Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

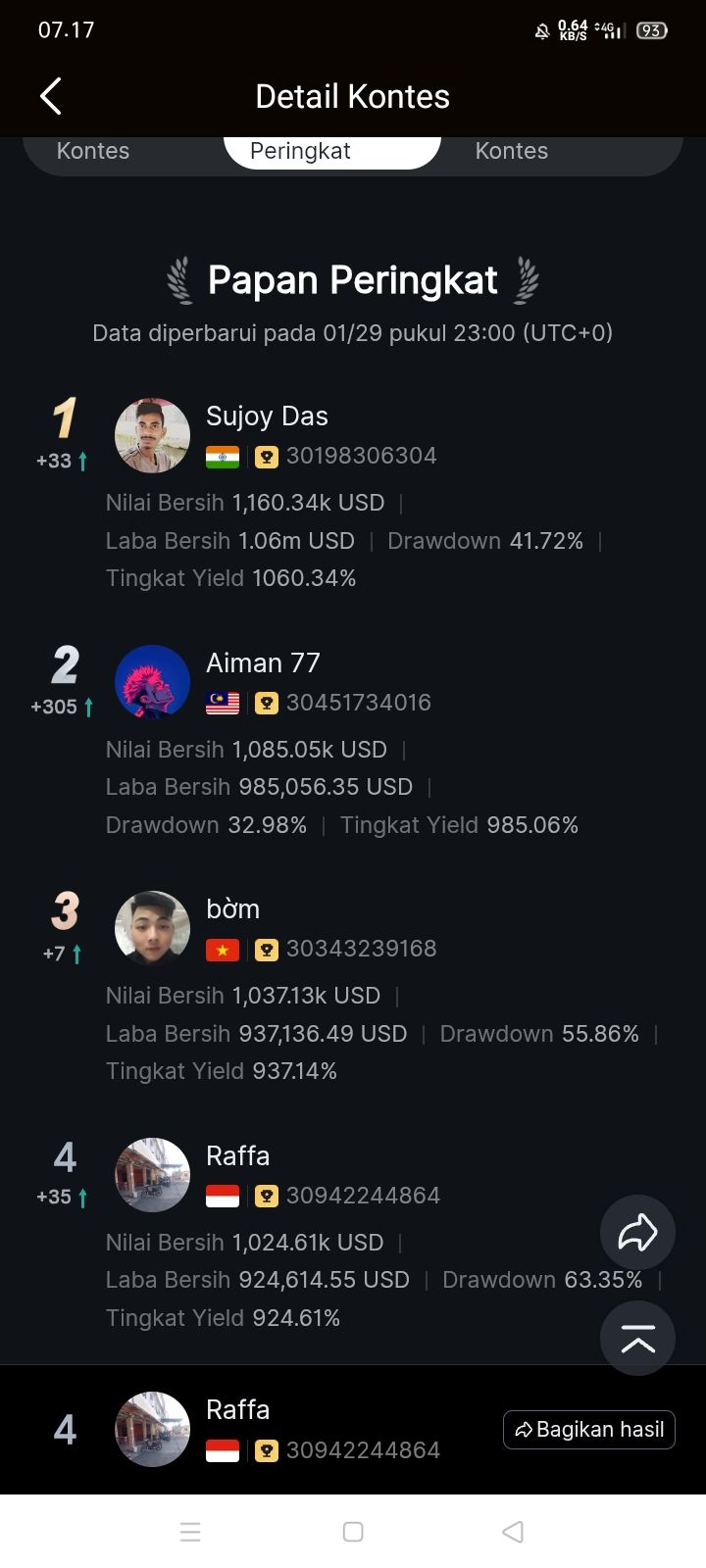

Signal Accounts for Members

All Signal Accounts

All Contests

China Central Bank Injects 477.5 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

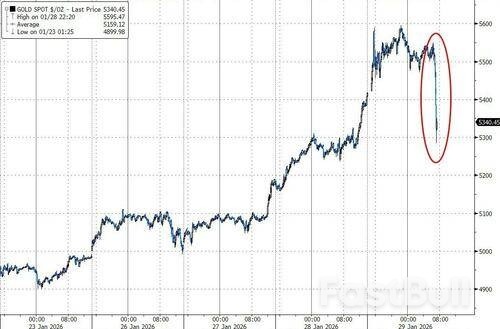

Spot Gold Fell Sharply, Dropping Nearly $50 In The Short Term To A Low Of $5,325.33 Per Ounce, Down 0.80% On The Day

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Trump: 'Very Dangerous' For UK To Get Into Business With China, More Dangerous For Canada To Get Into Business With China

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices surged to four-month highs, propelled by escalating US-Iran tensions and severe US weather disruptions.

