Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

BOE Governor Bailey: Falling Inflation Should Feed Into Expectations, That Should Give Me Confidence

Indonesia Central Bank: To Work With Government To Strengthen Communication With Markets, Maintain Market Confidence

Indonesia Central Bank: Financial Market Stability Is Also Expected To Remain Stable, Supported By Adequate Liquidity, Strong Banking Capital, Low Credit Risk

US News Website Axios Reports That The United States And Russia Are Close To Reaching An Agreement To Continue To Abide By The New START Treaty After It Expires On Thursday

Indonesia Central Bank: Rupiah Exchange Rate Is Expected To Remain Stable, Supported By Economic Prospects, Central Bank Stabilisation Commitment

BOE Governor Bailey: We Need To See More Evidence That We Are Going To Get Sustainable Return To Inflation Target

Indonesia Central Bank: Expects Indonesian Economic Prospects To Remain Solid With Improving Trend, Inflation Under Control

The US News Website Axios Reports That The US And Russia Are Negotiating An Extension Of The New START Treaty

Bank Of England Governor Bailey: If The Outlook Develops As We Expect, There Is Still Room For Further Easing In The Near Future

Bank Of England Governor Bailey: More Spare Capacity Could Lead To Inflation Falling Below Target

BOE Governor Bailey: On One Hand, Cutting Bank Rate Too Quickly Or Too Much Could Lead To Inflation Pressure Persisting

Bank Of England Governor Bailey: Institutions Expect Growth To Remain Sluggish Throughout The Year

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP GrowthA:--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)A:--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)A:--

F: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)A:--

F: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo Rate--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

No matching data

View All

No data

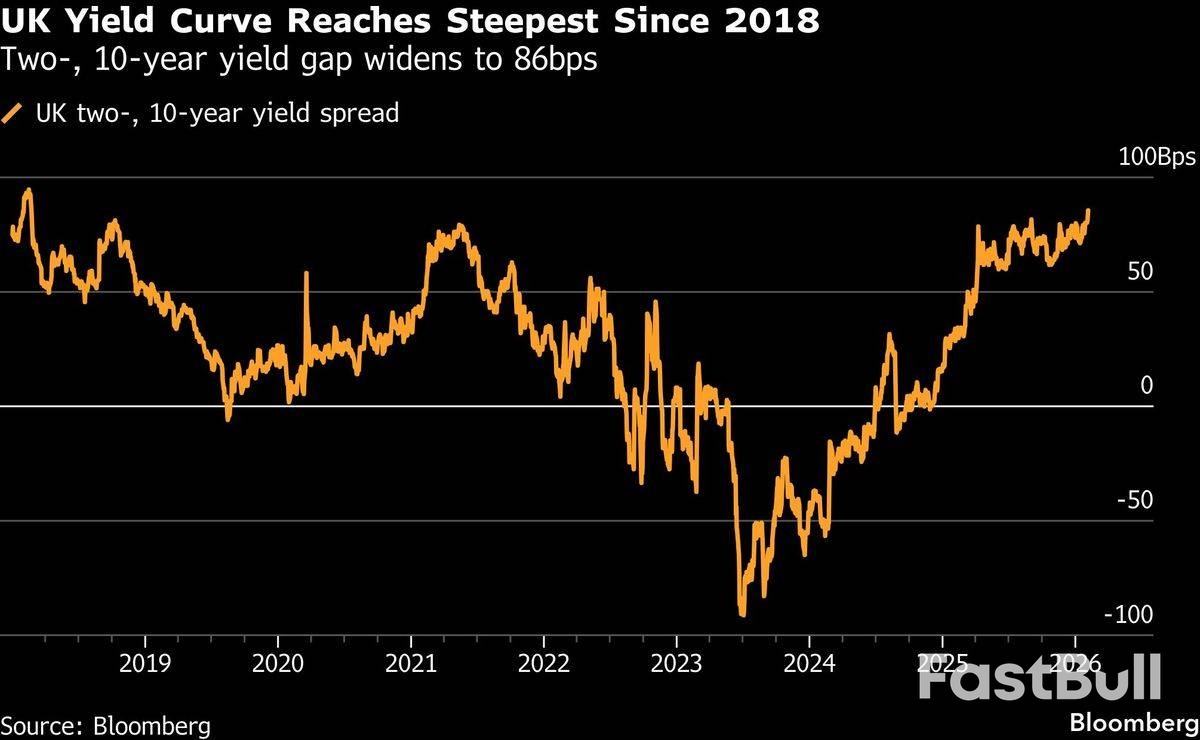

Political instability over PM Starmer's leadership rattles UK markets, causing bond yields to surge and the pound to fall.

