Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Dec)

U.S. Cleveland Fed CPI MoM (Dec)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina 12-Month CPI (Dec)

Argentina 12-Month CPI (Dec)A:--

F: --

P: --

U.S. Budget Balance (Dec)

U.S. Budget Balance (Dec)A:--

F: --

P: --

Argentina CPI MoM (Dec)

Argentina CPI MoM (Dec)A:--

F: --

P: --

Argentina National CPI YoY (Dec)

Argentina National CPI YoY (Dec)A:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Dec)

South Korea Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Jan)

Japan Reuters Tankan Non-Manufacturers Index (Jan)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Jan)

Japan Reuters Tankan Manufacturers Index (Jan)A:--

F: --

P: --

China, Mainland Exports YoY (CNH) (Dec)

China, Mainland Exports YoY (CNH) (Dec)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Dec)

China, Mainland Trade Balance (USD) (Dec)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)A:--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)A:--

F: --

P: --

China, Mainland Imports (CNH) (Dec)

China, Mainland Imports (CNH) (Dec)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Dec)

China, Mainland Outstanding Loans Growth YoY (Dec)--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction Yield--

F: --

P: --

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)--

F: --

P: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)--

F: --

P: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)--

F: --

P: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)--

F: --

P: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)--

F: --

P: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)--

F: --

P: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

December CPI masks deeper inflation: surging money supply and renewed Fed QE point to persistent price pressures.

The December Consumer Price Index (CPI) report was as complex as analysts predicted, but the real story of inflation isn't in the headline numbers. A closer look at money supply and central bank activity reveals pressures that the official data may be missing.

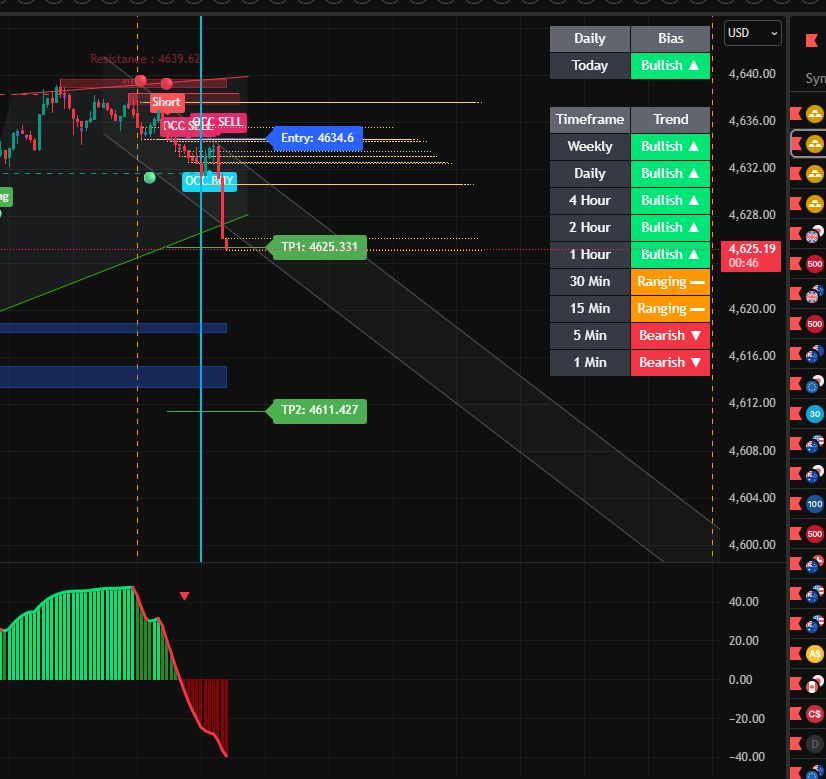

At first glance, the December inflation data seemed to align with expectations, offering a sliver of optimism for markets hoping for future monetary easing.

