Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Economic

Traders' Opinions

Russia-Ukraine Conflict

Daily News

Remarks of Officials

Commodity

Political

Energy

Middle East Situation

Oil prices rose on escalating Mideast unrest and Ukraine war, sparking global supply concerns.

Oil prices climbed on Friday, pushing crude benchmarks toward a weekly gain fueled by growing concerns over global supply. Escalating civil unrest in Iran and intensified attacks in the Russia-Ukraine war are putting traders on edge.

By 12:41 p.m. ET, Brent futures were up $1.58, or 2.55%, trading at $63.57 per barrel. U.S. West Texas Intermediate (WTI) crude saw a similar rise of $1.60, or 2.77%, to reach $59.36.

Both benchmarks had already jumped over 3% on Thursday, reversing two consecutive days of losses. For the week, Brent is on pace to gain 4.6%, while WTI is tracking a 3.5% increase.

Two major geopolitical flashpoints are driving fears of potential supply disruptions.

Intensifying Unrest in Iran

The market is closely watching an "uprising in Iran," according to Phil Flynn, a senior analyst with the Price Futures Group. Protests over economic hardship have spread across the country, including in Tehran, Mashhad, and Isfahan.

Ole Hansen, head of commodity analysis at Saxo Bank, noted that the protests "seem to be gathering momentum, leading the market to worry about disruptions." The situation escalated on Thursday when internet monitoring group NetBlocks reported a nationwide internet blackout.

