Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan's PM Takaichi may suspend food sales tax, a ¥5T pledge driving market shifts ahead of elections.

Japanese Prime Minister Sanae Takaichi is reportedly considering a temporary suspension of the sales tax on food as a key pledge for her upcoming election campaign. This potential policy shift comes as Takaichi is expected to dissolve the lower house of parliament next week.

According to a report from the Mainichi newspaper, citing people familiar with the matter, the government and Takaichi's ruling Liberal Democratic Party are set to decide on the tax suspension after carefully assessing its potential impact on financial markets.

While Takaichi endorsed the idea of a food sales tax cut before taking office in October of last year, she has since given little indication of her plans to implement it. The move would represent a significant fiscal measure, projected to reduce government revenue by about 5 trillion yen ($31.6 billion) annually.

The prime minister has pledged to pursue an "aggressive but responsible" fiscal policy, and markets have already begun reacting to speculation about her economic agenda.

News that Takaichi intends to call an election, likely for February, has triggered notable shifts in financial assets:

• The Japanese yen has weakened against the U.S. dollar.

• Bond yields have risen.

• Stocks have climbed to a record high on market expectations of expanded fiscal spending.

The Trump administration will pursue individual tariff agreements on semiconductors with different countries, a U.S. official confirmed Friday. This strategy rejects a one-size-fits-all approach, signaling that the recent U.S.-Taiwan deal on chip levies will not serve as a universal template for other nations.

The clarification came after the U.S. Commerce Department released details of a trade and investment pact with Taiwan that specifically addressed semiconductor tariffs. The country-specific approach has immediate implications for other major chip-producing nations, including South Korea, which will now likely face their own distinct negotiations with Washington.

The deal with Taiwan offers a clear framework for tariff relief tied to investment in American manufacturing capacity. According to a fact sheet from the Commerce Department, the agreement includes two key provisions:

• During Construction: Taiwanese companies building new semiconductor facilities in the U.S. can import up to 2.5 times their planned capacity without paying sectoral duties for the duration of the approved construction period.

• After Completion: Once a new U.S. production project is complete, these companies can continue to import 1.5 times their new domestic production capacity duty-free.

This model directly links tariff exemptions to the onshoring of chip production, a central goal of the administration's industrial policy.

The focus on semiconductors extends beyond bilateral deals. On Wednesday, President Trump signed a proclamation establishing a 25% tariff on certain semiconductors used for artificial intelligence (AI). This tariff applies specifically to chips imported into the U.S. that are then re-exported to other countries.

Furthermore, the White House has indicated that Trump may impose even "broader" tariffs on both semiconductors and their derivative products in the future.

These trade actions are being implemented under the authority of Section 232 of the Trade Expansion Act of 1962. This law grants the president the power to adjust imports if they are determined to be a threat to U.S. national security, providing a legal basis for the administration's industry-wide tariff strategy.

