Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Confidence among US homebuilders unexpectedly fell in January, as costly sales incentives outweighed a recent boost from lower mortgage rates and the president's housing proposals.

Confidence among US homebuilders unexpectedly fell in January, as costly sales incentives outweighed a recent boost from lower mortgage rates and the president's housing proposals.

An index of market conditions from the National Association of Home Builders and Wells Fargo decreased 2 points to 37 in January, its first decline since August. That fell short of the median estimate of economists surveyed by Bloomberg, who expected a reading of 40. A value below 50 means more builders see conditions as poor than good.

Builders' downbeat mood puts a damper on some momentum that grew in the housing market in recent weeks as mortgage rates slid to one of the lowest levels in years and home price growth slowed. Sales of previously owned homes in December reached their strongest pace in two years, and new-home sales also rose to 2023 levels in recent months.

Shares of homebuilders and related companies rose sharply earlier this month after President Donald Trump rolled out a flurry of policy proposals aimed at making housing more affordable. But NAHB said most of the survey responses were collected before last week's announcement that Fannie Mae and Freddie Mac would be buying $200 billion in mortgage-backed securities in an effort to bring down mortgage rates.

There were other challenges that contributed to the lower reading as well.

"Builders continue to face several issues that include labor and lot shortages as well as elevated regulatory and material costs," Robert Dietz, chief economist at the NAHB, said in a statement.

That was evident through the survey's gauge of sales expectations in the next six months, which slipped below the break-even level for the first time since September. Indexes of present sales and prospective buyer traffic have fallen short of that threshold for some time, and both continued to drop in January.

While Trump's ideas gave a "jolt" to industry stocks, builders' gross profits still are expected to decline in the first quarter, partly because of recent weakness in home prices, Alan Ratner, an analyst at Zelman and Associates, said in a Jan. 13 note.

Despite some improvement in affordability, prices are still high overall and mortgage rates remain double their 2021 levels. That has forced contractors to cut prices and offer costly sales incentives, often by buying down customers' mortgage rates.

Some 65% of builders reported using sales incentives in January, the 10th month in a row the metric has exceeded 60%, NAHB said. Meantime, 40% of builders reported cutting prices, unchanged from last month.

Across the US, builder sentiment fell in the South, the nation's biggest homebuilding region, as well as in the Midwest and West. Confidence picked up in the Northeast.

U.S. factory production unexpectedly rose in December, driven by a surge in primary metals that compensated for another decline at auto plants. However, the monthly gain masks a broader contraction for the manufacturing sector in the fourth quarter.

The Federal Reserve reported Friday that manufacturing output increased by 0.2% last month. This follows an upwardly revised 0.3% gain in November and defied economists' forecasts of a 0.2% decline.

Despite the positive monthly figure, factory production fell at a 0.7% annualized rate in the fourth quarter, a sharp reversal from the 2.8% growth pace seen in the third quarter. On a year-over-year basis, December production was up 2.0%.

The manufacturing sector, which makes up 10.1% of the U.S. economy, has been strained by import tariffs. While intended to boost domestic industry, the levies have created broad challenges. The sector shed 68,000 jobs in 2025. Economists have long cited structural issues, including worker shortages, as a barrier to a full manufacturing renaissance, though some anticipate an improvement driven by tax cuts.

The December data reveals a divided manufacturing landscape.

• Primary metals production jumped 2.4%.

• Electrical equipment, appliances, and components also saw significant increases.

• Aerospace and miscellaneous transportation output was also strong.

In contrast, the auto industry continued to struggle:

• Motor vehicle production fell 1.1%, marking its fourth consecutive monthly drop.

• Compared to the previous year, motor vehicle output was down 2.8% in December.

Beyond manufacturing, the Federal Reserve's report on overall industrial production showed mixed results across different sectors.

• Mining output declined by 0.7% after a 1.7% rebound in the prior month.

• Utilities production climbed 2.6% as cold weather boosted demand for heating.

Factoring in all sectors, total industrial production increased by 0.4% in December, matching November's gain. For the full fourth quarter, industrial output grew at a 0.7% rate, while the year-over-year increase for December stood at 2.0%.

The invasion of Chinese electric vehicles into North America is set to accelerate after Canadian Prime Minister Mark Carney agreed to roll back the triple-digit tariffs previously imposed on Chinese EVs. The move sharply diverges from President Trump's America First policy, which aims to revitalize the North American auto industry. While Chinese EVs remain effectively blocked from US import, there has been a noticeable increase in BYD Motor vehicles on highways in Mexico.

Canadian Prime Minister Mark Carney, who appears to have deep ties with Beijing, was the first prime minister to visit China since 2017 and is seeking a major thaw in relations after years of tense diplomatic and trade ties.

