Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)A:--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)A:--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)A:--

F: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)A:--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)A:--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)A:--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Dec)

U.S. Cleveland Fed CPI MoM (Dec)--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Imports (CNH) (Dec)

China, Mainland Imports (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. Yield--

F: --

P: --

U.S. Budget Balance (Dec)

U.S. Budget Balance (Dec)--

F: --

P: --

Argentina 12-Month CPI (Dec)

Argentina 12-Month CPI (Dec)--

F: --

P: --

Argentina National CPI YoY (Dec)

Argentina National CPI YoY (Dec)--

F: --

P: --

Argentina CPI MoM (Dec)

Argentina CPI MoM (Dec)--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech.

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China's rare earth export curbs on Japan, effective next month, spotlight acute supply chain vulnerabilities.

Japanese companies are in a holding pattern, working to understand the full impact of China's latest export controls targeting the nation. According to sources familiar with the situation, the real-world effects of these new rules are unlikely to become clear until next month.

The move from Beijing involves a ban on the sale of more than 800 dual-use items to any end-users that could potentially support Japan's military capabilities. While rare earths are on this list, these critical minerals have already been subject to broader export controls since April of last year, a period marked by escalating trade tensions with the United States.

Adding to the uncertainty, state-run media outlet China Daily has reported that Beijing is also considering stricter reviews for export licenses on certain medium and heavy rare earth products destined for Japan.

The full weight of China's tightening grip on rare earths is expected to be felt by Japanese firms starting next month. The delay is procedural, as processing new export applications typically takes several weeks.

Any recent reports of Japanese companies facing difficulties with license approvals likely stem from previous rounds of restrictions, not the most recent announcement.

These trade measures follow a period of heightened friction between Asia's two largest economies. Tensions flared in November after comments from Japanese Prime Minister Sanae Takaichi suggested a possible military deployment by Japan if China were to use force against Taiwan. China's new export controls have amplified concerns that Beijing may further leverage its dominance over rare earths—minerals essential for everything from electric vehicles and smartphones to advanced missile systems.

In response, a group of Japanese businesses operating in China is pressing for clarity. The Japan Chamber of Commerce and Industry in China has publicly urged Chinese authorities to stand by their initial statements that the new curbs on dual-use items would not disrupt normal civilian trade.

In a statement on Monday, the Chamber highlighted remarks made last week by He Yadong, a spokesman for China's Ministry of Commerce. He had assured that civilian applications would not be affected and that companies engaged in legitimate trade had no reason for concern.

"We request that this statement be reaffirmed and thoroughly communicated to relevant parties," the business group stated, adding that it would disseminate the ministry's explanation to its member companies. The chamber has also committed to raising any issues directly with the ministry should Japanese firms encounter operational difficulties.

Despite previous efforts to diversify its sources, Japan remains highly dependent on China for its supply of rare earths. This dependency became a critical issue over a decade ago when Beijing first blocked shipments of the minerals during a diplomatic dispute.

China's dominance in this sector is overwhelming. According to the Japan Organization for Metals and Energy Security, the country not only leads the world in rare earth reserves and production but also controls over 90% of global refining capacity.

The strategic importance of this issue was underscored this week when Japanese Finance Minister Satsuki Katayama met with global counterparts in the United States to discuss the need for more resilient supply chains. Katayama identified bolstering these critical networks as a major priority.

The Japanese yen has tumbled to a one-year low against the dollar, prompting Japan's Finance Minister Satsuki Katayama to express "deep concern" over the currency's "one-sided depreciation." Following a meeting with U.S. Treasury Secretary Scott Bessent, Katayama said her American counterpart shared this view, escalating threats of direct market intervention to support the yen.

The currency's sharp slide, which saw it cross the key 158-per-dollar mark, was fueled by reports that Prime Minister Sanae Takaichi may call a snap election in February.

Market speculation is mounting that an election victory would give Takaichi a firm mandate to pursue her expansionary fiscal policy. This prospect has put significant downward pressure on the yen.

