Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

CPI data spikes April Fed rate cut odds to 42%, challenging the central bank's cautious economic outlook.

The likelihood of the Federal Reserve cutting interest rates in April has climbed to 42%, driven by the latest Consumer Price Index (CPI) report. This shift has financial markets recalibrating their expectations for U.S. monetary policy.

However, not all forecasts are aligned. Goldman Sachs, for instance, projects a different timeline, anticipating rate cuts in June and September of 2026.

The recent CPI data has become a key catalyst for adjusting financial strategies. Following the release, analytics showed the probability of a rate reduction in April hitting 42%, prompting stakeholders to monitor financial conditions closely.

Markets are now actively responding to this revised outlook. A potential policy change by the Federal Reserve reflects its historical responsiveness to evolving economic indicators. If key indices continue to signal a change in conditions, policy adjustments become more likely.

Despite the market's reaction, Federal Reserve officials, including Chair Jay Powell, continue to emphasize a cautious strategy focused on maintaining economic stability.

Powell recently stated that "the economy is not 'hot' and not generating Phillips curve inflation," providing the rationale behind the central bank's current policy stance. This comment suggests that while the Fed is data-dependent, it is not rushing to alter its course based on a single report.

An anticipated change in interest rates is already influencing behavior across the economy. Investors and financial institutions may begin to adjust their funding and investment strategies to align with new economic forecasts.

Potential rate cuts could significantly affect asset liquidity and investment flows in the coming months. As a result, market participants are preparing to adapt to a new economic environment potentially shaped by a more accommodative Federal Reserve policy.

