Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

Brazil Retail Sales MoM (Nov)

Brazil Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Nov)

Canada Wholesale Inventory YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Nov)

Canada Manufacturing Inventory MoM (Nov)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Import Price Index YoY (Nov)

U.S. Import Price Index YoY (Nov)A:--

F: --

U.S. Import Price Index MoM (Nov)

U.S. Import Price Index MoM (Nov)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Wholesale Sales MoM (SA) (Nov)

Canada Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)--

F: --

P: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

BOJ keeps 0.75% rate, set to upgrade 2025-2026 economic outlook, citing stimulus and export strength.

The Bank of Japan (BOJ) is expected to hold its policy rate steady at 0.75% during its upcoming two-day monetary policy meeting. Following a rate increase in December 2025, the central bank is now in an assessment phase, closely monitoring the effects of its monetary tightening on Japan's economy and inflation.

A key focus of the January meeting will be the release of the BOJ's quarterly "Outlook for Economic Activity and Prices." The central bank is preparing to revise its economic growth forecasts upward for fiscal years 2025 and 2026.

This marks a notable shift from the previous outlook report in October 2025, where the median forecast from board members projected real gross domestic product (GDP) growth at 0.7% for both fiscal years.

Key Drivers Behind the Forecast

The more optimistic growth projections are fueled by several positive factors:

• Government Stimulus: The government's supplementary budget is anticipated to stimulate household spending and corporate capital investment. Policymakers expect the most significant impact from these measures to occur in fiscal 2026.

• External Strength: A strong U.S. economy is providing a favorable external environment.

• Weak Yen Advantage: The depreciated yen continues to boost Japan's export performance.

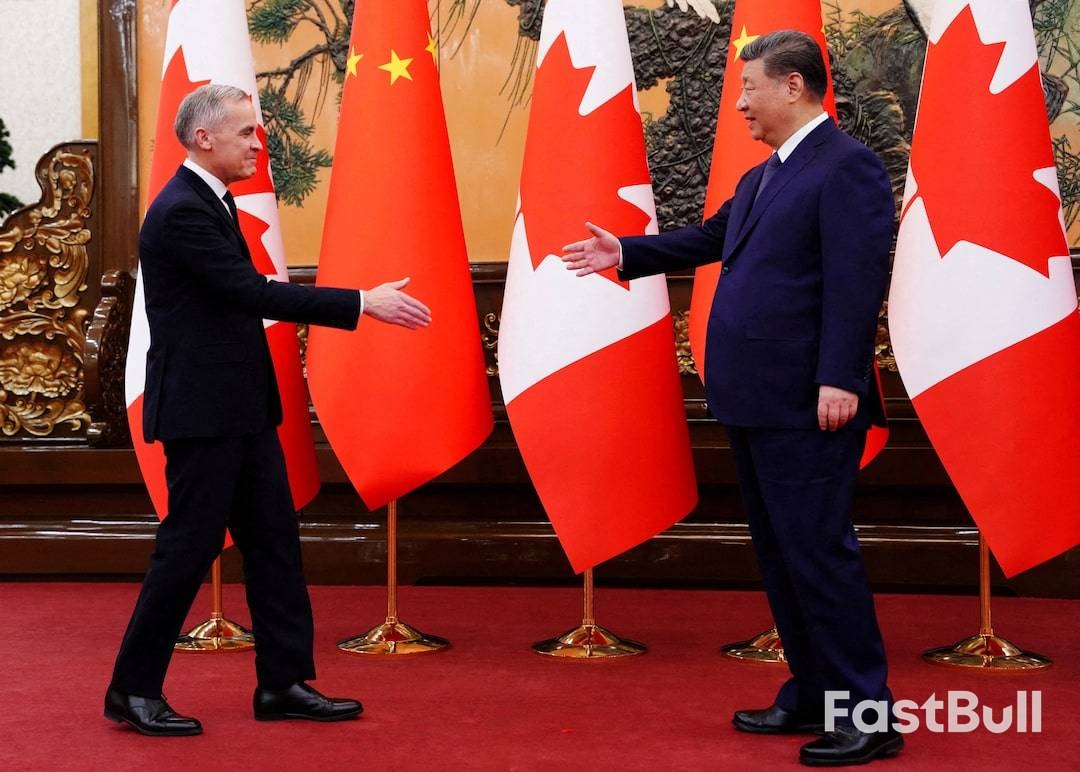

Canada and China have reached an initial trade agreement that dramatically lowers tariffs on Chinese electric vehicles and Canadian canola, signaling a major reset in economic relations. Prime Minister Mark Carney announced the deal on Friday in Beijing after meeting with Chinese leaders, including President Xi Jinping.

