Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Solid base pay clashes with a bonus plunge in Japan's latest wage data, posing a dilemma for BOJ's monetary policy.

Japan's latest wage report is sending conflicting signals to the Bank of Japan just weeks before its next policy decision, creating a complex picture for an economy at a monetary crossroads.

While a key measure of underlying salary growth remained solid, a sharp drop in bonuses dragged down the headline figures, complicating the central bank's path forward.

The most encouraging sign for policymakers came from base salary data. According to a labor ministry report on Thursday, base pay rose 2% in November compared to the previous year, maintaining a steady pace.

A more stable metric, which excludes bonuses and overtime for full-time workers, also showed a 2% increase. This suggests that the foundational momentum for wage growth, a critical factor for the BOJ, is holding firm.

Despite the stability in base pay, the overall wage numbers were surprisingly weak.

• Nominal Wages: Total nominal wage growth slowed to just 0.5%, a significant miss from economists' median forecast of a 2.3% rise and the weakest increase since 2021.

• Bonus Plunge: The slowdown was primarily driven by a 17% plunge in seasonal bonuses, as companies cut back on discretionary compensation.

• Real Earnings Fall: Consequently, real cash earnings, which account for inflation, fell by 2.8%. This drop was much steeper than the 1.2% decline analysts had expected.

Even with these mixed results, most economists believe the data won't derail the Bank of Japan from pursuing further rate increases later this year. The central bank raised its benchmark rate last month for the first time since 1995.

For now, officials are expected to keep policy unchanged at their upcoming meeting on January 23. Many analysts are not forecasting another rate hike until June, giving the BOJ more time to assess the competing trends in Japan's wage landscape.

Japan's real wages fell at the fastest rate in nearly a year this past November, marking the 11th consecutive month of decline and signaling continued pressure on consumer purchasing power.

Government data released Thursday shows that inflation-adjusted real wages dropped 2.8% from a year earlier. This decline, matching a similar fall in January, was the most significant since the 2.9% drop recorded in September 2023. The November figures represent a worsening trend from the revised 0.8% decrease seen in October.

The persistent gap between wage growth and inflation presents a significant challenge for the Bank of Japan, which has signaled its intention to continue raising interest rates this year.

The sharp fall in real wages was heavily influenced by a 17% plunge in special payments, which primarily consist of one-time bonuses. This category is often volatile outside the main summer and winter bonus seasons.

Reflecting this, average nominal wages, or total cash earnings, grew by just 0.5% to 310,202 yen, the slowest pace of growth recorded since December 2021.

A labour ministry official noted that preliminary November figures for special payments tend to be low, as data from most firms' winter bonuses has not yet been included. The official suggested that the overall wage environment remains fundamentally unchanged.

While bonus data skewed the headline numbers, other wage indicators also pointed to a cooling trend.

• Regular Pay: Base salary growth slowed to 2.0%, down from 2.4% in October but matching the pace from September.

• Overtime Pay: A key indicator of private-sector activity, overtime pay rose 1.2%. This was weaker than October's 2.1% increase but an improvement over September's 1.0% gain.

Despite these modest gains in nominal pay, high inflation continues to erode household earnings.

The consumer price index used by the ministry to calculate real wages—which includes fresh food but excludes rent—rose by 3.3%.

This sustained inflation complicates the Bank of Japan's monetary policy. Last month, the central bank raised its policy rate to 0.75%, a 30-year high, based on the expectation that companies would continue to raise wages throughout the year.

Attention is now turning to the annual labor-management talks. Rengo, Japan's largest union confederation, is advocating for an overall pay increase of at least 5% this year to combat the rising cost of living.

President Donald Trump has given his approval for a bipartisan bill designed to impose new sanctions on Russia, according to Senator Lindsey Graham. The South Carolina Republican announced the development on Wednesday, expressing hope for a Senate vote as early as next week.

The proposed legislation aims to intensify economic pressure on the Kremlin by targeting countries that continue to purchase Russian oil, a key source of funding for its war in Ukraine.

"After a very productive meeting today with President Trump on a variety of issues, he greenlit the bipartisan Russia sanctions bill," Graham said in a statement. "I look forward to a strong bipartisan vote, hopefully as early as next week."

Graham explained that the bill would grant President Trump significant leverage over nations like China, India, and Brazil. By punishing countries that buy "cheap Russian oil," he argued, the U.S. can incentivize them to cut off the revenue stream that "provides the financing for Putin's bloodbath against Ukraine."

Despite the announcement, Graham's office did not offer more specifics on the legislation's details or its path through Congress. The offices of the White House and Senate Majority Leader John Thune also did not immediately comment on a timeline for the long-delayed bill.

Previous versions of the legislation outlined measures that would authorize the president to impose secondary sanctions and tariffs on countries that purchase Russian oil and gas. This approach is designed to cripple Russia's energy exports, a critical pillar of its economy.

