Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Fear Of Losing To Starlink? French Government Blocks Eutelsat Sale Of Antenna Assets] French Minister Of Economy, Finance, Industry, Energy And Digital Sovereignty, Roland Lescuille, Disclosed To The Media On The 30th That The French Government Recently Blocked Eutelsat's Sale Of Ground Antenna Assets To A Swedish Buyer. He Said The Decision Was Based On "national Security" Concerns, Fearing That The Transaction Would Damage Eutelsat's Competitiveness And Allow Its Rival, SpaceX's Starlink System, To Dominate The European Market

[White House Office Of Management And Budget Instructs Affected Agencies To Begin Implementation Of Shutdown Plans] On January 30, Local Time, CCTV Reporters Learned That The Director Of The White House Office Of Management And Budget Issued A Memorandum To Heads Of Various Departments, Instructing Agencies Whose Funding Was Due At Midnight To Begin Preparations For A Government Shutdown. These Agencies Include The Department Of Defense, Department Of Homeland Security, Department Of State, Department Of Treasury, Department Of Labor, Department Of Health And Human Services, Department Of Education, Department Of Transportation, And Department Of Housing And Urban Development

Mexico's Ministry Of Foreign Affairs Says Minister Spoke With USA Secretary Of State Rubio To Reiterate Bilateral Collaboration On Agendas Of Common Interest

China Southern Command Says Carried Out Naval And Air Patrols Around Scarborough Shoal On 31 Jan

Pentagon - USA State Dept Approves Potential Sale Of Patriot Advanced Capability-3 Missile Segment Enhancement Missiles To Saudi Arabia For An Estimated $9.0 Billion

Hong Kong Port Operator Violated Panama's Constitution, Failed To Serve Public Interest, Panama Court Ruled

South Korea Signs Deal With Norway To Supply Multiple Launch Rocket System Valued At 1.3 Trillion Won -South Korea Presidential Chief Of Staff

[Arctic Cold Wave Hits: Florida Citrus Industry At Risk Of Frost] The Southeastern United States Is Bracing For A Powerful Storm, Potentially Bringing Devastating Frost To Florida's Citrus Belt And Heavy Snowfall To The Carolinas. The Wind Chill In Central Florida's Orange-growing Regions Could Drop To Single Digits (Fahrenheit); Much Of Polk County Is Expected To Experience Sub-zero Temperatures, Threatening The Statewide Citrus Harvest. The Storm Is Also Expected To Bring Strong Winds And Coastal Flooding To The East Coast. Approximately 1,000 Flights Have Already Been Canceled Across The U.S. This Weekend, With Half Of Them Concentrated At Hartsfield-Jackson Atlanta International Airport

[Former Goldman Sachs Executive: Warsh's Fed Chairship Could Reduce Risk Of Massive Sell-Off Of US Assets] Fulcrum Asset Management Stated That Nominating Kevin Warsh As The Next Federal Reserve Chairman Reduces The Risk Of A Massive Sell-off Of US Assets Because The New Leader Is Expected To Take Measures To Address Inflation. "The Market Will Breathe A Huge Sigh Of Relief, And So Will The Dollar Market," Said Gavyn Davies, Co-founder And Chairman Of The London-based Firm, In A Video Released On The Fulcrum Website. He Added That Choosing Warsh Reduces The Risk Of A "crisis-laden 'sell America' Trade."

