Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Colombia Central Bank Technical Team Revises 2026 Economic Growth Projection To 2.6% From Previous 2.9%

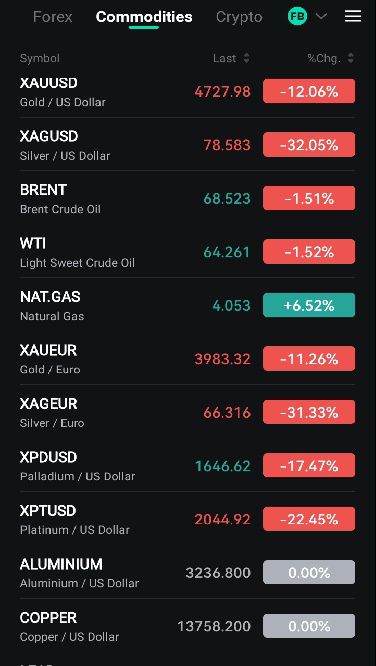

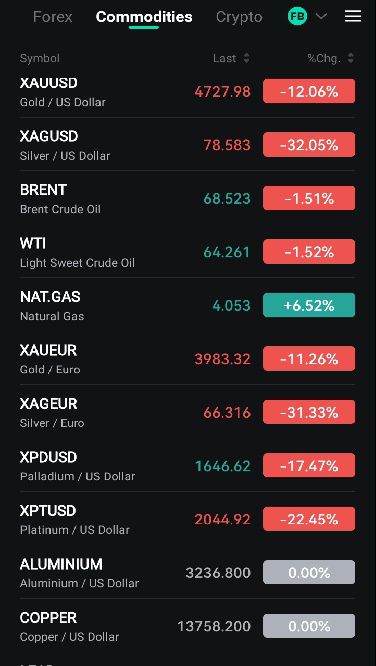

Spot Gold Fell 12.0% On The Day, To $4,725.64 Per Ounce. Spot Silver Fell 34.5% On The Day, To $75.25 Per Ounce

Spot Silver Fell 30.0% On The Day, Closing At $80.64 Per Ounce. New York Silver Fell 29.5% On The Day, Closing At $80.65 Per Ounce

Equipo Técnico Del Banco Central De Colombia Revisa Pronóstico De Crecimiento Económico Para 2025 A 2,9% Desde Previo De 2,6%

Colombia's Central Bank Hikes Interest Rate By 100 Basis Points To 10.25%, Surprising The Market

Baker Hughes - US Oil Drilling Rig Count Unchanged At 411 (Down 68 Versus Year Ago) In Week To Jan 30

Spot Gold Fell 10.5% On The Day, Its Biggest Drop In Decades, To $4,807.99 Per Ounce. New York Gold Fell 9.5% To $4,838.1 Per Ounce. Spot Silver Fell 26.0% To $85.06 Per Ounce. New York Silver Fell 25.5% To $85.17 Per Ounce

LME Copper Futures Closed Down $460 At $13,158 Per Tonne. LME Aluminum Futures Closed Down $74 At $3,144 Per Tonne. LME Zinc Futures Closed Down $10 At $3,402 Per Tonne. LME Lead Futures Closed Down $5 At $2,009 Per Tonne. LME Nickel Futures Closed Down $415 At $17,954 Per Tonne. LME Tin Futures Closed Down $3,129 At $51,955 Per Tonne. LME Cobalt Futures Closed Unchanged At $56,290 Per Tonne

Ukrainian Prime Minister Svyrydenko Says Russia Is Attacking Logistics, Launched Seven Attacks On Rail Facilities In Past 24 Hours

Ukraine President Zelenskiy: Ukraine Conducted No Strikes On Russian Energy Infrastructure On Friday

[German 10-year Bond Yields Fell More Than 6 Basis Points This Week And More Than 1 Basis Point In January] On Friday (January 30), In Late European Trading, The Yield On 10-year German Government Bonds Rose 0.3 Basis Points To 2.843%, A Cumulative Drop Of 6.3 Basis Points This Week, Continuing Its Overall Downward Trend. In January, It Fell 1.2 Basis Points, With An Overall Trading Range Of 2.910%-2.792%. The Yield On 2-year German Bonds Rose 0.5 Basis Points To 2.089%, A Cumulative Drop Of 4.1 Basis Points This Week And 3.2 Basis Points In January, Trading Within A Range Of 2.156%-2.048%. The Yield On 30-year German Bonds Rose 0.5 Basis Points To 3.494%, A Cumulative Increase Of 1.9 Basis Points In January. The Spread Between The 2-year And 10-year German Bond Yields Fell 0.163 Basis Points To +75.288 Basis Points, Down 2.147 Basis Points This Week And Up 2.142 Basis Points In January

