Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

South Korea Welfare Ministry: National Pension Fund Committee To Swiftly Review Forex Financing Plans, Forex Hedging Policies

Mitsubishi Corp CFO: Our Coking Coal Production In Australia Is Expected To Be Significantly Impacted By Heavy Rainfall And Other Factors In Q4

Czarnikow Forecasts EU Sugar Production In 2026/27 Of 15.5 Million Metric Tons, Down From 17.1 Million In 2025/26

Statistics Indonesia Chief: Fiscal Stimulus, Stable Purchasing Power Supported Household Consumption In Q4

[Ethereum Drops Below $2100] February 5Th, According To Htx Market Data, Ethereum Fell Below $2,100, With A 24-Hour Percentage Decrease Expanding To 8.66%

[Minneapolis Mayor Calls For End To Federal Immigration Enforcement] On April 4, Local Time, In Response To US President Trump's Statement That Federal Immigration Enforcement Needed A "more Lenient Approach," Minneapolis Mayor Jacob Frey Said That Such A Change Was Welcome. However, He Emphasized That The Presence Of 2,000 Federal Law Enforcement Officers In Minneapolis Is Still Insufficient To Ease The Situation, And The Federal Government Should Terminate Its Immigration Enforcement Operations In The City

[Bitcoin Drops Below $71,000] February 5Th, According To Htx Market Data, Bitcoin Fell Below $71,000, With A 24-Hour Decline Expanding To 7.56%

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP GrowthA:--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)A:--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

No matching data

View All

No data

Oil prices declined in volatile trading as the announcement of upcoming U.S.–Iran talks reduced short term risk premiums, even though structural geopolitical and supply risks remain firmly in place....

Indonesia's economy expanded by 5.11% in 2025, posting a modest acceleration over the 5.03% growth recorded in 2024. The performance, driven by a rebound in domestic demand, fell short of the government's 5.2% target but landed within Bank Indonesia's forecast range of 4.7% to 5.5%.

While the full-year figure points to resilience, it also highlights significant challenges facing Southeast Asia's largest economy.

A strong export sector was a primary engine of economic activity. According to Statistics Indonesia, exports grew 6.15%, powered by increased shipments of key commodities like palm oil, iron, and steel. Notably, exports of nickel and its derivatives to China, along with electronics, textiles, and footwear to the U.S., saw double-digit increases despite "reciprocal" tariffs from the Trump administration.

Domestically, the economy saw a late-year surge, with GDP expanding 5.39% year-on-year in the fourth quarter, up from 5.04% in the third. This boost was largely attributed to seasonal consumer activity, as household consumption and transportation spending rose during the Christmas and New Year holidays. However, this occurred even as severe floods and landslides in northern Sumatra caused substantial economic losses.

Despite the positive headline numbers, several underlying weaknesses pose a threat to President Prabowo Subianto's ambitious goal of achieving 8% annual growth by 2029.

Mass layoffs across industries from textiles to tech startups in recent years have weakened consumer purchasing power and slowed private consumption. This internal pressure is compounded by external challenges, including ongoing trade wars and geopolitical tensions.

Domestic market stability has also been shaken. Key concerns include:

• The Indonesian rupiah fell to a new historic low against the U.S. dollar last month.

• A warning from global index provider MSCI triggered a stock market sell-off.

• The market rout led to the resignations of the chiefs of both the stock exchange and the Financial Services Authority.

To support the economy, the government deployed a 110.7 trillion rupiah ($6.6 billion) stimulus package in 2025. The package included utility bill discounts, value-added tax incentives, and social assistance for low-income families. This spending was separate from the 71 trillion rupiah allocated to major programs like President Prabowo's free meals initiative for children.

Finance Minister Purbaya Yudhi Sadewa acknowledged that the state budget was critical to sustaining growth. However, this fiscal support pushed the budget deficit to 2.92% of GDP, bringing it dangerously close to the legal ceiling of 3%.

Defending the strategy, Sadewa told reporters last month, "I can make the deficit zero, but the economy would be in disarray." For the coming year, the government is targeting a growth rate of 5.4%.

Lebanon's Economy Minister, Amer Bisat, has openly acknowledged the deep crisis of confidence plaguing the nation, admitting that trust from both Arab and local investors was "lost very quickly" during its prolonged economic collapse. Since 2019, the country has been mired in a severe financial crisis, fueled by decades of corruption and government mismanagement.

