Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

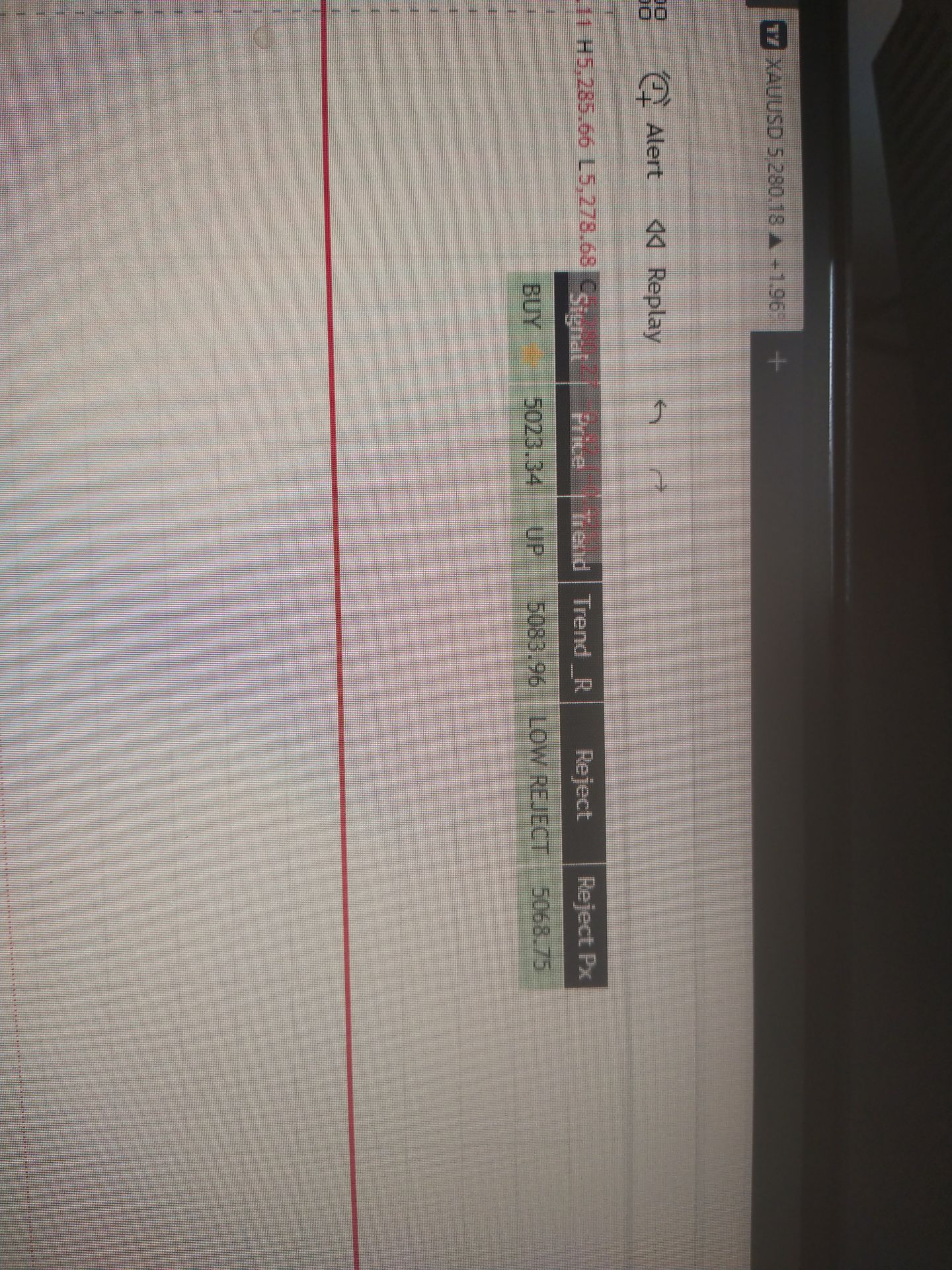

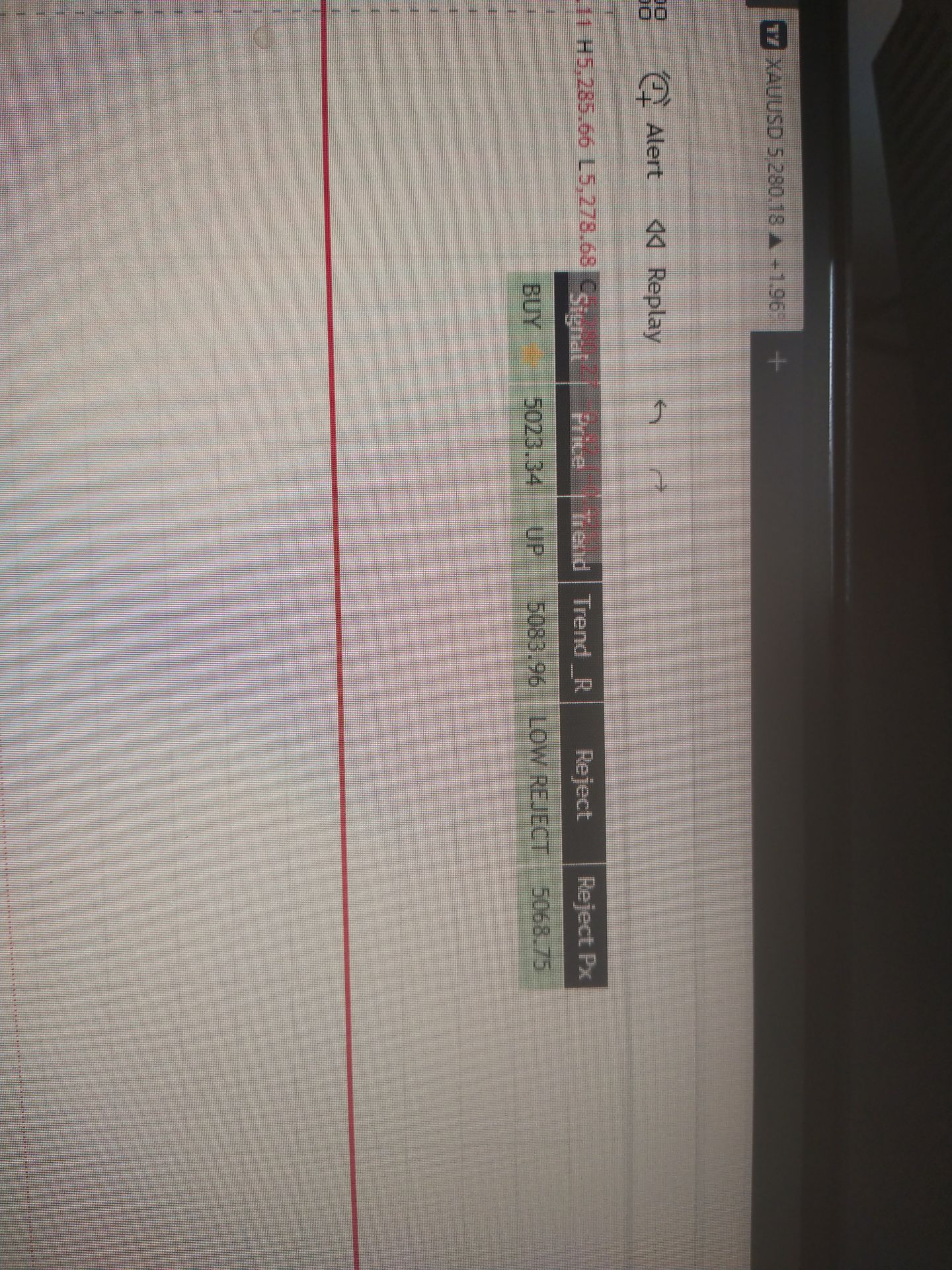

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan's Prime Minister says necessary actions will be taken against speculative market volatility; IDF says it is on high alert......

