Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump's challenge to Federal Reserve independence escalates to the Supreme Court, threatening central bank autonomy.

Since taking office, Donald Trump has repeatedly challenged the independence of the Federal Reserve, pressuring the central bank for lower interest rates and even considering the dismissal of Chair Jerome Powell to advance his economic agenda. In one unusual move, Trump personally visited the Fed to oversee renovations, signaling his intent to exert influence over the institution.

Jerome Powell has publicly detailed the extent of this pressure. In a video statement, he described how Trump threatened legal action when the Fed did not comply with demands for rapid rate cuts. Powell criticized the Justice Department's involvement, framing it as a tactic used solely because his institution resisted the president’s requests. This tension has brought a simmering conflict within the nation's financial leadership into the open.

The power struggle intensified with Trump's attempt to remove Federal Reserve member Lisa Cook, claiming he had secured a new majority on the board. Cook resisted the move, sparking a legal challenge that has now escalated all the way to the Supreme Court. This case highlights the profound standoff between the executive branch and the central bank.

Demonstrating the gravity of the situation, Powell announced he plans to attend the Supreme Court hearing on Cook's potential dismissal. A Fed Chair’s presence at such a proceeding is highly unconventional and underscores the serious threat to the central bank's operational independence. The court's decision on Trump's authority to terminate Cook carries significant constitutional weight. Powell’s testimony is expected to focus on the danger that political interference poses to the Fed's institutional stability and reputation.

These high-level disputes have tangible economic consequences. Last August, a similar scenario contributed to a decline in cryptocurrency values, proving that political turmoil can trigger market volatility. The current debate is stirring similar anxieties and raising the possibility of a downturn driven by widespread uncertainty.

Ultimately, this ongoing conflict raises critical questions about the independence of key financial institutions. Powell's firm stance has major implications for governance and policymaking at the Federal Reserve. Any successful challenge to the Fed's autonomy could destabilize both domestic and international markets, demonstrating the complex and critical interplay between political ambition and monetary governance.

Kevin Hassett has officially withdrawn from consideration to become the next chair of the U.S. Federal Reserve. The decision came after President Donald Trump indicated he preferred Hassett to remain in his current White House role, significantly narrowing the field of candidates and intensifying the focus on the political and legal pressures surrounding the central bank's leadership.

The race for the top job at the Fed is now defined by more than just monetary policy. With a criminal investigation into current Chair Jerome Powell underway and the prospect of a contentious Senate confirmation process, political viability has become a critical factor for any potential nominee. This dynamic is set to prolong uncertainty over the future of Fed governance and the direction of interest rates.

In a recent television interview, Hassett confirmed that discussions with President Trump about the Fed chair position had been ongoing for months, describing the situation as unresolved. However, Trump’s public remarks last week effectively made the decision for him. During a White House event, the president told Hassett directly that he wanted him to stay in the West Wing.

That conversation appears to have settled the matter. Hassett later acknowledged that Trump might be right to keep him in his current post, noting that several strong candidates were still in contention. He added that he felt valued in his role and viewed the president’s comments as encouraging.

With Hassett out, the list of potential successors has shrunk to four individuals. According to sources familiar with the selection process, the focus is shifting rapidly as the administration weighs its options.

As the search for a new Fed leader continues, the criteria appear to be evolving. One candidate gaining attention is Rick Rieder, whose appeal is reportedly based less on ideological alignment and more on political pragmatism. Insiders suggest he is viewed as a candidate who might face a smoother confirmation process in the Senate, a key consideration at a time of heightened political friction.

The selection process is now heavily influenced by several overlapping factors:

• A smaller pool of viable candidates.

• Growing concerns about Senate confirmation risks.

• An emphasis on political durability over specific policy stances.

• Intensifying scrutiny of the Fed's governance and independence.

• Legal challenges affecting the current leadership.

Adding another layer of complexity is the criminal investigation into current Fed Chair Jerome Powell. The inquiry centers on cost overruns from renovations at the Federal Reserve's headquarters in Washington. While presented as a matter of financial oversight, the probe carries significant political weight.

Powell has suggested the investigation is linked to his independent stance on interest-rate policy. In a video posted on the Fed’s website, he implied that the threat of legal action was a consequence of his resistance to the president's calls for lower rates.

