Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Ethereum Drops Out Of Global Top 50 Asset Market Cap Ranking, Now 56Th] January 31, According To 8Marketcap Data, After A 14.43% Cumulative Decline In 7 Days, Ethereum'S Current Market Cap Is $305.6 Billion, Falling Out Of The Top 50 Global Asset Market Cap Ranking, Currently Ranked 56Th

[Ethereum Plunges Below $2600, 24-Hour Loss Extends To 4.9%] January 31, According To Htx Market Data, Ethereum Dropped Below $2600, With A 24-Hour Decline Widening To 4.9%

[Melania Trump's Documentary Released, Costing Over 500 Million Yuan, Fails At Global Box Office, Receives 1.7 Rating] According To Xinhua News Agency, The Documentary "Melania: 20 Days To History" (hereinafter Referred To As "Melania"), Featuring First Lady Melania Trump, Was Released In Theaters Worldwide On January 30th, But Has Been Met With A Lukewarm Reception In Many Countries. Multiple International Media Outlets Reported That Ticket Sales In Theaters In The UK, Canada, And Even The US Have Been Dismal, With Some Screenings Almost Entirely Empty. On Rotten Tomatoes, A Globally Renowned Film And Television Rating Website, The Film Received A Low Score Of 1.7. The Film's Production And Promotion Costs Reached A Staggering $75 Million (approximately 521 Million Yuan, Similar To The Rumored Cost Of "Ne Zha 2"), Drawing Criticism For Amazon Founder Jeff Bezos's Massive Investment

Four Killed In Gas Explosion At Residential Building In Iran's Ahvaz - Iran's State-Run Tehran Times

IAEA: Chornobyl Site Briefly Lost All Off-Site Power. Ukraine Working To Stabilize Grid And Restore Output, No Direct Impact On Nuclear Safety Expected

IAEA: Ukrainian Npps Temporarily Reduced Output This Morning After Technological Grid Issue Affected Power Lines

Tigrayan Official And Humanitarian Worker: One Person Killed, Another Injured In Drone Strikes In Ethiopia's Tigray Region

Explosion In Iran's Southern Port Of Bandar Abbas , Iranian Media Denies Report Commander Of Revolutionary Guards Targeted

[Epstein Documents Continue To Be Released, Involving Multiple US Political And Business Figures] The US Department Of Justice Announced On January 30 That It Would Release The Remaining Documents, Totaling Over 3 Million Pages, Related To The Case Of The Late Billionaire Jeffrey Epstein. According To US Media Reports, The Documents Reveal That Numerous Prominent US Political And Business Figures Knew And Associated With The Businessman, Who Was Suspected Of Sex Crimes And Died Mysteriously In Prison. These Include Commerce Secretary Howard Lutnick, Entrepreneur Elon Musk, And Stephen Bannon, An Advisor During Trump's First Presidential Term

Moldova's Government: Problems In Ukraine's Power Grid Led To Moldova's Energy System Emergency Shutdown

[Bitcoin Falls Below $83,000, 24-Hour Gain Narrows To 0.53%] January 31, According To Htx Market Data, Bitcoin Fell Below $83,000, With A 24-Hour Growth Narrowing To 0.53%

[Canada Plans To Establish Defense Bank With Multiple Countries] Canadian Finance Minister François-Philippe Champagne Said On January 30 That Canada Will Work Closely With International Partners In The Coming Months To Establish A Defense Bank To Raise Funds For Maintaining Collective Security. Champagne Posted On Social Media Platform X That Day That More Than 10 Countries, Under Canada's Auspices, Discussed The Establishment Of A "Defense, Security And Reconstruction Bank." He Did Not Specify Which Countries Were Involved In The Discussions. According To Reuters, Supporters Hope The Proposed Defense Bank Will Be A Global Nation-support Institution With A AAA Credit Rating, Raising $135 Billion For Defense Projects In Europe And NATO Member States

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Fed shifts policy: future rate cuts now depend on labor market health, sparking crypto uncertainty.

Federal Reserve Chair Jerome Powell has signaled a significant shift in monetary policy, announcing that future interest rate cuts are now directly tied to the health of the U.S. labor market. The news introduces a new layer of uncertainty for cryptocurrency markets, which have been sensitive to the Fed's every move.

The announcement came after the Federal Open Market Committee (FOMC) meeting on January 28, 2026, where officials decided to hold the federal funds rate target steady in its current range of 3.5% to 3.75%.

