Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Dec)

China, Mainland Urban Area Unemployment Rate (Dec)A:--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)A:--

F: --

P: --

China, Mainland GDP (Q4)

China, Mainland GDP (Q4)A:--

F: --

P: --

China, Mainland GDP QoQ (SA) (Q4)

China, Mainland GDP QoQ (SA) (Q4)A:--

F: --

P: --

China, Mainland Annual GDP

China, Mainland Annual GDPA:--

F: --

P: --

China, Mainland Annual GDP Growth

China, Mainland Annual GDP GrowthA:--

F: --

P: --

China, Mainland GDP YoY (Q4)

China, Mainland GDP YoY (Q4)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)A:--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. Unemployment Rate (Dec)

U.K. Unemployment Rate (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Nov)

U.K. 3-Month ILO Employment Change (Nov)--

F: --

P: --

U.K. Unemployment Claimant Count (Dec)

U.K. Unemployment Claimant Count (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A leading think tank warns the British government: embrace bold reforms or risk squandering nascent economic recovery.

A leading think tank has issued a stark warning to the British government: abandon its pattern of policy indecision and embrace bold reforms, or risk squandering early signs of an economic recovery.

In a new report, the Resolution Foundation argues that to build on recent momentum, the government must stop its "flip-flopping" and take decisive action on trade, housing construction, and employment. The call comes 18 months into Prime Minister Keir Starmer's term, a period the think tank characterizes as being defined by U-turns and timidity.

According to the Resolution Foundation, the government's record has so far failed to match its economic promises. Despite pledges from Prime Minister Starmer and finance minister Rachel Reeves to accelerate the economy, there has been no significant change in its trajectory.

The report notes that planned reforms in critical areas like welfare and taxation have either been abandoned or significantly weakened. This inconsistency, it argues, is undermining the potential for real growth.

"With signs that productivity may be turning a corner, the government must capitalise by ramping up its plans," said Greg Thwaites, research director at the Resolution Foundation.

The think tank outlines a clear path forward with significant potential benefits for households. It calculates that a combination of key reforms could boost annual household incomes by £2,000 ($2,680). These reforms include:

• Housing: Changing planning rules to help cities meet housing targets.

• Trade: Pursuing deeper regulatory alignment with the European Union.

• Employment: Implementing policies to get more young and older people into the workforce.

Such growth would also yield major fiscal benefits, generating enough tax revenue to fund a 25% increase in spending for the public health service.

The call for action comes against a bleak backdrop. The UK economy has largely stagnated in the nearly two decades since the global financial crisis. The report highlights that Britain's GDP per person has fallen further behind other major European nations since the pandemic.

This long-term trend was worsened by the combined shocks of COVID-19, high energy prices, and the economic impact of Brexit, which together caused a drop in productivity growth.

Furthermore, the Resolution Foundation presents growing evidence that the economic damage from Brexit may already be close to double the 4% impact assumed by Britain's official budget forecasters.

Despite the challenges, the report identifies a crucial opportunity. It points to a significant 3.1% leap in productivity in the year ending in the third quarter of 2025. This figure, which adjusts for previous under-recording of employment in official data, represents the "nascent signs of improvement" that the government is being urged to seize upon.

As Japan gears up for an anticipated snap general election, a potential cut to the consumption tax is rapidly becoming a central issue, with major political parties signaling their support for the measure to ease the burden of rising living costs on households.

Currently, Japan's tax system imposes a 10% rate on most goods and services, with a reduced rate of 8% applied to food. This tax is a crucial revenue stream for funding the country's growing social welfare expenses, driven by a rapidly ageing population.

Both the ruling coalition and the main opposition party are now publicly advocating for a temporary tax reduction, suggesting a rare point of political consensus.

Shunichi Suzuki, a key executive in the ruling Liberal Democratic Party (LDP), confirmed the party's commitment to an earlier agreement with its coalition partner, Ishin. "It's our basic stance to sincerely achieve what's written in the agreement," Suzuki stated on a television program, referring to the plan to scrap the 8% levy on food sales for two years.

This move aligns with reports from the Mainichi newspaper that Prime Minister Sanae Takaichi may pledge to temporarily eliminate the 8% food tax as a core promise when she calls for a general election next month.