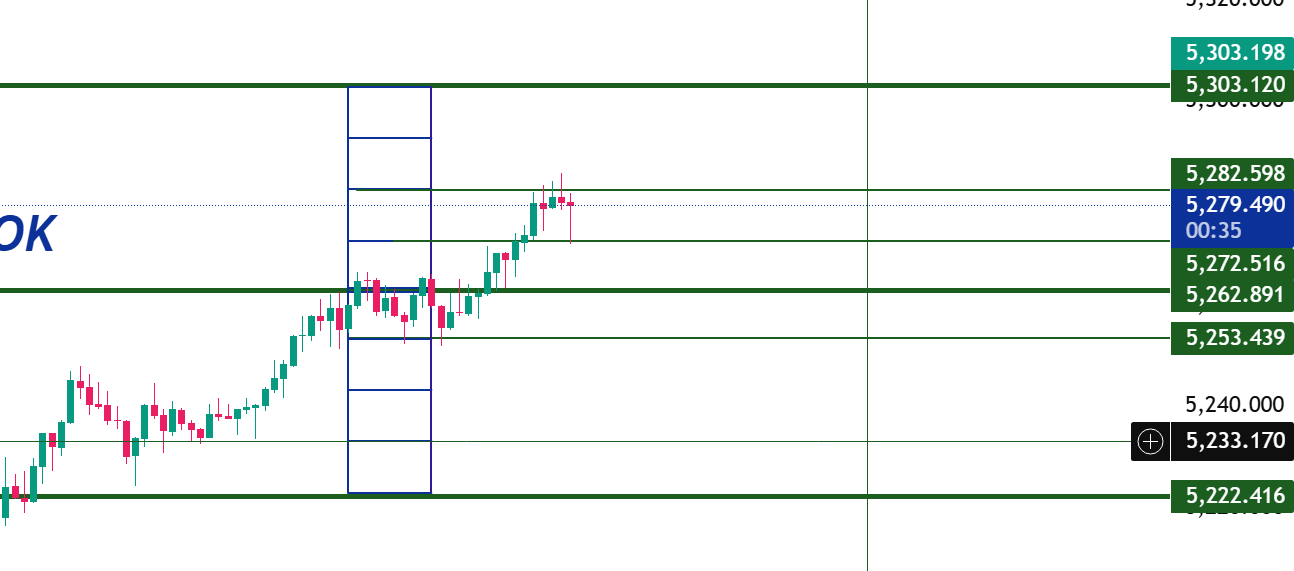

Gold prices climbed above the psychologically-important $5,000-per-ounce level for the first time, as investors sought the refuge of safe-haven assets on fears that the U.S. federal government may shut down for the second time in months.

Spot gold rose 1.2% to $5,049.68 a troy ounce on Monday after earlier touching a record high of $5,052.02 per ounce, ICE data showed. Spot silver also rose 3.8% to $107.22 an ounce after hitting a fresh all-time high of $107.30 per ounce earlier.

The risk of a government shutdown emerged as Senate Democrats, angered by the shooting in Minneapolis, said they wouldn't vote for a government funding package without major changes to the homeland security provisions. Lawmakers have to get a spending package to President Trump's desk for signature by Friday, or the shutdown could be triggered.

Also, Trump on his Truth Social platform Saturday warned that the U.S. would impose 100% tariffs on all Canadian goods and products coming into the U.S. if "Canada makes a deal with China." Trump's remarks threatened a major escalation in a brewing trade conflict with Canada.

"Precious metals show no signs of stopping on the upside," Sucden Financial's Research team said in commentary. "This momentum appears relentless, and for us, the question is not the directional view but how long market participants can finance these gains," the team added.

Precious metals have surged this year, driven by uncertainty in global economics and politics amid volatility in financial markets.

Some of those issues included the broad imposition of U.S. tariffs early last year, the U.S.'s seizure of Venezuela's strongman Nicolas Maduro, and increased concerns over the Federal Reserve's independence. More recently, President Trump's efforts to take control of Greenland sent the post-World War II alliance between the U.S. and its European partners into its worst crisis in over 70 years.

Spot gold has jumped around 17% in the year to date, while silver has powered roughly 50% higher, ICE data showed.

Oil prices continued their upward trend on Monday, building on gains of over 2% from the previous week as escalating tensions between the United States and Iran kept global markets on edge.

Brent crude futures edged up 12 cents, or 0.18%, to trade at US$66 a barrel. Meanwhile, U.S. West Texas Intermediate (WTI) crude climbed 14 cents, or 0.23%, to reach US$61.21 a barrel. Both benchmarks closed Friday at their highest levels since January 14, capping a weekly gain of 2.7%.

The primary driver behind the price surge is the heightened geopolitical risk in the Middle East. A U.S. military aircraft carrier strike group is reportedly en route to the region, amplifying concerns about a potential conflict.

On Thursday, U.S. President Donald Trump referenced an "armada" heading towards Iran, while warning Tehran against harming protestors or restarting its nuclear program. In response, a senior Iranian official stated on Friday that Iran would view any attack "as an all-out war against us."

This sharp exchange has directly impacted market sentiment. "President Trump's declaration of a US armada sailing towards Iran has reignited supply disruption fears, adding a risk premium to crude prices," explained Tony Sycamore, a market analyst at IG.