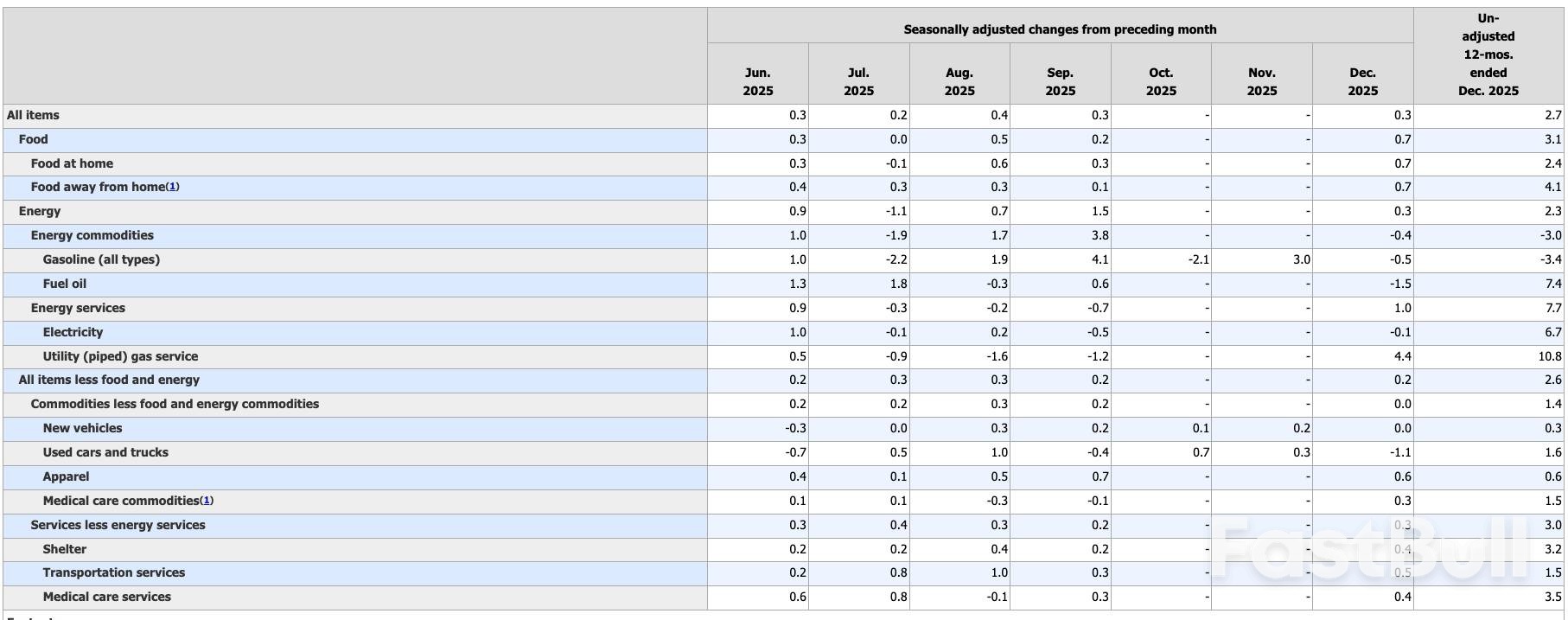

The overall CPI rose 0.3% month-on-month, holding the annual inflation rate steady at 2.7%. When stripping out volatile food and energy costs, the core CPI increased by 0.2% for the month, with the annual rate unchanged at 2.6%. This slightly cooler-than-expected core reading fueled speculation that the Federal Reserve might continue easing monetary policy in 2026.

However, a persistent trend lies beneath the surface. Over the last six available readings, core CPI has posted increases of 0.2%, 0.3%, 0.3%, 0.2%, 0.2%, and 0.2%. This pattern annualizes to a rate of 2.8%, showing that core inflation has been stuck in this range for over a year.

A detailed breakdown of the December report shows specific price pressures:

• Shelter: Increased by 0.4%

• Food: Surged by 0.7%

• Energy: Rose by 0.3%, even as gasoline prices fell 0.4%

• Services: Grew by 0.3%

• Used Cars & Trucks: Posted the largest decline, falling 1.1%

It’s crucial to approach the CPI report with caution. The data's reliability has been questioned, particularly following a November report some critics described as heavily estimated.