Discussions between Congress and the White House have reportedly centered on providing the president with greater flexibility in how and when to apply these sanctions. Given the wide bipartisan support for penalizing Russia, the bill is expected to pass easily if it is brought to the Senate floor for a vote.

The push for sanctions had been stalled for months, partly due to President Trump's stated desire to preserve diplomatic options for a peace deal between Russia and Ukraine. The president has previously pledged to end the war on his first day in office, citing his personal rapport with Russian President Vladimir Putin.

However, recent developments suggest a potential shift in strategy. Frantic diplomatic efforts involving Trump and Ukrainian President Volodymyr Zelenskiy have yielded progress, but Russian President Vladimir Putin has not backed down from his demands for Ukrainian territory.

In a late December phone call, Putin reportedly told Trump that Moscow would reconsider its negotiating stance, alleging that a Ukrainian drone had attacked one of his residences. Ukrainian officials have denied the claim, describing it as an attempt by Russia to sabotage peace talks.

President Trump has also signaled growing frustration with the Kremlin. "I'm not thrilled with Putin, he's killing too many people," he stated at a news conference earlier this year at his Mar-a-Lago resort. More recently, he shared a New York Post editorial on social media that was critical of Putin and called for tougher U.S. penalties against Moscow.

Graham framed the timing of the sanctions bill as a direct response to this dynamic. "This will be well-timed, as Ukraine is making concessions for peace and Putin is all talk, continuing to kill the innocent," he said.

The renewed legislative effort coincides with a breakthrough by U.S., Ukrainian, and allied negotiators on security guarantees for Kyiv. On Wednesday, President Zelenskiy noted his team would now focus on other unresolved issues, such as territory and control of a Russian-occupied nuclear power plant, before presenting a comprehensive deal to Moscow.

Oil traders and American refiners are moving quickly to gain access to Venezuelan crude after the Trump administration announced it would control up to 50 million barrels of oil, unleashing one of the largest unexpected supply flows in years.

The strategy, first revealed in a late-night social media post by President Donald Trump and detailed further by Energy Secretary Chris Wright, puts the federal government directly into the international oil market. This move promises to restart the flow of Venezuelan crude to U.S. refineries, which had been cut off by years of sanctions.

The return of Venezuelan oil to American buyers represents a major shift in global energy dynamics. The news has already sent Canadian crude prices plunging and put pressure on benchmark oil futures. Venezuela holds the world's largest oil reserves, but decades of underinvestment, sanctions, and economic turmoil have caused its production to collapse to below 1 million barrels a day.

"It's quite extraordinary that the United States is going to control Venezuelan oil sales indefinitely," noted Carolyn Kissane, an associate dean at New York University’s Center for Global Affairs.

The U.S. government's announcement has sparked a flurry of activity from companies previously sidelined by sanctions, as well as those few who have managed to maintain operations in Venezuela.

Citgo Petroleum Corp., the U.S. refiner indirectly owned by Venezuela, is reportedly considering a resumption of purchases for the first time since sanctions halted its supply in 2019. Meanwhile, trading giant Trafigura Group plans to hold talks with the U.S. government about re-entering the market to buy Venezuelan crude and supply the country with fuel, according to its global head of oil.

The potential access to Venezuelan crude also fueled a rally in the stocks of major U.S. refiners. Valero Energy Corp. saw its shares climb more than 5% to an all-time high. Oil major Chevron Corp. is also in discussions with Washington to extend its special license to operate in the country.

The Trump administration's policy signals a more direct intervention in global oil markets as part of its energy dominance agenda.

"The United States government has begun marketing Venezuelan crude oil in the global marketplace," the Energy Department confirmed in a fact sheet. "We have engaged the world's leading commodity marketers and key banks to execute and provide financial support for these crude oil and crude products sales."

As part of this plan, the agency will selectively roll back sanctions to permit the transport and sale of Venezuelan crude. The changes will also allow for the import of specific oil field equipment, parts, and services necessary for production.

While top U.S. oil executives are scheduled to meet with President Trump in the coming days, analysts believe many drilling firms will remain cautious about returning to Venezuela without clear assurances about the political and legal environment.

"I have a very hard time believing that companies are going to be willing to take the very high levels of risk associated with going in beyond the offshore," Kissane said.

Still, some market observers see this as a logical, if significant, evolution of government policy.

"It's worth noting that governments have already been actively influencing crude prices through SPR sale and repurchase programs, effectively creating implicit price bands," said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. "While the current situation represents a much larger and more direct intervention, it follows a clear progression in policy tools."

Even as Washington's strategy unfolds, tensions in the region remain high. This week, U.S. forces moved to seize two more sanctioned oil tankers, reinforcing the naval blockade designed to quarantine Venezuela’s energy sector.

President Donald Trump said Wednesday that Venezuela will purchase American products with revenue from its oil sales.

"I have just been informed that Venezuela is going to be purchasing ONLY American Made Products, with the money they receive from our new Oil Deal," Trump said in a post on social media.