MSCI Emerging Markets Benchmark Equity Index Fell 1.7%, Its Worst Single-day Performance Since November 2025, Narrowing Its January Gain To Approximately 9%, Still Its Best Monthly Performance Since 2012. The Emerging Markets Currency Index Fell About 0.3%, Narrowing Its January Gain To 0.6%. On Friday, The South African Rand Fell 2.6% Against The US Dollar, Its Worst Performance Since April

Pentagon - USA State Department Approves Sales Of Joint Light Tactical Vehicles To Israel For $1.98 Billion

Federal Reserve Governor Bowman: I Look Forward To Working With Kevin Warsh, President Trump's Nominee For Federal Reserve Chairman

On Friday (January 30), At The Close Of Trading In New York (05:59 Beijing Time On Saturday), The Offshore Yuan (CNH) Was Quoted At 6.9584 Against The US Dollar, Down 137 Points From The Close Of Trading In New York On Thursday, Trading Within A Range Of 6.9437-6.9612 During The Day. In January, The Offshore Yuan Generally Continued To Rise, Trading Within A Range Of 6.9959-6.9313

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Amid escalating US-Iran tensions, reports detail a possible Sunday military offensive, potentially targeting regime change.

As tensions escalate between the United States and Iran, reports of an impending military confrontation are gaining traction. President Trump has signaled that Iranian leaders are aware of a looming deadline, while the U.S. has simultaneously bolstered its military presence in the Middle East, fueling speculation of a potential conflict.

A significant report from Drop Site News, citing unnamed U.S. and Arab sources, alleges that a U.S. offensive on Iran could be scheduled for this Sunday. While the claims lack definitive evidence, the precedent of last year's abrupt attack lends them a degree of credibility.

According to sources who spoke with Drop Site News, top U.S. military officials have briefed a key ally in the region on the situation. The briefing suggests President Trump may soon authorize military action, and the allied nation is reportedly preparing for strikes to commence on Sunday.

An adviser to several Arab governments claims the primary U.S. objective is not neutralizing nuclear threats but instigating a change in the Iranian regime. This perspective appears to align with President Trump’s recent comments about supporting resistance movements and potentially sending aid, suggesting that the goal of regime change may be a core part of the administration's strategy.

Further intelligence suggests the Trump administration believes a successful military intervention could trigger internal protests within Iran, ultimately leading to the collapse of the current government.

The credibility of these reports remains a key question, as major leaks would typically be confirmed by more established media outlets. With Iran supposedly aware of the deadline, observers are closely monitoring official channels for credible information. Some analysts suggest the "final deadline" might simply refer to the end of January.

Former intelligence officials have noted that Israeli Prime Minister Netanyahu anticipates an attack and has assured President Trump of Israel's support in establishing a new, friendly government in Iran. High-level Arab intelligence sources have also indicated to Drop Site News that a U.S. strike may be forthcoming.

Should a military assault materialize, the repercussions could be widespread and severe. The most likely outcomes include:

• Bitcoin Market Volatility: The cryptocurrency market could see fluctuations similar to trends observed during last year's geopolitical events.

• Heightened Regional Instability: The entire Middle East would likely experience a sharp increase in instability.

• Long-Term Disruption: The conflict could trigger lasting disruptions across the region with serious global implications.

As the reported deadline approaches, both Iran and the international community remain on high alert. The possibility of military action continues to cast a shadow over the geopolitical landscape.

A new Dutch government is rapidly taking shape after the social liberal D66, Christian Democrats (CDA), and liberal conservative VVD parties reached a coalition agreement. With the cabinet expected to be assembled and in place by the end of next month, this formation period is proving significantly faster than in previous election cycles.

However, the incoming government faces a major hurdle from day one. Holding only 66 of the 150 seats in parliament, it will operate as a minority government—a new dynamic for Dutch politics. This setup means the coalition must build a majority by winning over opposition parties for every policy it wants to pass.

The coalition's economic agenda is firmly pro-business, even with tax increases planned to fund higher defense spending. Key pillars of the plan include:

• Lowering energy costs for Dutch manufacturers.

• Providing subsidies to support the transition to green energy.

• Allocating additional funds for housing to boost the construction sector.

• Tackling high nitrogen emissions through financial support for farmers who voluntarily cease operations.

The government also intends to cut regulatory burdens for businesses and maintain favorable conditions for expats. By reversing previous cuts to the science and education budget, the agenda supports long-term innovation. The coalition is actively targeting a structural GDP growth rate of 1.5%.