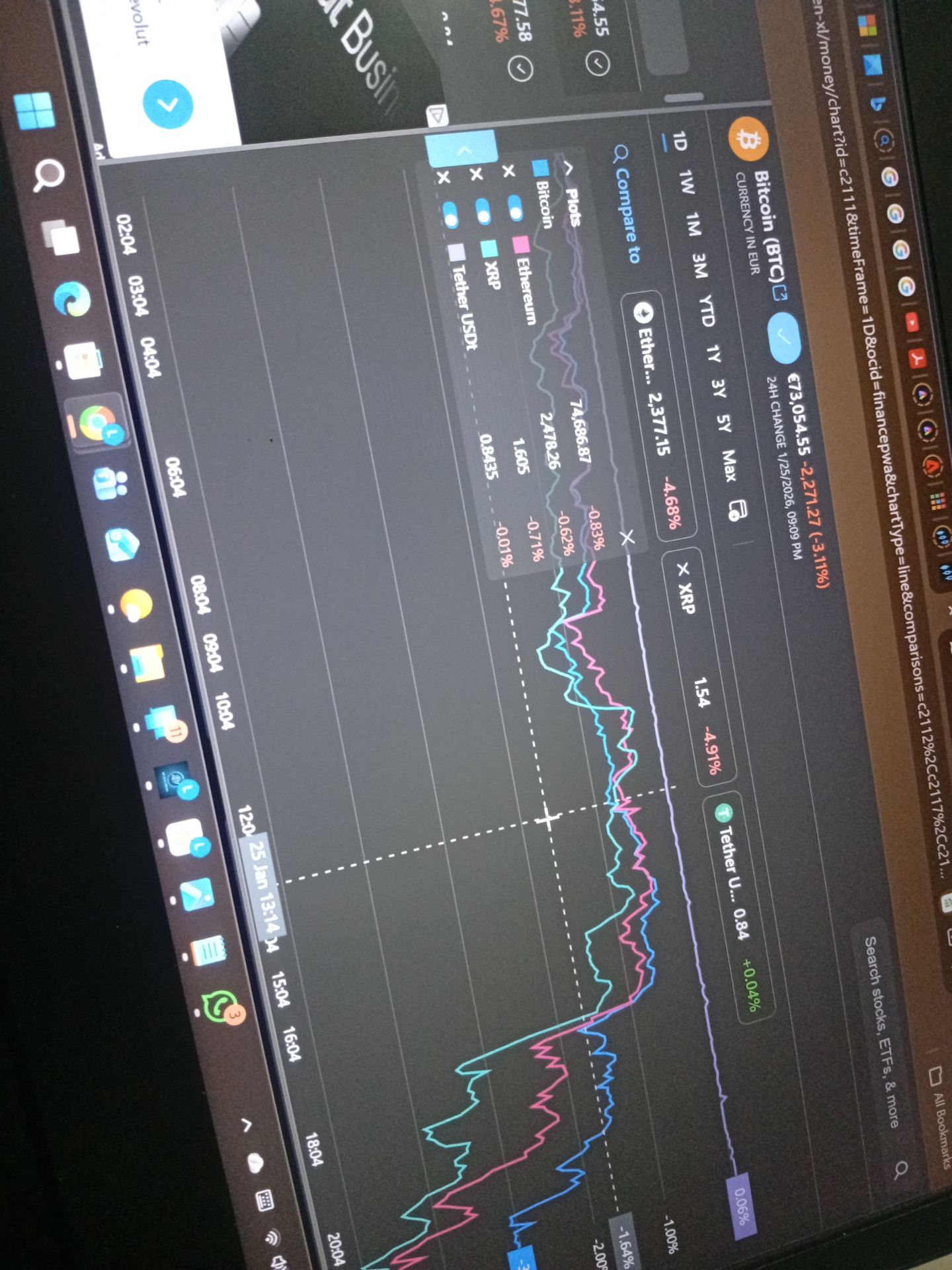

Bitcoin has climbed to a striking $94,500, showing remarkable strength as global instability intensifies. This unexpected rally coincides with signals from the U.S. Department of State and comments from former President Trump, suggesting significant market-moving events could be approaching.

Recent statements from Trump have fueled speculation. He has twice advised observers to be patient, stating, "Hold on, help is on the way." This message comes as the U.S. reportedly orchestrated the escape of Venezuela's Maduro, leading to theories that similar strategies could be applied in Iran.

Despite rising geopolitical tensions, Bitcoin’s value continues to push higher, defying historical trends. During past conflicts, such as the one between Russia and Ukraine, markets typically experienced downturns rather than rallies.

One prevailing theory is that Iranian assets are being moved into Bitcoin to hedge against war-related anxieties. While USDT is considered by some to be a more stable alternative, it carries the risk of being frozen. Separately, rumors have also surfaced about a potential leak concerning an upcoming U.S. Supreme Court decision, adding another layer of uncertainty.

The U.S. government is taking a clear stance on the situation. The Department of State has issued a strong advisory, urging American citizens to leave Iran immediately. Trump has indicated he is closely monitoring developments and consulting with international allies to manage the escalating crisis.

He also hinted at forthcoming announcements related to the death toll from Iranian protests, which could shape his next decisions. While leaving the door open for potential negotiations with allied nations, Trump stressed the urgent need for improved conduct from Iran.

In a separate discussion on economic policy, Trump disagreed with JPMorgan CEO Dimon, advocating for a reduction in interest rates. He also expressed optimism about expanding American trade within Chinese markets, signaling broader economic priorities.

As the global landscape remains highly unpredictable, the cryptocurrency markets are reflecting these mounting tensions and strategic shifts. The financial world is on high alert, waiting to see how these geopolitical and economic factors will unfold next.

The White House is considering military action against Iran in response to the deaths of protesters, while simultaneously exploring diplomatic solutions. President Donald Trump has signaled that all options are on the table, creating a tense geopolitical landscape with potential consequences for global markets.

Washington is actively discussing its response to the situation in Iran, with President Trump contemplating military strikes. White House Press Secretary Caroline Leavitt confirmed that airstrikes remain a viable option should diplomatic efforts prove unsuccessful.

Despite the preparations for a potential military response, Trump has also publicly suggested that Iran's leadership may be open to negotiations. This dual-track approach keeps both military and diplomatic pathways active as the administration determines its next steps.

In a significant economic move, President Trump announced a new policy aimed at isolating Tehran. He declared that any country engaging in trade with Iran will face a 25% tariff on all business conducted with the United States.

This move applies immediate economic pressure on nations maintaining trade relationships with Iran, potentially impacting global commerce and supply chains. Iran has warned it will retaliate against any hostile actions.

The prospect of military intervention in Iran raises concerns about regional market stability. However, the precise financial consequences remain difficult to forecast, particularly for digital assets. So far, no major cryptocurrencies have reportedly been affected by these geopolitical developments.