While the focus remains on geopolitics, other supply-side factors are also in play, though their impact is currently overshadowed.

On one hand, Kazakhstan's Caspian Pipeline Consortium announced that its Black Sea terminal had returned to full loading capacity on Sunday following maintenance at a mooring point. This development would typically ease supply concerns.

On the other hand, a winter storm sweeping across the United States has caused temporary production disruptions. According to analysts at JPMorgan, severe weather has affected oil output, leading to estimated losses of around 250,000 barrels per day. The report noted production declines in the Bakken region, Oklahoma, and parts of Texas.

Central Bank

Remarks of Officials

Commodity

Stocks

Middle East Situation

Daily News

Traders' Opinions

Political

Economic

Energy

Forex

Gold prices broke through the $5,000 per ounce barrier early Monday, kicking off a week defined by geopolitical anxiety and intense currency market speculation. Investor sentiment remains fragile after tensions involving Greenland and Iran, a sell-off in bonds, and violent price spikes in the Japanese yen rattled global markets.

In early trading, Japan's Nikkei index fell 1.6%, while S&P 500 futures dropped 0.4% and Nasdaq futures declined 0.7%. Traders are now bracing for the Federal Reserve's upcoming policy meeting later this week.

The Japanese yen strengthened 0.5% to 154.84 per dollar as of 0052 GMT, following sharp upward moves on Friday that fueled widespread speculation of official intervention. According to sources who spoke with Reuters, the New York Federal Reserve conducted rate checks on Friday, increasing the probability of a coordinated U.S.-Japan effort to support the currency.

"The cat-and-mouse game with the yen is likely to carry over to the new week's activity, but the one-way market has been broken, at least for the time being," said Marc Chandler, chief market strategist at Bannockburn Capital Markets.

Japanese authorities have not officially commented on the yen's extreme volatility, but the rate checks have left traders on high alert for intervention at any moment.

Tokyo Signals Lower Tolerance for Speculation

Japanese Prime Minister Sanae Takaichi stated on Sunday that her government is prepared to take necessary action against speculative currency moves. This follows a sharp rout in Japan's bond market last week, which drew attention to Takaichi's expansionary fiscal policies ahead of a snap election scheduled for February 8.

Michael Brown, a senior research strategist at Pepperstone, noted that rate checks are often the "last warning before interventions take place." He added that the Takaichi administration appears to "have a much, much lower tolerance for speculative FX moves than their predecessors."

For traders, this changes the calculation entirely. "The risk/reward has now tilted massively out of the favour of short JPY positions, as nobody will be wanting to run the risk of being caught 5/6 big figures offside if/when the MoF, or their agents, do indeed pull the trigger," Brown explained.

Markets found temporary relief last week after U.S. President Donald Trump backed away from tariff threats and softened his stance on potential action against Greenland. However, new sanctions targeting Iran have kept investors on edge, pushing safe-haven assets like gold to record highs.

This environment has also impacted the U.S. dollar. The dollar index, which tracks the greenback against six major currencies, traded near a four-month low of 97.224 after falling 0.8% on Friday—its largest single-day drop since August.

Charu Chanana, chief investment strategist at Saxo, suggested the dollar's recent softness could create an opportunity for Japan. "With the dollar starting to look softer, this is actually a cleaner window for Japan to lean against yen weakness," she said. "Intervention works better when it's going with the broader USD tide, not fighting it."

Investor focus is also turning to the Federal Reserve, which is expected to keep interest rates unchanged at its next meeting. The session is overshadowed by a Trump administration criminal investigation into Fed Chair Jerome Powell, whose term concludes in May.

In commodity markets, oil prices saw a slight pullback after gaining roughly 3% on Friday. Traders are assessing the impact of increased U.S. pressure on Iran, including new sanctions on vessels transporting Iranian oil.

Brent crude futures were down 0.18% at $65.74 a barrel, while U.S. West Texas Intermediate (WTI) crude futures dipped 0.2% to $60.92 per barrel.

A violent selloff has ripped through Japan's $7.3 trillion government bond market, wiping out $41 billion in value in a single session and shattering the market's long-held reputation for stability. The sudden chaos signals a new era of volatility for an asset class that once defined predictability.

The yield on the 30-year Japanese Government Bond (JGB) surged by more than a quarter of a percentage point in one day—an unprecedented move in a market where changes were once measured in tiny increments over weeks.

"A quarter-point surge in yields in a single session," noted Pramol Dhawan at Pacific Investment Management. "Let that sink in."