Despite significant new spending on defense, the Netherlands is on track to keep its budget deficit within the EU's 3% of GDP limit. Government debt is already well below the 60% debt-to-GDP target, positioning the Dutch as one of Europe's most fiscally disciplined nations.

This fiscal balance comes at a price. To offset the increased defense expenditure, the government plans large cuts to healthcare spending, primarily through higher co-payments. Social security will also see reductions, while both households and businesses will face higher taxes. Longer-term spending plans are also expected to add budgetary pressure beyond the upcoming government period.

The incoming government is poised to adopt a more positive and cooperative approach toward the European Union. While it still denounces Eurobonds, its definition is narrow, focusing only on the pooling of national public debt.

Crucially, the coalition remains constructive toward existing common financing instruments—a notable shift from the previous government. It also expresses support for strengthening the capital market and banking unions.

The Netherlands is set to have a new government in short order, armed with an ambitious agenda focused on business competitiveness, increased defense spending, and strict fiscal management. The coalition’s success, however, will hinge on its ability to negotiate and win support from the opposition. A new political experiment is just beginning.

Traders' Opinions

Daily News

Economic

Technical Analysis

Central Bank

Political

Commodity

Data Interpretation

Remarks of Officials

Gold and silver prices just experienced a stunning sell-off, with gold dropping over 10% and silver plummeting more than 30% ahead of the weekend. This historic volatility comes just two days after gold posted its largest one-day gain on record.

But for market analysts, this violent price swing was no surprise. After an explosive January that saw gold soar 29.5% to a high of $5,602 an ounce and silver skyrocket 68.5% to an intraday record above $121, both precious metals were seen as significantly overextended. This kind of momentum, especially within the first month of the year, was never going to be sustainable.

Analysts widely agree that the sell-off was a necessary technical correction. "The past couple of days have been incredibly volatile for metals across the board," said Neil Welsh, Head of Metals at Britannia Global Markets. "The pullback is probably not unexpected given the speed and magnitude of January's rally. Gold and silver had become technically overextended."

Welsh noted that positioning, leverage, and options activity had reached levels typically associated with short-term peaks.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, added that the rapid gains made trading conditions difficult, thinning out liquidity. "Market makers have grown reluctant to take and hold risk, resulting in thinner liquidity and wider bid-offer spreads," he explained. Hansen described the gold market's recent behavior as shifting from "the adult in the room to behaving like an angry teenager, just like silver."

Matthew Piggott, Director of Gold and Silver at Metals Focus, called the January rally "irrational exuberance" and framed the current sell-off, while extreme, as a healthy market correction.

Despite the brutal selling pressure, most analysts believe the fundamental uptrend for precious metals has not been broken. While cautioning investors against jumping back in too quickly, they expect buyers to step in and support prices at lower levels.

"I believe the broader trend remains intact," said Welsh. "The macro forces that drove gold, silver, and copper are still firmly in place. This episode appears to be a positioning correction within an ongoing uptrend, not the end of one." He expects precious metals to remain well-supported through 2026, though with wider trading ranges.

Hansen maintains that gold still has a potential path to $6,000 an ounce by the end of the year.

The core bullish case rests on persistent global uncertainty. "At any moment, we could see an unpredictable policy decision instantly upend the status quo again," Piggott noted. "As long as that threat remains in play, it will continue to drive bullish sentiment in gold and silver."

Key support levels to watch include $4,600 an ounce, according to Ipek Ozkardeskaya at Swissquote, and an initial support at $4,700, according to Alex Kuptsikevich at FxPro. Ozkardeskaya added that pullbacks will likely be seen as buying opportunities, as the primary drivers—G7 debt, a weaker U.S. dollar, and geopolitical tensions—are still in play.

Adding a new layer of complexity is a potential shift at the U.S. Federal Reserve. President Donald Trump announced Kevin Warsh as his nominee for the next Fed Chair. Warsh, a former Fed governor, is known as an "inflation hawk" and is expected by some to bring a more nuanced approach to monetary policy, according to Charlie Ripley of Allianz Investment Management.