The fallout has been catastrophic. The collapse has decimated economic output, drained public finances, and shattered faith in state institutions. For ordinary people and businesses, it has meant losing access to their own money trapped in the nation's banking system. With investors wary and reform efforts stalled by political gridlock, the path to recovery remains fraught with challenges.

"Our relationship with our Arab investors is as fractious or problematic as it is with the Lebanese investors," Bisat stated at the World Governments Summit in Dubai. "Let's not forget that we all went through a horrible period."

According to Bisat, the Lebanese government is now focused on practical measures to slowly rebuild trust and showcase the country's economic potential. "Our objective is to look forward and regain confidence," he said. "We're trying to do the serious hard work of bringing back confidence, slowly but surely."

While a recovery strategy is in place, its success hinges on external support. "We have the plan," Bisat confirmed, but "the money has to come from our friends."

Lebanon’s priority is to secure this funding through grants and highly favorable loans rather than taking on more debt. "We want to borrow them at concessional rates, very cheap interest rates. We need the money," he explained. The country's ability to access traditional capital markets is virtually non-existent, underscored by a 'C' sovereign rating from Moody's, reflecting ongoing defaults and deep financial distress.

For decades, investment from Gulf countries was a vital source of foreign currency for Lebanon. However, the financial crisis, compounded by tensions over the influence of the militant group Hezbollah, led many Gulf states to pull back.

The challenge of attracting investment was highlighted when the UAE-based Al Habtoor Group announced it would halt all its operations in Lebanon, which include a major hotel and a theme park, amid a legal dispute with the government.

Despite such setbacks, Beirut is pushing to signal that it is open for business. Bisat pointed to a government-organized conference in November that attracted 50 international firms, including Goldman Sachs, Accor, and BlackRock. "They're interested in Lebanon," he insisted. "Lebanon has so much opportunity."

The Slow Thaw in Relations

While most Gulf nations remain hesitant to commit significant capital until Lebanon implements reforms approved by the International Monetary Fund, there are signs of a cautious re-engagement. Qatar has taken a notable step, announcing over $430 million in aid to help stabilize Lebanon's struggling energy sector.

Diplomatic engagement has also intensified. Bisat noted increased bilateral visits and interest from Gulf sovereign wealth funds since the current government took office. "You can see it at many levels," he said, citing renewed contacts with the UAE, Kuwait, Qatar, and even Saudi Arabia after years of silence. "The engagement is there. And more important than the engagement is the attitude. The attitude is very positive."

The Saudi Arabia Challenge

Restoring a full relationship with Saudi Arabia is a top priority. Lebanon is focused on three key areas:

• Removing restrictions on Lebanese exports.

• Enabling the return of Saudi tourists and business people.

• Advancing economic, cultural, and environmental agreements.

Saudi Arabia was Lebanon's leading market for agricultural exports in 2019, but Riyadh suspended imports of fruits and vegetables in April 2021 over drug-smuggling concerns. A travel ban for Saudi citizens has also been in place since 2021 due to security issues. To mend this, Lebanon must demonstrate it is taking control. "We need to assure them that we're not exporting drugs," Bisat said, noting efforts to improve technical controls and scanning systems.

Ultimately, deeper engagement from the Gulf depends on tangible progress. "We have to do our homework," Bisat concluded.

Looking ahead, Lebanon has plans for a southern economic zone, a project first raised by U.S. officials as part of a broader stabilization effort. However, Bisat clarified that discussions are premature. "The first thing is that the war has to finish," he stated, referring to the ongoing hostilities with Israel. Rebuilding the south remains a "huge priority, socially, morally, politically." The World Bank estimates the cost of reconstruction and recovery from the war at $11 billion.

In the meantime, the government is advancing other economic zone projects in Tripoli and at the Beirut port. The strategy also includes a significant push into high-end technology.

"We now have virtual free zones for tech," Bisat said, adding that Lebanese companies are already producing advanced technology, including "chips for AI that Nvidia is buying." This focus on innovation represents a key part of Lebanon's vision for a post-crisis economy.

For years, Oman's quiet diplomacy with Iran was an outlier in the Gulf, viewed with suspicion by its neighbors. Muscat’s insistence on keeping channels open to Tehran, even during peak regional tensions, often isolated it within the Gulf Cooperation Council (GCC). Some partners saw this as naive; others, as unhelpfully independent.

