Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Donald Trump is making his return to the Group of Seven this weekend having taken the global economy on a roller-coast

President Donald Trump is making his return to the Group of Seven this weekend having taken the global economy on a roller-coaster ride toward a singular destination: A world in which he is the ultimate arbiter of trade, security and power relationships, and America harvests the economic benefits.

As he does so, US tariffs are meeting growing opposition at home and abroad. From G-7 host Canada to China and the European Union, major US trading partners are mounting a firmer resistance than they did during his first term. US courts are threatening to invalidate many of the duties altogether.

The US economy faces the prospect of a summer of rising prices, slowing hiring and consumer discontent. Tariff threats are now near-daily market movers, this week sending the dollar tumbling even after the US and China brokered a tentative trade truce.

Trump’s bid to upend the global trading system started in January 2017 when in his first few days in office, he abandoned the Trans-Pacific Partnership negotiated by the Obama administration. With that, he ripped up a carefully constructed 12-nation economic alliance designed to help contain China and rewrite global trade rules in America’s favor, instead launching the US toward greater protectionism.

That move has come with economic costs. By 2030, Bloomberg Economics forecasts, if Trump’s current tariff regime endures, the global economy will be $1 trillion smaller than it would have been had the US remained in the TPP. More than a third of that loss would come because of a smaller US economy, the analysis finds, with the US share of global trade tumbling even as China’s stays steady. The consequence for Americans: 690,000 fewer jobs.

As the G-7 leaders gather for their summit—on what is the 10th anniversary of the famous 2015 trip down the Trump Tower escalator that launched Trump’s first presidential campaign—that’s a pertinent reminder of the high cost of trade wars.

Three other members of the G-7 (Canada, Japan and the United Kingdom) are now also part of the TPP’s successor, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. Four of them (France, Germany, Italy and the UK) were parties in separate trans-Atlantic negotiations that Trump also abandoned.

For Trump—and many who voted for him—the costs of this realignment are overstated. And even if they’re not, they’re a price worth paying for reorienting a global trade system they view as fundamentally unfair to the US and reviving a manufacturing base that years of globalization have hollowed out. The administration is also claiming victories in emerging truces and other preliminary deals with China and the UK and promising more to come.

“Only Donald Trump understood American membership in the globalist-conceived TPP would have led to the complete offshoring of America’s auto industry to Japan, Vietnam, and broader Asia along with a massive hit to our manufacturing base,” Peter Navarro, a senior White House trade adviser, said in response to questions for this article. He also questioned the credibility of the Bloomberg Economics analysis, saying that past predictions of a severe impact from tariffs had not materialized.

Crying over lost economic output may not be a constructive exercise for the G-7 leaders. Neither may be confronting Trump—consensus is so hard to reach these days that this G-7 summit has scrapped the normal joint communique. But the Bloomberg Economics analysis adds to a growing pile of studies that have pointed to the cost of tariffs for the global economy.

The trade shock is already hurting global growth, with the US among the hardest hit. The World Bank this week slashed its global growth forecast, following the Paris-based Organization for Economic Cooperation and Development and the International Monetary Fund. The OECD recently predicted the US would grow by just 1.6% in 2025, a sharp drop from 2.8% in 2024, with Trump’s tariffs bearing much of the responsibility.

The free-trade consensus against which Trump has fired his battery of tariffs is credited with keeping global growth buoyant and inflation low. Beneath that positive headline, though, not everyone enjoyed the benefits. Free trade was good for bosses who could shift production from the US to lower cost locations like China and Mexico and for consumers who benefited from cheaper products, but bad for US factory workers who saw their jobs shipped overseas.

For some in manufacturing, the TPP was flawed from the start. The agreement needed to be more worker-centric and failed to tackle non-tariff barriers, such as undervalued exchange rates, according to Scott Paul, who heads the Alliance for American Manufacturing, a partnership of the steelworkers union and manufacturers, and served on Trump’s first-term manufacturing council.

“Even at the time, no one argued this was a slam dunk for US manufacturing,” he said.