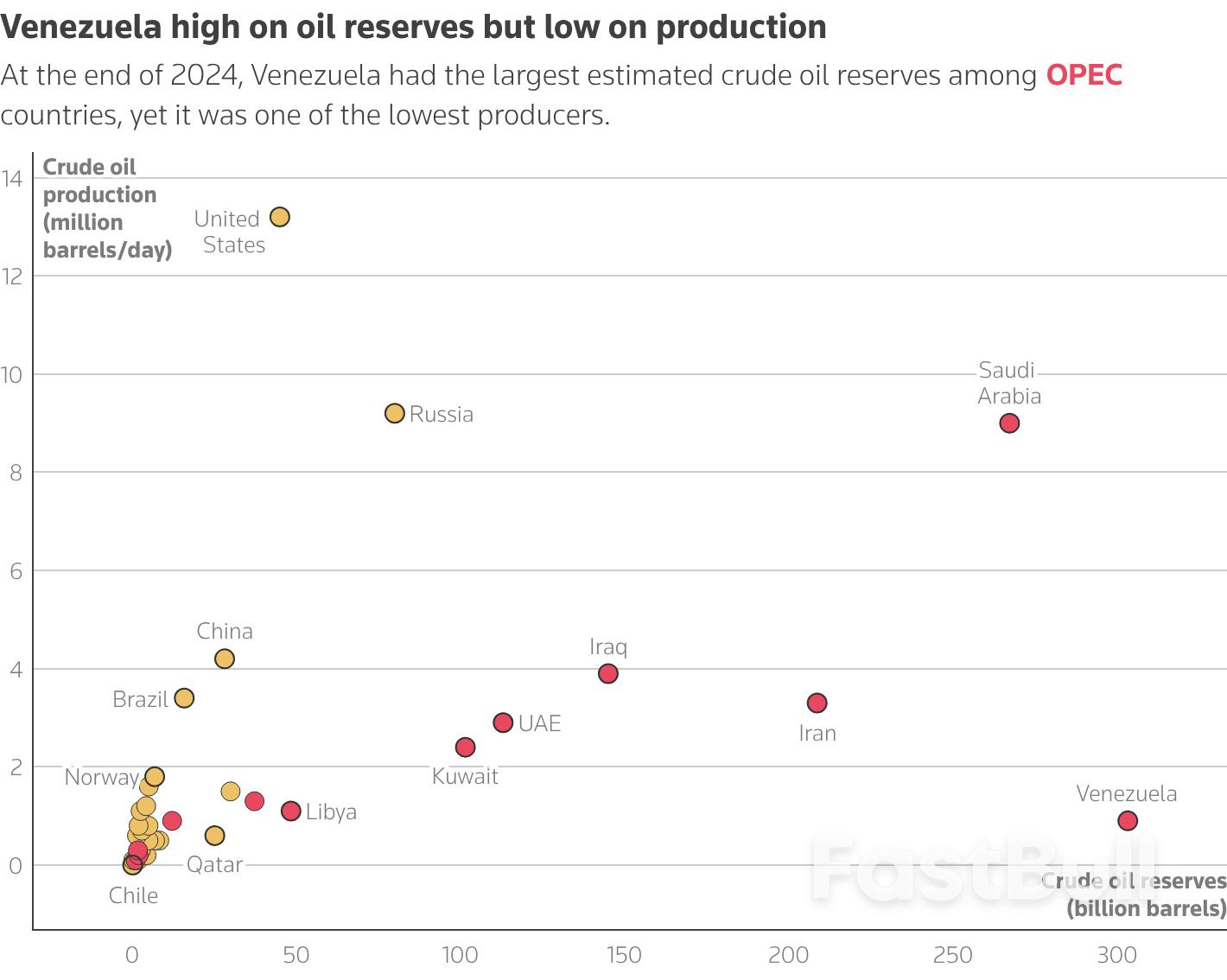

These concerns are backed by data. A recent survey showed that the Organization of the Petroleum Exporting Countries (OPEC) pumped 28.40 million barrels per day (bpd) last month, a decrease of 100,000 bpd from November. Iran and Venezuela posted the largest production declines.

Russia-Ukraine War Escalation

Adding to supply anxiety, Russia’s military announced Friday that it had fired its hypersonic Oreshnik missile at targets in Ukraine. The Russian defense ministry specified that the strikes targeted energy infrastructure that supports Ukraine's military-industrial complex.

In a separate development, the White House is scheduled to meet with oil companies and trading houses Friday afternoon to negotiate Venezuelan export deals. The meeting follows the capture of Venezuelan President Nicolas Maduro on Saturday.

U.S. President Donald Trump has demanded that Washington be given full access to Venezuela's oil sector. U.S. officials have stated their intention to control the country's oil sales and revenue indefinitely.

Oil major Chevron Corp, along with global trading firms Vitol and Trafigura, are among those competing for government deals. The contracts concern the marketing of up to 50 million barrels of oil that state-run company PDVSA accumulated in inventories during a severe embargo.

"The market will focus on the outcome in the coming days for how the Venezuelan oil in storage will be sold and delivered," said Tina Teng, a market strategist at Moomoo ANZ.

Despite the bullish geopolitical news, some analysts urge caution. According to Haitong Futures, global oil inventories are rising, and a potential oversupply could cap further price increases.

The firm suggests that unless the risks surrounding Iran escalate significantly, the current rebound in oil prices is likely to be limited and may struggle to be sustained.

President Trump's meeting with oil executives on Friday is stirring major tensions within the U.S. energy sector. Independent shale drillers are voicing sharp criticism, warning that the administration's push to revive Venezuela's oil industry could devastate American producers by flooding the market and driving down crude prices.

While major oil bosses are meeting with the president, many smaller shale leaders, who were not invited, feel the White House is abandoning domestic energy producers. The sentiment is that a potential influx of Venezuelan crude works directly against their interests.

"We're talking about this administration screwing us over again," one senior executive stated, calling the potential policy "against American producers." Another warned, "If the US government starts providing guarantees to oil companies to produce or grow oil production in Venezuela I'm going to be . . . pissed."

This frustration runs deep in Texas, where many oil executives who had previously backed Trump now describe the strategic shift as a "betrayal."

Kirk Edwards, CEO of Latigo Petroleum, captured the mood succinctly: "To me, the signal from the administration is: we'd rather spend our American money on propping up a Venezuelan oil business than supporting our current independent businesses."

The domestic oil industry is already navigating a difficult economic landscape. The number of active U.S. rigs has dropped to 412, a 15% decrease over the past year. Furthermore, the Energy Information Administration (EIA) projects that U.S. oil output will fall in 2026, marking the first annual decline since the pandemic.

With West Texas Intermediate (WTI) trading below $56 a barrel, many shale producers are struggling, as they often require prices above $60 to break even. This financial strain makes the prospect of new supply from Venezuela particularly alarming.

The administration's calculus appears tied to domestic politics. With the midterm elections approaching, President Trump has made it clear he wants cheaper oil and gasoline for consumers. Adding to supply-side pressures, OPEC producers are also increasing their output.

U.S. Energy Secretary Chris Wright projected that Venezuela's oil production could increase by 50% within a year. "I think you'll see more downward pressure on the price of gasoline," he told Fox News.

However, shale executives are skeptical, suggesting Wright is now "just toeing the party line." The frustration ultimately centers on Trump, with one Midland-based executive noting, "He's definitely not pro oil as far as independent oil companies' survival and vibrancy." He added that the real impact will become clear when "US production [starts] declining."

Financial markets are already reacting to the potential policy shift. This week, shares of prominent energy firms like Diamondback Energy, APA Corp, and Devon Energy fell by as much as 9%.

