Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)A:--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)A:--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. PCE Price Index MoM (Nov)

U.S. PCE Price Index MoM (Nov)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Nov)

U.S. PCE Price Index YoY (SA) (Nov)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Nov)

U.S. Real Personal Consumption Expenditures MoM (Nov)--

F: --

P: --

U.S. Personal Income MoM (Nov)

U.S. Personal Income MoM (Nov)--

F: --

P: --

U.S. Core PCE Price Index MoM (Nov)

U.S. Core PCE Price Index MoM (Nov)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Remarks of Officials

Cryptocurrency

Political

Central Bank

Data Interpretation

Traders' Opinions

Forex

Commodity

Economic

Bitcoin briefly topped $92,000 on Fed probe news, but ETF outflows and weak sentiment challenge its safe-haven narrative.

Bitcoin briefly climbed above $92,000 after news broke that U.S. federal prosecutors have opened a criminal investigation into Federal Reserve Chair Jerome Powell. Despite this seemingly bullish catalyst, traders remain skeptical, pointing to significant outflows from Bitcoin ETFs and weak demand for leveraged long positions.

Two key indicators highlight the market's cautious sentiment:

• Institutional Selling: Bitcoin ETFs have recorded $1.38 billion in net outflows across just four trading sessions, signaling that major players are selling.

• Weak Bullish Momentum: Data from BTC futures shows a neutral 5% basis rate, well below the 10% premium that typically indicates strong bullish sentiment.

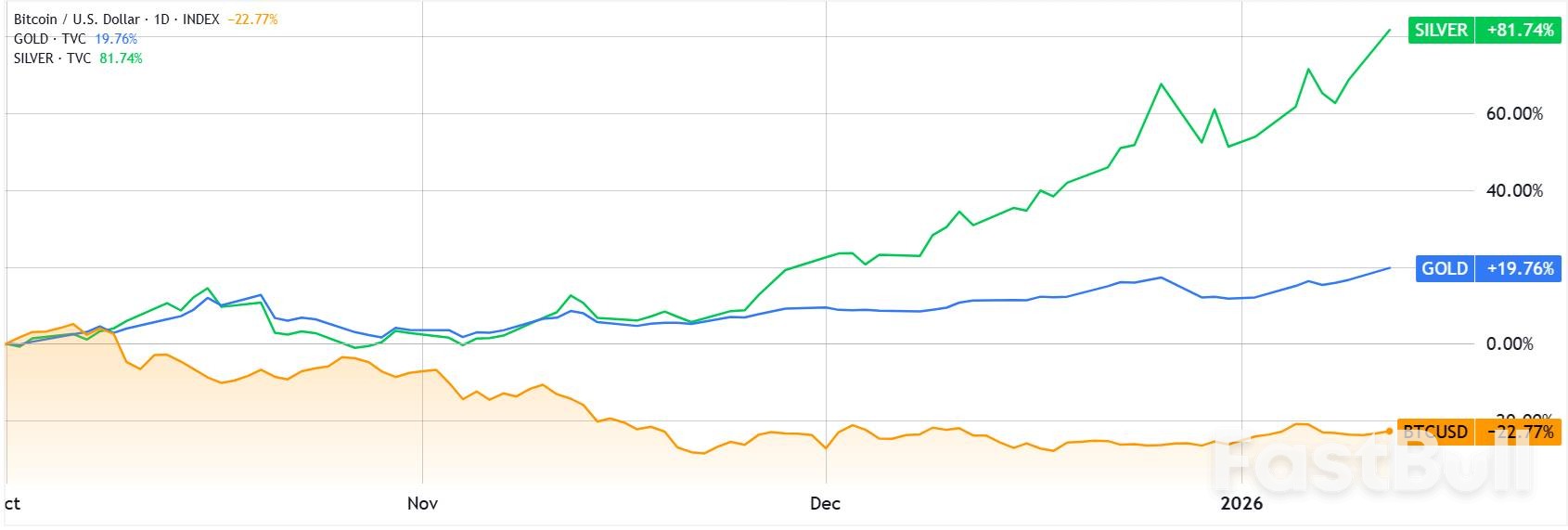

While Bitcoin has shown some resilience, it has significantly underperformed precious metals. The cryptocurrency is still down 23% since October 2025, a period during which both gold and silver reached all-time highs in 2026. This stark divergence has led traders to question whether Bitcoin's narrative as a digital store of value is losing its strength.

