Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Dec)

China, Mainland Urban Area Unemployment Rate (Dec)A:--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)A:--

F: --

P: --

China, Mainland GDP (Q4)

China, Mainland GDP (Q4)A:--

F: --

P: --

China, Mainland GDP QoQ (SA) (Q4)

China, Mainland GDP QoQ (SA) (Q4)A:--

F: --

P: --

China, Mainland Annual GDP

China, Mainland Annual GDPA:--

F: --

P: --

China, Mainland Annual GDP Growth

China, Mainland Annual GDP GrowthA:--

F: --

P: --

China, Mainland GDP YoY (Q4)

China, Mainland GDP YoY (Q4)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)A:--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. Unemployment Rate (Dec)

U.K. Unemployment Rate (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Nov)

U.K. 3-Month ILO Employment Change (Nov)--

F: --

P: --

U.K. Unemployment Claimant Count (Dec)

U.K. Unemployment Claimant Count (Dec)--

F: --

P: --

Euro Zone Current Account (Not SA) (Nov)

Euro Zone Current Account (Not SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

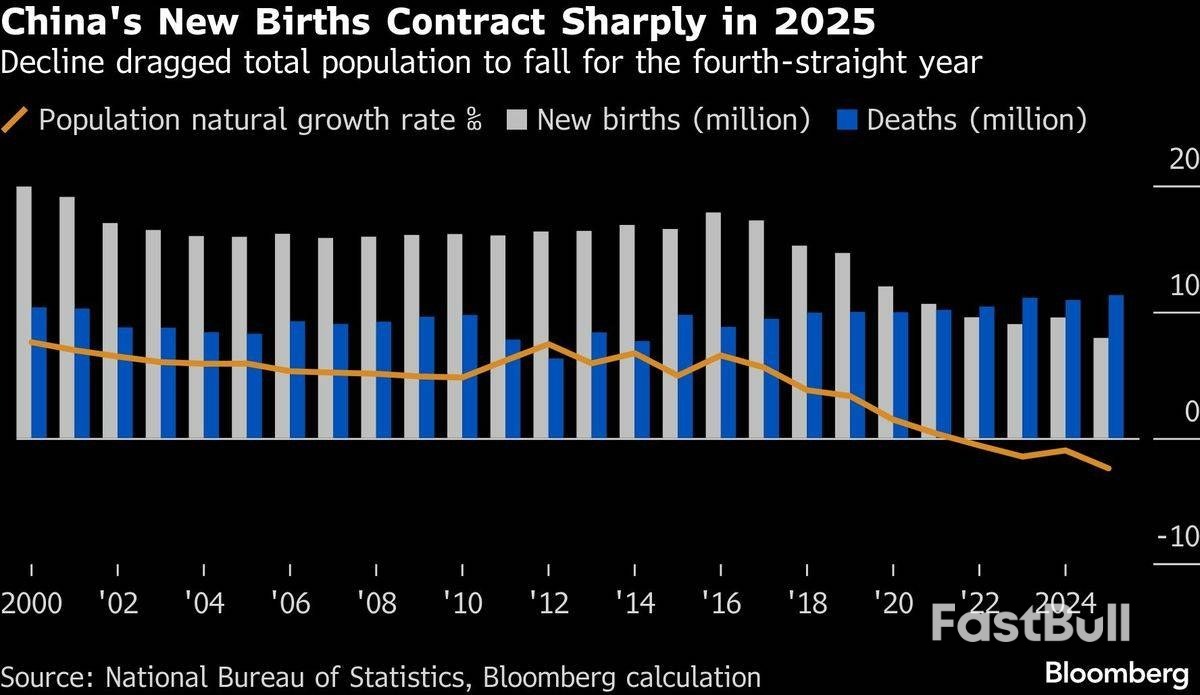

China's birthrate fell last year to its lowest level since 1949, highlighting a deepening demographic struggle for Beijing even as officials roll out new subsidies to encourage couples to have more children.

China's birthrate fell last year to its lowest level since 1949, highlighting a deepening demographic struggle for Beijing even as officials roll out new subsidies to encourage couples to have more children.

The number of births per 1,000 people dropped to 5.6, the lowest since at least the founding of the People's Republic, according to data released by the National Statistics Bureau on Monday. The number of newborns decreased 1.6 million, the most since 2020, to 7.9 million.