Carney's move abandons the 100% tariffs on Chinese EVs imposed by former Prime Minister Justin Trudeau in 2024, replacing them with a 6.1% rate capped at 49,000 Chinese EVs. In 2023, China exported 41,678 EVs to Canada. The shift in trade policy will certainly capture the Trump administration's attention.

"In order for Canada to build our own competitive EV sector, we need to learn from innovative partners, access their supply chains and increase local demand," Carney told reporters after talks with President Xi Jinping.

Carney may have given the wrong answer. Logically, if Canada wanted to build out an EV sector, it would turn to American expertise, such as Tesla, Rivian, Lucid, or even legacy Detroit automakers. Instead, that does not appear to be the case, raising questions about where Carney's allegiance truly lies, whether with the East or the West.

A recent report via The Bureau's Sam Cooper only suggests Carney's allegiance points towards Beijing...

He added that recent trade friction forced Beijing to slap 100% duties on Canadian canola oil - also known as rapeseed oil - as well as other ag products, with 25% on pork and seafood.

"China used to be the largest market for Canadian canola seed," Carney said. "We want to not just return to those levels, but to surpass them."

It appears Carney has not learned the lesson from Europe, where flooding the market with Chinese EVs helped decimate automakers across the continent.

Iran emerged as a key military supplier for Russia following the 2022 full-scale invasion of Ukraine, but experts now suggest this critical support has peaked and is no longer central to Moscow's war effort.

While Tehran officially denies supplying any military equipment, a Western security official cited by Bloomberg reported that Iranian missile sales to Russia have reached $2.7 billion since October 2021. Despite this, the evidence indicates Russia's reliance on Iranian hardware is diminishing as it boosts domestic production and leans on other partners.

"So long as conflict persists between the parties, Iran will abstain from rendering any form of military assistance to either side," Iran's permanent mission to the United Nations stated in May. However, the widespread use of Iranian Shahed drones early in the war tells a different story.

The dynamic of military transfers has shifted dramatically, particularly concerning unmanned aerial vehicles.

"I think we've long passed the peak of Iranian defense transfers to Russia," Hanna Notte, Eurasia program chief at the James Martin Center for Nonproliferation Studies, told RFE/RL. She noted that while some newer drone designs were still being sent from Iran as of last year, the high point of dependency is over.

Analyst Ruslan Suleymanov of the New Eurasian Strategies Center agrees. "Russia is no longer as dependent on Iranian weapons as it was four years ago," he explained.

The well-known Shahed drones are now produced inside Russia under the name "Geran." Thanks to technology and training provided by Iran, a plant in Alabuga, Tatarstan, is now mass-producing these systems. According to Suleymanov, about 90% of the drone's production cycle is now located entirely in Russia.

Ukrainian intelligence estimates that Russia now manufactures around 5,000 long-range drones of various types each month. This includes the Geran strike drone and the warhead-free Gerbera, which is used as a decoy to overwhelm Ukrainian air defenses.

Iran's support has also included missiles. In April, General Christopher Cavoli, then head of US Central Command, informed the US Senate Armed Services committee that Iran had donated over 400 short-range ballistic missiles and hundreds of thousands of artillery shells to Russia.

Reports in May from Reuters suggested Iran would also supply Fath-360 missile launchers, a claim Tehran denied. This followed a September 2024 statement from Pentagon spokesman Pat Ryder confirming that Fath 360 missiles had already been delivered.

These transfers triggered a response from the West. In October 2024, the United States sanctioned two Russian shipping companies for moving drone equipment and munitions across the Caspian Sea. The European Union followed by sanctioning three Iranian airlines and two procurement firms.

Despite these confirmed deliveries, there have been no public reports of Fath 360 missiles being used in Ukraine. Notte suggests two possibilities: either the launchers were never delivered, or Russia simply didn't need them. Moscow has significantly increased its domestic missile production and has also been receiving deliveries from North Korea. A report from the London-based think tank RUSI noted that Russia's Defense Ministry planned to produce approximately 750 ballistic and 560 cruise missiles in 2025.

"The Russians may just simply not have needed to use these Iranian missiles," Notte said.

Iran has also been a major source of conventional ammunition. A 2023 investigation by The Wall Street Journal estimated that Iran had shipped 300,000 artillery shells and about one million rounds of ammunition to Russia. Ukrainian drone strikes on the Caspian port of Olya in 2025 suggested these military supply lines remained active.

However, North Korea has since stepped in as a far larger supplier. A report by the Kyiv School of Economics detailed how North Korean supplies now account for 58% of Russia's explosives imports.

