Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)A:--

F: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Dec)

U.S. Cleveland Fed CPI MoM (Dec)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina 12-Month CPI (Dec)

Argentina 12-Month CPI (Dec)A:--

F: --

P: --

U.S. Budget Balance (Dec)

U.S. Budget Balance (Dec)A:--

F: --

P: --

Argentina CPI MoM (Dec)

Argentina CPI MoM (Dec)A:--

F: --

P: --

Argentina National CPI YoY (Dec)

Argentina National CPI YoY (Dec)A:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Dec)

South Korea Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Jan)

Japan Reuters Tankan Non-Manufacturers Index (Jan)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Jan)

Japan Reuters Tankan Manufacturers Index (Jan)A:--

F: --

P: --

China, Mainland Exports YoY (CNH) (Dec)

China, Mainland Exports YoY (CNH) (Dec)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Dec)

China, Mainland Trade Balance (USD) (Dec)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)A:--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)A:--

F: --

P: --

China, Mainland Imports (CNH) (Dec)

China, Mainland Imports (CNH) (Dec)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Dec)

China, Mainland Outstanding Loans Growth YoY (Dec)--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction Yield--

F: --

P: --

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)--

F: --

P: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)--

F: --

P: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)--

F: --

P: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)--

F: --

P: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)--

F: --

P: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)--

F: --

P: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

gold

gold

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Honda last week unveiled its third e-bike model for Vietnam, advancing its electrification plan after being caught off guard by an abrupt policy change in the world's fourth-largest motorcycle market.

Honda last week unveiled its third e-bike model for Vietnam, advancing its electrification plan after being caught off guard by an abrupt policy change in the world's fourth-largest motorcycle market.

"The restriction was too sudden," Sayaka Arai, general director of Honda Vietnam, told a news conference on Saturday. "It will have a fairly big impact on the lives and economic activities of Hanoians. Obviously, we at Honda are impacted to a certain level."

Arai was talking about Hanoi's ban on gasoline-powered bikes in the city center to combat worsening air pollution. When the ban takes effect in July, it will cover certain parts of Hanoi's Ring Road 1, which stretches over 7 kilometers. The coverage area will be enlarged in 2028 and 2030.

Honda said Hanoi accounts for more than 10% of its total bike sales in Vietnam. In Ho Chi Minh City, Vietnam's most populous city, metro leaders are also considering a ban on gasoline-powered vehicles downtown.

Sayaka Arai, general director of Honda Vietnam, calls Hanoi's gasoline-powered motorbike restrictions "too sudden."

Sayaka Arai, general director of Honda Vietnam, calls Hanoi's gasoline-powered motorbike restrictions "too sudden."

Honda right now offers only one e-bike, the poky Icon e, for sale. Priced from 26.8 million to 36.4 million dong ($1,019 to $1,385), the bike targets students and rings up just under 1,000 sales a month.

Honda also has the CUV e, which it only rents out, though it will start selling this model in March for 45 million to 65 million dong.

The Japanese manufacturer announced a third model last week. The UC3 goes on sale in June at a similar price range to the Icon e. The company will also roll out two cheaper e-bike models in 2027.

Honda might offer discounts on trade-ins of current gasoline bikes, or incentives for those not receiving government support, Arai said. It may also allow buyers to pay in installments or lower the up-front costs of batteries by selling subscriptions to them, Arai said.