"Somebody's looking at these stocks today going, why would I own this if in a few years, they're going to be competing against Venezuela for oil, for our refineries in the United States?" Edwards questioned, highlighting rising investor uncertainty.

Outrage grew after President Trump suggested that taxpayer money could be used to reimburse companies investing in Venezuela. "We should not subsidise the big companies in trying to retool Venezuela's infrastructure and develop their reserves for them," said another shale executive. He added that Trump seems content to see independent producers "drill their way into oblivion" and doesn't "give a damn if they went bankrupt."

Analysts note that this environment favors the industry's largest players. "All of this points to the advantage of being larger," said Maynard Holt of Veriten. "Because many of the opportunities that are coming—whether it's Venezuela or Algeria or some other complicated place—you will be able to consider them more seriously the larger you are."

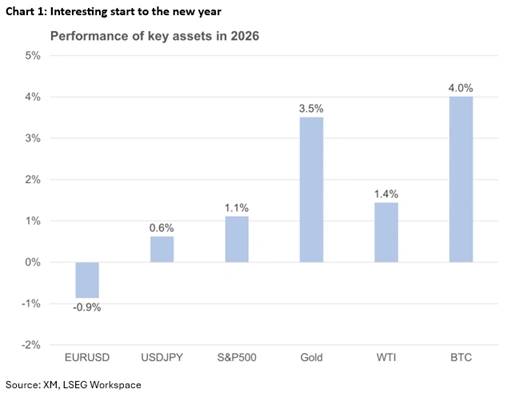

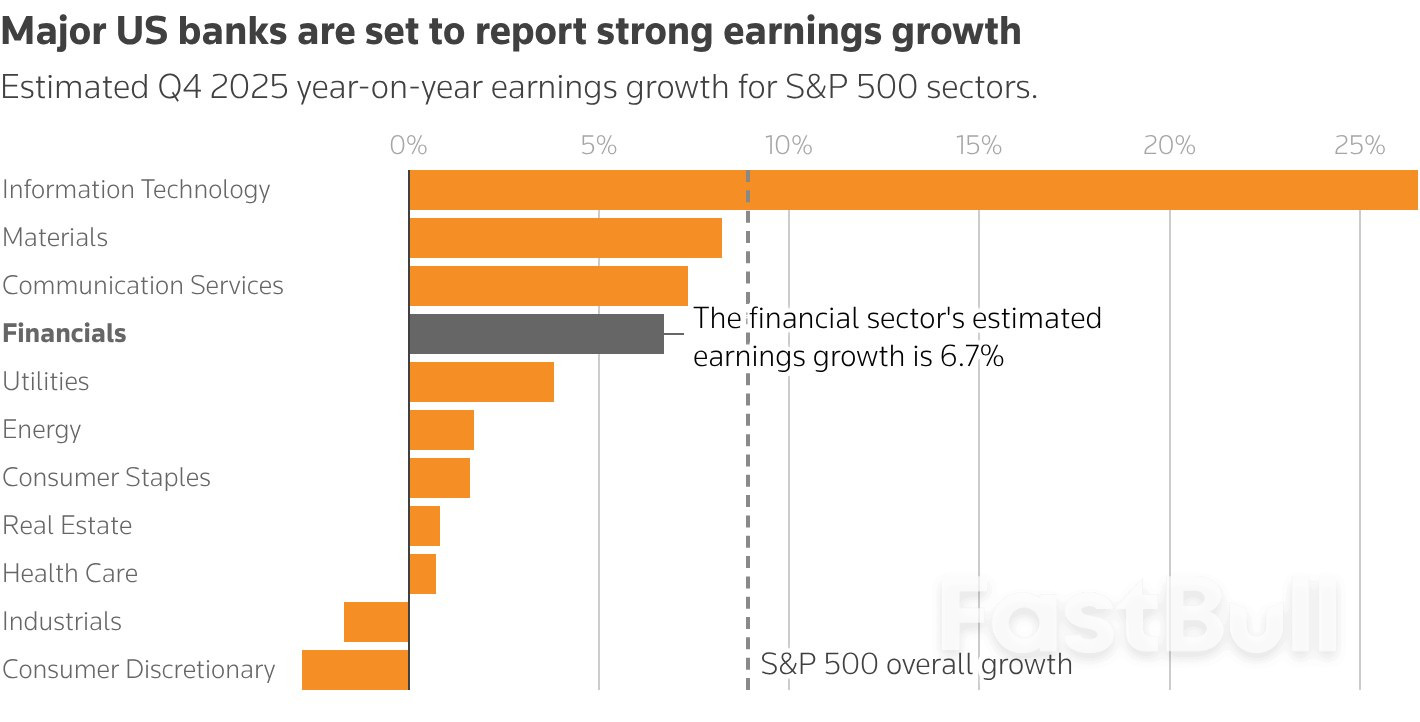

At the tail end of 2025, most investors focused on Fed rate cut expectations and AI developments further reshaping the global economy. The nonexistent Santa Rally disappointed equity investors, but with most investment banks remaining quite optimistic about the 2026 performance, the mood could not be characterized as negative.