Mona Yacoubian of the Center for Strategic and International Studies (CSIS) voiced concerns that an increase in protester deaths could trigger a military escalation. Market observers note that while historical tensions involving Iran or brief conflicts with Israel have not directly impacted the cryptocurrency market, they often lead to wider economic ramifications. The current situation suggests a similar pattern, with the most immediate effects likely to be felt in traditional trade and regional markets rather than crypto.

President Donald Trump has pushed back against criticism from JPMorgan Chase CEO Jamie Dimon, flatly stating the executive is "wrong" to suggest a Justice Department probe undermines the Federal Reserve's independence.

"I think it's fine what I'm doing," Trump said, adding that Fed Chair Jerome Powell is "a bad Fed person."

The dispute centers on a federal investigation into Powell regarding the cost of renovating the central bank's headquarters and his subsequent testimony to Congress on the matter.

The public disagreement highlights a growing tension between the White House and the financial industry over the central bank's autonomy.

Dimon Warns Against Political Interference

Earlier, Dimon had voiced strong concerns about the probe, emphasizing the importance of institutional independence.

"Everyone we know believes in Fed independence," he stated. "And anything that chips away at that is probably not a great idea."

Dimon warned that such actions could have the "reverse consequences," potentially leading to higher inflation expectations and increased interest rates over time. When asked about these remarks, Trump’s response was blunt: "I think he's wrong."

Political Fallout Mounts Over Powell's Successor

Despite the controversy, Trump confirmed he intends to announce Powell's replacement within "the next few weeks."

However, this plan faces resistance from Republican lawmakers. Senator Thom Tillis, a key Republican on the Senate Banking Committee, has threatened to block all new nominations to the Fed until the investigation is resolved.

The conflict also extended to consumer finance, with Trump defending his proposal for a one-year, 10% cap on credit card interest rates, a move that would likely require congressional approval.

The banking industry has warned that such a cap could restrict access to credit for many consumers and dismantle popular rewards programs.

Trump, however, framed the policy as a protective measure for borrowers. "I think that people that are paying 28% interest should be protected," he said, noting the cap would be for "a one-year period."

He then took another direct aim at the JPMorgan chief, stating that he did not believe it was right for "Jamie Dimon or anybody else" to charge customers high interest rates on their credit cards.

The Trump administration has officially approved the sale of Nvidia’s H200 artificial intelligence chips to China, implementing a new rule that greenlights the exports despite significant pushback from national security hawks in Washington.

This move allows shipments of the company's second most powerful AI chips to proceed under a strict set of conditions designed to manage technology transfer.

To manage the flow of advanced technology, the administration has established several key requirements for any China-bound sales of the H200 chips:

• Third-Party Vetting: All chips must be reviewed by an independent testing lab to verify their technical AI capabilities before shipment.

• Volume Cap: China cannot receive more than 50% of the total volume of H200 chips sold to American customers.

• Supply Certification: Nvidia is required to certify that there is a sufficient supply of H200 chips available within the United States.

• End-User Security: Chinese customers must demonstrate they have adequate security procedures in place.

• Military Use Prohibited: The chips are explicitly banned from being used for any military purposes.

The decision formalizes President Donald Trump's announcement last month to permit the chip sales, which will also be subject to a 25% fee. This policy has drawn sharp criticism from China hawks across the U.S. political landscape, who argue that providing Beijing with powerful AI chips could accelerate its military modernization and erode America's technological edge.

These concerns had previously led the Biden administration to block sales of advanced AI chips to China. The Trump administration, however, is pursuing a different strategy.

The new policy, championed by White House AI czar David Sacks, is based on a specific strategic calculation. The administration argues that allowing controlled sales of advanced American AI chips to China discourages domestic competitors like Huawei from aggressively accelerating their own research and development.

According to this view, supplying the market with top-tier chips from Nvidia and AMD disincentivizes Chinese firms from redoubling efforts to match or surpass the most advanced U.S. chip designs, thereby helping to manage the long-term competitive landscape.

U.S. President Donald Trump has declared his intention to impose a 25% tariff on any country conducting business with Iran, dramatically increasing economic pressure on Tehran. The move comes as the Iranian government contends with significant domestic protests fueled by years of economic hardship.