Trump’s tariffs attempt to redress that imbalance. The Bloomberg Economics analysis shows the costs and benefits of doing so. As foreign goods become more expensive, US-based manufacturers are likely to benefit, boosting factory jobs—notably in steel, autos and textiles—with a total of 1.2 million created by 2030. If that happens, it would deliver one of Trump’s main goals—restoring some of the lost vitality of US manufacturing.

As factory workers benefit, though, 1.6 million jobs are at risk in the service sector relative to what would have happened if no tariffs were added — a reflection of overall slower growth and lost competitiveness.

The impact of the TPP on US employment would likely have been positive but modest. Bloomberg Economics modeling suggests services and, to a lesser extent, manufacturing would both have benefited. Other studies—including from the Peterson Institute for International Economics— pointed to the risks of small losses in the manufacturing sector, offset by gains in services.

Jobs aren’t the only thing at stake as tariffs rise. The US role as a major economic partner for most countries and Washington’s influence over the global economic agenda also face a blow. Bloomberg Economics’ modeling shows that while the TPP would have helped stabilize the relative weights of the US and China in global trade flows, Trump’s tariffs risk cutting the US share to 16% from 22%.

The risks are particularly evident in Asia, where China is already the largest trading partner for most countries. Trade with China now accounts for 23% of all imports and exports of TPP countries located in Asia or Oceania, compared with only 13% for the US. Trump’s tariffs could widen this gap by lowering the US share to only 11%, while the TPP could have slightly boosted US trade and lowered China’s share to 21% instead.

Trump’s move to drop out of the TPP wasn’t in isolation. The agreement in 2016 faced opposition from Democratic lawmakers and candidates, including Hillary Clinton. Major trade unions fought it, and some US companies including Ford Motor Co. had reservations.

In a recognition of the toxic US domestic politics around the TPP, former President Joe Biden also didn’t move to rejoin it after his election in 2020.

Michael Froman, who as former President Barack Obama’s US trade representative led the negotiation of the TPP, argues the consequences of Trump’s withdrawal go far beyond economics to broader strategic relationships in the Asia-Pacific today.

“Trade is absolutely central and front of mind to everyone in that region” and China’s growing dominance in the sphere led many in the region to pursue an alternative to the model Beijing was offering, said Froman, who now leads the Council on Foreign Relations. He argues pulling out of TPP “was one of the most significant strategic blunders in recent American history” because it “left the field to China.”

The goal of the TPP wasn’t just opening up Japan and other markets to US exports, Froman said. It was also about forcing an update in global trading rules that could deal with China’s rise and issues like the conduct of Beijing’s state-owned enterprises and industrial subsidies. That, too, would be relevant today as the US and its G-7 allies are confronting new effects of China’s rise including its dominance in sectors like electric vehicles.

The TPP “would have forced a different kind of conversation with China,” Froman said. “Because they would be dealing now with an ever-increasing percentage of the global economy that agreed that the way China was managing their SOEs and subsidization and intellectual property was unacceptable.”

Many of the gripes about trade barriers that the Trump administration is airing now in talks were also addressed in the TPP negotiations concluded in 2015, said Wendy Cutler, a veteran US trade negotiator who oversaw the TPP talks as deputy US trade representative. Which means the US is litigating trade battles it arguably won a decade ago.

As Trump races to close deals with other major Asian economies like India, Japan and South Korea, the larger cost for the US of not being in the TPP may be a loss of trust among those allies.

Pulling out of the TPP “really discredited the United States,” said Cutler, who now leads the Washington office of the Asia Society Policy Institute. “It has broken trust with a lot of partners who remain skeptical about negotiating with the United States because I don't think they have any confidence that we’re going to stick to, or stay in, these agreements.”

Trump’s current administration, like his first, has focused much of its ire at China. Treasury Secretary Scott Bessent, who led a new round of negotiations with senior Chinese officials in London this week, has raised the possibility of new agreements with allies leading to collective action aimed at what he describes as the unbalanced export-dependent Chinese economy.

Yet Trump’s tariffs are also hitting the economies of many US allies who have their own relationships with China. Trading partners like Canada are confronting the possibility of imminent recessions as exports tumble. Japan and Germany face existential threats to their iconic auto sectors.

The consequences of Trump’s TPP withdrawal are still evident in allies’ changing attitudes eight years on.