However, a weak currency creates a policy dilemma. While it can benefit exporters, it also inflates the cost of imports, squeezing household budgets and potentially damaging Takaichi's popularity. After Katayama's remarks, the dollar briefly fell below 158 yen before rebounding to 158.925, its highest level since July 2024.

Japanese officials have become increasingly vocal in their warnings against excessive currency movements. Deputy Chief Cabinet Secretary Masanao Ozaki stated that the government "will take appropriate steps on excessive currency moves, including speculative ones," though he declined to comment on the election reports.

Finance Minister Katayama's comments from Washington, made after a bilateral meeting with Bessent, strongly hint at tacit U.S. approval for intervention. A senior Japanese government official added that Katayama had instructed him to coordinate closely with the U.S. if necessary.

This stance is based on a joint Japan-U.S. statement from September, which Katayama says gives Tokyo a "free hand." While the agreement reaffirms a commitment to "market-determined" exchange rates, it also reserves the right for intervention to combat excess volatility—a condition Japanese policymakers believe has been met.

Analysts are now on high alert for currency intervention, though the exact timing remains uncertain.

According to Hiroyuki Machida, director of Japan FX and commodities sales at ANZ, Tokyo's argument is that the yen's recent weakness deviates from economic fundamentals, especially as the interest rate gap between the U.S. and Japan has narrowed.

However, Machida believes the yen will continue to face selling pressure until the election outcome and the direction of fiscal policy become clear. This suggests that any intervention would require massive firepower to be effective.

"So intervention is possible anytime now," he noted, "but my guess is that wouldn't happen till the yen hits 160 per dollar."

Japan last intervened in the currency market in July 2024, after the yen weakened to a 38-year low of approximately 161.96 to the dollar.

While fiscal policy is in the spotlight, other officials have offered a more nuanced view. Economic Revitalisation Minister Minoru Kiuchi argued against blaming the weak yen solely on Takaichi's fiscal agenda. "Exchange rates and interest rates are determined in the market based on a wide range of factors," he said.

Beyond currency markets, the Washington meeting also covered critical mineral supply chains. Katayama told participants that Tokyo views Beijing's export ban on dual-use items as "highly problematic." She cited the ban's vague wording, broad scope, and re-export restrictions that affect third countries as major points of concern.

