Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Stats Office - Swiss December Retail Sales +2.9% Year-On-Year Versus Revised +1.7% In Previous Month

Iran's Foreign Ministry Spokesperson Baghaei Says Tehran Is Examining Details Of Various Diplomatic Processes, Hopes For Results In Coming Days

FAA Head Says Concerned Other Countries Aren't Putting Enough Resources Into Certifying USA Aircraft

German Dec Retail Sales +1.5 Percent Year-On-Year (Versus Reuters Consensus Forecast For +1.1 Percent)

Russian Security Committee's Vice Chairman Medvedev: Russia Will Not Accept NATO-Member Forces In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Nuclear Arms Control For Past 60 Years Helped Verify Intentions And Build Trust

Russian Security Committee's Vice Chairman Medvedev: The Territorial Issue In Ukraine Talks Is Most Complicated

Russian Security Committee's Vice Chairman Medvedev: If New Start Expires It Does Not Necessarily Mean A Catastrophe But It Should Alarm Everyone

Russian Security Committee's Vice Chairman Medvedev: Our Proposal To USA On Extending The Limits Of New Start Remains On The Table

Kazakhstan's Central Bank Says It Sold Foreign Currency Worth 350 Billion Tenge In January To Mirror Gold Purchases, Will Sell Foreign Currency Worth 350 Billion In February

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The rapid appreciation of the euro beyond 1.20 USD reflects growing skepticism toward the US dollar, reshaping monetary policy considerations in Europe and accelerating shifts in global capital allocation....

China’s manufacturing sector showed unexpected signs of life in January, according to a private survey, offering a rare piece of good news for an economy facing considerable headwinds.

The RatingDog China manufacturing purchasing managers index (PMI) climbed to 50.3 in January, up from 50.1 in December. This reading surpassed the median forecast from a Bloomberg survey of economists, who had anticipated the gauge would fall to the 50.0 mark.

A PMI figure above 50 indicates expansion in the manufacturing sector, while a reading below 50 signals contraction.

The positive results from the private survey stand in contrast to the official government data released over the weekend. The official poll revealed that China's factory activity had unexpectedly worsened last month, following a brief recovery in December.

This divergence can often be explained by the different compositions of the surveys. The private RatingDog poll tends to focus more on smaller, export-oriented firms. In recent months, these results have generally been stronger than the official data, reflecting the resilience of China's export market.

This flicker of manufacturing strength comes as China's broader economy continues to lose momentum. Policymakers have shown little inclination to introduce major stimulus, as they remain focused on managing risks associated with local government debt.

There are also indications that Beijing may be recalibrating its growth expectations. President Xi Jinping has signaled a greater tolerance for slower growth in certain regions, and the government may lower its national economic growth target for the first time in four years.

In the previous year, China's gross domestic product grew by 5%, a figure largely propped up by record exports that helped offset cooling private consumption and a significant drop in investment.

Gold and silver prices extended their sharp sell-off on Monday, deepening the losses from last Friday’s rout. The decline follows a period of intense rallying that sent both metals to record highs, but a strengthening U.S. dollar and widespread profit-taking have since reversed that momentum.

Spot gold fell approximately 5% to trade at $4,617.07 per ounce. This follows a dramatic crash of nearly 10% on Friday, which saw prices fall below the $5,000 mark.

Silver also remained under heavy pressure after nosediving 30% last Friday. The metal, which had climbed on safe-haven demand, saw spot prices drop more than 4% to $80.63 per ounce.

According to analysts, the sudden reversal was triggered by a collision of market optimism over U.S. interest-rate cuts with a major leadership change at the Federal Reserve. President Donald Trump nominated former Fed Governor Kevin Warsh to succeed Jerome Powell as Chair when his term concludes in May.

Warsh is widely seen as an advocate for tighter monetary policy, and his nomination immediately bolstered the U.S. dollar.

"The 'Buy America' trade is back as a result, and the independence bid that drove gold and silver to nosebleed record heights right below $5,600 and $122 per ounce early Thursday morning is unraveling," noted José Torres, a senior economist at Interactive Brokers.

Adding to the pressure on precious metals, recent statements from Trump have suggested a potential deal with Iran, which has eased some geopolitical tensions in the market.

Despite the sharp downturn, some analysts see it as a natural market correction rather than a fundamental shift in the long-term trend for precious metals.

