Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

South Korea's economy faces another sluggish year, with experts forecasting 1% growth amid currency, trade, and tech security risks.

A recent survey of economic experts suggests South Korea's economy is set for another year of sluggish performance, with more than half predicting growth will remain in the 1% range.

The poll, conducted by Southernpost Inc. for the Korea Enterprises Federation (KEF), surveyed 100 economics professors to gauge their outlook on Asia's fourth-largest economy.

The consensus among the surveyed economists points to a challenging year ahead. The average growth forecast for the Korean economy stands at 1.8%, a figure slightly more pessimistic than the government's 2% outlook and the International Monetary Fund's (IMF) 1.9% projection.

Key findings from the survey include:

• 54% of experts believe Korea's economy will post growth in the 1% range this year.

• 36% anticipate a return to 2% growth, but not until 2027, driven by a slow recovery in demand and consumption.

• 6% forecast that economic growth could fall below 1%.

This follows a year in which the economy expanded by just 1%, a notable slowdown from the 2% growth recorded in the previous year.

Beyond headline growth figures, the experts identified specific risks clouding the economic horizon. They projected the won-dollar exchange rate to fluctuate between 1,403 won and 1,516 won this year, indicating potential for currency volatility.

Furthermore, trade relations with the United States are a significant source of concern. Nearly 60% of the respondents said the outcome of U.S.-Korea tariff negotiations would negatively impact both Korean exports to the U.S. and domestic corporate investment.

On the domestic front, technology presents both opportunities and challenges. An overwhelming 92% of the economists surveyed believe the expanding use of artificial intelligence (AI) will help address labor shortages and boost productivity, particularly within the manufacturing sector.

However, this optimism is tempered by security concerns. Nearly 90% of the experts urged the government to implement effective measures to prevent the overseas leakage of critical technologies like semiconductors, calling for strict penalties for any violations.

Japanese Prime Minister Sanae Takaichi has issued a direct warning that the government is prepared to act against speculative market moves, following a sharp rebound in the yen that has put traders on high alert for currency intervention.

The statement comes as both the Japanese yen and government bonds face selling pressure. Markets are reacting to concerns that Takaichi's expansionary fiscal policies, combined with the Bank of Japan's slow pace of interest rate hikes, could lead to increased government debt and runaway inflation.

The yen's recent slide brought it close to the psychologically significant level of 160 per U.S. dollar. However, the currency experienced a sudden jump on Friday after the New York Federal Reserve was reported to be conducting rate checks.

Some traders interpreted this move as a potential signal of coordinated U.S.-Japan intervention aimed at halting the yen's decline, immediately increasing volatility in the currency markets.

When asked about the recent sell-off in bonds and the yen's weakness during an appearance on Fuji Television, Takaichi declined to comment on specific market fluctuations.

"The government will take necessary steps against speculative or very abnormal market moves," she stated, without providing further details on what those steps might entail.

The market jitters stem from Takaichi's economic agenda, which includes a substantial spending package to offset rising living costs. A plan to suspend an 8% levy on food sales for two years has also triggered a spike in bond yields, raising the cost of financing Japan’s massive public debt.

For Japanese policymakers, a persistently weak yen has become a major economic challenge. It directly increases the cost of imports, which in turn fuels broader inflation and diminishes the purchasing power of households across the country.

Despite campaign promises to slash energy bills, American consumers saw their costs rise in 2025. President Trump’s energy policy, enacted early in his second term, appears to have reversed previous trends, with higher prices expected to continue into 2026 and beyond.

An analysis of data from the Energy Information Administration (EIA) reveals the average U.S. household electricity bill was 6.7 percent higher in 2025 than in 2024. This translates to an additional $116 in spending per household for the year.

Some regions faced even steeper increases. Washington D.C. saw electricity costs jump by 23 percent, while Indiana experienced a 17 percent rise.

The financial pressure extends beyond electricity. Natural gas costs also climbed by an average of 5.2 percent last year. This has led to a sharp increase in utility disconnections for unpaid bills, with New York State, for example, recording a fivefold rise in its disconnection rate as households are forced to choose between essentials.

Upon taking office, President Trump declared a state of energy emergency and issued executive orders designed to curb former-President Biden's 2022 Inflation Reduction Act. These measures prioritized the expansion of fossil fuels while limiting the deployment of renewable energy.

This policy shift halted several wind energy projects and created investor uncertainty in the clean energy sector, stalling new development. Concurrently, the administration has moved to expand oil and gas operations and extend the operational life of several aging coal plants.

The impact on consumers has drawn sharp criticism. "Instead of reducing electric bills by 50 percent, the president's actions have raised the cost of home energy for all Americans," stated Mark Wolfe, executive director of the National Energy Assistance Directors Association.