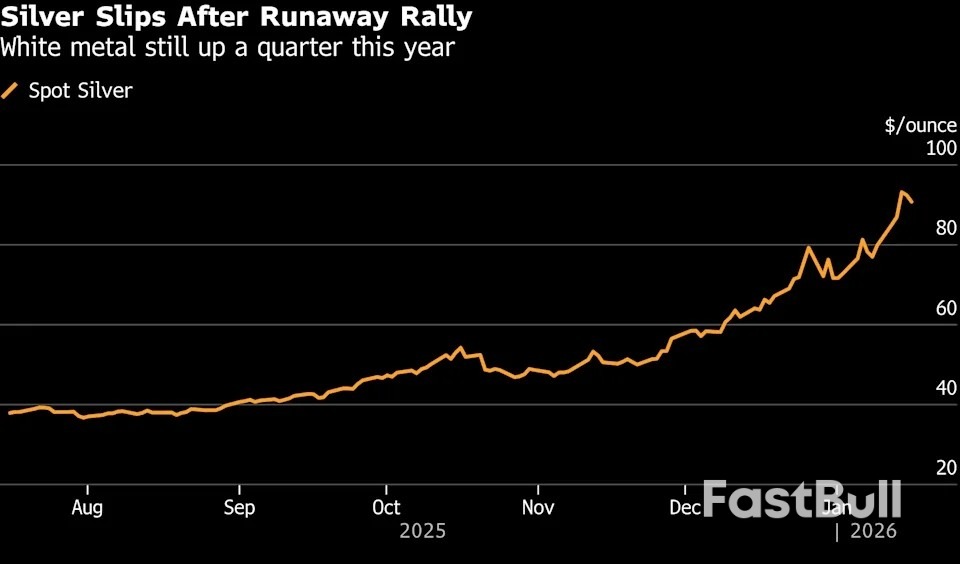

The precious metals market has packed a year's worth of action into the first two weeks of the year, with both gold and silver posting record-breaking gains before showing signs of a slowdown. The explosive momentum, particularly for silver, now appears to be meeting resistance.

Gold prices have climbed $256 this month, a 6% increase that is already nearing last year's 7% January rally. Silver has been even more dramatic, surging nearly $17.50, or more than 24%. This marks silver's strongest start to a year since 1983.

However, the blistering pace is cooling. Gold ended the week below $4,600, and silver slipped back under $90 an ounce, reminding traders that the market's upward trajectory isn't guaranteed.

Silver’s pullback is not entirely unexpected. The metal’s powerful rally through the second half of 2025 was largely fueled by a supply-crunch narrative, which has now been temporarily resolved.

Late Wednesday, President Donald Trump announced that his administration would not impose tariffs on critical metals following a Section 232 review. The decision, for now, removes a key source of market anxiety. With the U.S. having stockpiled silver for nearly a year over tariff fears, the physical market may begin to normalize as those pressures ease.

Gold, on the other hand, is facing headwinds from a different source: economic reality. Recent data suggests the Federal Reserve is under no immediate pressure to cut interest rates. While rate cuts are still anticipated this year, the market consensus is shifting, with the first move not expected until June at the earliest.

This delay gives support to higher bond yields and a stronger U.S. dollar, which typically weigh on gold prices. However, the long-standing inverse relationship between gold and interest rates has been unreliable for some time. Furthermore, ongoing geopolitical uncertainty continues to generate solid safe-haven demand for the metal.

While some short-term selling and consolidation seem likely for both metals, a complete return to "normal" market conditions is improbable. Traders are operating in an environment defined by tight supply, persistent demand, and evolving macroeconomic stories. Even if silver's liquidity improves, fundamental supply constraints remain.

For investors looking ahead, some analysts believe gold may have an advantage. Silver's staggering 150% rally over the past 12 months has driven the gold-to-silver ratio to its lowest level since 2012. Just as the ratio struggled to stay above 100 last year, many experts now view its current low level as unsustainable, potentially signaling a relative outperformance for gold.

Latest news on the Israeli-Palestinian conflict

Middle East Situation

Palestinian-Israeli conflict

Political

U.S. President Donald Trump has named a high-profile team to a new Gaza "board of peace," appointing Secretary of State Marco Rubio and former British Prime Minister Tony Blair as founding members.

The move establishes a core leadership group intended to guide the next phase of a U.S.-backed plan to end the conflict in the region.

The White House on Friday confirmed the seven-member "founding executive board." In addition to Rubio and Blair, the board includes:

• Steve Witkoff, Trump’s special envoy

• Jared Kushner, the president's son-in-law

• Ajay Banga, President of the World Bank

President Trump will personally chair the board, which he described on Thursday as the "Greatest and Most Prestigious Board ever assembled at any time, any place." The White House stated that additional members will be announced in the coming weeks.

The inclusion of Tony Blair is a controversial choice in the Middle East, given his role in the 2003 invasion of Iraq. President Trump previously noted last year that he wanted to ensure Blair was an "acceptable choice to everybody."