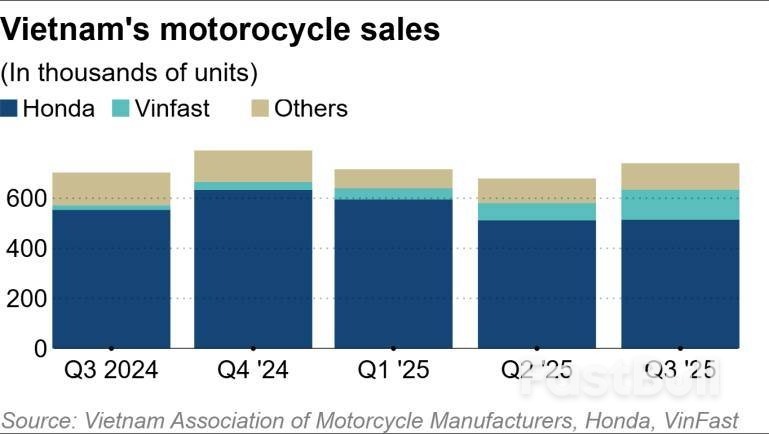

The company controls over 75% of Vietnam's motorcycle market, having sold 515,735 bikes in the country in the third quarter of 2025, down 7% from the year-earlier period, at least partly due to its limited e-bike offerings.

In contrast, sales of local e-bike producer VinFast surged in the third quarter of 2025 to 120,052 units, up more than 6 times from a year earlier. VinFast bikes are priced from 14.4 million to 34.9 million dong.

The VinFast sales number is still minimal compared to Honda's and to the 2.7 million bikes sold in 2024 across all brands, but the upstart's market share increased to 16% in the third quarter of 2025, up from the 3% share in the same quarter a year earlier.

The rapid deployment of electric motorcycles now has Honda worrying about a shortage of charging stations.

Honda will rely on its 100 stations, which can be shared with other brands using the CHAdeMO charging system. It also has 33 battery swapping stations. However, Honda's executives admit these numbers are insufficient to cope with an expected surge in demand.

"Charging stations require complex permits and licenses, and the process of who can operate and obtain approval is complicated," Arai said. "Furthermore, having a foreign company do it adds another hurdle."

Honda said the murky regulatory regime makes it a challenge to plan domestic production and set sales targets.

So the Japanese corporate icon that has been in Vietnam for more than 50 years will rely on its brand reputation for safety, durability and reliable service.

"Whether electric or internal combustion engine, I believe motorcycles are Honda," said Daiki Mihara, head of Honda Motor's motorcycle and power products electrification business unit and a former president of Honda Vietnam.

Pakistan took several key steps toward cryptocurrency adoption in 2025, with the latest move in December by a new regulator granting preliminary clearances to global exchanges Binance and HTX, a development that has raised concerns about potential oversight gaps posing financial and regulatory risks.

It was the Pakistan Virtual Assets Regulatory Authority (PVARA) -- established in July to regulate, license, monitor and supervise virtual asset service providers -- that allowed Binance and HTX to register, set up local subsidiaries and begin preparations for full exchange license applications.

Also in December, the country's finance ministry signed a memorandum of understanding with Binance to explore the tokenization of up to $2 billion in sovereign bonds, treasury bills and commodity reserves to improve liquidity and attract investors.

The move came nine months after the government formed the Pakistan Crypto Council to create a regulatory framework for the crypto industry. Binance founder Zhao Changpeng was appointed strategic adviser to the council in April. The memorandum of understanding also came five months after PVARA was established.

"We are moving way too quickly on the cryptocurrency front, and this poses risks for our fragile economy," a government official, privy to the developments, told Nikkei Asia on the condition of anonymity. "The quick developments have created confusion even for government bodies on dealing with crypto."

Multiple experts harbor similar concerns.

Ikram ul Haq, who runs a legal and tax consultancy in Lahore, told Nikkei that licenses are close to being granted to Binance and HTX even as the country's statutory and regulatory frameworks remain incomplete. "Pakistan has not even undertaken due diligence [of Binance and HTX], as both exchanges are facing some compliance issues in various jurisdictions," he said.

Hussain Nadim, a tech and geopolitics expert based in Washington, D.C., said Pakistan's quick moves to welcome crypto trading are being done in the dark. "In Pakistan, crypto is being implemented in a completely non-transparent way," he said. "The information being shared is essentially all vibes."