Oil prices surged to their highest levels in four months as markets grappled with a combination of escalating geopolitical risk and severe weather-related supply disruptions in the United States.

On Thursday, Brent crude futures for March delivery rose 2.2% to trade at $68.85 per barrel, after briefly touching $70.35, a peak not seen since late September. Meanwhile, West Texas Intermediate (WTI) crude futures gained 2.4%, reaching $64.72 a barrel and earlier clearing the $65 mark. Both oil benchmarks have climbed approximately 9% over the past week.

The primary driver behind the rally is mounting tension between the U.S. and Iran, which has injected a significant risk premium into the market. Traders are concerned that a potential conflict could disrupt crude output from a key Middle Eastern producer.

Recent reports indicated that U.S. President Donald Trump was considering new military actions against Iran, potentially targeting its leadership and nuclear facilities. This follows earlier calls for Tehran to renegotiate its nuclear program, which were rejected. The situation has been intensified by the arrival of U.S. warships in the Middle East, with Trump suggesting more naval assets are en route.

As the fourth-largest producer within OPEC, Iran's output of 3.2 million barrels per day is critical to global supply. Analysts at ING noted that while an immediate disruption to Iranian oil is a key concern, a wider escalation could endanger the nearly 20 million barrels of oil that pass through the Strait of Hormuz daily.

However, not all analysts see a conflict as inevitable. Kepler Cheuvreux argued in a note that the probability of a major supply disruption is low. They believe President Trump's main objective is a nuclear deal, not regime change, making a large-scale bombing campaign unlikely. While Kepler acknowledged that oil prices could continue to rise in the short term, they expect the gains to be temporary, lasting perhaps a couple of weeks.

Adding to supply-side pressures, a severe winter storm has swept across the United States, bringing heavy snow and freezing temperatures that have disrupted domestic crude production.

An estimated 2 million barrels per day of oil production were taken offline over the past week, and exports from the Gulf Coast were also hampered. The impact of these disruptions is already visible in official data, with U.S. oil inventories showing an unexpectedly sharp decline.

According to government figures released Wednesday, U.S. oil stockpiles for the week ending January 23 fell by 2.295 million barrels. This drawdown significantly outpaced market expectations of a 0.2 million barrel drop.

A closer look at the data reveals the sources of this tightening supply:

• Imports: Dropped by 805,000 barrels per day.

• Exports: Increased by 901,000 barrels per day week-over-week.

• Production: Crude output in the Lower 48 states fell by an estimated 42,000 barrels per day.

• Refinery Activity: Operating rates at U.S. refineries declined by 2.4 percentage points to 90.9% of capacity.

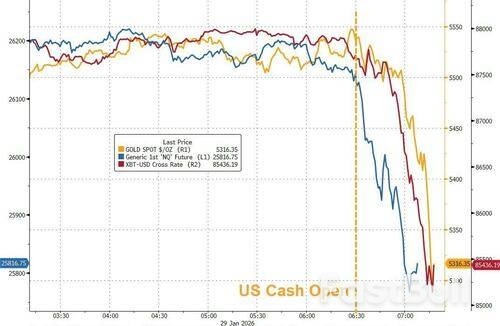

...aaaand it's gone!

Tech's wreck at the open started it... following Goldman's Privorotsky's warning earlier to 'keep an eye on the megacap tech names today'...

US equities puked as the cash market opened, with Nasdaq erasing overnight gains rapidly...

...as losses in MSFT accelerated...

...crypto followed with Bitcoin crashing to its lowest since Dec 18th...

...and then gold plunged back below $5300...

And for now we see no catalyst for this break.

India's economy is on track to grow between 6.8% and 7.2% in the fiscal year beginning in April, propelled by strong domestic demand even as global volatility presents significant headwinds.

The projection, detailed in the government's annual economic survey, marks a slight moderation from the current fiscal year's estimated 7.4% growth. Presented to parliament by Finance Minister Nirmala Sitharaman, the report strikes a tone of cautious optimism, forecasting "steady growth amid global uncertainty."

The government's assessment for the current year at 7.4% notably surpasses the 6.3%-6.8% range predicted in last year’s survey.

