Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Bank Of England Governor Bailey: There Is Still A Great Deal Of Uncertainty About Where Interest Rates Will Eventually Stabilize

Bank Of England Deputy Governor Ramsden: It Is Now Very Clear That The Unemployment Rate Has Exceeded 5%

BOE Governor Bailey: Falling Inflation Should Feed Into Expectations, That Should Give Me Confidence

Indonesia Central Bank: To Work With Government To Strengthen Communication With Markets, Maintain Market Confidence

Indonesia Central Bank: Financial Market Stability Is Also Expected To Remain Stable, Supported By Adequate Liquidity, Strong Banking Capital, Low Credit Risk

US News Website Axios Reports That The United States And Russia Are Close To Reaching An Agreement To Continue To Abide By The New START Treaty After It Expires On Thursday

Indonesia Central Bank: Rupiah Exchange Rate Is Expected To Remain Stable, Supported By Economic Prospects, Central Bank Stabilisation Commitment

BOE Governor Bailey: We Need To See More Evidence That We Are Going To Get Sustainable Return To Inflation Target

Indonesia Central Bank: Expects Indonesian Economic Prospects To Remain Solid With Improving Trend, Inflation Under Control

The US News Website Axios Reports That The US And Russia Are Negotiating An Extension Of The New START Treaty

Bank Of England Governor Bailey: If The Outlook Develops As We Expect, There Is Still Room For Further Easing In The Near Future

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP GrowthA:--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)A:--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)A:--

F: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)A:--

F: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo Rate--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

No matching data

View All

No data

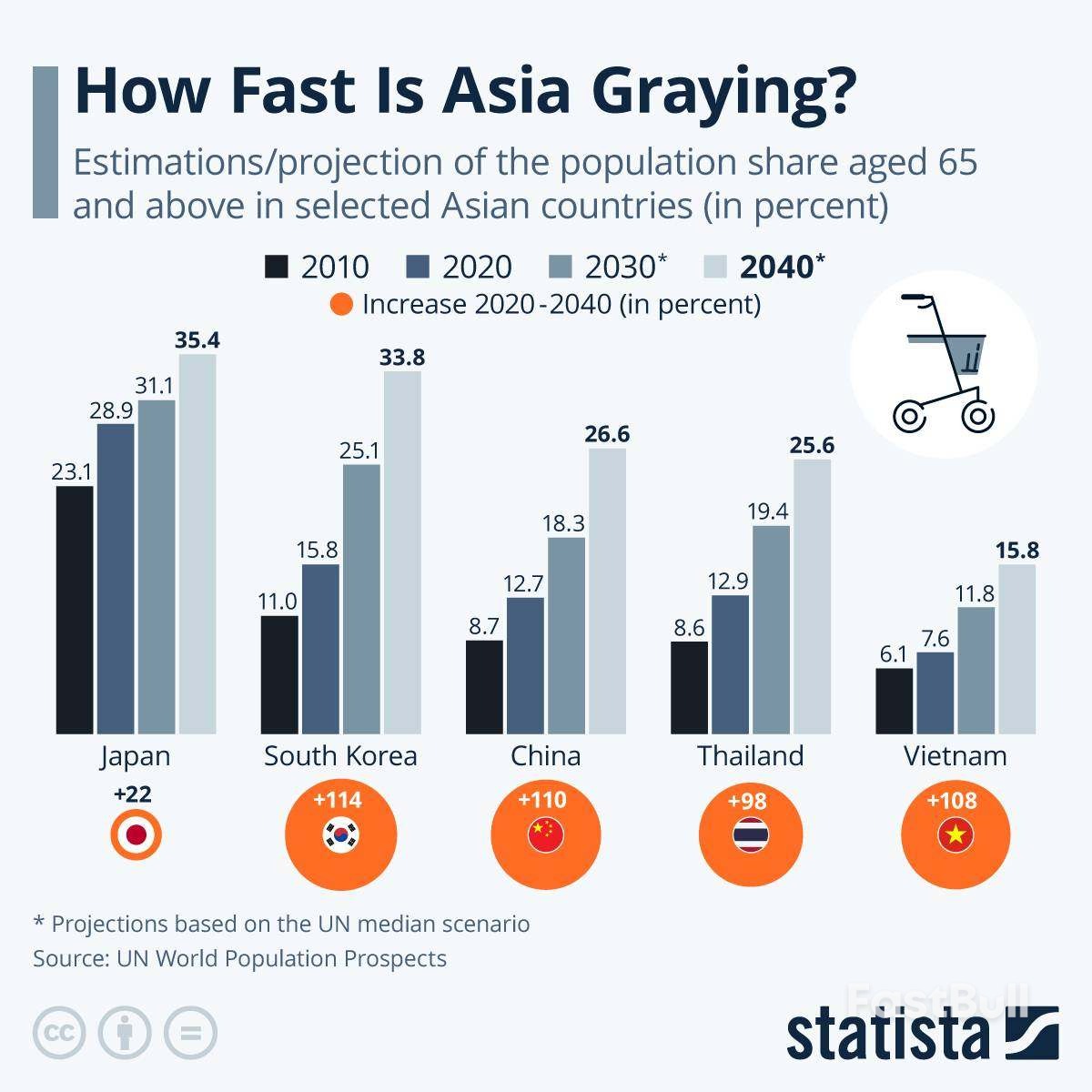

The latest revision of UN World Population Prospects reveals that demographic shift is no longer a distant projection but an accelerating reality across parts of Asia, with the share of people aged 65 and over rising fast in several countries.

