Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

BitMEX founder Arthur Hayes suggests Fed intervention in Japan's bond crisis with money printing could spark Bitcoin's revival.

BitMEX founder Arthur Hayes has outlined a scenario where the U.S. Federal Reserve could start printing money to support Japan's fragile government bond market, a move he believes could pull Bitcoin out of its current slump.

Hayes argues that for Bitcoin to "exit its sideways funk, it needs a healthy dose of money printing," and a looming crisis in Japan may provide the trigger.

Japan is currently facing a serious economic challenge: its currency, the yen, is weakening while the yields on Japanese government bonds (JGBs) are simultaneously rising. This combination signals a potential loss of confidence in the market.

The problem extends to the United States because Japanese investors, who are major holders of U.S. Treasuries, might be tempted to sell them to purchase higher-yielding JGBs back home.

"Will a meltdown of the yen and JGB markets cause some sort of money printing by the BOJ [Bank of Japan] or the Fed? The answer is yes," said Hayes.

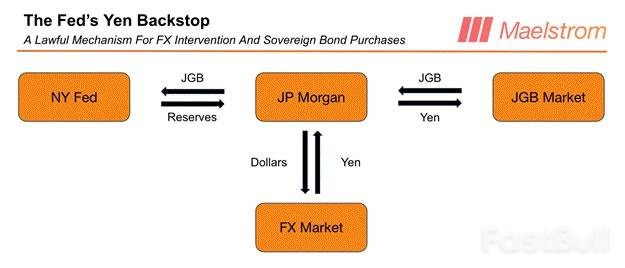

Hayes theorizes that the Fed could intervene through a specific mechanism to strengthen the yen and lower Japanese bond yields. The process would involve:

1. The Fed creating new dollar reserves with commercial banks like JPMorgan.

2. These banks would then sell the dollars to purchase yen on the open market, boosting the yen's value.

3. The acquired yen would then be used to buy JGBs, which would push their yields down.

This operation would effectively expand the Fed's balance sheet, showing up under the "Foreign Currency Denominated Assets" category. "This Fed intervention is just what the filthy fiat system needs to limp along a little longer," Hayes explained.

Despite his theory, Hayes is exercising caution and waiting for concrete evidence of intervention. He is closely monitoring the Fed's weekly H.4.1 report, which details the central bank's balance sheet.

"Bitcoin fell as the yen strengthened against the dollar. I will not increase risk before I confirm the Fed is printing money to intervene in the yen and JGB markets," he stated, indicating he is holding off on major market moves for now.

Meanwhile, the U.S. dollar index (DXY) has been under pressure, falling to 95.6 on Tuesday—its lowest point since January 2022. The dollar has declined 10% over the past year.

Speaking in Iowa on Tuesday, U.S. President Donald Trump maintained that the dollar was "doing great."

"I mean, the value of the dollar, look at the business we're doing. No, the dollar is doing great," he said, according to CNBC. Trump also recalled past tensions over currency valuation, stating, "I used to fight like hell with them because they always wanted to devalue their yen... you know that, the yen and yuan, and they'd always want to devalue it. They devalue, devalue, devalue. And I said, 'not fair.' They devalue, because it's hard to compete when they devalue."

Oil prices continued their ascent on Wednesday, driven by mounting supply concerns from a U.S. winter storm and rising geopolitical tensions in the Middle East.

Brent crude futures increased by 28 cents, or 0.4%, to $67.85 a barrel by 0410 GMT. Meanwhile, U.S. West Texas Intermediate (WTI) crude saw a 35-cent rise, or 0.6%, to $62.74 a barrel. This follows a significant rally where both benchmarks gained approximately 3% on Tuesday.

A major winter storm in the United States has severely impacted the country's energy infrastructure, becoming a primary driver for the price rally.

Analysts and traders estimate that U.S. producers lost as much as 2 million barrels per day (bpd) of crude output over the weekend, accounting for roughly 15% of the national total. The storm strained power grids and disrupted operations across the sector.

The impact extended to international trade, as ship-tracking service Vortexa reported that crude and liquefied natural gas exports from U.S. Gulf Coast ports dropped to zero on Sunday, tightening global supply.

Beyond the U.S., other international factors are contributing to supply tightness and supporting higher oil prices.

Slow Recovery at Kazakhstan's Tengiz Field

Production issues in Kazakhstan are also underpinning the market. According to two sources familiar with the matter, the country's largest oilfield, Tengiz, is expected to restore less than half of its normal production by February 7 as it recovers from a fire and power outage.

