Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)A:--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)A:--

F: --

Australia Employment (Dec)

Australia Employment (Dec)A:--

F: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)A:--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. PCE Price Index MoM (Nov)

U.S. PCE Price Index MoM (Nov)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Nov)

U.S. PCE Price Index YoY (SA) (Nov)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Nov)

U.S. Real Personal Consumption Expenditures MoM (Nov)--

F: --

P: --

U.S. Personal Income MoM (Nov)

U.S. Personal Income MoM (Nov)--

F: --

P: --

U.S. Core PCE Price Index MoM (Nov)

U.S. Core PCE Price Index MoM (Nov)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Jan)

U.S. Kansas Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Jan)

U.S. Kansas Fed Manufacturing Production Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump's Greenland tariff threat pressures the dollar and raises political risk, reigniting de-dollarization debate.

The U.S. dollar is facing renewed pressure after President Donald Trump suggested imposing tariffs on European nations in connection with his proposal to acquire Greenland, injecting fresh uncertainty into U.S. policy.

The Bloomberg Dollar Spot Index registered a 0.1% decline in Asian trading following Trump's threat of a 10% tariff on European allies that support Denmark's sovereignty over the territory. Meanwhile, Treasury futures saw mixed trading while cash markets were closed for a U.S. holiday.

In response, European currencies gained ground. The Swiss franc outperformed other Group-of-10 currencies as investors sought out haven assets. The euro also climbed, recovering from its lowest point in nearly two months.

Trump’s tariff threats have revitalized the "sell America" trade, as investors begin to price in a higher political risk premium for U.S. assets. This dynamic could encourage foreign investors to scale back their exposure to the United States.

However, some market watchers are looking for a "TACO trade," speculating that Trump might be using the tariff threat as a negotiating tactic. If this proves to be the case, the dollar could find some temporary support.

While the prevailing market belief is that a deal over Greenland will eventually be reached, the involvement of national sovereignty raises concerns that the situation could escalate into a more dangerous conflict.

Analysts predict Europe will be among the biggest losers from rising geopolitical risks under a Trump presidency in 2026. The proposed tariffs could amplify cyclical headwinds for the eurozone economy. Furthermore, such a move could undermine pressure on Russia to conclude its war in Ukraine.

These shifting conditions are making European bonds a more attractive option for some investors, especially as the region's inflation indicators deteriorate amid escalating tensions between Europe and the U.S.

The geopolitical friction over Greenland has reignited the de-dollarization debate, highlighting the United States' large net international liabilities as a key economic vulnerability.

A renewed U.S. isolationist stance is contributing to some dollar weakness. However, analysts note that markets are becoming increasingly numb to tariff announcements, which could lead to more muted reactions in the future.

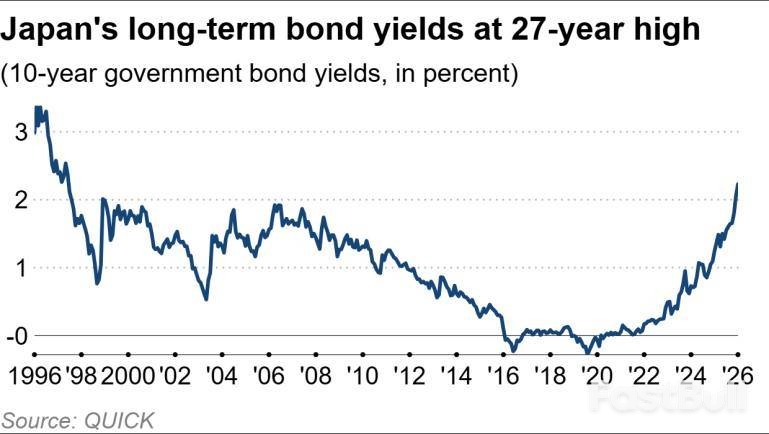

The yield on Japanese government bonds (JGBs) surged on Monday, with the benchmark 10-year rate hitting a 27-year high as markets braced for a wave of government spending ahead of an anticipated snap election.

Investors sold off Japanese debt amid expectations that Prime Minister Sanae Takaichi’s government will increase spending and issue more bonds. The yield on the 10-year JGB climbed past 2.2% in the morning and reached 2.24% in the afternoon, a jump of 0.055 percentage points from the previous week. Bond yields rise as their prices fall.

The sell-off is directly tied to the political landscape, as major parties prepare for an election expected next month. They are crafting platforms that promise significant fiscal support for an electorate struggling with persistent inflation and declining real wages. Japan's core inflation was 3.0% in November, and inflation-adjusted wages have been in negative territory for 11 consecutive months.