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

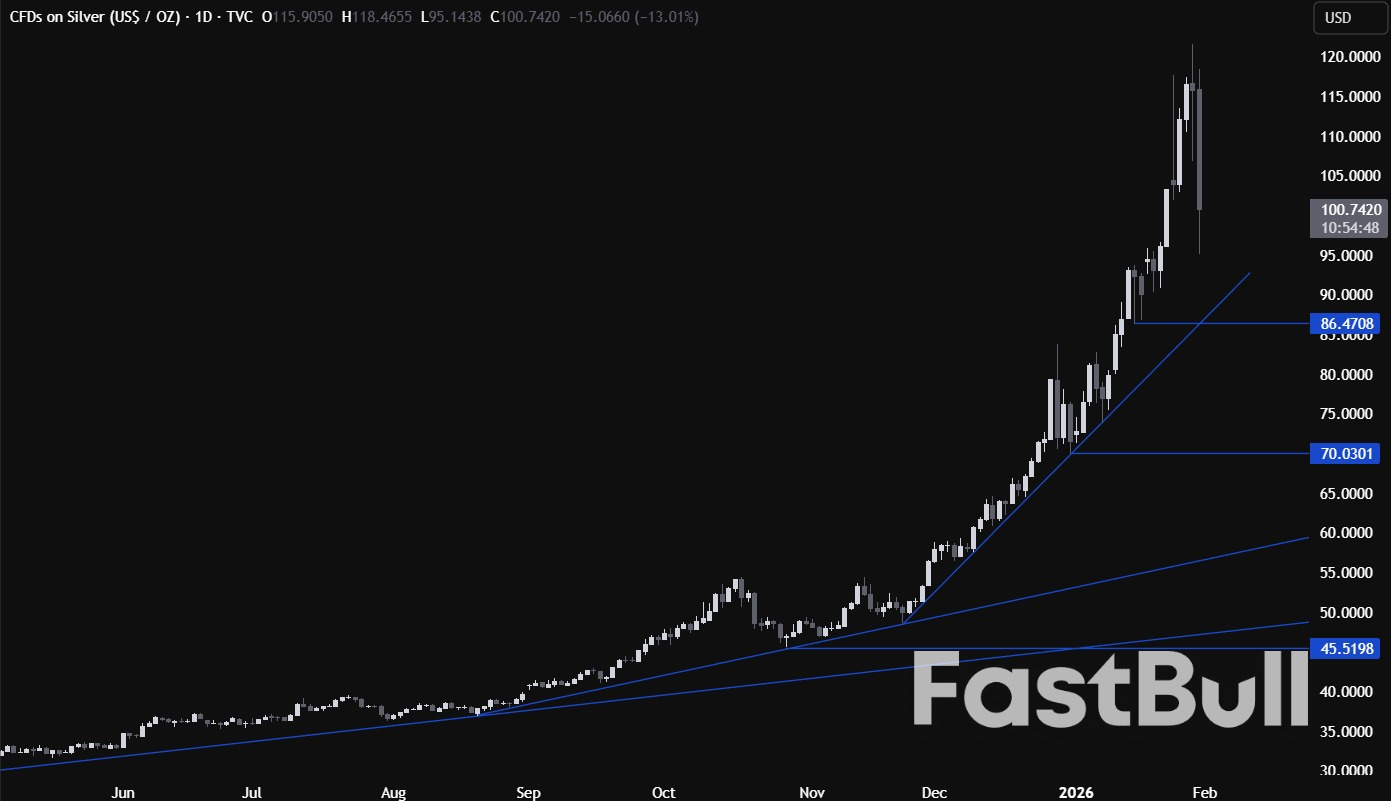

Silver continues to see a lot of volatility, as the momentum has gotten out of control. With this, the pullback is something that will give traders things to think about this weekend.

Silver daily chart.

Silver daily chart.The silver market initially tried to rally but then fell rather significantly during the early hours here on Friday, even breaking below the $100 level to reach near $95, an area that is round number, and seems to have been attractive for buyers.

We have turned around and recovered since then, but this to me looks a lot like serious problems just waiting to happen. It does make sense, after all; the silver market has been out of control for a while. Sooner or later, you see some type of deep correction or panic move. I have been warning about this for a couple of weeks now, and I suspect there are quite a few retail traders out there who have just blown their accounts.