The figure is a setback for President Xi Jinping's campaign to promote a fertility-friendly society including by offering cash rewards for parents. The total population fell by 3.4 million, the sharpest drop since the 1960 Great Famine under former leader Mao Zedong, to 1.405 billion.

A shrinking workforce and ageing population are major threats to the world's second-largest economy. As the elderly cohort grows, the worker-to-retiree ratio shrinks, piling more pressure on the underfunded pension system.

To counter these structural headwinds, the Chinese government has implemented a series of pro-natalist policies in recent years, from extending paternity and maternity leave to making it easier to register a marriage.

Among the incentives, couples are offered about US$500 (RM2,028.50) a year for each child born on or after Jan 1, 2025, until they reach the age of three. Starting this year, the government also imposed a 13% value-added tax on contraceptive drugs and devices, including morning-after pills and condoms.

He Yafu, an independent demographer, said the amount of government subsidies is "too small" to meaningfully lift birth rates.

He attributed the drop to young people's unwillingness to get married and a decline in the number of women of childbearing age, which fell by 16 million from 2020 to 2025.

This shrinking pool of potential mothers is partly the result of the one-child policy, which hollowed out the demographic base for future growth before being scrapped in 2015.

A basket of exchange-traded funds owned by China's so-called national team saw another day of record outflows on Friday, adding to signs that authorities are stepping in to curb the risk of a bubble.

Eight ETFs tracked by Bloomberg, which include the Huatai Pinebridge CSI 300 Index ETF and E Fund ChiNext ETF, saw a record 101 billion yuan ($14.5 billion) in outflows on Friday. Though state funds' involvement will be evident only through filings, analysts and traders have attributed those flows as proof that the national team is acting to cool markets.

The back-to-back record outflow is the first clear sign that the national team isn't simply taking a buy-and-hold strategy, but appears to be actively in the market working to smooth out moves both to the upside and downside. It's occurring as concern rises about crowding and speculation in sectors such as commercial rockets.

The securities watchdog on Friday pledged to step up oversight of market manipulation and to prevent wild swings, another move seen as trying to rein in major fluctuations. Earlier last week, regulators also tightened rules on margin financing.

Bloomberg Intelligence estimates that the selling by Central Huijin Investment on Thursday alone may have reached around $10 billion, marking its first move to offload holdings in three years, after amassing around $180 billion in such assets as of the end of August.

"Eight of 23 ETFs held by Central Huijin recorded abnormally large trade sizes, a typical indicator of national team activity, analysts including Rebecca Sin wrote in a note. "Additional selling can be expected if the intervention fails to cool markets, so far taking a targeted approach focusing on the tech-heavy Star 50 and ChiNext indexes."

Traders have pointed to clear signs of intervention throughout Friday in the expanded turnover in some of the ETFs that came in conjunction with market downdrafts in the session on Friday. However some analysts say that the moves may only be meant to slow, rather than end, the rally.

"Record outflows in stabilization fund ETFs and other market cooling factors should be read as a preemptive move to cool sentiment in the middle of a rally, not the end of an uptrend," Founder Securities analysts including Yuan Daoyu wrote in a note. Investors should watch whether the outflows subside and whether margin trades start to decelerate as signals of when the cooling measures may taper off, they added.

XRP fell for a fifth consecutive day on Sunday, January 18, and extended its losses in early trading on Monday, January 19.

Delays to the US Senate Banking Committee's Market Structure Bill markup vote triggered a sharp pullback from a January 6 high of $2.4151. However, increased geopolitical tensions added to the negative sentiment.

US President Trump announced fresh tariffs over the weekend, reviving the risk of a US-EU trade war. XRP and the broader crypto market previously came under selling pressure as President Trump rolled out tariffs in 2024.

Crucially, XRP dropped below the $2.0 psychological level, despite strong demand for XRP-spot ETFs through January. Nevertheless, the medium-term outlook remains bullish.

Below, I will explore the key drivers behind recent price trends, the medium-term (4-8 weeks) outlook, and the key technical levels traders should watch.

US President Trump announced a 10% tariff on eight European countries on Saturday, January 17, including Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. The tariffs will take effect on February 1. Tariffs will then increase to 25% on June 1 as Trump pressures the EU to allow the US to acquire Greenland. Trump stated:

"This Tariff will be due and payable until such time as a Deal is reached for the Complete and Total purchase of Greenland."

The EU is reportedly preparing to retaliate, fueling fears of a full-blown trade war. The Kobeissi Letter reported:

"The EU is preparing up to €93 billion in tariffs and other restrictions on US companies in response to President Trump's 10% tariff and demands for Greenland. Expect a busy night ahead for tariff headlines. US stock market futures open in 4 hours."