This disruption has partially offset reports from the CPC pipeline operator, which handles about 80% of Kazakhstan's oil exports. CPC stated it had returned to full loading capacity at its Black Sea terminal after completing maintenance.

OPEC+ Poised to Hold Production Steady

Adding to supply discipline, the Organization of the Petroleum Exporting Countries and its allies, including Russia (OPEC+), is expected to maintain its current output policy. Three OPEC+ delegates indicated that the group will likely keep its pause on oil production increases for March at its upcoming meeting on February 1.

Elevating market uncertainty, geopolitical risks in the Middle East are on the rise. Two U.S. officials, speaking anonymously, confirmed that an American aircraft carrier and its supporting warships have arrived in the region.

This deployment enhances President Donald Trump's military capabilities to defend U.S. forces or potentially take action against Iran. In a note, analysts at ANZ suggested this raises the prospect that Trump could follow through on threats against Iran's senior leadership in response to a crackdown on nationwide protests.

Despite the current rally, some market observers anticipate a potential pullback. Toshitaka Tazawa, an analyst at Fujitomi Securities, acknowledged that supply factors are supporting prices but warned, "once supply fears ease, selling pressure is likely to return." He projects that a global crude supply surplus this year could keep WTI trading around $60 a barrel.

Meanwhile, data on U.S. stockpiles presented a mixed picture. An extended Reuters poll on Tuesday showed that U.S. crude oil and gasoline stockpiles were expected to have risen in the week ended January 23, while distillate inventories were forecast to have fallen.

However, market sources citing figures from the American Petroleum Institute on Tuesday reported a different outcome: U.S. crude and gasoline stocks fell last week, while distillate inventories rose.

Japanese government bonds rallied after a 40-year bond auction attracted its strongest demand since March, offering a moment of calm to a market worried about long-term debt and mounting fiscal pressure ahead of a snap election.

The auction's bid-to-cover ratio, a key indicator of demand, climbed to 2.76 from 2.585 at the previous sale. In response, the 40-year bond yield fell 3.5 basis points to 3.9%, retreating from an all-time high of 4.215% set just over a week ago. Yields on 10-year and 20-year notes also declined.

"The results were strong, providing the bond market with a bit of relief," said Miki Den, a senior rates strategist at SMBC Nikko Securities Inc. "Still, volatility in the super-long sector is likely to persist until after the election is over."

The successful sale provides some breathing room after Prime Minister Sanae Takaichi's proposal to suspend the sales tax on food for two years triggered a period of exceptional market volatility.

All eyes are now on the Ministry of Finance's upcoming auctions of 10- and 30-year bonds next week. These sales will serve as a crucial test of whether the renewed appetite for sovereign debt can hold up ahead of the February 8 vote.

Despite the recent turbulence, some major institutional investors see value. Meiji Yasuda Life Insurance Co. stated in an interview that Japan's super-long government bonds present attractive investment opportunities, and the firm is now looking for the right entry point. Similarly, Pacific Investment Management Co. is maintaining its conviction in 30-year bonds following the sell-off.

Market analysts noted that JGB futures rose following the auction, suggesting traders were unwinding short hedges established beforehand. This dynamic is expected to help flatten the yield curve as the long end of the bond market outperforms.

The primary challenge for Prime Minister Takaichi's government and the Bank of Japan is navigating the markets through the election period without a major disruption, according to a Finance Ministry official. The prime minister's decision to call a surprise vote is seen as risky, with several recent polls showing a slight dip in her approval ratings.

Fiscal discipline remains a central concern for investors, as both major political camps are proposing tax cuts. The Centrist Reform Alliance, Japan's largest opposition party, has promised a permanent tax reduction on food. This has intensified fears that government finances will weaken regardless of the election's outcome. Meanwhile, some BOJ policymakers have expressed concern about how the yen's depreciation is affecting price trends.

Separately, the Japanese yen strengthened to its highest level since October during U.S. trading on Tuesday. The move was driven by two key factors:

• Intervention Speculation: Comments from Japanese officials, including the finance minister, fueled speculation that the government might intervene to stop the currency's slide.

• Weaker Dollar: The U.S. dollar broadly declined after President Donald Trump indicated he was comfortable with its recent weakness.

These developments followed a fresh warning from Prime Minister Takaichi on Sunday that the government was prepared to take action in response to a weakening yen and surging bond yields, though she did not specify any particular market.