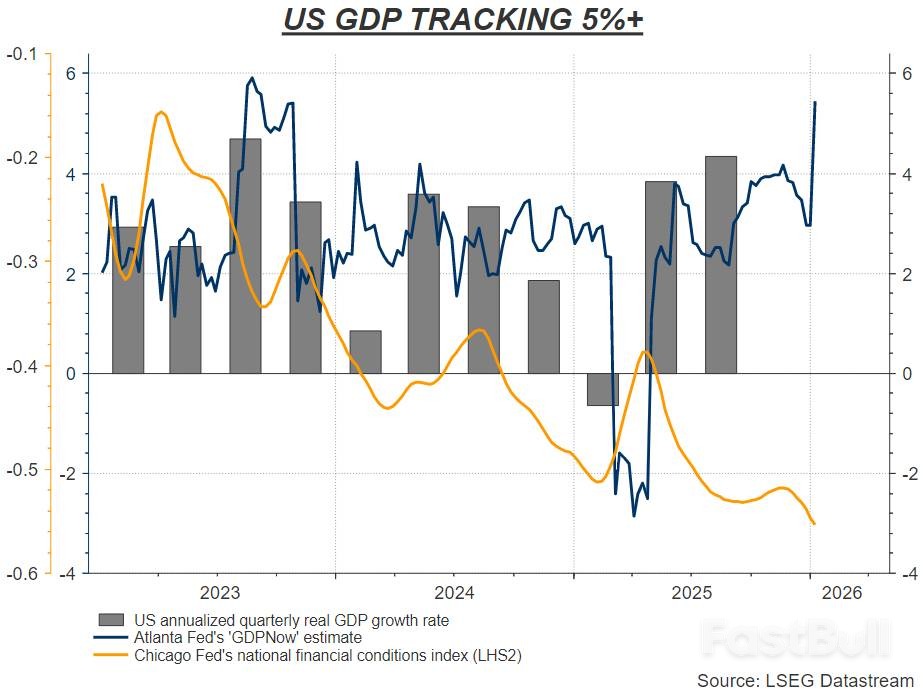

The Trump administration is escalating its campaign to lower borrowing costs for Americans, pursuing direct action that challenges the Federal Reserve's authority and raises concerns about overheating an already strong economy. With GDP growth tracking above 4%, the White House is deploying a mix of regulatory proposals and Treasury interventions to force down the cost of credit.

Over the past week, the administration has unveiled a multi-pronged strategy. This includes moves that Fed Chair Jerome Powell described as a "pretext" to weaken the central bank's independence, a proposal to cap credit card interest rates, and an executive order to purchase $200 billion in mortgage bonds.

The administration appears impatient with the Federal Reserve's pace of interest rate cuts and is moving to implement its own form of monetary easing. The effort faces significant pushback from within the Fed, financial leaders, and even some congressional Republicans, but the White House seems determined to deliver relief to voters in a midterm election year.

The key initiatives include:

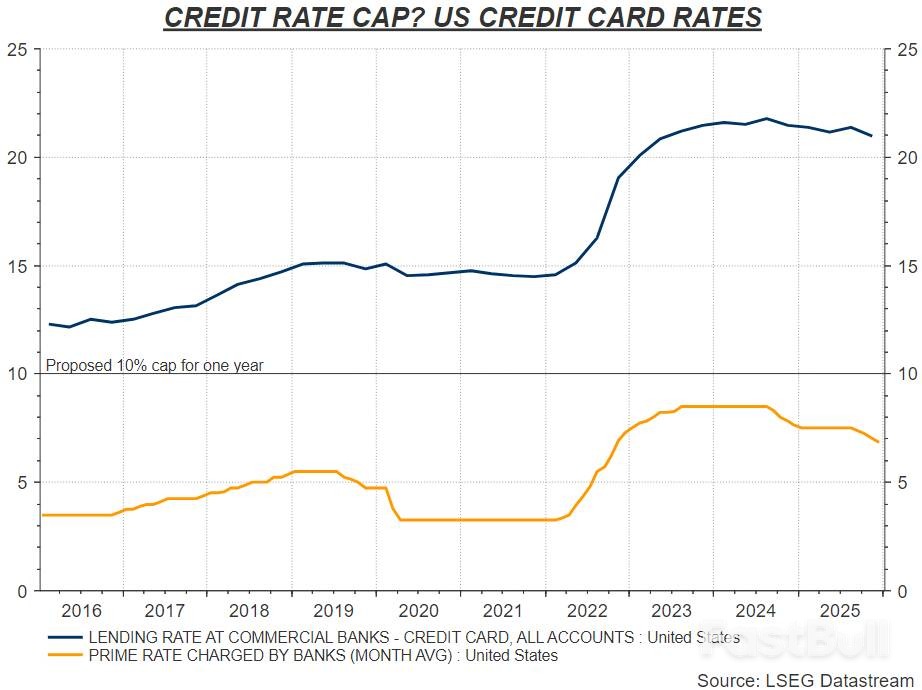

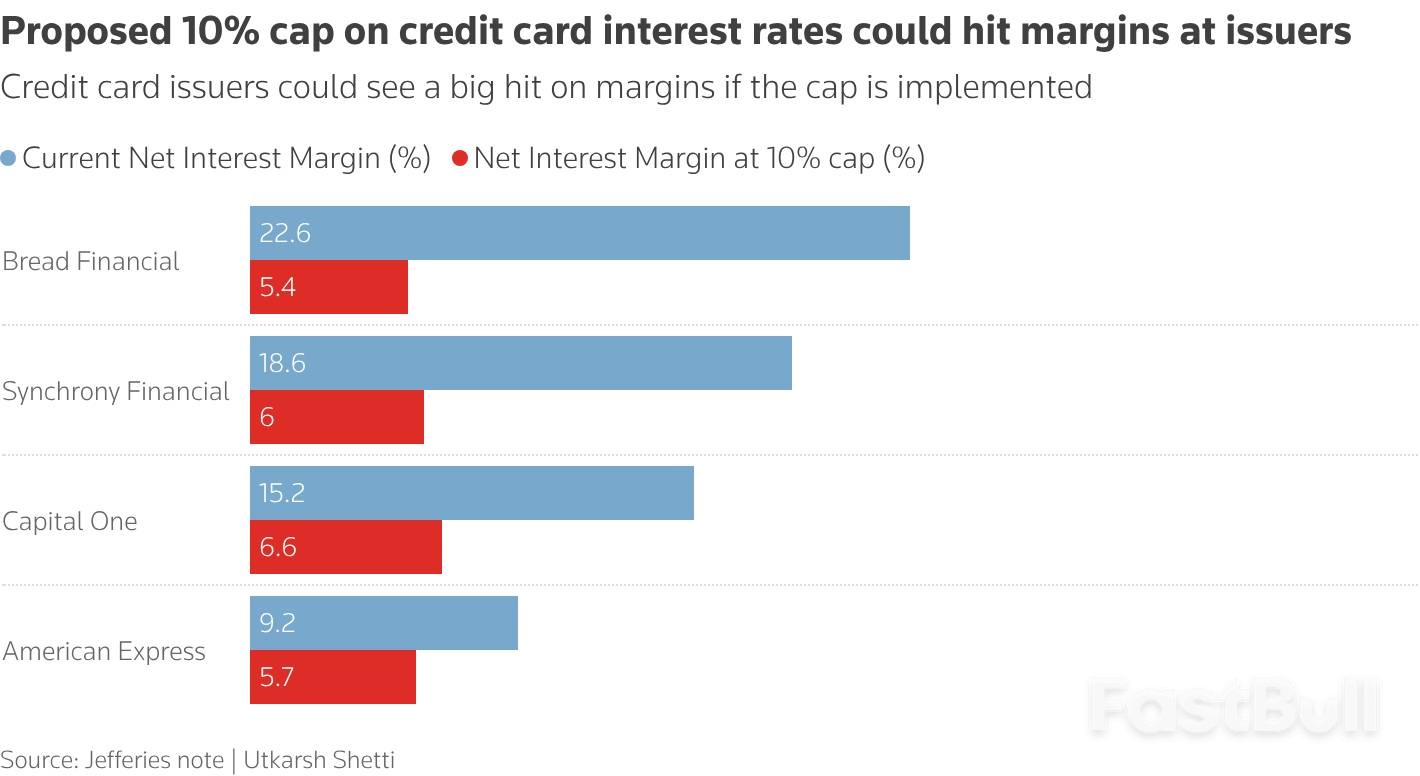

• A Credit Card Rate Cap: A proposal to cap credit card interest rates at 10% for one year.

