Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

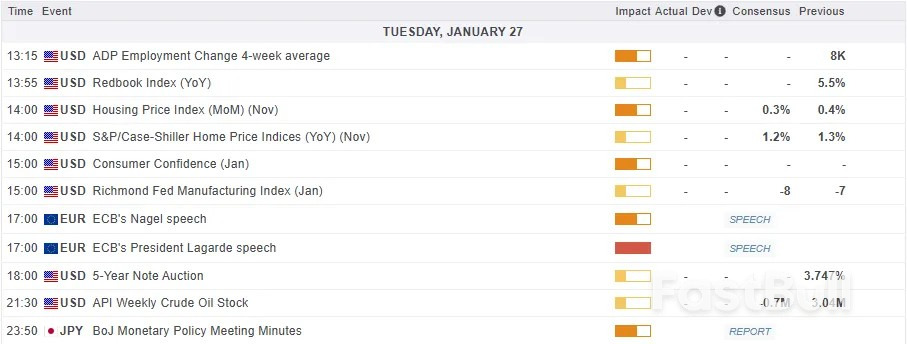

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Nasdaq futures rose as investors weighed trade tensions, major earnings and the Fed decision, while gold stayed above $5,000, the yen firmed, and energy markets reacted to severe U.S. weather.

The European Union’s competition chief has issued a sharp warning against becoming overly dependent on liquefied natural gas (LNG) from the United States as the bloc works to secure its energy future.

"We know that we cannot rely on Russian gas, and that we should pay attention not to rely too much on American gas," Teresa Ribera said in a radio interview on Tuesday.

This cautionary stance comes as Europe rapidly pivots away from its former primary supplier, Russia, following the invasion of Ukraine.

To replace lost volumes of Russian gas, European nations have increasingly turned to US LNG. This shift is solidified by a major trade agreement with Washington, which includes a commitment to purchase $750 billion in American energy by 2028.

The momentum is significant. A recent report from the Institute for Energy Economics and Financial Analysis (IEEFA) projected that if current supply deals are fulfilled and gas demand reduction efforts lag, the US could account for as much as 80% of Europe's gas imports by 2030. This would be a substantial increase from a projected 57% in 2025.

Even as the EU diversifies, Russia remains a key player, currently providing about 15% of the bloc's LNG supplies and standing as its second-largest provider after the United States.

Top officials are openly cautioning that trading one dependency for another is not a sustainable long-term strategy.

"One of the reasons why we need to produce much more of our own energy is that it is not good to be reliant on any country in the world fundamentally for our energy supply," EU energy chief Dan Jorgensen told reporters. He added, "we need to be very careful that now we're moving out of Russian energy, that we're not replacing that dependency with other dependencies."

These concerns are amplified by geopolitical uncertainties. Past actions by former US President Donald Trump, including his interest in Greenland's mining rights and threats of tariffs against European nations, serve as a reminder of the political risks associated with over-reliance on a single partner.

The EU's overarching goal remains a complete phaseout of Russian gas. To achieve true energy security, the bloc is focused on a two-pronged approach: seeking a diverse range of alternative suppliers while simultaneously accelerating its own transition to renewable energy.

This strategy is designed not only to secure its energy supply chain but also to meet the continent's ambitious climate target of achieving zero emissions by 2050.

The National Bank of Hungary has held its benchmark interest rate at 6.5%, opting for a wait-and-see approach as it looks for more conclusive evidence that slowing inflation is sustainable.

This marks the 16th consecutive month the rate has remained unchanged, tying with Romania for the highest in the European Union. The decision, announced on Tuesday, was in line with the forecasts of 22 out of 23 economists surveyed by Bloomberg.

Hungary's central bank recently adjusted its policy guidance. After previously ruling out rate cuts, policymakers now state that decisions will be made on a meeting-by-meeting basis, driven entirely by incoming economic data. The bank's projections indicate that inflation is expected to return to its 3% target, plus or minus a one percentage point tolerance band, over the monetary policy horizon.