When Donald Trump returned to office with an "America First" agenda, many predicted trouble for China's economy. Instead, Beijing has navigated the geopolitical landscape by strengthening ties with other global partners, culminating in a record trade surplus.

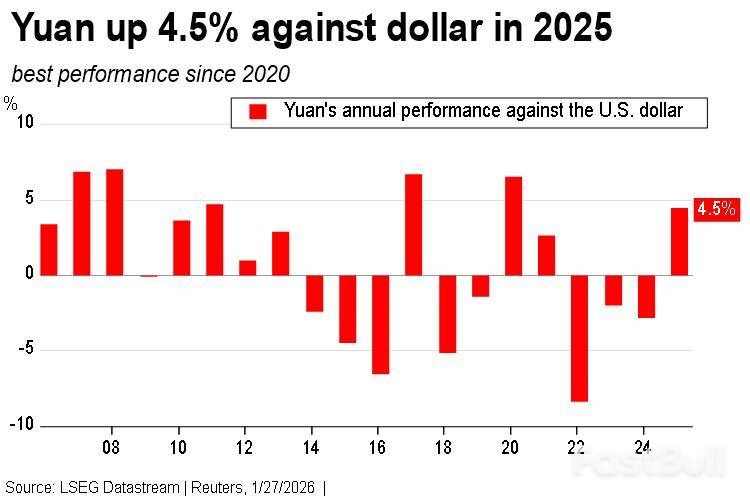

While U.S. policies have strained relationships with traditional allies, China has focused on building new economic bridges. In 2025, this strategy resulted in a $1.2 trillion trade surplus and monthly foreign exchange inflows that hit a record $100 billion. At the same time, the global use of the yuan has steadily expanded.

This pivot is gaining momentum, with leaders like British Prime Minister Keir Starmer visiting Beijing to reinvigorate business ties and explore new opportunities for cooperation.

As Washington's trade approach becomes more unpredictable, China is positioning itself as a stable and reliable economic partner. According to Aleksandar Tomic, an economics professor at Boston College, China is emerging as a "steady partner" for many countries looking for certainty.

"I think China has done a good job... to position itself as the reliable and stable trade partner," said Derrick Irwin, co-head of intrinsic emerging markets equity at Allspring Global Investments. "They basically said, look... We can offer predictability and certainty."

Starmer's four-day visit is the first by a British prime minister since 2018. It follows a trip by Canadian Prime Minister Mark Carney, who signed an economic deal to lower trade barriers and build a new strategic relationship with Beijing. Carney described China as "a more predictable and reliable partner."

This trend extends beyond China's direct efforts. Other major economies are also diversifying their trade relationships. India and the European Union recently finalized a trade deal that will slash tariffs, potentially doubling European exports to India by 2032.

The geopolitical tensions between the world's two largest economies escalated sharply in January 2025 when Trump returned to the White House. Tariffs on Chinese goods were raised to over 100% before a temporary truce was reached.

In response, Beijing focused on boosting exports to non-US markets and supporting its domestic enterprises. While Chinese shipments to the U.S. fell by 20% in 2025, they grew significantly elsewhere:

• Africa: +25.8%

• Latin America: +7.4%

• Southeast Asia: +13.4%

• European Union: +8.4%

"Many countries previously have not been China-friendly are now kind of pivoting to China... because the United States is becoming a lot less predictable," Tomic noted. "The more the U.S. gets difficult to deal with, the more it opens up for China."

Despite trade friction and domestic pressures from a property sector slump and weak consumption, China's economy still met the government's 5% growth target for 2025. To attract foreign investment, Beijing has also launched pilot programs in cities like Shanghai and Beijing to open market access in services like telecommunications, healthcare, and education.