Notably, the Dow Jones E-mini fell 0.66% in early trading on Monday, January 19. The Nasdaq 100 E-mini and the S&P 500 E-mini slid 1.08% and 0.80%, respectively.

XRP and the broader market remain exposed to tariff risks. XRP plunged from $2.8406 to $0.7773 (Binance) on October 10 before closing down 15.29% at $2.3756 in response to Trump threatening a 100% tariff on China.

XRPUSD – Daily Chart – 190126 – Tariffs

XRPUSD – Daily Chart – 190126 – TariffsWhile markets reacted to the escalation in the US-EU trade war, analysts continued to criticize the efforts of US banks to block stablecoin rewards.

Last week, Coinbase (COIN) withdrew its support for the US Senate Banking Committee's draft text of the Market Structure Bill. The Banking Committee responded by postponing its markup vote on the draft text, kick-starting XRP's retreat. Coinbase CEO Brian Armstrong referenced text relating to stablecoin rewards, stating:

"Draft amendments that would kill rewards on stablecoins, allowing banks to ban their competition."

US banks have warned that crypto legislation permitting stablecoin rewards could trigger more than $6 trillion in deposit outflows from the US banking system. The debate continued over whether US banks' push to block stablecoin rewards is competition-related or protection-related.

Bloomberg Intelligence ETF Analyst James Seyffart commented on US banks' concerns over stablecoin rewards, stating:

"I don't fully understand the Banks' argument here. There are so many high yield savings accounts out there that offer 3% or more. Betterment, Marcus/Goldman, CIT, SoFi, Amex, Wealthfront, etc. How are these not the same pressure on<0.1% yield deposits as stablecoin yields?"

Recent price action has highlighted XRP's sensitivity to developments in crypto-related legislation.

XRP rallied from $1.8103 on December 31 to a January 6 high of $2.4151 in response to the Banking Committee announcing a January 15 markup vote on the draft text. However, XRP has fallen to a January 19 low of $1.8502 following the Banking Committee's postponement of the markup vote.

Despite the delays to the markup vote, optimism over US lawmakers delivering much-needed crypto legislation supports a bullish medium-term price outlook for XRP.

Coinbase CEO Brian Armstrong fueled the optimism after withdrawing support for the draft text, stating:

"I'm actually quite optimistic that we will get to the right outcome with continued effort. We will keep showing up and working with everyone to get there."

XRPUSD – Daily Chart – 190126 – Market Structure Bill Price Action 2026

XRPUSD – Daily Chart – 190126 – Market Structure Bill Price Action 2026Strong demand for XRP-spot ETFs, the progress of the Market Structure Bill, and increased XRP utility reaffirm a cautiously positive short-term outlook (1-4 weeks), with a $2.5 price target.

Furthermore, hopes that US lawmakers will pass crypto-friendly legislation reinforced the bullish longer-term price targets:

Several events could change the positive outlook. These include:

These events would likely weigh on sentiment, sending XRP below $1.85, which would signal a bearish trend reversal.

XRP slid 3.4% on Sunday, January 18, following the previous day's 0.27% loss, closing at $1.9915. The token faced heavier selling pressure than the broader crypto market cap, which declined 1.60%.

A five-day losing streak left XRP below its 50-day and 200-day EMAs, signaling a bearish bias. However, the bullish fundamentals continue to offset technicals, limiting the downside.

Key technical levels to watch include:

Viewing the daily chart, a break above $2.0 would bring the 50-day EMA into play. A sustained move through the 50-day EMA would indicate a near-term bullish trend reversal. A bullish trend reversal would open the door to testing $2.2. A breakout above $2.2 would enable the bulls to target the 200-day EMA.

Significantly, a breakout above the EMAs would reaffirm the bullish medium- and longer-term price targets.

XRPUSD – Daily Chart – 190126 – EMAs

XRPUSD – Daily Chart – 190126 – EMAsNear-term price drivers include:

Holding above $1.85 will be crucial for the short- to medium-term outlook. Positive fundamentals, including spot ETF demand and increased XRP utility, continue to counter bearish technicals, indicating a near-term recovery. The token's recovery from a December low of $1.7712 and January gains of 6.25% reaffirmed the bullish structure and short- to medium-term price projections.