Political turbulence is rattling UK markets, with fresh doubts over Prime Minister Keir Starmer’s leadership sending the pound and long-term government bonds tumbling on Thursday.

Investors are increasingly pricing in a political risk premium as Starmer faces mounting pressure over his decision to appoint Peter Mandelson as US ambassador, despite his known connection to the disgraced financier Jeffrey Epstein. The market fallout signals growing concern that the Prime Minister’s grasp on power is weakening.

The market reaction was swift and clear. Sterling dropped as much as 0.4% to a near two-week low of US$1.36, making it the worst-performing currency among its peers.

In the bond market, the yield on 10-year government bonds, or gilts, climbed by four basis points to 4.59%. Because shorter-term rates remained relatively stable, the gap between the two-year and 10-year gilt yields widened to 86 basis points—its most substantial spread since 2018.

"It's worth keeping a closer eye on the UK with PM Starmer under considerable domestic pressure," noted Jim Reid, global head of macro research at Deutsche Bank AG. He added that the weakness in gilts reflects investor concern that "he could be replaced."

The divergence in bond yields highlights where investors are focusing their attention. Longer-dated debt is highly sensitive to political and fiscal risk, while shorter-dated notes are primarily driven by central bank policy.

With the Bank of England expected to hold interest rates steady on Thursday, the front end of the yield curve has been anchored. "While gilts are watching politics, the front-end will be paying attention to today's BOE meeting," said Jamie Searle, a strategist at Citigroup Inc.

Searle explained that with recent UK data surprising to the upside, there is little pressure on the Monetary Policy Committee to act. "Yesterday's rise in political uncertainty adds to the cheapening," he added, referring to the sell-off in longer-term gilts.

For investors, the instability is not just about a potential leadership change but what might follow. The market consensus is that any replacement for Starmer or his chancellor, Rachel Reeves, would be less committed to the UK's current fiscal rules.

"This is negative for the currency not simply because political instability is undesirable, but because any change in leadership is likely to be interpreted as fiscally expansionary," one analyst noted. "Given the UK's long-standing challenges around debt financing, markets will undoubtedly react negatively to such developments."

This sensitivity has been tested before. Just two weeks ago, gilts sold off after a potential path opened for Greater Manchester Mayor Andy Burnham, a left-wing rival of Starmer, to return to Parliament. Burnham, who has criticized the UK's deference to financial markets, is seen as a potential challenger for the premiership.

The political headwinds arrive at a difficult time for Starmer, whose Labour party is struggling with dire polling numbers and who faces a record disapproval rating himself ahead of local elections in May.

