Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan seeks a U.S.-Europe rare earths alliance to counter China's dominance, fearing economic weaponization of critical minerals.

Japan's Finance Minister, Satsuki Katayama, is calling for a strategic alliance with the U.S. and Europe to build a new supply chain for rare earths, directly challenging China's dominance over the critical minerals.

In a recent interview, Katayama stated the goal is to establish a "market of proper democracies and market economies" for these essential materials. The issue is set to be a key topic during her upcoming visit to the U.S. for a meeting of finance ministers hosted by the Treasury Department. Discussions will focus on creating a secure rare earths network that reduces reliance on China.

Katayama expressed deep concern over the Japanese manufacturing industry's heavy dependence on Chinese rare earths. She warned that without dismantling China's ability to monopolize and "weaponize" these metals, it would pose a "constant threat" far beyond traditional security issues.

"Predictability for businesses will become more and more limited, and they'll end up on the brink of a crisis," she explained.

This isn't a hypothetical risk. In April, Beijing restricted rare earth exports as a retaliatory measure against Washington's tariffs, leading to temporary production halts for some automakers. More recently, China curbed exports of dual-use products to Japan this past Tuesday, sparking fears that these restrictions could soon apply to rare earths.

When questioned about this possibility, Chief Cabinet Secretary Minoru Kihara declined to comment, citing a lack of clarity on the situation.

When asked about a potential crisis in Taiwan, Katayama noted the difficulty of outlining a response at this stage. However, she highlighted the island's critical economic role, particularly in semiconductors. "We'd have to see what the U.S.'s real intentions are," she added.

On other international matters, Katayama assessed that the recent capture of Venezuelan President Nicolas Maduro would have a limited impact on Japan. She pointed out that crude oil prices have remained stable and that Japan imports almost no crude oil from Venezuela.

As Japan's first female finance minister, Katayama is a key figure in Prime Minister Sanae Takaichi's government, which advocates for a "responsible and proactive" fiscal policy.

Katayama affirmed the government's commitment to dialogue with financial markets, stating it "will not hesitate to conduct foreign exchange intervention if the need arises." She emphasized that Takaichi's administration is focused on fiscal sustainability and creating a "virtuous cycle" where investment drives earnings and stimulates consumption.

Regarding rumors of a snap election, Katayama suggested the prime minister is more focused on policy than on dissolving the lower house. Despite Takaichi's high cabinet approval ratings, support for her Liberal Democratic Party (LDP) has not seen a corresponding increase.

"It seems that just because she's in the LDP doesn't mean there's a [popularity] premium" for the party, Katayama observed. She appeared cautious about an early election, suggesting it would be better for the LDP to first fully "embody" the Takaichi government's policies.

Katayama, a former minister for women's empowerment, also touched on the need for political reform to encourage more female participation. Based on her own experiences, she recommended focusing on rule changes to make electioneering less disadvantageous for women, rather than altering electoral districts.

The United States and Venezuelan governments confirmed on Friday they are exploring the possibility of restoring diplomatic relations, signaling a potential shift in their historically strained relationship.

This development comes as a surprise, considering the Trump administration had previously stated its intent to influence Venezuela's leadership and control its oil sales following a potential removal of President Nicolas Maduro.

A small delegation of US diplomats and diplomatic security officials from the Trump administration arrived in Venezuela on Friday to begin discussions.

According to a statement from the US State Department, the team's primary objective is to conduct a preliminary assessment regarding the potential reopening of the US Embassy in Caracas.

Venezuela's government officially acknowledged the US delegation's presence and announced its own intention to send a delegation to the United States, though a specific date was not provided.

In a formal statement, the government of Delcy Rodríguez confirmed it "has decided to initiate an exploratory process of a diplomatic nature with the Government of the United States of America." The stated goal of these talks is "the re-establishment of diplomatic missions in both countries."

Just a week after President Donald Trump spoke of U.S. oil majors "going in and spending billions" to rebuild Venezuela's failing crude industry, his administration is clarifying a crucial detail: who pays. Washington is now signaling that American taxpayers will not directly fund the massive undertaking, even as top energy executives gather at the White House.

The President's initial comments fueled speculation that Washington might offer hefty financial guarantees or underwrite the risks for firms like Chevron, ExxonMobil, and ConocoPhillips to re-enter the politically volatile nation.

However, the administration has since shifted its emphasis, managing expectations about the level of direct government financial involvement.

