Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone ZEW Economic Sentiment Index (Jan)

Euro Zone ZEW Economic Sentiment Index (Jan)A:--

F: --

P: --

Euro Zone Construction Output YoY (Nov)

Euro Zone Construction Output YoY (Nov)A:--

F: --

P: --

Euro Zone Construction Output MoM (SA) (Nov)

Euro Zone Construction Output MoM (SA) (Nov)A:--

F: --

Argentina Trade Balance (Dec)

Argentina Trade Balance (Dec)A:--

F: --

P: --

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)--

F: --

P: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Jan)

U.S. Kansas Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Jan)

U.S. Kansas Fed Manufacturing Production Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Global markets steadied ahead of President Trump’s Davos speech, with U.S. futures rising and gold hitting a record above $4,800 as investors sought safety amid tariff tensions and geopolitical uncertainty.

Formal negotiations to finalize a landmark trade deal between the United States and Switzerland are scheduled to begin in Bern in the first half of February. According to sources familiar with the matter, the talks aim to lock in a preliminary agreement that would slash US tariffs on Swiss goods from 39% to 15%, the highest rate among advanced economies.

A delegation from the US Trade Representative's office will travel to the Swiss capital for the first formal round of discussions on a legally binding accord. This visit is a significant development, as previous talks for the framework deal announced in November were conducted solely by Swiss delegations traveling to Washington. Insiders suggest this shift makes the process feel less one-sided.

Negotiators on both sides are reportedly aiming to complete the final agreement by the end of March. This timeline is crucial, as the US has threatened to reconsider its concessions if no final deal is reached by then, according to a note in the Federal Register.

The negotiations appear to have strong political backing. Speaking in Davos on Wednesday, US Treasury Secretary Scott Bessent confirmed he was meeting with Switzerland's President, Guy Parmelin, later that day and described the relationship between the two nations as "very good."

Bessent praised Parmelin as a "fantastic advocate" for his people. "I think with his leadership that we will be able to land a trade deal that is fair for the American people and ensures continued prosperity in Switzerland," he stated.

Official channels have remained quiet on the upcoming talks. A spokesperson for the Swiss economy ministry declined to comment, while the USTR could not be immediately reached outside of office hours.

The proposed agreement is built on a clear set of trade-offs. In exchange for the substantial reduction in US tariffs, Switzerland has committed to two key concessions:

• A $200 billion investment pledge from Swiss companies.

• Easier market access for certain American agricultural goods, including fish, seafood, and some meats.

The tariff relief has already taken effect retroactively from the date of the initial deal, but its permanence is contingent on successfully finalizing the accord in the coming weeks.

The United States has sharply criticized a French proposal for a NATO-led military exercise in Greenland, escalating a diplomatic feud over President Donald Trump's ambitions to take control of the territory.

Speaking Wednesday at the World Economic Forum in Davos, Treasury Secretary Scott Bessent warned European nations against sending troops to the island. "If this is all President Macron has to do when the... French budget is in shambles, I would suggest that he focuses on other things for the French people," Bessent told reporters.

The French suggestion came after eight European allies participated in a Danish-led planning exercise in Greenland. French President Emmanuel Macron argued that the entire NATO alliance should organize a drill on the island, which is a semi-autonomous territory of Denmark. Bessent questioned the message behind these military moves just before Trump was scheduled to arrive in Davos.

Tensions are running high as global leaders brace for a potential clash between Trump and European allies. The conflict centers on Trump's demands that Denmark relinquish Greenland to the United States.

The US president has intensified his campaign to acquire the island, threatening to impose tariffs on eight NATO allies who oppose his plans. Underscoring his intentions, Trump posted an AI-generated image on Tuesday showing him planting a US flag on Greenland's landscape.

In response, European leaders are reportedly considering economic countermeasures if the tariffs are implemented on February 1. The European Parliament has already signaled it may delay the ratification of a major EU-US trade deal over the crisis. However, Bessent forcefully dismissed the possibility of significant European retaliation, urging nations to honor their existing trade agreements with the US.

Amid the standoff, some leaders are searching for a diplomatic off-ramp. NATO Secretary General Mark Rutte is reportedly working behind the scenes to diffuse the tension.

Finnish President Alexander Stubb called for a dedicated NATO summit to address Arctic security, suggesting the intent behind the military exercises had been misunderstood. "Now what we need to do is to bring down the temperature," Stubb told Bloomberg. "I wish we could have a NATO summit where we all agree on a new Arctic security structure."