Wolfe added that the financial strain is expanding beyond the lowest earners. "It used to be the poorest Americans who struggled with their power bills, but now we are seeing more and more middle-income families who have to make sacrifices to avoid being shut off."

President Trump has pushed back on these concerns, recently calling the affordability crisis a "hoax" and a "fake narrative" created by political opponents. He also described 2025 as the "greatest first year in history" for the economy.

The administration's focus on fossil fuels has come at a direct cost to new energy capacity. A December report from Climate Power estimated that canceled or delayed renewable projects represent a loss of almost 25 GW of planned generation—enough to power nearly 13.2 million homes.

At the same time, U.S. energy demand has started increasing for the first time in decades, driven largely by the administration's support for large-scale data centers needed for artificial intelligence (AI).

Facing rising consumer bills and concerns about a potential energy supply gap, the White House has called for an emergency wholesale electricity auction. The goal is to compel tech companies to pay for the new power capacity their data centers require.

While the administration has also shown support for nuclear power with significant investments, these projects take years to develop and are unlikely to resolve the immediate supply shortage.

Slowing the development of new renewable energy capacity while demand from the tech sector grows is expected to keep upward pressure on consumer bills. While tech firms may be willing to pay a premium for power, securing affordable energy for households will remain a significant challenge for the foreseeable future.

The Federal Reserve is expected to keep interest rates unchanged this week, a move likely to be mirrored by central banks in Canada, Brazil, and Sweden as global policymakers navigate a tense economic landscape.

Officials in Washington are set to conclude their two-day meeting on Wednesday, where they are widely anticipated to resist President Donald Trump's demands for lower borrowing costs. This decision comes as Fed Chair Jerome Powell receives public backing from his international peers. Central bank chiefs from the UK, Europe, and over a dozen other nations have expressed "full solidarity" with Powell, reinforcing central bank independence against mounting political pressure from the White House.

The Fed is not just contending with verbal attacks. The institution is also facing grand jury subpoenas and a Supreme Court case concerning President Trump's authority to fire Governor Lisa Cook. This domestic drama unfolds against a backdrop of global uncertainty, marked by market volatility in Japan and ongoing trade tensions.

"We are in a more shock-prone world," International Monetary Fund head Kristalina Georgieva remarked at the World Economic Forum in Davos. "We're not in Kansas any more." While policymakers are focused on growth risks from tariffs, they remain vigilant about potential inflation pressures. With 18 central banks scheduled for decisions this week, the global policy landscape is varied; some African nations, for instance, may be poised to ease rates.

After implementing three consecutive rate cuts at the end of 2025, Federal Reserve officials are expected to hold rates steady. Chair Powell will likely signal that current policy is well-positioned, buying the committee time to assess the impact of its previous easing measures without committing to a future direction.

Recent economic data supports a pause. A decline in the U.S. unemployment rate in December, combined with inflation holding above the Fed's target, provides common ground for both hawks and doves on the committee.

Powell's upcoming press conference will be his first since the disclosure of Justice Department subpoenas targeting the Fed and the Supreme Court hearing on Governor Cook's employment. However, he is not expected to comment extensively on these legal matters. Key economic data this week includes the December producer price index, durable goods orders, the November trade deficit, and January consumer confidence.

Bank of Canada Expected to Stay on Sidelines

The Bank of Canada is widely projected to maintain its policy rate at 2.25% on Wednesday. The accompanying monetary policy report is likely to highlight slower growth and heightened uncertainty related to the upcoming review of the US-Mexico-Canada Agreement (USMCA). Traders see the bank holding rates for most of 2026, aligning with policymakers' view that the current rate is appropriate. Upcoming Canadian data includes November GDP figures, which are expected to show weak fourth-quarter output.

Inflation Data Guides Australia and Japan

Australia: All eyes are on inflation data due Wednesday, ahead of the Reserve Bank of Australia's (RBA) February 3rd decision. Economists forecast that consumer price gains accelerated to 3.6% year-over-year in the fourth quarter. Paired with recent strong jobs data, a high inflation reading could reinforce the RBA's hawkish stance and fuel speculation of a rate hike next month.

Japan: Tokyo's inflation report on Friday, a key indicator for national trends, is expected to show core inflation slowing to 2.2%. However, an index that excludes energy subsidies is projected to hold steady at 2.6%, suggesting underlying price pressure remains robust. This could keep the Bank of Japan on a path toward further rate increases.