On Friday, Interior Secretary Doug Burgum, who also heads the White House's National Energy Dominance Council, stated that the administration does not plan to use taxpayer money to underwrite the rebuilding of Venezuela's oil sector. He clarified that the necessary capital, estimated to be in the tens of billions over the next decade, must come from the companies themselves and private capital markets. The U.S. role, he suggested, would be to provide security and a stable operating environment, not direct funding.

Energy Secretary Chris Wright reinforced this position, noting that while institutions like the U.S. Export-Import Bank could offer credit support, companies have not yet requested direct government money.

This adjustment clarifies President Trump's earlier remarks, where he implied the government might backstop investments or allow companies to be reimbursed. The message from senior officials is now unambiguous: private capital is expected to carry the financial load.

To discuss this framework, the White House is hosting a high-level meeting with a wide array of global oil industry leaders. The guest list includes major U.S. and international players:

• Chevron

• ExxonMobil

• ConocoPhillips

• Continental Resources

• Halliburton

• HKN Energy

• Valero

• Marathon

• Shell

• Trafigura

• Vitol

• Repsol

• Eni

• Aspect Holdings

• Tallgrass

• Raisa Energy

• Hilcorp

Administration officials participating in the talks include Burgum, Wright, and Secretary of State Marco Rubio.

Any potential investment in Venezuela faces significant hurdles. Chevron is currently the only major U.S. producer with ongoing operations in the country, working under a special license. ExxonMobil and ConocoPhillips both left in the 2000s following the nationalization of their assets.

Industry leaders have been clear that a return would require strong legal, political, and financial guarantees from Washington to mitigate the decades of instability and expropriation risk.

Venezuela sits on one of the world's largest proven oil reserves, and a return to former production levels could reshape global crude markets and lower prices. However, the path forward is difficult. Decades of neglect have left the country's oil infrastructure in a state of disrepair. Compounding these operational challenges are significant political risks and geopolitical tensions, underscored by the U.S. seizing sanctioned tankers and controlling Venezuelan crude sales. Furthermore, current oil prices do not provide a strong incentive for the massive capital outlay required.

Ultimately, a genuine revival of Venezuela's oil sector will depend on private investment, supported by whatever assurances Washington can provide. Today's White House meeting is the first real test of whether that model is enough to convince the industry's key players to write the checks.