As a result, even if Bitcoin manages another 14% rally toward the $105,000 level, investors may remain hesitant to adopt a bullish stance. This caution is amplified as analysts become less confident that the U.S. will introduce further economic stimulus in the near future.

Adding to the complex economic picture, Goldman Sachs has revised its forecast and no longer expects an interest rate cut in March. The bank cited persistent inflation and resilient labor market data as reasons for the change.

The Federal Reserve's policies have been a point of contention. U.S. President Donald Trump has openly criticized the central bank for maintaining elevated interest rates even as inflation remained above the 2% target throughout the second half of 2025. With Jerome Powell's term as Fed chair ending in April, the door is open for a successor who may be more inclined toward a looser monetary policy.

The current investigation into Powell, centered on the Fed's building renovation project, has prompted analysts to question the future of central bank independence. A potential erosion of this independence could favor alternative scarce assets like Bitcoin. Powell himself has suggested that the investigation should be viewed within the broader context of threats from the Trump administration.

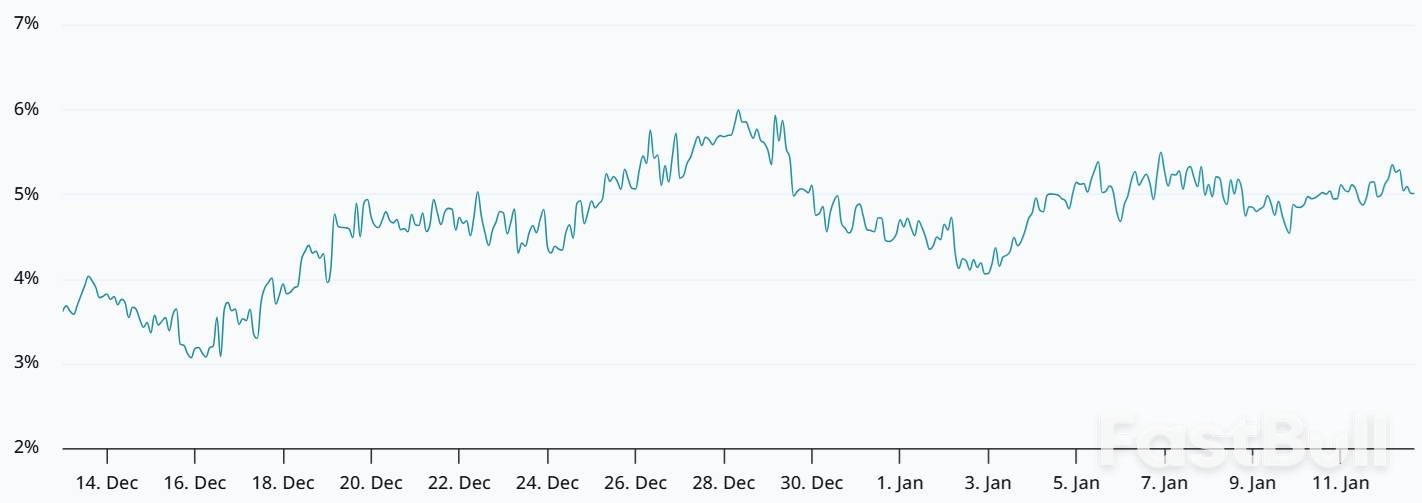

Even as Bitcoin reclaimed the $91,000 mark, derivatives data shows that traders are not rushing to open bullish positions. The annualized premium on BTC futures contracts, known as the basis rate, has remained near a neutral-to-bearish 5%. In contrast, periods of strong bullish sentiment are typically marked by a basis rate of 10% or more.

More importantly, spot Bitcoin ETFs have seen four consecutive days of net outflows, totaling $1.38 billion. This trend is particularly concerning because Bitcoin has struggled to sustain levels above $94,000 over the past month, even with significant corporate buying. Strategy, led by Michael Saylor, announced on Monday its largest purchase of Bitcoin since July 2025, adding $1.25 billion worth of BTC to its holdings.