Furthermore, the government's methodology for calculating CPI was revised in the 1990s, leading to a formula that many argue systematically understates the true rise in the cost of living. If the formula from the 1970s were still in use, today's official CPI figures would likely be closer to 6%.

Even based on the current official data, inflation remains well above the Federal Reserve's target. As Ellen Zentner, chief economic strategist at Morgan Stanley, noted, the situation feels familiar.

"We've seen this movie before—inflation isn't reheating, but it remains above target," Zentner stated. "Today's inflation report doesn't give the Fed what it needs to cut interest rates later this month."

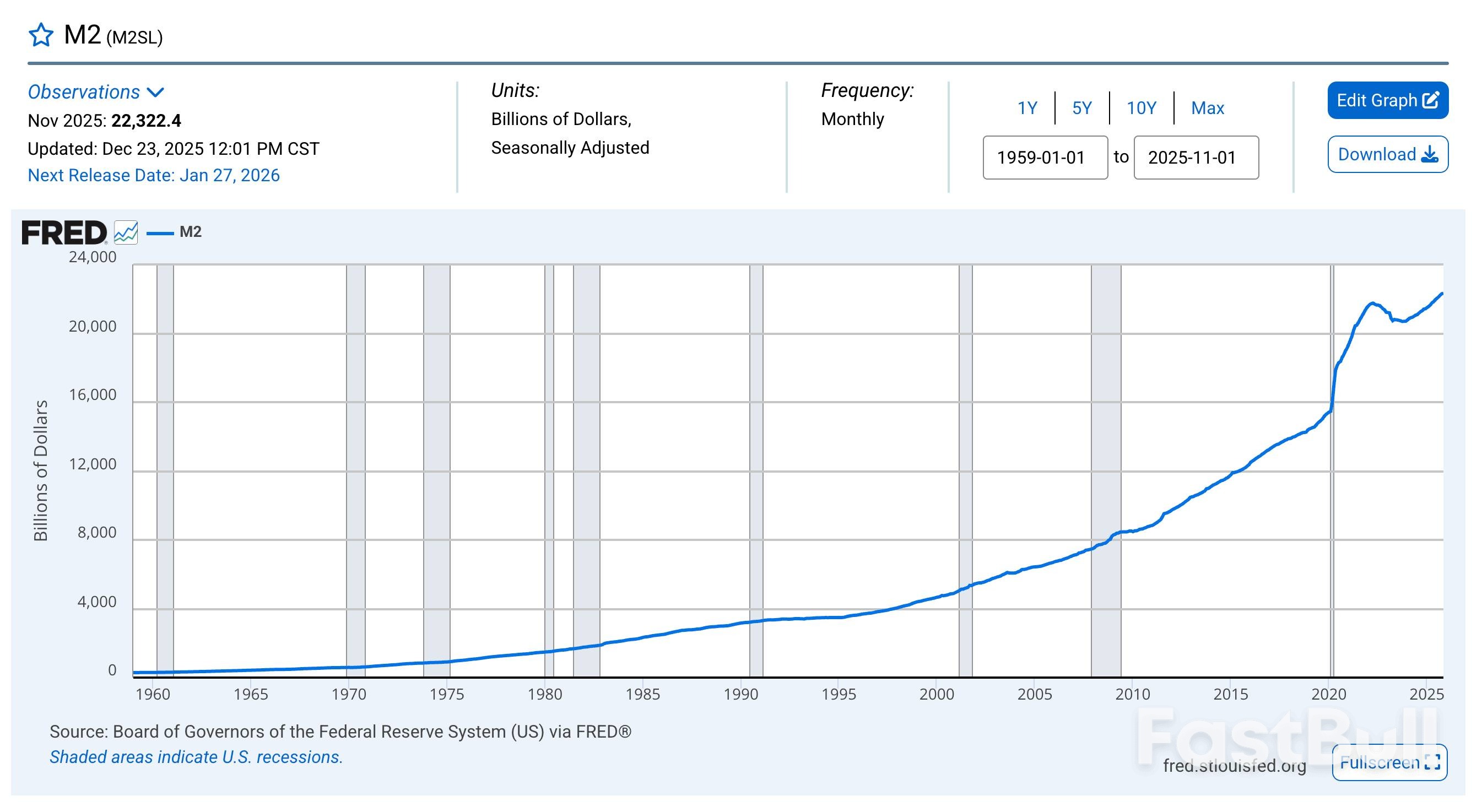

The CPI measures price changes in a specific basket of goods, but it only captures a symptom of inflation. Historically, economists defined inflation as an increase in the supply of money and credit. Rising prices are the consequence of this monetary expansion.