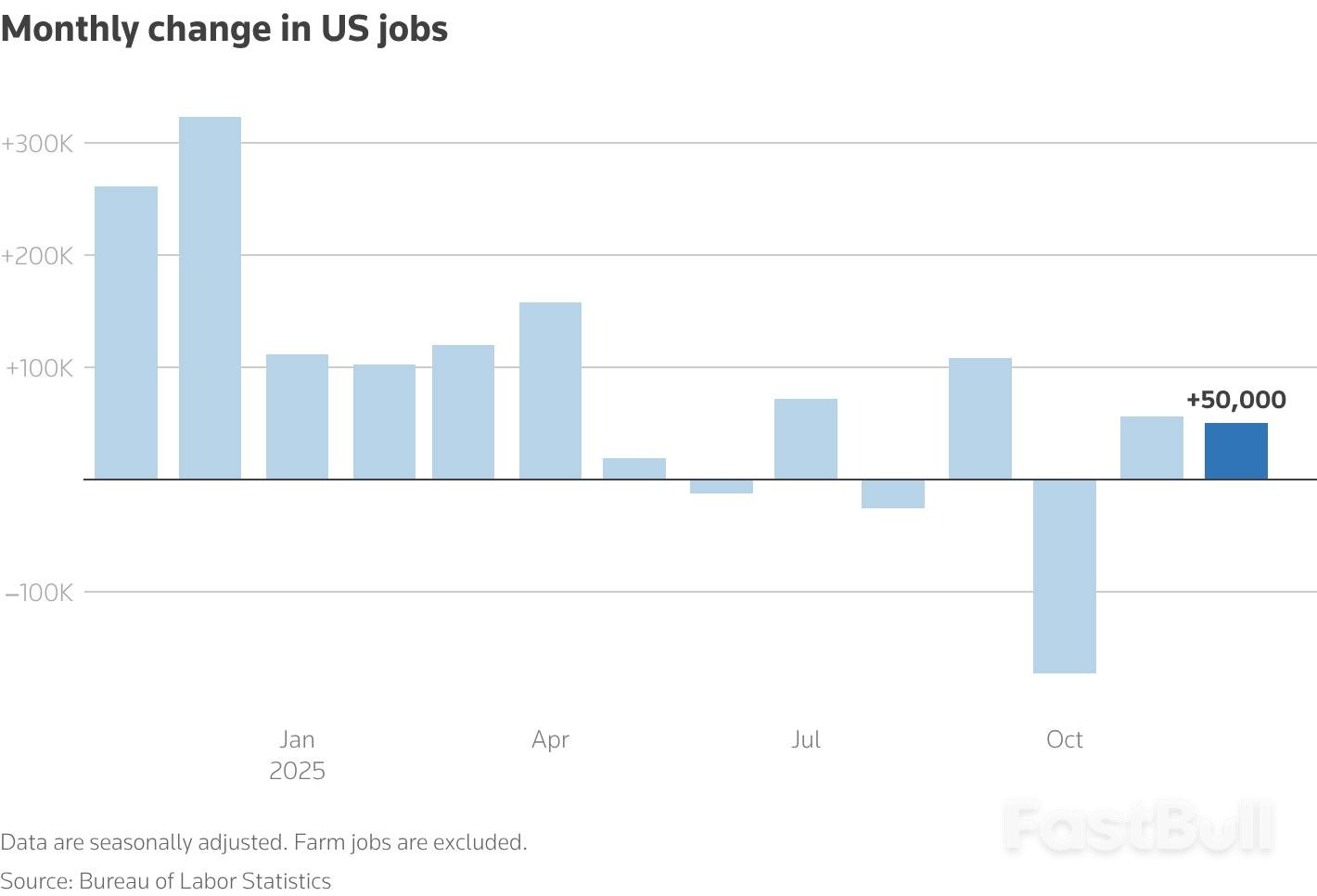

Richmond Fed President Tom Barkin characterized the latest employment data as a continuation of modest jobs growth within a low-hiring environment.

His comments followed a Bureau of Labor Statistics report showing that employers added 50,000 jobs last month, with the unemployment rate edging down to 4.4%.

"This fine balance between a modest job growth environment with a modest labor-supply growth environment seems to be continuing, and that was encouraging," Barkin told reporters on Friday.

According to the Richmond Fed chief, the current state of the jobs market is a reflection of two key factors: prevailing uncertainty among businesses and productivity gains that allow companies to operate with fewer new hires.

This landscape helps explain the restrained pace of hiring despite a relatively low unemployment rate.

Barkin emphasized that Federal Reserve policymakers must remain focused on the twin risks of rising unemployment and persistent inflation. The central bank cut its benchmark interest rate for the third consecutive time last month, but officials have signaled uncertainty about further reductions amid internal divisions over the economic outlook.

The challenge lies in balancing two conflicting trends.

On one hand, inflation remains a key concern. "Inflation has been above our target now for almost five years," Barkin noted. "It's in a lot better shape than it was two or three years ago, but it's certainly not all the way there."