The decision to maintain the current interest rate follows a period of easing that saw cuts totaling 75 basis points since September 2024. By pausing now, the Fed is adopting a cautious, data-driven stance.

Powell clarified the central bank's position, stating that its goal is to stabilize the labor market while guiding inflation back to its 2% target. He emphasized that incoming economic data, particularly employment figures, will be the primary driver for any future adjustments to monetary policy.

The Fed's explicit focus on labor conditions marks a critical pivot. Previously, inflation data was the main variable watched by markets. Now, traders and analysts must pay equally close attention to employment reports to anticipate the Fed's next steps.

This new dependency means that strong jobs data could delay rate cuts, while a weakening labor market might accelerate them. This conditionality complicates forecasts and adds a new variable for investors pricing assets.

The crypto market, including major assets like Bitcoin (BTC) and Ethereum (ETH), reacted immediately to the shift in guidance. The relationship between Fed policy and crypto prices is straightforward:

• Lower Rates, More Liquidity: Rate cuts typically increase liquidity in the financial system, which often flows into higher-risk assets like cryptocurrencies, potentially fueling rallies.

• Uncertainty Creates Volatility: With future cuts now dependent on a less predictable factor like the labor market, the path forward is less clear. This uncertainty can lead to short-term price volatility as traders adjust their expectations.

The broader digital asset ecosystem, including DeFi and Layer 1/Layer 2 protocols where borrowing and lending are core activities, remains highly sensitive to these macroeconomic signals. The Fed's pause and new wait-and-see approach could temper the momentum of recent asset rallies until a clearer policy path emerges.

The United States has officially ruled out supporting any intervention to prop up the weakening Japanese yen, according to a definitive statement from Treasury Secretary Scott Bessent. As Japan faces growing pressure to defend its currency against a surging dollar, this hands-off approach from the U.S. means Tokyo may have to act alone.

Bessent’s remarks confirm that the U.S. will not participate in coordinated actions to stabilize the yen, committing instead to a policy of market-determined exchange rates.

At a press briefing, Treasury Secretary Bessent underscored the core principle of American financial policy: supporting freely traded exchange rates. He stated that any move to artificially adjust currency values is inconsistent with this long-standing approach.

"We believe markets should set exchange rates," Bessent said, clarifying that the administration does not view the yen's current slide as a crisis requiring international intervention. This stance aligns with the U.S. policy of avoiding direct currency manipulation except in rare and extreme situations.

With the United States stepping back, the pressure now shifts entirely to Japan. The decision creates several significant implications for the Bank of Japan and the wider financial world.

• Potential for Unilateral Action: Japan may now be forced to act unilaterally to stop the yen's decline. However, without U.S. backing, such an intervention could have a limited impact and may even risk triggering further volatility in currency markets.

• Signal of Continued Dollar Strength: For investors, the U.S. position can be interpreted as a signal of continued dollar strength. A strong dollar often exerts downward pressure on risk-sensitive assets, including Bitcoin and other digital currencies.

• Broader Macro Uncertainty: The development highlights the ongoing geopolitical and macroeconomic uncertainties that continue to shape global markets.

Ultimately, the path forward for the yen now depends entirely on Japan's next move. With the U.S. firmly on the sidelines, the decisions made in Tokyo will have significant ripple effects across the global financial system.

Oil prices surged to a four-month high in Asian trading on Thursday, building on recent momentum as multiple factors tightened the market. The rally is being driven by rising geopolitical risk between the United States and Iran, severe supply disruptions from cold weather in the U.S., and a weaker dollar.

During Thursday's session, Brent oil futures for March delivery climbed 0.8% to $68.96 a barrel, while West Texas Intermediate (WTI) crude futures increased 0.9% to $63.75 a barrel.

A key driver behind the price spike is the escalating tension in the Middle East, which has traders pricing in a higher risk premium for crude oil. Markets are increasingly concerned that a potential conflict could disrupt crude output from Iran.

These fears intensified following reports that U.S. President Donald Trump was weighing new military options against Iran, potentially targeting its leadership and nuclear infrastructure. This consideration comes shortly after President Trump publicly urged Iran to abandon its nuclear ambitions and re-engage with the U.S. Tehran rejected these calls and threatened retaliation.

The situation is further strained by the arrival of U.S. ships in the Middle East, with Trump recently stating that another naval group was en route to the region.

In the United States, domestic supply is being squeezed by extreme weather. A major winter storm has brought heavy snowfall and sub-zero temperatures across large parts of the country, significantly disrupting crude production.

