Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

UBS CEO: As We Approach End Of Integration, Confident In Ability To Capture Remaining Synergies By Year-End, Which We Increased By $500 Million To $13.5 Billion

UBS: Remain On Track To Complete Integration By Year-End, With Greater Proportion Of Net Saves Weighted To H2 2026

UBS: Continued Wind-Down Of Non-Core And Legacy Risk-Weighted Asset, Reducing Rwa To $28.8 Billion

Kazakhstan's Kaztransoil: Supplies Of 1.017 Million Tons Of Oil, Including 863000 Tons Of Russian Oil, To China In January Via Kazakhstan

Hsi Closes Midday At 26724, Down 109 Pts, Hsti Closes Midday At 5347, Down 119 Pts, Tencent Down Over 3%, Xinyi Glass, Techtronic Ind, Wharf Reic, Yankuang Energy, China East Air Hit New Highs

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

No matching data

View All

No data

Middle East Situation

Russia-Ukraine Conflict

Traders' Opinions

Energy

Data Interpretation

Economic

Commodity

Daily News

Political

Oil prices surged on escalating US-Iran tensions in the Strait of Hormuz and a sharp decline in US crude stockpiles.

Oil prices pushed higher on Wednesday, extending gains from the previous session after a series of confrontations between the United States and Iran in the Strait of Hormuz stoked fears of a wider conflict in the critical energy chokepoint.

Brent crude futures climbed 65 cents, or 1.0%, to $67.98 per barrel. In the U.S., West Texas Intermediate (WTI) crude was up 69 cents, or 1.1%, trading at $63.90 per barrel. Both benchmarks had already risen by nearly 2% on Tuesday.

The latest rally is directly linked to two recent military incidents. The U.S. military reported on Tuesday that it had shot down an Iranian drone that approached the Abraham Lincoln aircraft carrier in an "aggressive" manner in the Arabian Sea.

Separately, maritime sources confirmed that a group of Iranian gunboats approached a U.S.-flagged tanker in the Strait of Hormuz, the narrow waterway between the Persian Gulf and the Gulf of Oman.

These events have amplified market uncertainty, which was already heightened by diplomatic friction. Tehran is reportedly demanding that its upcoming talks with the U.S. on nuclear issues be held in Oman instead of Turkey and be limited to two-way negotiations, raising doubts about whether the meeting will proceed as planned.

"Heightened tensions in the Middle East provided support to the oil market," noted Satoru Yoshida, a commodity analyst with Rakuten Securities.

The Strait of Hormuz is a vital artery for global energy, with major OPEC producers like Saudi Arabia, Iran, the UAE, Kuwait, and Iraq using it to export crude, primarily to Asian markets. According to U.S. Energy Information Administration data, Iran was the third-largest crude producer in OPEC in 2025.

Adding to the upward price pressure was industry data indicating a significant drop in U.S. crude stockpiles. According to sources citing American Petroleum Institute (API) figures, inventories fell by over 11 million barrels last week.

This sharp decline contrasts with expectations from analysts polled by Reuters, who had forecast an increase in crude inventories. The market is now awaiting official data from the U.S. Energy Information Administration (EIA), scheduled for release at 10:30 a.m. EST.

Beyond the immediate tensions in the Gulf, other global developments are also supporting oil prices. On Tuesday, a trade agreement between the United States and India boosted optimism for stronger global energy demand.

At the same time, continued Russian attacks on Ukraine are reinforcing concerns that sanctions on Moscow's oil exports will remain in place for an extended period.

"India's trade agreement with the U.S. to halt purchases of Russian crude, along with the ongoing Russia-Ukraine war, is also providing support," said Yoshida. He projected that WTI would likely continue to trade around the $65 per barrel mark for the time being.

The Trump administration is internally discussing plans to formalize a tariff increase on South Korea, a move that would escalate trade tensions between the two allies. Seoul's Trade Minister, Yeo Han-koo, confirmed on Tuesday that U.S. government agencies are consulting on the matter.