That perception has dramatically changed. By January 2026, with the threat of a US-Iran conflict looming, Gulf monarchies were actively lobbying the White House to support talks in Muscat. What was once seen as a weakness is now considered an essential tool for regional stability.

The urgency of this new reality crystallized in mid-January 2026. As fears of a US strike on Iran grew amid Tehran's crackdown on protests, a senior Saudi official confirmed a "frantic, last-minute" diplomatic push. Led by Saudi Arabia, Qatar, and Oman, the effort aimed to persuade President Donald Trump to stand down and give Iran a chance to de-escalate.

This was no symbolic gesture. The move followed a temporary drawdown of US personnel from Qatar's Al-Udeid Air Base and a flurry of security warnings from regional embassies. Gulf leaders were scrambling to prevent a conflict they feared would spiral out of control.

The region's leaders now recognize that a US-Iran war would be devastating for everyone involved. The consequences would be immediate and severe:

• Economic Shock: Oil markets would convulse, and investor confidence would evaporate.

• Direct Retaliation: Iranian counter-strikes would almost certainly target Gulf states.

Vivid memories of the 2019 strike on Saudi oil facilities and Iran's June 2025 attack on Al-Udeid—which followed US strikes during a 12-day Israel-Iran war—underscore how quickly escalation can cross borders.

By 2026, even Saudi Arabia, Iran's traditional rival, shifted its stance from spoiler to a cautious stakeholder in de-escalation. The debate within the GCC was no longer whether to engage with Iran, but how to keep Washington and Tehran from triggering a war. This marks a profound evolution in how the Gulf views Oman’s unique diplomatic role.

Oman's central role in this crisis is no accident. On January 10, 2026, Omani Foreign Minister Badr bin Hamad Al Busaidi visited Tehran, meeting with President Masoud Pezeshkian, Foreign Minister Abbas Araghchi, and Supreme National Security Council Secretary Ali Larijani. The visit occurred as traditional US-Iran channels were failing and Trump was openly threatening military action. Days later, Trump suggested Iran wanted to negotiate, a sign that messages were flowing through Muscat.

This is familiar ground for Oman. The country's policy of "positive neutrality"—a doctrine rooted in non-intervention and dialogue—has produced results before. It was Oman that:

• Hosted secret US-Iran talks in 2013, paving the way for the 2015 nuclear deal.

• Mediated prisoner releases and conveyed critical messages during past crises.

This approach is reinforced by Oman's internal culture of pluralism and its history of navigating relationships with larger, more volatile neighbors.

However, Oman's past success highlights the limits of its current approach. Mediation is effective only when both sides are incentivized by restraint. Today, Iran increasingly acts as if escalation is a tolerable, if not useful, strategy.

Tehran continues high-level uranium enrichment, restricts international inspections, and frames its regional policy around expelling the United States and Israel from the Middle East. While this posture serves an ideological purpose, it is strategically fragile. It misjudges the current risk tolerance in Washington and Jerusalem and ignores how exposed the Gulf would be in a wider conflict.

This is where Oman’s role must evolve. Simply passing messages is no longer enough. Muscat is one of the few capitals whose warnings Tehran takes seriously, giving it both unique influence and a heavy responsibility.

The trust that allows Oman to carry messages from the US must now be used to deliver a tougher one to Iran: its current trajectory is unsustainable. A major regional war would inflict lasting damage on everyone, including Iran itself.

This warning carries more weight coming from a Gulf neighbor focused on regional survival than from Washington or Israel. Even Iranian diplomats have acknowledged this reality. In mid-January, Iran’s ambassador to Saudi Arabia confirmed contacts with Saudi, Qatari, and Omani officials, warning that any conflict would have catastrophic regional effects. Tehran welcomes dialogue when it prevents escalation; it must now be convinced that dialogue also demands concessions.

A path to compromise still exists. Iran could scale back from its highest enrichment levels, restore full access for IAEA inspectors, or signal regional restraint. These moves would build trust without requiring an ideological surrender. In return, the United States can offer meaningful sanctions relief and avoid maximalist demands. These are the kinds of transactional steps Oman has successfully brokered in the past.

But this outcome is unlikely if Muscat remains a passive facilitator. The GCC states that once doubted Oman now depend on it as a firewall. This backing gives Muscat unprecedented political cover to speak bluntly, firmly, and privately in Tehran.