Khurram Schezad, an adviser to the finance minister, brushed aside the regulatory concerns surrounding crypto. "[The government] has formed a dedicated and independent regulatory [PVARA] to deal with regulatory issues. All these efforts are made to make sure that [Pakistan's crypto framework] is FATF-compliant," he told Nikkei, referring to the global anti-money laundering watchdog Financial Action Task Force.

Islamabad's embrace of crypto began after the International Monetary Fund in 2024 issued a warning about crypto-associated cross-border risks, particularly capital flight, unregulated money flows and Pakistan's volatile foreign exchange situation.

"With unregulated money and a fragile foreign exchange market, this kind of move is extremely risky," Nadim said. "It is the sort of decision that could spiral into a broader economic crisis for Pakistan."

Many Pakistanis have already invested in virtual currencies. A Binance official recently told a local media reporter that about 17.5 million people in Pakistan jointly hold around $5 billion in virtual assets with Binance.

As for the tokenization of government assets, it "could help Pakistan raise funds by making government and other assets easier to access for global investors, potentially widening the investor base and improving liquidity," Omer Azhar, a London-based financial analyst, told Nikkei. But cryptocurrencies, he pointed out, are volatile and are affected by market news.

"If tokenized assets are widely held offshore or sit outside normal fiscal controls," Azhar added, "this volatility could complicate debt management, raise concerns for credit rating agencies and ultimately increase Pakistan's borrowing costs."

Data Interpretation

Commodity

Political

Remarks of Officials

Economic

Traders' Opinions

Middle East Situation

Energy

Daily News

Oil prices cooled on Wednesday, halting a four-day winning streak as the market balanced rising geopolitical risk in Iran against fresh signs of increased global supply.

Brent futures edged down 9 cents, or 0.14%, to trade at $65.38 a barrel. Meanwhile, U.S. West Texas Intermediate (WTI) crude saw a 12-cent dip, or 0.20%, to $61.03 a barrel. The slight downturn follows a powerful rally where both benchmarks surged 9.2% over the last four sessions, driven largely by fears of supply disruptions.

The primary driver behind the recent price surge is the escalating civil unrest in Iran, the fourth-largest producer within OPEC. Mounting protests have traders on edge about potential interruptions to the country's oil output.

This tension was amplified after U.S. President Donald Trump encouraged the protestors on Tuesday, stating that help was on the way without providing specifics.

Analysts at Citi highlighted the market impact, raising their three-month Brent forecast to $70 a barrel. In a note, they stated, "Protests in Iran risk tightening global oil balances through near-term supply losses, but mainly through rising geopolitical risk premium."

However, Citi also noted that the protests have not yet reached Iran's main oil-producing regions. This suggests the immediate impact is more on market sentiment than on actual barrels, with risks currently centered on "political and logistical frictions rather than direct outages."

Countering the fears over Iran are clear signals of loosening supply from other parts of the world.

Venezuela, a founding OPEC member, has started to reverse production cuts previously imposed under a U.S. oil embargo. Three sources confirmed that crude exports are now resuming. On Monday, two supertankers, each carrying about 1.8 million barrels of crude, left Venezuelan waters. These shipments may be the first under a 50-million-barrel supply agreement between Caracas and Washington, established after the capture of Venezuelan President Nicolas Maduro.

Further weighing on prices, data from the American Petroleum Institute (API) late Tuesday pointed to a much looser supply-demand balance in the United States, the world's largest oil consumer.

According to market sources citing the API report for the week ending January 9:

• Crude Stocks: Rose by 5.23 million barrels

• Gasoline Inventories: Increased by 8.23 million barrels

• Distillate Inventories: Climbed by 4.34 million barrels

This build in stockpiles came as a surprise, as a Reuters poll had indicated an expected drop in crude inventories. Traders are now awaiting official data from the U.S. Energy Information Administration, due later on Wednesday, for confirmation of the trend.

President Donald Trump nominated David MacNeil to be a US Federal Trade Commissioner, according to statement posted on the White House website Tuesday.