For years, Japan offered a reliable source of low-cost funding for global investors. Now, with persistent inflation, it has become a source of global market instability.

The immediate trigger for the market turmoil appears to be politics. Prime Minister Takaichi Sanae's fiscal plans and a snap election called for February 8 have traders on edge. With both Takaichi and her rivals promising looser government spending, bond investors are bracing for a flood of new debt.

The reaction was severe. The 40-year JGB yield crossed 4% for the first time in history, and the 30-year bond's daily move was eight times its typical range. This isn't a simple market correction.

"I don't think Japan's yields have gone far enough yet," warned Masayuki Koguchi of Mitsubishi UFJ. "This is just the beginning. There's a chance that bigger shocks will happen."

Pressure has been building since the Bank of Japan (BOJ) ended its negative interest rate policy in March 2024. Since then, the JGB market has experienced nine separate days of losses that were more than double the daily average.

The yen has also been volatile. When BOJ Governor Kazuo Ueda suggested the central bank might resume bond purchases, long-term debt rallied, but the currency plummeted. The situation flipped again on rumors of government intervention, which gained credibility after the New York Fed reportedly began polling banks about the yen's exchange rate.

The issue escalated to the highest levels when U.S. Treasury Secretary Scott Bessent called Japanese Finance Minister Satsuki Katayama. According to Goldman Sachs, every 10-basis-point shock in JGB yields adds approximately 2 to 3 basis points to U.S. Treasury yields, demonstrating how Japan's domestic problems are now spilling over into global markets.

The yen's stability has long been the bedrock of the global "carry trade," where investors borrow in the low-yielding Japanese currency to invest in higher-return assets elsewhere. Mizuho Securities estimates that as much as $450 billion is tied up in these strategies. As Japanese yields rise, this entire financial architecture is now under threat.

The market has already had a preview of the potential fallout. A BOJ rate hike in mid-2024 caused the yen to soar, triggering a rapid selloff in global stocks and bonds as investors unwound an estimated $1.1 trillion in carry trades.

While the BOJ has tried to reassure markets with promises of a slow and steady approach to raising rates—which currently stand at just 0.75%—the message has failed to stick. With inflation at 3.1% for the fourth consecutive year, well above the central bank's 2% target, public anger over the cost of living forced former Prime Minister Shigeru Ishiba from office in October.

Takaichi's response—a promise for the largest stimulus package since the COVID-19 pandemic—only accelerated the bond market selloff. The 30-year yield climbed 75 basis points in less than three months. "Since Takaichi came into office, there's been some disregard toward the yield movements," said Shinji Kunibe from Sumitomo Mitsui DS. "The fiscal situation is causing a credibility issue."

Some analysts are now drawing parallels to the United Kingdom's 2022 market crisis. "The danger is that Japan was a market that never moved and now you're dealing with a level of volatility that is remarkable," said Ugo Lancioni at Neuberger Berman. "You could call it a Truss moment."

Japan's underlying debt problem remains immense, with a debt-to-GDP ratio of 230%, the highest in the G7. Takaichi's proposal to suspend the sales tax on food sent another shock through the bond market. In the past, the BOJ would have absorbed the impact by buying up government debt. With the central bank now stepping back, the market is directly exposed to bad news.

The composition of JGB ownership has also shifted dramatically. In 2009, foreign investors accounted for 12% of monthly trading volume; today, they represent 65%. These investors tend to trade more frequently and exit positions faster, adding to market volatility. Stefan Rittner at Allianz Global Investors described the market as being in a "fragile phase" as the BOJ retreats and domestic buyers have yet to fill the void.

The recent crash was triggered by surprisingly small trades—just $170 million in 30-year bonds and $110 million in 40-year bonds. In a $7.3 trillion market, these minor transactions snowballed into a major collapse, highlighting the market's newfound fragility.

With domestic yields finally rising, Japanese investors are beginning to reassess their strategies. An estimated $5 trillion of Japanese capital is currently invested overseas, but the incentive to bring that money home is growing.

"I always loved foreign bond investment, but not anymore. Now it's JGBs," stated Arihiro Nagata, head of global markets at Sumitomo Mitsui.

This shift is already underway. Japan's second-largest bank is adjusting its portfolio, and major life insurers like Meiji Yasuda, which holds $2 trillion in securities, see a buying opportunity emerging in domestic bonds. Goldman Sachs predicts Japan's 30-year yield could soon rival that of the U.S. Treasury.

