Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

UK warned: government timidity risks squandering nascent economic recovery; bold reforms are urged.

A new report from a leading think tank is calling on the UK government to end its policy indecisiveness and pursue bold reforms to capitalize on early signs of economic improvement.

The Resolution Foundation argues that without decisive action on trade, housing, and employment, Britain risks squandering an opportunity to reverse years of stagnation.

According to the report, the first 18 months of Prime Minister Keir Starmer's government have been characterized by policy U-turns, tentative tax proposals, and general timidity. While Starmer and finance minister Rachel Reeves have promised to accelerate the economy, significant changes have yet to materialize, with many planned reforms being dropped or significantly weakened.

"With signs that productivity may be turning a corner, the government must capitalise by ramping up its plans," said Greg Thwaites, research director at the Resolution Foundation.

The think tank outlines a clear path to boosting the economy. It recommends three key policy shifts:

• Planning Reform: Implement changes to help cities meet their housing construction targets.

• EU Alignment: Deepen regulatory alignment with the European Union.

• Labor Force Expansion: Create policies to bring more young and older people into the workforce.

Successfully implementing these measures could increase household incomes by an average of £2,000 ($2,680) a year. The resulting economic growth would also generate enough tax revenue to fund a 25% increase in spending on the public health service.

The call for action comes against a backdrop of long-term economic struggle. The UK economy has largely stagnated in the nearly two decades since the global financial crisis. Since the pandemic, GDP per person has fallen further behind other major European nations.

Recent shocks from COVID, high energy prices, and Brexit have all contributed to a drop in productivity growth. The Resolution Foundation report also noted growing evidence that the economic damage from Brexit could be nearly double the 4% impact officially assumed by budget forecasters.

Despite the challenges, the report identifies a reason for optimism. After adjusting official data using payroll figures, productivity was found to have jumped by 3.1% in the year leading up to the third quarter of 2025.

This uptick presents a crucial opportunity for the government to act decisively and build a foundation for sustained economic growth.

According to an analysis from HSBC, the Korean won's depreciation last year provided an unexpected boost to the nation's economy by strengthening export competitiveness. The bank's economists outlined this view in a virtual press conference for the HSBC Asian Outlook 2026 on Monday.

"We do not believe that the weak won itself was a challenge for Korea's economic performance — rather, it likely supported it over the past year," stated Frederic Neumann, HSBC's Chief Asia Economist.

Neumann explained that the won's weakness was a key factor in helping Korean exporters maintain a competitive edge on the global stage. This effect was amplified as global commodity prices, especially for oil, stabilized, which in turn eased inflationary pressures.

Despite challenging conditions like tariff frictions with the United States, this competitive advantage helped Korea’s exports surpass the $700 billion mark for the first time in 2025.

However, the currency's slide has created a difficult situation for monetary policy. Neumann warned that concerns over a persistently weak won could prevent the Bank of Korea (BOK) from implementing interest rate cuts. Such cuts would provide monetary easing to help sustain economic growth.

Reflecting these concerns, the BOK has held its key policy rate steady for five consecutive meetings. This has led some market observers to speculate that the central bank's easing cycle has effectively concluded.

Looking ahead, HSBC analysts see the Korean won as one of the few currencies in the region positioned for a potential rebound in 2026 after its significant depreciation last year. The Korean won was among the worst-performing currencies in Asia in 2025, with its real effective exchange rate hitting a 16-year low in October, according to data from the Bank for International Settlements.

Foreign exchange authorities have identified rising capital outflows from overseas investments as a primary cause. In response, the government has announced several measures aimed at stemming these outflows and encouraging capital to return to the domestic market. These plans include:

• Offering tax incentives on capital gains from foreign stock sales, on the condition that the proceeds are reinvested in the domestic stock market for at least one year.

• Considering the introduction of leveraged exchange-traded funds (ETFs) that track specific domestic stock indices at three times the rate.

How Capital Flows Could Trigger a Won Recovery

Joey Chew, head of Asia FX research at HSBC, detailed the mechanics of a potential recovery. She noted that when investors sell U.S. stocks and convert the funds back into Korean won to purchase local equities, there is a direct impact on the foreign exchange market.

Beyond this, government incentives could create a broader shift in behavior. More exporters might be encouraged to sell their dollar holdings, while foreign investors could be attracted to Korean assets, reinforcing the trend already started by domestic retail investors.