A breakout above $2.0 would pave the way toward the upper trendline. A sustained move through the upper trendline would affirm the bullish trend reversal and validate the bullish structure, supporting the price targets:

However, a sustained fall below the lower trendline would invalidate the bullish structure, signaling a bearish trend reversal.

XRPUSD – Daily Chart – 190126 – Bullish Structure

XRPUSD – Daily Chart – 190126 – Bullish StructureLooking ahead, trade developments and crypto-related regulatory headlines are likely to influence XRP's price outlook.

Traders should closely monitor trade developments. Additionally, updates from the Banking Committee and Agriculture Committee will be key. This week, the Agriculture Committee will release its draft text on the Market Structure Bill. The Agriculture Committee has scheduled a markup vote on January 27.

Meanwhile, central bank chatter and XRP-spot ETF flow trends will also influence the near-term price outlook.

Increased bets on a March Fed rate cut, and a dovish BoJ neutral rate (potentially 1%-1.25%) would lift sentiment. Strong demand for XRP-spot ETFs and positive crypto-related news from Capitol Hill would reinforce the constructive bias.

In summary, these scenarios support a medium-term (4–8 weeks) move to $3.0. Meanwhile, a March Fed rate cut and the Senate passing the Market Structure Bill would reaffirm the longer-term (8–12 weeks) price target of $3.66.

Looking beyond the 12-week time horizon, these events are likely to drive XRP to its all-time high of $3.66 (Binance). A break above $3.66 would support a 6- to 12-month price target of $5.

American battery companies are shifting supply chains away from China to South Korea to comply with U.S. restrictions aimed at strengthening domestic development of drones and advanced electric aircraft.

SES AI and Amprius Technologies have both announced they will expand battery cell manufacturing capacity in South Korea, as the U.S. National Defense Authorization Act (NDAA) will bar the Department of Defense from buying made-in-China batteries beginning in October 2027.

Boston-headquartered SES AI has converted electric vehicle battery production lines in its Chungju factory to make battery cells for drones and electric vertical takeoff and landing (eVTOL) aircraft. Built in 2021 for EV batteries, the South Korean facility will now produce mostly drone products -- to the tune of 1 million battery cells annually -- and production could eventually be ramped up to 1 gigawatt hour (GWh), matching the company's capacity in China. One-tenth of Chungju's production will be dedicated to SES AI's evTOL vehicle customers, which include Hyundai.

SES AI founder Qichao Hu said that the pivot to South Korea is in response to a series of U.S. policies and investments aimed at developing a domestic drone industry.

"[Defense Secretary] Pete Hegseth unleashed this really fast growth in the industry," Hu said. "So I think it's an opportunity."

U.S. President Donald Trump signed an executive order last July ordering federal agencies to fast track approvals for American drone manufactures and protect the U.S. drone supply chain from "foreign influence."

Producing a battery pouch cell in South Korea is two times more expensive than making it in its factory in China, Hu said. But, as demand grows for NDAA-compliant batteries, products from the South Korean factory will make up nearly half of its sales this year, he added. SES AI's Chinese factory and its contract manufacturers will continue to serve customers that are not U.S. defense contractors.

American drone executives have raised concerns over the industry's supply chain after Beijing barred Skydio and BRINC Drones from procuring from Chinese companies last April. After being added to the Chinese Commerce Ministry's "unreliable entity" list, Skydio began to ration batteries as it sought alternative suppliers.

America's drone industry is still in its early days and it will take time and capital for it to be able to meet the needs of the U.S. military.

In comparison, China's DJI is the world's largest drone manufacturer and accounts for about 70% of all commercial drones sold globally for hobby and industrial use.

Amprius Technologies, meanwhile, announced in December that it will also increase production in South Korea as its sales in the U.S. grew in the third quarter last year.

The addition of three South Korean companies to its list of contract manufacturers means it now works with as many such producers in that country as it does in China.

Tom Stepien, CEO of Amprius Technologies, said that while its South Korea factory serves only customers working with the U.S. government, there is growing interest from other clients in considering non-Chinese made batteries.

"I expect that drum beat for NDAA compliance will increase for sure," he said.

While the company has a pilot production line located at its headquarters in Fremont, California, producing batteries and NDAA-compliant components, it has no plans to revive construction of a Colorado factory that ceased last year as the market outlook for electric vehicles deteriorated.

Philippine President Ferdinand Marcos Jr. announced early Monday morning the country's most significant natural gas discovery "in over a decade," trumpeting the find as a key step in the nation's efforts to reduce its dependence on imported energy.