Kenichi Kawasaki, a former senior economist in the Japanese Cabinet Office, said the TPP has benefited Japan economically, as have other trade agreements. But like other G-7 economies, it’s facing a global economy in which US tariffs are threatening major disruptions even as US leadership is in retreat.

In a sign of how things have changed, Kawasaki is now a proponent of letting China join the successor of the TPP. In a 2023 study, Kawasaki found that the benefits to real GDP of Chinese accession for other CPTPP members as a group would be twice as large as having the US join.

In Canada, a founding member of the CPTPP, the pact is of growing interest as the US neighbor weighs the impact of tariffs and the need to diversify its economy away from its dependence on American demand.

As a result, he said, “the name of the game is diversification” for Canada as it negotiates with a US government it no longer trusts. “There is a huge incentive now for the government and private sector to search for alternatives and there are only two directions: Asia and Europe. With Asia, the starting point is CPTPP.”

Being in the CPTPP has allowed Mexico to diversify its exports to other high-income countries like Japan, Australia or New Zealand.

That’s useful at a time when US trade policy is generating uncertainty, said Juan Carlos Baker, Mexico's former undersecretary for foreign trade, who helped negotiate the TPP as well as the US-Mexico-Canada Agreement with Trump during his first term.

Beyond that, Baker said, Mexico has seen increases in investment from fellow CPTPP members like Canada, Japan, Australia and Singapore.

Other allies still hold out hope that the US will rejoin the TPP someday, though even advocates like Froman see that as unlikely. “I think from a factual substantive point of view, the rationale for TPP still largely holds. I do not think there's necessarily a path back toward it, however, because I think the politics have moved on.”

Some argue the G-7 and other US allies should find a way to use the disruption created by Trump’s tariffs to help deliver what Bessent and others around the US president say they are seeking: A rebalanced global order in which the benefits are shared more equitably between trading partners.

To Geoffrey Gertz, who served as the top international economics adviser on Biden’s National Security Council and is now at the Center for a New American Security, a Washington think tank, such an outcome may harken back to something like the TPP even if it isn’t called that. In a recent article in Foreign Affairs, Gertz and CNAS colleague Emily Kilcrease, who served as a deputy US trade representative during the first Trump administration, called for other countries to look through Trump’s tariffs and work with Washington to find a new global equilibrium.

But Gertz also said that happening depends on the Trump administration changing its chaotic ways. The window for action and success is also short for the US and its trading partners.

“The longer this drags on, the harder and harder it is going to be,” Gertz said. “Countries are going to just start working around the United States more and more.”

One reason for optimism for those who fear the economic damage from Trump’s tariffs is that there are signs they are also affecting the domestic politics of trade. That may lead to Trump confronting the inverse of the political phenomenon that first helped elect him in 2016.

The political curse of globalization in 2016, Froman said, was that the pain in lost manufacturing jobs in the US and other rich-world industrial countries was highly visible while the broad benefits were often invisible. “You never walked out of a Walmart and said, ‘Thank goodness for the World Trade Organization.’”

“Trump has flipped this dynamic on its head: Everybody is going to feel the pain and it's highly visible because there's so much attention to it,” Froman said. Meanwhile, if Trump’s tariff promise holds true and a surge in manufacturing jobs results, it’s still likely to take years to develop—and even then with “a limited number of workers and a limited number of geographies who will see the benefit.”

Together with increasing costs to the global economy that Trump’s disruption is causing, that means his tariffs are leading to a vastly different world from the one the US president envisions. And perhaps one more like the vision he abandoned.

European Union companies will be required to disclose details of their Russian gas deals to the EU, under upcoming European Commission proposals to ban Russian gas imports by the end of 2027, an internal Commission document, seen by Reuters, showed.

The Commission is preparing to propose legal measures to completely halt the EU's Russian gas imports by the end of 2027, and ban new Russian gas deals by the end of this year. The proposals are due to be published on June 17.

An internal European Commission analysis of its upcoming proposals, seen by Reuters, said to enforce the ban, the Commission will require information including the duration, annual contracted volumes, destination clause and date of conclusion of their Russian gas contracts.

"The implementation of the measures - as designed in the proposal - requires comprehensive and systematic information about the existing contracts for Russian gas, including specific contractual arrangements," the document said.