Christopher Forbes, head of Asia and the Middle East at CMC Markets, described gold's retreat as a "classic air-pocket after an extraordinary run." He attributes the sell-off to a combination of factors. "Profit-taking, a firmer dollar, and fresh geopolitical headlines from Washington have knocked froth off a crowded trade," Forbes said.

How a Strong Dollar Hits Precious Metals

The U.S. dollar's performance is a critical driver for gold prices. The dollar index, which tracks the greenback against other major currencies, has gained about 0.8% since Thursday.

• Pricing Power: Since gold is priced in U.S. dollars, a stronger dollar makes it more expensive for buyers using other currencies, which can dampen demand.

• Opportunity Cost: Higher interest rates, often associated with a hawkish Fed and a strong dollar, make interest-bearing assets like U.S. Treasurys more attractive. This raises the opportunity cost of holding gold, which pays no interest.

In the immediate future, Forbes expects gold prices to remain elevated but volatile as the market seeks more clarity on Warsh's potential policy direction at the Fed.

Even with the recent pullback, both metals are still showing strong year-to-date gains. Silver prices remain up around 15% since the start of the year, while gold is about 8% higher.

Looking ahead, the long-term bullish case for precious metals remains intact for some. "Renewed dollar weakness or confirmation of a dovish Warsh would bring dip-buyers back," said Forbes. He maintains a positive 12-month outlook, suggesting bullion could revisit its recent highs if the Federal Reserve continues its easing cycle amid uneven economic growth and inflation.

China's manufacturing sector showed renewed signs of life to start 2026, with a key private survey indicating that factory activity expanded at a faster pace in January, beating analyst expectations.

The RatingDog China General Manufacturing Purchasing Managers' Index (PMI), compiled by S&P Global, climbed to 50.3 from 50.1 in December. This marks the index's highest reading since October and holds it above the 50-point threshold that separates growth from contraction.

The upbeat private survey presents a conflicting picture of China's industrial economy. An official PMI released on Saturday suggested that factory activity had actually faltered, weighed down by deteriorating orders both at home and abroad. Analysts suggest that differences in survey scope and respondent profiles likely account for the divergent results.

The data follows a year in which China's economy grew by 5.0%, meeting the government's official target. This performance was largely supported by capturing a record share of global demand for goods, which helped compensate for weaker domestic consumption. Beijing has also ramped up trade diplomacy, securing deals with Britain and Canada as U.S. President Donald Trump's administration disrupts traditional trade relationships.

The January expansion was fueled by a rebound in foreign demand and a pickup in production, according to the RatingDog survey.

• Output Growth: The rate of production accelerated to a three-month high.

• New Business: Overall new orders rose for the eighth consecutive month.

• Export Orders: After contracting in December, new export orders swung back into expansionary territory, with firms noting particularly strong demand from Southeast Asia.

Factories also appeared to be front-loading work ahead of the Chinese New Year holiday. The nine-day festival, which falls in mid-February this year, typically encourages manufacturers to accelerate overseas shipments and boost production in advance.

The increase in orders and production needs led manufacturers to expand their workforce for the first time in three months, lifting hiring to its highest level since October. This boost in staffing, combined with efficiency gains, allowed companies to reduce their backlogs of work for the first time in eight months.

On the cost side, inflationary pressures are building. Average input costs for manufacturers rose to their highest level since September, primarily driven by price hikes for metals.

In response, producers raised their factory gate charges for the first time since November 2024. Prices for exported goods also saw a notable increase, rising at the fastest pace in a year and a half. These price hikes could offer some relief to producer margins, which have been squeezed by price cuts aimed at defending market share amid soft domestic demand.

"If cost pressures persist while demand recovery is limited, profit margins will remain under pressure," warned Yao Yu, founder of RatingDog.

Looking ahead, business sentiment among manufacturers remained positive at the start of the year. Companies expressed hope that new product launches and expansion plans would support sales and output over the next 12 months.

However, broader concerns about the economic growth outlook and rising costs weighed on confidence. As a result, overall optimism fell to its lowest level in nine months, signaling a more cautious outlook for the year ahead.