For decades, Oman thrived in the shadows as a discreet messenger. Today, discretion without direction is not enough. The risk is no longer diplomatic awkwardness but war by miscalculation. To remain credible and keep the region intact, Oman must use its influence not just to relay messages, but to shape Iran's choices. Its quiet role has always been valuable; now, it must be consequential.

Takaichi has called a snap election just three months into the job, taking a high-risk move. It is all about securing a public mandate for her policy.

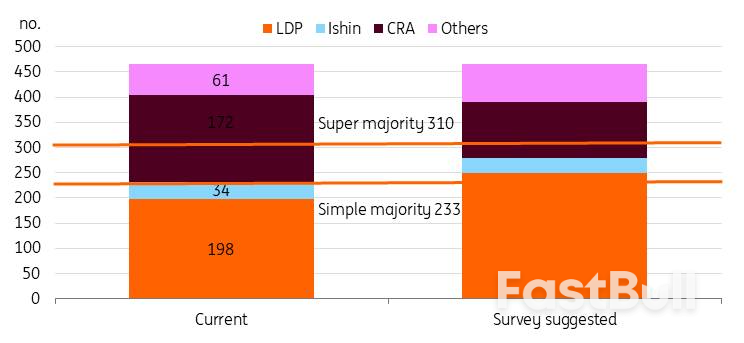

She inherited a troubled party and a minority government in October after Ishiba Shigeru, who lost both parliamentary elections, was nearly forced to resign. The LDP lost public support with a cost-of-living crisis and several political funding scandals. Despite only narrowly becoming prime minister, her approval ratings during the first three months were surprisingly strong at around 70%. Now, she seeks to leverage her popularity to secure a sole majority for the LDP and thereby advance her policy agenda later with greater consistency. She supports former Prime Minister Shinzo Abe's policies, advocating pro-stimulus macro policies and a Japan-focused foreign policy. Opposition parties may not fully agree with her policy perspectives. Should the minority government situation persist, she will have to negotiate with other parties on each policy issue. However, if she wins this election, she will interpret it as Japanese voters' endorsement of her pledges and will push her policy agenda much more forcefully.

According to recent local polls, the LDP leads the campaign for sure. The LDP is expected to well exceed a simple majority of 233 seats (vs its current 198 seats) and the alliance may reach near 300. In contrast, the main opposition, the Centrist Reform Alliance, could lose almost half of its current seats. If the LDP coalition secures a super majority, the government would gain significantly more power. This would allow Takaichi to pass legislation even without having sufficient support in the Upper House.

Source: various news papers and ING estimates

Source: various news papers and ING estimatesAlthough the food consumption tax cut was a major topic before the campaign, its prominence diminished once the campaign began.

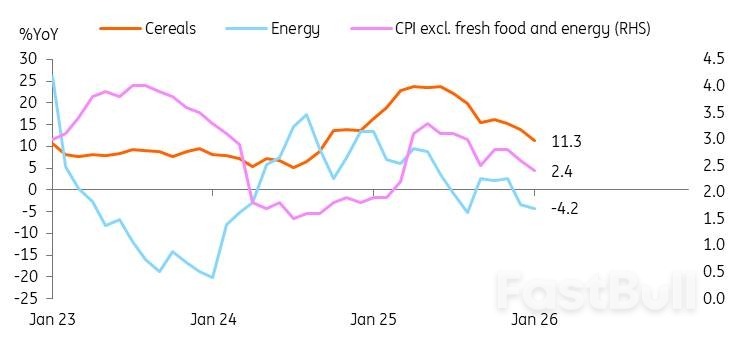

Japanese inflation has stayed above 2% since April 2022, but wages have lagged behind. The rise in living costs has increased public dissatisfaction. For instance, rice, the primary staple food, gained almost 100% year-on-year by mid-2025, although it came down to the 30% level recently. So, reducing inflation became a primary focus of the election campaign. Takaichi resumed energy subsidies last year via the supplementary budget. We see the impact of the subsidy from the recent sharp decline in inflation readings.

The focus has now turned to food prices. The food consumption tax rate of 8% is expected to reduce inflation by approximately one percentage point though at a cost of ¥5 trillion revenue loss (6% of total tax revenue). Although households may benefit from lower living costs, markets are worried about fiscal stability due to uncertain funding for the tax cuts.