The primary catalyst for the market's reaction is the widespread discussion of a potential cut to the consumption tax.

A new political alliance formed by the Constitutional Democratic Party (CDP) and Komeito is advocating for the elimination of the 8% consumption tax on food items. This move has pressured the ruling Liberal Democratic Party to consider a two-year suspension of the same tax. The unexpected formation of the CDP-Komeito alliance suggests a more competitive election, raising the stakes for Takaichi.

Quantifying the Fiscal Impact

According to Noriatsu Tanji, chief fixed-income strategist at Mizuho Securities, a freeze on the food consumption tax would cost the government an estimated 5 trillion yen ($32 billion) annually. "A fiscal measure worth a total of 10 trillion yen over two years is a fairly large spending program," he noted.

While Prime Minister Takaichi has stated she will balance fiscal activism with long-term fiscal sustainability, investors are concerned that the pressures of a snap election will push sustainability to the side, at least for now.

Beyond election politics, expectations of a more aggressive Bank of Japan (BOJ) are also fueling the upward trend in JGB yields. The central bank raised its policy rate from 0.5% to 0.75% on December 19, and markets are now anticipating that the BOJ may accelerate its pace of interest rate hikes beyond the current quarter-point increase every six months.

The pressure is evident across the entire bond market, not just in the 10-year benchmark. The yield on 20-year JGBs rose 0.09 points to 3.25%, while the 30-year JGB yield increased by 0.11 points to a record 3.58%.

However, some analysts question whether the proposed stimulus will be effective. Mizuho's Tanji expressed skepticism that temporary tax relief would significantly boost private spending, especially since food prices have already risen by 30% over the last five years.

President Donald Trump declared on Sunday that the United States would take action to counter a "Russian threat" emanating from Greenland, claiming Denmark has failed to address the issue.

In a social media post, Trump stated that NATO has been urging Denmark to resolve the situation for two decades. "Denmark has been unable to do anything about it," he wrote. "Now it is time, and it will be done."

These comments follow recent threats from the U.S. president to levy trade tariffs of up to 25% on major European nations, including Denmark, France, and the UK.

The administration's stance was reinforced by Treasury Secretary Scott Bessent, who earlier on Sunday cited European "weakness" as a reason for the U.S. to take control of Greenland. President Trump has consistently framed the issue around American national security, repeatedly demanding that Greenland be handed over to the United States to neutralize a potential threat from Russia.

Trump has also suggested the possibility of military intervention in Greenland. This threat has gained credibility following a U.S. incursion in Venezuela earlier this year.

European leaders have widely rejected Trump's claims and his tariff threats. France, in particular, has signaled it is considering retaliatory economic measures in response to the pressure from Washington.

Analysts warn that the persistent U.S. focus on Greenland is creating significant strain on the future of the NATO alliance. Greenland currently operates as an independently governed territory under the Kingdom of Denmark.

For decades, traders have viewed Iran through the lens of geopolitical conflict. The mere mention of the country conjures images of chokepoints in the Strait of Hormuz, a vital channel for global oil flow. But while markets fixate on the possibility of military action, the most significant danger to Iran's oil supply is far less dramatic: a labor strike by its own oil industry workers.

This distinction is critical. The risk of a US attack has cooled, yet the potential for labor unrest has quietly grown. A military strike scares the market but rarely disrupts supply for long. Widespread strikes, however, are often overlooked but have historically triggered massive production outages.

Recent protests in Iran were met with brutal state repression, and for now, the government has regained control of its major cities. The violence was severe, with a death toll potentially reaching several thousand, possibly making it the worst in the regime's 47-year history and surpassing the crackdowns of 1988, 1999, 2011, and 2022.

This suppression gave President Donald Trump an off-ramp. After initially encouraging protestors, Trump noted on January 14 that "the killing in Iran is stopping." When asked about military options, he adopted a wait-and-see approach.

But this sense of closure is misleading. The government can suppress dissent, but it cannot solve the severe economic crisis fueling public anger. The core grievances remain:

• Inflation is running near 50%.

• The national currency, the rial, is in free fall.

• Unemployment continues to rise.

Unless the authorities address this cost-of-living crisis, instability will persist, and with it, the risk of turmoil spreading to the country's vital oilfields.

While international sanctions and low oil prices have damaged Iran's economy, the root problem is internal. The economy is increasingly defined by corruption and military control, with Supreme Leader Ali Khamenei's inner circle and the powerful Islamic Revolutionary Guards Corps (IRGC) dominating a vast network of local companies.