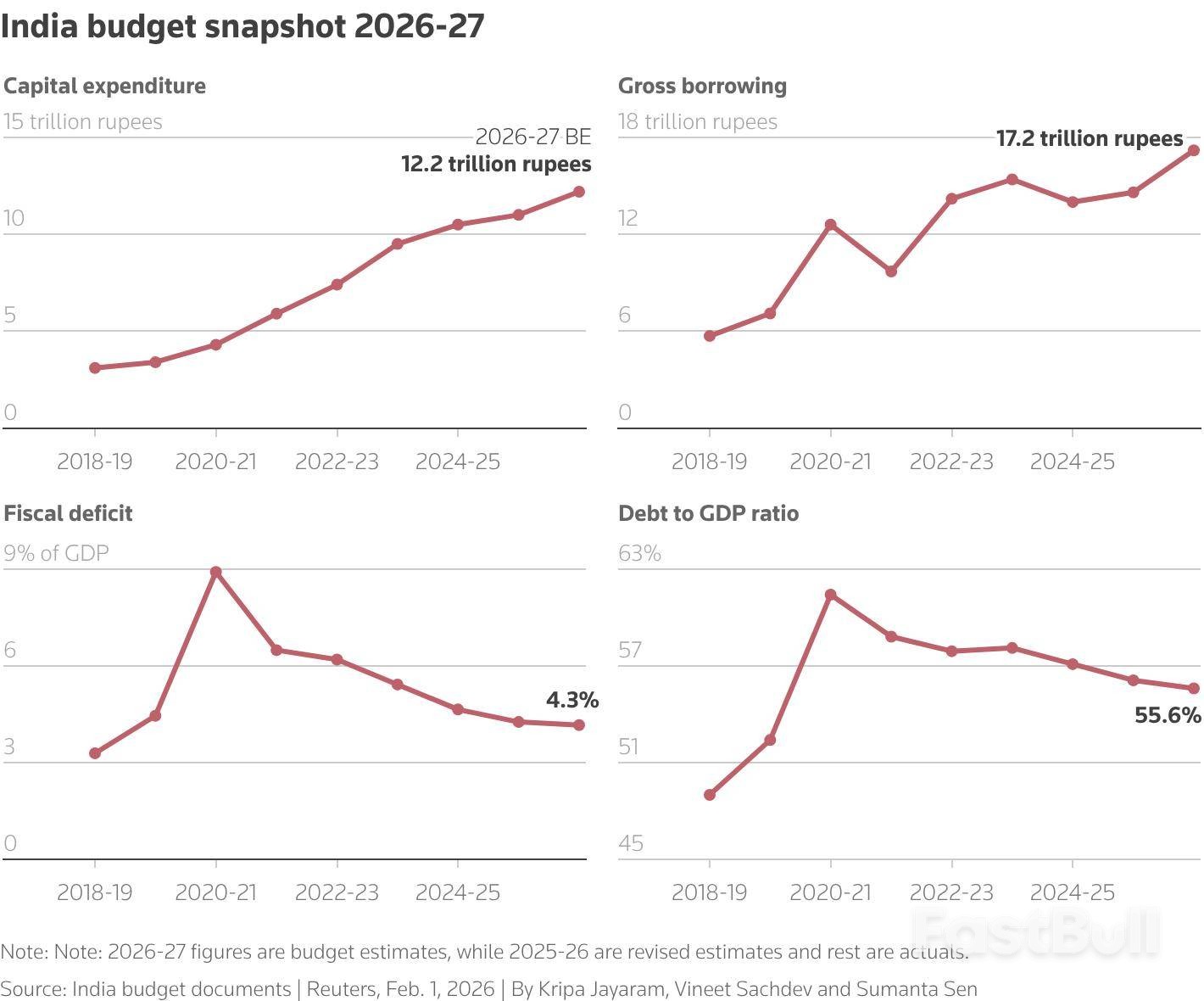

The Indian rupee and government bonds are bracing for continued pressure this week, as a record government borrowing plan and weak capital flows weigh heavily on market sentiment.

The rupee tumbled to an all-time low of 91.9875 per dollar last Friday, ending the session just shy of the 92 mark. The currency has fallen by more than 2% in January alone and is expected to weaken further.

India's federal budget for the fiscal year starting April 1, announced on Sunday, failed to inspire confidence. The absence of major reforms, coupled with an unexpected tax hike on equity derivative transactions, put a damper on local stocks.

The government's new fiscal policy framework shifts focus to the debt-to-GDP ratio, with a target of 55.6% for the next fiscal year. This is alongside a projected fiscal deficit of 4.3% of GDP.

To fund its plans, the government intends to borrow a record 17.20 trillion rupees ($187.63 billion) in fiscal year 2027. This figure is higher than market expectations, which ranged from 16 trillion to 17.50 trillion rupees, with a median forecast of 16.3 trillion rupees in a Reuters poll.