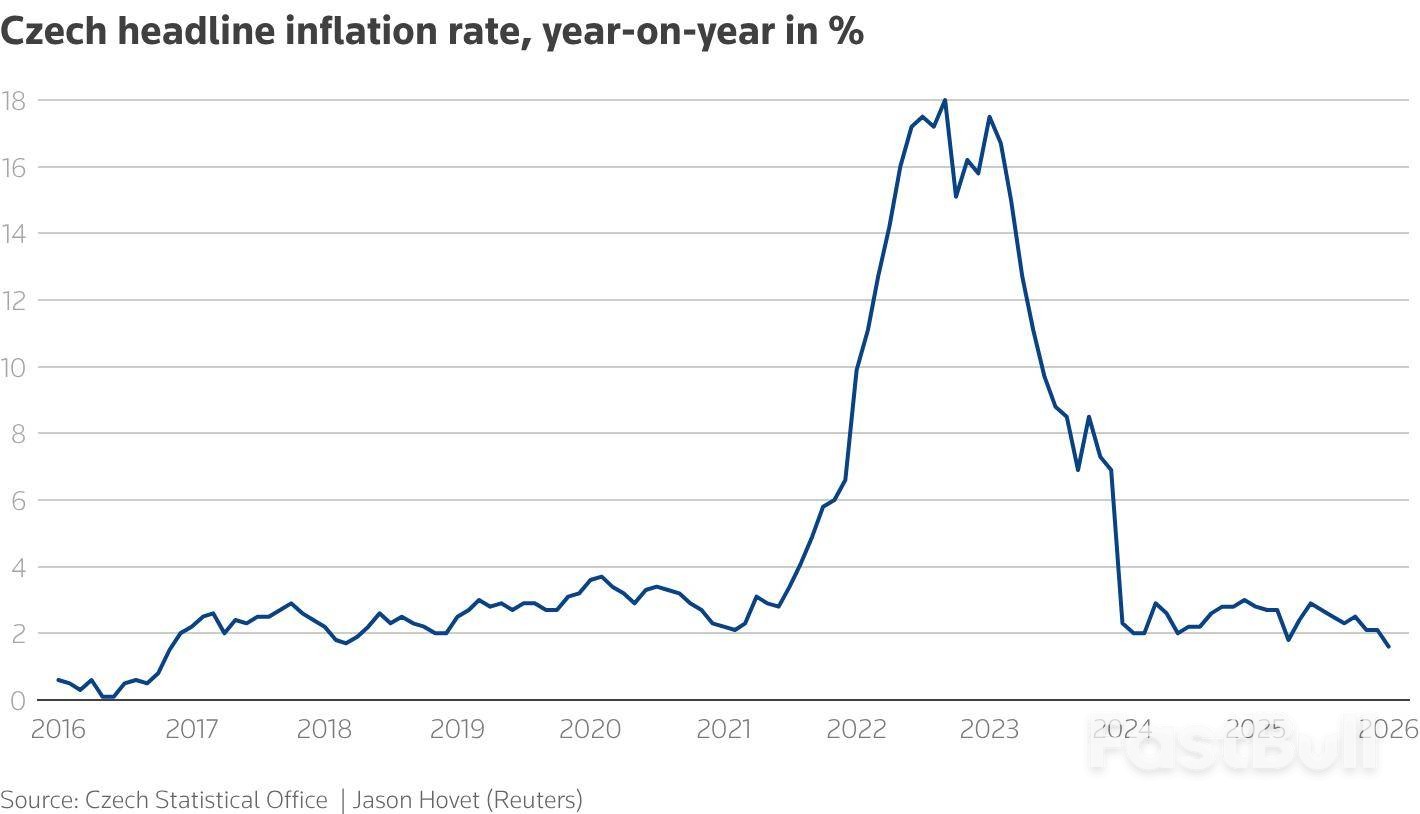

Czech headline inflation plunged to a nine-year low of 1.6% year-on-year in January, a development fueled by falling energy costs that has intensified the debate over future interest rate cuts.

The preliminary data was released just as the Czech National Bank (CNB) convened for a policy meeting. The central bank has kept its main interest rate on hold at 3.50% since May 2025. That decision followed an easing cycle that began in 2023, which halved the rate from its 7.00% peak reached during the 2022-2023 inflation surge.

According to the statistics office's flash estimate, the 1.6% annual inflation rate for January was slightly below the 1.7% forecast in a Reuters poll. Month-on-month, prices rose by an expected 0.9%.

Inflation has remained close to the central bank's 2% target since 2024, following a period where price growth reached double-digit levels.

Despite the sharp drop in the headline number, policymakers remain cautious due to underlying price pressures. A key concern is inflation in the services sector, which remained high at 4.7% year-on-year. Analysts agree that elevated core inflation and persistent price growth in services give the central bank reasons to remain vigilant.

The recent decline in energy costs was significantly influenced by a government policy decision. The administration of Prime Minister Andrej Babis shifted the burden of payments for renewable energy from households and companies to the state budget. The central bank typically does not adjust policy based on the primary impact of such regulatory changes.