This is the behavior of a market that is out of control. While you can make massive profits rather quickly, you can also get eliminated from the game just as quickly, and this is where position sizing matters.

The question now is whether or not we can stay above the $100 level on Friday at the close. That for me will tell you most of what you need to know about whether or not the correction is over. This is not a market you want to jump into with a huge position with this type of behavior at the moment. Quite frankly, this could be the beginning of something rather ugly. I would wait at this point until after the market closes to get a read on what is really going on.

Silver - daily

Silver - daily Silver - 4 hour

Silver - 4 hour Silver - 1 hour

Silver - 1 hourGermany's unemployment level has crossed the 3 million mark for the first time in 12 years, triggering an urgent response from Chancellor Friedrich Merz, who has declared an economic recovery his top priority for the year.

The bleak labor market data contrasts with other indicators showing unexpected resilience in Europe's largest economy, including better-than-forecast GDP growth in the fourth quarter and a minor uptick in inflation.

Data released by the Labour Office on Friday revealed a stark picture of the German jobs market, which is lagging behind the broader economy.

• Total Unemployed: The number of people out of work rose by 177,000 in January compared to December, bringing the total to 3.08 million.

• Unemployment Rate: In seasonally unadjusted terms, the unemployment rate climbed 0.4 percentage points to 6.6%.

"The rise in the number of unemployed to more than three million is an alarm signal," Chancellor Merz stated on the social media platform X. "The economic upturn must be this year's central priority."

Labour Office director Andrea Nahles noted the weakness, saying, "There is currently little momentum in the labour market." She explained that the sharp increase in January was partly due to seasonal factors.

When adjusted for seasonal trends, the situation appears more stable. The number of unemployed was unchanged from December at 2.976 million, keeping the adjusted jobless rate steady at 6.3%. This was better than the 4,000-person increase analysts had predicted.

While the jobs report raised concerns, other data offered a more positive outlook. The German economy demonstrated greater resilience than anticipated after two years of a mild contraction.

German gross domestic product (GDP) grew by 0.3% in the fourth quarter, outperforming the consensus forecast of 0.2%. The Statistics Office also confirmed its initial estimate of 0.2% growth for the full year.

Meanwhile, inflation data showed a slight acceleration in January, with the year-on-year rate hitting 2.1%. This was just above the 2.0% forecast and the European Central Bank's target. Core inflation, which strips out volatile food and energy prices, also rose to 2.5% from 2.4% in December.

Chancellor Merz has already committed to reviving the economy through increased spending on infrastructure and defense, but these measures are taking longer than anticipated to produce tangible results.

The government lowered its growth forecasts for 2026 and 2027 on Wednesday, acknowledging that its fiscal policies have not taken effect as quickly as hoped.

This has drawn skepticism from economists. Joerg Kraemer, chief economist at Commerzbank, said the government's fiscal package is "unlikely to fall on fertile ground," as most companies lack confidence in its economic policy.

Economy Minister Katherina Reiche argued that Germany must pivot to new "growth engines," stating that its traditional export strengths "no longer carry our growth."

Carsten Brzeski, global head of macro at ING, warned against complacency and called for structural reforms. "The biggest domestic risk remains any sudden shift from national depression to national complacency," he said.

Economists suggest the modest rise in German inflation is unlikely to concern the ECB.

"The small pick-up in German inflation in January won't worry the ECB too much as it was driven mainly by an increase in food inflation," explained Franziska Palmas, senior Europe economist at Capital Economics. She added that officials would be encouraged by a significant easing in services inflation.

Commerzbank's senior economist Ralph Solveen also noted that while core inflation ticked up, it remains below the roughly 2.75% level seen in the autumn.

This German data precedes the broader euro zone inflation reading, which economists forecast will slow to 1.7% in January from 1.9% in December.

A growing global oil surplus is expected to keep prices anchored near the $60 per barrel mark this year, overpowering the market impact of geopolitical flare-ups, according to a recent Reuters monthly poll.

The January survey, which included 31 economists and analysts, projects that Brent Crude will average $62.02 per barrel in 2026. This represents a slight increase from the December forecast of $61.27.

For the U.S. benchmark, West Texas Intermediate (WTI) Crude, the consensus forecast is an average of $58.72 per barrel, also a modest rise from the previous month's estimate of $58.15.

Despite these bearish long-term forecasts, current market prices are telling a different story. Early on Friday, Brent crude was trading at $70.50, while WTI surpassed the $65 mark to trade at $65.17.