The opposition is also on board. Jun Azumi, secretary-general of the main opposition Constitutional Democratic Party of Japan (CDP), announced on the same program that his party would also campaign for a temporary tax rate cut. The CDP recently agreed to form a new political entity with Komeito, solidifying this position.

Prime Minister Takaichi is expected to announce her intention to dissolve parliament and call a snap election for February, leveraging her administration's strong approval ratings.

However, the proposed tax cut carries significant financial implications. According to government data, eliminating the 8% food sales levy would reduce government revenue by an estimated 5 trillion yen ($31.71 billion) annually.

This revenue loss would place considerable strain on Japan's already stretched national finances. Analysts are concerned that such an expansionary fiscal policy could heighten the risk of a bond sell-off as investors scrutinize the government's fiscal discipline.

($1 = 157.6900 yen)

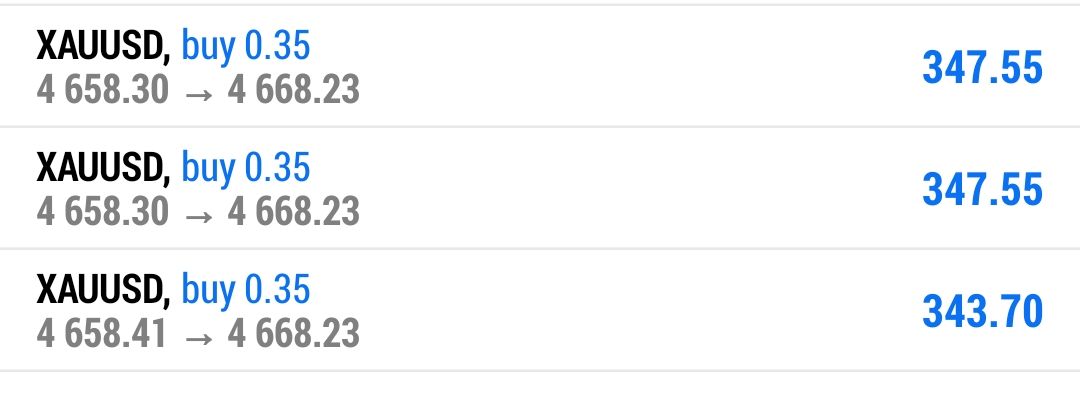

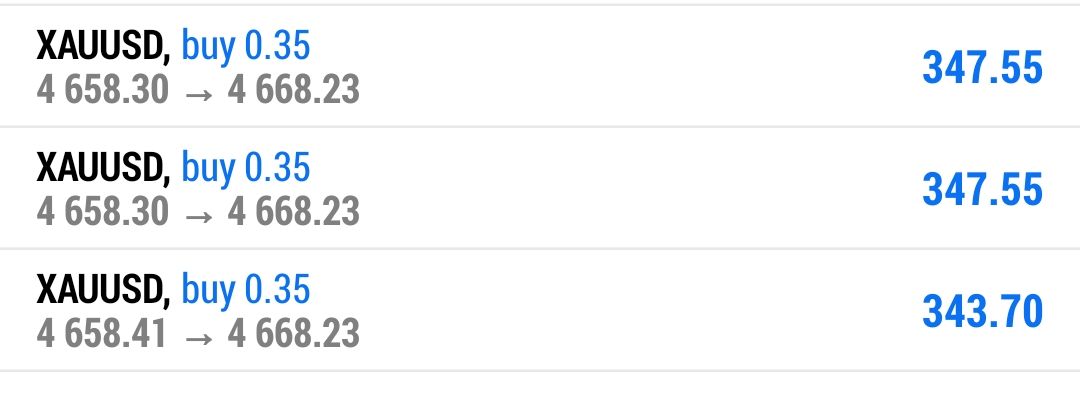

Precious metals surged to record highs after U.S. President Donald Trump announced plans to impose tariffs on eight European nations, escalating tensions over his administration's proposal to acquire Greenland. The move has ignited fears of a major trade war, sending investors flocking to safe-haven assets like gold and silver.

President Trump declared a new 10% tariff on goods from several countries, including France, Germany, and the United Kingdom. The tariffs are scheduled to take effect on February 1 and are set to increase to 25% in June.

This unexpected announcement has fueled concerns of swift retaliation from Europe, raising the prospect of a damaging trade conflict that could disrupt global markets and drive further demand for precious metals.