Gas importers will also be required to disclose the origin of their imports, to ensure it is not Russian, the document said. The disclosures aim to ensure the EU and countries' customs and energy authorities can ensure the ban is enforced.

"Except for cases where gas can clearly be considered as of Russian origin, the proposal requires importers to present documentation to the customs authorities about the origin of the imported gas," the document said.

The Commission's assessment said the upcoming proposals will ban EU LNG terminals from providing services to Russian customers from January 1, 2026, with a longer deadline of June 17, 2026 for existing services contracts under short-term LNG supply deals.

The deadline to stop providing these services under long-term contracts with Russia will be December 31, 2027, it said.

A Commission spokesperson declined to comment on the upcoming proposals, which could still change before they are published.

The oil market is pushing its luck. For two years, it’s weathered unthinkable events, including volleys of direct attacks and counterattacks between Israel and Iran. Yet not a single barrel of production has been lost. With hindsight, every oil-price rally has proven to be an opportunity to sell. It required nerves of steel, but shorting crude while bombs and the missiles were flying was the winning trade.The situation appears the same today after Israel launched a wide-scale attack against Iran, including its nuclear facilities, and Tehran warned of a “harsh” retaliation. Amid the chaos, the barrels are still flowing. Everywhere in the Middle East, oilfields were buzzing and tankers were loading on Friday. If anything, there’s still too much oil in the physical market, and prices, based solely on today’s supply and demand fundamentals, should retreat. But familiarity breeds contempt: the threat of a major oil Middle East shock is alarmingly high.Real-time knowledge of the exact level of global supply and demand is impossible. But there’s a telltale: global inventories. And, for several months, those had been rising above seasonal norms, a sure indication of oversupply.With Saudi Arabia pushing the OPEC+ cartel to boost production faster than previously expected and oil demand growth slowing, the imbalance was set to increase as the year progressed. The Northern hemisphere summer, which provides a seasonal lift to demand, is the last obstacle before an oil glut becomes plainly obvious. The Israeli attack hasn’t changed those supply and demand realities. Fatih Birol, the head of the International Energy Agency, spoke bluntly hours after the attacks: “Markets are well supplied today.”

If anything, the oversupply could worsen. On the demand side, geopolitical chaos is bad for business, so oil demand growth could slow even further. On the supply side, the current price rally – oil rose almost 10% in the initial hours after Israel launched its assault — is handing US shale producers an unexpected opportunity to lock-in forward prices, helping them to keep drilling higher than otherwise.The biggest risk is sleepwalking into believing that just because two years of violence hasn’t disrupted flows, the physical market would never be disrupted. Particularly in the Middle East, it’s always the last straw that breaks the camel’s back. The global oil market looked well oversupplied in late July 1990; a week later, Saddam Hussein’s Iraq had invaded Kuwait, and the global economy was weathering a large oil shock. On Friday, the energy market reaction has split between its two-year-old sense of we-have-been-here-before-and-nothing-happened and genuine alarm. In the initial hours, Brent rallied to almost $80 a barrel as every bearish position got covered. But it later pared its gains to trade around $75 a barrel as braver traders used the rally as a sell opportunity. Still, in the options market, where traders buy and sell insurance against sharp price moves, many were buying contracts that will make money if oil prices surge past $100 a barrel.