However, these expectations have been put aside, as US President Trump has other priorities. The transfer of Venezuelan President Maduro to the US to face heavy criminal charges and the control of Venezuela's vast oil reserves, with US firms ready to invest heavily in the aging infrastructure, have changed the market narrative.

With every win, Trump becomes bolder in his strategy. Following the Maduro operation, his focus quickly shifted to Colombia, Cuba and Greenland, bolstering the USA's foothold in the region after a period of relative inactivity. Greenland is the most intriguing case, as the US is trying to grab land from an ally and NATO member. Few expect this effort to fail, particularly as the US President has not excluded the military option to achieve his target.

Adding Iran to the mix, which was the main topic of discussion at the late-December meeting between Trump and Israel's Netanyahu, means then 2025, with its tariff shenanigans and the April market rout, might end up being a walk in the park for investors compared to 2026.

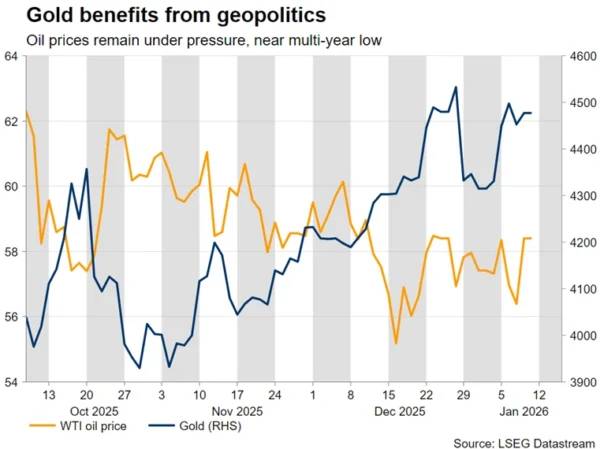

Both gold and oil have been quite responsive to the geopolitical developments, moving in opposite directions. Gold rallied towards the $4,500 level before correcting lower, partly dragged by silver's erratic behaviour, while oil has been drifting lower as the excess supply story for 2026 could get even worse if US firms gradually restore the flow of Venezuelan oil. Coupled with decent chances of a Ukraine-Russia ceasefire, the outlook remains bleak for the oil market, with the five-year low of $55.19 around the corner.

Notably, Secretary of State Rubio is scheduled to visit Denmark next week, carrying Trump's Greenland offer to Denmark, while the US President is expected to maintain his bold rhetoric on this issue. Gold stands ready to benefit from a likely deterioration of the EU-US relations and the previously unthinkable threat of military use in Greenland.

Amidst this volatile environment, there is growing speculation that on Friday, January 9, the US Supreme Court might announce its ruling on the legality of tariffs, after 10 am EST (3 pm GMT).

Should the ruling be positive, essentially confirming Trump's ability to impose tariffs without Congress's consent, Trump could restart his tariff rhetoric, targeting China and particularly Europe. He might feel compelled to threaten the EU with aggressive tariffs as a means to "acquire" Greenland.

If the ruling is negative, branding tariffs imposed using a 1977 law as illegal, Trump's reaction could prompt an acute market reaction, although his administration has already drawn up a plan B to reimpose the existing tariffs under different legislation.

Gold stands ready to benefit under both aforementioned scenarios, particularly if the ruling deems current tariffs illegal. On the flip side, investors tend to shun the dollar during trade flare-ups, boosting other currencies like the euro and the Swiss franc.

What would be extremely interesting is if the Supreme Court sets boundaries to the President's power, essentially limiting his ability to authorize tariffs or greenlight military operations without approval from Congress. Such a development could make Trump even more unpredictable going forward.