However, after experiencing recent market volatility, Takaichi has adopted a more cautious stance on food tax cuts. She has avoided directly addressing the proposal during the campaign, focusing instead on "responsible and proactive public finances". Now she remains vague on implementation timing and prefers to "accelerate the discussion" to keep the agenda neutral.

Source: CEIC

Source: CEICThe market seems to have a fear that Takaichi's big victory may hurt fiscal conditions quite badly. We don't fully agree with it. If the LDP secures a majority in the lower house, Takaichi could speed up tax cut talks. She will argue that she has the public mandate. But a consensus still needs to be reached by the national council. The same should apply in case there is a super majority. Other opposition parties now support more expansionary fiscal policies; for instance, the CRA favours abolishing the food tax permanently, while the LDP suggests two-year exemptions. The LDP victory could result in a more balanced spending plan. Under Prime Minister Abe, Japan raised its consumption tax twice to help finance social security programmes for an ageing society, as part of the "Abenomics" reforms. It is expected that Takaichi will similarly focus on securing revenue while also aiming for greater spending.

As previously stated, the LDP has not specified when the tax cut might take effect. Additionally, the party has made explicit commitments to lowering Japan's debt-to-GDP ratio and implementing fiscal reforms. Therefore, the LDP is anticipated to devise strategies that prevent a sharp increase in the fiscal deficit.

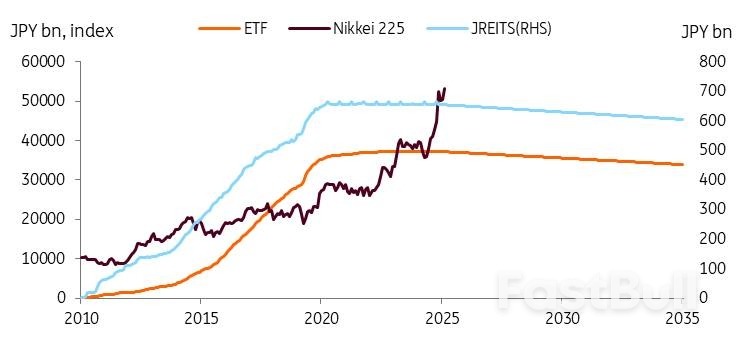

One potential funding approach involves seeking support from the BoJ. The BoJ commenced its initial asset sales in 2026, targeting an annual reduction of ¥330 billion in ETFs and ¥5 billion in JREITs. According to recent data, the BoJ's ETF and JREIT holdings declined by ¥5.3 billion and ¥0.1 billion respectively from December 2025 to January 2026. While this represents a modest decrease, the BoJ is expected to continue reducing its asset portfolio, a strategy anticipated to provide substantial returns over time. Since 2010, the Nikkei 225 has increased fivefold. With a simple calculation, the BoJ could earn about ¥1.7 trillion from selling an ETF book valued at ¥330 billion. If we suppose the Nikkei increases at the same rate as nominal GDP growth, this income stream has the potential to serve as a stable funding source.

Source: CEIC

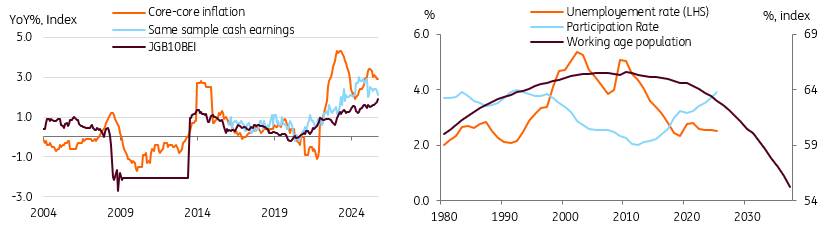

Source: CEIC'Return to normal' implies higher inflation expectations, less central bank control over Japanese government bond (JGB) markets, increased volatility, and more yield adjustments.

We expect that the economy will return to a normal state after experiencing many years of deflation. While fiscal sustainability may contribute to higher yields, we think economic normalisation plays a stronger role in driving yields upward. These are reasons behind why we expect JGB yields to hit 3.0% by the end of 2027.