"This could create a rolling effect and really help the Korean won recover from its excessive weakness last year," Chew explained. "At this moment, we still need to see the proper implementation of the measures. Assuming a lot of these measures do get passed, our view is a modest recovery in the Korean won in the first few months of this year."

Indonesian President Prabowo Subianto has put forward his nephew for a position on the central bank's board of governors, a move that is intensifying concerns over the institution's independence. Two sources familiar with the matter confirmed the nomination to Reuters.

The decision comes as investors watch for signs that Bank Indonesia (BI) might face pressure to support the government's ambitious economic agenda. President Prabowo is targeting 8% annual economic growth by 2029, a steep increase from the current rate of around 5%.

Fears about monetary policy independence had already been stoked after BI entered a "burden-sharing" agreement last year to help finance some government programs.

The nominee is Thomas Djiwandono, a current deputy finance minister and former businessman. According to the sources, who requested anonymity, Djiwandono will soon undergo a "fit-and-proper" test in Parliament to secure the new role.

If approved, the US-educated Djiwandono would replace current BI board member Juda Agung. Djiwandono previously attended at least one of the central bank's monetary policy reviews as a representative for the finance minister, though he did not hold any voting rights at the time.

Requests for comment from Djiwandono, Agung, a BI spokesperson, and the head of the parliamentary panel overseeing the assessment went unanswered. A spokesperson for President Prabowo declined to comment.

Each member of Bank Indonesia's board, which includes a governor and several deputy governors, has an equal vote in setting the country's key interest rates and shaping monetary policy. Board members are typically appointed from a pool of career central bankers, economists, or former commercial bank executives, gaining their posts through presidential appointment and parliamentary approval.

The nomination adds a new dimension to ongoing discussions in Parliament about a bill designed to strengthen the central bank's mandate in supporting national economic growth.

The news was also reported by domestic outlet IDNFinancials, which cited a source suggesting Djiwandono could assume the post as early as February, pending any last-minute developments. Meanwhile, Bank Indonesia is scheduled to conduct its next monthly monetary policy review this week.

Gold and silver prices surged to new peaks on Monday as investors flocked to safe-haven assets. The rally was triggered by U.S. President Donald Trump's threat to impose new tariffs on European countries in a dispute over the control of Greenland.

This escalation in geopolitical tension has sent shockwaves through global markets, prompting a broad move away from risk and into traditional stores of value.

The price action in precious metals was sharp and decisive. Spot gold climbed 1.6% to $4,666.11 as of 0551 GMT after setting an all-time high of $4,689.39. U.S. gold futures for February delivery also saw strong gains, advancing 1.7% to $4,671.90 per ounce.

Silver was not far behind, with spot prices rising 3.6% to $93.15 per ounce after reaching a record high of $94.08.

The market's anxiety stems from President Trump's declaration on Saturday. He vowed to implement escalating tariffs on European allies until the United States is permitted to purchase Greenland, a vast Arctic island territory of Denmark.

In response, European Union ambassadors have begun preparing retaliatory measures in case the U.S. duties are enacted, according to EU diplomats.

"Geopolitical tensions have given gold bulls yet another reason to push the yellow metal to new highs," said Matt Simpson, a senior analyst at StoneX. "With Trump throwing tariffs into the mix, it is clear that his threat to Greenland is real, and that we could be one step closer to the end of NATO and political imbalances within Europe."

The fallout from the tariff threats extended beyond precious metals. U.S. stock futures and the dollar slid as investors' appetite for risk diminished.

This risk-averse sentiment fueled demand for other safe-haven assets, including the Japanese yen and the Swiss franc, indicating a widespread flight to safety across financial markets.

While both metals rallied, analysts are closely watching their relative performance. Christopher Wong, a strategist at OCBC, noted that silver's medium-term outlook remains constructive, citing persistent physical deficits and strong industrial and safe-haven demand.