While Bitcoin may serve as an alternative hedge against the traditional financial system, there is little evidence that a crisis of confidence in the U.S. dollar is currently unfolding. Despite a $601 billion fiscal deficit in the final three months of 2025, U.S. government debt has maintained its investment-grade status, and yields on the 5-year Treasury have stayed below 3.8% for the past couple of months.

If traders were truly preparing for an economic downturn, the U.S. dollar would likely have weakened against other major currencies. Instead, the U.S. Dollar Strength Index (DXY) rebounded to 99 after hitting a low of 96.7 in late November 2025. This suggests that despite the strong rally in precious metals, there is no clear evidence of a widespread "debasement trade" in the market.

Ultimately, the appeal of Bitcoin and other cryptocurrencies remains subdued. The combination of heavy ETF outflows and muted demand for leveraged BTC positions suggests that the odds of a surprise rally toward $105,000 are relatively low in the near term.

New York City nurses walked out of 10 major private hospitals across the city on Monday to demand increased staffing, funding of health benefits and protection from workplace violence often coming from patients.

Mayor Zohran Mamdani, who is just two weeks into his term, joined the picket lines to support 15,000 nurses that the New York State Nurses Association said were on strike.

"They are not asking for a multi-million dollar salary. What they are asking is for their pensions to be safeguarded, to be protected in their own workplace, to receive the pay and the health benefits that they deserve," Mamdani told reporters.

Mount Sinai said that the union's proposals would cost it $1.6 billion over three years, with a $638 million increase in nursing costs by the third year, which is 74% more than current costs.

New York State Gov. Kathy Hochul had declared a disaster emergency last week, allowing out-of-state and foreign medical personnel to cover for striking staff. The disaster emergency is in effect until February 8.

On Monday morning, dozens of nurses spoke of lack of healthcare benefits and inability to take adequate breaks during their shifts as they rallied outside a NewYork-Presbyterian Hospital in uptown Manhattan. NewYork-Presbyterian is one of three healthcare networks affected by the strike along with Mount Sinai and Montefiore.

"In the operating room, I work as a night nurse and we're always short on staffing and this is unsafe for the patient," said Michael Lazar, a 53-year-old NewYork-Presbyterian nurse.

Mount Sinai said it had secured more than 1,000 qualified and specialized agency nurses to cover for striking medics and to deliver care for "however long a strike may last."

NewYork-Presbyterian said all of its hospitals were open and continued to provide services.

Montefiore did not immediately respond to a request for comment. A notice on its website said that services would not be impacted by the strike.

The union and the hospitals held the last round of the negotiations the day before the strike, according to Mount Sinai and NYSNA. As of Monday evening, there was no information about the next talks.

The U.S. will invest $115 million in counter-drone measures to bolster security around the FIFA World Cup and America's 250th Anniversary celebrations, the Department of Homeland Security said on Monday, the latest sign of governments stepping up drone defenses.

The FIFA World Cup will be a major test of President Donald Trump's pledge to keep the U.S. secure, with over a million travelers expected to visit for the tournament and billions more watching matches from overseas.

The threat of drone attacks has become a growing concern since the war in Ukraine has demonstrated their lethal capabilities. And recent drone incidents have worried both European and U.S. airports.

"We are entering a new era to defend our air superiority to protect our borders and the interior of the United States," DHS Secretary Kristi Noem said in a statement.

Defense companies are developing a range of technologies aimed at countering drones, including tracking software, lasers, microwaves and autonomous machine guns. The DHS did not specify which technologies it would deploy to World Cup venues.

The announcement comes weeks after the Federal Emergency Management Agency, which sits under DHS, said it granted $250 million to 11 states hosting World Cup matches to buy counter-drone technologies.

Last summer, New York Governor Kathy Hochul, a Democrat, called on Trump, a Republican, to bolster federal support for defending against drone attacks.