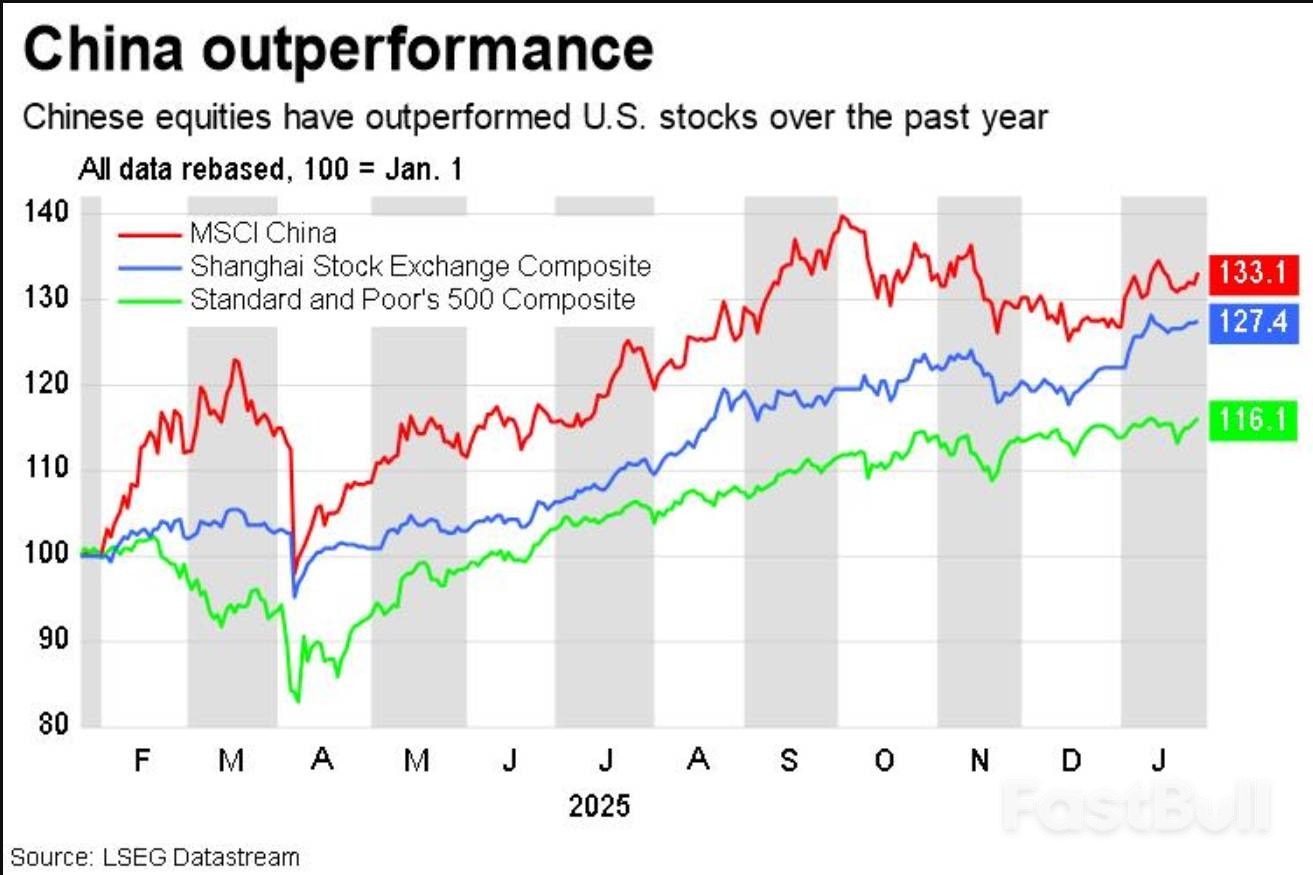

China's financial markets have also shown resilience. The Shanghai index climbed 27% over the past year, outperforming U.S. equities, while market turnover hit a record high. In December, the country recorded its largest-ever monthly forex inflows of $100.1 billion, and its official forex reserves reached a 10-year high of $3.36 trillion.

Beijing is also capitalizing on the situation to advance the internationalization of the yuan. With Trump's erratic approach to trade making the U.S. dollar less appealing to some investors, global banks are reportedly boosting yuan liquidity in offshore hubs and improving payment settlement frameworks.

"We have seen quite a few cycles of China trying to internationalise yuan and then pulling back," said a banker at a global bank with a presence in China. "This time it's different... Trump policies are very conducive for boosting yuan usage."

The data reflects this shift. More than half of China's cross-border transactions are now settled in yuan, up from almost zero 15 years ago. According to the PBOC and SAFE, nearly half of China's overseas bank lending is now in renminbi.

However, some foreign policy analysts advise caution. Patricia Kim, a fellow at the Brookings Institution in Washington, argues that distrust of the U.S. does not automatically translate into trust in Beijing for American allies.

"Many of these countries harbour deep concerns about China's approach to trade, its use of economic coercion, and unresolved maritime and historical disputes," Kim said.

She added that while China may currently appear more pragmatic compared to the Trump administration's rhetoric, "Beijing's actual behaviour has not been especially reassuring." This suggests that while China is successfully forging new economic pacts, underlying political and strategic concerns remain a significant hurdle for its long-term ambitions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up