China is set to release industrial profits data on Tuesday, which will provide fresh insight into the pressures facing its manufacturing sector from weak domestic and export demand. Elsewhere in the region, fourth-quarter GDP data is scheduled for the Philippines, Taiwan, and Hong Kong. Growth in the Philippines is forecast to have accelerated to 1.5% quarter-on-quarter, while Taiwan's year-on-year growth is seen rising to 8.75%.

Several economies, including the Philippines, Hong Kong, and Thailand, will release December trade data. Consumer confidence reports are also due from Japan and New Zealand, where business sentiment in December hit a 30-year high. On the policy front, Pakistan's central bank is expected to cut its SBP rate to 10%, while Sri Lanka is likely to hold its rates steady.

Economic momentum will be the main theme in the euro area this week. Germany's Ifo business sentiment survey on Monday will be closely watched to see if it aligns with recent positive industrial data.

The first look at fourth-quarter GDP for the region arrives on Friday, with economists unanimously predicting an expansion. Stronger-than-expected data from Germany has already set a positive tone, and output is also expected to have increased in France, Italy, and Spain.

Preliminary inflation figures from Spain and Germany are also due Friday. Inflation is anticipated to have slowed to a seven-month low of 2.4% in Spain, while holding at 2.0% in Germany. Both the European Central Bank and the Bank of England are now in their pre-meeting blackout periods ahead of their decisions on February 5.

Latin America's Mixed Policy Outlook

Brazil: The central bank will hold its first policy meeting of 2026 as mid-month inflation data is released. Inflation may have risen above the 4.5% upper limit of the target range. While most analysts expect Brazil to begin an easing cycle in the first quarter, trimming the key rate from its current 15%, a cut this Wednesday is seen as unlikely.

Colombia: The central bank is expected to act decisively on Friday in response to a 23% hike in the minimum wage. Analysts forecast a half-point rate increase to 9.75%, with more tightening expected by year-end as 2026 inflation expectations have jumped significantly.

Mexico & Chile: Mexico's fourth-quarter output data will likely show the economy avoided a technical recession, though uncertainty around U.S. trade policy clouds the 2026 outlook. Chile's central bank is expected to stand pat after cutting its rate to 4.5% in December. Major Latin American economies including Brazil, Chile, Colombia, and Mexico will also release December unemployment reports.

California is charting its own course on global health policy, with Governor Gavin Newsom announcing that the state will maintain its membership in a World Health Organization (WHO) network. The move comes just as the Trump administration finalized the United States' complete withdrawal from the global health body.

Newsom framed the decision as a necessary step to counteract what he described as a dangerous federal policy. "The Trump administration's withdrawal from WHO is a reckless decision that will hurt all Californians and Americans," Newsom stated.

California's governor declared that the state would not passively accept the consequences of the national exit. "California will not bear witness to the chaos this decision will bring," he said. "We will continue to foster partnerships across the globe and remain at the forefront of public health preparedness."

This commitment makes California the only state to be a member of the WHO's Global Outbreak Alert and Response Network.

The announcement followed a meeting between Newsom and WHO Director-General Dr. Tedros Adhanom Ghebreyesus at the World Economic Forum in Switzerland. This high-profile international engagement comes after Newsom confirmed in October that he is considering a presidential bid in 2028.

The Trump administration's withdrawal from the United Nations-managed agency marks a significant shift in U.S. foreign policy. The administration, long critical of the WHO's handling of global health crises, formalized the split on Thursday.

In a joint statement on January 22, Secretary of State Marco Rubio and Health and Human Services Secretary Robert Kennedy Jr. outlined their reasoning. "This action responds to the WHO's failures during the COVID-19 pandemic and seeks to rectify the harm from those failures inflicted on the American people," they wrote.

The statement accused the WHO of having "abandoned its core mission and acted repeatedly against the interests of the United States," despite the U.S. being a founding member and its largest financial backer.

With the withdrawal, all U.S. funding to the WHO has been terminated. According to the Department of Health and Human Services, this includes approximately $111 million in annual "mandatory dues" and $570 million in "voluntary contributions."

Rubio and Kennedy Jr. stated the WHO was "beyond repair" due to bureaucratic inertia, conflicts of interest, and international politics. Their press release adopted a resolute tone, declaring the withdrawal was made for the Americans impacted by the pandemic and what they termed "WHO-driven restrictions."

"We will get our flag back for the Americans who died alone in nursing homes, the small businesses devastated by WHO-driven restrictions, and the American lives shattered by this organization's inactivity," the statement concluded, adding that the WHO had refused to return the U.S. flag after the departure was announced.

The United Kingdom is poised to tighten its rules on tariff-free steel imports, a move designed to shield its domestic industry from a global supply surplus and rising international protectionism.