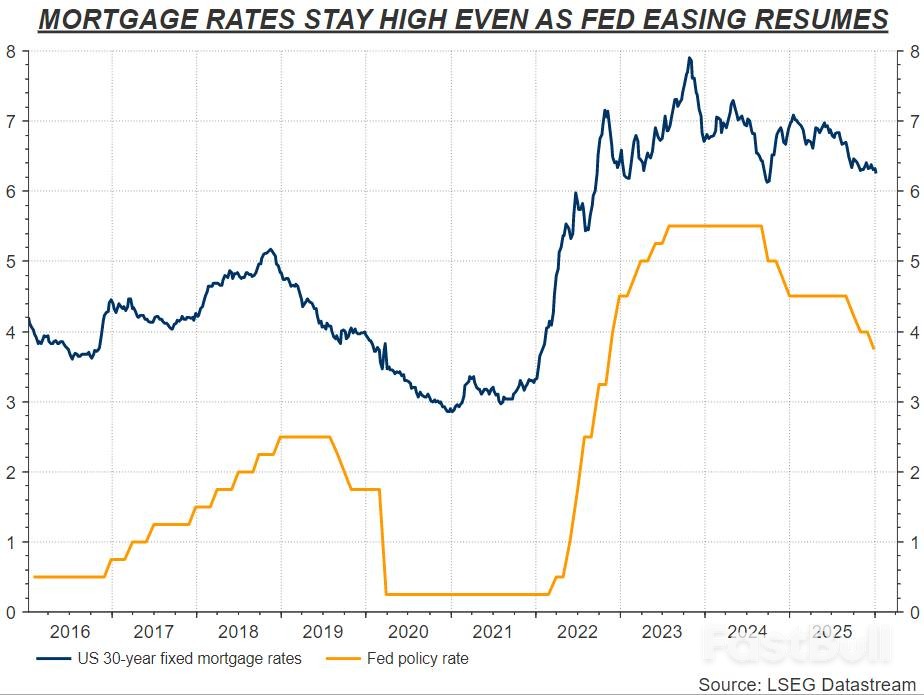

• Mortgage Market Intervention: An order for the Treasury to buy $200 billion in mortgage bonds to reduce housing finance costs.

• Pressure on the Fed: A continued campaign to influence the central bank, which critics see as an assault on its independence.

While these policies are designed for popular appeal, their economic effectiveness remains in question. A 10% cap on credit card rates, for example, could backfire if lenders respond by revoking credit lines for higher-risk borrowers to protect their margins.

The political objective is clear: address voter concerns about the cost of living. Opinion polls consistently show that monthly credit payments are a major source of financial anxiety for households. For President Trump, being seen as actively fighting to lower these costs is a powerful political message.

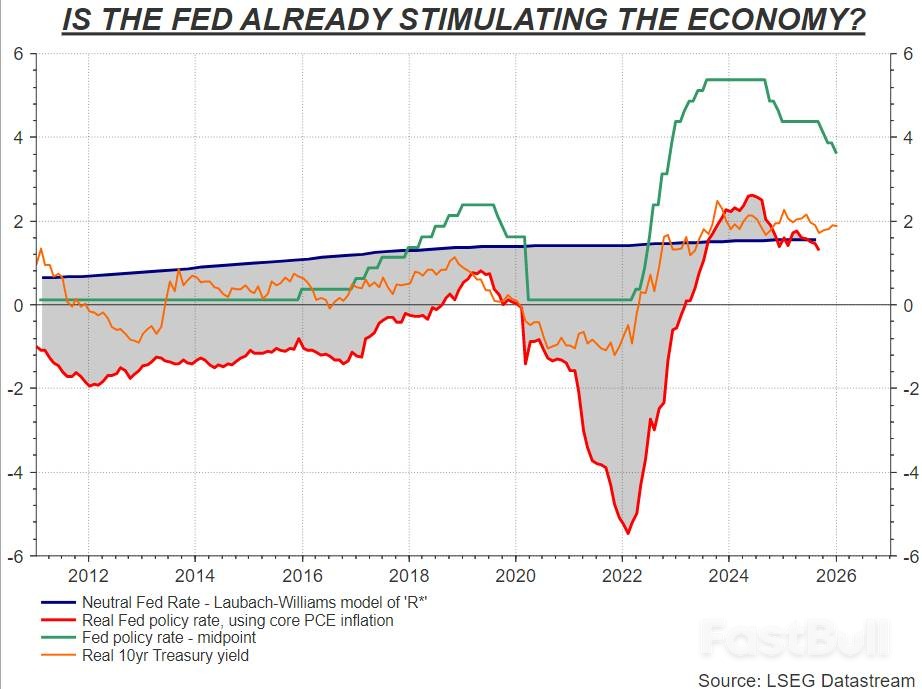

Despite the political logic, economists are raising alarms. The primary concern is that these easing measures are being introduced when the economy is already running hot. Current financial conditions are considered loose, GDP growth is tracking at over 4%, and inflation is settling above the Federal Reserve's target.