In response to the U.S. threat, European leaders are preparing to hold an emergency meeting to coordinate their strategy. Officials familiar with the discussions are exploring several countermeasures, including imposing retaliatory levies on €93 billion ($108 billion) worth of American goods.

French President Emmanuel Macron is also reportedly considering activating the EU's anti-coercion instrument, the bloc's most powerful tool for trade retaliation, signaling a serious potential for escalation.

The recent tariff threat adds to a series of geopolitical and economic drivers that have propelled precious metals higher this year, extending a dramatic rally that began in 2025. The market has been reacting to aggressive U.S. foreign policy, including the seizure of Venezuela's leader and repeated threats to take control of Greenland.

Simultaneously, the Trump administration has renewed its criticism of the Federal Reserve, raising concerns about the central bank's independence. This has fueled the "debasement trade," where investors move away from currencies and government bonds, fearing that rising debt levels will erode their value.

The market reaction to the tariff news was immediate and sharp:

• Spot gold climbed 1.7% to $4,676.22 an ounce as of 7:35 a.m. in Singapore, after reaching an earlier peak of $4,690.59.

• Silver surged 3.9% to $93.6305 an ounce, hitting a high of $94.1213.

• Platinum and palladium also posted gains.

• The Bloomberg Dollar Spot Index edged down 0.1%, reflecting currency market jitters.

High-level talks between Ukraine and the United States aimed at resolving the nearly four-year-long war with Russia are set to continue at the World Economic Forum in Davos, Switzerland, this week.

Ukraine's top negotiator, Rustem Umerov, confirmed the plan on Sunday following two days of discussions in Florida.

The recent meeting in Florida involved a U.S. team that included envoy Steve Witkoff and Jared Kushner, son-in-law of President Donald Trump. According to Umerov, the discussions centered on two primary topics: long-term security guarantees for Ukraine and a comprehensive post-war recovery plan.

While Umerov described the talks as an in-depth discussion of "practical mechanisms," he gave no indication that any firm agreements were reached.

The Ukrainian delegation, which included Kyrylo Budanov, head of President Volodymyr Zelenskiy’s office, and Davyd Arakhamia, head of Zelenskiy's parliamentary faction, also used the meeting to report on recent Russian strikes that severely damaged the nation's energy infrastructure.

"We agreed to continue work at the team level during the next phase of consultations in Davos," Umerov stated in a Telegram post.

A key objective for Kyiv is to gain clarity from Washington regarding Russia's position on the U.S.-backed diplomatic initiatives. Washington has been encouraging Ukraine to agree to a peace framework that could then be presented to Moscow. Meanwhile, Ukraine and its European allies are focused on establishing safeguards against future Russian aggression.

President Zelenskiy argued that Russia's recent military actions demonstrate a lack of genuine interest in a diplomatic solution. "If the Russians were seriously interested in ending the war, they would have focused on diplomacy," he said in his nightly video address.

Zelenskiy highlighted the widespread damage from the strikes, which left hundreds of apartment buildings without heating or electricity, as evidence of Moscow's intentions.

The humanitarian impact of the attacks is severe, with nighttime temperatures dropping to minus 16 degrees Celsius (3 degrees Fahrenheit). According to Zelenskiy, nearly 58,000 repair personnel are working to restore the nation's heating networks.

Deputy Prime Minister Oleksiy Kuleba reported that 30 apartment buildings in the capital, Kyiv, remained without heat following the recent attacks.

Adding to the concerns, Ukrainian intelligence suggests Russia is actively conducting reconnaissance for potential new strikes. Foreign Minister Andrii Sybiha warned on Saturday that there is evidence Russia may be considering attacks on power substations that supply the country's nuclear power plants. Russian officials did not immediately respond to requests for comment on these claims.

China's economy likely saw its growth slow to a three-year low in the final quarter of 2025 as domestic demand softened, creating a challenging outlook despite full-year performance meeting official targets. While the economy demonstrated notable resilience throughout the year, underlying structural problems and persistent trade tensions pose significant risks ahead.

A Reuters poll forecasts that gross domestic product (GDP) expanded by 4.4% year-on-year in the fourth quarter, a deceleration from the 4.8% recorded in the third quarter. If confirmed, this would mark the weakest pace of growth since the fourth quarter of 2022.