This recent price surge is linked to escalating tensions between the United States and Iran. The market reacted after U.S. President Donald Trump warned that a "massive armada" of U.S. Navy ships, led by the aircraft carrier Abraham Lincoln, was en route to the Persian Gulf.

"Like with Venezuela, it is, ready, willing, and able to rapidly fulfill its mission, with speed and violence, if necessary," President Trump stated. In response, Iran asserted that its military is prepared to react "immediately and powerfully" to any act of aggression.

Even with the heated rhetoric, analysts believe market fundamentals—specifically, oversupply—will ultimately dictate the price trajectory. The Reuters poll suggests this supply glut will offset the risk premium from political tensions.

Norbert Ruecker, head of economics and next generation research at Julius Baer, told Reuters that geopolitical events are creating temporary volatility but won't change the underlying market balance. "Geopolitics brings lots of noise but neither the events in Venezuela nor Iran should ultimately alter the big picture," he said. "The oil market appears to be in a lasting surplus."

Looking ahead, analysts identified three critical factors that will shape oil prices throughout the year:

• Oil Demand Trends: Consumption patterns, particularly in China, will be closely watched.

• OPEC+ Supply Policy: Decisions made by the producer group will have a direct impact on global supply.

• U.S. Trade Policies: Broader trade dynamics will influence global economic health and energy demand.

Taiwan’s economy expanded at its fastest pace since 1987, driven by surging global demand for its artificial intelligence technologies. According to a report from the statistics bureau in Taipei, the nation's gross domestic product (GDP) grew by 12.68% in the fourth quarter, shattering the median economist prediction of 8.75%.

This impressive quarterly performance capped off a strong year. The annual GDP for the previous year surged by 8.63%, also beating forecasts which had centered around 7.5%.

Lynn Song, Chief Economist for Greater China at ING Bank NV, noted that the results consistently outperformed market expectations. "Taiwan has remained a major winner from the tech boom," Song said, adding that the figures "come after an already impressive year in 2024."

Analysts had anticipated that AI would be a significant factor in Taiwan's economic performance this year, as businesses and individuals increasingly adopt related technologies. The strength of this trend has prompted major financial institutions to revise their forecasts upward.

Goldman Sachs Group Inc., for example, updated its 2026 growth projection for Taiwan from a range of 4.4% to 5.1%, surpassing the central bank's own forecast of 3.67%.

Confidence is also high within the industry. Taiwan Semiconductor Manufacturing Co. (TSMC), Asia's most valuable company, announced plans for up to $56 billion in capital spending this year, a figure that exceeded expectations. The chipmaker also projects revenue growth of nearly 30% in 2026, outstripping Wall Street forecasts.

The economic optimism is further supported by a robust export sector and a new trade agreement with the United States. Under the agreement, the tariff rate on Taiwanese products was lowered from 20% to 15%, and local companies were permitted to invest up to $500 billion in American operations.

Taiwan's export sector reached peak levels in 2025. Advanced chips, which are exempt from certain US duties, accounted for over 60% of these shipments. As a result, the island's trade surplus with the United States more than doubled, hitting an all-time high of $150.1 billion this year compared to $64.7 billion in the previous year.

The boom isn't just external. Private consumption on the island rose by 3.43% in the fourth quarter compared to a year ago, marking the quickest expansion since the second quarter of 2024. This growth was partly fueled by a government stimulus program that allocated approximately NT$10,000 ($318) to each citizen.

"The rise in household spending was even better than we expected, thanks to the government's cash payments," commented Michelle Lam, an economist for Greater China at Societe Generale SA.

This combination of strong domestic and international performance is expected to influence monetary policy. Analysts now predict that the Central Bank of the Republic of China (CBC) will maintain its policy rate at 2% throughout 2026, delaying rate cuts that were previously anticipated for early this year.

United Nations Secretary-General Antonio Guterres has issued his most urgent warning to date, telling member states that the 79-year-old global body is at risk of "imminent financial collapse." The crisis stems from a record amount of unpaid fees and a dysfunctional budget rule that forces the organization to return money it doesn't have.

In a stark letter to ambassadors, Guterres warned that the situation is worsening and threatens the UN's ability to deliver its programs. He projects the organization could completely run out of cash by July.

The UN's liquidity crisis has been deepening, culminating in a record $1.57 billion in outstanding dues by the end of 2025. This shortfall cripples the organization's operational capacity, which spans everything from peacekeeping and humanitarian aid to promoting human rights and economic development.