The administration's actions directly counteract the Fed's existing policy stance, which already accounts for prevailing credit rates and the gradual reduction of its mortgage bond holdings. If the White House successfully eases these conditions by decree, it could force the central bank to reconsider its own interest rate path.

Further evidence of economic strength comes from the labor market. The national unemployment rate recently fell below 4.4%, and annual wage growth has accelerated, showing few signs of a slowdown. Adding more stimulus now, on top of the fiscal boost from last summer's tax cuts, risks a "re-acceleration" of growth that could entrench inflation.

The most significant long-term risk is the erosion of the Federal Reserve's credibility. If the central bank is seen as bowing to political pressure, its ability to manage inflation could be permanently damaged.

Tim Duy at SGH Macro Advisors warns that this could lead to a "classic policy error of a central bank stripped of its independence." He argues that by mid-year, the debate might shift from rate cuts to resisting calls for higher rates.

Breaking from market consensus, which anticipates two more Fed cuts this year, JPMorgan now projects that the central bank's next move will be a rate hike in 2027. According to this logic, any politically motivated rate cuts now will only build the case for more aggressive tightening later.

The market reaction has been mixed. Wall Street stocks have rallied on the prospect of lower credit costs. However, the dollar's retreat and a surge in gold prices signal underlying anxiety about long-term inflation.

In a recent speech, Treasury Secretary Scott Bessent defended the administration's stance by invoking former Fed Chairman Alan Greenspan's decision to resist rate hikes during the 1990s tech boom. While Greenspan's approach allowed the internet economy to flourish, it is also remembered for enabling one of the largest stock market bubbles in modern history.

Prime Minister Sanae Takaichi’s consideration of a snap general election is sending shockwaves through Japan’s financial markets, raising concerns that political maneuvering could trigger a fiscal crisis by derailing critical government funding legislation.

Reports that Takaichi may dissolve parliament as early as this month for a February election have already pushed the yen and Japanese government bond (JGB) prices lower. The move, if it proceeds, would halt parliamentary business shortly after it convenes on January 23. This pause threatens the passage of an essential bill that authorizes the government to issue deficit-covering bonds, a cornerstone of its budget financing.

Japanese law strictly limits government bond issuance to "construction" bonds used for public works projects. To fund its massive stimulus packages and the rising social welfare costs of an aging population, the government has long relied on a workaround: a special, time-limited bill that permits the issuance of "deficit-covering" bonds.

The current five-year authorization is set to expire at the end of the fiscal year in March. To fund its spending plans for fiscal 2026 and beyond, the government must pass a new bill. Failure to do so would leave a massive hole in the national budget, creating a scenario many are calling Japan's version of a "fiscal cliff."

The stakes are exceptionally high. Takaichi's administration has laid out a record $783 billion budget, nearly a quarter of which is financed by debt.

Of the 29.6 trillion yen ($186.4 billion) in new debt planned for fiscal 2026, a staggering 22.9 trillion yen is composed of the deficit-covering bonds that require the new legislation. Without that bill, the government would lack the funds to cover its extensive spending commitments.

The political calculations behind a snap election are complex. While Takaichi's ruling coalition holds a slim majority in the lower house, it lacks control of the upper house. A decisive election victory could strengthen her political mandate but would still necessitate cooperation with the opposition to pass legislation.

Approval of the debt bill was previously considered a formality, with the opposition Democratic Party for the People (DPP) signaling its support. However, an early election could sour that cooperation, as it would sideline the DPP's own legislative priorities, including tax break proposals.

DPP leader Yuichiro Tamaki has now stated that his party's support for the debt bill is "in flux," according to Kyodo news agency. This new uncertainty has rattled investors.