Israel hasn’t yet targeted Iranian oil installations so perhaps the biggest risk of supply losses can be averted. But the important word here is “yet.” President Donald Trump is allergic to high energy prices, which will probably restrain Israel Prime Minister Benjamin Netanyahu who would otherwise love to blow up the oilfields that fund the Iranian nuclear program. On Thursday, hours before the attack, Trump spoke publicly about his unhappiness with the recent move above $70 a barrel. In a public event, he rhetorically asked Secretary of Energy Chris Wright: “Are we OK? Nothing wrong? Right? It’s going to keep going down, right? Because we have inflation under control.” Well, not any longer. Tehran hasn’t yet threatened to return to its old playbook of showering fire over the Saudi oilfields and close the Strait of Hormuz, the shipping chokepoint for 20% of the world’s oil supply. But here again, the key word is “yet.” To understand how risky the situation is, listen to everyone around Iran. Saudi Arabia and its neighbors are trying very hard not to give Tehran a pretext to attack them. Hence why Riyadh — and several others in the region — quickly condemned the Israeli attack. Don’t misunderstand the Arab condemnation as sympathy toward Tehran — it’s all about minimizing blowback. The two biggest risks for the oil market stem from Iranian weakness. First, if Tehran concludes that the only way to restore deterrence against Israel is to accelerate its efforts to build a nuclear bomb, sanctions are likely to follow. The Islamic Republic perhaps could withdraw from the 1968 nuclear non-proliferation treaty, but that would probably prompt United Nations sanctions that would make Chinese purchases of Iranian oil, running at more than 1.5 million barrels a day, more difficult, if not impossible. Second, as more Jewish bombs rain on the Islamic Republic, the sense that Ayatollah Ali Khamenei isn’t just fighting to keep his nuclear program but to preserve his own regime is rising. If Tehran concludes it’s defenseless and is fighting a war for survival, it’s likely to conclude that triggering economic upheaval via the oil market is a useful card to play.

So even though there’s plenty of crude and oversupply is evident, it will take nerves of steel to short the oil market.

Israel’s strikes on Iran on Friday have raised the prospect of global oil prices hitting $100 a barrel. If Tehran seeks to escalate the conflict by retaliating beyond Israeli borders, it could seek to choke off the Strait of Hormuz, the world’s most important gateway for oil shipping.

Israel launched a wave of strikes on Iran’s nuclear facilities, ballistic missile factories and military commanders, prompting Iran to launch drones against Israel. It is likely the two archenemies will continue to exchange blows in the coming days.

Oil prices soared by more than 8% to $75 a barrel on Friday on the news.

The United States has sought to distance itself from the Israeli strikes while President Donald Trump urged Iran to return to their bilateral nuclear talks.

While Tehran may strike Israel with additional drones or ballistic missiles, it could also opt to target the Middle East military facilities or strategic infrastructure of the United States and its allies such as Saudi Arabia and the United Arab Emirates. This could include oil and gas fields and ports.

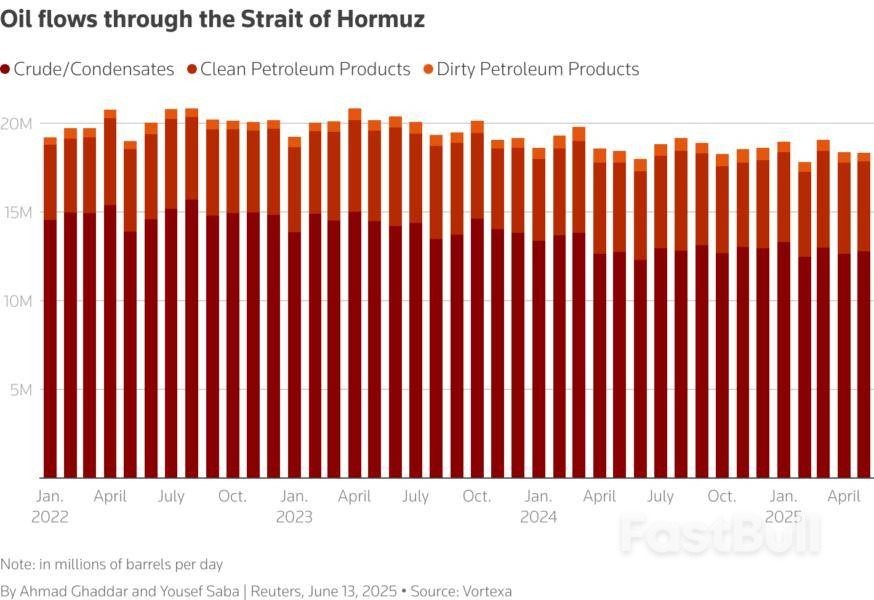

Of course, the most sensitive point Tehran could target is the Strait of Hormuz, a narrow shipping lane between Iran and Oman. About a fifth of the world's total oil consumption passes through the strait, or roughly 20 million barrels per day (bpd) of oil, condensate and fuel.