The latest revision of UN World Population Prospects reveals that demographic shift is no longer a distant projection but an accelerating reality across parts of Asia, with the share of people aged 65 and over rising fast in several countries.

As Statista's Tristan Gaudiaut reports, this trend poses a significant challenge in the region for labor markets, public finances and care systems within a single generation.

The figures (UN medium-scenario projections) show Japan already far ahead, as older adults made up already around 29 percent of the population in 2020, and are projected to surpass 30 percent in the coming years: 31.1 percent by 2030 and 35.4 percent by 2040. But, as our infographic shows, the more striking story is the pace of change elsewhere.

South Korea and China are among the standout accelerators.

Both countries are expected to see their 65+ population shares more than double between 2020 and 2040. In South Korea, this figure is projected to surge from 15.8 percent (2020) to 33.8 percent (2040), while in China, it is expected to rise from 12.7 percent to 26.6 percent.

Those trajectories mirror intensifying national concerns about future labor supply and pension burdens, amid persistent low fertility and a shrinking workforce.

Meanwhile, rapid ageing is not confined to the region's richest economies. Thailand and Vietnam start from lower baselines, yet both trend sharply upward by 2040.

Both South-East Asian countries are projected to see their 65+ population shares double in twenty-years: Thailand to 25.6 percent and Vietnam to 15.8 percent.

Canada’s government is set to scrap its planned 2035 ban on new internal combustion engine cars, shifting its strategy toward promoting electric vehicles through new incentives and stricter fuel standards.

According to reports citing government and auto industry sources, the Mark Carney administration will officially announce a new automotive strategy that pivots away from a hard deadline for phasing out gasoline-powered vehicles.

The new plan replaces the 2035 ban with a combination of consumer incentives and industry regulations. Key components of the new policy are expected to include:

• Tax Relief for EV Buyers: A subsidy of C$5,000 (approximately $3,660) per electric vehicle to encourage adoption.

• Infrastructure Investment: A C$1.5 billion fund dedicated to building out Canada's EV charging infrastructure.

• Stricter Fuel Efficiency Rules: New, potentially tighter fuel efficiency standards will be implemented for all new vehicles.

This approach signals that the government remains committed to transport electrification but is changing the method to achieve its goal.

The policy shift is seen as a major concession to Canada's automotive industry, which strongly opposed the previous EV mandates. The original targets required EVs to account for 20% of sales in the near term, rising to 60% by 2030 and a full 100% by 2035.

Automakers argued these goals were unrealistic and impossible to achieve within the proposed timeline. They also raised concerns that a forced transition to EVs would be expensive for consumers and limit their vehicle choices.

Another critical driver behind the new strategy is a move to protect the domestic auto sector from U.S. trade policy. The government plans to prioritize support for companies that manufacture cars in Canada, aiming to safeguard thousands of jobs.

This measure is a direct response to tariffs imposed by U.S. President Trump last year on foreign-made automobiles, creating pressure on Canada's export-oriented auto industry.

While the direct ban is being removed, it remains uncertain if the auto industry will fully embrace the new terms. The use of stringent fuel efficiency standards has been employed elsewhere as an indirect way to mandate EV sales.

California offers a prominent example. The state has implemented such demanding emissions rules for light vehicles that it is difficult for most carmakers to comply without selling a significant number of zero-emission vehicles. This raises the question of whether Canada's new policy will achieve a similar outcome, effectively pushing the market toward EVs without an explicit ban.

The Malaysian ringgit, Asia's top-performing currency last year, has further potential to strengthen as the nation's economy continues to show robust growth, according to Finance Minister II Datuk Seri Amir Hamzah Azizan.

In a recent interview, the finance minister suggested that official growth forecasts may soon be revised upward. He argued that the ringgit was undervalued in the past year and the market is now adjusting to its fundamental strength. This momentum is supported by January's capital inflows into Malaysia's equity and bond markets, a trend he expects to continue.

"I think the ringgit still has potential because growth is still intact in this country and it's still growing well," Amir Hamzah stated. The currency pared its losses during his remarks, trading at 3.9437 against the dollar in Kuala Lumpur.

Malaysia's economy has demonstrated impressive resilience, weathering challenges like US tariffs that have impacted global trade. This strength has allowed the central bank to hold its benchmark interest rate steady since July.

Economic performance is outpacing much of Southeast Asia, driven by several key factors:

• Strong Domestic Demand: Local consumption remains a solid foundation for growth.

• Strategic Investments: The country is attracting capital into high-value sectors like electronics, data centers, and energy transition projects.