A U.S. attorney approved the subpoena related to the investigation, which concerns Powell's testimony to Congress about the project's costs. President Trump has publicly denied directing the probe, but his past statements have consistently reflected his frustration with Powell's leadership.

The controversy has also hardened positions in the Senate. A senior Republican on the Senate Banking Committee warned that any Fed nominee put forward by Trump will now face more aggressive scrutiny. This resistance could delay or even prevent the appointment of a new chair before Powell’s term officially ends on May 15.

Furthermore, the administration faces significant legal constraints in its efforts to reshape the Fed's board:

• By law, Federal Reserve governors serve 14-year terms.

• A governor can only be removed "for cause," a standard that is not clearly defined.

• Even if replaced as chair, Powell can remain a member of the board until 2028.

• The administration is also attempting to remove another governor, but court challenges could slow this process.

The other governor targeted for removal has denied allegations of mortgage fraud, calling them baseless, and the dispute is expected to move to the courts. This adds another element of uncertainty to the Fed's future composition. Currently, three of the seven governors already favor lower interest rates, aligning with the president’s view. Replacing additional members could decisively shift the board's policy direction.

Meanwhile, the Treasury secretary, who had previously taken himself out of the running, is now leading the search for a new chair. While President Trump continues to distance himself from the Powell investigation, his public comments signal a clear desire for change. Speaking recently to a business group, he remarked that Powell would be gone soon.

UK Prime Minister Keir Starmer is facing a defining test of his foreign policy as Donald Trump’s latest threats challenge the core of the transatlantic alliance. While some called for a dramatic rebuke, Starmer used a Monday press conference to defend his strategy of relentless diplomacy, even as it appears to be faltering.

Trump was "completely wrong" to threaten tariffs over his ambition to purchase Greenland, Starmer stated, but he stressed that Britain's relationship with America "matters profoundly." The Prime Minister affirmed his determination to keep the US-UK partnership strong, just as it was under previous presidents.

However, with Trump escalating his trade war on Europe, Starmer's "pragmatic, sensible" approach is being pushed to its limits.

"We're at a critical point now where whether or not Starmer's diplomacy has worked is going to be revealed in the next days, weeks at most," said Sam Edwards, a historian at Loughborough University specializing in US-UK relations.

Like his predecessors, Starmer has tried to leverage the "special relationship" to manage an unpredictable US president. This approach is best symbolized by the Prime Minister brandishing an invitation from King Charles III for an unprecedented second state visit, which delighted Trump. Other European leaders have employed similar tactics, notably NATO chief Mark Rutte, who referred to the president as "daddy."

This strategy has yielded some benefits. Starmer reportedly helped mend ties after Ukrainian President Volodymyr Zelenskiy's heated exchange with Trump in the Oval Office. More recently, the US seemed to align more closely with Europe on Ukraine, suggesting robust security guarantees for Kyiv during a joint press conference in Paris.

Government officials argue that while it's impossible to prove a counter-factual, these diplomatic efforts may have averted far worse outcomes.

Despite small victories, the ledger shows a growing list of disappointments. Trump’s new tariff threat over Greenland—starting at 10% next month and rising to 25% by June if a deal isn't reached—is just the latest setback.

Key areas where the diplomatic approach has fallen short include:

• Ukraine: The country continues to fight through a harsh winter with only limited pressure applied to Russian President Vladimir Putin.

• Trade Deal: The much-hyped UK-US trade agreement has stalled.

• Steel Tariffs: 25% tariffs on British steel exports remain in place, despite a US agreement last May to remove them.

• Tech Deal: A major technology agreement with the US is on ice, with UK officials telling their American counterparts they will not compromise on key standards.

Even the most dedicated Atlanticist must now question if Starmer’s efforts are paying off.

The Prime Minister made it clear that Britain is not in a position to sever ties with the United States, citing both national security and economic realities.

Security and Intelligence Ties

The UK has been a major beneficiary of its close defense relationship with the US and would be highly exposed by a split. Officials highlight the deeply interconnected military, nuclear, and intelligence partnerships that they say make the UK the most secure nation in Europe. Replicating these capabilities domestically would be impossible or take years, creating an unacceptable security vacuum.