Key impacts of the weather include:

• An estimated 2 million barrels per day of crude production have been taken offline over the past week.

• Oil exports from the Gulf coast have also been disrupted.

This sharp drop in output is expected to tighten U.S. oil supplies, a trend already visible in the latest inventory data. Government figures released Wednesday showed that U.S. crude inventories fell by 2.295 million barrels for the week ending January 23. This draw was far greater than the market expectation of a 0.2 million barrel decline.

A weaker U.S. dollar is also providing support for oil prices. The currency remained under pressure after the Federal Reserve decided to leave interest rates unchanged, as was widely expected.

In an unexpected development, the United States is returning a seized oil tanker to Venezuela, according to two U.S. officials who spoke with Reuters on Wednesday. The move comes after a months-long American campaign to intercept vessels linked to Venezuela's oil trade, which has resulted in seven seizures since late last year.

The officials, who requested anonymity, identified the vessel as the M/T Sophia, a Panama-flagged supertanker. They did not provide a reason for the decision to return the ship. Neither the U.S. Coast Guard, which leads these interdiction operations, nor the Venezuelan communications ministry responded to requests for comment.

The M/T Sophia was carrying oil when it was intercepted by the U.S. Coast Guard and military forces on January 7. At the time of the seizure, the Trump administration described the tanker as a "stateless, sanctioned dark fleet motor tanker."

One source could not confirm whether the Sophia still contained its oil cargo. Earlier this month, the Sophia and another seized tanker were observed near Puerto Rico.

This latest action occurs within the context of President Trump's assertive foreign policy toward Venezuela. The administration initially focused on removing President Nicolas Maduro from power. After diplomatic efforts stalled, Trump ordered a raid on January 3 to capture Maduro and his wife.

Following the raid, the White House announced its intention to control Venezuela's oil resources indefinitely as part of a $100 billion plan to rebuild the nation's struggling oil industry. The return of the M/T Sophia raises questions about the current direction of this strategy.

Experts have raised alarms about the safety of many tankers linked to Venezuela, which are often part of a "shadow fleet" operating outside of standard regulations. A significant number of these vessels, including many seized by the U.S., were built over 20 years ago.

According to shipping and insurance industry sources, these aging tankers frequently lack proper safety certifications and adequate insurance coverage. This creates substantial risks for global shipping and the environment, as establishing liability for oil spills or collisions becomes nearly impossible.

In a related development, the Dubai-based company GMS has applied for a U.S. license to purchase and scrap ships seized by the American government that were involved in Venezuelan oil trading.

The Philippine economy expanded by 4.4% in 2025, marking its slowest annual growth in five years. The slowdown reflects the combined impact of a high-profile infrastructure corruption scandal and persistent global trade pressures.

Government data released Thursday confirmed that last year's gross domestic product (GDP) growth was the weakest since 2020, when the economy contracted by 9.5% during the COVID-19 pandemic.

Momentum faded toward the end of the year, with GDP expanding just 3.0% in the fourth quarter. This was a decline from the revised 3.9% growth in the previous quarter and the slowest quarterly performance since early 2021.

The full-year result fell short of the 5.5% to 6.5% target set by President Ferdinand Marcos Jr.'s administration and was also below the 4.8% median forecast from economists surveyed by BusinessWorld.

Several key factors contributed to the underperformance in the second half of 2025. A major graft scandal involving nationwide flood control projects disrupted public construction and dampened household spending. The economy also faced challenges from multiple typhoons and floods that struck the country throughout the year.

These domestic issues were compounded by external headwinds. The Department of Economy, Planning and Development cited global trade friction, particularly U.S. President Donald Trump's "reciprocal" tariffs, as a key factor.

In response, the government has already adjusted its future expectations. In early January, economic managers revised the 2026 growth target downward from an initial range of 6-7% to a more modest 5-6%.

Despite the missed targets, some experts view the situation as a slowdown rather than a crisis. Robert Dan Roces, an economist at SM Group, noted that the 2025 performance was "not a crisis story."

"Domestic demand and services kept growth intact, yet momentum stayed capped as public investment underperformed," Roces explained. "The main drag came from weak government spending execution, which limited the growth boost from infrastructure."

Looking ahead, Roces sees 2026 as a "confidence and execution test." He suggests that while trade pressures and governance issues may delay public projects, easing financial conditions "give room for a gradual recovery once private investment responds."

Miguel Chanco, chief emerging Asia economist at Pantheon Macroeconomics, offered a more cautious view. He projects a "trivial improvement in growth" to 5.0% in 2026, arguing that Filipino consumers are "still in no real financial health to provide a material boost."

