Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

UBS CEO: As We Approach End Of Integration, Confident In Ability To Capture Remaining Synergies By Year-End, Which We Increased By $500 Million To $13.5 Billion

UBS: Remain On Track To Complete Integration By Year-End, With Greater Proportion Of Net Saves Weighted To H2 2026

UBS: Continued Wind-Down Of Non-Core And Legacy Risk-Weighted Asset, Reducing Rwa To $28.8 Billion

Kazakhstan's Kaztransoil: Supplies Of 1.017 Million Tons Of Oil, Including 863000 Tons Of Russian Oil, To China In January Via Kazakhstan

Hsi Closes Midday At 26724, Down 109 Pts, Hsti Closes Midday At 5347, Down 119 Pts, Tencent Down Over 3%, Xinyi Glass, Techtronic Ind, Wharf Reic, Yankuang Energy, China East Air Hit New Highs

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

No matching data

View All

No data

Thailand's cheap assets are overlooked as global investors doubt its election will reform a struggling economy.

Thailand's sluggish economy has pushed its stocks and bonds into a precarious position: cheap, overlooked, and increasingly off the radar for global capital. With a general election this weekend, major money managers are signaling caution, viewing the vote as more likely to worsen existing challenges than to solve them.

Persistent issues like high household debt and weak growth have already taken their toll. In the past year, Thai stocks were among the world's worst performers, while its bonds lagged most emerging market peers in 2026. Investors see little reason to believe the country's fourth leader in three years can deliver the reforms needed to fix poor governance and policy drift.

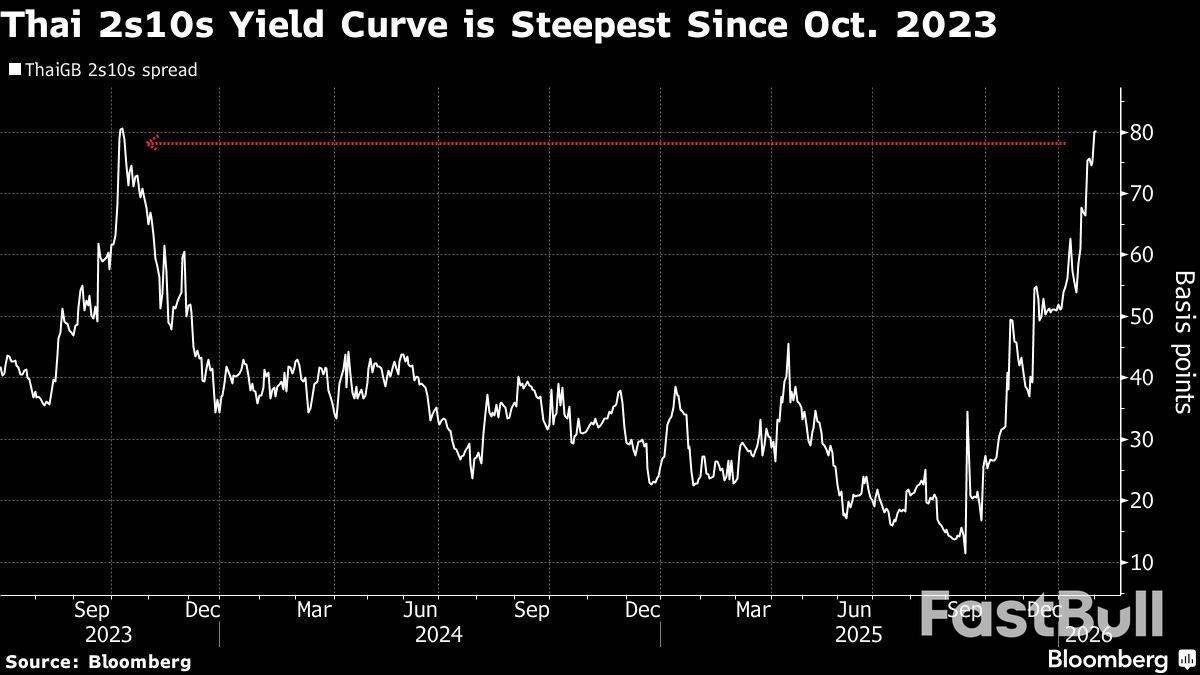

The market consensus points to a steeper yield curve, driven by potential interest rate cuts and government spending, while equities remain depressed as capital seeks opportunities elsewhere.