Returning to a normal state means achieving sustainable inflation growth of around 2%. Higher inflation expectations may explain the rise in JGB rates. The BEI index has been approaching 2%, and we expect inflation expectations to increase and stabilise near 2%, supported by structural labour shortages sustaining wage growth. Over the last three years, spring wage negotiations have resulted in wage growth exceeding 4-5%, and this year, an increase of over 5% is expected. Government subsidies, lowering energy and food prices, are expected to drive positive real wage growth this year, supporting demand-driven inflation and reinforcing progress toward a sustainable 2% target.

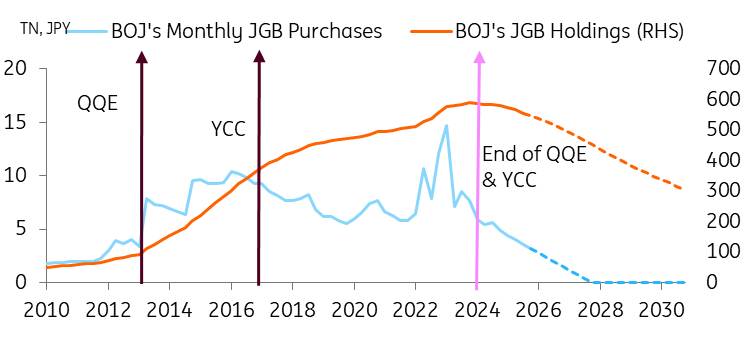

Source: CEIC, OECD, ING estimates

Source: CEIC, OECD, ING estimatesReturning to a normal state means that we expect the BoJ's slow and steady monetary policy normalisation via 1) policy rate hikes, a total of 75bp by the end of 2027 and 2) the BoJ's unwinding of unconventional monetary policy measures. As the BoJ buys less, the supply and demand balance shifts, creating upward pressure on JGB yields. While the BoJ will slow its reduction pace in April 2026, we expect the yield curve to steepen further during rate hikes, keeping spreads between the policy rate and 10Y JGBs at 150-175bp (currently 150bp). We believe that history doesn't necessarily predict well the future for JGBs, since past yield spreads happened during the deep disinflation. As quantitative tightening (QT) continues and bonds mature, the BoJ's control over the JGB market will diminish more, leading to more volatile, market-driven bond markets.

While sudden market movements may cause concern among market participants, they should be seen as part of the economy's return to normal. The BoJ and government must strike a careful balance; if a major sell-off occurs that is not driven by fundamentals, they can adjust the QT pace and bond issuances accordingly.

At the recent Bank of Japan meetings, following the JGB sell-off, Governor Ueda emphasised the bank's nimble approach to bond operations, which provides the BoJ significant flexibility. Nevertheless, his comments appear that the BoJ doesn't intend to change the path of rising yields; rather, just to smooth market volatility and prefers a more gradual progression. We believe that the BoJ will allow a gradual yield rise.

Lastly, we anticipate that government spending will rise further to address issues related to an ageing population and increased welfare needs. We expect investment in automation and digital technology to lead to higher expenditures as well. Due to Takaichi's significant spending plan, the goal of achieving a primary budget surplus by fiscal year 2025/2026 was not met and has been postponed. We do not expect an abrupt rise in debt issuance under the Takaichi administration, but we still believe her policy stance should keep pressure on JGB yields.

Source: Bank of Japan, CEIC, ING estimates

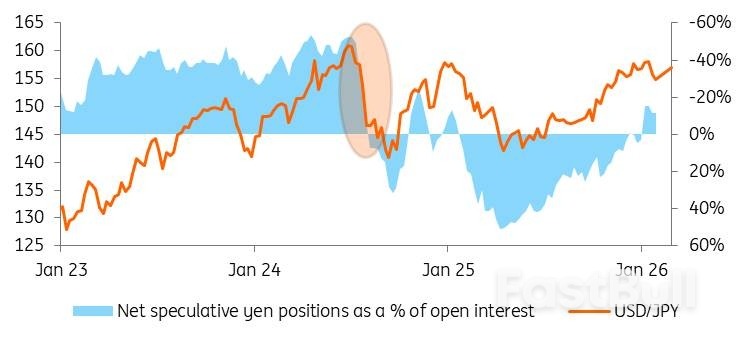

Source: Bank of Japan, CEIC, ING estimatesIt has been a volatile start to the year for USD/JPY, and it looks set to continue. The prevailing investment thesis has been that a negative real policy rate in Japan, burgeoning fiscal challenges and global investors favouring pro-cyclical currencies are all weighing on the yen. What seemed to be Japanese FX intervention near 160 and then reports of a Fed rate check late on Friday, 23 January have been the sole positives for the yen. Yet some official denials of US involvement and subsequent Japanese data question whether intervention took place at all. On the subject of intervention, we wonder whether strategic investment decisions from some of the government-influenced pension funds may be playing a role here – as is also the case in Korea when USD/KRW approaches 1500.