Chanco highlighted several underlying weaknesses:

• Consumer confidence remains subpar.

• Household debt levels have limited room to expand further.

• Spending intentions are still subdued compared to pre-pandemic levels.

A significant drop in inflation provided the central bank with flexibility. The average inflation rate for 2025 slowed to 1.7%, the lowest since 2016.

This cooling price environment allowed Bangko Sentral ng Pilipinas (BSP) to continue its monetary easing cycle, which began in August 2024. In December, the central bank cut its benchmark policy rate by 25 basis points to 4.5% to help stimulate consumption.

"A softer 2025 growth print gives the BSP space to ease policy," Roces said, adding that "any rate cuts will stay cautious and paced, anchored on inflation risks and currency stability."

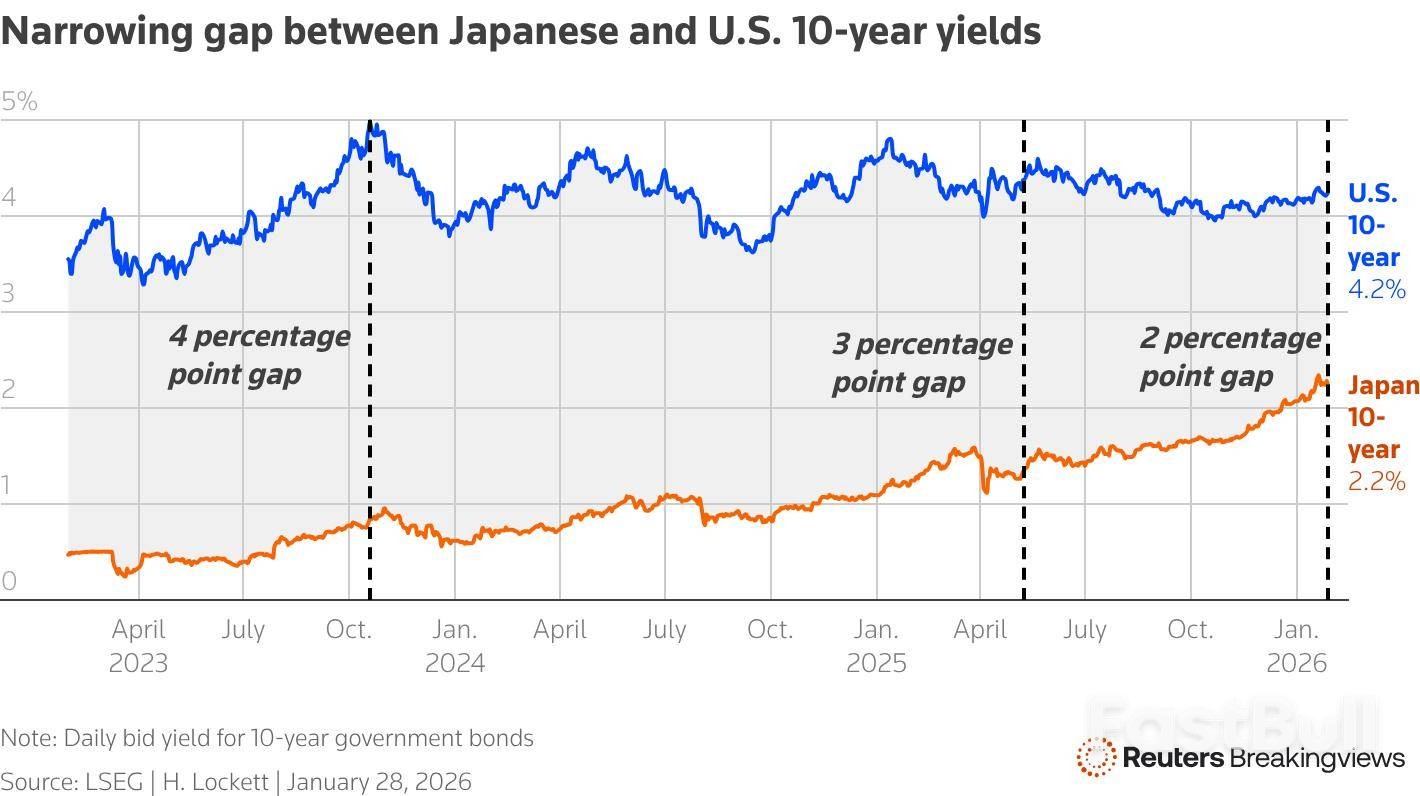

A snap election called by Prime Minister Sanae Takaichi is sparking fears of a major fiscal policy shift in Japan, sending tremors through global financial markets. Concerns about increased government spending are pushing Japanese government bond yields to new highs and weighing on the yen, raising a critical question: Will Japanese investors start bringing their money home?