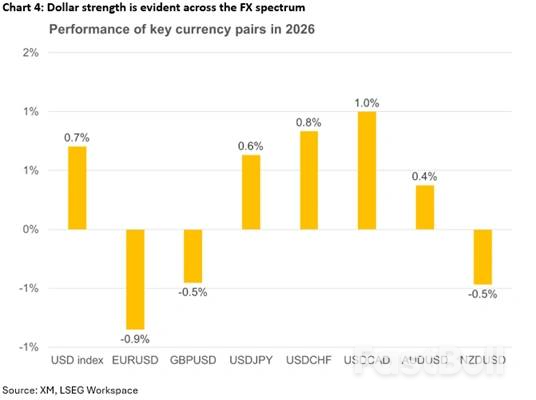

The US dollar has started the new year on the right foot, outperforming both the euro and the pound, as developments regarding Venezuela have prompted an odd risk-off reaction in markets, with US equities also faring relatively well. The pound performance has been a surprise, with the focus now shifting to Thursday's monthly GDP print for November.

On the other hand, the lack of new bullish catalysts is contributing to the euro's current weakness. More importantly, considering Rubio's visit to Denmark, the euro's appeal might be dented by the possibility of an aggressive deterioration in US-EU relations, damaging the momentum built in the Eurozone economy due to the much-discussed aggressive fiscal spending. The ECB remains on the sidelines, but a severe economic downturn, mostly driven by a protracted trade flare-up, might be forced to reassess its current balanced policy stance.

Putting geopolitics aside, a return to normal newsflow might dent the dollar's current appeal, as investors refocus on Fed rate cut expectations.

Stronger data releases, like Wednesday's impressive ISM Services PMI survey, might keep the dollar bid, but investors are still convinced that the one rate cut pencilled in by policymakers in the December 2025 dot plot is too cautious. On the flip side, with around 60bps of easing currently priced in for 2026, investors are currently more comfortable with weaker data prints and appear ready to sell the dollar.