In December, Governor Ales Michl confirmed the bank would not react to the measure and noted that inflation could fall below its target.

Analysts believe price growth will likely remain below 2% for a sustained period. While most expect the central bank to hold rates steady at Thursday's meeting, the probability of a rate cut later this year is growing.

The discussion has gained momentum after some policymakers floated the possibility. In a late January interview with Reuters, Vice-Governor Jan Frait said the bank could discuss slight monetary easing, citing external factors that might lead other major central banks to cut rates.

This sentiment was echoed in market analysis following the latest inflation data.

"The probability of a further decrease in CNB interest rates this year has increased significantly," said Jan Bures, an economist at CSOB bank.

India has confirmed its exports will benefit from a sharply lower 18% U.S. tariff, but the change is not immediate as previously announced by Washington.

Commerce Minister Piyush Goyal clarified that the new rate, a significant drop from 50%, will only take effect after both nations sign a joint statement and the U.S. issues an executive order. This timeline differs from President Donald Trump's earlier statement that the reduction was "effective immediately."

Goyal stated that the joint statement is expected to be signed within the next four to five days. Following the U.S. action, New Delhi will reciprocate by lowering its own duties on American goods around mid-March, but only once the formal agreement is officially in place.

While financial markets in India initially reacted positively to the news, the absence of official documentation has created confusion, even as leaders portray the deal as a reset in trade relations.

Prime Minister Narendra Modi’s government has confirmed the core tariff reduction on Indian goods but has not yet verified several other commitments outlined by President Trump. These unconfirmed claims include India agreeing to:

• Halt Russian crude oil purchases

• Import oil from Venezuela

• Reduce tariffs on some American products to zero

A key point of clarification from Indian officials concerns the announced $500 billion in purchases of U.S. goods. They explained that this figure is not entirely new business but is spread over a five-year period and incorporates deals that were already in the pipeline.

Goyal noted that existing aircraft orders from the U.S. could account for over $100 billion of that total. In recent years, major carriers including Air India Ltd., Akasa Air operator SNV Aviation Pvt., and SpiceJet Ltd. have collectively ordered 590 planes from Boeing Co.

Beyond aviation, Goyal added that India plans to increase its purchases of American energy, semiconductors, and electronic goods over the next five years.

French manufacturing output registered a 0.8% decline in December, a reversal from the 0.5% growth seen in November. However, a closer look reveals the drop was concentrated in specific, highly volatile sectors and does not signal a broader industrial slowdown.

The negative headline figure was primarily driven by weaker production in transport equipment, a sector that makes up 13% of France's total manufacturing output. The aerospace segment, in particular, saw a sharp drop that erased the gains from the previous three months.

Such volatility is typical for the aerospace industry, and this one-month dip is not considered a cause for alarm. In fact, on a yearly basis, production of transport equipment is still up by a strong 12.4%.

While coke production also fell by 0.9% over the month, every other industrial sector reported an increase in output, underscoring the narrow scope of the December downturn.

Despite the monthly dip, the forecast for French industry in the first half of 2026 remains optimistic. A cyclical improvement is expected, supported by several key factors:

• Regional Recovery: A broader European economic recovery is gaining momentum.

• German Stimulus: Germany's stimulus plan is anticipated to boost regional demand.

• Business Confidence: Improving business sentiment and healthier order books point to higher industrial production in the coming months.

• Defense Spending: Rising defense budgets will continue to support the industrial sector.

• Aerospace Strength: Aerospace production is projected to remain a significant driver of growth.

However, the path forward is not without challenges. Several factors could weigh on economic activity and exports:

• Stronger Euro: The recent appreciation of the euro poses a risk to export competitiveness. The European Central Bank estimates that a further 4.3% rise in the euro against the dollar could reduce eurozone GDP growth by 0.1 percentage points.

• High Tax Burden: The high tax burden on French companies may constrain business activity.

• Weak Investment: Recent business surveys indicate that investment intentions remain very weak.