The board's formation marks a key development in the second phase of a comprehensive peace plan for Gaza. The initiative, which first came into force on October 10, led to the return of all hostages held by Hamas and an end to the fighting between the militant group and Israel.

This new board is designed to oversee the long-term stabilization efforts following the initial ceasefire.

The board's creation coincides with two other major stabilization initiatives. A 15-member Palestinian technocratic committee was recently announced to manage the day-to-day governance of the devastated territory. This committee will be headed by Ali Shaath, a Gaza native and former Palestinian Authority deputy minister.

On the security front, U.S. Major General Jasper Jeffers was named to lead the International Stabilization Force (ISF) in Gaza.

While the plan's second phase is now underway, it is clouded by serious challenges. Allegations of aid shortages and ongoing violence continue to undermine progress on the ground.

Furthermore, a critical obstacle remains unresolved: Hamas has refused to publicly commit to full disarmament, which Israel considers a non-negotiable demand for lasting peace.

A surge in Japanese stocks, ignited by Prime Minister Sanae Takaichi's call for a snap election, is gaining momentum. But investors should be cautious: the very policies fueling the rally could ultimately undermine it if she wins, leading to higher inflation and rising government borrowing costs.

This week, Japan's Topix index jumped over 4% in its strongest rally since July, reviving the "Takaichi trade"—a strategy of buying stocks in anticipation of a massive government spending boost. Takaichi is betting that an election will consolidate her power, giving her a clear mandate to pursue pro-stimulus policies.

Investors see Takaichi potentially following the playbook of her mentor, Shinzo Abe, Japan's longest-serving prime minister. Abe's stimulus-heavy "Abenomics" program was a major driver of asset prices from 2012 to 2020.

Takaichi has already signaled her priorities for strategic investment, targeting key industries such as:

• Artificial intelligence

• Semiconductors

• Defense

• Space

• Content industries

This prospect of a government-backed capital expenditure boom has investors excited. Neil Newman, head of strategy at Astris Advisory Japan, predicts that a Takaichi victory could drive another 5% climb in the Nikkei 225 Stock Average. "With the government planning to invest strategically in key industries, we're likely to see a capex boom," he said.

While stocks are rallying, the bond market is sending a different signal. Investors are already demanding higher premiums to hold Japanese government debt, a move that contrasts with falling yields globally.

"Clearly, going by rising break-even inflation rates, the market is expecting slightly looser, more inflationary policies in the aftermath of the elections," noted Aninda Mitra, head of Asia macro and investment strategy at BNY Investments. He added that the market sees inflation remaining "higher-for-longer above the Bank of Japan's target."

The biggest immediate risk, however, is the yen. The currency slid to 159.45 per dollar on Wednesday, an over-a-year low. On a trade-weighted basis, it has fallen to its weakest point since 1992.

This sharp depreciation is intensifying inflation concerns. A weaker yen traditionally supports exporter stocks, but its current slide threatens to destabilize the economy. Takaichi's preference for a dovish monetary policy is seen as limiting the Bank of Japan's ability to raise interest rates, putting further pressure on the currency.

"I think the biggest risk for Takaichi is the yen," said Chisa Kobayashi, Japan equity strategist at UBS SuMi TRUST Wealth Management. "If it weakens further, that could fuel inflation, undermine consumer spending and ultimately hurt voter support."

Despite Takaichi's strong approval ratings, an easy victory is no longer a certainty. The political landscape recently shifted after Komeito—formerly a junior coalition partner of the Liberal Democratic Party—moved to align with the main opposition.

This development makes the election outcome difficult to predict, according to Shinichi Ichikawa, a senior fellow at Pictet Asset Management Japan.

However, he believes one trend is clear regardless of who wins. "The only certainty is that both sides will have little choice but to campaign on aggressive spending to win over voters," Ichikawa said. This suggests that fiscal expansion is on the horizon, but the market's initial optimism could face a reality check as the economic consequences unfold.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up