"Our cooperation on defense, nuclear capability, and intelligence remains as close and effective as anywhere in the world—keeping Britain safe in an increasingly dangerous environment," Starmer said.

Britain remains the junior partner in this arrangement and would suffer more if it fractured.

Post-Brexit Economic Vulnerability

Since leaving the European Union, the UK economy is more exposed to global trade conflicts. Outside the trading bloc, Britain has diminished leverage in negotiations with the US and no guarantee of securing favorable terms with Europe. This reality was on display as Starmer effectively ruled out retaliatory tariffs against the US, drawing a clear distinction from the EU's potential response.

"Unfortunately we just don't have that much control," noted Olivia O'Sullivan, Director of Chatham House's UK in the World Program. "Most important is that we start thinking long-term about how we manage the risk that the US continues to use our economic and security relationship in this way."

This situation leaves Britain vulnerable to the old accusation of being a "vassal state" to the US, a dependency that has only deepened after Brexit.

Starmer faces pressure to pivot, either by significantly increasing defense spending beyond his target of 2.6% of GDP by next year or by forging a closer relationship with the EU, perhaps through a customs union.

For now, there is little indication of a major policy shift. Starmer is sticking to his diplomatic course, dismissing "performative" anger and "grandstanding" on social media as ineffective. Amid the changing international climate, the government made a late decision to send Foreign Secretary Yvette Cooper to the World Economic Forum in Davos, a meeting the Prime Minister had not planned to attend.

Starmer insists that patient negotiation is superior to public confrontation. The problem, however, is that right now, diplomacy isn't looking very effective either.

Turkey plans to focus on testing honey products for authenticity as fake versions become a growing issue in the country, the world's third-largest producer of honey, amid high inflation and a decline in beekeepers.

Turkey produced roughly 95,000 metric tons of natural honey in 2024, according to the Food and Agriculture Organization of the United Nations -- behind only mainland China and India.

"We're being forced into unreasonable price competition," said Ali Demir, who heads the more than 70,000-member Turkish Association of Beekeepers. Fake products include those augmented with adulterants, while some products are fully industrially produced, he said.

Turkey's four seasons and diversity of flower species make it ideal for honey production, with something in bloom for the majority of the year. Bees make honey using the flowers in bloom through the seasons, including orange and tangerine blossoms in the spring, sunflowers in the summer, and pine trees in the fall.

The issue of fake honey has become more pronounced in recent years. In September 2024, authorities confiscated 960 million lira ($22.2 million at current rates) of sugar, fructose syrup and another ingredient used to make fake or adulterated honey from a producer in the capital, Ankara, according to local media.

There is some debate as to how prevalent fake honey actually is. According to sampling data released in 2023 by the European Commission -- the European Union's executive arm -- 93% of honey imported from Turkey was suspected of being adulterated. That is the highest proportion for any country, surpassing China's 74%.

Turkey's Ministry of Agriculture and Forestry keeps samples from all over the country for testing and research. (Photo by Kana Watanabe)

Turkey's Ministry of Agriculture and Forestry keeps samples from all over the country for testing and research. (Photo by Kana Watanabe)

Turkey's Ministry of Agriculture and Forestry, which has jurisdiction over counterfeit foods, has rejected the European Commission's claim outright.

The ministry's own testing in 2025 indicated that 0.02% of the honey available on the domestic market was fake. No counterfeits were found among products for export, it said. "They are disparaging Turkish honey to push down its price," a ministry spokesperson said, contesting the EU statistics.

But counterfeit products have undeniably grown more common in recent years. In 2019, testing of more than 2,000 samples revealed just nine cases of fake honey.

Stubborn inflation has come to affect honey, too. Turkey's consumer price index rose 30.9% on the year in December 2025. Beekeepers are also on the decline as many age out without passing on their knowledge to the next generation.

"There are also hotels, restaurants and other businesses that are seeking out cheaper products in hopes of saving on costs," Demir said.

Fake honey cannot be distinguished from the genuine article by taste, smell or appearance alone. Counterfeiting techniques are sophisticated and sometimes even involve feeding syrup to the bees. Honey can be verified as genuine only through analysis at a specialized laboratory.

The ministry is stepping up its testing with the aim of stamping out the fakes. "By having labs with access to the latest equipment, we can prevent counterfeits from ever getting to market," a spokesperson said.