While the domestic outlook is robust, the report acknowledges that global conditions introduce considerable uncertainty. Key external risks threatening India's economy include:

• Slower growth among major trading partners.

• Trade disruptions stemming from international tariff policies.

• Volatility in capital flows that could affect exports and investor sentiment.

The report, authored by Chief Economic Adviser V. Anantha Nageswaran and his team, positions these challenges as sources of uncertainty rather than immediate macroeconomic distress.

The survey directly addresses the impact of global trade tensions, particularly with the United States. In August, President Donald Trump imposed a 50% tariff on certain Indian goods, prompting New Delhi to accelerate efforts to diversify its export markets through new trade deals with the European Union, New Zealand, and Oman.

Since the tariffs were introduced, the Indian rupee has fallen 5%, hitting a record low of 91.9850 per dollar on Thursday.

The economic survey argues that the currency is now "punching below its weight." The report states that the rupee's valuation does not align with India's strong economic fundamentals. However, this "undervalued" status provides a partial buffer against the impact of higher U.S. tariffs on Indian exports.

This currency weakness comes with a trade-off. While beneficial for exporters and manageable during a period of low inflation, it has made foreign investors hesitant. This reluctance led to a record withdrawal of $19 billion from Indian equities in 2025, with foreign investors continuing to be net sellers in January.

To counter external pressures, the government is relying on a series of domestic reforms to stimulate investment and consumption. The survey highlights recent policy changes expected to strengthen the economy, including consumption-tax cuts, a comprehensive overhaul of labor laws, and measures to open up the nuclear power sector.

Furthermore, the report expresses optimism that "ongoing trade negotiations with the United States are expected to conclude during the year," which could help reduce uncertainty on the external front.

The Indian government's growth forecast is broadly in line with projections from major international institutions.

The International Monetary Fund (IMF) recently raised its growth forecast for India for the upcoming fiscal year to 7.3%. Similarly, the World Bank upgraded its projection to 7.2%.

Domestically, the Reserve Bank of India (RBI) has noted that high-frequency indicators point to sustained demand. The central bank has actively supported growth by cutting interest rates by 125 basis points since February 2025, its most aggressive easing cycle since 2019.

India's top private refiner, Reliance Industries, is set to drastically reduce its intake of Russian crude oil. Starting in February, the company plans to import approximately 150,000 barrels per day (bpd) of non-sanctioned crude, a significant cut driven by compliance with U.S. sanctions.

This move marks a major policy shift for the company, led by billionaire Mukesh Ambani. Previously, Reliance was a primary customer for Russian crude, importing over 500,000 bpd through a long-term agreement with Rosneft.

Following U.S. sanctions targeting Russian energy giants like Rosneft and Lukoil, Reliance completely stopped its purchases from Rosneft and began sourcing crude from non-Russian suppliers.

The decision to limit Russian oil imports aligns with India's broader strategy to navigate difficult trade negotiations with the United States. The Trump administration has specifically targeted India for its significant purchases of Russian crude, which are seen as supporting Moscow's energy revenues.

In response, President Donald Trump doubled a tariff on India from 25% to 50%, effective August 2025, as a punitive measure. Consequently, Reliance's import volume is dropping from over 550,000 bpd just months ago to the new, limited level of 150,000 bpd.

European Union regulations are also shaping Reliance's operational strategy. The EU recently implemented a ban, effective January 21, on importing petroleum products made from Russian-origin crude, even if they are processed in a third country.

To comply with this rule, Reliance will now process its limited Russian crude imports exclusively at its Jamnagar refinery unit that serves the domestic Indian market. As a proactive measure, the company had already ceased processing Russian crude at its export-oriented refinery units in November to ensure full compliance with the impending ban.