A bipartisan group of U.S. senators says it expects a legislative vote aimed at limiting President Donald Trump's authority to take military action against Greenland, a long-time American ally.

The move comes as Trump continues to publicly express his desire to gain control of the mineral-rich Arctic island from Denmark. Congressional concern has been heightened by recent events, including a U.S. special forces operation to seize Venezuelan President Nicolas Maduro, which has prompted questions about the president's willingness to launch similar unilateral actions.

Democratic Senator Tim Kaine of Virginia, a leading advocate for congressional oversight on military force, confirmed that lawmakers are preparing to assert their authority.

"You will see war powers resolutions introduced on Cuba, Mexico, Colombia, Nigeria, Greenland," Kaine told reporters. He noted his own involvement, stating, "I will likely be at least a co-sponsor and probably leading some."

This push builds on previous efforts. Kaine and other lawmakers have repeatedly tried to pass resolutions to prevent Trump from attacking Venezuela without congressional authorization, citing the Constitution's mandate that only Congress can declare war. A Senate vote on halting further military action in Venezuela without lawmaker approval is expected this Thursday.

Republican Senator Rand Paul of Kentucky, who co-sponsored the Venezuela resolution, stated he would "keep an open mind" about supporting similar measures concerning Greenland.

However, he criticized the administration's approach, arguing that threatening military action is counterproductive if the ultimate goal is to purchase the island. Paul noted that he has not heard any of his Republican colleagues express support for using force to take Greenland.

"If I wanted to buy Greenland, I'd be doing PR events up there, I'd be showering them with gifts," Paul explained. He suggested a diplomatic strategy focused on persuading the people of Greenland about the defense and economic benefits of becoming part of the United States.

Despite the legislative pressure, the Trump administration appears to be holding its course. Secretary of State Marco Rubio confirmed he will meet with Danish leaders next week to discuss Greenland but gave no indication that the president was retreating from his goal.

The situation is drawing international attention, with allies including France and Germany reportedly working on a coordinated response to the U.S. position.

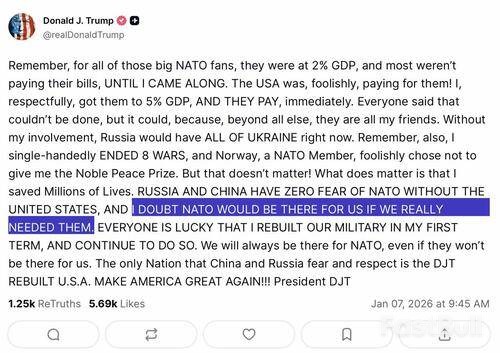

In a direct challenge to the transatlantic military alliance, President Trump declared on Wednesday that Russia and China "have zero fear of NATO" unless the United States is a member. The statement, posted on Truth Social, arrives as the White House signals its intent to acquire Greenland and follows controversial US military actions related to Venezuela's leadership.

Trump's post questioned the core principle of collective defense, expressing doubt that "NATO would be there for us if we really needed them." At the same time, he asserted America's own commitment, stating, "We will always be there for NATO, even if they won't be there for us."

To support his position, Trump pointed to the nearly four-year-long war between Russia and Ukraine, which has widely been viewed as a proxy conflict between Moscow and NATO. He claimed personal credit for containing the conflict, saying, "Without my involvement, Russia would have ALL OF UKRAINE right now."

He also highlighted his administration's focus on military investment, adding, "Everyone is lucky that I rebuilt our military in my first term, and continue to do so."

Trump's sentiment aligns closely with recent comments from his top advisory official, Stephen Miller. Discussing the potential acquisition of Greenland from Denmark, a fellow NATO member, Miller framed the issue as a matter of US strategic necessity for the alliance.

"The US is the power of Nato," Miller stated. "For the US to secure the Arctic region to protect and defend Nato and Nato interests, obviously Greenland should be part of the US." He presented this as a "conversation that we're going to have as a country."

Despite the diplomatic friction surrounding the Greenland issue, the underlying point made by both Trump and Miller about America's role in NATO is difficult to dispute. If Washington were to withdraw, the military alliance would likely become a pact in name only, resembling a theoretical "EU Army" without the power to project force effectively.

Without the backing of the US military, it is widely believed that the alliance would not command the same level of deterrence against strategic competitors like Russia and China.

Often overlooked in these strategic debates is the legacy of NATO's own military interventions over the past several decades. Operations from the bombing of Belgrade in 1999 to the regime-change campaign against Libya's Muammar Gaddafi and the long-term involvement in Afghanistan have left a trail of instability.

For instance, NATO's mission in Libya, framed as a "responsibility to protect," preceded the country's collapse into a fractured state with at least three rival power centers and the emergence of an ISIS foothold where none existed before. This history adds a complex layer to any discussion of the alliance's purpose and effectiveness.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up