"Thailand does look cheap in terms of valuations," said Christopher Leow, chief investment officer at Principal Asset Management in Singapore. "But looking cheap is probably not enough."

The sentiment is clear among institutional investors, who are limiting their exposure ahead of the election.

• T Rowe Price Group Inc. has reduced its bond holdings and remains cautious on local currency debt, waiting for clear policy direction before committing more capital.

• Allianz Global Investors holds a broadly underweight allocation but is considering a shift into longer-duration bonds.

• Aberdeen is favoring defensive stocks and exporters to minimize exposure to the domestic Thai economy, warning that a fragile coalition government could lead to uneven policy execution.

"For lasting investor confidence, the election is only the starting point," said Nattanont Arunyakananda, an investment manager at Aberdeen in Bangkok. He stressed that the outlook depends on credible reforms and sustained fiscal and monetary support. "Without reforms that lift productivity and improve the investment climate, any post-election bounce is likely to remain tactical rather than structural."

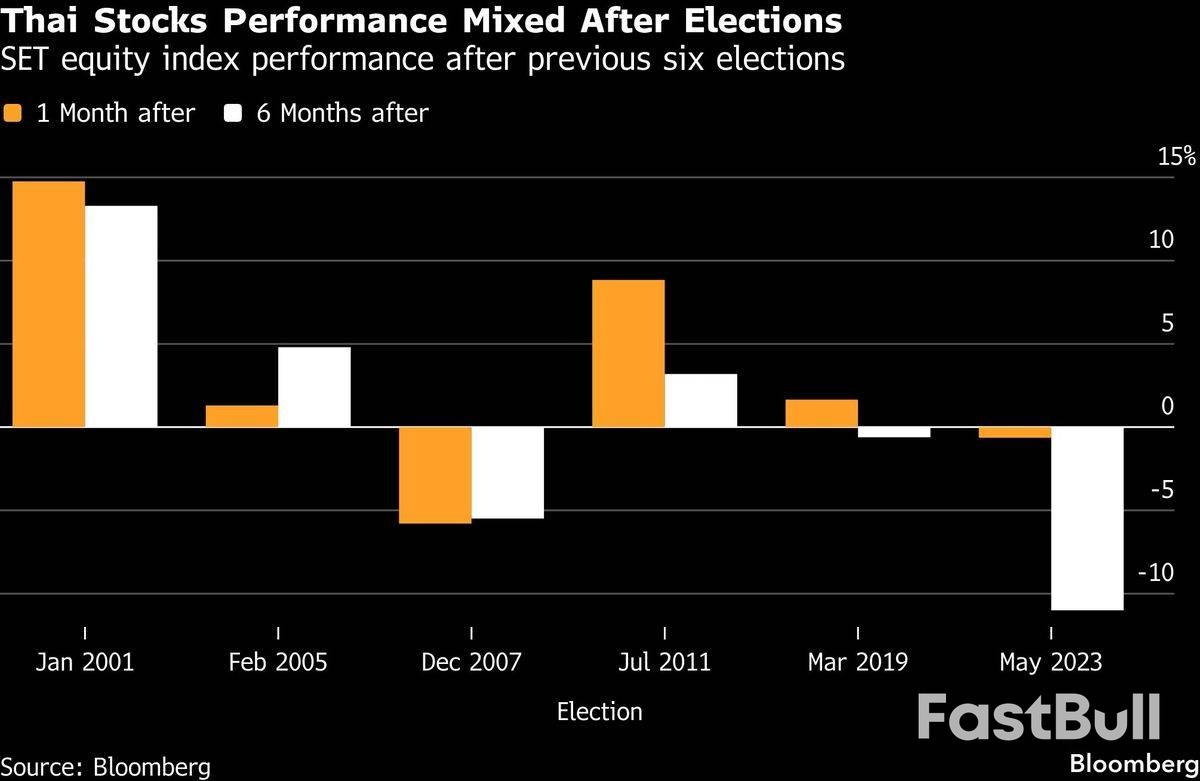

Historically, Thai markets have seen a brief lift after elections. Over the past three votes, the benchmark Stock Exchange of Thailand (SET) Index gained an average of 3.3% in the month following the polls. However, these rallies often fade as political realities set in.