Interest in Arctic security has grown within NATO, particularly since Finland and Sweden joined the alliance following Russia's invasion of Ukraine.

Denmark has stated that its military exercises were intended to address US security concerns and had invited American participation. The country is also drafting plans for a larger deployment of up to 1,000 Army soldiers to Greenland for exercises in 2026, with potential support from its Navy and Air Force, according to Danish broadcaster TV2. A final decision on the scale has not yet been made.

Meanwhile, Greenland's Prime Minister Jens-Frederik Nielsen advised the territory's population and authorities to begin preparing for a possible military invasion, while acknowledging it remains an unlikely scenario.

Greenland has a population of 57,000 and is part of the Kingdom of Denmark. It maintains its own government for most domestic affairs, while Denmark manages its defense and foreign policy.

Remarks of Officials

Commodity

Middle East Situation

Data Interpretation

Daily News

Traders' Opinions

Political

Economic

Energy

Oil prices declined on Wednesday as market focus shifted to an anticipated increase in U.S. crude stockpiles, outweighing the impact of a major production halt in Kazakhstan and persistent geopolitical tensions.

Brent futures fell by 97 cents, or 1.5%, to trade at $63.95 a barrel by 0745 GMT. At the same time, U.S. West Texas Intermediate (WTI) crude lost 78 cents, or 1.3%, to hit $59.58 a barrel.

The drop reverses gains from the previous session, where both contracts closed nearly $1 higher. Those earlier gains were driven by strong economic data from China and news of the production outage in Kazakhstan.

Output at the major Tengiz and Korolev oilfields, operated by OPEC+ producer Kazakhstan, was halted on Sunday due to issues with power distribution. According to industry sources, production could remain offline for another seven to ten days.

However, market analysts see this disruption as a short-term issue. IG market analyst Tony Sycamore noted on Wednesday that the production halt is temporary. He argued that persistent downward pressure from rising U.S. inventories and other geopolitical factors would likely dominate market sentiment.

The primary driver for the current price drop is the expectation of growing crude oil stockpiles in the United States.

A preliminary Reuters poll of six analysts on Tuesday indicated that U.S. crude inventories likely rose by an average of 1.7 million barrels in the week ending January 16. The poll also suggested that gasoline stockpiles increased, while distillate inventories probably fell.

Traders are now awaiting official data to confirm the trend:

• The American Petroleum Institute (API) will release its weekly inventory data at 4:30 p.m. EST (2130 GMT) on Wednesday.

• The U.S. Energy Information Administration (EIA) will publish its official figures at 12:00 p.m. EST (1700 GMT) on Thursday.

Both reports are being released one day later than usual due to a U.S. federal holiday on Monday.

Adding to market concerns are ongoing geopolitical tensions. U.S. President Donald Trump's threat of new tariffs on European nations—tied to his goal of gaining control over Greenland—is weighing on oil markets by risking a slowdown in economic growth. Trump stated on Tuesday there was "no going back" on this objective.

However, other conflicts could still push prices higher. Gregory Brew, a senior analyst with Eurasia Group, said that the potential for U.S.-Iran tensions to re-escalate would help support oil prices. Trump recently threatened to strike Iran following its crackdown on anti-government protests.

Tensions flared after Iran's national security parliamentary commission was quoted on Tuesday stating that any attack on Supreme Leader Ayatollah Ali Khamenei would trigger a declaration of jihad.

"While the U.S. demurred from striking Iran immediately, tensions are likely to remain high as additional U.S. military assets move to the Middle East and diplomacy to de-escalate tensions fails to make progress," Brew commented in a note.