A positive election result for the LDP that would pump more air into the 'Takaichi trade' is a USD/JPY positive. USD/JPY could even approach 160/162 levels again on the back of this. Officials in Tokyo have made it clear they are uncomfortable with those kinds of levels, which, while good for exporters, also stand to increase import prices at a time when the government is trying to ameliorate the cost-of-living crisis. Therefore, FX intervention near 160/162 looks likely.

Will intervention be effective? Effective intervention requires heavy one-way market positioning and a turn in the fundamentals. Intervention proved effective in July 2024 when the speculative market was extremely short yen and the Fed was about to embark on an easing cycle – which the Fed did with a 50bp cut in September that year. USD/JPY fell from 160 to 140 over that two-month period.

Today, speculative positions are nowhere near as short yen as they were in 2024. And with the Fed funds rate now much closer to neutral at 3.75%, the prospect of lower short-dated US rates is far less compelling than it was two years ago. In short, the conditions are not in place today for a large correction lower in USD/JPY.

Instead, it looks like an LDP-inspired push higher in USD/JPY (assuming polls prove correct) will spark a sustained intervention campaign that could potentially last for the remainder of this year. For reference, the BoJ sold $100bn over four separate days between May and July in 2024. And in addition to the yen negatives discussed above, there is also the uncertainty about the timing of Japan's commitment to invest $550bn into the US – and whether that gets funded with dollar instruments (probably) or whether any FX flows are involved.

In all, we forecast USD/JPY to bounce around in a 155-160 range through the first half of the year and then 50bp of Fed rate cuts to drag it closer to 150 by year-end. But upside risks prevail for the rest of this quarter.

This USD/JPY narrative adds weight to our preference to receive Tonar and pay SOFR on the cross-currency swap. This is the 'negative carry play', which benefits from fixing USD/JPY at today's rate, and then buying back dollars in a year or two's time at that same rate. It is especially suitable for shorter tenors, ideally 1–2 years. Leave the positive carry play for longer tenors. Or, wait for a better entry point; a lower USD/JPY, with the bliss entry point at 140. See more on that here.

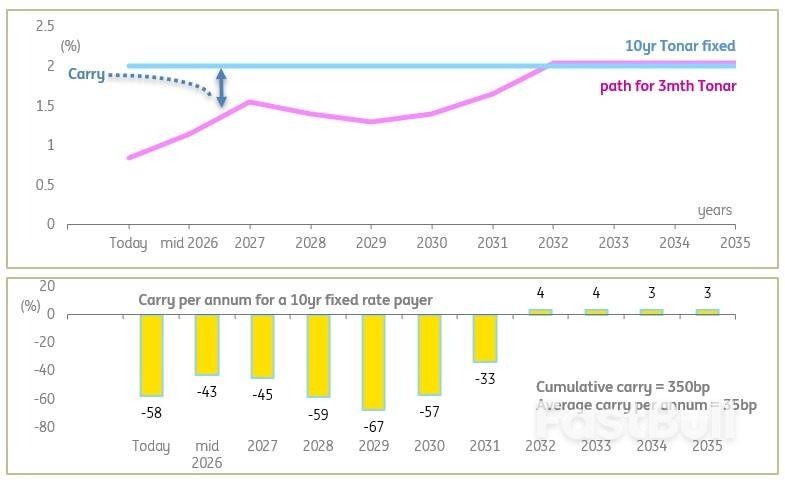

For corporates looking at the relationship between floating rate exposure and fixed rate exposure post the elections, there are two key observations. First, floating rate Tonar rates are on a long winding path higher, eventually to 2%, although more likely to see a peak at around 1.5% in this current cycle. Still, floating-rate exposures remain the cheaper funding option for the coming few years, when compared with say 10yr Tonar (now at 2%).