The agreement aims to dismantle trade barriers and establish new strategic partnerships, rebuilding a relationship that has been strained. Carney's visit is the first by a Canadian prime minister since 2017 and follows months of diplomatic efforts to restore ties with Canada's second-largest trading partner.

Under the new terms, Canada will allow up to 49,000 Chinese electric vehicles to be imported annually at a 6.1% tariff. This marks a sharp reversal from the 100% tariff imposed in 2024 by the former government of Justin Trudeau, which followed similar penalties enacted by the United States. In 2023, China exported 41,678 EVs to Canada.

"This is a return to levels prior to recent trade frictions, but under an agreement that promises much more for Canadians," Carney told reporters.

The Trudeau government had justified the high tariffs by citing an unfair global market advantage for Chinese manufacturers who benefited from state subsidies, which was seen as a threat to Canada's domestic auto industry.

However, Carney argued that a new approach is necessary. "For Canada to build its own competitive EV sector, we will need to learn from innovative partners, access their supply chains, and increase local demand," he said. The prime minister also stated he expects the agreement to attract "considerable" Chinese investment into Canada's auto sector, create high-quality jobs, and accelerate the country's transition to a net-zero economy through collaboration in clean energy.

The deal also provides a massive boost for Canadian farmers and fish harvesters, who were hit by retaliatory tariffs from China last year. In March 2025, after Trudeau's EV tariffs, China imposed duties on over $2.6 billion of Canadian agricultural products, which caused a 10.4% slump in Canadian goods imported by China that year.

Key agricultural concessions in the new agreement include:

• Canola Seed: Canada expects China to lower tariffs on its canola seed to a combined rate of approximately 15% by March 1. Carney described this as a "significant drop from current combined tariff levels of 84%" for a market worth $4 billion to Canada.

• Other Products: Anti-discrimination tariffs are expected to be removed from Canadian canola meal, lobsters, crabs, and peas starting March 1, lasting until at least the end of the year.

Carney projected that these changes will unlock nearly $3 billion in export orders for Canadian producers by allowing them to fully access the Chinese market.

The Canada-China pact comes as both nations navigate a complex global trade environment, particularly concerning relations with the United States. Under President Donald Trump, the U.S. has imposed tariffs on some Canadian goods, creating friction with its longtime ally. China has also faced significant U.S. tariffs since Trump's return to office.

When asked if China was now a more reliable partner than the United States, Carney emphasized the positive trajectory of the relationship.

"In terms of the way our relationship has progressed in recent months with China, it is more predictable, and you see results coming from that," he said. The deal positions Canada to deepen ties with the world's second-largest economy while diversifying its strategic partnerships.

France’s finance minister has issued a stark warning that a U.S. attempt to take control of Greenland could seriously damage trade relations with the European Union. Analysts suggest that any U.S. sanctions or tariffs aimed at pressuring Denmark could escalate into a full-blown trade war.

The controversy follows President Donald Trump's intensified discussions about annexing Greenland, the world's largest island. Recent talks on Wednesday involving the U.S., Denmark, and Greenland concluded without a diplomatic resolution.

French Finance Minister Roland Lescure stressed that economic ties between Washington and Brussels are at risk if the Trump administration pursues the self-governing Danish territory.

"Greenland is a sovereign part of a sovereign country that is part of the EU. That shouldn't be messed around with," Lescure told the Financial Times on Friday.

When asked if the EU would retaliate with economic sanctions against a U.S. invasion of Greenland, Lescure avoided a direct confirmation but signaled a major strategic shift. "If that happened, we would be in a totally new world for sure, and we would have to adapt accordingly," he said.

President Trump has framed the U.S. interest in Greenland as a matter of national security. According to analysts who spoke with CNBC, the move is also driven by a desire to secure emerging trade routes and gain access to critical minerals essential for industries like defense, keeping rivals at bay.