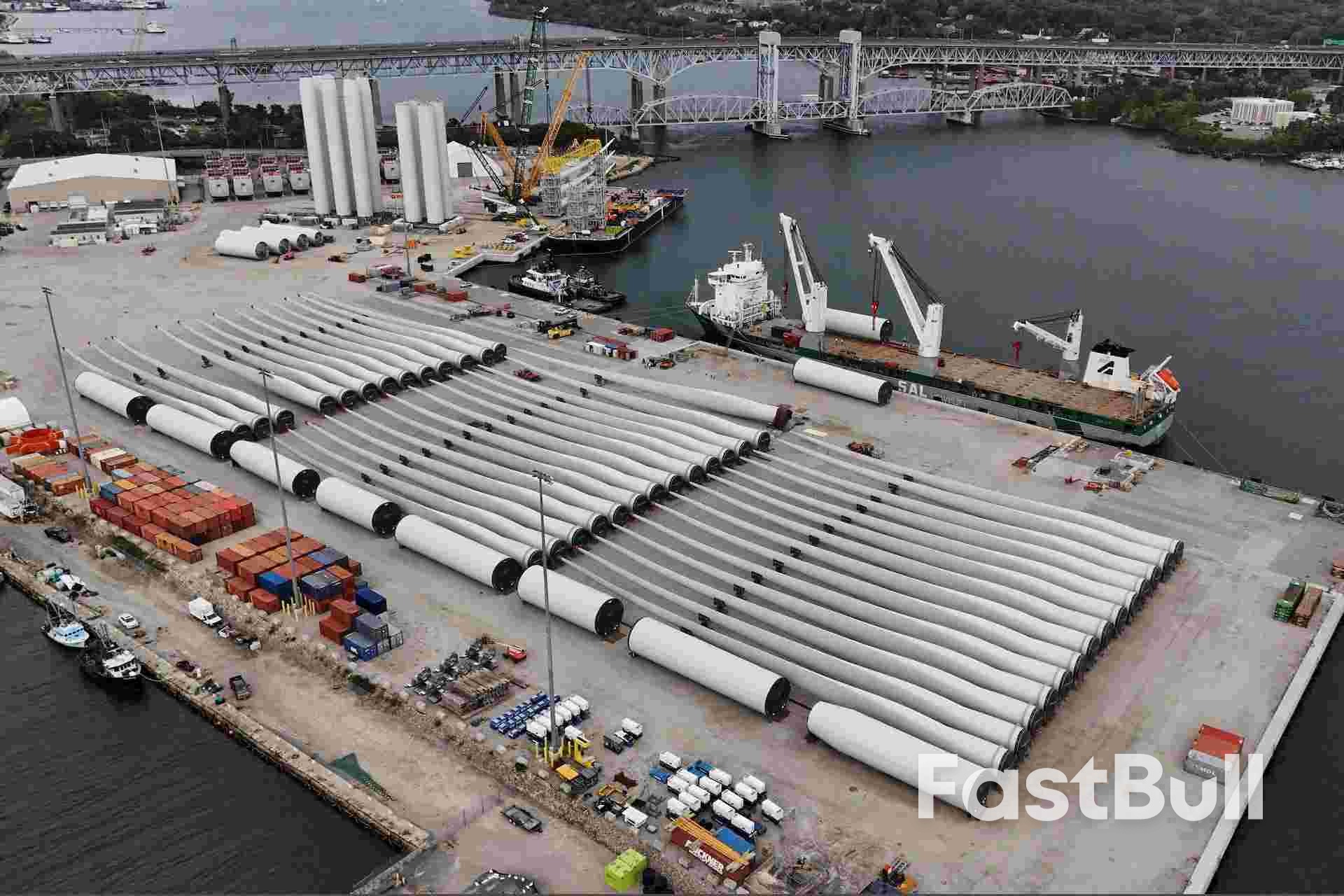

A federal judge on Monday cleared Danish offshore wind developer Orsted (ORSTED.CO) to resume work on its nearly finished Revolution Wind project, which U.S. President Donald Trump's administration halted along with four other projects last month.

The ruling by U.S. District Judge Royce Lamberth is a legal setback for Trump, who has spent the last year seeking to block expansion of offshore wind in federal waters. It was the second time in four months the $5 billion Revolution Wind project has sought, and won, a temporary court order to block a government stop-work order.

Orsted's Revolution Wind lawsuit is one of several filed by offshore wind companies and states seeking to reverse the Interior Department's December 22 suspension of five offshore wind leases over what it said were national security concerns around radar interference.