The funding crisis is amplified as key member states back away from their financial commitments. The United States, the UN's largest contributor at 22% of the core budget, has been retreating from multilateralism. Under President Donald Trump, the U.S. has slashed voluntary funding to UN agencies and refused to make mandatory payments for the regular and peacekeeping budgets.

Guterres noted that "decisions not to honour assessed contributions" have been formally announced, though he did not name the specific countries. The funding structure, based on the size of each member's economy, places China as the second-largest contributor at 20%.

Compounding the problem of unpaid dues is an antiquated financial regulation that Guterres described as a "Kafkaesque cycle." Under this rule, the UN is required to credit back hundreds of millions of dollars in unspent funds to member states each year.

The fatal flaw is that these credits must be returned even if the initial dues were never paid, forcing the organization to give back cash it never received. "In other words, we are trapped in a Kafkaesque cycle expected to give back cash that does not exist," Guterres explained.

Faced with this dual threat, the Secretary-General presented member states with a clear choice: either honor their financial obligations in full and on time, or agree to a fundamental overhaul of the UN's financial rules to prevent a collapse.

Efforts to improve efficiency are already underway. Guterres launched a reform task force, UN80, to cut costs, and member states agreed to reduce the 2026 budget by approximately 7% to $3.45 billion. However, these measures alone appear insufficient to solve a crisis rooted in massive funding gaps and broken internal processes.

U.S. producer prices recorded their largest monthly gain in five months in December, a development that suggests underlying inflation could be accelerating. This uptick, driven by a sharp rise in the cost of services, may give the Federal Reserve reason to keep interest rates steady in the coming months.

The Labor Department reported on Friday that the Producer Price Index (PPI) for final demand jumped 0.5% last month, beating the 0.2% increase forecast by economists polled by Reuters. This followed an unrevised 0.2% gain in November.

On a year-over-year basis, the PPI rose 3.0% through December, matching the previous month's pace. For the full year, producer prices advanced 3.0% in 2025, following a 3.5% increase in 2024.

The primary driver behind the unexpectedly strong PPI reading was a 0.7% increase in the prices for services, while goods prices remained flat. The surge in services accounted for the entirety of the headline increase.

A key factor was a 1.7% jump in margins for final demand trade services, which measures the change in margins for wholesalers and retailers. This component alone was responsible for two-thirds of the overall services increase.

Other notable price hikes in the services sector included:

• Hotel and motel rooms: Surged 7.3%

• Airline fares: Soared 2.9%

• Portfolio management fees: Increased 2.0%

These components are significant as they feed into the Personal Consumption Expenditures (PCE) price indexes, which are the Federal Reserve's preferred measures for tracking its 2% inflation target.

Economists suggest that the effects of import tariffs are starting to filter through the supply chain, though the impact remains uneven.

"Tariff impacts continued to flow through producer costs unevenly in December," noted Ben Ayers, a senior economist at Nationwide. "At a broad level, costs associated with tariffs remain muted... but localized effects can be pronounced."

Ayers added that the spike in trade services likely reflects "producers looking to recoup some of the losses caused by higher production costs over 2025."

The latest inflation data supports the Federal Reserve's current policy stance. The U.S. central bank recently left its benchmark interest rate unchanged in a range of 3.50% to 3.75%.

Fed Chair Jerome Powell acknowledged that tariffs had contributed to an overshoot in inflation but said he expected that pressure to peak around the middle of the year.

The report reinforces the central bank's shifting focus, according to Carl Weinberg, chief economist at High Frequency Economics. "This report validates the pivot of the Fed away from labor market risks back toward price stability," he said.

Economists now estimate that core PCE inflation for December could rise by 0.3% to 0.4%, which would bring the annual rate to 3.0%.

In sharp contrast to services, producer prices for goods were unchanged in December after rising 0.8% in the prior month.

A 1.4% drop in energy prices, driven by lower gasoline costs, weighed on the goods index. Food prices also declined by 0.3%, partly due to a 20.4% plunge in the cost of fresh and dry vegetables.

However, when volatile food and energy components are excluded, producer goods prices advanced 0.4%, up from a 0.2% rise in November.

The stronger-than-expected PPI data overshadowed President Trump's nomination of Kevin Warsh, a former Fed governor, to replace Powell as head of the central bank.

Following the report, U.S. stocks opened lower, the dollar strengthened against a basket of other currencies, and U.S. Treasury yields rose.

The data release also comes as the Bureau of Labor Statistics (BLS) works to catch up on reports delayed by a 43-day federal government shutdown. Lawmakers were working on Friday to avoid another shutdown that could postpone future data releases.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up