The heightened tensions come as a Democratic-led U.S. delegation prepares to meet with Danish lawmakers in Copenhagen.

Experts believe that aggressive economic measures by the U.S. would provoke a strong European response.

"Significant economic pressure in the form of tariffs or sanctions on Denmark by the U.S. could likely mean a significant E.U. pushback," said Dan Alamariu, chief geopolitical strategist at Alpine Macro. He warned that the EU could "respond in kind, leading to a sort of trade war with the U.S. as well as constant headline risks."

Alamariu added that such a conflict would "rattle markets" and challenge the integrity of NATO, although he noted that internal political and market pressure would likely restrain the Trump administration.

In a clear show of solidarity, European troops arrived in Greenland on Thursday for a joint military exercise. Maria Martisiute, a policy analyst at the European Policy Centre, told CNBC this demonstrates that Arctic defense is an "allied effort" and not solely dependent on the U.S.

"If we want to reinforce veterans and defense in Greenland or the wider Arctic, it's not up to the U.S. It can be done via allied efforts," Martisiute explained, adding that the exercise sends a "powerful message."

The EU is also bolstering its financial commitment. The European Commission, the bloc's executive body, has proposed doubling its spending on Greenland in its latest draft budget.

European Commission President Ursula von der Leyen affirmed this support on Thursday, stating, "What is clear is that Greenland can count on us — politically, economically, and financially and when it comes to its security."

Yesterday was refreshing in the sense that we briefly went back to the optimistic, euphoric mood of the past three years, with AI dominating headlines for the right reasons — strong numbers from TSMC and a very strong market reaction.

TSMC was relatively timid during the Asian session, likely reflecting uncertainty around reports that Nvidia could face tariffs of up to 25% on H200 chip exports to China. There were also lingering concerns over US-Taiwan trade negotiations, with Washington pushing TSMC to invest more heavily in US-based chip manufacturing. That demand is not only costly upfront — the company is committing around $165bn to build six fabs — but would also raise operating costs by an estimated 30–50% compared with production in Taiwan.

Those worries largely evaporated once Western markets stepped in. AI-related stocks ended the day firmly higher: TSMC rose more than 4% in New York, ASML jumped 6% to a fresh record in Amsterdam, and VanEck's Semiconductor ETF gained around 2%.

Optimism was further boosted by news of a trade agreement between the US and Taiwan, reportedly bringing the tariff rate to 15%. The S&P 500 closed near record levels.

That said, it's worth noting that most candlesticks on my daily charts were red, suggesting the session was not outright positive. Early strength faded into the close as investors spent much of the day trimming gains and reassessing the news flow. Is the news really that good?

As we dive into the heart of earnings season in the coming weeks, tech results will be scrutinised in far greater detail. Recall that last earnings season delivered blowout headline numbers from Big Tech, but in some cases those figures were wearing a bit of make-up. Think Meta offloading the bulk of its AI data-centre financing to private credit players such as Blue Owl and Pimco — and Nvidia booking revenues that have not yet turned into cash.

Concerns around circular AI deals, leverage and delayed returns on investment remain front of mind for investors. These are compounded by rising electricity and metals costs, higher memory-chip prices, and the risk of supply disruptions — including China's threats to restrict rare-earth exports amid geopolitical tensions involving Iran and Venezuela, where China has historically sourced oil.

All of this suggests that this earnings season may not be a walk in the park. These "details" — or elephants in the room — will matter just as much as the shiny headline figures. AI stocks are valued to perfection and leave no room for error. As we head into earnings, it increasingly feels as though Big Tech's ability to impress is diminishing, a risk that matters given its outsized weight in equity indices. Recently, the S&P 500 fell despite around 300 stocks closing higher — it was tech that dragged the index down.

If that dynamic persists, and tech earnings fail to reignite investor enthusiasm, the rotation trade is likely to continue. The equal-weighted S&P 500 has been playing catch-up with the market-cap-weighted, tech-heavy version, while US small caps have outperformed the S&P 500 for a tenth consecutive session — something we haven't seen in a long time. That trend should continue as long as risk appetite remains intact.

For now, risk appetite is being supported by renewed Federal Reserve (Fed) liquidity. A small but notable uptick in the Fed's balance sheet suggests the central bank is back in the market — not buying the same assets as before, but adding liquidity nonetheless. And liquidity always has to find a home.