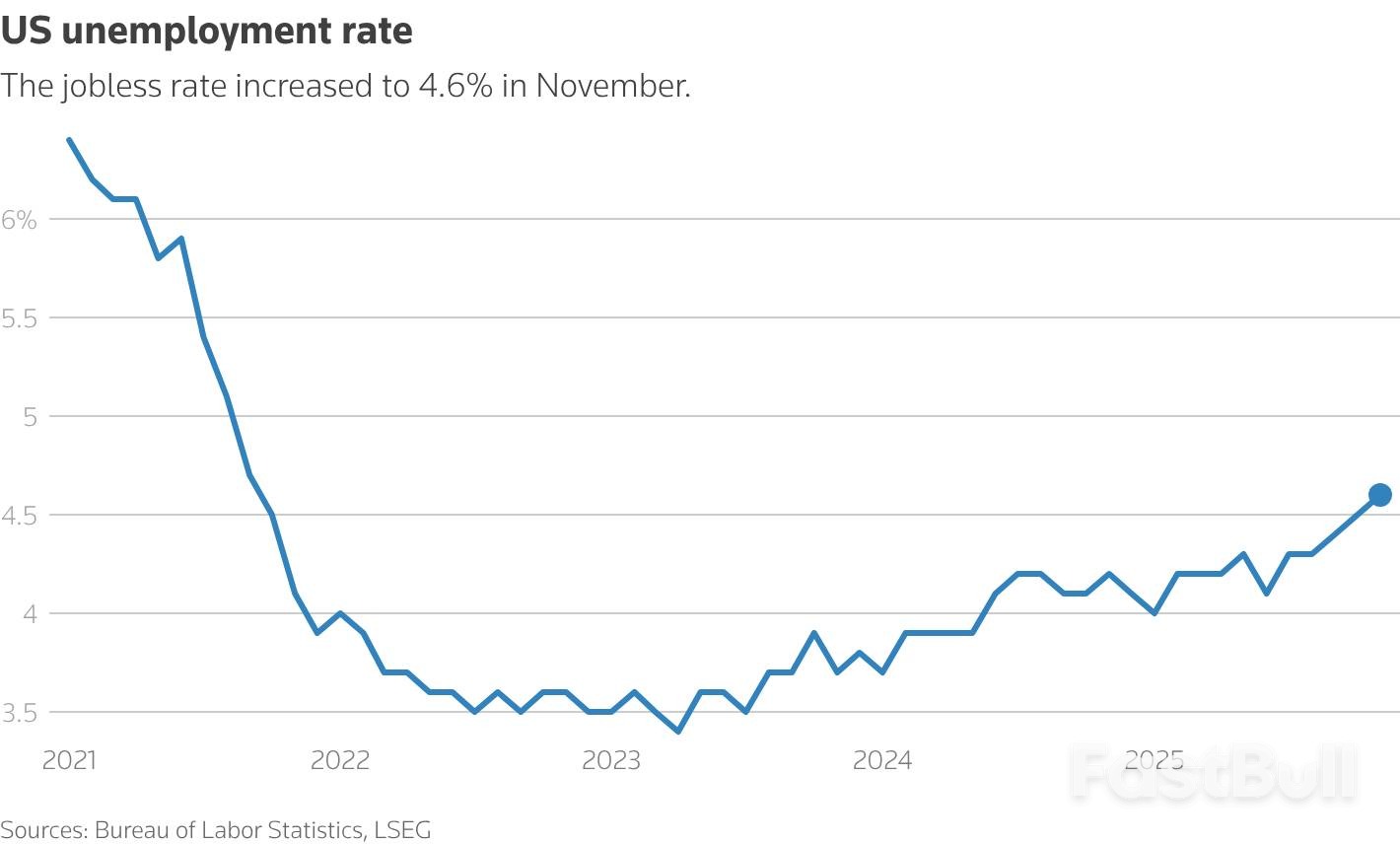

On the other hand, the labor market is showing signs of cooling. "The unemployment rate has ticked up in the last year, and job growth is modest," he said.

This delicate situation requires careful monitoring from the central bank. "So I think you've got to watch both of them," Barkin concluded.

U.S. employment growth slowed more than anticipated in December, with notable job losses in construction, retail, and manufacturing. However, a surprising dip in the unemployment rate to 4.4% suggests the labor market isn't collapsing, creating a mixed picture for the economy.

The latest employment report also revealed solid wage growth, reinforcing expectations that the Federal Reserve will likely hold interest rates steady at its upcoming meeting on January 27-28.

Nonfarm payrolls rose by only 50,000 jobs last month, falling short of the 60,000 gain economists had forecast. This comes after November's figure was revised downward to a 56,000 increase.

The data for previous months shows a weakening trend. Job losses in October were revised to 173,000, the largest drop in nearly five years, primarily due to federal government buyouts. Over the last three months, the economy has lost an average of 22,000 jobs per month, highlighting a significant loss of momentum.

The full-year data paints a stark picture. In 2025, only 584,000 jobs were created, averaging just 49,000 per month. This is less than a third of the 2 million jobs added in 2024, which saw an average monthly gain of 168,000. Economists describe the current environment as a "low-hire, low-fire" labor market.

Job growth in December was concentrated in a few key areas, with the share of industries reporting hiring falling from 55.6% to 50.8%.

Gaining Sectors:

• Restaurants and Bars: +27,000 jobs

• Healthcare: +21,000 jobs

• Social Assistance: +17,000 jobs

• Federal Government: +2,000 jobs

Losing Sectors:

• Retail: -25,000 jobs

• Construction: -11,000 jobs

• Manufacturing: -8,000 jobs

Manufacturing employment fell by 68,000 over the past year, a decline some economists link to the Trump administration's tariffs. The retail sector's losses were driven by weak holiday season hiring. Job losses were also recorded in mining, wholesale, transportation and warehousing, and professional and business services.

Economists point to several factors driving the slowdown. President Donald Trump's trade and immigration policies are seen as reducing both the demand for and supply of workers. At the same time, businesses are investing heavily in artificial intelligence, making them uncertain about future staffing needs and cautious about hiring.

This has led to a "jobless expansion," where economic growth and worker productivity surge—as seen in the third quarter—without a corresponding increase in employment. Lydia Boussour, a senior economist at EY-Parthenon, noted that "persistent policy headwinds weighed on business sentiment and curtailed hiring."