If that scenario played out, it would likely push oil prices sharply higher, very possibly into triple-digit territory, as OPEC members Saudi Arabia, Iran, the United Arab Emirates, Kuwait and Iraq export most of their crude via the strait, mainly to Asia.

To be sure, an Iranian strike in the Gulf risks drawing a response from the United States and its regional allies, dramatically escalating the conflict and stretching Iran's military capabilities. But Iran has been heavily weakened over the past year, particularly following Israel’s successful campaign against Hezbollah, the Iranian-backed militants in Lebanon.

With its back to the wall, Tehran could see an attack now as a deterrent.

The U.S. military and its regional allies will obviously seek to protect the Strait of Hormuz against an Iranian attack. But Iran could use small speed boats to block or seize tankers and other vessels going through the narrow shipping lane. Iran's Revolutionary Guards have seized several western tankers in that area in recent years, including a British-flagged oil tanker in July 2024.

However, any Iranian efforts to block the strait, or even delay transport through it, could spook energy markets and lead to disruptions in global oil and gas supply.

Saudi Arabia and the UAE have sought in the past to find ways to bypass the Strait of Hormuz, including by building more oil pipelines.

Saudi Arabia, the world's largest oil exporter, sends some of its crude through the Red Sea pipeline that runs from the Abqaiq oilfield in the east into the Red Sea port city of Yanbu in the west.

The Saudi Aramco-operated pipeline has a capacity of 5 million bpd and was able to temporarily expand its capacity by another 2 million bpd in 2019.

It is used mostly to supply Aramco’s west coast refineries. Saudi Arabia also exported 1.5 million bpd of oil from its west coast ports in 2024, including 839,000 bpd of crude, according to data from analytics firm Kpler.

The UAE, which produced 3.3 million bpd of crude oil in April, has a 1.5 million bpd pipeline linking its onshore oilfields to the Fujairah oil terminal that is east of the Strait of Hormuz.

But even the western route could be exposed to attacks from the Iran-backed Houthis in Yemen, who have severely disrupted shipping through the Suez Canal in recent years.

Diverting oil away from the Strait of Hormuz would be more difficult for Iraq and Kuwait, which only have coastlines on the Gulf.

One factor that could keep a lid on crude prices, however, is that these heightened Middle East tensions come at a time of ample global oil supply.

Rising production in the United States, Brazil, Canada, Argentina and other non-OPEC countries has reduced the global market share of the Middle East in recent years. This could help mitigate if not fully offset any supply disruption.

Additionally, any serious disruption to oil supplies in the Middle East would also likely prompt the International Energy Agency to trigger the release of strategic reserves.

Investors have often shrugged off Middle East tensions in recent years, believing that the potential for a truly regional clash is limited. They may do so again, particularly if this strike pushes Iran back to the negotiating table with the U.S. over Tehran’s nuclear program.

But crude prices are apt to be volatile in the coming days as traders seek to get a handle on where this conflict is heading.

U.S. President Donald Trump praised Israel's strike on Iran, describing it as "very outstanding," according to reports from sources on June 13, 2025. The statement has sparked international concern, highlighting potential increases in geopolitical tensions in the region.

U.S. President Trump has commended Israel’s recent military action against Iran. The praise has raised alarm among various international diplomatic circles who are weighing the potential for escalated Middle Eastern tensions. Reported by ChainCatcher, these events have not yet shown a direct impact on the global financial markets linked to cryptocurrency.

The U.S. President's approval has been met with mixed responses across the international community. Many political analysts warn that such comments might lead to heightened regional conflict, although current market trends indicate stability within crypto trading volumes.

Diplomatic leaders from across the globe have expressed concerns about Trump's statement’s impact, although no major cryptocurrency markets have shown fluctuations correlating to this geopolitical development. The lack of direct economic disruption suggests limited immediate repercussions in the blockchain sector.

Did you know? Historically, major geopolitical tensions have not always equated to immediate cryptocurrency market volatility, although they often influence long-term investment strategies.