MacNeil is the Chief Executive Officer of WeatherTech, an Illinois-based company selling automotive accessories. He will replace Melissa Holyoak, who left the agency late last year to serve as US Attorney for Utah, and joins two other Republicans, chair Andrew Ferguson and Commissioner Mark Meador.

A billionaire who supported Trump starting in 2016, MacNeil gave hundreds of thousands of dollars to the Republican National Committee and state Republican parties during the 2024 election season, according to campaign finance records.

Last year, Trump nominated MacNeil to be the Ambassador at Large for Industrial and Manufacturing Competitiveness. He was never confirmed and the Senate returned his nomination to the president at the end of the year.

At WeatherTech, founded in 1989, MacNeil has been a prominent supporter of American manufacturing, producing nearly all products in the US. WeatherTech brought in US$900 million in revenue in 2024, according to an interview MacNeil gave last year with CBS Evening News. The FTC polices "Made in America" claims and enforces truth-in-advertising laws as part of its consumer protection portfolio.

"Being deceptive, and saying its made in America when it's not, is not fair," MacNeil told CBS. "We love having American workers and we love having our factories right here on American soil."

Contact information for MacNeil wasn't immediately available.

MacNeil has spent the past several years in Florida, buying up several properties in Manalapan, a town south of Palm Beach popular with billionaires including Oracle Corp. founder Larry Ellison, according to the Palm Beach Post.

The nomination was announced shortly after the White House pulled its support for its previous candidate for the FTC role, Ryan Baasch, a staffer on the National Economic Council.

FTC Chair Ferguson congratulated MacNeil, writing on X, "I look forward to working with this outstanding businessman and great patriot."

Tesla Inc. will enter into settlement negotiations with the US Equal Employment Opportunity Commission over the agency's 2023 lawsuit accusing the electric-vehicle maker of race-based harassment at its California factory.

The agency said in a Tuesday court filing that Tesla has agreed to private mediation in the case, which is expected to take place in March or April after the two sides select a mediator.

"Should this matter not resolve through settlement discussions and mediation efforts, the parties will submit to the court on or before June 17, 2026, a proposed protocol for the next phase of the litigation," lawyers for the EEOC said in the filing.

The lawsuit accuses Tesla of subjecting Black workers at its Fremont factory to "severe or pervasive racial harassment" and claims that leaders at the company unfairly retaliated against workers who complained.

Tesla and the EEOC engaged in "mandatory mediation" in June 2023, but did not come to a resolution.

Lawyers for Tesla and the EEOC didn't immediately respond to requests for comment.

The case is US Equal Employment Opportunity Commission v. Tesla, 3:23-cv-04984, US District Court, Northern District of California.

The dark fleet of tankers shipping illicit oil around the world is rushing to seek the perceived protection of the Russian flag after the US started seizing vessels involved in the Venezuelan trade.

At least 26 ships have switched registration to Russia since the beginning of last month, with the bulk of those happening after the US snatched the Skipper supertanker off the coast of Venezuela on Dec. 10, according to Starboard Maritime Intelligence data. That's a jump from six in November and just 14 over the previous five months.

About 13% of the almost 1,500 tankers that carry Russian, Iranian and Venezuelan oil are already registered to Moscow, with the rest typically operating under the flags of smaller countries, such as Panama, Guinea and Comoros. Using false flags is also a common dark-fleet tactic, enabling ships to avoid having to comply with regulations while appearing legitimate.

The recent move toward Russian registration is a calculation by vessel owners that Moscow will provide political cover when other nations won't, according to Charlie Brown, a senior adviser at United Against Nuclear Iran, an advocacy group that tracks the dark fleet.

"This may offer a new potential solution for the illicit dark-fleet networks, but it also raises the stakes," he said. "Because it underscores that sanctions evasion is no longer just a maritime compliance problem, but a strategic challenge involving state protection and geopolitical risks."