"In terms of a snap election, there's little to be bullish about the bond market," noted Keisuke Tsuruta, a senior bond strategist at Mitsubishi UFJ Morgan Stanley Securities. He warned that heightened political risk would make investors hesitant, potentially putting "upward pressure on the yield curve."

This pressure is already visible, with the yield on the benchmark 10-year JGB hitting a 27-year high on Tuesday amid expectations that a snap election could empower Takaichi to pursue even more aggressive fiscal stimulus.

The political turmoil unfolds against a backdrop of immense national debt, which stands at twice the size of Japan's economy—the highest ratio among major economies. Debt-servicing costs already consume over a quarter of government spending. These costs are projected to grow as the Bank of Japan continues to raise interest rates, compounding the long-term fiscal challenges facing the nation.

($1 = 158.8000 yen)

Donald Trump has issued a stark ultimatum, threatening a 25% tariff on any country that conducts business with Iran. The announcement, made as Washington assesses its response to major anti-government protests in Iran, marks a significant escalation in economic pressure.

In a Monday post on Truth Social, the US president declared, "Effective immediately, any Country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with the United States of America."

Trump added that the order was "final and conclusive," but offered no further details. Tariffs of this nature are typically paid by US-based importers, and Washington already maintains heavy sanctions against Iran.

Despite the definitive tone of the social media post, the White House website showed no official documentation of the policy. There was no information regarding the legal authority Trump would use to impose such tariffs or a clear list of targeted trading partners. The White House did not respond to a request for comment.

The move drew a swift response from China, a major destination for Iranian exports along with the United Arab Emirates and India. Beijing stated it opposes "any illicit unilateral sanctions and long-arm jurisdiction" and would "take all necessary measures to safeguard its legitimate rights and interests."

A spokesperson for the Chinese embassy in Washington reinforced this position on X, saying, "China's position against the indiscriminate imposition of tariffs is consistent and clear. Tariff wars and trade wars have no winners, and coercion and pressure cannot solve problems."

Trump's tariff threat comes at a time of high tension. Iran, which engaged in a 12-day war with US ally Israel last year and saw its nuclear facilities bombed by the US military in June, is now facing its largest anti-government demonstrations in years.

Trump has previously stated that the US might meet with Iranian officials and that he is in contact with Iran's opposition, while simultaneously threatening military action to pressure Tehran's leaders.

On Monday, White House Press Secretary Karoline Leavitt confirmed that airstrikes were among the "many, many options" under consideration but stressed that "diplomacy is always the first option for the president."

Leavitt also suggested a disconnect between public and private communications. "What you're hearing publicly from the Iranian regime is quite different from the messages the administration is receiving privately, and I think the president has an interest in exploring those messages," she said. Tehran confirmed on Monday that communication channels with Washington remain open.

The demonstrations in Iran have evolved from grievances over economic hardship into direct calls for the fall of the clerical establishment. The Iranian regime has responded with a harsh crackdown.

Key elements of the government's response include:

• Mass arrests, with the US-based Human Rights Activists News Agency reporting over 10,600 detentions.

• Severe internet blackouts, making it difficult to gauge the situation from abroad.

• Public warnings that participating in protests could result in the death penalty.

While the Iranian government has not released casualty figures, the Norway-based NGO Iran Human Rights has confirmed at least 648 deaths. In response to the unrest, France has evacuated non-essential embassy staff from Iran.

The government has also organized pro-regime rallies, with tens of thousands taking to the streets of Tehran on Monday in a state-sponsored show of support.

Throughout his second term, Trump has frequently used tariffs as a tool to pressure countries over their ties with US adversaries or what he deems unfair trade policies.

This latest move adds to a trade policy agenda already facing legal challenges, as the US Supreme Court is currently considering a case that could strike down a wide range of Trump's existing tariffs.

The potential scope of the new Iran-focused tariff is vast. According to the most recent World Bank data from 2022, Iran, a member of OPEC, exported products to 147 different trading partners.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up