That being said, 10yr Tonar is likely to remain under upward pressure (in line with JGBs), which means that fixed rate payers set today would prove a positive mark-to-market outcome in the intermediate period. Also, we doubt there will be a fall to materially lower-rate lock-in opportunities, so the rate seen on screens today is about as good as it gets (give or take c.20bp, and barring the unexpected). The alternative is to look at lower lock-in levels in shorter tenors, say the 1.5% attainable in the 4yr tenor. We calculate that the average carry cost there per annum is about 20bp, compared with 35bp for the 10yr lock-in.

For those looking to swap to floating, there is positive impact carry and positive cumulative carry, but it tapers, and is not dramatically high (350bp in the 10yr). The chart below illustrates the profile in the coming 10yrs, and the carry outcome for a 10yr fixed rate payer set today (reverse the signs for the fixed rate receiver).

The long end is already at 2%, while the BoJ is on a slow path towards it, getting there eventually

Taiwanese President Lai Ching-te has declared that the island's relationship with the United States "will not change," delivering a firm message after Chinese leader Xi Jinping warned Washington over arms sales to Taipei.

Speaking to reporters on Thursday, Lai emphasized the stability of the partnership. "Taiwan-U.S. relations are rock-solid, and all cooperation programmes will continue," he stated during a visit to a textile factory in central Taiwan.

Lai added that Washington's "commitments (to Taipei) remain unchanged" and highlighted the "excellent channels of communication" between the two governments.

Lai's comments followed a phone call on Wednesday between Xi Jinping and U.S. President Donald Trump, during which the Chinese leader issued a pointed warning. According to state broadcaster CCTV, Xi stressed the sensitivity of the Taiwan issue.

"The Taiwan question is the most important issue in China-US relations... the U.S. must handle arms sales to Taiwan with caution," Xi reportedly said, calling for "mutual respect" in the broader relationship.

In contrast, Trump described the conversation as "excellent" in a post on his Truth Social platform. "The relationship with China, and my personal relationship with President Xi, is an extremely good one, and we both realize how important it is to keep it that way," Trump said. He noted that their discussion covered trade, Taiwan, the war in Ukraine, Iran, and his planned trip to China.

Beijing's Communist Party considers democratic Taiwan part of its territory and has not renounced the use of force to achieve unification. While Washington does not formally recognize Taiwan, it remains the island's primary military supplier, a long-standing policy that has become a major point of friction with China.

In December, the United States approved $11 billion in arms sales to Taiwan. China responded swiftly with major live-fire military exercises that simulated a blockade of Taiwan's key ports.

Following the latest Xi-Trump call, Taiwan's foreign ministry released a statement supporting efforts to "reduce the risks posed by any unilateral use of force or threats."

Japan's latest 30-year bond auction saw surprisingly strong demand, calming market nerves ahead of a pivotal election that could usher in a new wave of government spending.

The auction's bid-to-cover ratio, a key measure of demand, hit 3.64 on Thursday. This figure comfortably surpassed the previous auction's 3.14 and the 12-month average of 3.35. In response to the positive results, Japanese bond futures ticked higher.

This auction was this week's second major test of investor sentiment toward longer-maturity Japanese debt. It stood in contrast to a 10-year bond sale on Tuesday, which reflected market anxiety over the prospect of increased fiscal spending after the vote.

The political uncertainty may be suppressing some underlying demand. Meiji Yasuda Life Insurance Co. has noted that Japan's super-long government bonds present attractive opportunities, stating that it is waiting for the right moment to make a purchase. This suggests that once the election passes, more buyers could enter the market.

Investors remain cautious ahead of Sunday's snap election. The market was recently rattled when Prime Minister Sanae Takaichi proposed cutting the sales tax on food, a move that sent bond yields to record highs and created ripple effects across global markets. While the initial stress has subsided, Japan's 30-year bond yield continues to trade near its highest levels on record.

Recent opinion polls indicate that Takaichi's public support is holding firm, while a new opposition alliance has failed to gain significant traction. This polling positions the ruling party to secure a comfortable majority in the upcoming vote.

Adding another layer of complexity for investors is the falling yen. The currency has returned to the spotlight after Prime Minister Takaichi highlighted the advantages of its weakness. In response, hedge funds are reportedly building positions to bet on a further decline in the yen ahead of the weekend election.

The election results are also expected to influence the Bank of Japan's path on interest rates. Takaichi is widely viewed as an advocate for continued monetary easing. However, a summary of opinions from the central bank's January meeting showed a growing acknowledgment of the need to eventually raise rates, with officials monitoring how the weak yen is contributing to inflation.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up