Despite the quarterly slowdown, the full-year economic expansion for 2025 is expected to reach 4.9%. This figure aligns with Beijing's official target of "around 5%" and is only slightly below the 5.0% growth seen in 2024. The data for Q4 and the full year is scheduled for release on Monday.

A key driver of China's 2025 performance was its powerful manufacturing sector, which fueled a record trade surplus of nearly $1.2 trillion. Exporters successfully diversified away from the United States, offsetting tariff pressures and helping the economy withstand headwinds better than anticipated. This export boom allowed policymakers to maintain a relatively modest level of stimulus.

However, this heavy reliance on external demand highlights critical vulnerabilities. The strength in exports stands in stark contrast to sluggish activity at home, where the economy is grappling with a prolonged property slump, weak domestic spending, and persistent deflationary pressures.

On a quarter-on-quarter basis, the economy is projected to have grown 1.0% in the fourth quarter, a slight easing from the 1.1% pace seen between July and September.

The economic picture for 2026 appears clouded. Forecasters see China's growth slowing further to 4.5% as it confronts rising global trade protectionism and the unpredictability of U.S. economic policy under President Donald Trump, who has threatened a 25% tariff on countries trading with Iran.

This downbeat forecast increases the pressure on policymakers to deliver more stimulus. In a move to boost demand, China's central bank announced sector-specific interest rate cuts on Thursday and signaled that further reductions in bank reserve requirements or broader rate cuts could follow.

However, some analysts remain skeptical about the immediate impact of these measures. "Growth is likely to stay weak in Q1 2026, as the policy package offers limited economic support," noted analysts at ANZ.

Deeper economic imbalances continue to impede long-term development. ANZ analysts estimate that China's nominal GDP grew by about 4.0% in 2025, the slowest rate since 1976, excluding the pandemic year of 2020. Furthermore, the GDP deflator, a broad measure of prices, has remained negative since 2023, underscoring the severe mismatch between excess supply and weak demand.

"China is facing a macroeconomic problem currently: excess supply. Overall domestic demand lags supply," said Louis Kuijs, chief Asia economist at S&P Global Ratings. "That weighs on growth and is leading to downward pressures on prices and profits. It also causes friction internationally as many companies are resorting to exports to escape 'involution' conditions at home."

At a key economic meeting in December, Chinese leaders pledged to maintain a "proactive" fiscal policy to support growth. They also vowed to "significantly" increase the share of household consumption in the economy over the next five years. To achieve this, several obstacles must be overcome:

• Slowing Income Growth: Household incomes need a substantial boost.

• Weak Social Safety Net: A stronger welfare system is required to reduce high precautionary savings.

• Falling Asset Prices: The decline in property values has eroded household wealth, discouraging spending.

The struggles of ordinary citizens highlight these policy challenges. Fang Ying, a 54-year-old delivery worker in Beijing, said his monthly income of 8,000 yuan barely covers his family's expenses. A failed restaurant business also cost him around 100,000 yuan. "It's not easy… I cannot compete with young people," Fang said. "There are many opportunities in Beijing, but not for people like me."

For years, institutions like the World Bank and the IMF have urged China to rebalance its economy toward consumption-led growth and rely less on investment and exports. While Beijing has taken steps to address excess industrial capacity, economists believe more fundamental reforms are needed.

Separate data for December, set to be released alongside the GDP figures, is expected to reinforce the narrative of a two-speed economy.

• Retail sales, a key indicator of consumption, are forecast to grow just 1.2% year-on-year, down from 1.3% in November and the weakest reading since December 2022.

• Factory output, in contrast, is expected to have grown by 5.0%, an acceleration from November's 4.8% rise.

This divergence clearly illustrates the central challenge facing China: an industrial engine that continues to fire while the domestic consumer remains on the sidelines.

UK Prime Minister Keir Starmer is preparing to publicly defend Britain's commitment to NATO on Monday following a direct threat from US President Donald Trump. The president has warned he will impose tariffs on the UK and other European allies if his bid to purchase Greenland from Denmark is not successful.

According to a Number 10 source, Starmer will use a press conference to stress "the importance of maintaining our alliances for our national interest." This follows his Saturday statement where he labeled Trump's tariff threat "completely wrong."