However, despite headline inflation slowing in December and moving closer to the target, officials remain cautious. Deputy Governor Zoltan Kurali highlighted a key concern on January 14, pointing to "stubborn" price increases in the services sector, a critical indicator of underlying inflation expectations.

At an annual rate of 6.8%, services inflation was more than double the headline figure last month. Kurali noted that policymakers would need "a lot of conviction" before they could begin cutting rates.

With the central bank holding firm for now, market focus is shifting to the next policy meeting in February. A crucial factor in that decision will be the January inflation report, scheduled for release by the statistics office on February 12.

This data will provide the first clear picture of how businesses, particularly in the services industry, have repriced their offerings at the start of the new year.

Money market traders are already positioning for a change in policy. According to forward rate agreements, investors are anticipating one or two quarter-point rate cuts within the next three months, with the first potentially coming as soon as February.

Adding another layer to the bank's decision-making is the strength of the Hungarian forint. The currency is trading near a two-year high against the euro, buoyed by a broader emerging-market rally and a weaker U.S. dollar. A stronger forint helps to lower the cost of imported goods, including energy, which eases inflationary pressures and gives the central bank more room to consider rate cuts.

This economic maneuvering occurs ahead of parliamentary elections scheduled for April 12, where Prime Minister Viktor Orban's party is reportedly trailing in most polls after 16 years in power.

Recent headlines about Iran’s internal turmoil and potential military confrontations obscure a more fundamental shift in the Middle East. Tehran is no longer the primary force shaping the region’s strategic direction. Instead, a new era is dawning, defined by competition between two emerging coalitions: an Abrahamic bloc and an Islamic bloc. The evolution of this rivalry—not Iran's next move—will determine the future of the region and America's role within it.

Though not yet a formal alliance, the first bloc is becoming increasingly coherent. Centered on Israel and the United Arab Emirates, this group extends to include Morocco, Greece, and even India. This coalition aims to reconfigure the region through a combination of military power, technological partnership, and economic integration.

Core members believe the existing Middle Eastern order has failed to stop militant Islam, whether the Shiite version backed by Iran or the Sunni variant supported by Turkey and Qatar. They argue that true stability can only be achieved by intervening in regional conflicts to support more secular forces. Capitalizing on President Donald Trump's push to broaden the Abraham Accords, these nations are prioritizing the expansion of Arab-Israeli normalization, regardless of progress on Palestinian self-determination or a two-state solution.

This Abrahamic coalition is gaining momentum. Israel's military operations following the Oct. 7, 2023, Hamas attack have bolstered its deterrence and power projection capabilities. The UAE, known as "Little Sparta," continues to use its economic might and diplomatic agility to expand its influence far beyond the Gulf. United Nations experts and international NGOs suspect the UAE of supplying weapons to the Rapid Support Forces in Sudan, the Southern Transitional Council in Yemen, and Libyan strongman Khalifa Haftar.

Greece has become a vital partner in the Eastern Mediterranean, collaborating with Israel on military drills and energy projects to counter their shared competitor, Turkey. Further east, India’s growing ties with both Israel and the UAE—through bilateral agreements and multilateral platforms like I2U2 and the India-Middle East-Europe Economic Corridor—give the bloc strategic depth far beyond the region itself.

Opposing the Abrahamic axis is the Islamic coalition, a counterbalancing effort led by Saudi Arabia and including Turkey, Pakistan, Qatar, and a more cautious Egypt. These nations view the Israel-UAE axis as a source of instability, arguing that its support for separatist groups worsens fragmentation in conflict zones. They see the narrative of pushing back against Islamists as a self-serving excuse to project power.

This group prefers to preserve and operate within existing structures, however flawed. In Yemen, Sudan, and elsewhere, they are backing weak states struggling to maintain sovereignty and territorial integrity.

Over the past year, Saudi Arabia has bolstered its defense relationship with Pakistan, creating a mutual security pact after an Israeli airstrike on Qatar. Its military cooperation with Turkey has also grown, with a more formal defense agreement seemingly on the horizon. Egypt, concerned by Israeli and Emirati activities in the Horn of Africa, is also discussing closer coordination with Riyadh on Sudan and Somalia. Together, these states are forming a loose but expanding counterweight across the region.