By this fundamental measure, inflation is not only present but accelerating. The M2 money supply is currently growing at its fastest rate since July 2022. After hitting a low in October 2023, the money supply has resumed its upward trajectory, now surpassing its pandemic-era peak as money creation has quickened in recent months.

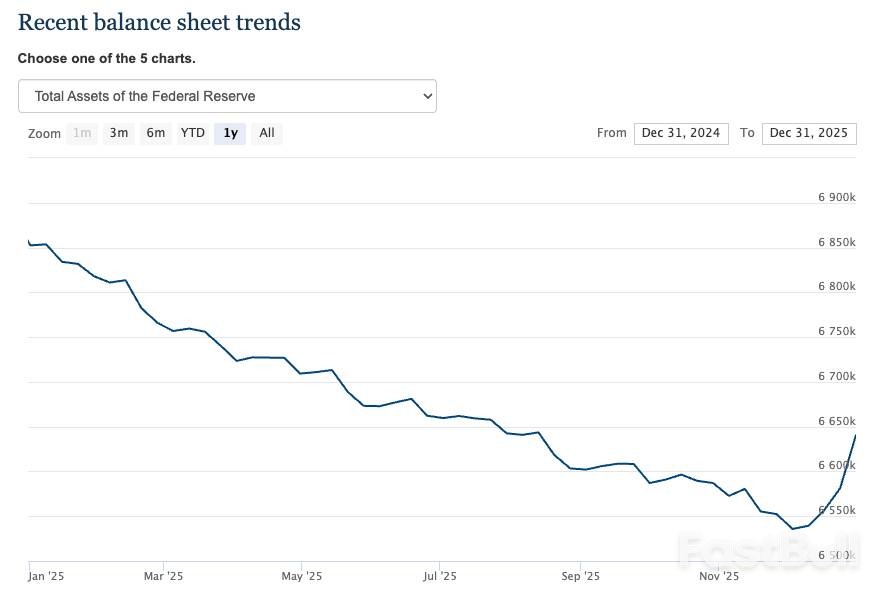

Further evidence of rising inflationary pressure comes from the Federal Reserve's balance sheet, which is once again expanding.

Last month, the central bank resumed purchasing U.S. Treasuries with newly created money, effectively restarting its quantitative easing (QE) program. This direct injection of liquidity into the financial system is, by definition, inflationary.

This leads to a fundamental conflict for the central bank. The Fed is caught in a Catch-22: it needs to loosen monetary policy through rate cuts and QE to support a debt-laden economy, but it also needs higher rates to bring price inflation back under control. It cannot do both at the same time.

Any "cooler than expected" CPI report provides political cover to prioritize easing, despite official rhetoric aimed at managing expectations. This dynamic ensures that even if official price metrics cool temporarily, the underlying inflationary forces are likely to grow stronger.

The latest data from the U.S. Bureau of Labor Statistics confirms that headline inflation remained at 2.7% for the year ending in December 2025, signaling a period of continued economic stability.

This figure, which met market expectations, provides crucial insight for both Federal Reserve policymakers and market participants, including those in the cryptocurrency space. The report also showed that core inflation, which strips out volatile food and energy prices, held firm at 2.6%.

The December 2025 report revealed no month-over-month changes from November, reinforcing the theme of price stability. The primary components driving the annual figure include:

• Energy Prices: Increased by 2.3% year-over-year.

• Food Prices: Rose by 3.1% over the same period.

The consistency in these numbers suggests that the underlying price pressures in the economy are not accelerating, providing a predictable environment for businesses and consumers.