The potential action follows a threat from President Donald Trump last week to raise tariffs on Korean goods. The proposed hikes target "reciprocal" tariffs as well as specific levies on automobiles, lumber, and pharmaceuticals, which would jump from 15% to 25%. The administration cited delays in South Korea's legislative process for implementing a bilateral trade deal as the primary reason for the threat.

Concerns in Seoul are mounting over the possibility that the White House will publish the tariff plan in the Federal Register, the official public record of the U.S. government. Such a step would transform the president's threat into a more concrete administrative action.

"Regarding the issue of putting the tariff plan on the Federal Register, I think that consultations among relevant government agencies are under way," Yeo told reporters. He described the process as a routine administrative procedure but acknowledged that discussions within the U.S. government are ongoing.

In response to the tariff threat, South Korea has launched a diplomatic effort to de-escalate the situation. Minister Yeo arrived in Washington on Friday to dissuade the Trump administration from moving forward.

During his visit, Yeo met with U.S. Trade Representative Jamieson Greer. In their talks, he emphasized Seoul's firm commitment to fulfilling its side of the existing trade agreement, which includes significant investment pledges.

The diplomatic push involves multiple high-level officials. Industry Minister Kim Jung-kwan also met with Commerce Secretary Howard Lutnick, though those discussions reportedly ended without a clear conclusion.

At the heart of the dispute is a trade deal under which Seoul agreed to invest $350 billion in the United States, with an annual cap of $2 billion. In exchange for this and other commitments, Washington agreed to lower its reciprocal tariffs on Korean goods to 15% from 25%.

Minister Yeo suggested that part of the friction may stem from a lack of understanding in Washington about South Korea's political and legislative systems. "I think we might have to continue our outreach to the U.S. as there are aspects of our system that the U.S. side does not fully understand," he noted.