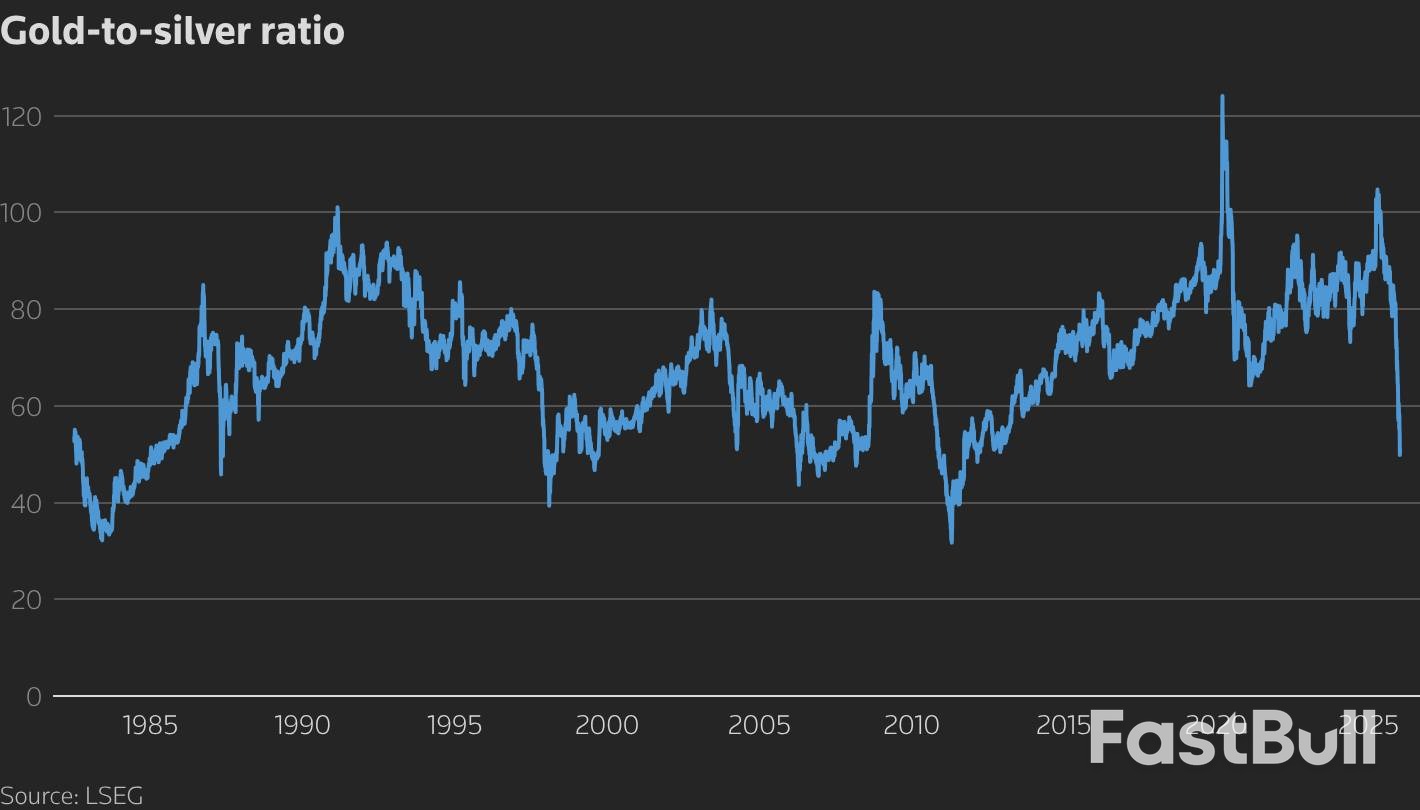

However, Wong also advised "near-term tactical caution" due to the rapid pace of silver's recent gains. He pointed out that the gold-silver ratio has fallen sharply from highs near 105 in late 2025 to the low-50s, a clear signal of silver's outsized performance compared to gold.

Analysts at J.P. Morgan expressed a stronger preference for gold over silver. They believe gold possesses a "cleaner, bullish structural story." While acknowledging that a disruptive correction in silver could temporarily affect gold, they would view any resulting dip in gold's price as a buying opportunity.

Other metals in the complex posted more modest gains.

• Spot platinum added 0.6% to trade at $2,341.08 per ounce.

• Palladium rose 0.1% to $1,801.87.

China's mostly coal-based thermal power generation fell in 2025 for the first time in 10 years, government data showed on Monday, as growing renewable generation met growth in electricity demand even as overall power usage hit a record.

The data is a positive signal for the decarbonisation of China's power sector as China sets a course for carbon emissions to peak by 2030. Still, coal output edged up to a record high last year.

Thermal electricity, generated mostly by coal-fired capacity with a small amount from natural gas, fell 1% in 2025 to 6.29 trillion kilowatt-hours (kWh), according to the National Bureau of Statistics (NBS).

It fell more sharply in December, down by 3.2%, from a year earlier, the data showed.