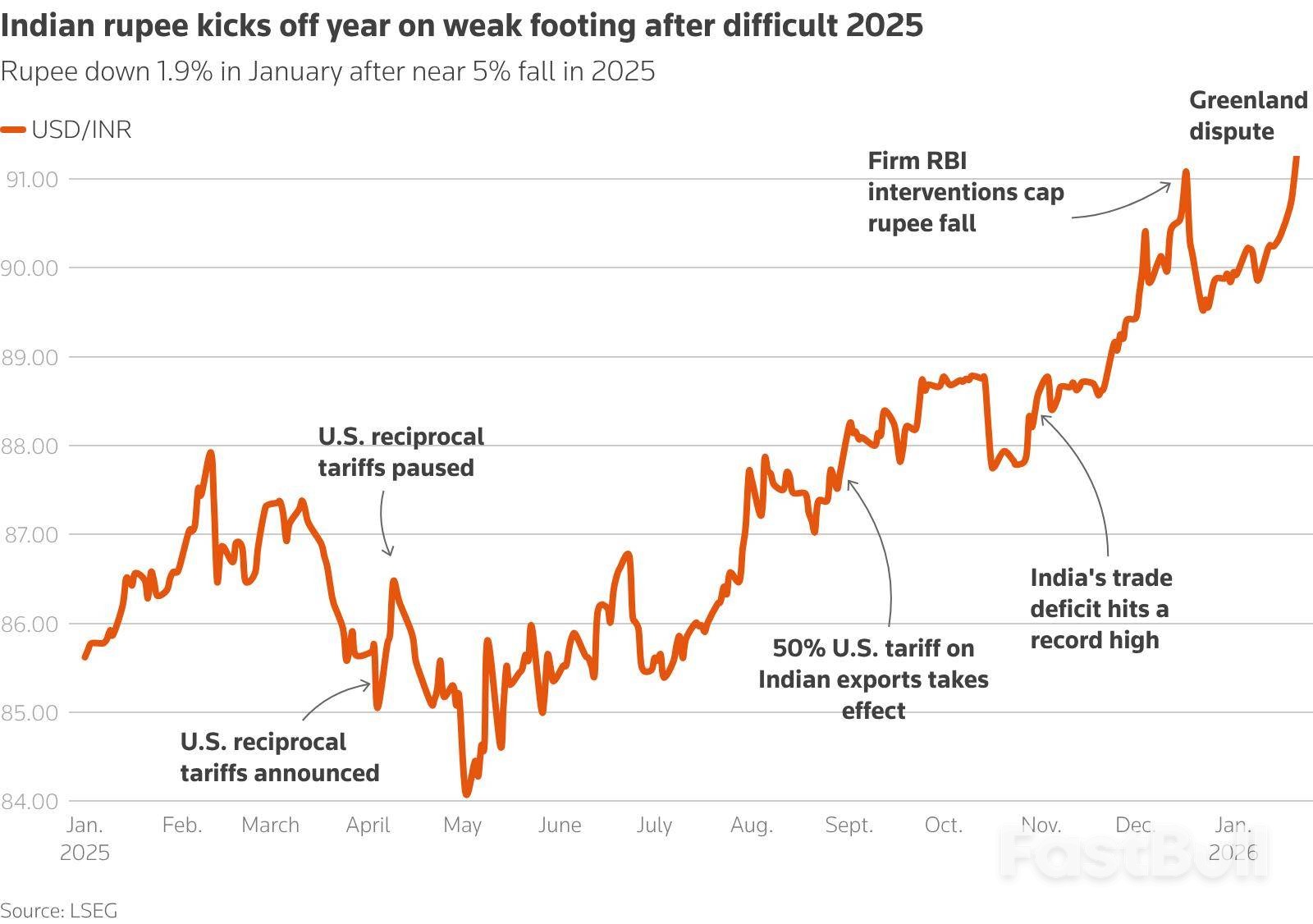

The Indian rupee tumbled to a record low on Wednesday, marking its most significant single-day drop in two months amid a global bond sell-off and rising investor anxiety over capital outflows.

The currency fell for the sixth consecutive session, hitting an unprecedented 91.7425 against the U.S. dollar. It ultimately closed at 91.6950, a 0.8% decline from the previous day's 90.9750.

Market traders noted that the fall was amplified by the Reserve Bank of India’s decision to refrain from intervening with dollar sales. As the worst-performing currency in Asia for the day, the rupee has already weakened by 2% this month, extending the approximately 5% decline it registered in 2025.