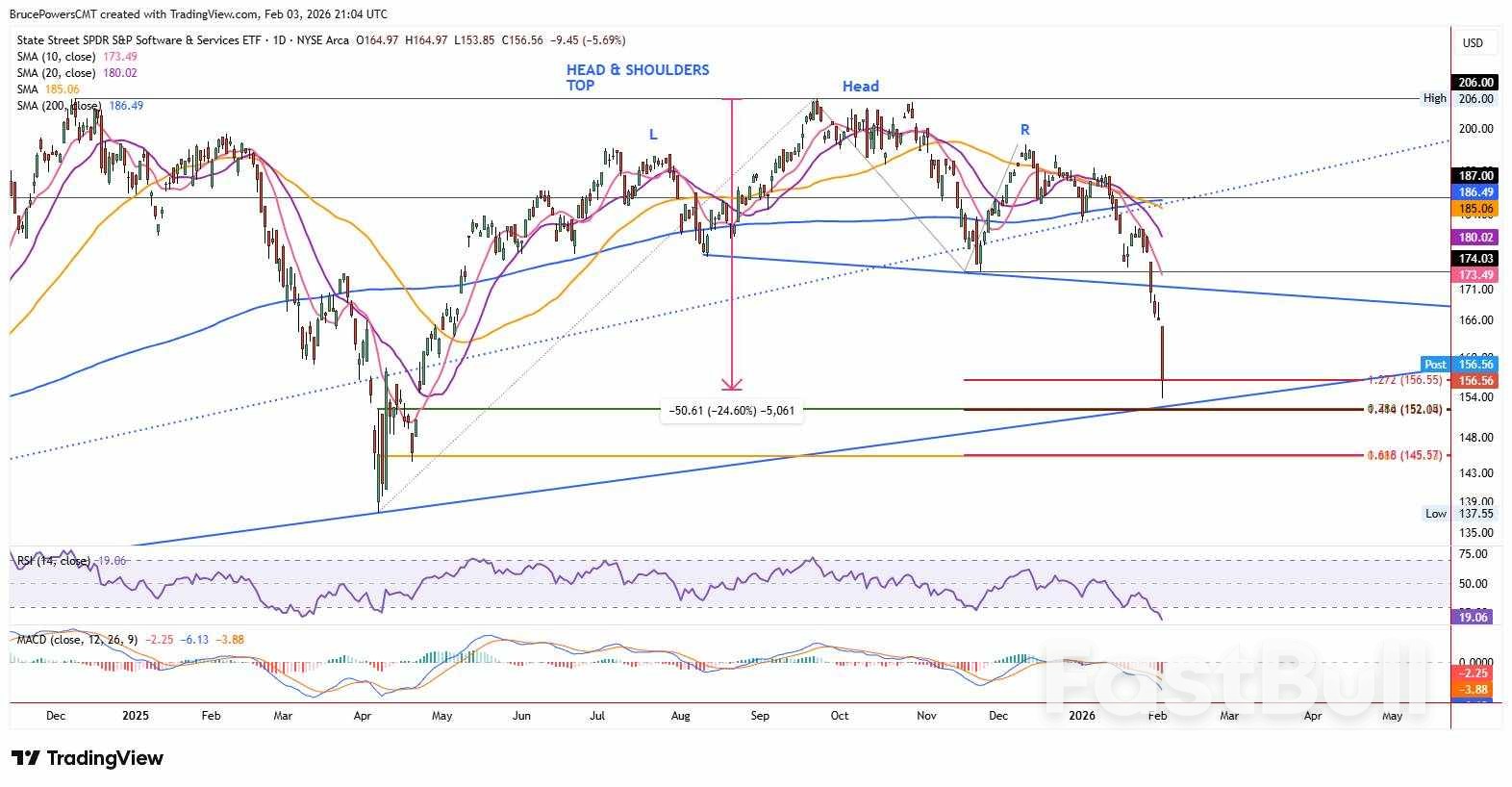

AI-Driven Selloff Pressures Software Sector

Software related stocks got pummeled on Tuesday, as sentiment grew more bearish due to concerns about the impact of artificial intelligence (AI) on the industry. Fears were triggered following a disappointing earnings release from PayPal (PYPL) pre-market. Also, Anthropic released productivity tools for attorneys, which increased selling pressure on related legal publishing and software firms. Risks to the sector have been rising in recent months in anticipation that further advances in AI will cause a greater threat to software business models. Given the sharp declines across the sector, once support is found, buyers may return.

The SPDR S&P Software & Services ETF (XSW) is a proxy for the sector. It broke down from a head and shoulders top reversal pattern last week, on a drop through a swing low at $174.03 and then the neckline of the pattern around $172. Bearish follow-through has been sharp and decisive, leaving little doubt that the sellers are in charge. XSW reached a low of $153.85 on Tuesday. Nonetheless, XSW is rapidly approaching a potentially significant support zone at the convergence of several indicators near $152.

When multiple indicators point to a similar price zone, that area can act both as a magnet, pulling price to it, and a strong support zone in the case of XSW. A 78.6% Fibonacci retracement of the previous upswing is at $152.15, and a 141.4% (√2) projection of a bearish measured move points to $152.04. Further, a long-term uptrend line is currently rising through that price zone. If there is an overshoot to the downside, then the 200-day average is at $149.75, providing a lower potential target zone. Since XSW has fallen hard and is very close to that long-term average, it wouldn't be surprising for it to be hit before the current retracement bottoms.

The head and shoulders pattern suggests a lower target could be reached. Measuring the pattern provides an initial downside target around $141.79. Of course, that level would be preceded by a failure of support at the uptrend line and 200-day average. That target is derived when using the neckline as the bear trigger. However, if the swing low at $174.03 is used, a target at $144.12 is indicated.

On January 30 2026 our clients was expecting for USDCHF to push higher to terminate red wave c, red wave y, blue wave (iv).