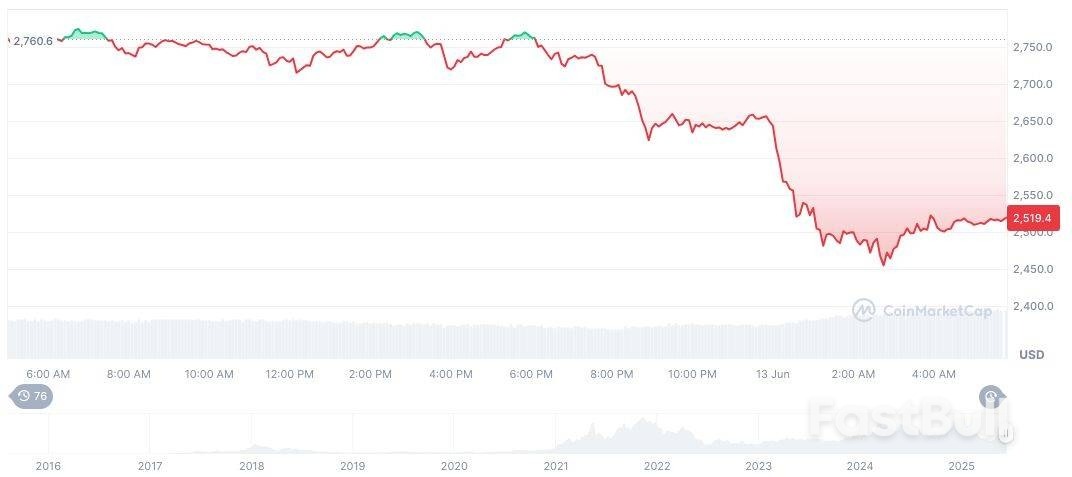

Ethereum (ETH) currently trades at $2,532.42 with a market cap of DeepBrainChain, marking a 7.38% decrease over 24 hours, according to CoinMarketCap. The 24-hour trading volume surged by 36.37% to $40,011,974,417, reflecting market participants’ cautious positioning. The cryptocurrency holds a 9.38% market dominance while exhibiting a mixed performance trend in recent weeks.

Ethereum(ETH), daily chart, screenshot on CoinMarketCap at 11:44 UTC on June 13, 2025. Source: CoinMarketCap

Ethereum(ETH), daily chart, screenshot on CoinMarketCap at 11:44 UTC on June 13, 2025. Source: CoinMarketCapBreaking news from the Middle East indicates a significant development: the Israeli Air Force has reportedly conducted a strike within Iran. This action, reported by Axios and shared widely via platforms like X by figures such as Walter Bloomberg, marks a critical moment in the ongoing regional tensions. For those following global events and their potential ripple effects on financial markets, including the often-sensitive cryptocurrency space, understanding the nuances of this situation is paramount. This event injects a new level of Geopolitical Risk into an already volatile global landscape.

The report of an Iran Israel Strike follows a period of heightened direct confrontation between the two nations. For years, the conflict has primarily unfolded through proxies and covert operations. However, recent events saw Iran launch an unprecedented direct missile and drone attack on Israel, which Iran stated was in retaliation for a strike on its consulate in Damascus. Israel had vowed to respond to Iran’s direct attack. The reported strike in Iran appears to be that response, bringing the long-simmering conflict into a more overt phase.

While details are still emerging, initial reports suggest the strike targeted specific locations within Iran. The nature and extent of the damage, as well as Iran’s official response, are key factors that will determine the immediate trajectory of the situation. The world watches closely, assessing the potential for further escalation.

Major geopolitical events inherently introduce uncertainty, which financial markets dislike. An increase in Geopolitical Risk can trigger significant reactions across various asset classes. Historically, conflicts in the Middle East, a region central to global energy supplies, have had pronounced effects on oil prices. Rising oil prices can contribute to inflation, impacting monetary policy decisions by central banks worldwide. This, in turn, influences everything from bond yields to stock valuations.

Beyond energy, heightened tensions can disrupt supply chains, affect international trade, and dampen investor confidence. In times of uncertainty, investors often move towards assets traditionally considered ‘safe havens,’ such as gold or certain government bonds. However, the definition of a safe haven can shift, and the interconnectedness of modern markets means that even traditional safe havens can experience volatility during extreme stress events.