Western sanctions have already taken a heavy toll on the OPEC member's economy, leading to high inflation, unemployment, and a collapse in its currency, the rial. The current wave of protests is a direct result of these persistent economic troubles, which Iran has struggled to manage amid its international isolation.

This new tariff threat directly targets Iran's primary sources of revenue, which come from exports to key partners including China, Turkiye, Iraq, the United Arab Emirates, and India. The central questions are how this will impact Iran's global trade and how nations like China, which buys 80% of Iran's oil, will react.

The policy was announced via a post on Trump's Truth Social platform.

"Effective immediately, any country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with the United States of America," Trump stated, adding, "This Order is final and conclusive."

Notably, the announcement was not accompanied by any official documentation from the White House, leaving the legal authority for such a sweeping tariff unclear.

The threat marks a significant escalation in Trump's pressure campaign against Iran's leadership. In response, Iranian Foreign Minister Abbas Araghchi issued a stark warning in an interview with Al Jazeera Arabic, stating that Iran is prepared for war if the U.S. wants to "test" its military capabilities. "If Washington wants to test the military option it has tested before, we are ready for it," Araghchi said, expressing hope that the U.S. would choose dialogue instead.

China stands to be the most affected by the new policy. As Iran's largest trading partner, the two nations officially conducted over $13 billion in trade in 2024, according to U.N. Comtrade data. However, the actual figure is likely much higher, with 2022 World Bank data suggesting a trade volume of $37 billion, much of it conducted through unofficial channels to bypass sanctions.

Last year, China imported 80% of Iran's oil, providing a crucial economic lifeline as other major buyers like India scaled back purchases following U.S. sanctions during Trump's first term. Chinese imports from Iran are not limited to oil; they also include plastics, iron ore, chemicals, and methanol.

For Chinese manufacturers, this potential 25% tariff would be applied on top of an existing 35% tariff on goods sold to the U.S. The development threatens a recent trade truce between Washington and Beijing, which saw tariffs on Chinese goods reduced from over 100%. It could also jeopardize Trump's planned visit to Beijing in April.

Chinese officials have condemned the move. The Chinese embassy in Washington warned that Beijing would take "all necessary measures" to protect its interests and rejected the use of "illicit unilateral sanctions." Foreign Ministry spokeswoman Mao Ning reiterated that "there are no winners in a trade war" and affirmed that "China will resolutely safeguard its legitimate rights and interests."

Several other countries maintain significant trade relationships with Iran and now face potential U.S. tariffs.

• Turkiye: As Iran's second-largest trading partner, Turkiye's bilateral trade was valued at approximately $5.7 billion in 2024. The country already faces a baseline U.S. tariff of 15%, with tariffs on steel and aluminum recently doubled to 50%.

• Pakistan: A top destination for Iranian exports, trade with Pakistan totaled about $1.2 billion in 2024. Pakistani exports to the U.S. are currently subject to a 19% tariff.

• India: Another key export market for Iran, India's trade value exceeded $1.05 billion in 2024. India already contends with 50% U.S. duties on its steel and aluminum, along with a 50% tariff on a range of other exports.

The U.S. has long used sanctions to target Tehran's nuclear program, which Washington alleges is aimed at developing a nuclear weapon—a claim Iran denies.

Most sanctions were lifted under the 2015 nuclear deal brokered by the Obama administration. However, Trump withdrew the U.S. from the agreement in 2018 and launched a "maximum pressure" campaign, reimposing sanctions and adding new ones targeting Iran's petrochemical, metals, and senior officials.

This campaign has severely restricted Iran's oil exports and its access to the global financial system.

The economic consequences of past sanctions have been severe. Iran's oil exports, its primary revenue source, fell by 60% to 80%, costing the government tens of billions of dollars annually.

• GDP Per Capita: Dropped from over $8,000 in 2012 to just over $5,000 in 2024, according to World Bank data.

• Oil Exports: Plummeted from 2.2 million barrels per day (bpd) in 2011 to a low of just over 400,000 bpd in 2020. While exports have since recovered to around 1.5 million bpd in 2025, they remain well below pre-2018 levels.

Despite the pressure, foreign trade remains vital. In 2024, Iran's exports were worth approximately $22.9 billion, accounting for about 5% of its total GDP of $475.3 billion. Trump's latest threat aims to squeeze this remaining economic activity even further.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up