The first chart below was published in our private members area and clearly shows the Elliott Wave count was calling for the red wave c push higher.

The second chart is my buy entry. When the USDCHF pair tagged the bullish FVG zone (Gray Box) I entered the buy trade at 0.7667 with a 29 pip stop loss at 0.7638 and a take profit target at the 2R 0.7725.

Added confirmation for the buy entry was the bullish divergence market pattern (Pink) which formed at the red wave x termination.

USDCHF moves higher and hits 2R target at 0.7725 where I closed buy position for +58 pips and a +2% profit gain. (Risking 1% on every trade)

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup.

We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

The unemployment rate ticked up to 5.4% in the December quarter. The details were positive though, with growth in jobs and hours being outstripped by an even larger rise in participation.

The December quarter labour market surveys showed some early signs of improvement in the jobs market, despite a further small rise in the headline unemployment rate. Wage growth measures remained unsurprisingly subdued at this stage of the cycle.

Overall, we think the results were broadly in line with the Reserve Bank's forecasts and won't give them much new to mull over ahead of their 18 February policy review. What that means is there is little here to hurry the RBNZ quickly towards reversing those last 75bp of OCR cuts made after August 2025. Still muted wage pressures should imply there is time to assess the strength and durability of the recovery before raising rates. We remain comfortable with our forecast of a December 2026 first rate hike.

The number of people employed rose by 0.5% for the quarter – actually more than what was suggested by the Monthly Employment Indicator, and ahead of the 0.3% rise in the working-age population. However, there was an even more significant rise in labour force participation from 70.3% to 70.5%, with the net result being an uptick in the unemployment rate. In any case, both of these 'surprises' are well with the margin of error for this survey, and we don't regard them as being meaningfully different from our expectations.

Another positive indicator from the household survey was a 1% rise in hours worked for the quarter, on top of a 1.1% rise in the September quarter. We certainly wouldn't dismiss this lightly, given that this measure has been an unusually good guide to the swings in quarterly GDP in recent times. However, there was a contrasting 0.5% fall in total hours paid in the business-oriented Quarterly Employment Survey (which had also seen a strong 1.1% rise last quarter).

Given the existing degree of slack in the labour market, wage trends unsurprisingly remained subdued. The Labour Cost Index rose by 0.4% overall for the quarter, with a 0.5% rise in the private sector and a more modest 0.3% rise in the public sector. On an annual basis the LCI rose by 2.0%, its slowest pace since March 2021.

The unadjusted analytical LCI, which includes pay increases that are related to higher productivity, rose by 0.8% for the quarter, slightly more than the 0.7% rise in the September quarter. The annual growth rate slowed from 3.4% to 3.3%, also the lowest reading since March 2021. The distribution of pay rates continues to drift towards annual increases in the 2-3% range, and away from the larger increases that were more common in previous years.

The United States and Israel have kicked off joint naval military exercises in the Red Sea, a clear show of force as diplomatic tensions with Iran continue to build. The war games began on Monday, signaling a coordinated military posture between the two allies amid fears of a potential conflict.

The Israel Defense Forces (IDF) confirmed the exercise on X, stating, "A joint exercise was conducted yesterday between a U.S. Navy destroyer and Israeli Navy vessels." The statement noted that the drill is part of the ongoing cooperation between the Israeli Navy and the US Fifth Fleet. The IDF added that the American destroyer's port visit was a pre-planned, routine part of the "strategic and close cooperation between the two navies."

This move comes as the US continues to bolster its military presence in the Gulf region with cargo planes, fighter jets, and advanced air defense systems in preparation for any potential escalation with Iran.

The joint drills follow a series of military maneuvers by Iran. In recent days, Iran conducted limited live-fire exercises in the strategic Strait of Hormuz and previously held joint naval operations with China and Russia.