According to Notte, North Korean shells and bullets have eclipsed Iranian contributions in sheer scale. "The Ukrainians estimated last year that 50 percent of all the ammunition that Russia used in Ukraine was DPRK (North Korea)," she said. "My sense here is that once the DPRK came in as a major defense supply to Russia, there was just probably not a need to get Iranian ammunition."

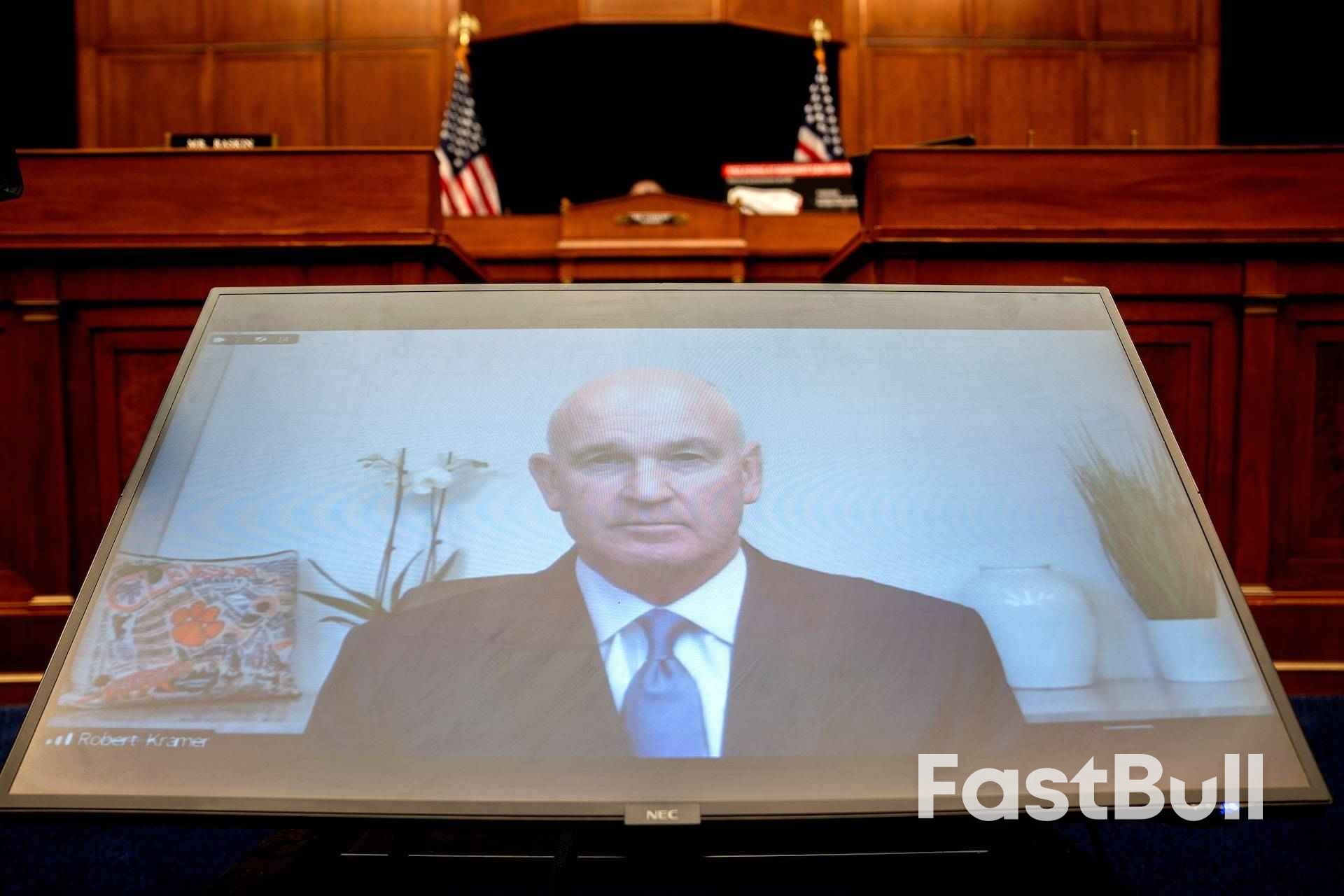

A former chief executive of Emergent BioSolutions (EBS.N) was charged on Thursday with insider trading by New York Attorney General Letitia James for allegedly selling the contract drug manufacturer's stock while knowing about contamination problems at a Baltimore plant that made COVID-19 vaccines.