Balancing these positive drivers and potential headwinds, the overall outlook for 2026 is moderately positive. GDP growth is forecast to reach approximately 1%, a slight acceleration from the 0.9% growth recorded in 2025.

The S&P 500 is navigating a complex landscape. The economic impact of President Trump's tariffs, combined with high stock market valuations and the uncertainty of midterm elections, could trigger a significant decline or even a crash in 2026. For investors, understanding these interconnected risks is crucial.

In a January editorial for The Wall Street Journal, President Trump argued that his administration's tariffs have fueled "extraordinarily high economic growth." He also claimed that foreign exporters are footing the bill. However, a closer look at the data suggests a different narrative.

Deconstructing 2025 GDP Growth

The assertion of tariff-driven growth doesn't align with economic figures. Here’s a breakdown of the first nine months of 2025:

• Underwhelming Performance: Real GDP grew by 2.51%. This rate is actually below the 10-year average (2.75%), the 30-year average (2.58%), and the 50-year average (2.84%).

• The AI Factor: According to the Federal Reserve Bank of St. Louis, spending on artificial intelligence (AI) contributed 0.97 percentage points to GDP growth during this period. Without the boost from AI, the economy would have expanded by just 1.54%. Goldman Sachs noted that without AI, "U.S. GDP would have almost flatlined."

Who Really Pays for the Tariffs?

President Trump’s editorial also stated that foreign producers are absorbing "at least 80% of tariff costs," citing a Harvard Business School study. This appears to be a misinterpretation of the research.

The study he referenced explicitly concludes, "Our results suggest that U.S. consumers paid up to 43 percent of the tariff burden, with the rest absorbed by U.S. firms." The report does not suggest that foreign exporters paid a substantial portion of the tariffs.

The takeaway is clear: contrary to claims, GDP growth in 2025 was subpar and heavily propped up by AI investment, not tariffs.

Beyond the tariff debate, two historical patterns are signaling caution for the S&P 500 in 2026: elevated valuations and the midterm election cycle.

A Market Priced for Perfection

The S&P 500 currently trades at 22.2 times forward earnings, according to FactSet Research. This is a very expensive valuation from a historical perspective. In the last 40 years, the index has only sustained a forward price-to-earnings (P/E) ratio above 22 during two periods: the dot-com bubble and the COVID-19 pandemic. Both were followed by bear markets.

This high valuation is particularly risky because the forward P/E metric already incorporates Wall Street's optimistic expectations for accelerated earnings in 2026. If companies fail to meet these high forecasts as tariffs weigh on the economy, stocks could fall sharply.

Midterm Election Year Jitters

History shows that midterm election years often bring market volatility. The S&P 500 has experienced a median intra-year drawdown of 19% in these years. This pattern suggests there is a 50/50 chance the index could see a similar decline in 2026.

This volatility stems from the uncertainty that midterm elections create. The party in power typically loses seats in Congress, leaving investors to speculate about future fiscal, trade, and regulatory policies.

The stock market faces a convergence of headwinds in 2026. The combination of high valuations, the economic drag from tariffs, and the historical uncertainty of a midterm election year raises the probability of a bear market or even a crash.

However, there is a silver lining for long-term investors. Every past market drawdown has ultimately proven to be a buying opportunity, and there is no reason to believe this time will be different.

India's Trade Minister Piyush Goyal confirmed that a formal trade agreement with the United States is expected to be signed in March, a move that will see New Delhi reduce its tariffs on American goods.

Goyal laid out the first official timeline for the deal, which President Donald Trump first announced on Monday. A joint statement is expected within four to five days, which will trigger Washington to slash duties on Indian exports from 50% to 18%.

The agreement hinges on India halting its purchases of Russian oil and lowering existing trade barriers in exchange for more favorable tariff treatment from the U.S.

A core component of the deal is a commitment from India to import at least $500 billion worth of American goods over the next five years. The purchases will focus on high-value sectors, including energy, aircraft, and computer chips.

Goyal specified that orders from planemaker Boeing alone could amount to between $70 billion and $80 billion. He added that the total value of these aircraft deals would likely "cross $100 billion" when factoring in the cost of engines.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up