Banks kicked off earnings season this week with broadly positive results. While price action earlier in the week failed to reflect those results — with markets focused on the White House's proposed 10% cap on credit-card interest rates — Goldman Sachs and Morgan Stanley reversed selling pressure yesterday with blockbuster numbers. Both posted record revenues, and both stocks hit all-time highs. Their long-term charts now make the 2008 drawdown look almost insignificant.

One of the biggest energy boosts for banks right now is AI — and we've been saying it all along: AI is not just a tech story. Goldman's CEO pointed to the "tremendous public and private capital" flowing into AI (surprised?), while Morgan Stanley's CFO noted that "the need for capital-markets and structuring expertise across the AI ecosystem is clearly there." Hell yeah —look at Meta, structuring debt in a way that makes its balance sheet look like a fresh sheet of paper.

The risk, however, is that investors now want returns — and they want them before AI infrastructure risks becoming outdated.

Zooming out briefly to macro data: the Philly Fed and Empire Manufacturing indices surprised to the upside yesterday, while US initial jobless claims fell last week. That combination suggests the Fed may be in no rush to cut rates further. The US 2-year yield, which captures rate expectations, climbed to a five-week high, pushing the dollar index toward the 100 mark. Crude oil fell sharply — around 4% — on signs of de-escalating tensions around Iran, while precious metals retreated. That said, the hammer formation in silver suggests dip-buyers remain active, and I still expect a move toward $100 per ounce before a more meaningful pullback.

There is little doubt that a 10–20% correction will hit at some point — the question is when. Over the medium term, the debasement trade should continue to weigh on the dollar and support metals prices.

Finally, for investors concerned about a commodity-led inflationary cycle, building exposure to commodities remains one of the most effective hedges.

Recent U.S. sanctions have triggered a notable shift in India's crude oil import landscape, pushing shipments from Russia to a two-year low in December and elevating OPEC's market share to its highest point in 11 months.

Trade data from December reveals a significant change in India's oil sourcing strategy. OPEC's portion of the country's total crude imports climbed to 53.25%.

This increase came as Russian oil flows dropped by 22% to 1.38 million barrels per day, accounting for just 27.4% of India's total imports. A key driver behind this decline was Reliance Industries' decision to suspend purchases from the sanctioned Russian company Rosneft, with whom it holds a long-term supply contract.

Despite the drop in volume, Russia maintained its position as the single largest crude oil supplier to India in December. Iraq and Saudi Arabia followed as the second and third-largest suppliers, respectively.

The continued flow of Russian oil is largely supported by India's state-owned oil companies, which have shifted their procurement to non-sanctioned Russian entities. Looking ahead, Kpler analyst Sumit Ritola predicts that Russian oil flows to India will likely stabilize between 1.2 million and 1.4 million barrels per day.

The trend extends beyond a single month. Data for the full year 2025 shows OPEC's share of Indian imports rose to 50%, up from 49% the previous year. In contrast, Russia's share decreased from 36% in 2024 to 33% in 2025.

A report from the Centre for Research on Energy and Clean Air (CREA) noted that Russian oil shipments to India fell by 29% month-on-month in December, reaching their lowest point since the G7 implemented a price cap. This drop was far less severe than some predictions, such as a Bloomberg forecast that suggested flows could fall to just 800,000 barrels per day.

While India's intake of Russian crude decreased, China's imports surged by 23% in the same period. This increased demand from China helped drive an 11% rise in Russia's total oil exports for December, highlighting a broader pivot in global energy trade.

Geopolitical tensions yesterday receded as a driver for global trading. President Trump taking a more guarded tone regarding direct action against Iran halted the recent upward squeeze in the oil price. Brent returned below $64/b.

The 'safe haven/scarcity' rally in gold and sliver that recently also spilled-over to other industrial metals (copper, thin,…) also fell prey to some profit taking. It has often been different of late, but in this (temporary?) more benign geopolitical context, US eco data even play a role in intraday price action. US weekly jobless claims (198k) eased back to sub 200k levels. The New York Fed Empire manufacturing survey (7.7 from -3.7, with strong orders and shipments) and the Philly Fed business outlook (12.6 from -8.8 also with solid underlying details) printed strong.