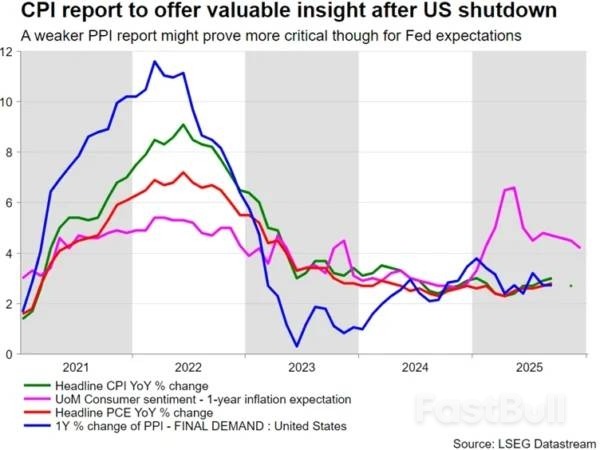

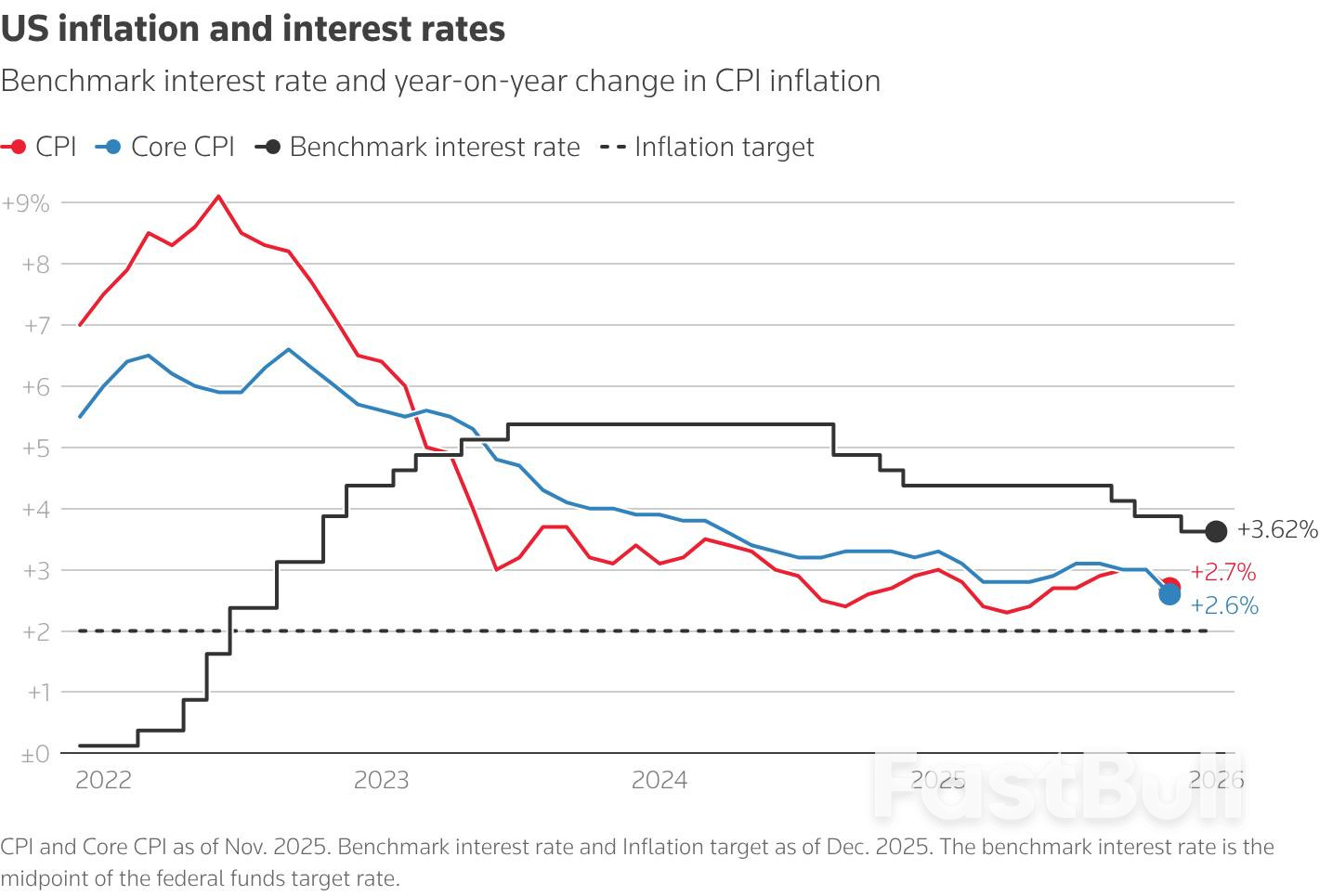

Next week, the calendar is crammed with pivotal data, mostly focusing on inflation and the consumer side of the US economy. On Tuesday, the December CPI report will be in the spotlight, the first inflation print potentially not affected by the US government shutdown.

Another deceleration in price pressures, partly contradicting Fed members' expectations for near-term inflation to remain elevated, as seen in the December 10 Fed meeting minutes, would potentially play into the hands of the new Fed Chair, potentially bringing forward the first 25bps rate cut currently priced in for mid-June. Notably, Trump has been mum on the name of Powell's replacement.

On Wednesday, retail sales and producer price index data for November will be released, with the former giving significant insight into consumer spending appetite. A strong set of figures could beef up the current 2.7% growth forecast by the Atlanta Fed GDPNow model.

Meanwhile, after a relatively quiet period, Fedspeak is expected to intensify. The next Fed meeting is just 20 days away, which means that Fed members have to put their arguments across ahead of the usual blackout period. The focus will be on the more hawkish voting members, like Cleveland's Hammack and Dallas' Logan. Interestingly, the doves clearly have the upper hand this year in terms of the votes, adding to expectations for a persistently dovish Fed stance in 2026.

It has been a difficult start to the new year for peripheral currencies. Central bank rate expectations should be at the forefront, but, for now, dollar strength is dominating the moves. Apart from the Aussie, which is marginally gaining against the greenback, the remaining currencies are on the back foot at this stage versus the dollar, despite their respective central banks completing their easing cycles.

Specifically, developments with Venezuela could turn into a serious headache for Canada. A good part of Canada's production is heavy oil, which is also the dominant product of Venezuela, further denting PM Carney's bargaining power with President Trump, who is not the biggest fan of Canada.

Similarly, Australia is closely monitoring China's newsflow. There is a renewed attempt by Chinese authorities to improve the situation on the ground by expediting investment plans and further allowing banks to address bad loans, in order to beef up their financial health and profitability. Notably, on Wednesday, Chinese trade balance data for December will be published, with investor attention on whether exports maintain their recent robust annual pace of increase and imports continue to grow, validating China's efforts to prop up domestic demand.