The diplomatic friction escalated after President Trump announced on Truth Social that he would levy a 10% tariff on eight European nations, including the UK and Denmark, starting February 1. He warned the tariffs would rise to 25% in June unless a deal over Greenland was reached.

Trump’s justification centers on his view that recent commitments by European nations to conduct NATO military exercises in Greenland amount to a "dangerous game." He has repeatedly insisted that US control of Greenland is essential for national security, specifically citing threats from Russia and China.

The strategic importance of Greenland is underscored by its rich deposits of critical minerals and its location along new shipping routes opening up as Arctic ice melts.

In response to the threat, Prime Minister Starmer has engaged in a series of high-level calls. A Downing Street spokeswoman confirmed he spoke with Trump on Sunday afternoon, following conversations with Danish Prime Minister Mette Frederiksen, European Commission President Ursula von der Leyen, and NATO Secretary-General Mark Rutte.

Starmer's message has been consistent: Greenland's future is a matter for its people and the Danish government. "He said that security in the High North is a priority for all NATO allies in order to protect Euro-Atlantic interests," the spokeswoman stated. "He also said that applying tariffs on allies for pursuing the collective security of NATO allies is wrong."

The standoff presents a significant challenge for Starmer, who has so far avoided the most severe tariffs imposed by the Trump administration, which began in 2025. During his Monday press conference, the prime minister is expected to state that the UK's foreign policy will be guided by its core values in working with allies.

Any new tariffs on UK goods could severely hamper the government's efforts to stimulate the country's anemic economic growth. The United States is the UK's single-largest trading partner, making any disruption to trade a serious economic risk.

Global markets opened the week on a cautious note after U.S. President Donald Trump proposed new tariffs on eight European nations, immediately dampening risk appetite and sending investors toward safe-haven assets.

Early Monday trading saw currencies like the pound and euro decline against the U.S. dollar, while the Japanese yen and Swiss franc gained ground. Equity futures signaled a lower open for markets in Japan and Hong Kong, with Australian shares expected to see little change. The negative sentiment followed a modest dip in U.S. stocks on Friday.

The market jitters stem from President Trump's weekend announcement of a potential 10% tariff on goods from eight European countries, slated to begin February 1. He stated the tariff could rise to 25% in June unless a deal is reached for a "purchase of Greenland."

The proposal was met with swift condemnation from European officials, who are now prepared to block the approval of a trade agreement finalized last year. Bloomberg reported that French President Emmanuel Macron might seek to activate the EU's anti-coercion instrument, the bloc's strongest tool for retaliation.

Analysts at ING Bank, including global head of macro Carsten Brzeski, noted the growing uncertainty. "The outcome of these new trade tensions is unclear, but what has long been evident is that there is no such thing as trade or tariff certainty anymore," they wrote. "What is clear is that a full-blown trade war between the EU and the US would leave only losers."

Market strategists are now focused on the European open, where regional equities are expected to bear the brunt of the selloff. However, not all analysis points to sustained damage. Deutsche Bank suggested the impact on the euro might be limited, as the U.S. depends on Europe for capital.

Others interpret the move as a strategic ploy ahead of this week's World Economic Forum in Davos.

"My working assumption is that an 'off ramp' from these threats will soon be found, and that this turns into yet another 'TACO moment'," wrote Michael Brown, a strategist at Pepperstone Group, referring to a tactical, aggressive, chaotic, and over-the-top negotiating style. He added, "I would view equity dips as buying opportunities for now and wouldn't be surprised to see the week's initial FX moves fade relatively rapidly."

The new tariff tensions add to existing market headwinds. On Friday, U.S. stocks lost earlier gains to close 0.1% lower after Trump's comments about a potential successor to Fed Chair Jerome Powell. His remarks, which pointed away from Kevin Hassett, raised the odds of former Fed Governor Kevin Warsh being nominated, prompting traders to scale back expectations for interest rate cuts and sending Treasury yields higher.

Meanwhile, upcoming economic data from China is expected to show continued softness. According to a Bloomberg survey, gross domestic product for the fourth quarter is forecast to rise 4.5% year-on-year, down from 4.8% in the previous quarter. The release may show the economy capped 2025 with its weakest quarterly expansion in three years.

In commodity markets, oil prices edged higher Friday to close near $60 a barrel as traders monitored ongoing tensions in Iran. Gold, however, experienced its largest decline in two weeks.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up