"The government's borrowing number is slightly higher than what the market expected, so the supply-demand imbalance issues for government bonds are likely to persist," noted Vivek Rajpal, Asia macro strategist at JB Drax Honore.

The gross borrowing figure represents a 17% increase from the current year's 14.61 trillion rupees. Net borrowing is also set to rise, climbing to 11.73 trillion rupees from 11.33 trillion this year.

Worries over a demand-supply mismatch have already pushed bond yields higher. The 10-year benchmark 6.48% 2035 yield settled at 6.6963% on Friday, marking its fourth weekly rise in five.

Traders anticipate the yield will trade between 6.62% and 6.75% ahead of the central bank's monetary policy decision this Friday, where interest rates are expected to remain unchanged.

The heavy debt supply is likely to keep yields elevated, even after the Reserve Bank of India (RBI) has taken significant measures to ensure liquidity, including bond purchases and foreign-exchange swaps.

According to Rajpal, "The Reserve Bank of India (RBI) will have to continue to be the marginal buyer of government debt."

The upcoming policy meeting will focus on the transmission of last year's 125 basis points in rate cuts, a process that has been slowed by rising bond yields and liquidity pressures from market interventions aimed at supporting the rupee.

Indian markets also face pressure from a stronger U.S. dollar and rising U.S. bond yields. The dollar index rose 1% on Friday, while yields on 10-year and 30-year U.S. Treasuries also increased.

This shift follows the selection of former Federal Reserve Governor Kevin Warsh as the next Fed chair. Warsh is generally expected to favor lower interest rates but is seen as less aggressive in his easing preferences compared to other potential nominees.

India

• Feb. 2 (Mon): January HSBC manufacturing PMI (10:30 a.m.)

• Feb. 4 (Wed): January HSBC services PMI (10:30 a.m.)

• Feb. 6 (Fri): RBI monetary policy decision (10:00 a.m.)

U.S.

• Feb. 2 (Mon): January S&P Global manufacturing PMI final (8:15 p.m. IST)

• Feb. 2 (Mon): January ISM manufacturing PMI (8:30 p.m. IST)

• Feb. 4 (Wed): January S&P Global composite & services PMI final (8:15 p.m. IST)

• Feb. 4 (Wed): January ISM non-manufacturing PMI (8:30 p.m. IST)

• Feb. 5 (Thurs): Initial weekly jobless claims (7:00 p.m. IST)

• Feb. 6 (Fri): January non-farm payroll and unemployment rate (7:00 p.m. IST)

($1 = 91.6710 Indian rupees)

Crude oil prices fell by 3% on Monday, retreating from multi-month highs after U.S. President Donald Trump indicated that talks with Iran were progressing, easing fears of an immediate military conflict.

Brent crude futures dropped $2, or 2.9%, to trade at $67.28 per barrel. Similarly, U.S. West Texas Intermediate (WTI) crude saw a decline of $2, or 3.1%, falling to $63.17 per barrel. The sharp drop followed a period of heightened market tension where Brent reached a six-month peak and WTI neared its highest level since late September.

The market sentiment shifted after President Trump told reporters on Saturday that Iran was "seriously talking" with Washington. His comments came just hours after Tehran's top security official, Ali Larijani, announced on X that arrangements for negotiations were in progress.

"I hope they negotiate something acceptable," Trump stated, adding, "You could make a negotiated deal that would be satisfactory with no nuclear weapons."

This diplomatic softening was further supported by reports that the naval forces of Iran's Revolutionary Guards have no current plans for live-fire exercises in the Strait of Hormuz.

According to IG market analyst Tony Sycamore, these developments signal a clear de-escalation. "The crude oil market is interpreting this as an encouraging step back from confrontation," he said, explaining that it is "easing the geopolitical risk premium built into the price during last week's rally and prompting a bout of profit-taking."

While geopolitical headlines have recently dominated oil price movements, some analysts argue they mask a fundamentally bearish outlook for the market.

In a January 30 note, Capital Economics suggested that a well-supplied oil market will ultimately weigh on prices. "Geopolitical risks mask a fundamentally bearish oil market," the firm wrote, predicting that these factors "will still bear down on Brent crude prices by end-2026."

Adding to this perspective, OPEC+ agreed on Sunday to maintain its current oil output levels for March. The group had previously decided in November to freeze planned production increases from January through March 2026, citing seasonally weaker consumption.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up