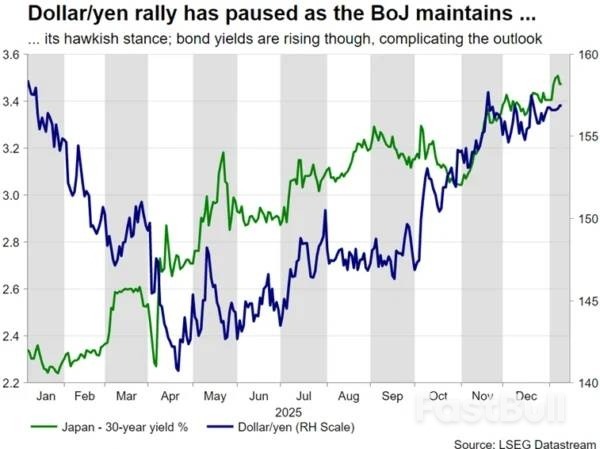

Finally, the yen has been resisting the dollar's strength, courtesy of the hawkish BoJ. Investors are trying to bring forward the next rate hike, currently priced in for September, but mixed data have been muddling the outlook. The BoJ will probably have to wait until the Shunto round, which realistically means that the April meeting is the key one for the next move. Until then, Japanese government officials will probably continue to verbally intervene to keep dollar/yen well below the ¥160, unless of course, the Fed surprises with a Q1 rate cut.

Tensions between China and Japan have escalated sharply after Beijing imposed export controls on dual-use goods, a direct response to political statements from Tokyo regarding Taiwan.

On January 6, China's Ministry of Commerce announced an immediate prohibition on the export of certain dual-use items to Japan. The move signals Beijing's willingness to leverage its critical position in global supply chains as a tool of foreign policy, raising the stakes in an already tense East Asian geopolitical landscape.

Dual-use goods are products, technologies, and software that have both civilian and military applications. This category includes a wide range of essential components for modern economies that can also be used to enhance military capabilities:

• Advanced materials

• Precision machinery

• Semiconductors

• Rare earth elements

• Chemical components

By controlling the flow of these goods, a country can exert significant pressure on another nation's industrial and defense sectors.

Beijing’s decision is a direct retaliation for recent comments made by Japanese Prime Minister Takaichi Sanae. In November 2025, she stated that a potential Chinese military assault on Taiwan could be interpreted as a threat to Japan's own survival.

China's export ban moves its response from diplomatic protests to targeted economic coercion. It serves as a clear signal meant to reinforce Beijing's strategic red lines on Taiwan and counter what it perceives as Japan's increasing alignment with U.S. security policy in the region.

This strategy is not new. In 2010, Beijing suspended rare-earth supplies to Japan for two months during a territorial dispute, exposing Tokyo's dependence on Chinese resources.

In the years since, Japan has worked to diversify its suppliers, reducing its reliance on Chinese rare earths from 90% in 2010 to around 60-70% today. However, a critical vulnerability remains: Japan is still almost entirely dependent on China for heavy rare earths like terbium and dysprosium, which are vital for high-tech manufacturing.

The new controls could act as a de facto export restriction, with China using extensive screening to ensure these materials are not used for military purposes. Given that China remains Japan's largest trading partner, extended restrictions could translate into hundreds of billions of yen in economic losses and severe impacts on manufacturing.

Japan immediately condemned the export ban, calling it inconsistent with international trade norms and criticizing the lack of transparency in Beijing's decision-making.

The incident reinforces the urgency for Japan to accelerate its supply chain diversification. This strategy involves deepening economic and security ties with key partners to build resilience against Chinese economic pressure. The United States, in particular, has become a central partner in this effort.

The U.S. is also actively working to secure its own rare earth supply chain away from China through government investments, international alliances, and domestic processing initiatives. Washington has recently signed agreements on critical minerals with Australia, Malaysia, Thailand, and Japan, including a rare earth pact signed during a meeting between President Donald Trump and Prime Minister Takaichi in October 2025. Beyond the U.S., Japan is expected to strengthen its relationships with other regional powers like Australia and India to further reduce its economic dependencies.

China’s action against Japan highlights a structural shift in the global economy, where strategic competition increasingly shapes trade and technology. As security considerations become paramount, other countries are likely to reassess their own supply chain vulnerabilities, potentially triggering a broader reorganization of global networks for critical technologies.

At a regional level, the friction between East Asia's two largest economies risks creating further instability. Disruptions to their trade relationship could have significant spillover effects across the world, especially in high-tech industries that rely on components from both nations.

While the deep economic interdependence between China and Japan has historically been a stabilizing force, growing mutual distrust threatens to harden strategic alignments and shrink the space for diplomacy. Beijing's use of economic coercion may ultimately push Tokyo even closer to its security allies, particularly Washington. This move marks a new chapter in geopolitical competition, testing whether careful diplomacy can still manage a rivalry that will define East Asia's future.

President Donald Trump posted a chart on social media Thursday evening that included figures in the yet-to-be released December employment report.