Turkish honey has appeal abroad as well. A traditional Turkish breakfast dish, bal kaymak, in which rich clotted cream and honey are spread onto toast, has caught on as a sweet treat in South Korea. The trend has started to slowly gain traction in Japan as well.

Weekly Silver (XAG/USD)

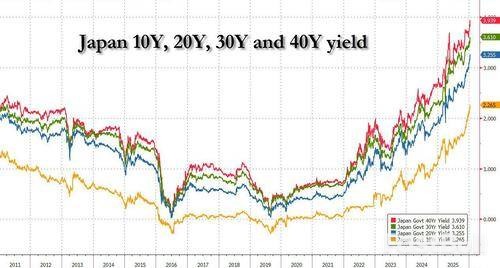

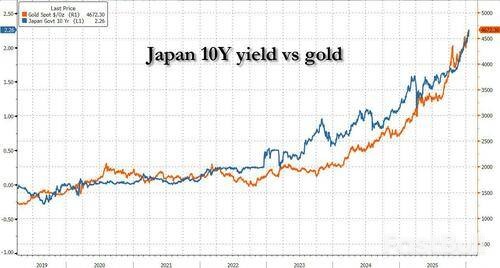

Weekly Silver (XAG/USD)Japan's bond market is flashing warning signs as Prime Minister Sanae Takaichi has called a snap national election for February 8. The move sent long-term Japanese government bond yields surging by as much as 10 basis points, pushing them to new highs and fueling a rally in gold to prices above $4,600.

The market's reaction is a direct response to Takaichi's proposed platform, which centers on increased government spending, significant tax cuts, and a new national security strategy poised to accelerate defense expenditures.

Prime Minister Takaichi, who became Japan's first female premier in October, plans to dissolve parliament on Friday ahead of the vote for all 465 seats in the lower house. "I am staking my own political future as prime minister on this election," Takaichi stated at a press conference on Monday. "I want the public to judge directly whether they will entrust me with the management of the nation."

Her economic proposals include a two-year suspension of the 8% consumption tax on food, a measure the government estimates will reduce its revenue by 5 trillion yen ($32 billion) annually. In response to this prospect, the yield on Japan's 10-year government bonds climbed to a 27-year high earlier on Monday. Takaichi argues her spending plans will stimulate job creation, boost household spending, and ultimately increase other tax revenues.

The early election is a strategic move to solidify her political standing, leverage strong public support, and strengthen her control over the ruling Liberal Democratic Party (LDP) and its coalition.

The election will test voter sentiment on higher government spending at a time when the rising cost of living has become the primary public concern. After nearly four decades of deflation, Japan is now grappling with accelerating prices. A recent poll by public broadcaster NHK found that prices are the top worry for 45% of respondents, with diplomacy and national security trailing at 16%.

Further adding to spending pressures, Takaichi's administration is planning a new national security strategy. This includes a decision to increase military spending to 2% of GDP, a significant departure from the post-war cap of around 1%. This move is driven by rising tensions with China over Taiwan and disputed islands, as well as pressure from the United States for allies to increase their defense commitments. China recently banned exports to Japan of certain critical minerals with both civilian and military applications.

"China has conducted military exercises around Taiwan, and economic coercion is increasingly being used through control of key supply-chain materials," Takaichi noted. "The international security environment is becoming more severe."

Going into the February 8 election, the LDP and its partner Ishin hold a combined 233 seats. Takaichi's goal is for the coalition to maintain its majority in the lower chamber.

Her main opposition is the Centrist Reform Alliance, a new party formed by the Constitutional Democratic Party of Japan and Komeito, which ended its 26-year coalition with the LDP after Takaichi became its leader. Together, these opposition parties hold 172 seats and have floated the idea of permanently abolishing the 8% sales tax on food.

"Now may be the best chance she has at taking advantage of this extraordinary popularity," said Jeffrey Hall, a lecturer at Kanda University of International Studies. However, he noted that with opposition parties joining forces, a victory may not be guaranteed.