The data reflects output from industrial enterprises with annual revenue of more than 20 million yuan ($2.87 million).

The National Energy Administration announced on Saturday that China's electricity consumption had climbed 5% to a record high, surpassing 10 trillion kWh for the first time.

That was more than the combined consumption of the European Union, Russia, India and Japan in 2024, driven by rapid consumption growth in internet and related services and EV manufacturing.

The NEA statistics offer a fuller picture of power use than the NBS data, which omits some smaller-scale renewables generation, particularly from solar. The NBS statistics showed power generation reached 9.72 trillion kWh last year, up 2.2% compared with 2024.

Hydropower grew at a steady pace, up 4.1% in December and rising 2.8 % for the full year, the NBS data showed. Nuclear power output rose 3.1 in December and 7.7% in 2025, respectively.

Thermal power generation is unlikely to accelerate in 2026 as renewables growth continues apace.

"This trend towards a structural shift in power generation is difficult to reverse," said Feng Dongbin, vice general manager at Fenwei Digital Information Technology, which operates Chinese coal analytics platform Sxcoal.

A lawyer filed an impeachment complaint against Philippine President Ferdinand Marcos Jr on Monday, accusing him of betraying public trust by allowing his predecessor Rodrigo Duterte to be arrested and taken to The Hague to face trial.

The complaint, filed by Andre De Jesus, described the move against Duterte as an act of "kidnapping," echoing the narrative of the former president's family.

Duterte, president from 2016 to 2022, was arrested and taken to the International Criminal Court in the Hague in March over the thousands of killings that took place during his controversial war on drugs.

The complaint also accuses Marcos of constitutional violations over budget irregularities, failing to act against alleged graft involving flood control projects, and failing to answer allegations of drug use that have raised questions about his fitness to govern.

"We feel that this avenue would enable not just myself as complainant ... but the Filipino people to thrash out all these matters which are being raised and are not answered at all by the president and his cabinet and his officers," De Jesus told reporters in comments posted on X by DZRH radio.

Marcos' office did not immediately respond to a request for comment.

The filing comes nearly a year after the lower house impeached Sara Duterte, Marcos' estranged Vice President and the daughter of his predecessor.

The impeachment was later struck down by the Supreme Court for breaching the Constitution's one‑year bar rule.

Although the lower house of Congress is no longer led by Marcos' cousin, Martin Romualdez, who resigned as House Speaker after being linked to the flood control corruption scandal, it remains dominated by the president's allies, raising doubts about whether the complaint against him can gain traction.

Marcos, elected in 2022, is serving a single six‑year term and is barred by the Constitution from seeking re‑election in 2028, leaving him with about two years remaining in office.

His vice president Sara Duterte is widely viewed as a strong contender for the 2028 presidential race.

Japan's opposition Democratic Party for the People (DPP) is set to propose a sweeping economic platform featuring massive new spending on education and a significant cut to the national consumption tax. The proposals, detailed in a draft campaign document, emerge as Prime Minister Sanae Takaichi is widely expected to call a snap election in February.

The DPP's platform centers on two key initiatives designed to boost household finances and long-term growth.

Doubling Down on Education and Research

The party plans to issue five trillion yen ($32 billion) in "education bonds" every year. The goal is to use this capital to double Japan's total spending on childcare, education, and scientific research, addressing key areas of investment for the country's future.

A Conditional Consumption Tax Cut

Alongside the spending push, the DPP is proposing a temporary but substantial tax cut. The plan would slash the national consumption tax from its current 10% rate down to 5%. This relief measure would remain in effect until a specific economic condition is met: when the pace of wage increases surpasses the rate of inflation by a margin of 2%.

To finance its ambitious spending measures, the DPP has identified several large pools of capital. The party suggests Japan should utilize investment proceeds from three main sources:

• Currency Intervention Reserves: 180 trillion yen

• Pension Reserves: 280 trillion yen

• Bank of Japan ETFs: 90 trillion yen in exchange-traded funds held by the central bank

The DPP's platform is being rolled out at a critical political moment. The party currently holds the third-largest number of seats among opposition parties and has gained popularity with younger voters by focusing on policies that expand tax breaks and increase pay.

With a potential election just weeks away, the DPP's performance could be pivotal. Analysts note that depending on the outcome, the party's support could become crucial for the government to pass the fiscal 2026 budget and a bill authorizing the issuance of deficit-covering bonds.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up