Those risks were on display in the pursuit of the Bella 1, sanctioned by the US in 2024. The vessel initially evaded capture near Venezuela in mid-December, and then headed north, switching from fake Guyanese registration to a Russian flag and changing its name to Marinera, with the crew even painting Moscow's tricolor on its hull.

The chase raised fears of a direct conflict between Washington and Moscow. A Russian naval ship was on its way to escort the Marinera but never made it close enough before US forces boarded the supertanker south of Iceland last week, according to people with knowledge of the matter who asked not to be named due to its sensitivity.

The US has now seized five tankers involved in the Venezuelan oil trade and, given President Donald Trump's latest threat to slap tariffs on countries buying Iranian goods, oil traders and ship owners are watching to see if the White House will go after vessels carrying crude from the Islamic Republic.

The histories and geographical spread of the 26 tankers that have recently switched flags illustrates the growing risks. They're currently located across the world, from the Baltic Sea, to the Suez Canal and the Yellow Sea, although it's possible some are spoofing their locations.

They're all sanctioned by at least one Western government. Among their current or former owners or managers, a few names keep popping up: Eight of the vessels are linked to Glory Shipping HK Ltd., a Hong Kong-based entity. Two Russia-registered firms — New Fleet Ltd. and North Fleet Ltd. — are each listed as new owners for three of the ships, and have addresses that appear to be in the same building as a unit of Russian state-owned shipping line Sovcomflot PJSC in St. Petersburg.

Neither Glory Shipping nor the two Russian companies responded to emailed requests for comment.

A country's flag registry makes it the governing body of a vessel to enforce compliance with maritime laws, and safety and environmental standards, although some nations outsource this to commercial entities. The flag also acts like a passport that gives the ship access to friendly ports around the world.

The 26 flag-hoppers were observed based on the day they started transmitting with a new nine-digit number for telecommunications. This number, called the maritime mobile service identity, or MMSI, is issued by flag registries and can be immediately observed once a ship changes flag and starts transmitting. For Russia, the MMSI begins with 273.

"The story is really a persistent, global reflagging of dark-fleet tankers," said Mark Douglas, a maritime domain analyst at Starboard Maritime Intelligence. "It's unlikely to stop at this number."

Ford Motor Co. Chief Executive Officer Jim Farley gave a measured response to Senator Ted Cruz for accusing the auto executive of being too terrified to testify before Congress.

"Frankly, I'm running a car company and that's my priority," Farley told reporters on the sidelines of the Detroit Auto Show Tuesday. "All I can say is we're a little busy here in Detroit this week," he said in reference to Cruz's comments.

Cruz earlier this month had to postpone a hearing he'd planned on auto affordability when Farley said he was unavailable because he had scheduling conflicts with the auto show opening in Detroit this week. Farley also was reluctant to appear because Tesla Inc. was sending its chief engineer, while Ford, General Motors Co. and Chrysler-parent Stellantis NV were asked to send their CEOs. GM CEO Mary Barra also expressed reluctance unless it was an all-CEO panel, which would require Tesla to send Elon Musk.

After postponing the hearing, Cruz criticized Farley in a Jan. 6 interview with Politico, in which he accused the auto executive of costing Ford shareholders $19.5 billion for charges the company is taking on under-performing electric vehicle assets. Cruz also said Ford was trying to "swindle American taxpayers" with a since-canceled plan to try to extend expiring $7,500 EV consumer tax credits by letting dealerships continue to offer them on leased vehicles.

"For whatever reason, it appears Jim Farley was terrified of testifying before Congress," Cruz told Politico.

Cruz was calling the auto chieftains to Washington to explain why average new car prices have topped $50,000 and to ask what they're doing about the auto industry's affordability crisis. A new date has not been set for the hearing.

"We had the president of the United States here today, we have the Detroit Motor Show and our Formula One launch," Farley added. "It wasn't the right time to be in Washington, D.C., when we have so much to do in Detroit."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up