The benchmark 10-year JGB is also under pressure. Koguchi from Mitsubishi UFJ believes its yield could rise another 1.25 percentage points to 3.5%—a level that would have a significant impact on everything from mortgage rates to corporate borrowing costs.

James Athey at Marlborough Investment called these potential repatriation flows "the elephant in the room." While he notes that Japanese investors historically move cautiously, the economic case for bringing capital home is becoming overwhelming. Headlines suggesting Sumitomo is looking to increase its JGB exposure are early signs of this monumental shift. Without a major change in policy, the pressure on Japan's bond market—and the global financial system—is unlikely to fade.

Interest rate cuts appear all but certain this year. The Federal Reserve projects a 75-basis-point reduction in the federal funds rate for 2026, and data from CME FedWatch shows that market participants are pricing in the same outcome.

For the stock market, the implication seems clear. Falling interest rates are typically a bullish signal for equities. However, the current economic environment presents an unusual set of circumstances that adds a layer of risk to that straightforward conclusion.

The Federal Reserve manages a fine line, using interest rates as a tool to either stimulate or cool the economy. Lower rates can spur growth but risk fueling inflation, while higher rates can tame inflation but may stifle economic activity.

This balancing act is particularly tricky right now. Recent economic reports show a resilient economy that doesn't necessarily need a boost from rate cuts. The Bureau of Labor Statistics reports annualized consumer inflation at a manageable 2.7%. Meanwhile, the U.S. posted an impressive 4.3% GDP growth in the third quarter, and Goldman Sachs forecasts a respectable 2.5% expansion for all of 2026.

This data suggests that lowering rates could do more harm than good by overheating an already solid economy. On the other hand, investors have come to expect these cuts. If the Fed fails to deliver, it could trigger a market shock and force a reassessment of stock valuations.

Despite this complex backdrop, the analyst community remains broadly optimistic. Goldman Sachs highlights a consensus view that the S&P 500 will see solid gains this year.

This outlook is supported by strong fundamentals. Standard & Poor's projects that per-share earnings for the index will grow by 18%, driven primarily by the technology sector. With earnings rising so substantially, stocks could hit higher price targets without becoming more expensive from a valuation perspective.

Even bullish analysts acknowledge the potential pitfalls. In a recent article, Goldman Sachs identified the primary risks to an equity rally: "weaker than expected economic growth or a hawkish shift [like a failure to lower interest rates as much as anticipated] by the Fed."

However, the firm doesn't see these risks as imminent. Goldman's Chief U.S. Equity Strategist, Ben Snider, added, "Neither appears likely in the near future."

Given the strange circumstances, the most logical approach is to interpret the expected rate cuts through a straightforward, bullish lens. This has historically been the correct move for investors.

However, it's crucial to remember that this optimism leaves little room for error. The bullish case hinges on continued strength in GDP and corporate earnings. Should the economy falter, the planned interest rate cuts may not be enough to quickly reverse the trend.

Japan’s top currency official has indicated the government is prepared to act on foreign exchange markets, following a sudden spike in the yen driven by speculation of a potential joint intervention with the United States.

The yen jumped against the U.S. dollar on Friday after reports surfaced that the New York Federal Reserve had conducted rate checks, a move often seen as a precursor to market intervention.

In response, Japan's top currency diplomat, Atsushi Mimura, emphasized close cooperation with American authorities. "We will continue to closely coordinate with the U.S. authorities as needed... and will respond appropriately," Mimura told reporters on Monday.

While Mimura declined to confirm the news of the rate checks, his statement focused on a key agreement between the two nations. He referenced a joint U.S.-Japan statement from September that outlines the framework for any potential currency market actions.

Mimura did not comment on whether a coordinated intervention was actively being considered, leaving traders and analysts to interpret the government's next steps.

The September statement is central to understanding Japan's current position. In it, both countries reaffirmed their commitment to market-determined exchange rates.

However, the agreement also established a critical understanding: foreign exchange intervention should be reserved for combating "excessive volatility." Japanese officials have previously highlighted this as the first formal U.S. confirmation of Japan’s right to intervene under such conditions.

The official stance from Tokyo remains cautious and deliberately vague. Japan's Finance Minister, Satsuki Katayama, also refused to comment on Friday's reported rate checks.

"There is nothing I can talk about," Katayama said, deflecting questions about the yen's sudden strength and the underlying reasons for the currency's move. This disciplined silence from top officials keeps the market guessing about the threshold for direct government action.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up