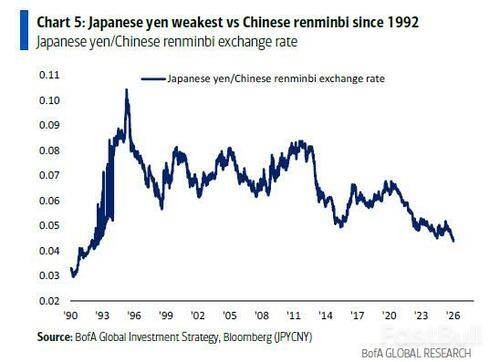

Amid this political uncertainty, the Japanese yen is trading near an all-time low against the U.S. dollar and is also at its weakest point against the Chinese yuan since 1992.

This currency weakness helps keep Japan's export-driven economy competitive by making its goods cheaper abroad. However, it puts the Bank of Japan (BOJ) in an increasingly difficult position. The central bank, which holds approximately 60% of the Japanese bond market, faces a critical choice: either raise interest rates to contain inflation, which would likely cause the yen to surge, or continue its bond-buying program to suppress yields, risking further currency depreciation and an overheating economy.

Gold is gaining significant traction as investors scramble for a hedge against rising geopolitical turmoil. With global economic leaders identifying "geoeconomic confrontation" as the primary risk for the year, the precious metal appears poised to continue its strong upward trend.

This warning comes from the World Economic Forum's latest Global Risks Report 2026, released just as business and political elites gather for their annual conference in Davos, Switzerland. The report paints a picture of deep concern among the world's experts and leaders.

The conference kicks off just days after President Donald Trump escalated his global trade war. In a social media post, Trump threatened to impose tariffs of 10%, potentially rising to 25%, on Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. The move is designed to pressure these nations into supporting his bid to annex Greenland. In response, members of the European Parliament announced they would freeze the ratification of a trade deal struck last summer between Trump and European Commission President Ursula von der Leyen.

The WEF report highlights a climate of persistent uncertainty. Following geoeconomic confrontation, the top risks identified include interstate conflict, extreme weather, societal polarization, and the spread of misinformation and disinformation.

Survey data from the report reveals a pessimistic outlook:

• Next Two Years: Roughly 50% of WEF members expect a turbulent or stormy global environment, a 14-percentage-point increase from last year. Another 40% anticipate conditions will be unsettled.

• Next Ten Years: The long-term view is even more fraught, with 57% forecasting a turbulent or stormy world and 32% expecting unsettled conditions.

"A new competitive order is taking shape as major powers seek to secure their spheres of interest," said Børge Brende, President and CEO of the World Economic Forum. "This shifting landscape, where cooperation looks markedly different than it did yesterday, reflects a pragmatic reality: collaborative approaches and the spirit of dialogue remain essential."

This environment of sustained uncertainty is a key factor driving commodity analysts to predict gold prices could surpass $5,000 an ounce in the first half of the year. The metal has already started strong, with spot gold last trading at $4,671.40 an ounce, a 1.6% gain on the day.

From Tactical Hedge to Embedded Necessity

According to Aakah Doshi, Head of Gold Strategy at State Street Investment Management, geopolitical risk is no longer just a source of temporary market noise. He explained that it has become an "embedded threat" that will provide long-term support for gold.

While gold prices may seem elevated, Doshi argues the metal remains undervalued in the broader market context.

"I would be more concerned if the S&P 500 was at March or April 2025 levels and gold was trading at 4,500," he noted. "But the fact that the S&P has touched 7,000... This gives me more confidence to hold gold because when there is a drawdown or volatility shock or liquidity event, gold can really benefit as a hedge against those tail risks."

A Strategic Revaluation Beyond Speculation

Linh Tran, Senior Market Analyst at XS.com, believes the gold rally is no longer driven by simple speculative momentum. She suggests that new highs reflect a fundamental shift in investor confidence.

"The current upside momentum is no longer anchored to short-term economic cycles, but rather to confidence in the global financial and policy framework," she stated in a note.

Tran argues that gold is undergoing a major re-evaluation, transitioning from a peripheral defensive hedge into a central pillar of risk management strategies.

"As risks stemming from unpredictable policy actions intensify and confidence in fiat currencies is increasingly tested, gold is gradually transitioning from a defensive hedge into a core asset," she added. "This implies that any pullbacks, should they occur, are more likely to reflect technical adjustments or position rebalancing rather than a reversal of the broader long-term trend."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up