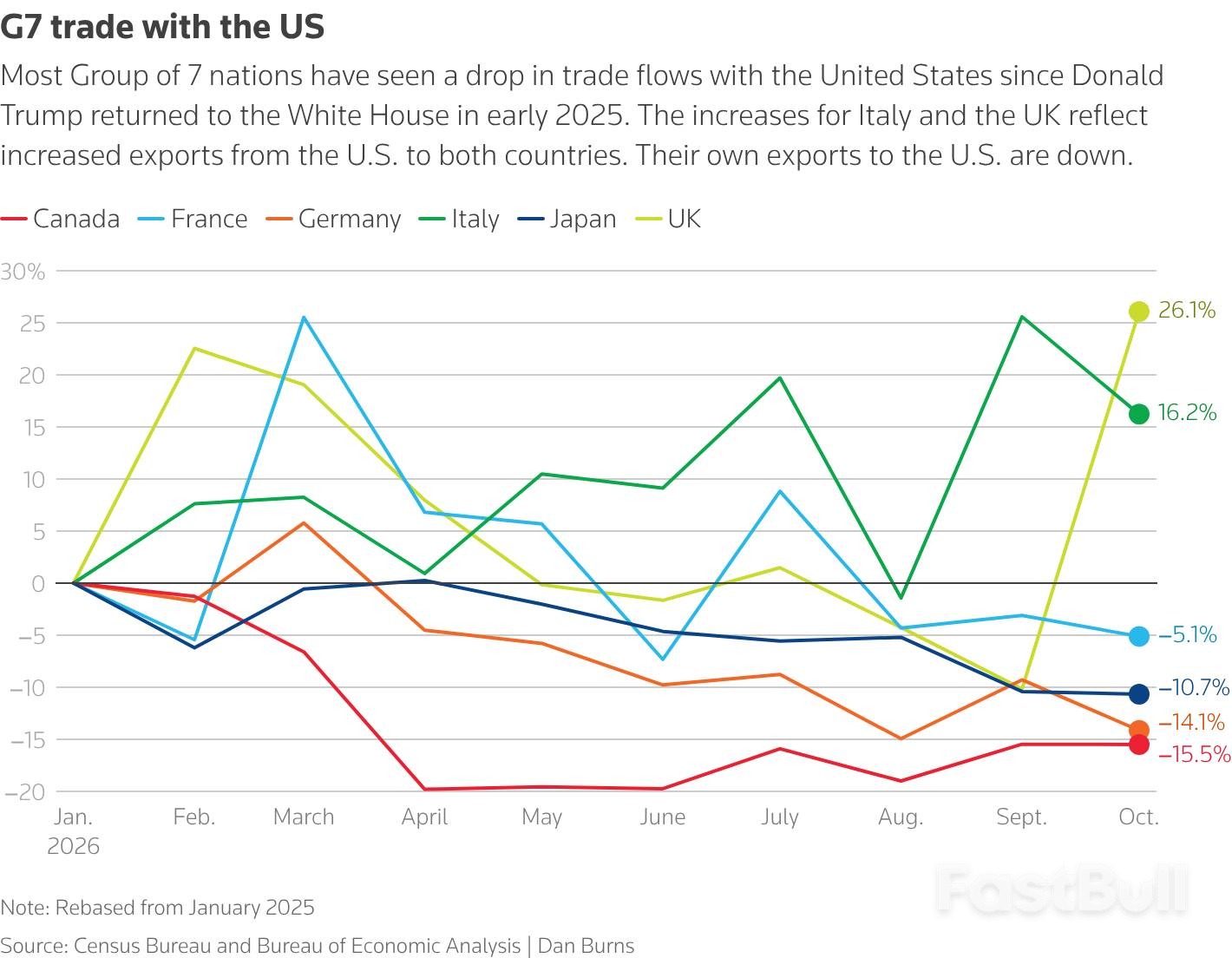

While America's military and technological dominance remains unchallenged, a subtle but significant shift is reshaping the global trade landscape. Prompted by President Donald Trump's affinity for tariffs, U.S. allies are discovering they have more options than previously thought in the trade of goods, and they are adapting with surprising speed.

This isn't a dramatic decoupling. No one is seriously attempting to abandon the U.S., which is still the world's most lucrative market. Instead, a recent wave of bilateral pacts signals a more measured strategy: "de-risking." This term, once primarily used in discussions about China, now applies to hedging against unpredictability from Washington.

Pursuing this strategy comes with costs, from reconfiguring supply chains to forging alliances with nations that don't share identical values. However, early indicators suggest the economic price of this insurance policy is manageable.

"Trade is probably one of the areas where middle powers have some of the greatest agency in choices," notes Alexander George, senior director for geopolitics at the Tony Blair Institute for Global Change (TBI).

He points to the European Union as a prime example. The threat of U.S. trade actions appeared to galvanize the bloc, leading to the recent signing of the long-stalled EU-Mercosur trade deal with Latin American countries and a new agreement with India.

Of course, these deals face political and legal hurdles. The EU's ability to ratify the Mercosur pact will be a key test of its resolve. Similarly, recent efforts by British and Canadian leaders to mend ties with China are in their early stages, though some initial deals have already been made.