In 2025, Malaysia's economy expanded by 4.9%, exceeding the government's own forecast of 4% to 4.8%. While the official projection for this year is a more moderate 4% to 4.5%, Amir Hamzah expressed optimism that Bank Negara Malaysia could raise this estimate in its upcoming review. He also noted a lack of catalysts that would cause inflation to rise this year.

Bank Negara Malaysia (BNM) is focused on maintaining stability to support the economy. BNM Governor Datuk Seri Abdul Rasheed Ghaffour recently stated that while uncertainty remains high, he is "cautiously optimistic" about 2026.

"What's important for us is to ensure that we provide a conducive environment from monetary stability and financial stability for us to be able to achieve sustainable growth," he explained.

This sentiment is shared by the private sector. Datuk Seri Khairussaleh Ramli, CEO of Malayan Banking Bhd (Maybank), the country's largest bank, anticipates that BNM will likely keep interest rates unchanged throughout the year as economic growth moderates.

The ringgit’s rally—up 3% this year after a nearly 10% gain in 2025—is not just a story about a weaker dollar. It is rooted in structural improvements, rising investment, and a clear government agenda for fiscal consolidation.

Prime Minister Datuk Seri Anwar Ibrahim's administration aims to narrow the budget deficit to 3.5% of GDP this year, down from a target of 3.8% in 2025. Amir Hamzah confirmed the 2025 target was "within reach," with final figures expected by the end of February. This commitment to fiscal health is designed to boost investor confidence.

A core part of this strategy is a deliberate shift away from reliance on petroleum-related revenue. The government is focused on diversifying its economic base, improving tax collection, and reducing subsidy spending.

"The key for Malaysia was the diversification," said Amir Hamzah. "The more we push for economic diversification, the more we improve our fiscal space and tax collections, the resilience of the fiscal space of the government is much better."

UK inflation unexpectedly rose for the first time in five months, climbing to 3.4% in December and complicating the timeline for a potential interest rate cut from the Bank of England.

Data from the Office for National Statistics (ONS) confirmed the annual inflation rate, as measured by the consumer prices index (CPI), increased from 3.2% in November. This figure surpassed City economists' forecasts of a more modest rise to 3.3% and marks a reversal after months of falling or stagnant price growth.

While analysts believe the uptick is likely temporary, financial markets have almost entirely priced out the possibility of an interest rate cut by the Bank of England next month.

The December inflation increase was largely fueled by volatile items and specific policy changes, rather than a broad resurgence in price pressures.

Key drivers include:

• Air Fares: A significant 28.6% surge in air travel costs occurred in December. While flight prices typically jump over the Christmas holiday, the increase was magnified when compared to an unusually low base in 2024.

• Tobacco Duties: Higher taxes on tobacco products, introduced by Chancellor Rachel Reeves in the autumn budget, took effect in December and contributed to the headline rate.

Martin Beck, chief economist at WPI Strategy, advised against alarm, stating, "December's uptick in inflation should not set alarm bells ringing. The increase was largely driven by temporary and technical factors, not a broader resurgence in price pressures."

Beneath the headline figure, the details paint a more complex picture of the UK economy. Core inflation, which excludes volatile food and energy prices, remained unchanged from November at an annual rate of 3.2%. This stability suggests underlying price pressures may not be accelerating.

However, the cost of groceries continued to climb over the holiday period. Annual food inflation rose to 4.5% from 4.2% in November, with the ONS highlighting rising prices for bread and cereals as a primary factor.

Services inflation, a key metric for the Bank of England, edged up from 4.4% to 4.5%. Although this measure is watched closely for signs of domestic price pressures, the December rise was smaller than economists had feared.

Yael Selfin, chief economist at KPMG UK, noted that the Bank of England would likely look through this increase. "Despite services inflation increasing in December, this was not reflective of domestically generated price pressures and was largely driven by volatile categories, such as air fares," she said, adding that slowing wage growth should help ease services inflation in the coming months.

The stronger-than-expected CPI reading has prompted the Bank of England's Monetary Policy Committee (MPC) to maintain a cautious stance. City traders now see an interest rate cut in February as highly unlikely and are not fully pricing one in until June.

Despite the market's reaction, many economists still forecast a potential rate cut in April, provided that UK price and wage growth continue to soften. Bank of England Governor Andrew Bailey stated last month that he expects inflation to return to the MPC's 2% target by the middle of this year.

Chancellor Rachel Reeves, who has made tackling the cost of living a central theme, pledged that 2026 would be the "year that Britain turns a corner" on inflation. "My number one focus is to cut the cost of living," she said, referencing measures from the budget including discounts on energy bills and freezes on rail fares and prescription charges.

In a separate report, the ONS revealed that private rental price growth is slowing. Average monthly rents increased by 4% in the year to December, down from 4.4% in November and the slowest pace since May 2022. Property portal Zoopla attributes this shift to an increase in available rental homes, as more first-time buyers are leaving the rental market due to improved mortgage conditions and slower house price growth.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up