The chart, which showed the private sector added 654,000 jobs "since January," matched figures that were not publicly published until 8:30 a.m. in Washington on Friday. It was posted on Truth Social about 12 hours before the data was set to be released.

The White House didn't immediately provide comment.

The president and his economic team are typically briefed on the jobs report the day before the numbers are published. No one from the administration is allowed to comment on the figures until they've been out for 30 minutes to allow the public time to process the policy-neutral statistics before the executive branch weighs in with its interpretation.

Although the post did not disclose the specific payrolls figure for December, it could have hinted to investors the direction of the report. Market watchers were circulating the president's post on social media following the publication of the numbers, noting that he appeared to share data early.

It's not the first time Trump hasn't adhered to protocol. In his first term, he tweeted that he was "looking forward" to seeing the jobs report an hour before it was released, which traders interpreted as a signal that the numbers would be positive. That was in fact the case, as payrolls in May 2018 beat forecasts and the unemployment rate dropped.

President Donald Trump’s recent foreign policy actions—from orchestrating the removal of Venezuela's Nicolas Maduro to issuing warnings to Tehran—are sending mixed signals across the globe. While seemingly decisive, these contradictory moves are creating deep uncertainty among both allies and adversaries about America's true intentions and future commitments.

This unpredictability raises the stakes for global stability. It increases the risk of a dangerous miscalculation by a rival power like China, Russia, or Iran, potentially triggering a serious international conflict. As the world watches, several critical questions about current U.S. foreign policy emerge.

The first question centers on the scope of U.S. security interests. Following the operation that seized Maduro, Secretary of State Marco Rubio declared, "[W]e're not going to allow the Western Hemisphere to be a base of operation for adversaries, competitors, and rivals." The justification for action was clear: Maduro had fostered close economic and military ties with China, Russia, and Iran, giving them a strategic foothold in Latin America.

However, Trump's territorial ambitions appear to extend far beyond that. The administration has issued warnings to Colombia, Cuba, and Mexico, but it has also set its sights on the territory of a founding NATO ally. "We need Greenland," Trump has said, viewing it as a strategic counter to the growing Russian and Chinese presence in the Arctic.

A forceful attempt to acquire this self-governing Danish territory, where the U.S. already has a military base, could fracture the NATO alliance. A more judicious approach, however, could see the U.S. negotiate with Denmark and Greenland to expand its military footprint, gain access to natural resources, and block Russian and Chinese companies from operating there.

After a successful military intervention, how long will the United States remain engaged? History offers cautionary tales. President George W. Bush declared "mission accomplished" in Iraq in 2003, only to leave behind a conflict that lasted nearly two decades and cost countless American lives and dollars. Similarly, Libya descended into chaos after President Barack Obama backed NATO action that led to the death of Muammar Gaddafi. In both cases, Washington was unprepared for the aftermath.

President Trump is not known for his patience. His plan for Gaza's reconstruction is already reportedly faltering, as neither the U.S. nor other nations seem willing to commit the necessary troops to disarm Hamas.

While Trump has stated the U.S. will "run" Venezuela for the time being, the immense challenges of rebuilding its shattered economy and oil infrastructure raise serious doubts about America's long-term commitment to the task.

The administration’s stance on human rights appears inconsistent. As nationwide protests against Iran's theocracy resurfaced, Trump threatened forceful action if the regime "violently kills peaceful protestors."

Yet, Washington's concern for human rights under Trump has been episodic. The suffering of the Venezuelan people was not the primary driver of the action against Maduro. Furthermore, Trump seems unmoved by the torture, deportations, and sexual violence Russia has inflicted upon Ukraine since February 2022. He has even proposed a peace plan that would reward Russia for its aggression.

Protecting Iranians from a brutal regime is a worthy goal. However, U.S. actions regarding Venezuela and Ukraine suggest that human rights may be more of a convenient tool to pressure Tehran than a deeply held principle.

Ultimately, what message will America's adversaries take from these actions?

Optimists believe that by toppling Maduro, Washington will make China, Russia, and other autocratic regimes more reluctant to use force in their own regions. They argue that U.S. threats will now be taken more seriously.

However, the opposite scenario is just as plausible. Trump's intense focus on the Western Hemisphere may convince Beijing that he will not defend Taiwan from an invasion. Likewise, Moscow may conclude that he will not risk U.S. troops to defend Europe from Russian aggression, a sentiment he has suggested himself.

Moreover, Trump's recent military actions have targeted decidedly weaker opponents. His decision to side with Russia over Ukraine could signal to more powerful adversaries that he has no appetite for a direct confrontation. In a world left wondering about America’s next move, instability and risk are on the rise.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up