Here are some potential ways geopolitical risk can ripple through markets:

The current Middle East Tensions between Iran and Israel are particularly concerning due to the potential for a wider regional conflict involving other state and non-state actors. The involvement of proxies, the strategic importance of the region, and the complex web of alliances make de-escalation challenging. Any miscalculation could have severe consequences, extending beyond the immediate combatants.

Understanding the historical context is crucial. The animosity between Iran and Israel dates back decades, rooted in political, religious, and strategic disagreements. Iran’s support for groups hostile to Israel and its nuclear program are central points of contention. Israel views Iran as an existential threat. This latest direct exchange marks a dangerous evolution in their rivalry.

International reactions play a key role in shaping the narrative and potential outcomes. Calls for restraint from global powers are common, but the effectiveness of such calls depends on the willingness of the parties involved to step back. The position of major global players like the United States, European Union nations, Russia, and China will be critical in diplomatic efforts, or lack thereof.

The immediate Global Market Impact of the reported strike is likely to manifest as increased volatility. Futures markets often react quickly to such news, and the start of trading sessions will reveal how this development is being priced in by investors worldwide. Sectors most directly affected might include energy, defense, and potentially technology, given the reliance on global supply chains.

However, the longer-term impact depends heavily on whether this event leads to further escalation or if diplomatic efforts manage to contain the situation. A prolonged or expanded conflict would likely have a more sustained negative impact on global economic growth prospects and market stability. Conversely, a swift de-escalation could see markets recover relatively quickly, having priced in the initial shock.

Market participants will be closely monitoring official statements from Iran and Israel, as well as reactions from major international bodies and governments. The language used and the actions taken in the coming hours and days will be critical indicators of the potential trajectory of the conflict and, consequently, the markets.

The relationship between geopolitical events and the cryptocurrency market is complex and not always straightforward. While Bitcoin was envisioned by some as a non-sovereign store of value, potentially acting as a safe haven during traditional financial system stress, its price often behaves like a risk asset, correlating with technology stocks.

Crypto Volatility is already a defining characteristic of the market. Geopolitical events can exacerbate this volatility, though the direction isn’t always predictable. In some instances, initial news of conflict might lead to a sell-off in risk assets, including crypto. However, if the event is perceived as weakening traditional financial systems or increasing inflation fears (due to rising commodity prices, for example), some investors might theoretically turn to Bitcoin or other cryptocurrencies as an alternative store of value, potentially driving prices up.

The crypto market is also influenced by global liquidity and macroeconomic factors, which are indirectly affected by geopolitical stability. Increased global uncertainty can lead to tighter financial conditions, which typically pressure risk assets like cryptocurrencies. Conversely, if central banks were to react to a geopolitical crisis with more accommodative monetary policy (though this is not the current trend), it could potentially provide tailwinds for crypto.

Here’s a look at potential, though not guaranteed, impacts on crypto:

For cryptocurrency holders and traders, this period calls for increased vigilance. Monitoring global news alongside market data is essential. Understanding that external, non-crypto specific events can significantly impact digital asset prices is a crucial part of navigating this market.

Predicting the future in geopolitical situations is impossible, but analysts are considering several potential scenarios following the reported Iran Israel Strike:

The actions and rhetoric of leaders in Tehran, Tel Aviv, Washington D.C., and other capitals will provide clues about which path is most likely being taken. Diplomatic efforts, back-channel communications, and public statements will all be scrutinized.

Given the unfolding situation and its potential Global Market Impact, what should readers, especially those with exposure to volatile assets like cryptocurrencies, consider?

While it’s impossible to perfectly predict how Middle East Tensions will specifically affect Crypto Volatility in the short term, being prepared for potential market reactions is prudent. This involves understanding the underlying factors at play and maintaining a rational approach to investing during uncertain times.

The reported Iran Israel Strike marks a significant escalation in long-standing Middle East Tensions. This event immediately heightens Geopolitical Risk, with potentially far-reaching consequences for regional stability and the global economy. The Global Market Impact is likely to be characterized by increased uncertainty and Crypto Volatility, at least in the short term. While the exact trajectory of events remains uncertain, the coming days will be critical in determining whether this leads to further conflict or a path towards de-escalation. For investors and global citizens alike, staying informed and understanding the potential implications of this developing situation is essential.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up