the aggressive rate cuts over the past year, the benefits have not fully reached borrowers. The primary challenge for the RBI is now "policy transmission"—ensuring its lower rates translate into lower funding costs across the financial system.

A key indicator of this disconnect is the benchmark 10-year government bond yield, which has barely fallen. This yield serves as a reference for pricing corporate and bank loans, and its stickiness has kept borrowing costs high, limiting the economic boost from the RBI's easing.

"The challenge now is to ensure that transmission of previous rate cuts is not hampered, while the central bank remains on an extended pause," said Kaushik Das, chief economist for India, Malaysia, and South Asia at Deutsche Bank.

The bond market has been under significant pressure from multiple fronts. To manage foreign capital outflows from equity markets prior to the trade deal, the RBI sold $30 billion from its foreign exchange reserves between September and November. This intervention drained rupee liquidity from the system, adding to the strain on bond markets already grappling with record government borrowings.

To counter these pressures and improve policy transmission, analysts expect the RBI to increase its open market bond purchases by at least 1 trillion rupees ($10.92 billion). This move would inject liquidity into the market, ease the strain, and help bring down yields.

The need for RBI support has grown more urgent following the announcement of a higher-than-expected government borrowing program for the upcoming fiscal year. As economists at Nomura stated, "Higher market borrowing numbers mean concerns around bond supply will remain a challenge for policy transmission."

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up