According to sources familiar with the discussions, the government is considering changes to the quota system that currently allows a specific quantity of foreign steel to enter the country before a 25% levy is applied. An announcement on lower tariff-free quotas could be made in April, with the new measures taking effect on July 1.

The potential policy shift comes as the global market contends with an oversupply of steel, largely driven by producers in China. Chinese steel exports reached another all-time high in December, while other nations like Vietnam, Korea, and Turkey are also actively seeking international buyers.

This trend toward protectionism was accelerated in March 2018 when Donald Trump, during his first presidential term, imposed 25% tariffs on steel. He later doubled these levies to 50% in June of last year. These actions effectively restricted access to the U.S. market, triggering a domino effect as producers scrambled for new customers and major economies like the EU and Canada implemented their own import barriers.

The UK's steel imports are currently regulated by quotas known as "safeguards," which are set to expire in June. These measures were originally put in place by the European Union in 2018 to prevent a surge of cheap steel diverted from the U.S. market. The UK adopted these same measures post-Brexit and extended them until June 2026, but World Trade Organization rules prevent another extension.

With the government retaining control over British Steel and Speciality Steel, there is a clear incentive to implement new protective measures. The situation is further complicated by the EU's decision in October to replace its own safeguards with 50% tariffs and smaller duty-free quotas, forcing the UK to negotiate its own allocation to avoid being shut out.

The British steel industry has been vocal about the need for new quotas, warning that a failure to act would leave the country vulnerable to a flood of cheap imports.

Vlad Darahan, head of international trade and compliance at Tata Steel UK, argued that current UK quotas are overly generous. "In certain cases, [they are] higher than the total UK demand of that product," he said. "This results in the UK being an unfairly priced dumping ground for cheap imports." Darahan urged the government to implement a "clearer, stricter UK system" based on the country's actual needs.

Gareth Stace, director general of the industry group UK Steel, described the issue as fundamental to the sector's survival. "Much of the UK steel industry will no longer be viable unless the government puts in place robust trade measures," he stated. Stace pointed to China's model of subsidizing production and exporting its excess capacity as a core problem that requires a strong policy response from countries like the UK.

While steel producers are advocating for lower import quotas, some companies that use steel as a raw material have raised objections. They argue that tighter restrictions will lead to higher material prices and that UK-based steelmakers are unable to meet demand for certain product categories.

Discussions between the Department for Business and Trade, the steel industry, and steel buyers are ongoing to determine appropriate quota levels for specific types of metal.

A government spokesperson described the reports as "speculation about a complex issue where no final decisions have been taken," but confirmed that officials are "working at pace to ensure the best outcomes to protect UK industry."

The spokesperson reiterated the government's commitment to a "bright and sustainable future for steelmaking and steel jobs in the UK," adding that a long-term vision for the sector will be detailed in a steel strategy to be published this year.