However, analysts believe Warsh is unlikely to defy Trump's public demand for lower interest rates. "The U.S. president has made it sufficiently clear that he wants to see significantly lower interest rates," said Thu Lan Nguyen, Head of Commodity and FX Research at Commerzbank. She predicts the Fed would likely yield to pressure and cut rates more than the market currently expects, which would keep gold prices well-supported.

Current market pricing reflects this uncertainty. According to the CME FedWatch Tool, traders see the first rate hike of 2026 in June and are only pricing in two cuts for the entire year.

Some institutions are even more hawkish. Economists at BNP Paribas now expect the central bank to keep interest rates unchanged at the current 3.5%-3.75% range throughout 2026, citing solid economic growth.

Meanwhile, fresh inflation data complicates the Fed's path. The U.S. Producer Price Index (PPI) for December jumped 3.0% year-over-year. Core PPI, which excludes food and energy, rose 3.3%, suggesting inflation is becoming more embedded in the economy. This data muddle interest rate expectations ahead of a busy week of economic reports.

Key Economic Events to Watch

• Monday: ISM Manufacturing PMI, Reserve Bank of Australia monetary policy meeting

• Tuesday: US JOLTS job openings

• Wednesday: U.S. ADP employment data, ISM Services PMI

• Thursday: Bank of England and European Central Bank monetary policy meetings, US jobless claims

• Friday: US Nonfarm Payrolls, University of Michigan Preliminary Consumer Sentiment

Traders' Opinions

Russia-Ukraine Conflict

Daily News

Economic

Middle East Situation

Central Bank

Political

Commodity

Forex

Remarks of Officials

Energy

Oil prices edged slightly lower on Friday, consolidating gains near six-month highs as the market continues to be swayed by persistent geopolitical tensions between the United States and Iran.

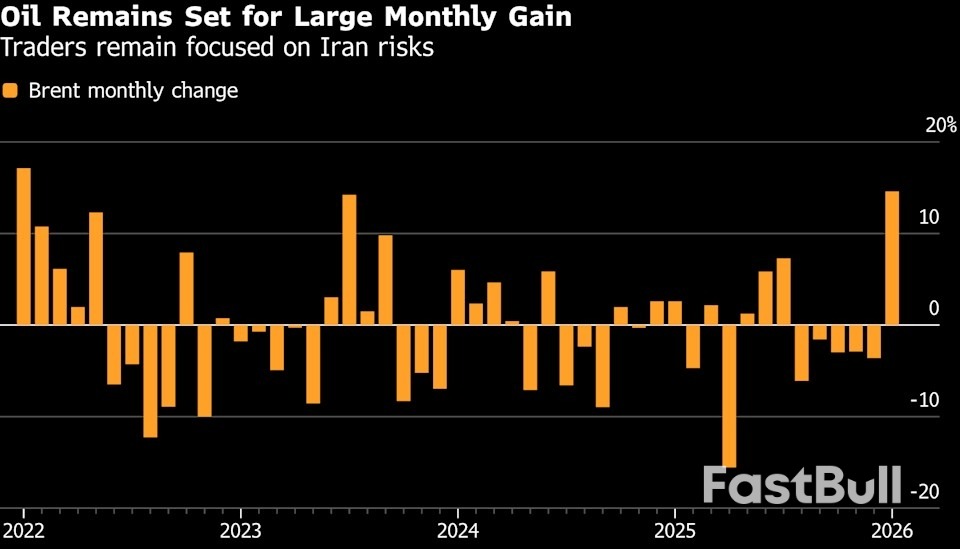

Brent crude futures settled at $70.69 a barrel, down a marginal 2 cents, or 0.03%. Meanwhile, U.S. West Texas Intermediate (WTI) crude ended the session at $65.21 a barrel, a decline of 21 cents, or 0.32%. Despite the small dip, both benchmarks are set for their largest monthly gains since 2022.