Without genuine economic and political reform, Iran appears headed for more turmoil. Raz Zimmt, an analyst at the Institute for National Security Studies in Tel Aviv, suggests the country could be entering a period of civil disobedience marked by sporadic eruptions of protest.

The 2018-2019 protests, which included nationwide strikes in sectors like transportation, offer a potential blueprint. On January 10, Reza Pahlavi, the exiled son of the Shah deposed in the 1979 revolution, called on protestors to cut the regime's "financial lifelines" by launching nationwide strikes in the oil, gas, and energy sectors.

History proves that labor action can have a catastrophic impact on Iran's oil output. In mid-1978, a strike by oil workers caused production to collapse by roughly 80% in a matter of weeks. That event, which remains the largest oil outage in history, helped pave the way for the revolution that brought Ayatollah Khomeini to power the following year.

However, the industry has changed significantly since then. Several factors now make a repeat more difficult:

1. IRGC Control: The IRGC now tightly controls the oil industry, owning major infrastructure and employing loyal workers.

2. Heavy Security: The security apparatus maintains a firm grip on Khuzestan and Kohgiluyeh and Boyer-Ahmad, the two provinces where the largest oilfields are located.

3. Precarious Labor: Many oil employees are contract workers with little job security, making them less likely to risk their livelihoods by striking.

Today, Iran produces nearly 5 million barrels a day of crude and other petroleum liquids, a level comparable to 1978. The potential for internal disruption remains a low-probability but high-impact scenario.

Crucially, this is a threat beyond Washington's control. The White House can calibrate military action to avoid hitting the energy sector, as it did in June when it discouraged attacks on oil facilities. But it cannot control the actions of protestors on the streets or in the oilfields. For those watching the energy markets, the real story isn't about bombs—it's about the workers.

HSBC is taking a contrarian stance on U.S. monetary policy, predicting the Federal Reserve will maintain current interest rates throughout 2026. The bank argues there is simply no macroeconomic justification for a rate reduction.

This forecast puts HSBC directly at odds with the prevailing market consensus, which anticipates one or two rate cuts in 2026.

According to Frederic Neumann, HSBC's chief Asia economist, several factors will sustain U.S. economic growth and eliminate the need for rate cuts. These include the impact of tax cuts, a booming artificial intelligence (AI) hardware sector, and robust equity prices.

"HSBC is actually not expecting the Fed to cut interest rates," Neumann stated during a recent outlook webinar. He projects that U.S. growth will accelerate to 2.3% in 2026, an increase from 2.2% last year.

"It's not clear [if] the Fed necessarily has major macroeconomic justifications for cutting rates aggressively this year," Neumann added.

For context, the U.S. Fed delivered a 25 basis point cut in its December meeting last year, which brought the federal funds rate to a range of 3.5%-3.75%.

The Fed's policy decisions have unfolded amid heightened tensions between the Trump administration and Fed Chair Jerome Powell.

The central bank was served grand jury subpoenas concerning renovations at its headquarters. Powell alleged this action was a direct result of the Fed's refusal to align its interest rate policy with President Donald Trump's preferences.

While Powell's term as Fed Chair is set to end in May, he will remain a governor at the central bank until January 2028. The Federal Open Market Committee (FOMC) has scheduled its next policy meeting for January 27 and 28.

Romania’s central bank is set to maintain one of the highest interest rates in the European Union as it struggles to control inflation that is running close to 10%. The inflation rate is expected to cool only gradually over the coming months.

According to a Bloomberg survey, economists unanimously predict the National Bank of Romania will hold its benchmark interest rate at 6.5% for the eleventh consecutive meeting.

This rate, matched within the EU only by neighboring Hungary, has been in place for a year and a half. During this period, the Black Sea nation has navigated significant political turmoil and a market selloff.

The central bank faces persistent price pressures driven by the government's fiscal policies. In an effort to reduce the EU's widest budget deficit, the ruling coalition has implemented several key measures:

• Increases in value-added tax (VAT)

• Higher excise duties

• Removal of a price cap on energy

These actions contributed to an inflation rate of 9.7% in December.

Despite the high inflation, a rate hike is considered improbable. Kevin Daly, an economist at Goldman Sachs Group Inc. in London, noted that the primary drivers of inflation are beyond the central bank's direct control.

"The elevated inflation has primarily been due to two factors that are beyond the control of monetary policy — the removal of the energy price cap and a VAT rate hike," Daly stated in a report. He predicts that interest rates will likely remain on hold until at least the third quarter of this year.