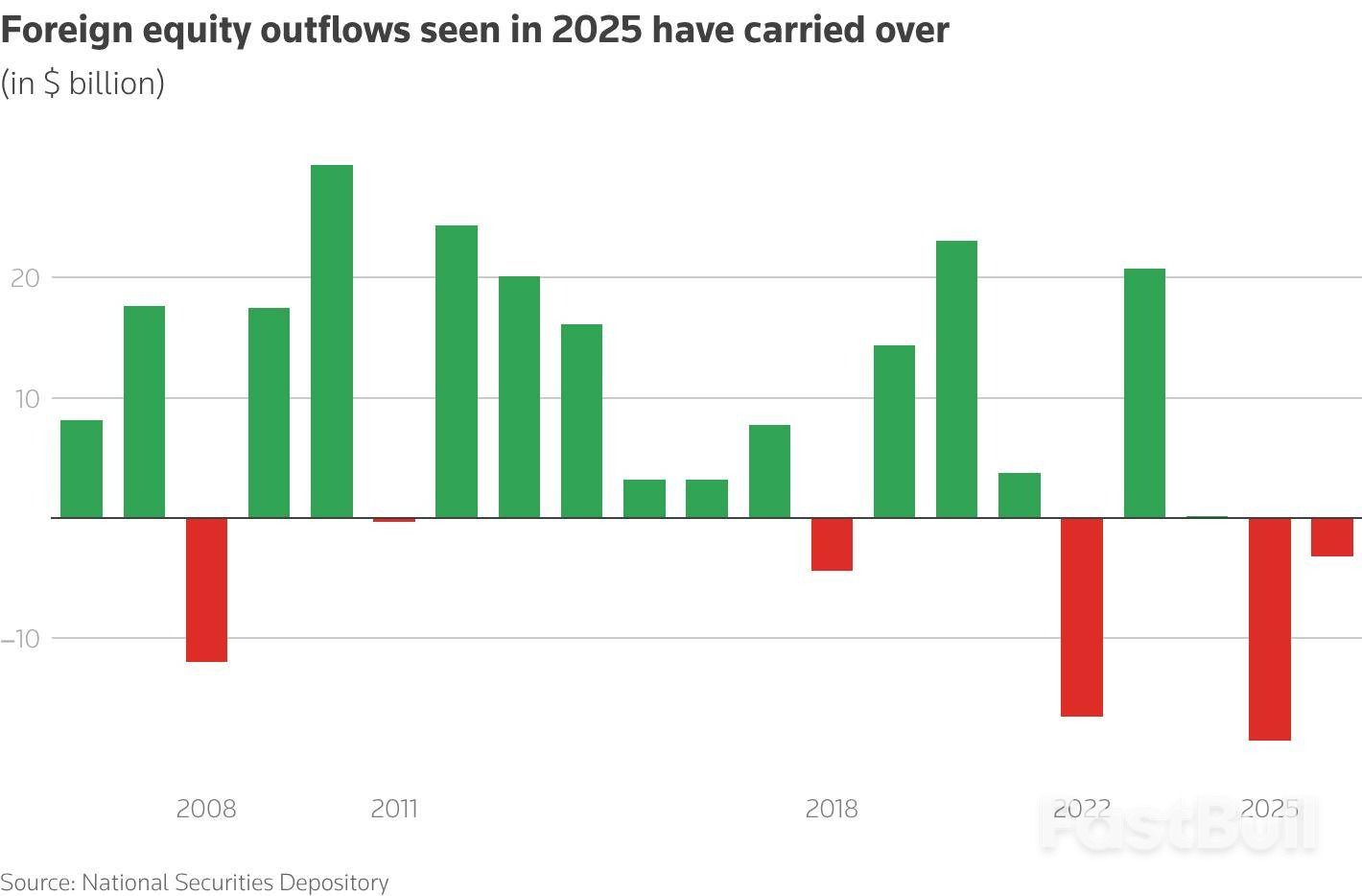

Many of the headwinds that pressured the rupee in 2025 have carried over into the new year. A key factor is the continued exit of foreign capital from Indian equities.

Foreign investors have already pulled around $3 billion from Indian shares in January, following record outflows of nearly $19 billion in 2025. This trend has put pressure on the domestic stock market, which fell 0.3% on Wednesday after its largest drop in over eight months the day before.

"Flows mainly drive the USD/INR pair, thus weakness may continue to persist with interim legs of intervention expected from RBI in case of excess volatility," said Kunal Sodhani, head of treasury at Shinhan Bank India.

Analysts point out that while India’s current-account deficit is manageable, a lack of sufficient capital inflows leaves the currency vulnerable. This situation is worsened by importers, who are more inclined to hedge their dollar exposure than exporters are, anticipating further rupee depreciation.

According to India Forex Advisors, the currency will remain sensitive to shifts in corporate demand and portfolio flows. An increase in global risk aversion, fueled by factors like a global bond rout and U.S. threats regarding Greenland, would likely accelerate outflows and intensify the downward pressure.

Adding to the currency's challenges this year are several external factors:

• Regional Weakness: Unlike in 2025, most of the rupee's Asian peers are also experiencing weakness, removing a potential source of relative stability.

• Trade Deal Stalemate: A lack of progress on a trade agreement with the United States has deprived the rupee of a potential catalyst for inflows.

With multiple pressures mounting, investors are now closely watching for U.S. President Trump's upcoming speech in Davos for further direction.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up