The primary driver for oil markets remains the tense situation involving Iran. "It's really all about Iran right now," said John Kilduff, a partner with Again Capital. "The market had priced in a lot of geopolitical risk on Iran, but it's difficult to quantify the market at this point."

Prices had surged to their highest levels since early August on Thursday after reports that U.S. President Donald Trump was considering actions against Iran, including targeted strikes, which heightened concerns over potential supply disruptions.

While both nations have since indicated a potential willingness to engage in dialogue, significant hurdles remain. Tehran stated Friday that its defense capabilities are not up for discussion. Adding to the pressure, the U.S. issued new sanctions targeting seven Iranian nationals and at least one entity as it reinforces its military presence in the Middle East.

Phil Flynn, a senior analyst with Price Futures Group, noted that the recent price gains have paused amid "prospects of a chilly ceasefire between Russia and Ukraine and the possibility that an attack on Iran might not occur."

Beyond the geopolitical arena, other factors are beginning to weigh on oil prices.

Dollar Strength Creates Headwinds

A stronger U.S. dollar, which rose from four-year lows, put some pressure on crude. The dollar gained strength after President Trump announced he would nominate former Federal Reserve Governor Kevin Warsh to lead the central bank once Jerome Powell's term concludes in May. A stronger dollar can curb demand for oil by making it more expensive for buyers using other currencies.

Global Supply Picture Shows Easing

Signs of increasing oil supply also contributed to the shift in market sentiment. Key developments include:

• Rising U.S. Production: American crude oil output is recovering following recent shutdowns.

• Kazakhstan Resumption: Production at the Tengiz oilfield is nearing a restart.

• Russian Maintenance: Russia's primary oil refining maintenance periods are expected this month and again in September.

"Given the week's bullish performance, it is reasonable to expect some profit-taking ahead of the weekend," said Tamas Varga, an analyst at PVM Oil Associates.

Looking ahead, market analysts are balancing the risk of supply disruptions against the prospect of oversupply. A Reuters poll of 32 analysts concluded that most expect oil prices to hold near the $60 per barrel mark for the year, reflecting this delicate equilibrium.

Germany’s inflation rate accelerated in January, challenging the European Central Bank’s decision to cut interest rates just one day prior.

Official data released Friday showed consumer prices in Germany rose by 2.1% last month, an increase from the 2.0% rate recorded in December. The figure surprised analysts who had anticipated that inflation would remain unchanged.

The timing of the data is critical. On Thursday, the ECB lowered its key interest rate by a quarter percentage point to 2.75%, marking the fifth consecutive reduction since June. Despite the cut, central bank officials described their policy as "restrictive" and suggested that further reductions could be on the table.

The slight uptick in German inflation, Europe's largest economy, comes as the broader eurozone demonstrates unexpected resilience. Inflation across the currency bloc has stabilized near the ECB's 2% target, and consumer surveys indicate expectations for prices to continue rising at a similar pace over the next year.

Economic growth in the final quarter of 2025 exceeded forecasts across major economies:

• Spain: 0.6% expansion

• France: 0.5% expansion

• Germany: 0.3% expansion

• Italy: 0.1% expansion

The overall eurozone economy grew by 0.3%, matching Germany's performance.

Despite the conflicting signals from inflation and growth, the market consensus points toward a period of policy stability. Most economists predict that the ECB will hold borrowing costs steady at their current level through at least the end of 2027. Previous speculation about a potential rate hike in 2026 has largely subsided.

This view is echoed by key policymakers. Joachim Nagel, President of Germany's Bundesbank, recently stated there is no immediate need to adjust interest rates, though he cautioned that long-term predictions are difficult.

The ECB's upcoming meetings will force officials to weigh the minor increase in German inflation against the region's recent economic strength, all while navigating ongoing concerns related to trade and the war in Ukraine.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up