Governor Mugur Isarescu also signaled in November that any discussions about potential rate cuts would likely not begin before the summer. The central bank, which targets an inflation range of 1.5% to 3.5%, forecasts that price growth will slow to 3.7% by the end of this year.

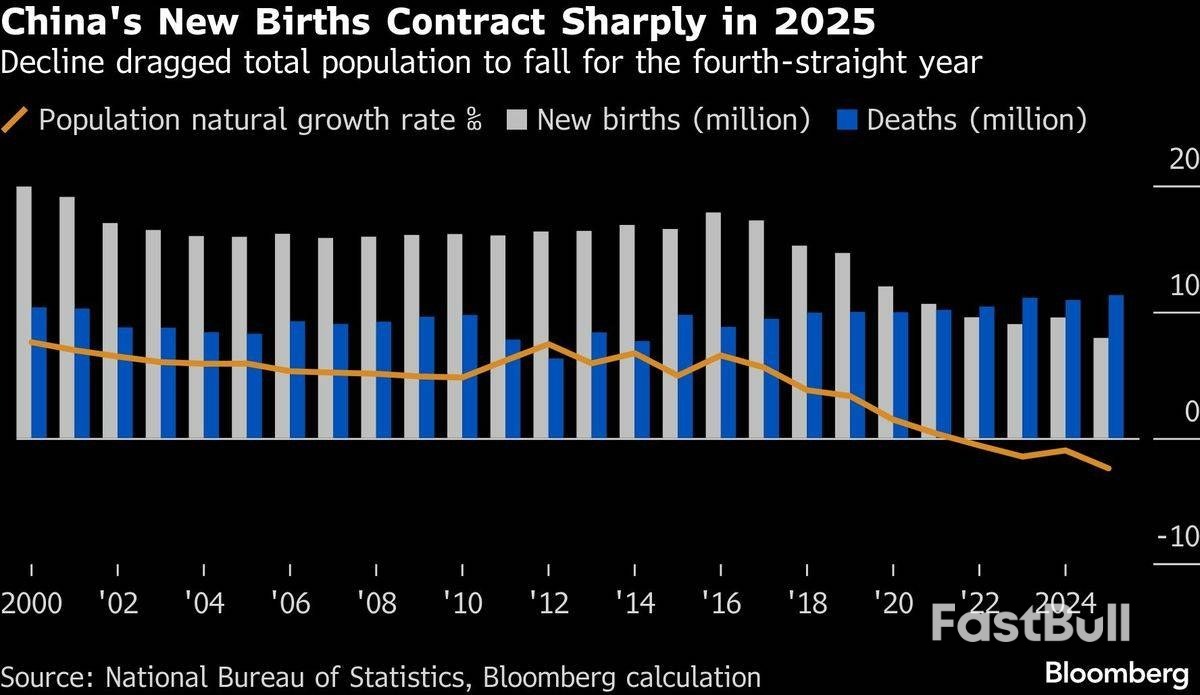

China's birthrate fell last year to its lowest level since 1949, highlighting a deepening demographic struggle for Beijing even as officials roll out new subsidies to encourage couples to have more children.

The number of births per 1,000 people dropped to 5.6, the lowest since at least the founding of the People's Republic, according to data released by the National Statistics Bureau on Monday. The number of newborns decreased 1.6 million, the most since 2020, to 7.9 million.

The figure is a setback for President Xi Jinping's campaign to promote a fertility-friendly society including by offering cash rewards for parents. The total population fell by 3.4 million, the sharpest drop since the 1960 Great Famine under former leader Mao Zedong, to 1.405 billion.

A shrinking workforce and ageing population are major threats to the world's second-largest economy. As the elderly cohort grows, the worker-to-retiree ratio shrinks, piling more pressure on the underfunded pension system.

To counter these structural headwinds, the Chinese government has implemented a series of pro-natalist policies in recent years, from extending paternity and maternity leave to making it easier to register a marriage.

Among the incentives, couples are offered about US$500 (RM2,028.50) a year for each child born on or after Jan 1, 2025, until they reach the age of three. Starting this year, the government also imposed a 13% value-added tax on contraceptive drugs and devices, including morning-after pills and condoms.

He Yafu, an independent demographer, said the amount of government subsidies is "too small" to meaningfully lift birth rates.

He attributed the drop to young people's unwillingness to get married and a decline in the number of women of childbearing age, which fell by 16 million from 2020 to 2025.

This shrinking pool of potential mothers is partly the result of the one-child policy, which hollowed out the demographic base for future growth before being scrapped in 2015.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up