At the heart of this realignment is the most critical bilateral rift in the Middle East today: the escalating rivalry between Saudi Arabia and the UAE. Once close partners, the two Gulf powers are now strategic competitors. This divergence was highlighted in Yemen, where Saudi Arabia struck the Port of Mukalla to stop Emirati arms shipments, ultimately forcing a UAE withdrawal.

If left unchecked, this competition could escalate from proxy conflicts to direct confrontation. Threats of airspace restrictions, border closures, and even a UAE withdrawal from Saudi-led institutions like OPEC+ have already been voiced by senior officials. Such moves, once unthinkable, would disrupt energy markets, regional travel, and cross-border business. While Gulf diplomacy has contained the friction so far, the underlying divide is structural, not merely personal.

This new competition complicates a key U.S. foreign policy goal: Saudi-Israeli normalization. Riyadh still sees the value in a deal that would grant it a U.S. security treaty in exchange for integrating Israel into the region. However, without significant changes in Israeli policy, especially regarding Gaza and the West Bank, the kingdom is more likely to align with Turkey and Pakistan than with Israel.

For the United States, the primary challenge is no longer countering an Iranian regime that appears critically weakened. The new task is managing the damaging rivalries among its own partners to prevent further fragmentation. This is made more difficult by divisions within Washington, where officials reportedly have diverging views and independent business interests in the region, leading to a hands-off approach.

To achieve a breakthrough, the Trump administration must take two steps. First, it needs to actively manage the rivalries among its partners and its own aides, perhaps by appointing a special envoy to coordinate a unified regional strategy. Second, it must preserve a viable path to Saudi-Israeli normalization by influencing political outcomes in Jerusalem after upcoming elections. The next Israeli government cannot be beholden to radical elements opposed to Palestinian self-determination.

Saudi Arabia is the Middle East's crucial swing state. A senior Saudi official described the kingdom's policy as pragmatic, guided by "maximum flexibility at a time of maximum uncertainty." If President Trump can secure Saudi-Israeli normalization, he could steer Riyadh and the wider region away from its current path of rivalry. This would fold both coalitions into a broader American-led framework, stabilizing the post-Iran Middle East for decades to come.

While many investors focus on big tech, the precious metals sector has delivered stunning returns, with silver leading the charge. Prices for the metal have soared by an incredible 240% over the last 12 months, driven by supply concerns from China and political uncertainty in the U.S.

This month, silver prices topped $100 per ounce for the first time ever. But before jumping into the frenzy, it's worth examining the drivers behind this rally and why history suggests it may not be sustainable.

The current surge in silver's value isn't based on a single factor but a combination of geopolitical tensions, currency weakness, and supply chain fears.

Geopolitical Risk and a Weaker Dollar

A primary catalyst is growing geopolitical turmoil. The Trump administration's unpredictable trade policy, which has imposed tariffs ranging from 10% to 50% on most of the world, has rattled international investors. This uncertainty is raising questions about the U.S. dollar's long-term stability as the world's primary reserve currency.

Reflecting this sentiment, the U.S. dollar index, which measures the greenback against other major currencies, has fallen nearly 10% in the past year, signaling that some investors are moving their capital elsewhere.

Further eroding confidence in the dollar are concerns over rising deficit spending and the independence of the central bank. President Trump has repeatedly pressured Federal Reserve Chairman Jerome Powell to lower interest rates. While Powell has resisted, these confrontations risk reducing trust in the U.S. monetary system.

China's Export Policy Stokes Supply Fears

Adding to the momentum, China announced new export restrictions that fueled market anxiety. Under the policy, only 44 companies will be permitted to export silver from 2026 to 2027.

However, the real-world impact of this announcement may be limited. According to Bloomberg, a similar licensing system has been active since 2019 without causing any significant supply bottlenecks. Furthermore, China’s silver exports reached 5,100 tons last year—the highest volume in 16 years—suggesting that supply remains robust for now.