These series are no game-changers regarding the broader eco picture and their message still can be contradicted by other more high profile releases. Still, they confirm the view that the Fed is right in its assessment that the US economy is holding up rather well and that no immediate stimulus is needed, especially not as inflation is holding above target. After a risk-off driven bull flattening on Wednesday, the US yield curve yesterday bear flattened with yields rising between 5.5 bps (2 & 5 y) and 1.2 bps (30-y). Moves in Europe stayed more benign with the German 2-y yield adding 2.6 bps. The 30-y still eased 1.8 bps. Decent data and some easing in geopolitical tensions was enough to inspire a bid on global equity markets (Dow & Eurostoxx +0.6%). Still the dollar outperformed (DXY close 99.3) EUR/USD is struggling not to fall below the 1.16 barrier. The yen-decline took a breather after the announcement of new elections (USD/JPY 158.6), but the (yen)-picture remains fragile. UK yields rebounded 3.5-5.5 bps across the curve on better UK monthly GDP/production data, but it didn't help further sterling gains. EUR/GBP even rebounded from the 0.8650/55 support area to close at 0.8675.

Asian equities show a mixed picture today, with Japan and China suffering modest losses. US futures are gaining slightly (S&P +0.3%). The dollar is holding its recent gains (DXY 99.35, EUR/USD 1.1605). The eco calendar again only contains second tier eco data (NY Fed services activity, US production data, NAHB housing index). US markets are also preparing for a long weekend (Martin Luther King Day on Monday). A long weekend in the current uncertain (geopolitical) context might cause some cautious positioning. The technical picture in the likes of DYX and EUR/USD (break above 99.25 and below 1.161) at least suggests an ongoing constructive USD-momentum for now.

The European Commission in reviewing the EU accession rules is considering to replace the current system with a two-tier model, the Financial Times reported. Under the current 30-yr old system, an EU member state candidate can only enter when it ticks all the boxes, including adopting huge amounts of EU regulation. The new model under discussion would allow for fast-tracking a candidate's entry. After joining, the country would hold far less decision-making power, stripped from voting rights at leaders' summits for example, and gain incremental access to parts of the bloc's single market as well as funding and subsidies, after meeting post-membership milestones.

The proposal is specifically being considered for Ukraine. As part of the US-led peace plan, the country is allowed to join the EU. But officials note it could take a decade of reform for Ukraine to meet the current EU accession rules and understand that president Zelenskyy can probably only accept other parts of the peace deal (including territorial concessions) if he has short-term EU membership to showcase in return. The EC's proposal is highly contentious with some fearing it waters down the value of membership and may undermine stability in the bloc.

The US and Taiwan signed a trade agreement yesterday that slashes the current 20% tariff rate on Taiwanese imports to 15%. That's in line with regional peers including Japan and South Korea. The deal also waives tariffs on generic drugs, aerospace parts and natural resources that are unavailable in the US and offers Taiwan a most-favoured nation treatment. In return, Taiwan pledges a $250bn investment in the chip industry in the US and tariff-free imports of chips to the US are subject to a quotum. President Trump has previously threatened to impose a 100% levy on semiconductors, which would significantly weigh on Tawain as being the world's most important producer. Some in Taiwan, however, criticize the agreement as moving the chip industry out of the country and thereby disincentivizing Washington to protect Tapei against a possible Chinese attack.

Yen is once again attempting to recover from its recent sharp losses, with momentum this time supported by a more forceful policy backdrop. Japanese authorities have stepped up verbal intervention, and crucially, officials have gone beyond routine warnings and have explicitly flagged the possibility of joint action with the US. Additionally, combined with speculation of earlier BoJ rate-hike , this has strengthened the perception that Japan is increasingly determined to defend the 160 level against Dollar.

That shift matters for positioning. After weeks of one-way yen selling, this week's developments argue that Tokyo is no longer comfortable letting depreciation run unchecked. With that resolve now more visible, speculators may be reluctant to test the authorities aggressively in the near term, opening scope for a more sustained rebound in USD/JPY.

Japanese Finance Minister Satsuki Katayama reinforced the message on Friday, saying the government is ready to take "decisive action" to stem Yen's continued fall. "I have repeatedly said that we will take every possible measure," she told reporters. Katayama pointed specifically to last September's joint statement with the US, emphasizing that its language on intervention was deliberate. Importantly, she stressed that the statement does not specify whether intervention must be coordinated, adding that "no options are excluded."