Monday's hearing was the first of three that will be held this week. The others involve Equinor's (EQNR.OL) Empire Wind, off the coast of New York, and Dominion's Coastal Virginia Offshore Wind facility.

There was no immediate comment from the Interior Department.

Orsted said it would resume work on Revolution Wind as soon as possible while its lawsuit progresses.

"Revolution Wind will determine how best it may be possible to work with the US Administration to achieve an expeditious and durable resolution," the energy company said in a statement.

Government attorneys had argued that the pause was justified by new, classified information regarding offshore wind's impacts on national security revealed to Interior officials by the Defense Department in November.

Lamberth rejected the administration's argument that national security concerns justified halting the project, which he said would be irreparably harmed without an injunction.

"You want to stop everything in place, costing them one-and-a-half million a day, while you decide what you want to do?" Lamberth, who was appointed by former President Ronald Reagan, asked Justice Department attorney Peter Torstensen during the hearing.

Lamberth also said he was troubled by Interior Secretary Doug Burgum's recent criticism of offshore wind for reasons unrelated to national security. In television interviews on the day Interior ordered the pause, Burgum said offshore wind was expensive, unreliable, reliant on foreign-made equipment and harmful to ocean life.

Revolution Wind attorney Janice Schneider argued the government's pause had violated federal laws governing administrative procedure and due process, adding that the developer had not been able to review the classified assessment on offshore wind.

"This Court should be very skeptical of the government's true motives here," Schneider said.

Offshore wind developers including Orsted have faced repeated disruptions to multi-billion dollar projects under U.S. President Donald Trump, who has said he finds wind turbines ugly, expensive and inefficient.

The project is about 87% complete and is expected to begin generating power this year, Orsted has said.

Revolution Wind LLC is a 50-50 joint venture between Orsted and Global Infrastructure Partners' Skyborn Renewables. Orsted has also sued on behalf of its Sunrise Wind project off the coast of New York.

Four migrants died while in custody of U.S. immigration authorities over the first 10 days of 2026, according to government press releases, a loss of life that followed record detention deaths last year under President Donald Trump.

The deaths included two migrants from Honduras, one from Cuba and another from Cambodia, and occurred from January 3-9, according to U.S. Immigration and Customs Enforcement.

The Trump administration aims to ramp up deportations and has increased the number of migrants in detention. As of January 7, ICE statistics showed that the agency was detaining 69,000 people. The numbers were expected to rise following a massive ICE funding infusion passed by the U.S. Congress last year.

At least 30 people died in ICE custody in 2025, the highest level in two decades, agency figures showed.

Setareh Ghandehari, advocacy director at Detention Watch Network, called the high number of deaths "truly staggering" and urged the administration to shutter detention centers.

U.S. Department of Homeland Security spokesperson Tricia McLaughlin said the rate of deaths had remained in step with historic norms as the detention population has climbed.

"As bed space has expanded, we have maintained (a) higher standard of care than most prisons that hold U.S. citizens — including providing access to proper medical care," McLaughlin said.

The Cuban detainee, Geraldo Lunas Campos, 55, died on January 3 in Camp East Montana, a detention site opened by the Trump administration on the grounds of Fort Bliss in Texas.

ICE said it was investigating the death of Lunas, adding that officials said he had become disruptive and placed him in isolation. Officials later found him in distress, and emergency medical technicians pronounced him dead, ICE said.

The two Honduran men - Luis Gustavo Nunez Caceres, 42, and Luis Beltran Yanez–Cruz, 68 - died in area hospitals in Houston and Indio, California, on January 5 and 6, respectively, both following heart-related issues, ICE said.

Parady La, a Cambodian man, 46, died on January 9 following severe drug withdrawal symptoms at the Federal Detention Center in Philadelphia, ICE said. The administration began using that space last year, it said.

The Trump administration has greatly reduced the number of migrants released from detention on humanitarian grounds, a move critics say has driven some to accept deportation.

In addition to the in-custody deaths, an ICE officer fatally shot a Minnesota mother of three last week, an incident that sparked protests in Minneapolis and cities around the country.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up