Despite the hiring slowdown, businesses are not cutting pay. Wages increased 3.8% year-over-year in December, up from 3.6% in November. This solid wage growth is seen as a sign of worker shortages in certain industries.

This dynamic makes the Federal Reserve's job more complex. The combination of a low unemployment rate and rising wages gives the central bank little reason to cut its benchmark interest rate, which currently stands at a 3.50%-3.75% range after a quarter-point cut in December. Financial markets now expect the Fed to remain on hold beyond this month's meeting, as rate cuts may be less effective at stimulating job growth if the underlying issues are structural rather than cyclical.

Following the report, U.S. stocks traded higher, the dollar strengthened, and longer-term Treasury yields fell.

The labor market may be even more fragile than current figures suggest. The Bureau of Labor Statistics (BLS) is set to publish its annual payrolls benchmark revision next month. The agency has already estimated that about 911,000 fewer jobs were created in the 12 months through March 2025 than initially reported.

This overcounting has been blamed on the BLS's "birth-death" model, which estimates job creation from new and closed businesses. The BLS plans to change this model starting in January to incorporate more current data.

Alongside the December report, the BLS published revisions to household survey data, from which the unemployment rate is calculated. November's unemployment rate was revised down to 4.5% from 4.6%. The dip to 4.4% in December was due to a drop in the labor force combined with a rise in household employment.

However, some underlying details show weakness. The number of people experiencing long-term unemployment increased, and the median duration of joblessness jumped to a four-year high of 11.4 weeks. Oscar Munoz, chief U.S. macro strategist at TD Securities, expects these dynamics will "continue to push the unemployment rate higher through the first quarter of 2026."

Economic

Traders' Opinions

Russia-Ukraine Conflict

Daily News

Remarks of Officials

Commodity

Political

Energy

Middle East Situation

Oil prices climbed on Friday, pushing crude benchmarks toward a weekly gain fueled by growing concerns over global supply. Escalating civil unrest in Iran and intensified attacks in the Russia-Ukraine war are putting traders on edge.

By 12:41 p.m. ET, Brent futures were up $1.58, or 2.55%, trading at $63.57 per barrel. U.S. West Texas Intermediate (WTI) crude saw a similar rise of $1.60, or 2.77%, to reach $59.36.

Both benchmarks had already jumped over 3% on Thursday, reversing two consecutive days of losses. For the week, Brent is on pace to gain 4.6%, while WTI is tracking a 3.5% increase.

Two major geopolitical flashpoints are driving fears of potential supply disruptions.

Intensifying Unrest in Iran

The market is closely watching an "uprising in Iran," according to Phil Flynn, a senior analyst with the Price Futures Group. Protests over economic hardship have spread across the country, including in Tehran, Mashhad, and Isfahan.

Ole Hansen, head of commodity analysis at Saxo Bank, noted that the protests "seem to be gathering momentum, leading the market to worry about disruptions." The situation escalated on Thursday when internet monitoring group NetBlocks reported a nationwide internet blackout.

These concerns are backed by data. A recent survey showed that the Organization of the Petroleum Exporting Countries (OPEC) pumped 28.40 million barrels per day (bpd) last month, a decrease of 100,000 bpd from November. Iran and Venezuela posted the largest production declines.

Russia-Ukraine War Escalation

Adding to supply anxiety, Russia’s military announced Friday that it had fired its hypersonic Oreshnik missile at targets in Ukraine. The Russian defense ministry specified that the strikes targeted energy infrastructure that supports Ukraine's military-industrial complex.

In a separate development, the White House is scheduled to meet with oil companies and trading houses Friday afternoon to negotiate Venezuelan export deals. The meeting follows the capture of Venezuelan President Nicolas Maduro on Saturday.

U.S. President Donald Trump has demanded that Washington be given full access to Venezuela's oil sector. U.S. officials have stated their intention to control the country's oil sales and revenue indefinitely.

Oil major Chevron Corp, along with global trading firms Vitol and Trafigura, are among those competing for government deals. The contracts concern the marketing of up to 50 million barrels of oil that state-run company PDVSA accumulated in inventories during a severe embargo.

"The market will focus on the outcome in the coming days for how the Venezuelan oil in storage will be sold and delivered," said Tina Teng, a market strategist at Moomoo ANZ.

Despite the bullish geopolitical news, some analysts urge caution. According to Haitong Futures, global oil inventories are rising, and a potential oversupply could cap further price increases.

The firm suggests that unless the risks surrounding Iran escalate significantly, the current rebound in oil prices is likely to be limited and may struggle to be sustained.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up