Despite this activity, a fragile de-escalation appears to be in effect. The USS Lincoln carrier group has reportedly moved away from the potential flashpoint and into waters off Yemen, seemingly to lower the temperature ahead of anticipated nuclear negotiations between the US and Iran, which are set to be hosted by Turkey.

While Iran has shown willingness to discuss its nuclear program, negotiations are complicated by Washington's maximalist demands. A key sticking point is the US insistence that Tehran curtails or abandons its ballistic missile program—a non-starter for Iranian leaders.

Iran views its missile capability as a critical defensive tool, particularly after being attacked without warning during the June war. Giving up this deterrent would leave the country vulnerable in any future conflict with Israel. This deep-seated distrust is compounded by the Trump administration's unilateral withdrawal from the Obama-era JCPOA nuclear deal, leaving Iran suspicious of US motives.

Simultaneously, Israeli defense officials have been meeting with top US military leaders, with the Netanyahu government reportedly lobbying the Pentagon for a more robust stance against Iran.

However, an underlying strategic gap may exist between the US and Israeli leadership. One Middle East observer noted a "persistent and unresolved gap between Trump and Prime Minister Netanyahu," which was not closed even during the recent 12-day war.

According to the same analyst, even when President Trump authorized potential strikes in June, his goal was to use military pressure to force Iran into a better deal, not to achieve regime change. Until recently, the overthrow of the Iranian government was not a frequently stated objective from Trump. This nuance highlights the complex and sometimes conflicting strategies at play as all sides navigate the delicate balance between diplomacy and military deterrence.

The UK unemployment rate is on track to hit its highest level since 2015 this year, driven by a sharp increase in labor costs, according to a new forecast from the National Institute of Economic and Social Research (NIESR).

The think tank predicts the jobless rate will average 5.4% in the current year, a notable increase from 4.8% in 2025 and higher than most other economic projections.

A key factor behind the forecast is the mounting cost of hiring workers. "Part of this unemployment story in the UK is rising labour costs," explained NIESR economist Ben Caswell.

According to the institute's analysis, the cost of employing an entry-level worker surged by 10.6% last year. This was fueled by two main drivers:

• A rising minimum wage: Recent government policy has pushed the minimum wage to two-thirds of median earnings.

• Higher employer taxes: An increase in social security contributions last year added to the financial burden on companies.

NIESR found a direct correlation between these costs and job figures. "Industries which have a larger share of their workforce on the minimum wage have also experienced larger increases in their respective unemployment rates," Caswell noted.

The pressure on employers is set to continue, with Britain's minimum wage scheduled to rise by another 4% in April. Prime Minister Keir Starmer's government also plans to continue phasing out the lower minimum wage rates for 18-20 year-old workers, further standardizing labor costs.

NIESR's analysis also identified emerging weakness in the IT sector, where a rise in unemployment may be linked to the adoption of artificial intelligence reducing the demand for certain entry-level positions.

However, the think tank clarified that the rising unemployment rate isn't solely due to a lack of job vacancies. The labor pool itself is expanding. More people who were previously considered economically inactive—neither working nor looking for a job—are now seeking employment. This trend, which follows a post-pandemic rise in inactivity rates, is increasing the number of people officially counted as unemployed.

Looking ahead, NIESR projects the unemployment rate will likely fall to 5% by 2028 or 2029, which it considers a sustainable long-term level outside of an economic boom. This comes after the official unemployment rate hit a nearly 50-year low of 3.8% in 2022 and 2019, though the survey used for that data is currently being overhauled due to quality concerns.

Alongside its unemployment forecast, NIESR also revised its economic growth projections for 2026 and 2027 upward to 1.4% and 1.3%, respectively. The institute anticipates two interest rate cuts from the Bank of England this year, which would lower the benchmark rate from 3.75% to 3.25%.

This prediction is more aggressive than the market consensus. Economists surveyed by Reuters do not expect the first rate cut to occur before March at the earliest. The Bank of England is scheduled to release its own updated economic forecasts on Thursday.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up