The potential for a massive repatriation of capital is forcing global investors to pay close attention.

Concerns over Japanese investors selling foreign assets are grounded in the sheer scale of their holdings. For decades, low domestic interest rates drove a hunt for yield abroad, turning Japan into one of the world's largest creditors.

According to Brad Setser, a senior fellow at the Council on Foreign Relations, Japanese investors hold over $2 trillion in foreign long-term bonds, in addition to another $1 trillion in reserves. U.S. data underscores this dominance, showing Japanese residents as the single largest foreign owners of Treasury securities, holding $1.2 trillion as of November.

If Japan's pension funds, insurers, banks, and asset managers were to suddenly dump these assets, the shock could disrupt markets, particularly in the long-dated sovereign debt space where they are major global players.

Despite the risk, a large-scale rotation out of U.S. Treasuries, German bunds, or UK gilts and into Japanese government bonds (JGBs) faces significant hurdles.

The primary obstacle is the Japanese bond market's limited scale and depth. The Bank of Japan (BOJ) already owns half of all outstanding JGBs, leaving an investable market of about 55 trillion yen ($3.6 trillion). This is just a fraction of the $30 trillion market for U.S. Treasuries.

The BOJ's massive presence also drains liquidity, especially for long-term debt, making prices susceptible to sharp swings. A recent market dislocation index from Bloomberg hit a record high, indicating that yields were suppressed by a tenth of a percentage point due to a lack of liquidity. This inherent volatility poses a risk for any investor moving large sums into JGBs, a danger that could intensify if Takaichi’s Liberal Democratic Party wins the election and implements ambitious spending plans.

Even with these structural challenges, the appeal of domestic bonds is undeniably growing. Benchmark yields on 10-year and 30-year JGBs have reached 2.2% and 3.6%, respectively, offering newly competitive returns.

This shift is already influencing behavior. Toru Nakashima, CEO of Sumitomo Mitsui Financial Group, Japan's second-largest banking group, told Reuters in December that the company would gradually increase its exposure to local government debt if the 10-year yield rose "a bit further" and stabilized.

Such statements from major institutional leaders are a clear signal that global investors must begin pricing in a steady reduction of Japanese demand for foreign assets, even if the process is gradual.

Investors will be looking for more clarity on Tokyo's fiscal strategy after the February 8 election. However, a sudden rush back into the domestic market is unlikely.

"These kinds of investors – especially insurance companies, pension funds – they don't move all at once," notes Prashant Bhayani, Asia chief investment officer at BNP Paribas Wealth Management. "These flows play out over many years."

Recent market activity highlights the tension. On January 28, a strong auction for super-long-term debt caused JGB yields to dip, with the 40-year yield falling to 3.9% and the 10-year to 2.3%. This followed a spike just days earlier on January 20, when the 40-year yield surpassed 4% for the first time since its 2007 debut. That surge was driven by fears that an election win for Takaichi would open the door to tax cuts and further spending for Japan's heavily indebted economy.

A Brooklyn man was sentenced to 15 years in prison on Wednesday for taking part in what prosecutors called a failed Iran-backed murder-for-hire plot against Masih Alinejad, a prominent Iranian dissident living in the U.S., the Justice Department said.

Carlisle Rivera, also known as "Pop," previously pleaded guilty to one count of conspiracy to commit murder-for-hire and one count of conspiracy to commit stalking before U.S. District Judge Lewis Liman for the Southern District of New York, who imposed Wednesday's sentence, the Justice Department said in a statement.

Alinejad, who fled Iran in 2009, is a longtime critic of Iran's head-covering laws and a journalist. She has promoted videos of women violating those laws to her millions of social media followers. She was living in Brooklyn at the time of the alleged plot on her life.

The case was part of a crackdown by the Justice Department on what it calls transnational repression: the targeting by authoritarian governments of political opponents on foreign soil.

Prosecutors said Iran's elite Revolutionary Guard Corps and its intelligence officials have repeatedly tried to target Alinejad.

Iran has dismissed as baseless allegations that its intelligence officers sought to kidnap or kill her.

Other people have also been convicted in the U.S. and sentenced in relation to the alleged plot.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up