With both headline and core inflation showing no unexpected volatility, the Federal Reserve is less likely to make aggressive adjustments to its monetary policy. Economists widely believe that this trend of stable inflation supports the case for holding interest rates steady in upcoming policy meetings.

Continued stability over several months could strengthen confidence in the effectiveness of current economic strategies and allow for more predictable financial planning.

The cryptocurrency sector registered no significant reaction to the inflation report. Market analysts noted that major assets like Bitcoin and Ethereum did not experience any immediate volatility following the release of the data.

This lack of response is typical when economic figures align with consensus forecasts. Since the stable inflation numbers did not introduce new uncertainty into the broader financial landscape, the crypto market continued to trade on its own specific drivers and sentiment.

U.S. Secretary of State Marco Rubio and India's External Affairs Minister Subrahmanyam Jaishankar held discussions on trade Tuesday, raising questions about the future of a long-awaited bilateral deal.

According to a U.S. Department of State statement, the two officials discussed ongoing trade negotiations, energy security, and critical minerals. The conversation also touched on their "shared interest in strengthening economic cooperation" and expanding bilateral civil nuclear cooperation.

The call took place just one day after Sergio Gor, the new U.S. ambassador to India, expressed confidence that the two nations, as close partners, would resolve their differences, including the delayed trade agreement.

The negotiations are happening against a backdrop of a sharp downturn in U.S.-India relations during Donald Trump's second presidency. Washington has imposed tariffs of 50% on India—among the highest in the world—partly due to its purchases of Russian oil.

Despite months of negotiations and multiple phone calls between Trump and Indian Prime Minister Narendra Modi, India remains one of the few major economies without a trade agreement with the United States.

Recent official comments have sent mixed messages about the deal's progress. Last week, U.S. Commerce Secretary Howard Lutnick claimed a trade agreement failed to materialize last year because Modi did not call Trump. India dismissed this assertion as inaccurate.

Despite the friction, India has taken steps to appease the Trump administration, such as reducing its purchases of Russian oil. Ambassador Gor noted this week that both sides "continue to actively engage" and are determined to get the trade talks across the finish line.

Japan's latest auction of five-year government bonds showed a clear drop in investor appetite on Wednesday, signaling that mounting political risks are beginning to weigh on the market.

Bond futures slid after the results were released, confirming investor nervousness. The selloff comes as markets digest reports that Prime Minister Sanae Takaichi is considering a snap election, a move that has revived the so-called "Takaichi trade" and sent the yen tumbling.

The auction's results pointed to weaker-than-average demand. The bid-to-cover ratio, a key metric of investor interest, stood at 3.08. This figure is a decline from the 3.17 ratio recorded at the previous sale in December and falls short of the 12-month average of 3.54.

In response to the political uncertainty, the five-year government bond rate has surged to 1.615%, its highest level since the bond was first issued in 2000. Another indicator of weak demand, the "tail"—the difference between the average and lowest accepted prices—widened to 0.05 from 0.04 last month.

Investors are now bracing for heightened fiscal risks. A snap election could solidify the position of the ruling Liberal Democratic Party, potentially clearing the path for increased government stimulus spending.

This prospect arrives as Takaichi's government prepares to introduce a record initial budget for the fiscal year starting in April. According to the Ministry of Finance, this new budget will involve reducing the issuance of super-long government bonds while increasing sales of two- and five-year debt.

At the same time, the yen has fallen to its lowest point against the U.S. dollar since July 2024. This currency weakness is increasing the pressure on the Bank of Japan (BOJ) to consider an early interest rate hike to stabilize the yen.

While most economists anticipate the central bank will wait until June before hiking rates again—following its December move to a three-decade high—the yen's persistent slide could force the BOJ to act sooner.

Former BOJ board member Makoto Sakurai stated in an interview that concerns over Takaichi's fiscal policy could prompt the central bank to raise its benchmark interest rates as early as April.

Current market pricing reflects this uncertainty. Overnight index swaps show that traders have not fully priced in the first rate hike of the year until July, leaving significant room for market sentiment to shift if the yen's weakness continues.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up