Robert Kramer was accused in the civil lawsuit of violating the Martin Act, a powerful state securities law, by generating $10.12 million of illegal profit under a so-called 10b5-1 stock trading plan he set up shortly after learning in October 2020 about tainted batches of AstraZeneca (AZN.L) vaccines at Emergent's plant.

The sales ended shortly before Emergent's share price began declining as concerns mounted about the plant, where vaccine production was halted in April 2021 because of contamination.

Emergent, based in Gaithersburg, Maryland, agreed to pay a $900,000 civil fine for approving Kramer's trading plan, and will tighten its insider trading policy.

"The lawsuit against Mr. Kramer is baseless and an overreach," his lawyer Kirby Behre said in an email. "Mr. Kramer followed company procedures and federal rules regarding 10b5-1 plans, (and) is confident that the facts will show that this suit should never have been brought."

Emergent said it has "taken significant action to improve transparency and integrity" throughout its operations.

Named for a U.S. Securities and Exchange Commission rule, 10b5-1 plans let insiders at public companies sell shares at predetermined times to shield against accusations their sales might be timed to negative corporate news.

James said Kramer's sales ended on February 8, 2021, shortly before analysts publicly questioned the Baltimore plant's slow vaccine production.

Johnson & Johnson's (JNJ.N) COVID-19 vaccine was also produced at the plant, and the U.S. Food and Drug Administration halted production on April 16, 2021, after learning that the vaccine had been contaminated by ingredients from AstraZeneca's vaccine.

Emergent eventually destroyed tens of millions of vaccine doses.

"Corporate executives who use insider information to illegally trade company stocks and make a profit betray the public's trust," James said in a statement. "Kramer's actions were illegal and unethical."

Kramer retired from Emergent in June 2023.

James filed her complaint in a New York state court in Manhattan. Emergent's share price has fallen about 90% since Kramer completed his stock sales.

Venezuelan opposition leader Maria Corina Machado met with U.S. President Donald Trump at the White House on Thursday, presenting him with her Nobel Peace Prize medal in a strategic bid to shape his administration's policy on her country's future.

A White House official confirmed that President Trump plans to keep the medal. In a social media post following the meeting, Trump wrote, "Maria presented me with her Nobel Peace Prize for the work I have done. Such a wonderful gesture of mutual respect. Thank you Maria!"

Machado described the meeting as "excellent," framing the gift as recognition for the president's commitment to the freedom of the Venezuelan people.

The White House later released a photo of the two leaders holding a large, gold-colored frame displaying the medal. An accompanying text read, "To President Donald J. Trump In Gratitude for Your Extraordinary Leadership in Promoting Peace through Strength," calling the gesture a "Personal Symbol of Gratitude on behalf of the Venezuelan People."

The gesture comes after Trump had previously complained about being snubbed for the prize, which Machado won last month. Despite the handover of the physical medal, the Norwegian Nobel Institute has stated that the honor itself cannot be transferred, shared, or revoked. When asked by Reuters on Wednesday if he wanted Machado to give him the prize, Trump replied, "No, I didn't say that. She won the Nobel Peace Prize."

This lunch meeting, lasting just over an hour, was the first time the two have met in person.

Machado's efforts to sway the president face significant headwinds. Trump has previously dismissed the idea of installing her as Venezuela's leader to replace the deposed Nicolas Maduro. According to White House press secretary Karoline Leavitt, Trump stood by his "realistic" assessment that Machado currently lacks the necessary support to lead the country.

The president's primary stated goals for Venezuela are securing U.S. access to the nation's vast oil reserves and overseeing its economic reconstruction.

In a striking contrast to his meeting with Machado, Trump has repeatedly praised Venezuela's interim President Delcy Rodriguez, who took power after Maduro's capture. In a Reuters interview on Wednesday, Trump said of Rodriguez, "She's been very good to deal with."

After her White House visit, Machado met with over a dozen Republican and Democratic senators on Capitol Hill, where she has found a more receptive audience. Machado, who fled Venezuela in a seaborne escape in December, is competing for influence against members of the current Venezuelan government.

The capture of Maduro by the United States earlier this month sparked hopes among opposition figures and international observers for a democratic transition in Venezuela.

However, some lawmakers remain wary. Democratic Senator Chris Murphy noted that Machado told senators that repression in Venezuela has not changed since Maduro's removal. He expressed concern that Rodriguez is a "smooth operator" who is becoming more entrenched daily due to Trump's support. "I hope elections happen, but I'm skeptical," Murphy said.

The political situation remains complex. While Rodriguez's government has recently freed dozens of political prisoners, advocacy groups argue the scale of these releases has been exaggerated. In a recent address, Rodriguez called for diplomacy with the U.S. and announced plans for oil industry reforms aimed at attracting foreign investment.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up