Businesses aren't waiting for governments to draw a complete map of the new trade order. The Irish Whiskey Association, for example, celebrated the EU-India deal as a "critical" move to find new customers and offset the impact of a 15% U.S. tariff on its largest market.

Meanwhile, German corporate investment in China reached a four-year high last year. According to the IW German Economic Institute, this was partly driven by a need to build local supply chains in response to a more challenging U.S. trade environment.

Despite the turbulence, the global economy has remained resilient. A quarterly Reuters poll of 220 economists showed that the forecast for global economic growth this year remains at 3%, unchanged from a year ago, even with supply chain adjustments underway.

Some experts see long-term benefits in this restructuring. World Trade Organization Director-General Ngozi Okonjo-Iweala told Reuters that diversifying investment and production builds global resilience and creates jobs. This aligns with Canadian Prime Minister Mark Carney's call for "middle powers" to build a network of alliances among themselves.

For most nations, diversification is a safer bet than direct confrontation with the United States.

Modeling from the UK's Aston University found that if tensions over Greenland had escalated, a threatened 25% U.S. tariff would have cost European economies only 0.26% of per capita income if they chose not to retaliate. In contrast, a retaliatory 25% levy on U.S. goods would have more than doubled that cost.

Mujtaba Rahman, managing director for Europe at Eurasia Group, notes that forging new trade alliances abroad can be politically easier for governments than implementing difficult domestic economic reforms. "Diversification on the trade side is absolutely happening and continuing," he said of Europe.

Two key factors could limit the pace and scope of this global adaptation.

First, China's reluctance to stimulate domestic consumer demand means it cannot easily absorb the slack from the U.S. market. The Tony Blair Institute observed that while China's exports have grown since the implementation of higher U.S. tariffs, its imports have stayed flat, forcing other nations to accept widening trade deficits with Beijing.

Second, the United States may actively discourage countries from pursuing diversification strategies that pull them out of its economic orbit. "The question is to what extent this becomes a geopolitical faultline," said TBI's George, highlighting the risk of trade shifts escalating into broader strategic tensions.

Russian oil giant Lukoil has announced plans to sell its international assets to the U.S. private equity firm Carlyle Group. The move comes as the company races to divest its global portfolio ahead of a U.S. sanctions deadline.

While financial details of the proposed deal were not disclosed, Lukoil confirmed in a statement that the sale would not include its assets in Kazakhstan.

The sale is a direct response to sanctions imposed by U.S. President Donald Trump, aimed at pressuring Russia for a ceasefire in its war on Ukraine. The U.S. Treasury has given Lukoil until February 28 to sell its foreign holdings.

However, the transaction is not yet final. It still requires approval from the U.S. Office of Foreign Assets Control (OFAC), the agency responsible for administering sanctions. In the meantime, Lukoil stated it will continue negotiations with other prospective buyers.

Carlyle Group issued a statement highlighting its commitment to ensuring operational continuity and preserving jobs. The firm also acknowledged the "critical importance" of the assets to the energy security and infrastructure of the nations where they are located.

When questioned about the deal, the Kremlin stated it could not comment on corporate agreements. Kremlin spokesman Dmitry Peskov remarked, "For us, the most important thing is that the interests of the Russian company involved are protected and respected."

This is not the first attempt to sell these assets. In October, the Swiss commodities trading firm Gunvor announced a proposal to buy Lukoil’s portfolio but later withdrew its offer.

The withdrawal followed accusations from the U.S. that Gunvor was "the Kremlin's puppet," a claim the Geneva-based company rejected. A November 6 post on X from the U.S. Treasury Department underscored the political climate, referencing President Trump's stance on the war and stating, "As long as Putin continues the senseless killings, the Kremlin's puppet, Gunvor, will never get a license to operate and profit."

The sanctions put a significant portion of Lukoil's international business at risk. The company's global operations include:

• Stakes in oil and gas projects across 11 countries.

• Refineries located in Bulgaria and Romania.

• A 45% stake in a refinery in the Netherlands.

• Gas station networks in several countries.

The new sanctions, announced by Trump on October 22, target both Lukoil and Rosneft, Russia's two largest oil companies. Together, these firms account for approximately half of the country's oil exports, a major source of revenue for the Russian government.

The sanctions severely restrict their ability to conduct business outside of Russia by barring U.S. entities from dealing with them and threatening secondary sanctions against any foreign banks that handle their transactions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up