Over the last century, silver has experienced several massive speculative rallies, all of which ultimately ended in a crash. The current situation bears a striking resemblance to previous cycles.

Echoes of the 2011 Price Collapse

The most recent boom and bust occurred in 2011, following the Great Recession. The drivers then were remarkably similar to today's: macroeconomic anxiety fueled by the first-ever U.S. credit rating downgrade, the eurozone debt crisis, and fears of runaway inflation.

That rally, however, was short-lived. After its peak, silver's price collapsed, shedding approximately 70% of its value by 2015 before beginning the slow climb that led to the current surge.

Speculative rallies often lose steam because they are fueled by hype rather than sustainable, fundamental demand. For silver, industrial use is a critical and often overlooked factor.

Industrial applications account for about 59% of all silver consumption, with major demand coming from the solar and electric vehicle (EV) industries, which value its high conductivity.

Cheaper Metals Poised to Replace Silver

When silver prices rise to uneconomical levels, manufacturers begin substituting it with cheaper alternatives like copper or aluminum. This trend is already underway.

Bloomberg recently reported that major Chinese solar cell manufacturer LONGi Green Energy Technology has started replacing silver with base metals to cut costs. This shift is likely to continue across other industries until silver prices return to more reasonable levels. In the long run, high prices will also incentivize increased mining output, further boosting supply and putting downward pressure on prices.

When a commodity price hits unprecedented highs, it’s easy to believe that "this time is different." But history shows it rarely is. Silver, much like crude oil and cobalt, has a long record of boom-and-bust cycles.

The current rally appears driven by speculation that will likely fade as market hype subsides and industrial users shift to alternatives. For now, investors should consider taking profits or avoiding new positions in this volatile market.

Russian forces have launched a significant wave of drone strikes across Ukraine, heavily targeting energy infrastructure in the southern port city of Odesa. Ukrainian President Volodymyr Zelenskiy stated the attack directly threatens ongoing diplomatic efforts to end the war.

The overnight assault involved some 165 drones deployed against cities from Lviv in the west to Kharkiv in the east. The main focus was Odesa, where Zelenskiy reported on social media platform X that over 50 unmanned aerial vehicles struck energy facilities, injuring dozens.

This strategy appears timed to exploit harsh winter conditions, with freezing temperatures straining heat and water supplies for Ukrainian families. The strikes aim to cripple the nation's already damaged energy system.

The attacks coincide with a series of US-brokered peace talks between Russian and Ukrainian negotiators, part of an initiative sought by President Donald Trump. Zelenskiy argued that the Kremlin's actions are undermining the fragile diplomatic process.

"Every such Russian strike erodes the diplomacy that is still ongoing and undermines the efforts of partners who are helping to end this war," he said, calling for increased pressure on Moscow from the US and European allies. "Without pressure on the aggressor, wars do not stop."

Negotiations, which began last week in the United Arab Emirates, are set to continue but have yet to produce tangible results. The talks in Abu Dhabi have been described as constructive by Trump officials, particularly because the two sides met face-to-face instead of through intermediaries.

Key Sticking Points in Negotiations

Deep disagreements over territorial control remain the primary obstacle. Russia continues to demand that Ukrainian forces withdraw from areas in the eastern Donbas region that its troops have not yet seized. This demand, which covers parts of the Donetsk and Luhansk regions, has been rejected by Zelenskiy.

Despite the deadlock, the Ukrainian leader has pointed to some progress, especially regarding the establishment of security guarantees from the United States.

Odesa and its surrounding region host vital Black Sea port infrastructure that is essential for Ukraine's grain exports. This strategic importance has made the city a frequent target of Russian attacks since the full-scale invasion began in February 2022.

According to the national grid operator Ukrenergo, the latest strikes damaged the region's power infrastructure, triggering local blackouts. These power failures add to more than 500 weather-related outages across the country. However, no damage to the port facilities themselves was reported.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up