The reservoir, called Malamapaya East-1, is located some five kilometers east of the Malampaya gas field, located off the west coast of Palawan Island . The area is thought to contain 98 billion cubic feet of gas, the president said in a Facebook video.

The Philippines' energy costs are among the highest in the region, a hurdle for many businesses and investors since the country depends on imported fuel to keep the economy churning.

"This helps Malampaya's contribution and strengthens our domestic gas supply for many years to come," Marcos said in his video. The Malampaya gas field currently supplies 20% of the energy needs of Luzon, the Philippines' largest island.

Marcos signed a law in January 2025 to develop the downstream natural gas industry and support the country's efforts to increase the share of the transition fuel in its energy mix.

"This is equivalent to almost 14 billion kilowatt-hours of power in a year," Marcos added. "This means it can supply electricity to more than 5.7 million households, 9,500 buildings or almost 200,000 schools for one year."

The Philippine leader said initial testing showed that the exploration well flowed at 60 million cu. feet per day, with a potential to "produce even more."

This is comparable to the natural gas produced by the original Malampaya wells, according to Marcos.

The field, however, is still small compared to those in neighboring Malaysia and Indonesia, which have resources totaling trillions of cubic feet.

Drilling in the area started in mid-2025 by a consortium led by Prime Energy, a company backed by billionaire tycoon Enrique Razon Jr. The government said this was the first milestone in a phase 4 drilling campaign, noting that there are other exploration efforts in the area.

Japanese government bonds sold off sharply as reports of a potential cut to the food tax stoked concerns about the nation's fiscal health ahead of a snap election expected next month.

The prospect of increased government spending led investors to demand higher returns, pushing bond yields to multi-decade highs.

The sell-off was most pronounced in long-term debt. The yield on Japan's 30-year government bond climbed 10 basis points to 3.58%, its highest level since the bond was first issued.

Meanwhile, yields on 10-year and 20-year notes also surged, reaching their highest points since 1999. Investors are now closely watching a 20-year bond auction scheduled for Tuesday for further signals on market sentiment.

The market's reaction was triggered by a Kyodo report stating that Japan's ruling bloc is considering a tax plan that includes suspending the sales tax, with a possible implementation date as early as January.

Fiscal discipline concerns are not limited to one party. The Centrist Reform Alliance, a new coalition of opposition parties, is also proposing a sales tax cut, although it has stated it aims to do so without issuing additional deficit-financing bonds.

Eiichiro Miura, senior general investment manager at Nissay Asset Management, summarized the market's core concern. "Both ruling and opposition parties are advocating for consumption tax cuts, increasing the risk of fiscal expansion regardless of the outcome of the election," he said.

Prime Minister Sanae Takaichi is expected to detail her plans at a press conference on Monday for an election that could happen as soon as February 8.

While bond markets reacted negatively, the news had a different effect on equities. Some food-related stocks in Tokyo saw a lift on Monday morning, driven by expectations that a tax cut would boost consumption.

Separately, the Japanese yen edged higher as traders sought safe-haven assets following threats from U.S. President Donald Trump to impose new tariffs on certain European nations.

Hedge funds closed their bullish euro positions just days before US President Donald Trump threatened to impose new tariffs on European nations as he ramped up efforts to take over Greenland.

Leveraged funds flipped to a small net short on the common currency during the week ended Jan. 13, data from the Commodity Futures Trading Commission show. It was the first bearish shift since late November, and the move may add to the downward pressure on the euro after Trump proposed the levies unless there's a deal for the US to acquire Greenland.

"Hedge funds will be happy to be sitting net short and maybe looking to add to it if the 'spat' looks like it could turn into a full-on trade war," said Nick Twidale, chief analyst at AT Global Markets.

The euro swung between gains and losses on Monday morning in Asia, underscoring the uncertainties that lie ahead as investors contemplated the specter of a renewed trade war that could undermine European growth. Morgan Stanley had warned that traders are underpricing the risk of extreme scenarios potentially causing ruptures in major currencies, especially in the euro.

The common currency dipped as much as 0.2% before climbing 0.3% to $1.1628. The Bloomberg Dollar Spot Index declined 0.2%.

"Euro-dollar can test support at 1.1499 this week" on the tensions, Commonwealth Bank of Australia strategists including Joseph Capurso and Carol Kong wrote in a note. "The trade spat, centered on who controls Greenland, is likely to escalate before it de-escalates."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up