Monetary policy expectations are also in flux. According to a Reuters report, some BoJ policymakers see scope for raising rates earlier than markets expect, with April under discussion if Yen weakness amplifies inflationary pressures. That view contrasts with broader market consensus. Analysts polled by Reuters still expect the BoJ to wait until July before hiking again, with more than 75% forecasting rates to reach 1% or higher by September. Still, the gap between official thinking and market pricing is narrowing.

Sources suggest some policymakers are willing to move sooner if evidence builds that Japan can sustainably meet its 2% inflation goal. The BoJ is also expected to revise up its fiscal 2026 growth and inflation projections at next week's meeting, adding to the sense of policy optionality. That said, there remains no consensus within the policy board. Governor Kazuo Ueda has consistently signaled caution, stressing the need to assess how previous rate hikes affect a still-fragile economy before committing to faster normalization.

In FX performance terms this week, Kiwi remains the strongest, lifted again by robust domestic manufacturing data released today. Aussie follows, supported by stable risk sentiment, with Loonie third as it digests recent losses. Euro is the weakest, followed by the Swiss franc and then Yen, which has stabilized but not yet decisively turned. Sterling and Dollar are trading in the middle of the pack.

ECB Chief Economist Philip Lane said the Eurozone is now in a "remarkably stable situation," arguing there is "no near term interest rate debate" under the central bank's baseline scenario. Speaking in an interview with La Stampa, Lane said the current policy setting is consistent with inflation staying around target, growth close to potential, and low, declining unemployment.

Lane stressed that the current level of interest rates provides the baseline for "the next several years." With the economy expected to grow in the neighborhood of its potential rate, he said it would take a significant acceleration in activity to push outcomes meaningfully above the baseline and trigger a policy response.

One alternative scenario he flagged was a major global disruption similar to 2021–2022, involving supply-chain bottlenecks. Lane described this as a "nightmarish" outcome, noting it would also carry recessionary forces rather than a clean inflationary impulse.

New Zealand's manufacturing sector ended 2025 on a strong footing, with the BusinessNZ Performance of Manufacturing Index jumping sharply from 51.7 to 56.1 in December. The reading marked the highest level of activity since December 2021 and moved decisively above the long-run average of 52.5.

The rebound was broad-based. Production rose from 53.2 to 57.4, while new orders surged from 52.5 to 59.8, pointing to strong demand momentum. Employment also improved, climbing from 52.6 to 53.8, suggesting firms are beginning to respond to higher workloads. Positive commentary from respondents increased to 57.1%, up from 54.4% in November and just 45.9% in October.

BNZ Senior Economist Doug Steel said the PMI is positive for Q4 GDP calculations and points to good momentum heading into the new year, flagging "upside risks" to already constructive near-term growth forecasts.

Daily Pivots: (S1) 158.26; (P) 158.57; (R1) 158.94;

USD/JPY's retreat from 159.44 extends lower today. Intraday bias remains neutral for the moment, and deeper fall could be seen. But downside should be contained above 156.10 support to bring another rally. On the upside, above 159.44 will resume larger rise from 139.87. Next target is 200% projection of 142.66 to 150.90 from 145.47 at 161.95, which is close to 161.94 high.

In the bigger picture, corrective pattern from 161.94 (2024 high) could have completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94. Decisive break of 158.85 structural resistance will solidify this bullish case and target 161.94 for confirmation. On the downside, break of 154.38 support will dampen this bullish view and extend the corrective range pattern with another falling leg.

| GMT | CCY | EVENTS | Act | Cons | Prev | Rev |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Dec | 56.1 | 51.4 | 51.7 | |

| 07:00 | EUR | Germany CPI M/M Dec F | 0.00% | 0.00% | 0.00% | |

| 07:00 | EUR | Germany CPI Y/Y Dec F | 2.00% | 2.00% | 2.00% | |

| 14:15 | USD | Industrial Production M/M Dec | 0.20% | 0.20% | ||

| 14:15 | USD | Capacity Utilization Dec | 76% | 76% | ||

| 15:00 | USD | NAHB Housing Market Index Jan | 40 | 39 |

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up