The ongoing worries are forcing a rethink of Thai assets in international portfolios. Once valued for their exposure to global growth, they have lost appeal due to a stagnant economy, weak tourism, and recurring political instability.

A key concern is the expected rise in debt issuance needed to fund campaign promises from leading political parties. With the central bank forecasting economic growth of just 2.2% in 2025—trailing regional peers—the government has already approved a US$1.4 billion food and services subsidy program.

These additional spending pledges have helped push the spread between Thailand's two- and 10-year bond yields to its widest point since October 2023.

"We'll be looking for them to invest into unleashing the potential of the economy," said Leonard Kwan, a portfolio manager at T Rowe Price in Hong Kong. While Thailand has some fiscal capacity, he added, "the key question is effectiveness in how they utilize it."

Despite the bearish outlook, some signs of value are emerging. Thai stocks are trading at around 14 times forward earnings, which is below both their five-year average and a gauge of regional peers. The steepening yield curve, with expectations of higher fiscal spending already priced in, may also present opportunities at the long end.

BlackRock Inc., while holding less exposure than a year ago, has recently begun buying more bonds with longer maturities, according to Navin Saigal, its Asia Pacific head of fundamental fixed income in Singapore.

Ultimately, investors are watching to see if the election will be followed by meaningful reforms or if policy will be watered down by the compromises needed to form a government. The frequent turnover in political leadership is also dimming hopes for lasting change.

"With no clear majority for any single party in sight, it's hard to envisage a sharp turn in investor confidence," said Wai Kiat Soh, a portfolio manager at Ninety One in Singapore. "The 'muddle-through' scenario will likely play out once again."

China's services activity expanded at its quickest pace in three months in January, buoyed by stronger new orders and pushing hiring to its highest since July last year, a private-sector survey showed on Wednesday.

The RatingDog China General Services PMI, compiled by S&P Global, edged up to 52.3 in January from 52.0 the previous month, the highest reading since October. The 50-point mark separates expansion from contraction.

The reading, coupled with the manufacturing survey, points to a tentative improvement for some businesses at the start of the year. However, they contrast with an official survey which showed both factory and services activity losing momentum. Barclays analysts say recent readings suggest the front-loaded measures may be insufficient, or may still need time to translate into improved sentiment and activity.

According to the RatingDog survey, the Composite Output Index, which combines manufacturing and services performance, rose to 51.6, compared with 51.3 in December.

Growth in new orders in the services sector picked up from December. New product launches also lifted export business.

To cope with rising workload, service providers hired more full-time and temporary staff at the start of the year. Although marginal, the increase marked the first rise in headcount since July 2025.

Average input costs increased at a slower pace in January, while output charges fell as some service providers lowered prices to support sales.

Business sentiment remained positive as companies were hopeful that expansion plans and better market conditions would lift growth in sales and activity this year. However, confidence slipped from December and was below the 2025 average, reflecting concerns over the global economic outlook.

Looking ahead to February, Yao Yu, founder of RatingDog, said consumption-oriented services such as culture and tourism, catering, and instant retail may see growth driven by the extended nine-day Spring Festival holiday. Producer services, by contrast, are likely to enter a seasonal lull due to factory closures.

According to data by China's Tujia, an online holiday rental portal, booking of homestays grew 48% week-on-week from January, with February 17-19 being the most popular period.

The Spring Festival holidays, as the new year celebrations are known in China, run from February 15 to 23.

This year's Lunar New Year travel rush, the world's biggest annual human migration, kicked off on Monday and will last for 40 days.

Authorities expect a record 9.5 billion passenger trips to be made during the travel period, surpassing the 9.02 billion trips made last year.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up