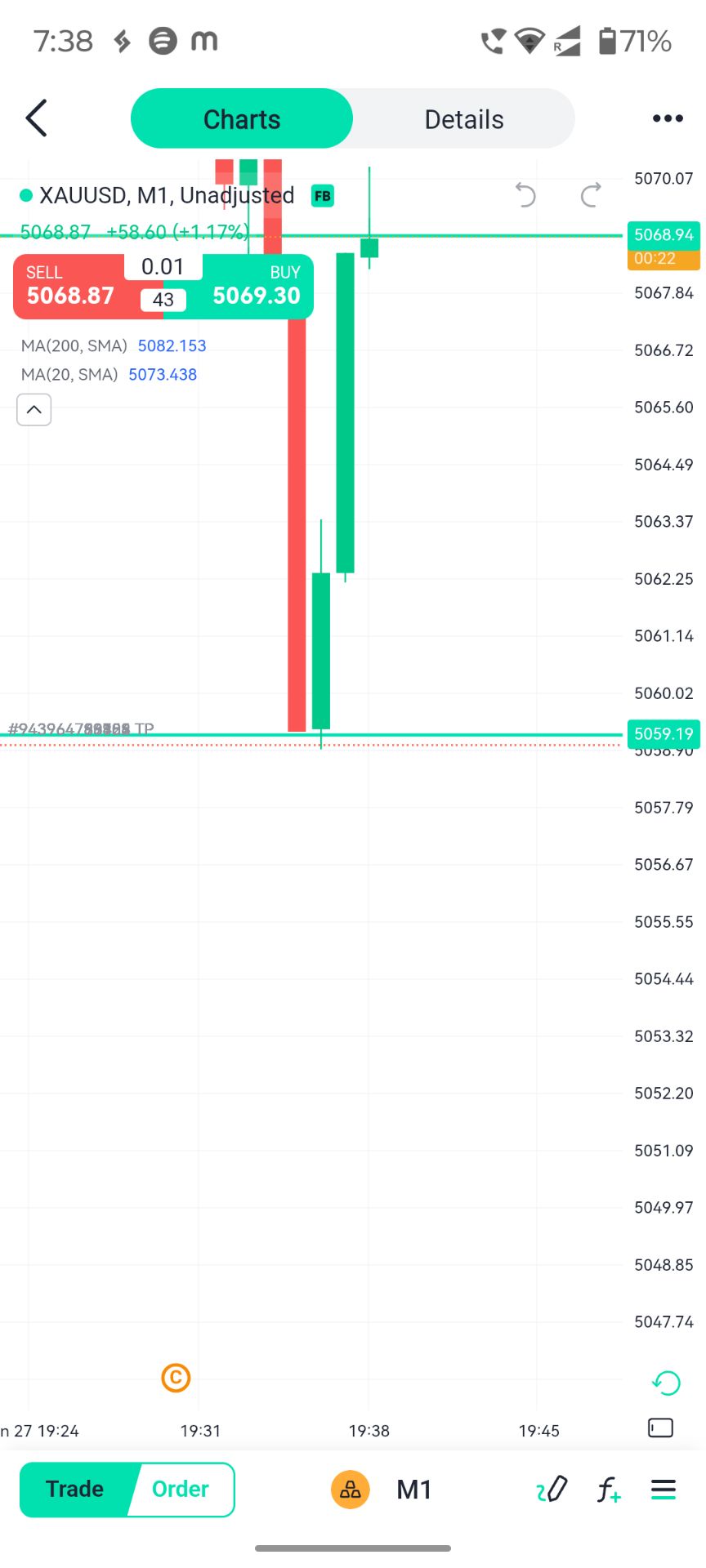

Poland's central bank is set to significantly increase its gold reserves, approving a plan to purchase up to 150 more tonnes of the precious metal. The announcement, made on January 20, raises the country's maximum gold holding target to 700 tonnes.

According to National Bank of Poland (NBP) Governor Adam Glapiński, this move is designed to elevate the country's financial standing. "This will place Poland among the elite 10 countries with the largest gold reserves in the world," he stated.

The central bank has not provided a specific timeline for completing the purchases. Under the new policy, the NBP can hold up to 700 tonnes of gold, even if its value surpasses the previous target of 30 percent of total reserves.

This decision marks the latest step in Poland's multi-year strategy to bolster its gold holdings. The country has emerged as one of the world's most active central bank buyers, consistently adding to its reserves.

In November, the NBP added another 12 tonnes of gold, bringing its official holdings to 543 tonnes. At the time, this represented 28 percent of its total reserves. To put this growth into perspective, Poland's central bank held just 14 tonnes of gold in 1996 and now holds more than the European Central Bank.

The NBP has repeatedly raised its targets in recent years:

• 2021: First announced a plan to increase gold holdings.

• 2024: Governor Glapiński raised the target to 20 percent of reserves.

• Later: The goal was increased again to 30 percent of reserves.

This latest 700-tonne ceiling continues that aggressive trend. In a concrete demonstration of its strategy, the NBP also repatriated 100 tonnes of gold in 2019, covertly moving the bullion from vaults in London to a secure facility in Warsaw.

Governor Glapiński has framed the gold acquisition strategy as a critical measure for ensuring financial security in an uncertain world. He previously called gold "the only safe investment for state reserves" amid "difficult times of global turmoil and the search for a new financial order."

According to the NBP, gold serves several key functions for a central bank:

• Ultimate Safe Haven: It is not directly linked to any single country's economic policies and provides security during crises.

• Credibility: As a "symbol of stability," it enhances Poland's standing with international investors and partners.

• Risk Mitigation: Gold is free from counterparty and credit risk and retains its real value over the long term.

• Durability: Its physical properties make it virtually indestructible.

Glapiński has emphasized that holding gold prepares the central bank for even the most extreme scenarios. "Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records," he explained. "The central bank is required to be prepared for even the most unfavorable circumstances."

Poland's actions are not happening in isolation. Central banks worldwide have been buying gold at a historic pace.

In 2024, global central banks collectively increased their official reserves by 1,044.6 tonnes. This was the third-largest annual expansion on record, only slightly behind the purchases seen in 2023 and the all-time high of 1,136 tonnes set in 2022.

This recent surge marks a dramatic acceleration in central bank demand. For comparison, the average annual increase in gold reserves between 2010 and 2021 was just 473 tonnes.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up